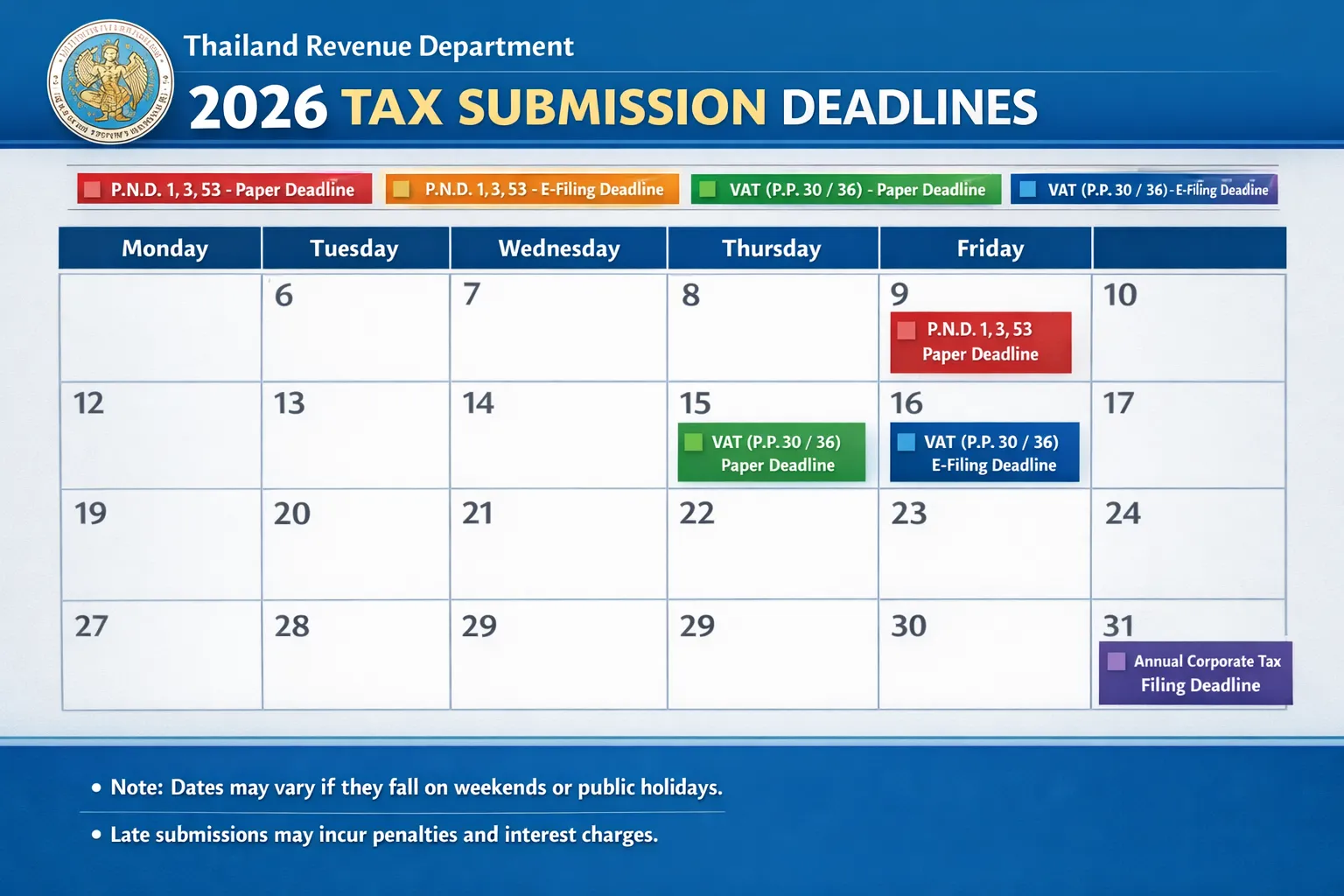

Tax Deadlines in January

Tax Calendar

Tax Deadlines in February

Tax Calendar

Tax Deadlines in March

Tax Calendar

Tax Deadlines in April

Tax Calendar

Tax Deadlines in May

Tax Calendar

Tax Deadlines in June

Tax Calendar

Tax Deadlines in July

Tax Calendar

Tax Deadlines in August

Tax Calendar

Tax Deadlines in September

Tax Calendar

Tax Deadlines in October

Tax Calendar

Tax Deadlines in November

Tax Calendar

Tax Deadlines in December

Tax Calendar

Thailand’s 2026 tax filing season requires careful planning and attention to multiple deadlines across income types and filing methods. This comprehensive guide covers personal income tax, corporate tax, VAT, and withholding tax deadlines, along with rates, deductions, exemptions, and critical compliance requirements for residents, non-residents, and expatriates. Whether you’re an individual employee, business owner, or expatriate, understanding Thailand’s tax calendar ensures you remain compliant while optimizing deductions and managing liabilities effectively.

1. Understanding Thailand’s Tax Year & System Overview

What is Thailand’s Tax Year?

Thailand’s tax year follows the calendar year: January 1 to December 31. Unlike some countries with fiscal year flexibility, the Thai tax system operates on a fixed calendar-based cycle. This means all taxable income earned from January 1 through December 31 is filed in the following year’s filing season (typically March–May).

Who Must File a Tax Return?

Thailand uses a 180-day rule to determine tax residency status. Any individual physically present in Thailand for 180 or more days during a single calendar year-whether continuous or cumulative-is classified as a Thai tax resident and must file a tax return on their worldwide income. This threshold is one of the most critical factors in Thai tax planning, as it determines the scope of your tax obligations.

Non-residents (those with fewer than 180 days in Thailand) are only taxed on Thailand-sourced income and can avoid filing on foreign-earned income.

