What You Need to Know About Importing Tablets to Thailand

Thailand’s import tax system underwent a seismic shift on January 1, 2026-and if you’re importing tablet computers, this directly impacts your costs and profit margins. The elimination of the 1,500 baht tax-free threshold means every single tablet entering Thailand is now subject to duties and VAT, whether purchased through e-commerce platforms like Lazada and Shopee or imported through commercial channels.

For e-commerce buyers, this translates to an unexpected 17-18% price increase. For business importers and dropshippers, this requires urgent recalculation of sourcing strategies and product margins. For sellers and distributors, this signals a critical need to understand Free Trade Agreement benefits and HS code optimization.

This comprehensive guide decodes Thailand’s 2026 tablet import framework, providing actionable strategies to minimize tax exposure, ensure customs compliance, and maintain competitive margins in this highly regulated market.

Part 1: Quick Answer-What’s the Current Tablet Import Duty in Thailand?

The Simple Answer

If you’re importing a tablet to Thailand right now, expect to pay:

- Import duty: 5–10% of the product’s CIF value (Cost + Insurance + Freight)

- VAT: 7% on the duty-inclusive amount

- Total tax burden: 12–17% depending on origin and classification

- With Free Trade Agreement: Potentially 0–5% duty (VAT always applies)

The 2026 Game-Changer

Until December 31, 2025, packages valued under 1,500 baht could arrive tax-free. That’s gone. Starting January 1, 2026, Thailand taxes imported goods from the first baht, automatically collected at e-commerce checkout and enforced through customs for commercial shipments.

Why Thailand Made This Change

Thailand’s government had three motivations:

- Protect local SMEs: Thai retailers and tablet vendors couldn’t compete with undercutting foreign imports arriving duty-free

- Generate revenue: The policy is projected to generate 3 billion baht annually for government coffers

- Level the playing field: Create fair competition across online platforms (Lazada, Shopee, TikTok Shop, etc.)

Part 2: Understanding Tablet HS Codes-The Foundation of Your Tax Bill

What is an HS Code and Why It Matters

An HS (Harmonized System) code is a standardized six-digit number used globally to classify goods for customs, duties, and trade statistics. Thailand uses an eight-digit extension called the AHTN code (ASEAN Harmonized Tariff Nomenclature) for even more precision.

Your HS code determines your duty rate. Misclassify a tablet and you’ll either overpay or face customs penalties.

The HS Code for Tablets: 8471

Tablet computers fall under HS Code 8471-“Automatic Data Processing Machines and Units Thereof.”

The full Thai classification breaks down as:

| Code Level | Number | Description |

|---|---|---|

| HS Heading | 8471 | Automatic data processing machines |

| HS Subheading | 8471.30 | Portable automatic data processing machines |

| Thai AHTN (8-digit) | 8471.30.10 | Portable ADP machines ≤10kg with CPU, keyboard, display |

| Alternative code | 84713000 | Used in some contexts (same classification) |

Key qualifier: The tablet must weigh no more than 10 kilograms and include a CPU, keyboard, and integrated display to qualify as 8471.30. Heavier devices or standalone components use different codes.

Why This Specific HS Code Matters for Your Import

- Determines duty rate: Standard tablets under 8471.30 face 5–10% duty in Thailand

- Affects FTA eligibility: Your Free Trade Agreement benefit depends on correct HS code classification

- Determines inspections: Certain codes trigger stricter customs review or require additional documentation

- Controls licensing requirements: The HS code determines if special permits or approvals are needed

- Influences fees: Customs broker fees and processing times vary by code complexity

How to Find and Verify the Correct HS Code

Step 1: Check specifications

- Confirm tablet weight (must be ≤10kg to qualify for 8471.30)

- Verify it has integrated CPU, keyboard (physical or virtual), and display

- Note processor type, storage, and connectivity features

Step 2: Consult WCO (World Customs Organization) database

- Visit WCO’s HS nomenclature browser

- Search “8471” to see the global structure

- Verify your product fits the 8471.30 definition

Step 3: Check Thailand’s official AHTN database

- Access the Thai Customs Department website (customs.go.th)

- Look up the 8-digit AHTN code (8471.30.10 for standard tablets)

