Thailand’s tax system can seem complex, especially for foreigners and first-time filers. This comprehensive guide covers everything you need to know about Thai tax filing, including filing deadlines, tax rates, deductions, penalties, and answers to the most common questions that expats and residents face.

Understanding Your Tax Residency Status in Thailand

Before filing, you must determine your tax residency status, as it directly affects your tax obligations. Thailand uses the 180-day rule to determine tax residency: if you spend 180 or more days in Thailand during a calendar year, you are considered a tax resident and must file an annual tax return on your worldwide income. Non-residents who stay fewer than 180 days are only taxed on income earned within Thailand.

This distinction is critical because tax residents must report both Thai-sourced income and foreign-sourced income remitted to Thailand within the same tax year. Non-residents, by contrast, have no obligation to report foreign income, even if substantial amounts are transferred into Thailand.

Critical Tax Filing Deadlines for 2026

The 2026 tax filing deadline depends entirely on your chosen filing method. Paper returns filed at a local Revenue Department office must be submitted by March 31, 2026. If you file electronically through the Thai Revenue Department’s official e-filing portal (efiling.rd.go.th), the deadline extends to April 8-9, 2026. This eight-day extension applies to all eligible electronic filings and represents a significant advantage for taxpayers who file online.

Missing either deadline triggers automatic penalties, regardless of whether you owe taxes. This makes early filing a strategic priority rather than a last-minute task.

Thailand’s Progressive Personal Income Tax Rates

Thailand applies progressive tax rates ranging from 0% to 35% on personal income. Critically, the first 150,000 THB of annual income is completely tax-exempt. This means many employees and self-employed individuals with moderate incomes may owe zero tax even if they’re required to file a return.

| Taxable Income (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | Exempt |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,000 | 35% |

Example: If your annual taxable income is 600,000 THB, you would calculate tax as follows: 150,000 THB (exempt) + 150,000 THB @ 5% (7,500 THB) + 200,000 THB @ 10% (20,000 THB) + 100,000 THB @ 15% (15,000 THB) = 42,500 THB total tax owed.

Determining Which Tax Form You Must File

Thailand requires different tax forms based on your income sources. Form PND 91 is for individuals with only employment income (salary, wages, or pension). This simplified form has a lower filing threshold and is the most common choice for employees.

Form PND 90 is required if you have any income beyond simple employment, such as:

- Self-employment or business income

- Rental income from property

- Dividend or interest income

- Professional services income

- Any combination of income types

Choosing the wrong form can delay processing or trigger corrections from the Revenue Department, so verify your income sources before filing. If you’re uncertain, PND 90 is the safer choice.

Maximum Deductions and Allowances That Reduce Your Tax Bill

Thai tax law provides numerous deductions and allowances that significantly reduce your taxable income. Understanding these options is essential for minimizing your tax liability.

Standard Deductions by Income Type: Employment income is deductible at 50% of gross salary, up to a maximum of 100,000 THB. Self-employment and business income follow similar rules but vary by profession-ranging from 10% to 60% depending on business type and whether you use actual or standard deductions.

Personal and Family Allowances: Every taxpayer receives a 60,000 THB personal allowance. If you’re married, your spouse qualifies for an additional 60,000 THB spousal allowance (if they have no income). Children qualify for 30,000 THB each, or 60,000 THB for children born in 2018 onwards. Parents over 60 years old who depend on you add another 30,000 THB per parent.

Tax-Advantaged Investments: Contributions to retirement mutual funds (RMFs) are deductible up to 30% of income or 500,000 THB (combined with pension contributions). Life insurance premiums are deductible up to 100,000 THB, while home mortgage interest on your primary residence is deductible up to 100,000 THB.

Recent Incentives: Home construction costs under contracts entered from April 2024 onwards are deductible at 10,000 THB per 1 million THB spent, up to 100,000 THB. Purchases of art and donations to eligible causes also qualify for deductions under specific conditions.

Understanding Thailand’s Foreign Income Tax Rules (Critical for 2024+ Earnings)

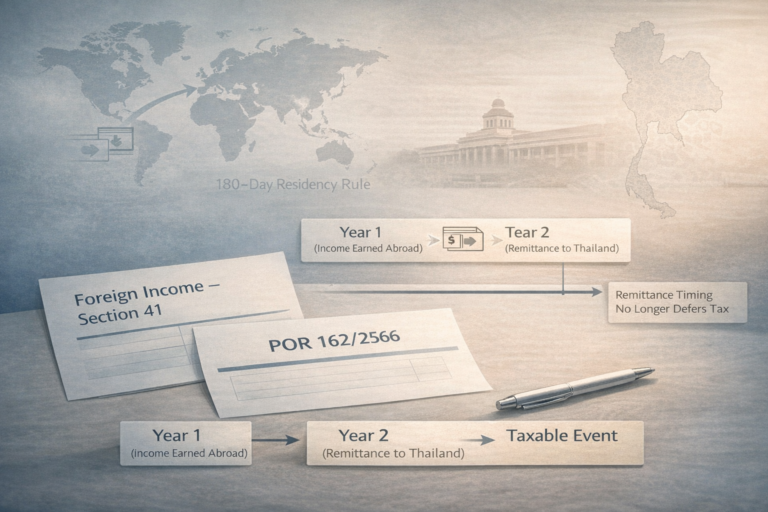

Starting January 1, 2024, Thailand fundamentally changed how it taxes foreign-sourced income. Under the new “remittance rule,” foreign income becomes taxable only when it enters Thailand-not when it’s earned or held overseas.