Key Tax Administration Bodies

- Revenue Department (กรมสรรพากร): Administers income tax, corporate tax, VAT, and withholding tax

- Department of Business Development (DBD): Requires financial statement filings for companies

- Social Security Office: Manages social security contributions

2. 2026 Tax Filing Calendar: Critical Deadlines at a Glance

| Tax/Report Type | Form | Frequency | Paper Filing Deadline | E-Filing Deadline | Notes |

|---|---|---|---|---|---|

| Withholding Tax (Salary) | PND 1 | Monthly | 7th of following month | 15th of following month | Mandatory e-filing since Jan 2024 |

| Withholding Tax Annual Summary | PND 1 Kor | Annually | 28 February 2026 | 8 March 2026 | Employers only; all employees |

| Social Security Contributions | Sor Por Sor 1-10 | Monthly | 15th of following month | 22nd of following month | Payroll-related |

| Half-Year Personal Income Tax | PND 94 | Semi-annually (Jan–Jun) | 30 September 2025 | 8 October 2025 | Non-employment income only |

| Half-Year Corporate Tax Prepayment | PND 51 | Semi-annually (Jan–Jun) | 31 August 2026 | 8 September 2026 | Estimated tax for companies |

| Annual Personal Income Tax | PND 90/91 | Annually (2025 income) | 31 March 2026 | 8 April 2026 | Individuals and residents |

| Annual Corporate Income Tax | PND 50 | Annually (FY2025) | 30 May 2026 | 7 June 2026 | All companies; within 150 days of year-end |

| VAT Return (Domestic) | PP 30 | Monthly | 15th of following month | 23rd of following month | Updated form effective 1 March 2026 |

| VAT Return (Reverse Charge) | PP 36 | Monthly | 7th of following month | 15th of following month | Services from foreign providers |

| Financial Statement Submission | DBD e-Filing | Annually | 30 May 2026 | 30 May 2026 | Within 1 month of AGM or 150 days from FYE |

| Annual General Meeting (AGM) | N/A | Annually | – | – | Must be held within 4 months of FYE (30 April 2026) |

Critical Insight: E-filing extensions provide an 8-day advantage across most forms. Filing electronically through the Revenue Department’s official e-filing portal (efiling.rd.go.th) is strongly recommended to avoid rushed compliance and late-filing penalties.

3. Personal Income Tax in Thailand 2026

Filing Requirements & Tax Residency

You must file a personal income tax return if you meet either of these criteria:

- You are a Thai tax resident (180+ days in Thailand in 2025) with any assessable income

- You earned Thailand-sourced income in 2025, regardless of your residency status

The 180-Day Rule Explained

The 180-day threshold is calculated on a calendar-year basis:

- Days counted: All days physically present in Thailand, whether continuous or fragmented

- Reset annually: The count begins fresh on January 1 each year

- Visa type irrelevant: Tourist visas, education visas, work permits-all count toward the 180-day threshold

- Example: If you arrive January 15 and leave December 15, you have 335 days and are a tax resident for the full year

Action Item: If you’re close to the 180-day threshold, document your entry/exit dates carefully. The Revenue Department can audit travel records up to 5 years back.

Personal Income Tax Rates 2026

Thailand uses a progressive tax rate structure that taxes income at increasing rates as the total taxable income rises. After applying deductions and allowances, your remaining assessable income is taxed as follows:

| Taxable Income (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | 5% |

| 150,001 – 300,000 | 10% |

| 300,001 – 500,000 | 15% |

| 500,001 – 750,000 | 20% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,000 | 35% |

Planning Tip: The progressive rate structure rewards strategic timing of deductions and investment into tax-deductible savings vehicles (up to 500,000 THB combined in pension/provident funds). Even small reductions in taxable income can shift your income bracket downward, resulting in significantly lower tax liability.

Personal Income Tax Deductions & Allowances 2026

Thailand’s personal tax deductions work in two stages: standard deductions on income categories, followed by personal allowances applied to the taxable income.

Stage 1: Category-Specific Standard Deductions

These deductions apply to different types of income:

| Income Source | Deduction Rate | Maximum |

|---|---|---|

| Salary/Wages/Pensions | 50% of income | 100,000 THB |

| Service Fees, Agent Fees, Director Fees | 50% of income | 100,000 THB |

| Rental Income (Buildings/Vehicles) | 30% of income | No maximum |

| Rental Income (Agricultural Land) | 20% of income | No maximum |

| Rental Income (Other Land) | 15% of income | No maximum |

| Medical Services | 60% of income | No maximum |

| Engineering/Architecture/Legal/Accounting | 30% of income | No maximum |

| Construction Services | 60% of income | No maximum |

| Business/Commerce/Agriculture/Transport | 60% of income | No maximum |

Example: An employee earning 240,000 THB annually can deduct 120,000 THB (50%), leaving 120,000 THB of assessable income. A landlord earning 150,000 THB in rental income can deduct 45,000 THB (30%), leaving 105,000 THB.

Stage 2: Personal & Family Allowances

After calculating category deductions, you can claim personal and family allowances:

| Allowance Type | Amount | Conditions |

|---|---|---|

| Personal Care (Self) | 60,000 THB | Resident of Thailand |

| Spouse Support | 60,000 THB | Spouse is dependent; married filing joint or single |

| Dependent Child | 30,000 THB per child | Under 25 years old; max 3 children (max 4 if includes adopted) |

| Additional Child Born 2018+ | 60,000 THB per child | Must be biological child; not adopted |

| Dependent Parent (60+ years) | 30,000 THB per parent | Living in Thailand; financially dependent |

| Disabled/Incapacitated Dependent | 60,000 THB per person | Thai resident; under your care |

| Health Insurance Premiums (Parents 60+) | Up to 15,000 THB | Parents living in Thailand |

| Life Insurance Premiums | Up to 100,000 THB | Paid to Thai insurer; subject to combined limit |

| Health Insurance Premiums | Up to 25,000 THB | Paid to Thai insurer; subject to combined limit |

| Home Loan Interest | Up to 100,000 THB | Mortgage on residential property |

| Home Construction (2024–2025) | Up to 100,000 THB | 10,000 THB per 1 million baht of costs |

Maximum Allowances: Life insurance, health insurance, and related items are capped at 500,000 THB combined for retirement/savings products (pension funds, provident funds, insurance savings accounts, NSF, retirement mutual funds).