- Note any local specific duties or restrictions

Step 4: Request binding classification (optional but recommended)

- Submit a written request to Thai Customs with product specifications

- Cost: 1,000–3,000 baht

- Benefit: Binding classification prevents future disputes

- Timeline: 10–15 business days

Step 5: Validate with professionals

- Confirm classification with your customs broker or freight forwarder

- Request written confirmation to include in your records

- Use for all future shipments from same supplier

Common HS Code Mistakes (And How Much They Cost)

| Mistake | What Happens | Cost Impact |

|---|---|---|

| Misclassifying as communication device (8517) | Duty assessed at 15–20% instead of 8–10% | +100–200% tax overpayment per tablet |

| Using 6-digit code instead of 8-digit | Thai Customs reassigns to higher duty subheading | Duty increase of 5–10 percentage points |

| Incorrectly classifying accessories (cases, chargers) | Charged 8471 duty (15%) instead of 8473 (5–7%) | 2x tax bill on accessories |

| Component parts classified as complete units | Duty jumps from 5% to 20% | Massive unplanned costs |

| Result: Customs holds shipment | Shipment delayed 7–30 days pending reclassification | Lost sales, storage fees, compliance risk |

Part 3: Thailand’s 2026 Tax System Explained-What Changed and Why

The Seismic Shift: January 1, 2026

Thailand eliminated the most significant tax exemption in the e-commerce era: the 1,500 baht de minimis threshold.

Before January 1, 2026

- Packages valued under 1,500 baht: Zero tax (duty-free and VAT-free)

- Packages valued 1,500–50,000 baht: 7% VAT only, no duty

- Packages valued over 50,000 baht: 7% VAT + import duties (0–20%)

From January 1, 2026 Onwards

- All packages: Taxed from 1 baht upwards

- All packages: Subject to 7% VAT (mandatory since July 2024)

- All packages: Subject to import duty (0–80% depending on HS code)

- All packages: Duties and VAT apply regardless of value

The 2026 Tax Collection Architecture

Thailand implemented a seamless, automated tax collection system integrated directly into e-commerce checkouts:

How it works:

- Customer adds tablet to cart on Shopee/Lazada

- Platform automatically calculates: CIF value + import duty + VAT

- Tax displays at checkout with transparent breakdown

- Customer pays total (product price + duty + VAT) upfront

- Platform remits taxes to Thai Customs on behalf of customer

- Package clears customs with no additional payment at delivery (in 97% of cases)

Who This Most Affects

The 2026 changes create three tiers of impact:

Tier 1: E-Commerce Buyers (Highest Impact)

- Previously imported tablets under 1,500 baht tax-free

- Now paying 17–18% extra

- Budget impact: +1,700–1,800 baht per 10,000-baht tablet

- Affected: Casual e-commerce importers, international travelers, small resellers

Tier 2: Dropshippers & Retailers (Medium Impact)

- Margin compression from 25–30% to 15–20% on high volumes

- Must recalculate product pricing and supplier sourcing

- Can partially offset via FTA strategies (see Part 6)

- Affected: Amazon/eBay resellers, Lazada/Shopee sellers, micro-entrepreneurs

Tier 3: Business Importers (Manageable with Strategy)

- Can leverage FTA duty elimination (potentially 0% duty + 7% VAT only)

- Bulk ordering provides leverage to negotiate supplier concessions

- Can absorb costs via margins and scale efficiency

- Affected: Distributors, B2B retailers, corporate buyers

VAT: The Universal Tax (July 2024 Rule)

A critical precursor to the 2026 duty expansion was the July 2024 VAT universalization:

The rule: Every import to Thailand, regardless of value, is now subject to 7% VAT.

