WINkLink (WIN) represents the first comprehensive decentralized oracle network built specifically for the TRON blockchain ecosystem. As of January 2026, WIN trades at approximately $0.000028 with a market capitalization exceeding $27 million and daily trading volumes surpassing $10 million across major cryptocurrency exchanges. This pillar page provides exhaustive coverage of WINkLink’s technology, use cases, security architecture, market positioning, and practical guidance for investors and developers evaluating this oracle infrastructure project.

1. What is WINkLink (WIN): The Foundation

Understanding the Oracle Problem in Blockchain

Smart contracts represent revolutionary technology for automated, trustless agreement execution on blockchains. Yet they face a fundamental limitation: blockchains cannot directly access data outside their network boundaries. This limitation creates what industry professionals call “the oracle problem”-the challenge of securely bringing real-world data into smart contract systems.

Traditional databases and centralized APIs cannot provide the trustlessness required for blockchain applications. Introducing a single centralized oracle reintroduces the very counterparty risk that blockchain technology eliminates. WINkLink solves this problem through a decentralized oracle network architecture specifically engineered for the TRON ecosystem.

WINkLink’s Positioning Within the Crypto Ecosystem

Launched as the first comprehensive oracle project on TRON, WINkLink operates as a decentralized protocol that connects smart contracts with reliable, verified off-chain data sources. Unlike most oracle solutions built for Ethereum (such as Chainlink), WINkLink leverages TRON’s architectural advantages: higher throughput, significantly lower transaction costs, and native integration with TRON’s rapidly expanding decentralized application ecosystem.

The protocol currently ranks #629 among all cryptocurrencies by market capitalization, demonstrating its specialized positioning within the broader crypto market. WINkLink operates across multiple major cryptocurrency exchanges including OKX, Binance, KuCoin, Kriptomat, and MEXC, ensuring liquidity and accessibility for global investors.

2. How Does WINkLink Technology Work: Technical Architecture

The Decentralized Oracle Node Network

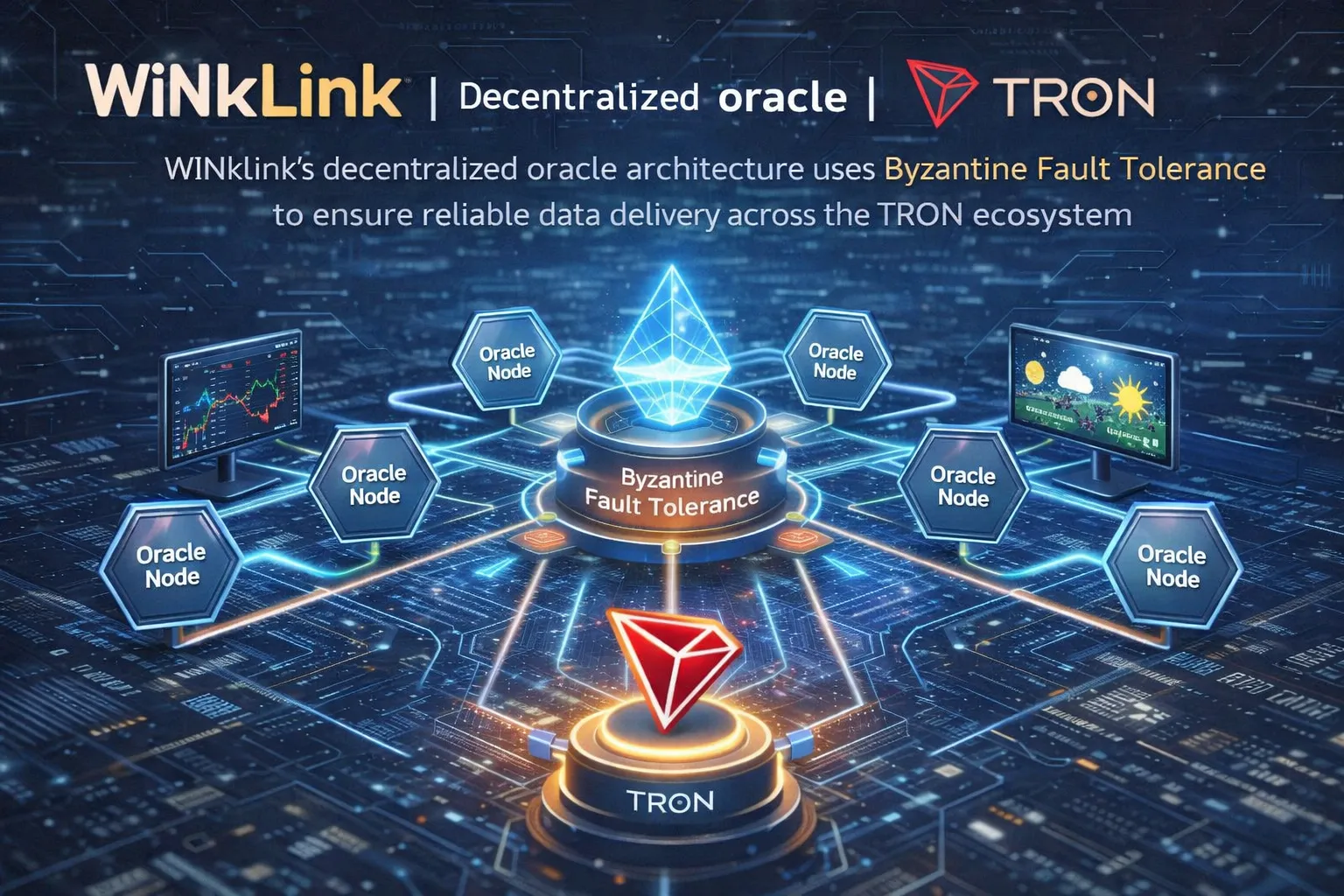

WINkLink operates through a network of independent oracle nodes that collect, verify, and aggregate data from multiple external sources. This decentralized architecture eliminates single points of failure inherent in centralized oracle solutions.

