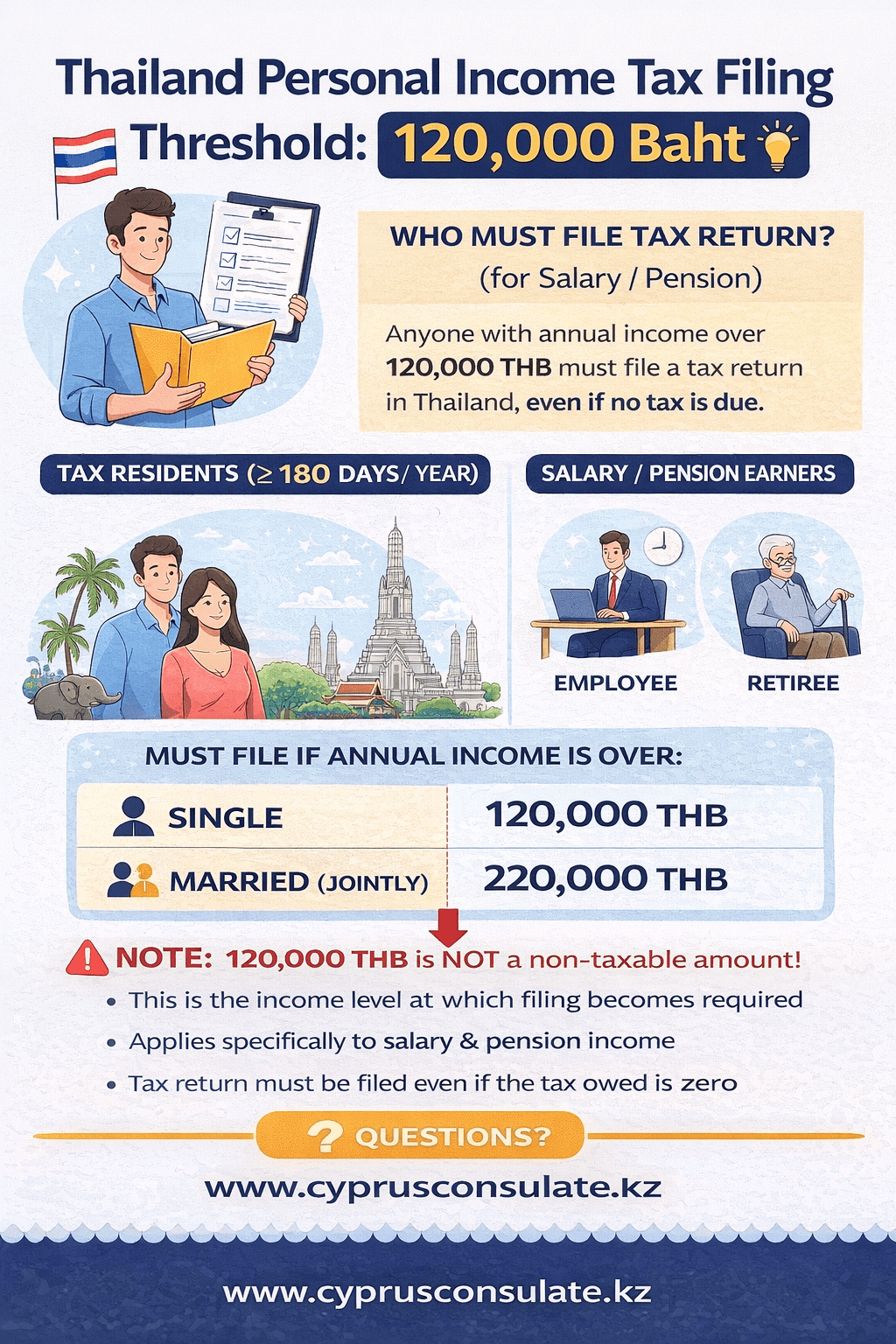

The 120,000 Thai Baht (THB) filing threshold is the most critical number for anyone working abroad and residing in Thailand as a tax resident. Yet it remains the most misunderstood tax requirement among expats, freelancers, and digital nomads. Here’s what makes it essential: you must file a tax return if your assessable income exceeds 120,000 THB-even if you owe absolutely no tax. This mandatory filing requirement catches thousands of expats unprepared each year, resulting in penalties ranging from 1,000 to 200,000 THB, audit investigations, and even potential imprisonment.

This guide cuts through the confusion. Whether you’re a salaried employee earning foreign income, a freelancer working remotely for international clients, or a business owner with investment returns, understanding this threshold determines your tax compliance obligations in Thailand. Unlike many countries where filing is optional if you don’t owe tax, Thailand’s Revenue Department treats filing as a mandatory legal obligation above the 120,000 THB income threshold.

The stakes are real: non-compliance exposes you to visa complications, future audit exposure, and potential prosecution. Compliance, meanwhile, is straightforward once you understand the rules. This comprehensive guide walks you through everything you need to know-from tax residency basics through strategic planning techniques to reduce your taxable income below the threshold.

Key Takeaway: The 120,000 THB threshold is a filing requirement trigger, not a tax-free allowance. Filing is mandatory above this amount. Non-filing carries severe penalties. Smart use of allowances and deductions can keep you below the threshold legally.

Understanding Tax Residency in Thailand: The Foundation

Before the 120,000 THB threshold applies to you, you must first understand whether you’re classified as a Thai tax resident. Tax residency is the gate that opens filing obligations in Thailand-and it’s based on a simple but strict rule: the 180-day calendar year test.