Income earned from 2024 onwards is taxable in Thailand if you were a tax resident in the year it arose AND you remit the funds to Thailand. This applies regardless of when the remittance occurs-if you earn money abroad in 2025 and bring it into Thailand in 2026, it’s still taxable at 2025 rates.

Income earned before January 1, 2024 is permanently exempt from Thai tax, even if remitted years later. This grandfather provision protects individuals who accumulated overseas savings before the rule change.

Proposed relief (pending legislation): The Thai Revenue Department has drafted amendments offering a two-year grace period-foreign income would be exempt if remitted within the same year it’s earned or the following year. Income brought into Thailand after this window would remain taxable. This legislation is expected to take effect in the first quarter of 2026, though it requires Cabinet and Council of State approval.

Claiming Tax Relief Through Double Taxation Agreements

If you paid taxes on foreign income in your home country, you can avoid double taxation through Thailand’s Double Taxation Agreements (DTAs) with 61+ countries. These agreements typically use one of two methods:

Exemption Method: Your country of residence (Thailand) completely exempts foreign-sourced income from taxation if it’s already taxed in the source country. This creates a clean division of taxing rights.

Credit Method: Thailand taxes your total income but grants a credit for taxes paid abroad, effectively limiting your Thai tax to the difference between Thai and foreign tax rates.

To claim DTA benefits, you must obtain official tax certificates from the source country proving taxes paid and submit them with your Thai tax return. DTA eligibility depends on your residency in a treaty country-verify that your home country has an active DTA with Thailand before relying on these provisions.

Tax Penalties and Enforcement: What Happens If You File Late or Not at All

Thailand’s Revenue Department enforces strict compliance. Late filing penalties are automatic and escalate quickly:

For filing late but within reasonable timeframes:

- Standard late filing fine: 2,000 THB

- Interest on unpaid tax: 1.5% per month (accumulating from due date until payment)

For significantly overdue or missing returns:

- Penalties can reach 100-200% of unpaid tax if the Revenue Department determines you should have filed

- Additional interest continues accruing at 1.5% monthly

- Criminal charges possible in fraud cases (imprisonment up to 7 years)

Beyond financial penalties, non-compliance can trigger:

- Full audit of your financial records

- Suspension or non-renewal of work permits

- Visa status complications

- Potential deportation in severe cases

Filing late is far preferable to not filing at all. Even overdue submissions avoid the most severe penalties, and the Revenue Department rarely pursues prosecution for honest mistakes if you correct them promptly.

Step-by-Step Filing Process for 2026

Step 1: Obtain Your Tax Identification Number (TIN)

If you don’t have a TIN, visit your local Revenue Department office with your passport, work permit (if applicable), and employment documentation. This 10-digit number is required before filing and takes days to obtain.

Step 2: Gather Required Documentation

- Employment income: payslips, employment contracts, withholding tax statements (Form PND 1)

- Self-employment income: invoices, expense receipts, business records

- Investment income: bank statements, dividend notices, interest statements

- Foreign income: original payslips, tax paid certificates, proof of remittance to Thailand

- Deductible expenses: insurance receipts, mortgage statements, donation certificates, fund contribution records

Step 3: Choose Your Filing Method

Access the e-filing portal at efiling.rd.go.th (online) or visit your local Revenue Department office (in-person). Online filing is recommended-it’s faster, provides automatic calculations, allows multiple payment options, and extends your deadline to April 8-9.

Step 4: Complete the Correct Tax Form

File PND 91 if your sole income source is employment. Use PND 90 for all other situations, including self-employment, rental income, or mixed income sources. The form requires detailed income breakdown by category, applicable deductions, and tax calculations.

Step 5: Pay Your Tax and Submit

Once your form is complete, you’ll see your calculated tax liability. Pay immediately using online banking, credit card, or ATM transfers (for e-filing) or cash/bank transfer at the office (for paper filings). Keep payment receipts-the Revenue Department may request proof of payment during audits.

Frequently Asked Questions About Thai Tax Filing

Q: Do I have to file a tax return if I didn’t earn any income in 2025?

No. You only file if you earned assessable income exceeding 120,000 THB (for single individuals) or 220,000 THB (for married couples). Income below these thresholds has no filing requirement, even if you’re a tax resident.

Q: What happens if I file my tax return after April 9, 2026?

You’ll face a 2,000 THB fixed fine plus 1.5% monthly interest on any unpaid tax. The penalty increases if the delay exceeds 30 days. However, late filing is still far better than not filing at all-penalties for deliberate non-filing can reach 200% of your tax debt.