Key architectural components include:

Oracle Nodes: Individual nodes maintain their own sets of data sources, which may overlap with other nodes’ sources. Each node fetches data from these sources, aggregates the results, and participates in the network consensus process. To ensure robustness, the WINkLink network adheres to Byzantine Fault Tolerance (BFT) principles, allowing the system to maintain security even if up to one-third of nodes behave maliciously or malfunction.

The Off-Chain Reporting (OCR) Aggregator: WINkLink recently upgraded from its FluxAggregator system to Off-Chain Reporting technology. This upgrade reduces gas consumption by approximately 65% compared to the previous implementation. For example, a 7-node oracle providing price feeds requires only 1 on-chain transaction with OCR versus 7 transactions with FluxAggregator-consuming roughly 110 TRX in gas costs versus 350 TRX respectively.

Pacemaker Protocol: This component divides report generation into epochs with designated leader nodes. The pacemaker continuously monitors progress and can abort instances if insufficient advancement occurs within specified timeframes. This ensures timely data delivery to smart contracts.

Report Generator: Within each epoch, the protocol operates in rounds, collecting observations from multiple oracle nodes. The system calculates the median value from observations provided by more than 2f honest nodes (where f represents the maximum number of faulty nodes the system can tolerate). This median-based approach ensures Byzantine oracle nodes cannot manipulate reported values beyond the range provided by honest oracles.

Transmission Protocol: After report generation, the transmission protocol uses a sophisticated filtering mechanism to minimize gas expenditure. Rather than submitting every report, the system only transmits reports that either represent the first update since the contract received its last report, or demonstrate a significant deviation from the previously reported value. A randomly selected node from the oracle network transmits the filtered report to minimize on-chain transactions.

Data Aggregation and Quality Assurance

WINkLink implements two complementary strategies to mitigate faulty data sources:

Multi-Source Data Integration: Rather than relying on single data sources, WINkLink aggregates results from multiple independent external sources. Aggregation functions remove abnormal data points and calculate weighted averages, ensuring robust data quality.

Oracle Diversity: By distributing data requests across multiple oracle nodes with partially overlapping data sources, WINkLink prevents any single source or node from unduly influencing reported values.

Real-Time Performance Characteristics

WINkLink’s design philosophy prioritizes:

- Latency Minimization: Achieving report generation within seconds of data source updates, critical for DeFi trading platforms requiring current price information

- Cost Efficiency: Leveraging virtually free off-chain communication between oracles while minimizing on-chain TRON transactions

- Scalability: Supporting growing numbers of data streams and node operators without degrading performance or increasing costs proportionally

- Simplification: Using Trongrid HTTP and gRPC endpoints rather than requiring nodes to maintain full TRON nodes, reducing operational complexity

3. WINkLink vs. Chainlink and Other Oracle Networks: Comparative Analysis

WINkLink vs. Chainlink: Core Differences

Blockchain Foundation

Chainlink operates primarily on Ethereum, inheriting that blockchain’s characteristics: higher transaction costs, slower finality, and sequential transaction processing. WINkLink builds directly on TRON, leveraging Delegated Proof of Stake (DPoS) consensus, which provides faster transaction finality, higher throughput, and substantially lower energy consumption per transaction.

Transaction Cost Comparison

Chainlink users face continuous gas cost increases due to Ethereum’s congestion and fee market dynamics. WINkLink’s TRON foundation provides transaction costs measured in single-digit cents, compared to Ethereum’s dollar-range fees. During network congestion, this cost differential becomes more pronounced.

Data Feed Coverage

Chainlink maintains market-leading breadth of supported data feeds and integrations with established DeFi platforms like Aave and Compound. However, this dominance reflects Ethereum’s current DeFi market share rather than superior technology. WINkLink provides focused coverage of price feeds, VRF (Verifiable Random Function) services, and event data optimized for TRON-based applications.

Governance and Decentralization

Chainlink uses a more centralized approach to node operator selection and network governance, despite operating on Ethereum. Nodes require significant minimum stake requirements and pass through Link Marine’s selection processes. WINkLink implements more distributed governance where the TRON community and node operators collectively determine network parameters through voting mechanisms.

First-Mover Advantage

Chainlink’s 2014 founding and Ethereum ecosystem establishment provide enormous network effects and developer mindshare. WINkLink, launched on TRON in 2019, operates in a less congested oracle market segment. This distinction means WINkLink avoids the “switching costs” that lock Ethereum developers into Chainlink despite potential technical advantages of alternatives.

Comparison with Pyth Network and Other Emerging Oracles

Pyth Network: Focuses on low-latency price data for financial applications, emphasizing frequent updates rather than comprehensive oracle functionality. Pyth complements rather than competes with WINkLink-the former specializes in high-frequency financial data, while WINkLink provides general-purpose oracle services including event data, randomness generation, and broader smart contract integration.