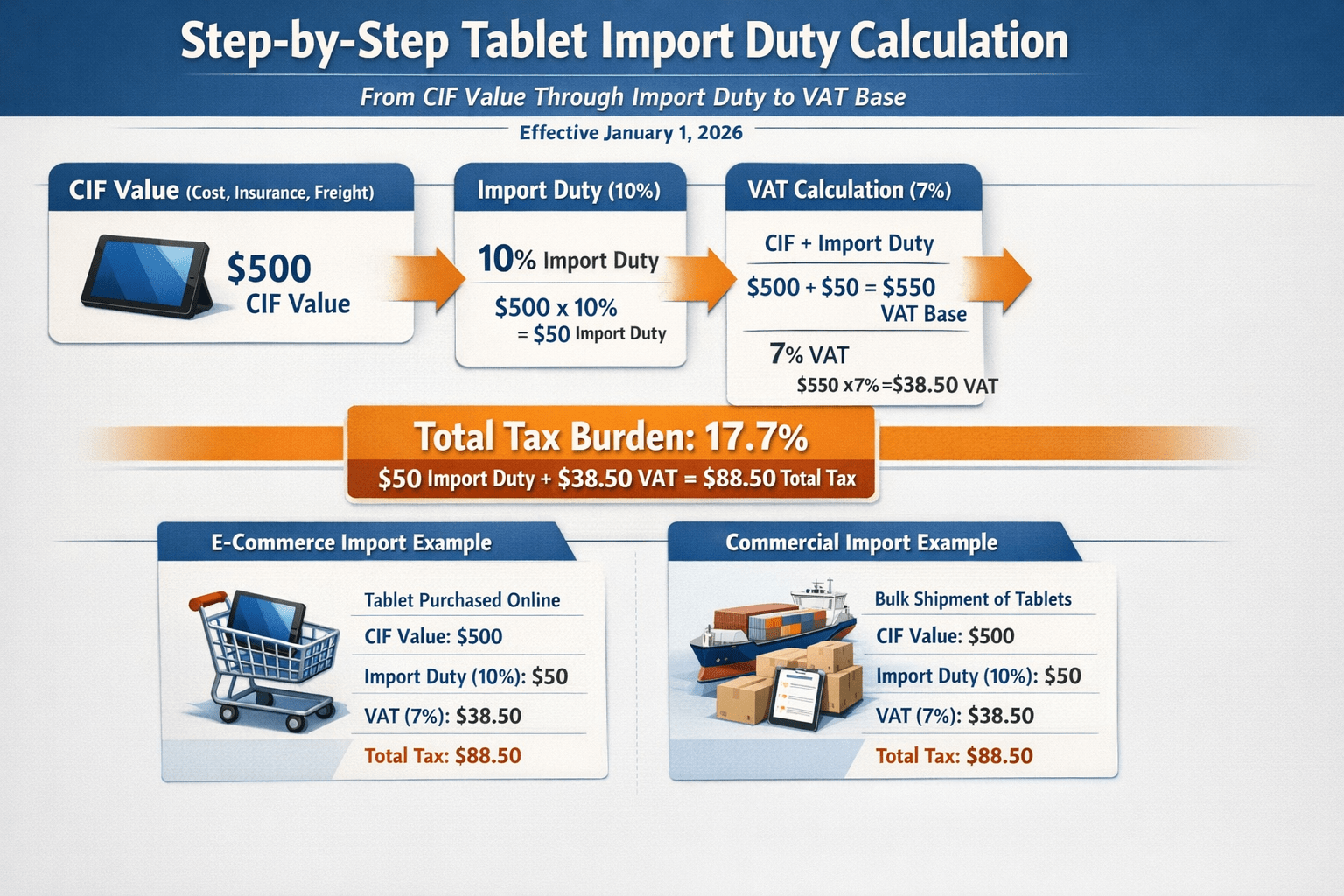

Why it matters: VAT is applied to a cumulative base-not just the product price, but the CIF value PLUS import duty. This creates a compounding effect:

Example:

- Tablet CIF value: 10,000 baht

- Import duty (10%): 1,000 baht

- VAT base: 10,000 + 1,000 = 11,000 baht

- VAT (7%): 770 baht

- Total tax: 1,770 baht (17.7% markup)

Part 4: Complete Import Duty & Tax Calculation Guide-With Real Numbers

Seven-Step Duty Calculation Framework

Follow these steps to calculate your exact tablet import tax:

Step 1: Determine CIF Value

CIF stands for Cost, Insurance, Freight-the landed value before any duties or taxes.