Stage 3: Retirement & Investment Savings

Thailand incentivizes long-term savings with generous deduction limits:

| Vehicle | Annual Deduction Limit | Lifetime Cap |

|---|---|---|

| Life Insurance Premium | 100,000 THB | Combined 100,000 THB |

| Pension Fund Contribution | 15% of income, max 200,000 THB | 15% of income, max 500,000 THB (with others) |

| Provident Fund Contribution | 15% of income, max 500,000 THB | 15% of income, max 500,000 THB (with others) |

| National Savings Fund (NSF) | 15% of income, max 500,000 THB | 15% of income, max 500,000 THB (with others) |

| Retirement Mutual Fund | 30% of income, max 500,000 THB | 30% of income, max 500,000 THB (with others) |

| ESG Mutual Fund (2024–2026) | 30% of income, max 300,000 THB | 30% of income, max 300,000 THB annually |

| ESG Extra Fund (May–June 2025) | 30% of income, max 300,000 THB | One-time contribution |

| Tax Donation | Up to 10% of net income | Based on eligible organization |

Tax Planning Strategy: Maxing out retirement contributions (reaching 500,000 THB combined) can reduce taxable income by 500,000 THB annually. For a mid-level earner, this translates to 75,000–150,000 THB in tax savings depending on bracket.

Special Tax Exemptions & Allowances for 2026

Antenatal Care & Childbirth

- Amount: Up to 60,000 THB per pregnancy (or 60,000 THB total if expenses span 2 years)

- Eligibility: Actual costs incurred by taxpayer or spouse

- Documents Required: Hospital invoices, medical receipts

Involuntary Termination Severance

- Amount: Up to 400 days of last salary or 600,000 THB (whichever is lower)

- Requirement: Must comply with Labor Protection Act (Thailand)

Age-Based Exemption (65+ Years Old)

- Amount: 190,000 THB of assessable income is tax-exempt

- Requirement: Must be 65 years old or older on the first day of the tax year

Disability Exemption

- Amount: 190,000 THB of assessable income is tax-exempt

- Requirement: Must have official disability certificate from Thai authorities

Domestic Tourism Incentive (October 29 – December 15, 2025)

- Deduction: 100% or 150% of domestic tour costs

- Cap: 30,000 THB

- Scope: Hotels, restaurants, attractions, transportation within Thailand

Goods & Services Purchase (January 16 – February 28, 2025)

- Deduction: 100% of eligible purchases

- Cap: 50,000 THB

- Scope: Specified goods and services (check Revenue Department guidelines)

4. Corporate Income Tax in Thailand 2026

Who Must File Corporate Tax Returns?

All companies-whether private limited, public limited, partnerships, cooperatives, or foreign-incorporated entities operating in Thailand-must file annual corporate income tax returns (Form PND 50) within 150 days of their accounting period’s conclusion.

Corporate Income Tax Rates 2026

| Entity Type | Tax Rate | Notes |

|---|---|---|

| Standard Company | 20% | Applies to most businesses |

| Small Company | 0–20% (graduated) | Based on net profit thresholds |

| SEZ Business | 10% | For 10 consecutive years (effective 2026) |

| BOI-Promoted Activity | 0–20% or reduced rates | Varies by activity and zone |

| LTR Visa (Highly-Skilled Professional) | 17% on Thai income | Foreign-sourced income exempt |

| Foreign Business in Thailand | 20% | Same as standard rate |

New for 2026: The cabinet approved on January 13, 2025, a 10% corporate income tax rate for businesses in special economic zones (SEZs) for 10 consecutive accounting periods. This reduction applies to targeted industries operating in border SEZs (Tak, Mukdahan, Sa Kaeo, Songkhla, Trat, Nong Khai, Narathiwat, Chiang Rai, Nakhon Phanom, Kanchanaburi).

Corporate Tax Filing Deadlines 2026

Annual Corporate Income Tax Return (PND 50)

- Deadline: 30 May 2026 (paper) or 7 June 2026 (e-filing)

- Calculation: Within 150 days of accounting period end-date

- For companies with 31 December 2025 FYE: Deadline is 30 May 2026

- Documents Required: Audited financial statements, profit & loss statement, balance sheet, deduction schedules

Half-Year Corporate Tax Prepayment (PND 51)

- Deadline: 31 August 2026 (paper) or 8 September 2026 (e-filing)

- Calculation: Within 2 months after the first 6 months of the accounting period

- For calendar-year companies: Due by August 31 for Jan–Jun interim period

- Minimum Prepayment: Companies must prepay at least 50% of estimated annual tax liability; failure to do so may result in surcharges

Annual General Meeting (AGM) & Financial Statements

- AGM Deadline: Within 4 months of accounting period end (for 31 Dec FYE: 30 April 2026)

- DBD e-Filing: Within 1 month of AGM approval (30 May 2026 for calendar-year companies)

- Content Required: Directors’ report, auditor’s report, audited financial statements, shareholders’ list

Corporate Tax Deductions & Expenses

Companies can deduct all ordinary and necessary business expenses incurred in earning income, including:

- Salaries and wages (with related withholding taxes)

- Rent and utilities

- Depreciation on assets (using prescribed rates)

- Interest expenses (subject to thin-capitalization rules)

- Professional fees (accounting, legal, consulting)

- Insurance premiums

- Advertising and marketing

- Bad debts (if properly documented and written off)

- Cost of goods sold (with proper inventory management)

Documentation: All expenses must be supported by invoices, receipts, contracts, or bank statements. The Revenue Department requires companies to retain documentation for at least 5 years (10 years for electronic records).