The 180-Day Rule: Calendar Year Basis

Thailand uses a calendar year (January 1 through December 31) to count residency days, not a rolling 12-month period. This distinction matters enormously. If you arrive in Thailand on January 1 and depart December 31, you’ve spent 365 days in-country and become a tax resident for that entire calendar year. Conversely, if you arrive September 1 and leave August 31 the following year, you span two tax years and may have non-resident status in both.

How days count: Both your arrival day and departure day count as full days in Thailand. An arriving on January 1 and departing on January 2 counts as two days. This means you need to be careful with your exact travel dates if you’re near the 180-day threshold.

The calendar year structure creates opportunities for expats who manage their residency strategically. Stay under 180 days in a calendar year and you’re not a tax resident-meaning your foreign-sourced income is NOT taxed by Thailand, even if it exceeds 120,000 THB.

Who Qualifies as a Tax Resident

Tax residency in Thailand applies to Thai nationals and foreign nationals equally. Your nationality doesn’t matter. Your visa type doesn’t matter. What matters exclusively: Are you in Thailand for 180 or more days in the calendar year?

This catches many expats by surprise. You can hold a retirement visa, DTV (Digital Nomad) visa, or any long-term visa and still not be a tax resident if you don’t meet the 180-day threshold. Conversely, you can arrive on a tourist visa without intending to stay long-term, and if you reach 180 days, boom-you’re a tax resident with filing obligations.

Multiple entries in the same calendar year complicate matters but work against you: all days are counted cumulatively. If you spend 100 days in Thailand in January-April, travel to a neighboring country for May, then return for 100 days in June-September, your total is 200 days. You’re over 180 and become a tax resident for that entire calendar year.

Obtaining Tax Residency Verification

To prove your tax residency status officially, you can obtain a Certificate of Residency (CoR) from the Thai Revenue Department. This document is essential for visa renewals, certain visa applications, and tax compliance documentation.

To apply for a CoR, you’ll need:

- Completed form L.P. 10.1 (available from Revenue Department or online)

- Valid passport with current Thai visa

- Proof of Thai address (lease agreement, Tabien Baan-Thai house registration, or recent utility bill)

- Completed within 60 days of becoming a tax resident (though late applications are accepted)

Processing typically takes 1-2 weeks. The certificate is free but may require a small donation to the tax office depending on the location. Once obtained, it serves as proof of residency status for Revenue Department, immigration, and visa applications.

The 120,000 THB Filing Threshold Explained

Now that you understand tax residency, let’s examine the threshold itself. The 120,000 THB figure represents the assessable income limit for individuals above which filing becomes mandatory.

Single Taxpayers: 120,000 THB Threshold

For a single individual classified as a Thai tax resident, the filing threshold is straightforward: if your total assessable income in a calendar year exceeds 120,000 THB, you must file a tax return. This applies regardless of whether:

- You owe any tax (you might not, after deductions)

- Your employer withholds tax already

- You paid tax in your home country

The 120,000 THB is just the income trigger. Actual tax liability is calculated separately after applying deductions and allowances-but filing itself is mandatory at this income level.

Married Couples: 220,000 THB Joint Threshold

Married couples filing jointly have a combined threshold of 220,000 THB. This is not 120,000 per spouse; it’s a combined household income limit. If spouses file together, they can earn up to 220,000 THB combined without mandatory filing requirement.

However, couples must choose their filing strategy carefully:

- Filing jointly: Use the 220,000 THB threshold if both spouses have income

- Filing separately: Each spouse gets a 120,000 THB threshold, allowing higher total household income before filing but requiring separate returns

The choice depends on income distribution and available deductions. A household earning 150,000 THB total (100,000 from one spouse, 50,000 from another) must file because they exceed 220,000 combined-but they could avoid filing by filing separately if each stays under 120,000 THB individually. Strategic analysis is needed based on your situation.

Different Thresholds by Income Category

Here’s where many expats get confused: not all income uses the same 120,000 THB threshold.

Category 1 Income (Salary/Wages): 120,000 THB filing threshold

- Employment income from a Thai employer

- Employment income from a foreign employer (if you work in Thailand)

- Regular salary remittances from abroad

- W-2/1099 equivalent income

Categories 5-8 Income (Business/Investment/Other): 60,000 THB filing threshold

- Self-employment income

- Freelance work

- Business profits

- Investment income (rental, dividends, capital gains)

- Agricultural income

- Professional fees

If you earn 80,000 THB from freelance work alone, you must file because you exceed the 60,000 THB threshold-even though you’re under 120,000 THB. Categories 5-8 also trigger a mid-year filing requirement (PND.94 form) by September 30 of the same year.

