When your company receives payments from Thai clients, understanding Thailand’s withholding tax (WHT) system is critical to protecting your profit margins. Many foreign vendors unknowingly pay 15% tax on income that could be exempt, or conversely, face unexpected liabilities because they misunderstand the Revenue Code.

Withholding tax is the Thai Revenue Department’s mechanism for collecting income tax at the source. For foreign companies, this means your Thai client acts as the tax collector – deducting a percentage of your invoice and remitting it directly to the government.

Whether you lose 15% of your invoice or 0% depends entirely on one legal classification: Are you “carrying on business” in Thailand?

Executive Summary: The Dual-Track System

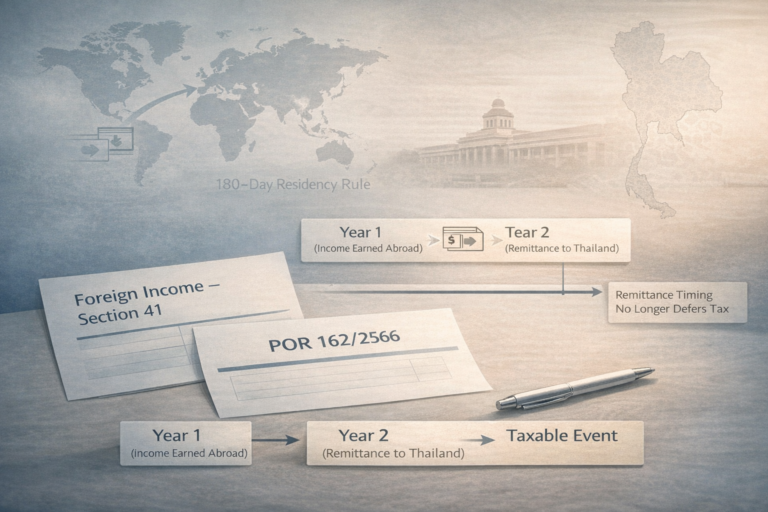

Thailand operates a dual-track tax system for foreign entities. Your classification determines which tax form is filed (PND 53 vs. PND 54) and what rate applies.

1. Foreign Companies NOT Carrying on Business (Section 70)

Most common for: Offshore software vendors, remote consultants, foreign licensors.

If you operate entirely outside Thailand and have no physical presence, you fall under Section 70 of the Revenue Code.

- Tax Liability: You are liable for WHT only on specific income types paid from Thailand (Service fees, Royalties, Dividends).

- Final Tax: The tax deducted is generally your final obligation. You do not need to file an end-of-year corporate tax return in Thailand.

- Filing Form: Your client files Form PND 54.

2. Foreign Companies Carrying on Business (Permanent Establishment)

Most common for: Companies with branch offices, long-term on-site staff, or dependent agents.

If you have a “Permanent Establishment” (PE), you are treated similarly to a local Thai company.

- Tax Liability: You pay standard domestic WHT rates (typically lower, e.g., 3%).

- Not Final Tax: This WHT is merely an advance credit. You must file a Corporate Income Tax (CIT) return (Form PND 50) at the end of the year and pay 20% on net profits.

- Filing Form: Your client files Form PND 53.

Self-Assessment: Are You at Risk of PE?

The Revenue Department is aggressive in classifying foreign entities as having a PE to capture them in the CIT net. You may trigger PE status if you:

- Maintain an office, warehouse, or fixed place of business in Thailand.

- Have employees stationed in Thailand for extended periods (often >6 months).

- Have a “dependent agent” in Thailand who has the authority to sign contracts on your behalf.

- Carry out construction or installation projects lasting longer than 6 months.

If you fit these criteria, you should seek professional advice immediately, as you are likely liable for full Corporate Income Tax (20%).

2026 Withholding Tax Rates

Scenario A: Non-Resident Rates (No PE) – Section 70

If you are a standard foreign vendor, these rates apply to the gross amount before VAT.

| Income Type | WHT Rate | Applicable Form |

|---|---|---|

| Service Fees / Brokerage | 15% | PND 54 |

| Royalties / License Fees | 15% | PND 54 |

| Interest Payments | 15% | PND 54 |

| Dividends | 10% | PND 54 |

| Capital Gains | 15% | PND 54 |

| Rental (Property) | 15% | PND 54 |

Scenario B: Resident Rates (With PE) – Domestic System

If you have a registered branch, domestic rates apply. Note the special e-Withholding Tax incentives active through 2025.

| Income Type | Standard Rate | e-Withholding Rate (2025)* |

|---|---|---|

| Service Fees | 3% | 1% |

| Royalties | 3% | 1% |

| Advertising | 2% | 1% |

| Transportation | 1% | 1% |

2025 Update: The reduced 1% rate applies only if your client pays via the Revenue Department’s e-Withholding Tax system. This is primarily for domestic/PE transactions. Cross-border Section 70 payments generally remain at 15%.