Formula:

textCIF Value = Product Cost + International Shipping + Insurance

Example:

- Tablet purchase price: $150 USD

- International freight (China to Bangkok): $20 USD

- Insurance (2% of goods): $3 USD

- Total CIF: $173 USD

Step 2: Convert to Thai Baht

Use the current exchange rate (as of January 2026, approximately 1 USD = 35 THB).

Example:

text$173 × 35 = 6,055 THB CIF value

Step 3: Identify the Applicable Duty Rate

This depends on your tablet’s HS code and origin country. For standard tablets under HS 8471.30:

| Scenario | Duty Rate |

|---|---|

| Standard import (no FTA) | 5–10% |

| From China (ACFTA) | 5% |

| From Japan (RCEP) | 0% |

| From ASEAN (AFTA) | 3–5% |

| E-commerce platform import | 10% (flat rate for low-value items) |

For this example, assume 10% (standard rate without FTA):

Step 4: Calculate Import Duty

Formula:

textImport Duty = CIF Value × Duty Rate

Example:

text6,055 THB × 10% = 605.50 THB import duty

Step 5: Determine VAT Base

The VAT is charged on the CIF value PLUS the import duty (not on the original price).

Formula:

textVAT Base = CIF Value + Import Duty + Other Fees

Example:

textVAT Base = 6,055 + 605.50 + 0 (no other fees) = 6,660.50 THB

Step 6: Calculate VAT

Formula:

textVAT = VAT Base × 7%

Example:

text6,660.50 × 7% = 466.24 THB VAT

Step 7: Calculate Total Tax Payable

Formula:

textTotal Tax = Import Duty + VAT

Example:

textImport Duty: 605.50 THB

VAT: 466.24 THB

Total Tax: 1,071.74 THB (17.7% of CIF)

Real-World Scenario: Bulk Tablet Order

Now let’s apply this framework to a realistic business scenario-importing 50 tablets for resale.

| Component | Calculation | Amount |

|---|---|---|

| Unit cost | 50 tablets @ 5,000 THB each | 250,000 THB |

| Shipping | International freight, CIF | 25,000 THB |

| Insurance | 2% of goods value | 5,000 THB |

| CIF Value | Total landed value | 280,000 THB |

| Import duty (10%) | 280,000 × 10% | 28,000 THB |

| VAT base | 280,000 + 28,000 | 308,000 THB |

| VAT (7%) | 308,000 × 7% | 21,560 THB |

| Customs broker fee | Estimated for 50-unit shipment | 3,500 THB |

| Total taxes & fees | 28,000 + 21,560 + 3,500 | 53,060 THB |

| Final cost per tablet | (280,000 + 53,060) / 50 | 6,661 THB per tablet |

| Price increase | vs. CIF cost alone | +18.9% |

Business implication: If your supplier cost is 5,000 baht per tablet and you must resell at 6,661 baht to break even, your margin on e-commerce platforms (30% typical) drops dramatically.

VAT Calculation Deep Dive: The Compounding Effect

Many importers fail to account for VAT being calculated on a cumulative base. This creates an unexpected tax multiplier:

Why it matters:

The 7% VAT isn’t charged on just the tablet price-it’s charged on (tablet CIF + import duty). This means:

- Your import duty becomes part of the taxable base

- VAT “taxes the tax,” compounding the effective rate

- On a 10,000-baht tablet with 10% duty, you pay VAT on 11,000 baht (not 10,000)

Effective tax rate calculation:

textCIF: 10,000 THB

Duty (10%): 1,000 THB

Subtotal: 11,000 THB (VAT base)

VAT (7%): 770 THB

Effective rate = (1,000 + 770) / 10,000 = 17.7%

Without understanding the compounding effect, you’ll consistently underestimate your true cost of goods.

Part 5: Free Trade Agreements-How to Cut Your Tablet Duty to Zero

Thailand has negotiated 25+ free trade agreements. For tablet importers, the most valuable are those covering Asia-Pacific manufacturers.