What Constitutes “Assessable Income”

Not all income moving to your Thai bank account is assessable. Understanding what counts and what doesn’t is critical for staying below the threshold:

Income that COUNTS (Assessable):

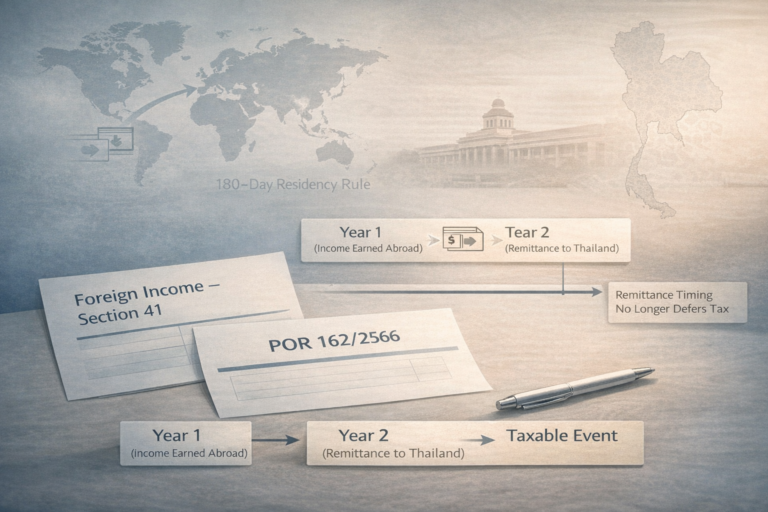

- Foreign-sourced employment income earned after January 1, 2024, that you remit to Thailand

- Self-employment income earned after January 1, 2024

- Rental income from Thai properties

- Dividend and interest income remitted to Thailand

- Capital gains from investments remitted to Thailand

- Pension income earned after January 1, 2024 (with DTA exceptions)

Income that DOES NOT COUNT (Non-Assessable):

- Pre-2024 savings (transferred to Thailand from accounts established before January 1, 2024)

- Loans from family or banks

- Gifts (taxable to recipient in some cases, but with 20 million THB annual exemption)

- Inheritance (generally non-taxable in Thailand)

- Return of principal from investments (only gains are taxable)

Filing Obligations Based on Income Levels

Understanding where your income falls determines your filing requirement. Here’s the practical breakdown:

Under 120,000 THB (Category 1 Income): No Mandatory Filing Required

If you’re a tax resident earning only Category 1 income (salary/wages) below 120,000 THB, you have no legal filing requirement. You’re not obligated to file a tax return.

However, this doesn’t mean you shouldn’t consider filing:

- Establishing a compliance record: Filing voluntarily creates documentation that proves you’re tax-aware and compliant, which helps if audited later

- Claiming refunds: If your employer withheld tax and you had deductions, filing may recover money owed to you

- Visa applications and renewals: Some visa types (particularly retirement and LTR visas) favor documented tax compliance history

- Peace of mind: Filing eliminates ambiguity about your compliance status

Important caveat: If you earn Categories 5-8 income above 60,000 THB, this exemption doesn’t apply-see below.

120,000 THB Exactly: You’re at the Threshold

If your income totals exactly 120,000 THB, you’ve hit the threshold but not exceeded it. Technically, this is a gray area, but the conservative approach is to treat it as “not exceeded” and no filing required for Category 1 income. However, even one baht over 120,000 THB triggers mandatory filing.

Given this razor’s edge, having precise income documentation is essential. Small foreign exchange variations or last-minute transfers can push you over the line. If you’re close to 120,000 THB, consider:

- Filing voluntarily to be safe

- Timing income transfers to ensure you stay under 120,000 THB in a specific tax year

- Consulting a tax advisor about your exact situation

Above 120,000 THB: Mandatory Filing Required

Once your assessable income exceeds 120,000 THB, filing is not optional-it’s mandatory. You must file a tax return by March 31 (or April 8 for e-filing) regardless of whether you owe any tax after deductions and allowances are applied.

This is where strategic planning kicks in. Your marginal tax rate applies only to income above certain brackets:

| Taxable Income | Tax Rate |

|---|---|

| First 150,000 THB | 0% (tax-free) |

| 150,001-300,000 THB | 5% |

| 300,001-500,000 THB | 10% |

| 500,001-1,000,000 THB | 15% |

| 1,000,001-2,000,000 THB | 20% |

| 2,000,001-5,000,000 THB | 25% |

| Over 5,000,000 THB | 30% and 35% |

The critical insight: even if your total income is 150,000 THB, your taxable income is 0% after the tax-free allowance. You must still file (because you exceeded 120,000 THB), but you may owe no tax.

Married Couples: 220,000 THB Joint Threshold Strategy

For married couples, the strategy becomes more complex. A household earning 240,000 THB total income exceeds the 220,000 THB joint threshold and triggers mandatory filing. However, you can structure this to your advantage:

Joint filing scenario: Both spouses file one combined return, using the 220,000 THB threshold. If combined income is 200,000 THB, no filing required. If 230,000 THB, filing required.

Separate filing scenario: Each spouse files individually under their own 120,000 THB threshold. A household with 100,000 THB (spouse A) + 100,000 THB (spouse B) = 200,000 THB combined can avoid filing entirely if both file separately and stay under 120,000 THB each.

The choice depends on deductions available, visa type, and tax liability calculation. Most couples benefit from joint filing if one spouse has significantly lower income and can utilize spousal allowances, but consultation with a tax advisor is recommended.

Tax Residency & Filing Threshold Interaction

Your tax residency status directly determines whether the 120,000 THB threshold applies to you at all.

Tax Residents (180+ Days): Full Filing Obligations

Once you exceed 180 days in a calendar year and become a tax resident, the 120,000 THB threshold applies to your worldwide assessable income. Your foreign-sourced income earned after January 1, 2024 is taxed in Thailand if it exceeds the threshold.

As a tax resident, you must file if your income exceeds 120,000 THB. This applies to Category 1 income. If you also have Categories 5-8 income above 60,000 THB, you must also file separately for those categories using form PND.94 by September 30.