Q: Can I claim deductions for expenses if I’m an employee with only salary income?

Yes. Even employees filing PND 91 can claim the standard 50% employment income deduction (up to 100,000 THB) plus all personal and family allowances. You cannot, however, claim business-related or professional expenses-those require PND 90.

Q: Is my foreign income automatically taxable if I bring it into Thailand?

For income earned from 2024 onwards: Yes, foreign income becomes taxable when remitted if you were a tax resident that year. For income earned before 2024: No, it remains permanently exempt regardless of remittance timing. The proposed two-year grace period (expected 2026) would expand the exemption window.

Q: Can I use a Double Taxation Agreement to avoid paying tax on foreign income in Thailand?

Possibly. If you’re a tax resident of a country with a DTA with Thailand, you may claim a tax credit for taxes paid abroad or qualify for an exemption under the treaty’s specific provisions. You must submit proof of foreign taxes paid and obtain official tax certificates.

Q: What’s the difference between PND 90 and PND 91, and which should I file?

PND 91 is simpler and designed exclusively for employees with single-source employment income. PND 90 is comprehensive and required if you have self-employment, business, rental, investment, or mixed income. When in doubt, PND 90 is the safer choice-filing the wrong form can cause delays.

Q: Do DTV visa holders have to pay tax on their income?

Only if they stay in Thailand more than 180 days in a calendar year. DTV holders staying under 180 days are non-residents and only owe tax on Thai-sourced income. Those exceeding 180 days become tax residents and must report foreign income remitted to Thailand.

Q: What records should I keep for tax compliance?

Maintain records for at least 5 years, including: payslips and income statements, business invoices and receipts, proof of tax payments (withholding and annual), deduction documentation (insurance, donations, mortgage), and bank statements showing foreign remittances. The Revenue Department requests these during audits.

Q: Can I file my tax return before January 1 of the following year?

No. Tax returns for 2025 income can only be filed starting January 1, 2026 and must be submitted by March 31 (paper) or April 8-9 (e-filing). Filing before the tax year closes is not permitted by the Revenue Department system.

Q: What happens if my employer didn’t withhold tax from my salary?

You remain responsible for filing and paying any due tax by the March 31 deadline. Lack of withholding is an employer responsibility issue-it doesn’t relieve your obligation to file. However, you may pursue the employer for reimbursement if withholding was legally required.

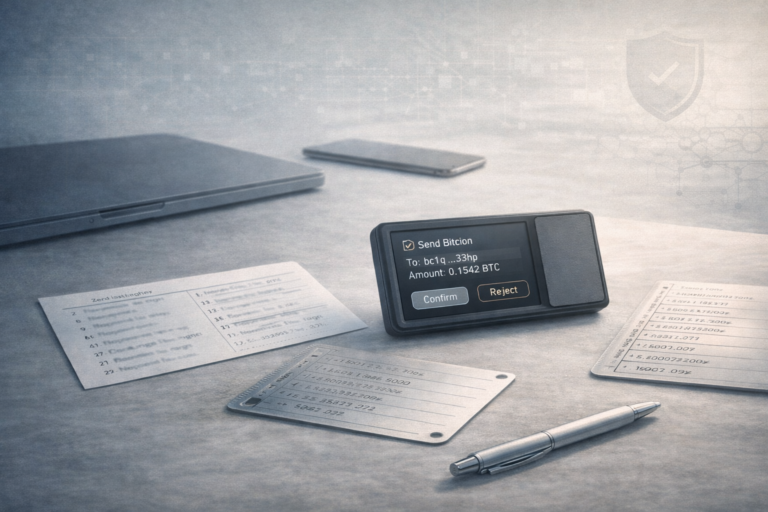

Q: Is income from cryptocurrency, freelancing, or online work subject to Thai tax?

Yes. All assessable income-regardless of source-is taxable if you’re a tax resident and earned it in a year you qualified for residency. Freelancing income, cryptocurrency gains, and online work must be reported under self-employment income categories on PND 90.

Final Recommendations for Successful 2026 Tax Compliance

File electronically to gain the April 8-9 extended deadline and avoid the risks of paper filing. The e-filing system is secure, performs automatic calculations, and provides instant submission confirmation.

File early if possible, rather than waiting until late March or early April. Early filing reduces stress, minimizes errors, and protects you against unexpected complications.

Organize documentation throughout the year rather than scrambling in March. Maintain a folder for all income statements, receipts, and supporting documents so you’re ready when filing season arrives.

Consult a Thai tax professional if your situation involves foreign income, multiple income sources, complex deductions, or DTA claims. The cost of professional advice is minimal compared to penalties for errors or missed optimizations.

Keep payment receipts and filing confirmations for at least 5 years. The Revenue Department conducts random audits, and documentation is your proof of compliance.

Thai tax filing doesn’t have to be stressful. By understanding deadlines, tax rates, available deductions, and filing requirements, you can confidently navigate the system, minimize your tax liability, and maintain full compliance with Thai law. Start early, stay organized, and consider professional guidance for complex situations-this approach ensures you file correctly and on time every year.