Witnet: A decentralized oracle protocol emphasizing strong cryptographic guarantees. Witnet operates on multiple blockchains but lacks the ecosystem specialization WINkLink achieves through TRON integration.

API3: Provides oracle data through decentralized APIs managed by data providers themselves. API3 emphasizes transparency and direct data source relationships but lacks the comprehensive aggregation framework WINkLink implements.

WINkLink’s Competitive Advantages

- TRON Ecosystem Specialization: Deep integration with TRON dApps including JustLend, Sun.io, and gaming protocols

- Cost Efficiency: 65% lower oracle costs versus FluxAggregator systems

- Byzantine Fault Tolerance: Proven cryptographic security model ensuring data integrity

- Decentralized Governance: Community-driven decision-making on network parameters

- Gaming-Ready Infrastructure: Built-in VRF (Verifiable Random Function) for provably fair randomness in gaming applications

- Multi-Ecosystem Roadmap: Future plans for cross-chain oracle services beyond TRON

4. The WIN Token: Utility, Governance, and Staking

WIN Token Fundamentals

WIN represents a TRC-20 token (TRON’s equivalent to Ethereum’s ERC-20 standard) serving as the economic foundation for WINkLink’s oracle network. Launched with a circulating supply of approximately 990 billion WIN, the token functions as both a utility asset and governance instrument.

Current Token Metrics (January 2026):

- Circulating Supply: 990B WIN

- Fully Diluted Valuation: ~$29.5M

- Market Capitalization: ~$27.9M

- Daily Trading Volume: $10M-$18.3M

- Major Exchange Listings: OKX, Binance, KuCoin, MEXC, Kriptomat, Kraken

Core Use Cases for WIN Tokens

Oracle Service Payment

The primary WIN utility involves paying WINkLink node operators for services:

- Data Retrieval: Operators receive WIN for fetching external data and formatting it into blockchain-readable formats

- Off-Chain Computation: WIN compensates nodes for complex calculations performed outside the blockchain

- Data Aggregation: Operators earn WIN for participating in consensus processes that verify and aggregate data from multiple sources

- Uptime Guarantees: Long-term operators who maintain consistent service receive WIN-denominated rewards

- Service Fees: Smart contract developers deploying oracle requests pay WIN to access data feeds

Staking and Node Operation

Node operators must stake WIN tokens as security collateral:

- Staking demonstrates financial commitment to honest behavior

- Misbehaving nodes face stake slashing (partial or total token loss) as punishment

- Minimum stake requirements ensure operators maintain meaningful exposure to network health

- Staking rewards compensate operators for providing continuous service

Governance and Decision-Making

WIN holders participate in protocol governance:

- Fee Structure Voting: Community determines appropriate compensation levels for different data types

- Network Parameter Adjustments: Stakeholders vote on performance thresholds, Byzantine fault tolerance settings, and expansion parameters

- Software Upgrades: Major protocol improvements require community consensus expressed through WIN holder voting

- New Feature Integration: Proposed additions to the oracle network (new data sources, cross-chain functionality) require governance approval

WIN Token Economics and Incentive Alignment

WINkLink’s token design aligns incentives across all network participants:

Node Operators: Face financial incentives to provide accurate data (reward collection) and penalties for poor performance (stake slashing). This creates powerful motivation for maintaining robust data sources and operational infrastructure.

Token Holders: Benefit from network growth and utility expansion, as increased oracle usage drives demand for WIN tokens. Governance participation allows holders to influence network direction toward their preferences.

Smart Contract Developers: Access reliable oracle infrastructure at market-competitive rates, with fee transparency and predictability enabled through token-based pricing.

Long-Term Token Supply and Deflationary Mechanisms

While total WIN supply remains fixed at approximately 990 billion tokens, the protocol implements several mechanisms that effectively reduce circulating supply:

- Fee Burning: A percentage of transaction fees paid in WIN are permanently removed from circulation

- Staking Lock-ups: Billions of WIN remain locked in node operator stake during active operation periods

- Community Treasury: Governance-controlled reserves accumulate WIN for ecosystem development

These mechanisms create deflationary pressure over time, potentially benefiting long-term holders as inflation-adjusted per-token scarcity increases.

5. Real-World Use Cases and Ecosystem Integration

DeFi Protocol Integration

Lending Platforms: JustLend, a major TRON-based lending protocol, relies on WINkLink for reliable price feeds determining collateral values and liquidation thresholds. Accurate WINkLink data prevents catastrophic liquidations and maintains protocol security.

Yield Farming: Sun.io implements WINkLink price feeds to determine yield distributions across multiple token pairs, ensuring farmers receive fair compensation reflecting current token values.

Decentralized Exchanges: TRON-based DEXs depend on WINkLink for accurate trading prices, preventing flash loan attacks and maintaining price equilibrium across trading pairs.

Gaming and VRF Applications

Provably Fair Gaming: WINkLink’s Verifiable Random Function (VRF) provides cryptographic randomness for gaming dApps, ensuring game outcomes are genuinely random while remaining verifiable on-chain. Players can mathematically verify fairness rather than trusting developer claims.

Wink Gambling Platform: Implements WINkLink’s VRF for slot games, sports prediction markets, and other chance-based applications, providing transparent randomness generation.

NFT Ecosystem: Gaming protocols integrating NFTs use WINkLink randomness for loot drops, character generation, and other probabilistic mechanics, enhancing user experience through verifiable fairness.