Your entire calendar year of 180+ days makes you a tax resident for the full year-meaning you’re subject to Thailand’s tax system on worldwide income from January 1 through December 31.

Non-Residents (Under 180 Days): Limited Obligations

If you remain under 180 days in a calendar year, you stay classified as a non-resident for tax purposes. This is enormously valuable: your foreign-sourced income is not taxed by Thailand. You can receive 500,000 THB in foreign income and owe no Thai tax as a non-resident.

However, non-residents are taxed on Thailand-sourced income. If you work for a Thai employer or generate rental income from a Thai property, that Thailand-sourced income is taxable even as a non-resident. But foreign income is not.

The non-resident status doesn’t completely exempt you from filing obligations-it just changes what you must report. If you have Thailand-sourced income above the threshold, filing may still be required.

Borderline Cases & Strategic Considerations

Many expats live near the 180-day threshold strategically. A DTV visa holder who spends 170 days in Thailand and then travels abroad for 20 days avoids tax residency status entirely. However, this strategy has risks:

- Cumulative counting: All days in a calendar year count, even with multiple exits and entries

- Evidence burden: You must have clear departure/arrival stamps in your passport to prove your days out

- Revenue Department scrutiny: Highly mobile residents triggering exactly 179 days is suspicious to auditors

- Visa compliance: Some visas require meeting minimum day counts, creating tension with tax planning

If you’re considering strategic under-180-day positioning, consult with a tax advisor about your specific visa and residency situation.

The Filing Process When You Exceed 120,000 THB

Once you’ve determined you’re a tax resident with assessable income exceeding 120,000 THB, filing is mandatory. Here’s exactly how to comply:

Step 1: Obtain a Tax Identification Number (TIN)

Your first filing step is securing a Tax Identification Number (TIN) from the Thai Revenue Department-if you haven’t already. A TIN is required if you have any assessable income. Some visa types (like LTR visa) require TIN for renewal, while others technically don’t, but the requirement applies if you have taxable income.

When to apply: Within 60 days of becoming a Thai tax resident (though late applications are accepted)

Required documents:

- Completed form L.P. 10.1 (get from the nearest Revenue Department office or download online)

- Valid passport with current Thai visa

- Proof of Thai address (rental lease agreement, Tabien Baan house registration, or recent utility bill)

- Employment contract or business registration (if self-employed)

Where to apply: Your local Revenue Department office (corresponding to your registered address in Thailand)

Processing time: 1-2 weeks typically, longer during tax season (February-March)

Cost: Free. Some offices may request a small donation to the Thai tax office.

Once approved, you’ll receive a TIN (usually a 10-digit number). Keep this safe-you’ll use it for all future tax filings and certain visa renewals.

Step 2: Gather Required Documentation

Before you even start filing, compile all necessary documentation. Missing documents is the second most common filing error (after calculating wrong income).

Income documentation:

- All payslips from the year (if employed)

- Bank statements showing all income transfers to Thailand

- Contracts proving work performed (for freelancers)

- Income statements from clients or employers

- Proof of foreign tax paid (if claiming foreign tax credit)

Remittance documentation:

- Bank transfer records (date, amount, exchange rate)

- Screenshots or statements showing funds entering Thailand

- If using third-party services (Wise, Western Union), copies of transaction receipts

- Exchange rate documentation for all remittances

Deduction and allowance documentation:

- Receipts for health insurance premiums

- Invoices for education expenses

- Medical bills if claiming medical deductions

- Proof of charitable donations

- Receipts for pension life insurance

Spouse and dependent documentation (if applicable):

- Marriage certificate (filed with Thai authorities)

- Children’s birth certificates

- School enrollment documents (for education deductions)

Pre-2024 savings documentation:

- Bank statements dated December 31, 2023, showing account balances

- Proof of account opening date (before January 1, 2024)

Organize these into clear folders. The Thai Revenue Department rarely requests hard copies during e-filing, but you must keep them for audit defense. Revenue Department audits can occur up to 5 years after filing.

Step 3: Calculate Your Tax Liability

Understanding this calculation is essential to your compliance and potential refunds. Here’s the step-by-step process:

Step 3a: Determine total assessable income

Sum all your assessable income from all sources in the calendar year:

- Category 1 (employment): All salary, wages, and remitted foreign employment income

- Categories 5-8 (business/investment): All self-employment, rental, dividend, and capital gains income

Example: You earned 100,000 THB in salary (Category 1) + 80,000 THB in freelance income (Category 5). Your total assessable income is 180,000 THB.

Step 3b: Apply allowances and deductions

Subtract all eligible deductions from your total income:

- Personal allowance: 60,000 THB (everyone)

- Spouse allowance: 60,000 THB (if spouse has no income)

- Senior allowance: 190,000 THB (if age 65+)

- Child allowance: 30,000-60,000 THB per eligible child

- Deductible expenses: 50% of employment income, capped at 100,000 THB

- Health insurance premiums (approved policies only)

- Pension life insurance: Up to 15% of income, capped at 200,000 THB

- ESG fund investments: Up to 30% of income, capped at 300,000 THB

Continuing our example: Total income 180,000 THB – Personal allowance 60,000 THB – Employment deduction (50% of 100,000 = 50,000 THB, capped at allowance) = Adjusted income after first round of deductions: 70,000 THB.

Step 3c: Account for the tax-free threshold

Thailand’s first 150,000 THB of adjusted income is tax-free:

- If your adjusted income is under 150,000 THB: You owe 0% tax

- If over 150,000 THB: Only the amount above 150,000 is taxed

In our example: Adjusted income is 70,000 THB. This is under 150,000 THB, so no Thai income tax is due despite exceeding the 120,000 THB filing threshold.