5. Withholding Tax & Social Security: Monthly Requirements

Withholding Tax on Salaries (PND 1)

Employers must withhold personal income tax from employee salaries and remit it monthly to the Revenue Department.

- Filing Deadline: 7th of following month (paper) or 15th (e-filing)

- Withholding Rate: Progressive rates (5–35%) based on employee salary

- Annual Summary (PND 1 Kor): Due 28 February 2026 (paper) or 8 March 2026 (e-filing)

- Mandatory e-Filing: All employers must file PND 1 and PND 1 Kor electronically since January 2024

Other Withholding Tax Forms

| Income Type | Form | Filing Frequency | Paper Deadline | E-Filing Deadline |

|---|---|---|---|---|

| Dividends | PND 2 | Monthly | 7th | 15th |

| Services/Rental/Freelance | PND 3, PND 53 | Monthly | 7th | 15th |

| Foreign Company Payment | PND 54 | Monthly | 7th | 15th |

Social Security Contributions

- Form: Sor Por Sor 1–10

- Filing Deadline: 15th of following month (paper) or 22nd (e-filing)

- Payment Deadline: By 15th of following month

- Annual Contribution Adjustment: By 31 March 2026 (if actual wages exceed estimates)

Employer & Employee Shares: Standard rate is 5% employee contribution + 5% employer contribution (total 10%) on monthly salary, capped at 15,000 THB per month. Contributions must be submitted to the Social Security Office.

6. Value-Added Tax (VAT) in Thailand 2026

VAT Registration & Filing Requirements

VAT Registration Threshold: Businesses with annual revenue exceeding 1.8 million THB must register for VAT within 30 days of crossing the threshold. Even below-threshold businesses may voluntarily register if they anticipate growth or wish to claim input VAT credits.

VAT Rate 2026

Thailand extended the 7% VAT rate (reduced from 10%) through 30 September 2026 via Royal Decree No. 799 (effective 13 September 2025). This temporary rate applies to:

- Sale of goods

- Provision of services

- Imports

After 30 September 2026: VAT rate reverts to 10% unless further extended.

VAT Filing Requirements

| Return Type | Form | Monthly Deadline | Notes |

|---|---|---|---|

| Domestic VAT | PP 30 | 15th (paper) or 23rd (e-filing) | Updated form effective 1 March 2026 |

| Reverse-Charge VAT (Imported Services) | PP 36 | 7th (paper) or 15th (e-filing) | Digital services, cross-border payments |

New for 2026: The Revenue Department updated the VAT return form (PP.30) effective 1 March 2026 to streamline tax calculation and reduce compliance burden. Businesses should review the new form structure in advance.

Input VAT & Deductions

Registered VAT businesses can deduct (recover) input VAT paid on:

- Purchase of goods for resale

- Raw materials and packaging

- Equipment and machinery

- Professional services

- Utilities

Documentation: All input VAT deductions require supporting VAT invoices with a 13-digit tax ID from the vendor.

7. Foreign Income Taxation in Thailand: Updated Rules for 2026

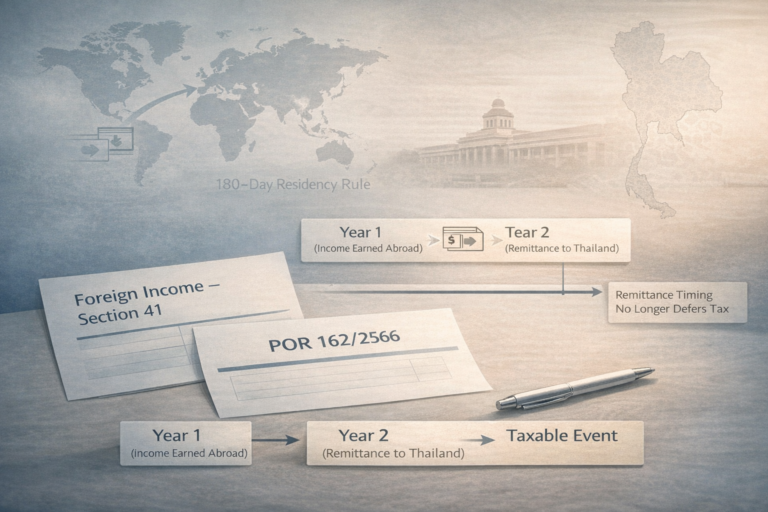

Current Foreign Income Rules (2024–2025)

As of 1 January 2024, Thailand implemented Revenue Department Order No. Por. 161/2566, fundamentally changing how foreign-sourced income is taxed for Thai residents. This is one of the most important tax law changes in Thailand’s modern history.

Core Rule: Remittance-Based Taxation

Any foreign-sourced income earned in 2024 or later becomes taxable in Thailand when remitted into Thailand, regardless of when the remittance occurs. The tax applies in the year the money enters Thailand, not the year it was earned.

Example:

- You earn $50,000 USD in 2024 as a Thai tax resident

- You don’t bring it to Thailand until 2026

- The 2026 Thai tax return must include this $50,000 as 2026 income

- Tax rate: Progressive rates (5–35%), applied to the USD amount converted to THB at the central bank rate

Pre-2024 Income: Permanent Exemption

Order No. Por. 162/2566 provides grandfather protection: All foreign-sourced income earned before 1 January 2024 remains permanently exempt from Thai tax, even if remitted to Thailand years later.

This is critical for planning: If you have overseas savings earned before 2024, you can bring them into Thailand tax-free indefinitely, provided you were not a Thai tax resident in years of earning prior to 2024.