Real-World Data Integration Use Cases

While fully deployed use cases remain focused on price feeds, WINkLink’s architecture supports future integration of:

- Sports Event Data: Enabling prediction markets and outcome-based financial instruments

- Weather and Environmental Data: Supporting insurance derivatives and agricultural finance applications

- IoT Sensor Data: Connecting Internet-of-Things devices to smart contracts (supply chain verification, equipment monitoring)

- Supply Chain Events: GPS tracking, customs clearance verification, and shipment milestone confirmations

- Corporate Data: Stock prices, bond yields, and other financial instrument data for institutional-grade applications

Partnerships and Exchange Listings

WINkLink’s legitimacy receives validation through:

Major Exchange Support: Listings on OKX, Binance, KuCoin, and other Tier-1 exchanges ensure liquidity and institutional exposure. Exchanges maintain rigorous listing standards, and WINkLink’s presence demonstrates meeting these requirements.

TRON Ecosystem Partnerships: Deep integration with established TRON dApps provides functional validation of oracle services.

Developer Adoption: Growing number of TRON developers implementing WINkLink integration demonstrates practical utility beyond theoretical potential.

6. Security Architecture and Audit Status

Smart Contract Security Audits

WINkLink’s security posture reflects requirements for an infrastructure protocol handling billions in smart contract value:

Comprehensive Security Audits: Smart contracts implementing WINkLink oracle functionality have undergone professional security audits by specialized blockchain security firms. No critical vulnerabilities were identified in completed audits.

Ongoing Monitoring: The protocol maintains continuous security monitoring systems that track suspicious oracle behavior and potential attack vectors.

Transparent Audit Results: Audit reports are publicly available, allowing developers to independently verify security claims rather than relying on developer assertions.

Byzantine Fault Tolerance and Cryptographic Security

WINkLink implements proven cryptographic protocols specifically designed for decentralized systems:

Byzantine Fault Tolerance: The protocol maintains security guarantees even if up to one-third of oracle nodes behave maliciously (provide false data, perform denial-of-service attacks, or attempt coordinate manipulation). This mathematical guarantee stems from BFT protocol properties: with 2f+1 minimum nodes, honest nodes always constitute a supermajority sufficient to outvote faulty nodes during consensus.

Digital Signature Verification: Each oracle report includes cryptographic signatures from participating nodes. Smart contracts can mathematically verify that sufficient honest nodes endorsed the reported data, ensuring authenticity without requiring trust in individual nodes.

Reputation System: WINkLink maintains on-blockchain records of oracle performance, tracking:

- Availability (uptime and responsiveness)

- Correctness (deviation from other oracle nodes)

- Response time metrics

- Historical penalty payments

This transparent reputation system allows smart contract developers to select oracle providers based on demonstrated performance rather than marketing claims.

Sybil Attack Prevention

Certification Service: WINkLink implements a certification service specifically designed to prevent Sybil attacks-scenarios where attackers control multiple nodes appearing as independent operators but actually coordinating to provide false data.

The certification service:

- Monitors oracle statistics for suspicious patterns (multiple nodes always reporting identical values)

- Conducts post-hoc spot-checking of high-value transaction data by comparing oracle responses with independent data sources

- Identifies nodes employing “mirroring” (fetching data from single sources but misrepresenting as multiple independent sources)

- Issues certifications endorsing legitimately independent oracle operators

Contract-Upgrade Service

Unlike immutable smart contracts deployed on most blockchains, WINkLink implements an optional contract-upgrade service:

Vulnerability Response: If critical security vulnerabilities are discovered after deployment, new contract versions can be deployed while previous versions remain available.

User Choice: Rather than forcing all users to adopt new contracts, WINkLink maintains both old and new versions with users controlling which they employ. This approach respects user autonomy while enabling security improvements.

Decentralized Decision-Making: Upgrade decisions require community consensus rather than developer unilateral action, preventing centralized control.

Comparison of Security Models

WINkLink’s security model differs from centralized alternatives:

- Versus Centralized APIs: Traditional centralized data providers lack the security guarantees that decentralized validation provides

- Versus Chainlink: WINkLink’s Byzantine Fault Tolerance provides equivalent security guarantees with more distributed operator networks

- Versus Weaker Oracles: Single-node oracle solutions or those relying on weak aggregation methods lack the security assurances WINkLink provides

7. Market Performance and Price Analysis

Historical Price Performance and Market Context

Price Trajectory: WINkLink’s price history reflects the cryptocurrency market’s broader volatility and evolving interest in oracle infrastructure:

- Circulating supply of 990 billion WIN creates meaningful price movements from relatively modest trading volume

- Daily trading volumes exceeding $10 million during active periods provide adequate liquidity for most transaction sizes

- Price volatility exceeds broader cryptocurrency market averages, reflecting WINkLink’s smaller market capitalization and more concentrated investor base

Current Valuation: At $0.000028 per token and $27.9 million market capitalization, WINkLink remains significantly smaller than established alternatives:

- Chainlink (LINK): ~$30+ billion market capitalization

- Comparison ratio: Chainlink trades at approximately 1,075x WINkLink’s market cap

This size differential reflects both Chainlink’s established market position and WINkLink’s specialization within the TRON ecosystem.