Step 3d: Calculate progressive tax

If adjusted income exceeds 150,000 THB, apply rates by bracket:

- 150,001-300,000 THB: 5%

- 300,001-500,000 THB: 10%

- Etc. (per the tax table above)

Example: If your adjusted income was 200,000 THB instead:

- Tax on 50,000 THB (portion from 150,000 to 200,000) at 5% = 2,500 THB

Step 3e: Claim foreign tax credit (if applicable)

If you paid tax to another country on the same income, you can claim a foreign tax credit to reduce Thai tax owed. You cannot claim a refund for foreign tax paid; you can only reduce Thai tax liability.

Requirements:

- Thailand has a Double Taxation Agreement (DTA) with that country

- You actually paid tax to that country

- Documentation proof (tax certificate from foreign country)

- Amount claimed cannot exceed Thai tax liability on that income

Our example: If you paid 1,000 THB in US federal tax on 200,000 THB of US-sourced income, and Thai tax on that is 2,500 THB, you can reduce Thai tax by 1,000 THB, owing only 1,500 THB to Thailand.

Step 4: Choose Your Filing Method

Thailand offers two filing methods. Choose based on your comfort with technology and deadline flexibility:

E-Filing (Recommended):

- Platform: Thai Revenue Department’s e-filing portal (https://efiling.rd.go.th)

- Deadline: April 8 (later than paper filing)

- Forms: Digital PND.90 or PND.91

- Access: Requires username/password login (can be set up online)

- Advantages: No need to visit the office, more time to prepare, automatic deadline calculation, receipt confirmation immediate

- Payment options: Direct bank transfer, credit card, or ATM payment

Paper Filing:

- Location: Local Revenue Department office corresponding to your address

- Deadline: March 31 (earlier than e-filing)

- Forms: Printed PND.90 or PND.91

- Advantages: No need for computer setup if unfamiliar with online systems

- Payment: Bank payment coupon (bring to bank) or pay cash at the tax office

- Disadvantage: Requires in-person office visit; earlier deadline

For most expats, e-filing is preferable. It avoids office queues, provides a week’s extra buffer for preparation, and creates an immediate digital receipt of filing.

Step 5: Select the Correct Tax Form

Choosing the right form is crucial. Using the wrong form delays processing and may trigger audit questioning:

Form PND.91 (Simple Return):

- Use if you have only one source of income: employment (Category 1)

- All income is salary/wages from a single employer or foreign employment income

- No business, rental, investment, or other income sources

- Shorter form, simpler process

- Most common for expatriates

Form PND.90 (Complex Return):

- Use if you have multiple income sources (any Category 5-8 income)

- Self-employment or freelance income

- Rental income

- Dividend or investment income

- Capital gains

- Any combination of income categories

- Longer form requiring more detail

Form PND.94 (Mid-Year Return):

- Use if you have Categories 5-8 income above 60,000 THB

- Required filing by September 30 (separate from annual return)

- Estimates tax liability mid-year to prevent underpayment

- Reduces penalties if year-end tax differs significantly from mid-year estimate

Filing the wrong form delays your case and may trigger additional requests for information from the Revenue Department. When in doubt, use PND.90 (complex return)-it’s safer than underfiling on a simpler form.

Step 6: Submit & Pay by Deadline

Filing deadline is strict. Missing the deadline incurs penalties immediately:

E-Filing deadline: April 8 (or later if your deadline is extended)

Paper filing deadline: March 31

Tax payment due: Same deadline as filing (you cannot file and pay later; both are due together)

Payment methods (E-Filing):

- Direct bank transfer to government account

- Credit card (small fee applies)

- ATM payment (via government payment system)

- Online banking transfer

Payment methods (Paper filing):

- Bank transfer coupon (Revenue Department provides; take to any bank)

- Cash payment at the tax office

- Check (rare)

Once you’ve filed and paid, keep your receipt (digital or printed). This proves you’ve complied with Thailand’s tax obligations. The Revenue Department will send a confirmation, and your status is now established as a compliant taxpayer.

Allowances & Deductions That Reduce Your Taxable Income

The most effective way to manage the 120,000 THB filing threshold is understanding how to reduce taxable income through allowances and deductions. In many cases, aggressive use of available allowances can drop your taxable income below the threshold entirely-meaning you may owe zero tax while still being over 120,000 THB in gross income.

Personal & Family Allowances

These are the first line of income reduction. Unlike deductions that require documentation, allowances are granted automatically if you meet eligibility:

Personal allowance: 60,000 THB

- Available to all individuals

- Always granted, no documentation needed

- First deduction applied to income

Spouse allowance: 60,000 THB

- Available only if your spouse has no income

- If spouse earns any assessable income, this allowance is not available

- Valuable in single-income households

Senior allowance: 190,000 THB

- Available if you’re age 65 or older

- Only one person per household can claim this

- Dramatically reduces tax liability for retirees

Disabled dependent allowance: 60,000 THB

- Available for each dependent with disability

- Requires disability ID documentation

- Can be claimed multiple times for multiple disabled dependents

Child allowances: 30,000-60,000 THB per child

- Amount depends on child’s birth year and eligibility

- Children born 2018 or later: 60,000 THB each

- Children born before 2018: 30,000 THB each

- Limited to number of qualifying children

- Requires birth certificate documentation

Combined example: A married couple age 65+ with three children born after 2018 can claim:

- Personal allowance (spouse): 60,000 THB

- Senior allowance (one spouse): 190,000 THB

- Child allowances (3 children × 60,000): 180,000 THB

- Total allowances: 430,000 THB

On 200,000 THB household income, these allowances reduce taxable income to zero (200,000 – 430,000 = 0). Despite exceeding the 120,000 THB filing threshold, the household owes no tax.