Proposed Foreign Income Relief (Expected Q1 2026)

The Thai Revenue Department has drafted a royal decree that would significantly ease the foreign income tax burden, expected to take effect for the 2026 tax filing period:

Proposed Two-Year Exemption Window

Under the proposed rule:

- Foreign-sourced income earned 2024 onward would be tax-exempt if remitted to Thailand within the same calendar year earned OR in the following calendar year

- Example: If you earn foreign income in 2025:

- Remit in 2025: 100% exempt

- Remit in 2026: 100% exempt

- Remit in 2027 or later: Subject to full progressive taxation

Status: Pending Cabinet and Council of State approval; expected implementation Q1 2026. Taxpayers should monitor Revenue Department announcements for confirmation.

Who Qualifies for Foreign Income Exemptions

1. Non-Tax Residents (Fewer Than 180 Days)

- Exemption: 100% exempt from Thai tax on all foreign-sourced income

- Requirement: Fewer than 180 days in Thailand in the year of earning

2. LTR Visa Holders (Specific Categories)

The Long-Term Resident (LTR) Visa offers the most generous foreign income exemption:

| LTR Category | Requirement | Foreign Income Benefit |

|---|---|---|

| Wealthy Global Citizen | $1M+ global assets | 100% exempt on foreign income |

| Wealthy Pensioner | $80,000+/year pension | 100% exempt on foreign income |

| Work-From-Thailand Professional | $80,000+/year salary + remote employment letter | 100% exempt on foreign income |

| Highly-Skilled Professional | Specific skill/industry requirement | 17% flat rate (not on foreign income) |

Key Advantage: LTR categories 1–3 enjoy complete exemption on foreign-sourced income earned before LTR approval, with no remittance timing restrictions. This is more generous than standard residents.

3. Tax Treaties & Double-Tax Avoidance Agreements

Thailand has tax treaties with numerous countries (e.g., USA, UK, Australia, Japan, Canada). If your foreign income is taxed abroad, you may be entitled to credits or exemptions under the treaty. Common treaty benefits:

- Foreign tax credits to offset Thai tax

- Reduced withholding rates on dividends, interest, royalties

- Treaty-specific exemptions

Professional Consultation Required: Tax treaty application is complex; consult a tax advisor if applicable.

Calculating Foreign Income Tax

When foreign income is remitted to Thailand and becomes taxable:

- Convert to Thai Baht: Use the Bank of Thailand’s central rate on the remittance date

- Add to Other Thai-Source Income: Foreign-sourced remittances are added to salary, rental income, and other assessable income

- Apply Standard Deductions: Deduct where applicable (e.g., business expenses for foreign business income)

- Calculate Tax: Apply progressive rates (5–35%) to the combined assessable income

- Report on Annual Return: Include on Form PND 90 filed by 31 March 2026 (or 8 April for e-filing)

Example:

- Thai salary: 500,000 THB (after 50% deduction = 250,000 THB assessable)

- Remitted foreign income: 60,000 USD (converted at 35 THB/USD = 2,100,000 THB)

- Combined assessable income: 2,350,000 THB

- Tax rate: 30% (applies to the 2–5M bracket)

- Estimated tax: ~705,000 THB (simplified; actual calculation includes allowances and credits)

8. Public Holidays & Deadline Extensions in Thailand 2026

Thailand recognizes numerous public holidays that may affect tax deadlines. When a deadline falls on a public holiday, it automatically extends to the next working day.

Thailand Public Holidays 2026

| Date | Holiday | Day of Week |

|---|---|---|

| 1 January | New Year’s Day | Thursday |

| 2 January | Additional Public Holiday | Friday |

| 3 March | Makha Bucha Day | Tuesday |

| 6 April | Chakri Memorial Day | Monday |

| 13–15 April | Songkran Festival | Mon–Wed |

| 1 May | National Labour Day | Friday |

| 4 May | Coronation Day | Monday |

| 11 May | Royal Ploughing Ceremony | Monday |

| 31 May | Visakha Bucha Day | Sunday |

| 1 June | Substitute Holiday for Visakha Bucha | Monday |

| 3 June | Queen Suthida’s Birthday | Wednesday |

| 28 July | King Rama X Birthday | Tuesday |

| 29 July | Asalha Bucha Day | Wednesday |

| 30 July | Buddhist Lent Day | Thursday |

| 12 August | Mother’s Day | Wednesday |

| 13 October | King Bhumibol Memorial Day | Tuesday |

| 23 October | Chulalongkorn Day | Friday |

| 26 October | End of Buddhist Lent | Monday |

| 5 December | Father’s Day / National Day | Saturday |

| 7 December | Substitute Holiday for Father’s Day | Monday |

| 10 December | Constitution Day | Thursday |

| 31 December | New Year’s Eve | Wednesday |

Note: The 5-day New Year break (31 Dec 2025 – 4 Jan 2026) is the longest continuous holiday in 2026. Plan ahead to avoid last-minute filing delays.

9. Tax Penalties, Late Filing, and Compliance Enforcement

Late Filing & Payment Penalties

Missing tax deadlines triggers automatic penalties and surcharges:

| Violation | Penalty | Additional Charges |

|---|---|---|

| Late Filing (Paper) | 2,000 THB fixed fine | 1.5% monthly interest on unpaid tax |

| Late Filing (E-Filing) | 2,000 THB fixed fine | 1.5% monthly interest on unpaid tax |

| Non-Filing | Up to 200% of tax owed | Plus 1.5% monthly interest |

| Underpayment | Surcharge up to 1.5x actual tax | Plus interest from due date |

| Falsified Documents | Criminal prosecution | Fines up to 100,000 THB + imprisonment |

Important: If you file late but still file, the 2,000 THB penalty applies, but it’s significantly better than non-filing, which can reach 200% of tax. Even if you cannot pay the full amount, filing and requesting an installment plan is strongly recommended.