Price Prediction Analysis and Future Outlook

Multiple cryptocurrency analysis platforms provide WINkLink price forecasts:

2026 Price Targets:

- Conservative estimates: $0.000026 – $0.000029 (minimal growth)

- Moderate estimates: $0.0001 – $0.0004 (150-1,300% gains)

- Optimistic estimates: Up to $0.004 (assuming major institutional adoption)

2027-2030 Projections:

- Moderate scenarios: $0.0003 – $0.0006 range

- Bull case: $0.001+ reflecting significant ecosystem growth

Important Caveats: These predictions represent analyst speculation rather than probability forecasts. Cryptocurrency price prediction accuracy remains low, and factors driving WINkLink’s price evolution include:

- TRON ecosystem adoption rates

- Oracle market consolidation or expansion

- Regulatory environment changes

- Technological breakthroughs or setbacks

- Competition from alternative oracle solutions

Factors Influencing WIN Price

Positive Catalysts:

- Increased DeFi activity on TRON network

- Adoption by major new TRON dApps

- Expansion into cross-chain oracle services

- Improved brand recognition and institutional exposure

- Token burning or supply-reduction mechanisms

Negative Headwinds:

- TRON ecosystem decline or reduced developer activity

- Competitive pressures from established oracle solutions

- Regulatory restrictions on cryptocurrency

- Technical vulnerabilities or oracle failures

- Loss of key partnerships or exchange listings

8. How to Buy, Store, and Secure WIN Tokens

Purchasing WIN on Major Exchanges

Step-by-Step Purchase Process (Using OKX as Example):

- Create and Verify Account: Sign up on OKX, Binance, or another major exchange, providing name, email, phone number, and identity verification (government-issued photo ID)

- Deposit Funds: Transfer fiat currency (USD, EUR, etc.) or cryptocurrency to your exchange account using:

- Bank transfer (SEPA for EU, domestic transfers for other regions)

- Credit/debit card payment (3-5% premium typical)

- Alternative payment methods (Skrill, PayPal where available)

- Navigate to WIN Spot Market: Search for WIN token on the exchange’s trading interface

- Place Market or Limit Order:

- Market order: Purchase immediately at current market price

- Limit order: Set specific price and wait for execution

- Enter quantity in WIN tokens or fiat equivalent

- Review and Confirm: Double-check purchase details and transaction fees before final confirmation

- Secure in Wallet: Transfer WIN from exchange to secure personal wallet (recommended for holdings exceeding $1,000)

Recommended Exchanges for WIN Purchases

Tier-1 Exchanges (Recommended for security and liquidity):

- OKX: Largest trading volumes, 24/7 customer support, comprehensive security features

- Binance: Most established exchange, excellent UI, strong security history

- KuCoin: Specialized in altcoins, good trading tools, competitive fees

- MEXC: Strong TRON ecosystem focus, low fees, responsive support

Alternative Purchase Methods for TRON-Based Tokens:

For users outside regions where exchanges operate, decentralized exchanges (DEXs) provide alternatives:

- Acquire ETH or Another Base Currency: Use exchanges accepting your payment methods

- Transfer to MetaMask Wallet: Set up MetaMask with TRON network support

- Connect to DEX: Link MetaMask to decentralized exchanges like SundexSwap or other TRON DEXs

- Execute Swap: Trade your base currency for WIN at market rates

- Store in Wallet: WIN remains in MetaMask under your control

Optimal Storage Solutions for WIN Tokens

Hardware Wallets (Maximum Security):

- Ledger Nano S Plus (~$79): Industry-standard hardware wallet supporting TRC-20 tokens

- Trezor Model T (~$170): Premium hardware wallet with excellent TRON support

- Process: Connect hardware wallet to desktop application, verify transaction details on device display before signing, sign transaction using device button press

Advantages: Private keys never exposed to internet, resistant to malware and hacking, ideal for long-term holdings exceeding $10,000

Disadvantages: Require one-time purchase, slightly more complex user experience, require physical backup recovery phrase management

Hot Wallets (Convenience vs. Security Trade-off):

- MetaMask: Browser-based wallet enabling quick transactions, suitable for amounts under $1,000

- TronLink: TRON-specific wallet with excellent exchange integration, mobile-friendly interface

- Trust Wallet: Mobile wallet supporting TRON network, accessible but riskier than hardware alternatives

Exchange Storage (Not Recommended for Large Holdings):

- Maintaining WIN on exchanges enables quick trading but exposes tokens to exchange hacking risks

- Use only for quantities you’re actively trading

- Enable two-factor authentication (2FA) on all exchange accounts

Security Best Practices

Immediate Actions Upon Purchasing WIN:

- Enable Two-Factor Authentication: Protect exchange account with 2FA (authenticator app, not SMS)

- Create Secure Password: Use unique, randomly-generated 16+ character passwords

- Record Backup Codes: Save 2FA backup codes in secure location separate from primary passwords

- Record Recovery Phrase: If using non-custodial wallets, securely record 12-24 word recovery phrase

Ongoing Security Maintenance:

- Regular Backup Updates: Test wallet backups periodically to ensure recovery ability

- Avoid Public WiFi: Never access wallet on public networks or shared computers

- Verify Addresses: Always confirm complete token addresses before transactions (copy-paste mitigates typos)

- Monitor Transactions: Regularly review account activity for unauthorized access

- Update Software: Keep wallet applications, operating systems, and browsers current

Advanced Security (For High-Value Holdings):

- Multi-Signature Wallets: Distribute control across multiple devices/people, requiring majority approval for transactions

- Cold Storage: Store private keys offline (paper, hardware wallet) for extended periods

- Geographic Redundancy: Maintain backup recovery phrases in physically separate secure locations

- Deceased Account Planning: Document wallet access procedures for estate beneficiaries

9. Investment Considerations and Risk Assessment

Why Investors Consider WINkLink

Utility-Driven Investment Thesis:

Oracle infrastructure represents genuine utility within cryptocurrency systems. Unlike purely speculative tokens, WIN tokens enable actual smart contract functionality. As TRON-based DeFi grows, oracle demand increases proportionally-creating natural demand growth for WIN tokens.