Income-Based Deductions

Beyond allowances, employment income has special deductions:

Employment deduction: 50% of employment income, capped at 100,000 THB

- Applies to salary and wages only

- Calculated as 50% of employment income, but cannot exceed 100,000 THB

- If you earn 200,000 THB in salary, the deduction is 100,000 THB (50% would be 100,000)

- If you earn 150,000 THB, the deduction is 75,000 THB (50% of 150,000)

This deduction recognizes work-related expenses without requiring documentation. You don’t need to prove you spent money; it’s an automatic allowance.

Insurance & Health-Related Deductions

Documentation is required, but these provide significant tax reduction:

Health insurance premiums:

- Approved health insurance policies only (must be Thai-recognized)

- Can be claimed by both spouses if each has separate policies

- Fully deductible with policy documentation

Pension life insurance: Up to 15% of income, capped at 200,000 THB

- Life insurance with pension/retirement component

- Must specify this is pension life insurance, not regular life insurance

- Provide policy documents proving insurance type

- Valuable for retirees who maintain insurance

Child & Family-Related Deductions

Additional reductions available for education and family support:

Education expenses: Up to 2,400 THB per child per year

- Covers tuition, fees, textbooks for education at any level

- Provide school invoices and receipts

- Can be claimed per child annually

School fees and training: Separate from education allowance, can reach significant amounts

- International school tuition

- Professional training and development courses

- Language classes

- Apprenticeships

Tax-Advantaged Investments

Strategic investments offer both tax reduction and wealth building:

ESG Fund investments: Up to 30% of income, capped at 300,000 THB

- Environmental, Social, Governance focused mutual funds

- Investment must be made during the tax year

- Reduces taxable income dollar-for-dollar with investment amount

- Encourages sustainable investing while reducing taxes

Long-term mutual funds:

- Certain investment vehicles qualify for preferential tax treatment

- Can be combined with ESG fund strategies

Special Scenarios & Exceptions

Pre-2024 Savings: Tax-Free Remittance Strategy

One of the most valuable tax planning tools available is pre-2024 savings remittance. Any funds in your bank account as of December 31, 2023 can be transferred to Thailand completely tax-free, no matter the amount.

Proof requirements:

- Bank statement dated December 31, 2023, showing the account balance

- Account opening documentation (proving account existed before January 1, 2024)

- Deposit history showing funds were accumulated over time (not recent accumulation)

How it works:

Example: You have $50,000 USD in a US bank account as of December 31, 2023. You can transfer this entire amount ($50,000) to Thailand in 2024, 2025, or any future year without Thai tax consequences. These funds don’t count toward your 120,000 THB threshold.

Strategy tip: Transfer large pre-2024 savings into Thailand in years when you’re near the threshold, essentially covering your living expenses with tax-free funds. This reduces the percentage of your gross income that becomes taxable post-2024 income.

Double Taxation Agreements (DTAs)

A Double Taxation Agreement with your home country can dramatically reduce Thai tax liability. Thailand has DTAs with 60+ countries including the US, UK, Germany, Canada, Australia, and many others.

How DTAs work:

DTAs protect certain types of income from being taxed twice. For example, the US-Thailand DTA protects US Social Security, US military pensions, and certain government benefits from Thai taxation. If your income is protected by a DTA, it doesn’t count toward your 120,000 THB threshold.

Critical misunderstanding:

Many expats think a DTA exempts them from filing altogether. This is false. A DTA doesn’t exempt you from the filing requirement; it only exempts specific types of income from taxation. You still file, but certain income lines are marked as “DTA-protected” and not taxed.

Example: You earn $5,000 USD monthly from a US employer (Category 1 income) = $60,000 USD annual income. This exceeds the 120,000 THB threshold and requires filing. However, if you also receive a US Social Security payment of $2,000 monthly, that $2,000 is protected by the US-Thailand DTA and doesn’t count toward Thai tax. Your taxable income is reduced by the DTA protection, but you still file.

Claiming foreign tax credit:

If you paid taxes to another country and that country also has a DTA with Thailand, you can claim a foreign tax credit in Thailand. This credit reduces Thai tax owed. However, you must have paid actual tax in the other country and the credit cannot exceed Thai tax liability on that income.