Revenue Department Audit & Compliance

- Statute of Limitations: The Revenue Department can audit tax returns up to 5 years from the filing date (10 years for fraudulent returns)

- Documentation Retention: Keep all tax documents (invoices, receipts, contracts, bank statements) for at least 5 years (10 years for electronic records)

- Installment Payment Option: If you owe tax after filing, you can request to pay in 3 installments under Section 64 of the Revenue Code (available for e-filed returns)

Handling Overpayments & Refunds

If you pay more tax than you owe (e.g., excessive withholding from your employer), you can request a refund:

- Refund Claim Window: Within 3 years of the filing date

- Process: File a refund request (Sor. Khor. 3) with the Revenue Department

- Timeline: Refunds typically process within 60–90 days

- No Interest: Refunds do not accrue interest, so filing early to avoid overpayment is preferable

10. Special Tax Incentives & Strategies for 2026

Long-Term Resident (LTR) Visa: Tax Benefits

The LTR Visa, introduced in September 2023, is one of Thailand’s most valuable immigration and tax benefits for high-income earners.

Eligibility Categories & Tax Benefits

| Category | Requirements | Tax Benefit | Annual Cost |

|---|---|---|---|

| Wealthy Global Citizen | $1M+ global assets (verified) | 0% on foreign-sourced income (no residency limit) | 500,000 THB / 5 years |

| Wealthy Pensioner | $80,000+/year pension (verified) | 0% on foreign-sourced income (no remittance timing) | 500,000 THB / 5 years |

| Work-From-Thailand Professional | $80,000+/year remote salary + employment letter | 0% on foreign-sourced income | 500,000 THB / 5 years |

| Highly-Skilled Professional | Specific industry/skill, $80,000+ income | 17% flat rate on Thai-sourced income (foreign income still exempt) | 500,000 THB / 5 years |

Tax Impact Example: A retiree with $100,000/year USD pension under current rules would owe 15,000–35,000 THB/year in Thai tax when remitted. With LTR status, the tax obligation is zero indefinitely-potentially saving 75,000–175,000 THB over 5 years (the visa cost).

Special Economic Zone (SEZ) Incentives

Companies operating in Thailand’s 10 border SEZs can now benefit from a 10% corporate income tax rate (approved January 2025, effective 2026):

SEZ Locations:

- Tak (Myanmar border)

- Mukdahan (Laos border)

- Sa Kaeo (Cambodia border)

- Songkhla (Malaysia border)

- Trat (Cambodia border)

- Nong Khai (Laos border)

- Narathiwat (Malaysia border)

- Chiang Rai (Myanmar border)

- Nakhon Phanom (Laos border)

- Kanchanaburi (Myanmar border)

Eligibility:

- Business must be in one of 13 targeted industries (manufacturing, agricultural processing, logistics, etc.)

- Must occupy a permanent structure in the SEZ

- Must generate income from production/services in the SEZ

- Tax rate applies for 10 consecutive accounting periods

Tax Savings Example: A manufacturing company with 5,000,000 THB net profit would pay 1,000,000 THB under standard 20% rate but only 500,000 THB under SEZ 10% rate-a savings of 500,000 THB annually.

Board of Investment (BOI) Promotion

Beyond SEZs, the BOI offers tax incentives for promoted activities in priority sectors:

- Corporate Income Tax Exemption: Up to 8 years for manufacturing and technology

- Reduced Rates: 50% reduction for 5 additional years after exemption

- Import Duty Exemptions: Machinery and raw materials

- Double Deductions: Transportation, electricity, water supply costs

Sectors Promoted: Electronics, automotive, machinery, chemicals, renewable energy, telecommunications, and software development.

11. Frequently Asked Questions (FAQ)

Personal Tax & Residency

Q: Does the 180-day rule require continuous stay in Thailand, or can the days be split across multiple trips?

A: Days are cumulative and can be split. If you enter Thailand multiple times in one calendar year, all days in the country count toward the 180-day threshold. For example, two 90-day trips (January–March and September–November) = 180 days = tax resident status for the full year. The Revenue Department counts days based on passport entry and exit stamps.

Q: If I become a tax resident on 1 July 2026 (having just reached 180 days), do I owe tax for the full calendar year or only from July onward?

A: Once you exceed 180 days in any calendar year, you are a tax resident for the entire year, not just from the 180-day date onward. This means you must declare all assessable income from 1 January, even if you only arrived in July. The practical implication: if you cross the 180-day threshold mid-year, plan for significant tax liability on the full year’s income.

Q: I’m a non-resident (under 180 days in Thailand). Do I have to file a tax return if I earned only foreign-sourced income with no Thailand-sourced income?

A: No. Non-residents are only taxed on Thailand-sourced income (salary from Thai employer, Thai rental income, etc.). If all your income is foreign-sourced and you don’t remit it to Thailand, no Thai filing is required. However, if you become a tax resident later, this changes.

Q: Can my spouse and I file taxes jointly or separately in Thailand?

A: Yes, married couples can choose to file jointly or separately. Joint filing may result in lower progressive tax rates since deductions are combined, but individual filing may be better if one spouse has high income and the other has minimal income. Spouses must make the same election annually and cannot mix filing methods in a single year.

Q: Is there any grace period if I file my return after the 31 March deadline?

A: No grace period; penalties apply immediately. However, filing late is still much better than non-filing. If you file by 8 April (e-filing deadline), the 2,000 THB penalty applies. If you file after 8 April, you incur the 2,000 THB fine plus 1.5% monthly interest on any unpaid tax. The maximum penalty (200% of tax owed) applies only to deliberate non-filing.

Foreign Income & Remittance Tax

Q: I earned foreign income in 2023 (before 1 January 2024). If I remit it to Thailand in 2026, is it taxable?

A: No. Under Order Por. 162/2566, all foreign-sourced income earned before 1 January 2024 is permanently exempt from Thai tax, regardless of when it is remitted. This is a grandfather provision that protects expats who accumulated overseas savings before 2024.