Undervaluation Thesis:

Compared to Chainlink’s $30+ billion market capitalization, WINkLink operates at 1,000x lower market cap despite providing comparable functionality for a major blockchain ecosystem. This valuation gap suggests potential for repricing as TRON adoption increases.

TRON Ecosystem Growth:

TRON hosts billions in total value locked (TVL) in DeFi protocols, gaming applications, and NFT projects. WINkLink captures value from this ecosystem’s expansion through oracle service demand.

Significant Risks and Limitations

Technology Risks:

- Protocol Vulnerabilities: Undiscovered security flaws could compromise oracle reliability or enable attacks

- Scalability Limitations: As WINkLink usage grows, system architecture might encounter bottlenecks

- Competition: Emerging oracle solutions or competing projects could reduce WINkLink’s market share

Market Risks:

- TRON Ecosystem Decline: If TRON-based applications lose adoption, oracle demand decreases proportionally

- Price Volatility: Cryptocurrency price swings can exceed 20-30% in single day trading sessions

- Liquidity Risk: Unlike highly-capitalized tokens, WIN spreads on exchanges can widen significantly during volatile periods

Regulatory Risks:

- Crypto Regulation: Government restrictions on cryptocurrency trading or token sales could impact WIN liquidity and value

- Oracle Regulation: As regulators examine oracle dependencies in financial applications, new restrictions could emerge

- Geographic Restrictions: Trading restrictions in major markets (China, Russia, specific US states) could reduce addressable market

Operational Risks:

- Team and Leadership: Project success depends on continued technical development and community engagement from core team

- Partnership Stability: Reliance on TRON ecosystem and JustLend, Sun.io relationships creates concentration risk

- Exchange Listing Risk: Delisting from major exchanges would severely impact liquidity

Investment Strategy Recommendations

For Conservative Investors:

- Limit WINkLink to 1-3% of cryptocurrency portfolio

- Focus on long-term holding (2+ years) rather than trading

- Dollar-cost average into position across 6-12 months

- Use hardware wallet storage for amounts exceeding $5,000

For Growth-Oriented Investors:

- Allocate 5-10% of cryptocurrency portfolio to oracle infrastructure plays

- Monitor TRON ecosystem development metrics and adoption trends

- Consider profit-taking at 2x, 5x, and 10x return milestones

- Maintain staking position to earn additional WIN rewards

For Traders/Active Investors:

- Trade volatility swings around support/resistance levels

- Monitor exchange volumes for liquidity patterns

- Follow crypto social media and sentiment indicators

- Use stop-loss orders to limit downside risk (typically 10-15% below entry)

For DAO/Governance Enthusiasts:

- Stake WIN tokens to participate in governance decisions

- Monitor protocol development and voting processes

- Engage with community discussions and proposal reviews

- Consider node operation if technical requirements are manageable

10. Frequently Asked Questions About WINkLink (WIN)

General Questions

Q: What exactly is WINkLink (WIN), and why does it matter?

A: WINkLink is a decentralized oracle network connecting smart contracts on the TRON blockchain with reliable real-world data. It matters because smart contracts cannot natively access external information-without oracles, blockchain applications cannot interact with prices, events, or other off-chain data. WINkLink specifically solves this problem for the TRON ecosystem, enabling DeFi, gaming, and other applications requiring trusted external data.

Q: Is WINkLink the same as Chainlink?

A: No. While both are oracle networks, they serve different purposes. Chainlink operates primarily on Ethereum and charges higher gas fees due to Ethereum’s congestion. WINkLink specializes in the TRON blockchain, offering lower costs and better integration with TRON dApps. Chainlink has larger market capitalization and broader adoption, but WINkLink provides superior value for TRON-based applications.

Q: How does the WIN token differ from LINK (Chainlink)?

A: While similar in function, WIN and LINK serve their respective blockchain ecosystems. WIN benefits from TRON’s faster, cheaper transaction processing, resulting in lower oracle service costs. LINK holders benefit from Ethereum’s larger ecosystem but face higher transaction costs. The price of WIN is currently 1,000x lower than LINK, reflecting market capitalization differences rather than functionality differences.

Q: What rank does WINkLink hold in the cryptocurrency market?

A: As of January 2026, WINkLink ranks #629 by market capitalization among all cryptocurrencies, with a market cap around $27.9 million. This ranking reflects its specialized positioning within the TRON ecosystem rather than representing either success or failure-many successful utility tokens maintain mid-to-lower-tier market cap rankings.

Technical and Security Questions

Q: Is WINkLink safe? Have the smart contracts been audited?

A: Yes, WINkLink’s smart contracts have undergone professional security audits by specialized blockchain security firms. Audits identified no critical vulnerabilities. The protocol implements Byzantine Fault Tolerance cryptographic security and maintains ongoing security monitoring. Like all cryptocurrency projects, it carries inherent risk, but the security architecture is robust and has been independently validated.

Q: How does WINkLink prevent oracle attacks or data manipulation?