Visa Status Considerations

Your visa type doesn’t change the 120,000 THB threshold, but it does interact with tax obligations in other ways:

Retirement visa (Non-O/Multiple Entry):

- Subject to 120,000 THB threshold if tax resident

- Some immigration offices require tax compliance documentation for renewal

- Combination of retirement visa + regular tax filing is common

DTV (Digital Nomad) visa:

- If under 180 days: No Thai tax on foreign income

- If over 180 days: Becomes tax resident, 120,000 THB threshold applies

- Many DTV holders strategically stay under 180 days to avoid tax residency

Elite visa:

- Some Elite visa categories offer foreign income exemption (5-10 year window)

- Others don’t; depends on specific Elite visa type purchased

- Check your specific Elite visa terms

LTR visa (Long-Term Resident):

- Highly Skilled Professionals category may exempt foreign income from Thai tax

- Requires specific employment category and salary level

- Must still file but certain income lines are protected

- Most comprehensive visa for tax optimization

Married Couples: Filing Jointly vs. Separately

Joint filing (220,000 THB threshold):

- Single tax return for both spouses combined

- Uses combined income and deductions

- One spouse typically files on behalf of both

- Useful if both spouses have income and want to consolidate

Separate filing (120,000 THB each):

- Each spouse files individual tax return

- Each gets their own 120,000 THB threshold

- Can be advantageous if income is skewed (one spouse earns much more)

- More paperwork but sometimes lower tax

Example: Household earning 150,000 THB total

- Joint filing: Combined income 150,000 exceeds 220,000 threshold? No. No filing required? Wait-220,000 is the exemption threshold. Actually, if combined is 150,000, you’re under 220,000 so no joint filing required.

- Separate filing: If spouse A earns 100,000 and spouse B earns 50,000, both are under 120,000 individually. No separate filings required either.

The strategy gets complex with higher incomes and multiple deduction types. Consult a tax advisor for your specific scenario.

Self-Employed & Business Owners: The 60,000 THB Category 5-8 Threshold

Self-employed individuals and business owners operate under a lower 60,000 THB threshold for certain income categories:

Category 5-8 income includes:

- Self-employment income (freelance, consulting)

- Business profits

- Rental income

- Dividend income

- Capital gains from asset sales

- Investment returns

If you earn 80,000 THB from freelancing, you exceed the 60,000 THB threshold and must file-even though you’re under 120,000 THB. Moreover, you must file twice annually:

- Mid-year filing (PND.94): By September 30, estimate year-end tax

- Annual filing (PND.90): By March 31 following year, file actual year-end return

This dual filing creates extra compliance burden but helps the government ensure tax is paid on investment/business income throughout the year.

Digital Nomads & Short-Term Residents: Strategic Planning

For frequent travelers, the 180-day threshold creates planning opportunities. A digital nomad who spends exactly 179 days in Thailand, then travels abroad, is not a tax resident-avoiding the 120,000 THB threshold entirely.

However, this strategy requires careful documentation:

- Passport stamps proving all entry/exit dates

- Consistent travel pattern (raising red flags if exactly at 179 days annually seems suspicious)

- Awareness that Revenue Department can audit travelers with suspicious patterns

Most digital nomads find it more practical to accept tax residency status and use allowances/deductions to reduce tax liability rather than constantly near-missing the 180-day mark.

Consequences of Not Filing

Understanding penalties motivates compliance. Thailand takes tax filing seriously-non-compliance carries civil and criminal consequences.

Penalties & Fines

Late filing penalty: Minimum 1,000 THB, escalating based on amount and duration

- Files late but eventually files: 1,000 THB + potential interest

- Discovered by Revenue Department without filing: Significantly higher

- Pattern of late filing: Enhanced penalties

Interest on unpaid tax: 1% per month (12% annually)

- Charged on any tax owed but paid late

- Compounds over time; unpaid tax for multiple years becomes substantial

Failure to file penalty: Depends on tax owed, ranges from 1,000-200,000 THB

- Small income amounts: Lower end of scale

- Larger amounts or deliberate non-compliance: Higher end approaching 200,000 THB

Legal Consequences

Tax evasion prosecution:

- Up to 7 years imprisonment (rare but possible)

- Up to 200,000 THB fine (or both)

- Requires proof of intent to evade; honest mistakes are typically treated civilly

Criminal prosecution:

- Revenue Department can refer cases to Department of Special Investigation (DSI)

- Typically only in egregious cases (multiple years non-compliance, large amounts owed)

- Creates permanent criminal record affecting future visa status

Practical Consequences

Visa complications:

- Some visa types require tax compliance documentation for renewal

- Non-compliance flagged during immigration background checks

- Visa renewal may be delayed or denied pending tax settlement

Audit exposure:

- Non-compliance establishes pattern triggering future audits

- Revenue Department maintains audit authority 5 years back

- Discovered non-compliance from prior years can be assessed with penalties and interest

Business operation disruption:

- Self-employed or business owners face agency suspensions

- Work permits may be revoked if tax not filed

- Business license renewals may be denied

Bank account freezes:

- Serious non-compliance can trigger revenue department requests for bank freeze

- Blocks access to funds until compliance is resolved

When Non-Filing Is Actually Legal

To be clear: if you’re a tax resident earning Category 1 income below 120,000 THB, not filing is legally acceptable. The Revenue Department cannot compel you to file if you’re below the threshold.

However, this doesn’t mean you shouldn’t consider filing voluntarily:

- Creates compliance documentation

- Allows claiming refunds if taxes were over-withheld

- Helps visa renewals (demonstrates tax awareness)

- Provides peace of mind

The cost of filing (whether through an advisor or self-filing) is minimal compared to the peace of mind gained.

Frequently Asked Questions

Q: Do I need to file if I’m under 120,000 THB but over 60,000 THB?

A: It depends on your income category. If your income is Category 1 (salary/wages) between 60,000-120,000 THB, you have no mandatory filing requirement. If your income is Categories 5-8 (business, investment, etc.) above 60,000 THB, you must file form PND.90 and also submit mid-year form PND.94 by September 30. Income category is the determining factor.

Q: Is it better to file even if I don’t owe any tax?