Q: I have an LTR visa and I’m a “Wealthy Pensioner.” My bank sends my pension to my Thailand bank account every month. Is the monthly remittance taxable?

A: No. LTR “Wealthy Pensioner” visa holders enjoy 100% exemption on foreign-sourced income with no timing restrictions. Regular monthly remittances of your pension are not taxed. Ensure your bank provides documentation showing the income source (pension, not capital withdrawal) for audit protection.

Q: I earned foreign income in 2025 and I’m planning to remit it to Thailand in March 2026. Under the proposed new rules (expected Q1 2026), would this be taxable?

A: If the proposed rule is enacted as expected: No, it would not be taxable. The proposed two-year exemption window would allow you to remit 2025 income tax-free if brought into Thailand in 2025 or 2026. However, this rule is not yet law-it requires Cabinet approval expected in early 2026. Conservative planning: Remit your foreign income by 31 December 2025 (same year earned) to ensure exemption under current rules, rather than betting on the proposed rule taking effect.

Q: My Thai-resident friend transferred $100,000 from a US bank to a Thailand bank. The Revenue Department is questioning whether this is income or capital. How is it taxed?

A: The Revenue Department uses a substance-over-form analysis. They will examine:

- Source of funds: Did the $100,000 come from employment, investment returns, or capital withdrawal from previously invested funds?

- Documentation: Bank statements, investment account history, loan documentation (if borrowed)

- Frequency: Is this a one-time capital repatriation or regular income remittances?

Taxation Depends on Source:

- Earned income (salary, business profit, rental income): Taxable if earned 2024 onward

- Return of previously invested capital: Not taxable (you already paid tax on the original income)

- Investment gains (stock sale proceeds, interest, dividends): Taxable if earned 2024 onward

Action: Maintain clear documentation (bank statements, investment account statements, withdrawal confirmation) showing the true source of the funds.

Corporate Tax & Deductions

Q: My company has a 31 December 2025 fiscal year-end. When is my corporate tax return (PND 50) due?

A: Your PND 50 must be filed by 30 May 2026 (paper filing) or 7 June 2026 (e-filing). This deadline is calculated as 150 days after the 31 December 2025 year-end. If you file electronically, you receive an 8-day extension.

Q: Can I deduct salaries I plan to pay to employees in 2026 on my 2025 tax return?

A: No. Only expenses actually incurred and paid in 2025 can be deducted on the 2025 return. Accrued but unpaid salaries (e.g., year-end bonuses to be paid in January 2026) must be deducted on the 2026 return. However, if you accrue a liability on your financial statements, the Revenue Department may require a book-to-tax adjustment.

Q: I’m a self-employed consultant. Can I deduct 60% of my income without documenting expenses?

A: Yes. Self-employed professionals and business owners can choose between:

- Estimated Deduction: 30–60% of income (no documentation required), depending on profession

- Actual Expense Deduction: Document all expenses (requires detailed records)

Choose whichever results in a lower tax liability. For freelancers, the estimated deduction (30–60%) is often simpler than tracking receipts.

Q: My company had a net loss in 2025. Can I carry the loss back to 2024 or forward to 2026?

A: Thailand does not allow loss carryback or carryforward for individual taxpayers. Corporate losses generally cannot offset other years’ income. However, companies can carry forward losses in some cases; consult your accountant for corporate-specific rules.

Withholding Tax & VAT

Q: I’m a foreign freelancer providing consulting services to a Thai company. What withholding tax will the company deduct?

A: The Thai company must withhold 3% of the service fee if you are a non-resident or 5–15% if you are a resident (depending on your tax bracket). The company files this withholding on Form PND 3 by the 7th of the following month (15th for e-filing). As a non-resident consultant, you likely won’t have a Thai tax filing requirement if the 3% withholding is sufficient to cover your liability.

Q: My business has revenue of 1.5 million THB annually. Do I need to register for VAT?

A: No. VAT registration is mandatory only for businesses with annual revenue exceeding 1.8 million THB. At 1.5 million THB, you are below the threshold. However, you may voluntarily register for VAT if you wish to claim input VAT credits on purchases or if you plan to cross the threshold soon.

Q: My company is VAT-registered. I purchased equipment worth 500,000 THB (including 7% VAT = 35,000 THB). Can I deduct the 35,000 THB VAT?

A: Yes, the 35,000 THB VAT is recoverable input VAT, provided you have a proper VAT invoice from the vendor showing a 13-digit tax ID. The VAT input credit is claimed on Form PP.30 in the month of purchase, reducing your monthly VAT liability to the Revenue Department.

Deductions & Allowances

Q: I have a dependent child who is 26 years old but unemployed. Can I claim the 30,000 THB child dependant allowance?

A: No. The dependant child allowance of 30,000 THB applies only to children under 25 years old. Since your child is 26, the allowance does not apply. However, if the child has a disability, you may claim the 60,000 THB allowance for disabled dependants instead.

Q: I paid 150,000 THB in life insurance premiums in 2025. How much can I deduct on my 2026 tax return?

A: You can deduct only 100,000 THB, as this is the maximum life insurance deduction. The remaining 50,000 THB cannot be deducted and carries no carryforward to future years.

Q: I’m 67 years old and earned 300,000 THB in 2025. Can I claim both the 190,000 THB age exemption and standard deductions?

A: Yes. The age exemption (65+) is applied after standard deductions:

- Gross income: 300,000 THB

- Standard deduction (50%): 150,000 THB

- Assessable income before exemption: 150,000 THB

- Age exemption (190,000 THB cap): 150,000 THB fully exempted

- Final taxable income: 0 THB

This is one of the most generous provisions for seniors in Thailand’s tax code.

Filing & Deadlines

Q: The 31 March 2026 PIT filing deadline falls on a Saturday. When is the actual deadline?