A: WINkLink prevents attacks through multiple mechanisms:

- Byzantine Fault Tolerance: Even if one-third of oracle nodes become compromised, honest nodes retain supermajority and prevent false data acceptance

- Data Aggregation: Median calculations across multiple independent data sources prevent individual source manipulation

- Reputation System: Transparent performance tracking allows developers to identify and avoid unreliable oracle nodes

- Certification Service: Detects Sybil attacks (multiple fake nodes appearing independent) through statistical pattern analysis

- Stake Slashing: Node operators face financial penalties for providing inaccurate data, creating powerful incentive for honesty

Q: What happens if a WINkLink oracle provides false data?

A: The protocol addresses oracle failures through multiple layers:

- Immediate Detection: Off-chain computation compares new data against historical trends and other oracle reports

- On-Chain Verification: Smart contracts can verify oracle report signatures and reject those lacking sufficient validator signatures

- Reputation Impact: Poorly-performing oracles receive lower reputation scores, reducing likelihood of future selection

- Stake Slashing: Consistently inaccurate oracles can face partial loss of staked WIN tokens

- Community Response: Users can migrate to alternative oracle providers if reliability declines

Q: Can WINkLink expand beyond TRON?

A: The WINkLink roadmap explicitly includes cross-chain oracle functionality. While currently TRON-specialized, future development phases envision supporting additional blockchains. This expansion would increase WIN token utility across broader cryptocurrency ecosystem, potentially increasing value significantly. However, cross-chain expansion remains in planning phases rather than current implementation.

Investment and Market Questions

Q: Does WINkLink (WIN) have a future?

A: WINkLink’s future depends on several factors: TRON ecosystem adoption, oracle market growth, regulatory environment, and competitive dynamics. Positive indicators include deep TRON ecosystem integration, growing DeFi activity, and technological advantages. Risks include TRON competition and regulatory uncertainties. Most analysts maintain neutral-to-bullish outlooks, reflecting reasonable potential balanced against execution risks.

Q: Should I buy WINkLink in 2026?

A: This depends on your investment objectives, risk tolerance, and portfolio composition. WINkLink merits consideration for cryptocurrency investors seeking oracle infrastructure exposure at lower market valuation than Chainlink. However, investment decision requires individual analysis of:

- Your risk tolerance (WINkLink exhibits volatility)

- Your timeline (longer holding periods reduce volatility impact)

- Your portfolio diversification (avoid overconcentration in single tokens)

- Your belief in TRON ecosystem growth

If any of these factors present concerns, reduce allocation size or skip the investment entirely.

Q: What’s a realistic price target for WIN?

A: WINkLink price forecasting remains speculative. Realistic scenarios include:

- Conservative 2026: $0.000029-$0.0001 (modest growth)

- Moderate 2026: $0.0001-$0.0004 (significant growth)

- Optimistic Long-term (2030): $0.001-$0.004 (if major adoption occurs)

Price depends fundamentally on TRON ecosystem utilization growth and cryptocurrency market cycles. Nobody can reliably predict these factors. Avoid making investment decisions based on price predictions alone.

Q: What would cause WINkLink to “moon” (spike significantly)?

A: Potential “moonshot” catalysts include:

- Major institutional adoption of TRON-based DeFi platforms

- Regulatory approval of oracle-enabled financial instruments

- Successful cross-chain expansion announcement

- Integration with major traditional financial institution

- Acquisition or partnership with tier-1 blockchain platform

- Significant TRON network upgrade or user base growth

Conversely, negative catalysts could trigger opposite price movements. Weigh both possibilities in investment decisions.

Q: Will Wink ever go up significantly?

A: Technically, any token with trading volume shows price fluctuation-“up” movements occur regularly. The more relevant question: will WINkLink experience sustained price appreciation reflecting genuine utility expansion? This depends on TRON ecosystem growth and oracle market evolution. Skeptics doubt this; bulls believe TRON’s underutilization relative to Ethereum creates significant appreciation potential.

Your personal outlook on TRON’s future should drive your WIN investment decision more than historical price charts.

Purchasing and Storage Questions

Q: How do I buy WINkLink tokens?

A: Purchase via major exchanges:

- Create account on OKX, Binance, KuCoin, or MEXC

- Complete identity verification

- Deposit fiat currency or cryptocurrency

- Search for WIN on spot trading market

- Place buy order at market or limit price

- Confirm transaction

- Transfer to secure wallet for storage

Detailed step-by-step process is provided above in “How to Buy, Store, and Secure WIN Tokens.”

Q: What’s the best way to store WIN tokens?

A: Storage choice depends on holding quantity and security priority:

- Hardware Wallets (Ledger, Trezor): Maximum security for holdings exceeding $5,000

- Hot Wallets (MetaMask, TronLink): Convenience for active trading under $1,000

- Exchange Storage: Not recommended except for amounts actively trading

Never share private keys or recovery phrases. Enable two-factor authentication universally.

Q: Can I stake WIN tokens and earn rewards?

A: Yes, WINkLink includes staking mechanisms for node operators. However, node operation requires technical expertise and significant WIN stake (minimum amounts vary). Casual investors can typically achieve better returns through trading or holding appreciation rather than staking. If interested in staking, research minimum requirements and responsibilities thoroughly before committing funds.

Q: What exchanges list WIN tokens?

A: Major exchanges currently listing WIN include:

- OKX (largest volumes)

- Binance

- KuCoin

- MEXC

- Kriptomat

- Kraken

- Additional regional exchanges in various countries

Availability varies by geographic region. Check current listings as they change occasionally.