The Hidden Cost: VAT Form PP36

Many foreign companies miss this critical component. If you provide a service from abroad that is used in Thailand (e.g., software, digital marketing, consulting), that service is subject to 7% VAT.

Since you are not in Thailand to collect VAT, the Thai payer must self-assess and remit this VAT to the government using Form PP36.

- Who pays? Usually, the Thai client pays this 7% out of their own pocket (an added cost to them), but they can claim it back later as input tax.

- Why it matters: If your contract states “$10,000 Net of all taxes,” the Thai client must absorb both the 15% WHT and the 7% VAT.

How to Save Money: Double Tax Agreements (DTA)

Thailand has DTAs with over 60 countries (including Singapore, US, UK, Japan, Australia). Properly applying a DTA can often reduce your WHT from 15% to 0%.

1. Service Fees (Business Profits)

Under most DTAs (e.g., Thailand-Singapore), “Business Profits” are exempt from Thai WHT unless the foreign company has a Permanent Establishment in Thailand.

- Result: A Singapore consultant with no office in Bangkok pays 0% WHT instead of 15%.

2. Royalties

DTAs rarely eliminate tax on royalties but often reduce the rate.

- Standard Rate: 15%

- DTA Rate: Reduced to 5%, 8%, or 10% depending on the IP type (Copyright vs. Patent).

3. How to Claim DTA Benefits

DTA benefits are not automatic. To apply the 0% or reduced rate, your Thai client requires:

- Certificate of Residence (COR): Issued by your local tax authority (e.g., IRAS, IRS, HMRC) proving your tax residency.

- Clear Invoice Breakdown: Distinguish between “Services” (potentially 0% tax) and “Royalties” (taxable).

Calculation: The “Gross-Up” Method

In many contracts, foreign vendors demand to be paid the full invoice amount (“Net of Tax”). In this case, the Thai client must absorb the tax by “grossing up” the payment.

Scenario: You invoice $10,000. You require $10,000 in your bank account. The WHT rate is 15%.

- Calculate the Base for Tax:

10,000/(1−0.15)=$11,764.70 - Calculate the Tax to Pay (PND 54):

$11,764.70×15%=$1,764.70 - Total Cost to Thai Client:

$10,000 (paid to you) + $1,764.70 (paid to Revenue Dept) = $11,764.70

(Plus 7% VAT on the grossed-up amount via Form PP36).

Compliance Checklist & Deadlines

| Form | Purpose | Submission Deadline |

|---|---|---|

| PND 54 | Remitting WHT for foreign payments (Section 70) | 7th of the following month (15th if e-filed) |

| PP 36 | Remitting Self-Assessed VAT (7%) on foreign services | 7th of the following month (15th if e-filed) |

| PND 53 | Remitting WHT for domestic/PE payments | 7th of the following month (15th if e-filed) |

Penalties for Non-Compliance:

- Surcharge: 1.5% of the tax due per month (capped at the tax amount).

- Fine: 100–2,000 THB for late filing.

- Non-Deductibility: If the Thai client fails to deduct WHT, the expense becomes non-deductible for their own Corporate Income Tax, effectively increasing their cost by another 20%.

Conclusion

Navigating Thailand’s Section 70 Withholding Tax is a balance between compliance and cost efficiency. While the standard 15% rate is high, the strategic use of Double Tax Agreements (DTA) can often eliminate this liability entirely for service providers.

Action Plan for Foreign Vendors:

- Audit your status: Ensure you have not accidentally triggered a Permanent Establishment (PE).

- Check the Treaty: Verify if a DTA exists between your country and Thailand.

- Get Certified: Obtain a Certificate of Residence (COR) immediately – it is your primary tool for tax reduction.

- Discuss VAT: Clarify who bears the cost of the PP36 VAT with your Thai client before signing.

Need help interpreting the Thailand-US DTA or filing PND 54?