A: When a deadline falls on a weekend or public holiday, it automatically extends to the next working day. 31 March 2026 is a Wednesday, so the deadline is firm. However, if a deadline falls on a Sunday, the next Monday is the deadline.

Q: Can I file my 2025 tax return before 1 January 2026?

A: No. Tax returns for 2025 income can only be filed starting 1 January 2026. The Revenue Department’s e-filing system is not activated until January 1 of the following year. Filing before the tax year closes is technically not permitted.

Q: I missed the 31 March 2026 deadline, but I filed on 10 April 2026. What penalty do I face?

A: You incur the 2,000 THB late-filing penalty (since you filed after 8 April e-filing deadline). Additionally, 1.5% monthly interest accrues on any unpaid tax balance. Interest is calculated from the original due date (31 March) to the date of payment, making early payment advisable even for late filings.

Q: I filed my return but underpaid my tax by 50,000 THB. What are my options?

A: You have several options:

- Pay the full 50,000 THB immediately plus 1.5% monthly interest from 31 March

- Request an installment plan (Section 64 of Revenue Code, available for e-filed returns): 3 equal installments over 3 months

- File an amended return if you made an error (Form Sor. Khor. 1)

Early payment is strongly recommended to minimize interest charges.

LTR Visa & Tax Planning

Q: I’m a remote worker earning $100,000/year. Is an LTR visa worth the 500,000 THB cost for tax purposes?

A: Calculation:

- Annual tax under standard residence: Approximately 20,000–30,000 THB (assuming deductions)

- Annual tax under LTR (foreign income exempt): Approximately 0 THB

- Payoff period: 500,000 THB ÷ 25,000 THB annual savings = 20 years

For a long-term Thailand resident planning to stay 10+ years, the LTR visa provides tax savings that justify the cost, plus non-tax benefits (easier re-entry, simplified extensions, international recognition). For short-term residents (3–5 years), the cost-benefit is weaker unless other visa complications exist.

Q: I have an LTR visa, but I earned foreign income before receiving the visa. Is that income taxable?

A: No. LTR holders enjoy exemption on foreign-sourced income earned before receiving the visa. This is one of the LTR’s most powerful features. You can bring in years of accumulated overseas savings tax-free.

Penalties & Compliance

Q: The Revenue Department says I owe 200,000 THB in back taxes plus penalties. What’s the total I’ll owe?

A: Back tax penalties depend on the reason for underpayment:

- Late filing: 2,000 THB fixed fine + 1.5% monthly interest

- Deliberate non-filing: Up to 200% of tax owed (in this case, 200,000 THB) + interest

- Fraud/false documentation: Criminal penalties, fines up to 100,000 THB, and imprisonment

Total could range from 202,000 THB (with interest) to 600,000+ THB depending on the violation type. Negotiating a payment plan immediately is advisable.

Q: Can the Revenue Department fine me if I didn’t file a return because I didn’t know I had to?

A: Ignorance of tax law is not a legal defense in Thailand. Whether or not you knew about filing requirements, penalties apply once the Revenue Department discovers non-compliance. However, if you file immediately upon discovery, the penalty is the standard 2,000 THB plus interest, not the 200% penalty for deliberate non-filing.

Planning & Optimization

Q: What’s the best strategy to minimize my 2025 tax liability before filing in March 2026?

A: Unfortunately, it’s too late for 2025 income optimization (tax year is already closed). However, you can optimize 2026 income:

- Max out retirement contributions (500,000 THB combined limit)

- Invest in ESG mutual funds (300,000 THB deduction available)

- Time large purchases (charitable donations up to 10% of income)

- Claim all eligible allowances (dependant care, insurance, mortgage interest)

- Review income source timing (defer bonuses, accelerate expenses, if possible)

- Consider LTR visa (if foreign-income heavy)

Special 2026 Changes

Q: I heard Thailand is changing tax deduction rules in 2026. How will this affect my 2025 filing?

A: The Thai government announced tax deduction reforms expected in 2026, including restrictions on personal allowances and possible rate adjustments. However, these changes apply only to 2026 and future income, not 2025 income. Your 2025 tax return (filed March 2026) uses current deduction rules unchanged. The reforms will affect filings in 2027 for 2026 income.

Q: Thailand removed the tax exemption for online imported goods starting 1 January 2026. What does this mean for personal imports?

A: Previously, imported goods ordered online (Amazon, eBay, etc.) valued under a certain threshold were exempt from import duty and VAT. Effective 1 January 2026, this exemption was eliminated. For individuals, this means:

- Import duties now apply to cross-border e-commerce purchases

- VAT at 7% (through September 2026) applies to all imports

- Exception: Certain essential goods (medicine, educational materials) may still have exemptions

This is primarily a VAT/import duty issue for retailers, less so for individuals making personal purchases.

Your 2026 Tax Compliance Roadmap

Thailand’s 2026 tax calendar requires proactive planning across multiple deadlines, forms, and income categories. The key to successful compliance is:

- Determine your tax residency status (180-day rule) early in the year

- Understand which income types apply to you (salary, rental, foreign-sourced, etc.)

- Maximize deductions and allowances (retirement contributions, dependant care, insurance)

- File electronically to gain deadline extensions and reduce penalties

- Document everything (5–10 years retention) to support deductions and foreign income sources

- Monitor proposed reforms (foreign income relief, deduction restrictions) for anticipated changes

- Consider specialized visas (LTR for foreign-income earners) if applicable to your situation

File on time, claim everything you’re entitled to, and stay informed of annual changes-this triple approach minimizes tax liability while avoiding penalties and audit risk.

For questions or specialized guidance on your individual tax situation, consult with a registered Thai tax advisor (Certified Tax Accountant or CPA licensed by the Thai Revenue Department).

Last Updated: January 2026

Applicable Tax Year: 2025 Income (Filed 2026)

Data Sources: Thai Revenue Department, Official Gazette, Board of Investment, Ministry of Finance