Comparative and Strategic Questions

Q: How does WINkLink compare to other TRON-based protocols?

A: WINkLink occupies the oracle infrastructure niche within TRON. Other major TRON protocols serve different functions: JustLend (lending), Sun.io (yield farming), BTT (file sharing), etc. These protocols often depend on WINkLink for reliable data, creating symbiotic relationships. Competition within oracle space on TRON remains minimal, giving WINkLink dominant positioning.

Q: Should I diversify between WINkLink and Chainlink?

A: Many investors maintain exposure to both:

- Chainlink (LINK): Larger market cap, established dominance, multi-blockchain support, higher price

- WINkLink (WIN): Lower valuation, TRON-specific strength, potentially higher growth rates

A hybrid approach provides oracle infrastructure exposure across ecosystems while reducing single-token concentration risk. Allocation depends on your TRON vs. Ethereum ecosystem beliefs.

Q: What’s the difference between investing in WIN vs. holding TRON (TRX)?

A: These represent different exposure levels:

- TRON (TRX): General TRON network infrastructure; benefits broadly from TRON adoption

- WINkLink (WIN): Specialized oracle infrastructure; benefits specifically from DeFi and data-dependent applications growth

WINkLink shows higher volatility but potentially higher upside if DeFi specialization creates concentrated growth. TRON provides more diversified ecosystem exposure with lower volatility.

Q: Is WINkLink overvalued or undervalued currently?

A: Valuation assessment remains subjective. Arguments for undervaluation:

- Significantly smaller market cap than functionally equivalent Chainlink

- Growing TRON DeFi ecosystem showing increasing oracle demand

- Lower valuation reflects market recognition of oracle importance

Arguments for fair valuation:

- Smaller addressable market (TRON-only vs. Chainlink’s multi-chain)

- Concentrated ecosystem risk

- Limited institutional adoption compared to Chainlink

Evaluate both perspectives before deciding if current pricing represents opportunity or risk.

Regulatory and Future Questions

Q: Are there regulatory risks with WINkLink?

A: Potential regulatory risks include:

- Cryptocurrency Trading Restrictions: Stricter regulations could limit token trading

- Oracle Regulation: As oracles enable financial applications, regulators may impose new requirements

- Money Transmission Licensing: Node operators might face regulatory classification questions

- Geographic Restrictions: Specific countries may restrict access or trading

These remain uncertain. Monitor regulatory developments in your jurisdiction before investing.

Q: What’s WINkLink’s long-term roadmap?

A: The published roadmap focuses on:

- Improving safety and reliability of oracle system

- Expanding data source quality and variety

- Improving ease of use for smart contract developers

- Future cross-chain oracle functionality

More detailed roadmap information should be obtained from official WINkLink documentation and community channels.

Q: Could WINkLink be replaced or become obsolete?

A: Technological disruption risks exist for any cryptocurrency project:

- Competing oracle solutions might achieve superior technology or adoption

- TRON’s market position could decline, reducing oracle demand

- Blockchain technology could evolve in directions making current oracles irrelevant

However, WINkLink’s current deep TRON integration creates significant switching costs protecting against near-term displacement.

Q: What should I watch to stay informed about WINkLink?

A: Key information sources:

- Official WINkLink website: winklink.org

- GitHub repositories: Technical development tracking

- TRON community forums: Ecosystem discussions

- Major cryptocurrency news sites: Announcements and market analysis

- Exchange listings: Volume and liquidity trends

- Reddit and Twitter: Community sentiment indicators

Regular information review enables informed decision-making as the project evolves.

WINkLink in the Broader Cryptocurrency Context

WINkLink (WIN) represents a specialized infrastructure solution addressing specific technical requirements within the TRON blockchain ecosystem. Unlike many cryptocurrency projects characterized primarily by speculation, WINkLink provides genuine utility-connecting smart contracts with reliable external data through decentralized oracle mechanisms.

The technology demonstrates maturity, with professional security audits, Byzantine Fault Tolerance implementation, and active ecosystem integration validating technical soundness. The WIN token implements economically rational incentive structures aligning network participants toward honest behavior and reliable service provision.

From an investment perspective, WINkLink presents an alternative valuation opportunity relative to established oracle infrastructure competitors like Chainlink. However, this alternative reflects both opportunity and risk-opportunity stemming from potentially undervalued positioning within a growing TRON ecosystem, risk arising from concentrated ecosystem dependence and competition uncertainties.

Individual investment decisions should reflect personal risk tolerance, technical conviction regarding TRON’s future, and portfolio composition objectives. Neither dismissing WINkLink as insignificant nor assuming inevitable explosive appreciation represents reasonable analysis. Thorough evaluation of the factors outlined throughout this pillar page enables informed decision-making aligned with individual investor objectives and constraints.

The cryptocurrency infrastructure market remains early-stage, with oracle solutions evolving rapidly. WINkLink’s specialized positioning, ongoing technical development, and ecosystem integration suggest meaningful long-term relevance within blockchain systems requiring reliable external data integration. Whether this relevance translates into investment returns remains contingent on factors partly within the project’s control and partly dependent on broader market developments.

Last Updated: January 14, 2026

Disclaimer: This content is provided for informational purposes only and does not constitute financial advice, investment recommendation, or guarantee of future performance. Cryptocurrency investments involve substantial risk including potential total loss of invested capital. Conduct thorough personal research and consult qualified financial advisors before making investment decisions.