A: Yes, filing voluntarily when not required has several advantages. It establishes a compliance record useful if audited later, creates documentation for visa renewals (some visas favor tax compliance history), and clarifies your tax status with authorities. The cost is minimal, and the benefit-avoiding ambiguity-is substantial.

Q: How does my Double Taxation Agreement with my home country affect the 120,000 THB threshold?

A: The DTA doesn’t change the threshold-you still file if over 120,000 THB. What the DTA does is protect certain types of income from Thai taxation. For example, US Social Security protected by the US-Thailand DTA doesn’t count toward your 120,000 THB filing threshold. The DTA exempts specific income from taxation but doesn’t exempt you from filing.

Q: If I split my income with my spouse to stay under 120,000 THB each, can we avoid filing?

A: The Revenue Department can combine spouses’ income if it determines they’re deliberately splitting to avoid thresholds. While individual thresholds allow up to 120,000 THB per spouse, aggressive income-splitting-particularly if one spouse has minimal legitimate income-is considered tax evasion. File legitimately based on actual income sources.

Q: What if I earned 120,000 THB in my home country but haven’t remitted it to Thailand yet-do I owe tax?

A: Income not remitted to Thailand is not immediately taxable. Only when you transfer the funds to Thailand does it become assessable. Until then, it’s a foreign bank account balance. However, once you remit, it becomes taxable income in the year of remittance. If you wait to remit until next calendar year, it may fall under a different tax year’s threshold.

Q: Are US Social Security and government pensions taxable in Thailand, and do they count toward the 120,000 THB?

A: Most US government pensions (Social Security, military pensions) are protected by the US-Thailand Double Taxation Agreement and are NOT taxed in Thailand. They don’t count toward the 120,000 THB filing threshold. However, private pension income earned after January 1, 2024 may be taxable. Verify your specific pension type against the US-Thailand DTA.

Q: Is there a way to legally stay under the 120,000 THB threshold?

A: Yes, several strategies work legally:

- As a non-resident (under 180 days): No Thai tax on foreign income

- Keep remittances under 120,000 THB: Transfer only needed funds annually

- Use pre-2024 savings tax-free: Live off pre-2024 savings while earning post-2024 income below 120,000 THB

- Maximize deductions and allowances: Reduce taxable income below 120,000 THB through eligible deductions

- Stay under 180 days: Multiple entry-exit strategy (risky; see borderline cases section)

Tools & Resources for Thailand Tax Compliance

Official Government Resources

Thai Revenue Department (สำนักงานสรรพสรุป):

- Official website: https://www.rd.go.th

- Search for your provincial office on the website to find local contact information and office hours

- English support available at main office; provincial offices often Thai-language only

E-Filing Portal:

- https://efiling.rd.go.th

- Allows online tax return submission

- Deadline: April 8 each year

- Username/password registration required

- Forms submitted digitally; no printing needed

RD SmartTax Mobile App:

- Available on iOS and Android

- File taxes directly from smartphone

- Useful for checking filing status and receiving updates

Form Downloads:

- Form L.P. 10.1: Tax ID application

- Form PND.91: Simple tax return (employment income)

- Form PND.90: Complex tax return (multiple income sources)

- Form PND.94: Mid-year return (Categories 5-8 income)

- All available free at Revenue Department website

Tax Calculation & Planning Tools

Progressive Tax Bracket Calculator:

Calculate exact tax liability based on your income and deductions

Deduction and Allowance Worksheet:

Calculate which allowances and deductions apply to your situation

Exchange Rate Converter:

Calculate remittance income in THB using official Revenue Department exchange rates

Professional Assistance Resources

Thai-based tax accountants and advisors:

Many firms specialize in expat tax compliance; typical cost 3,000-10,000 THB for annual preparation

International tax preparation services:

Online services for expats; rates vary but typically 200-500 USD annually

Expat community groups and forums:

Online communities where expats share experiences and recommendations for tax advisors

Mastering the 120,000 THB Threshold

The 120,000 THB personal income tax filing threshold isn’t complicated once you understand its components. Tax residency determines whether it applies to you. Income category determines which threshold you face (120,000 or 60,000 THB). Strategic use of allowances and deductions can reduce your tax liability to zero despite exceeding the threshold.

The key insight: filing obligation ≠ tax obligation. You may file and owe no tax. But you cannot skip filing if over the threshold-penalties are severe and consequences are real.

For tax residents with assessable income exceeding 120,000 THB, compliance is straightforward:

- Verify residency status: Are you 180+ days in-calendar year?

- Calculate total assessable income: Sum all sources from January-December

- Identify income categories: Category 1 (salary, 120K threshold) vs. Categories 5-8 (business/investment, 60K threshold)?

- Gather documentation: Payslips, remittance records, deduction receipts

- Apply allowances: Personal, spouse, senior, child, disability allowances

- Calculate taxable income: After-allowance income minus tax-free threshold (first 150,000 THB)

- Determine tax liability: Apply progressive rates; claim foreign tax credits if applicable

- File and pay: E-filing by April 8 or paper filing by March 31

- Keep records: Document everything for 5-year audit period

The path to tax compliance is clear. The consequences of non-compliance are severe. Take the threshold seriously, file on time, and avoid penalties entirely.

Your next step: Determine your 2026 tax residency status and income category, gather documentation over the next few weeks, and file by the March 31 (paper) or April 8 (e-filing) deadline. If uncertainties remain, consult a tax professional-the investment in advice pays for itself in avoided penalties and peace of mind.