Thailand’s Major FTA Partners for Tablet Imports

1. RCEP (Regional Comprehensive Economic Partnership) ⭐ BEST SAVINGS

Partners: ASEAN + China, Japan, South Korea, Australia, New Zealand

Tablet duty benefit: Often 0% for Japanese, South Korean, and Australian tablets

Coverage: Electronics from partner countries typically in immediate duty elimination schedule

How it works: If your tablet manufacturer has a valid Certificate of Origin from Japan, duty-free entry applies to Thailand

Savings example on 280,000 THB bulk import:

textStandard duty (10%): 28,000 THB

RCEP duty (0%): 0 THB

Savings: 28,000 THB (plus VAT savings of ~1,960 THB)

Total savings: ~29,960 THB per shipment

Requirement: Valid RCEP Certificate of Origin from exporter

2. JTEPA (Japan-Thailand Economic Partnership)

Partners: Japan only

Tablet duty benefit: 0–3% depending on product specifics

Processing: Faster clearance than other FTAs; bilateral agreement provides clarity

Best for: Direct imports from Japanese manufacturers (Sony, Sharp, etc.)

Requirement: Japanese Certificate of Origin

3. ASEAN FTA (AFTA)

Partners: All 10 ASEAN countries (Singapore, Vietnam, Malaysia, Laos, Cambodia, Philippines, Indonesia, Brunei, Myanmar, Thailand)

Tablet duty benefit: 0–5% depending on origin country

Coverage: Broad electronics range with phase-down schedule (most products already at 0% by 2026)

Best for: Tablets manufactured or assembled in Vietnam, Malaysia, Singapore, or Indonesia

Savings on 280k shipment: ~14,000–28,000 THB depending on exact origin

4. ACFTA (ASEAN-China FTA)

Partners: China + 10 ASEAN countries

Tablet duty benefit: Often 0–5% for machinery/electronics from China

Coverage: Most favorable rates for components from China; final assembly duty varies

Best for: Bulk imports directly from Chinese manufacturers (most tablet production is in China anyway)

Requirement: Chinese Certificate of Origin proving manufacturing origin

5. Bilateral Agreements

Additional FTAs offer smaller but meaningful savings:

| FTA | Countries | Tablet Duty | Best For |

|---|---|---|---|

| TAFTA | Thailand-Australia | 0–5% | Australian-designed tablets |

| Thailand-Singapore FTA | Thailand-Singapore | 0% | Singapore-origin tech |

| South Korea (AKFTA) | Thailand-South Korea | 0–3% | Samsung tablets (if made in Korea) |

Step-by-Step: How to Claim FTA Duty Reduction

Step 1: Verify manufacturer origin

Confirm where your tablet is manufactured, not where it’s shipped from. Check:

- Manufacturer nameplate on device

- Supply chain documentation

- Supplier’s Certificate of Origin

Example: A tablet stamped “Made in Japan” shipped from Singapore still qualifies for RCEP (0%) if Certificate of Origin says Japan.

Step 2: Obtain Certificate of Origin (CoO)

Request from your supplier-this is the golden ticket to FTA benefits.

What to request:

- RCEP Certificate of Origin (if eligible)

- Or JTEPA CoO (if Japan origin)

- Or AFTA CoO (if ASEAN origin)

Timeline: Most reputable suppliers provide within 3–5 business days

Format: Usually printed document or digital file with issuing body certification

Step 3: Verify FTA eligibility

Not all products qualify. Check the specific FTA product schedule for HS code 8471.30:

- Is your tablet on the “duty-free” list?

- Are there any “safeguard” limitations?

- Do origin percentages matter (local content rules)?

Example: RCEP electronics typically have 40–50% ASEAN content requirement; tablets with 100% foreign components may not qualify.

Step 4: Apply correct HS code

Declare HS 8471.30 (or 8471.30.10 for Thai AHTN) on all documents. Incorrect HS codes invalidate FTA benefits.

Step 5: Submit complete customs declaration

Via e-Customs system, include:

- HS code: 8471.30.10

- CIF value in baht

- FTA declaration

- Attached Certificate of Origin

Step 6: Request preferential rate at import

On the customs declaration form, explicitly request FTA treatment. Thai Customs won’t apply preferential rates unless requested.

Template language: “Claiming preferential tariff treatment under RCEP with valid Certificate of Origin for goods of Japanese origin.”

Step 7: Keep records for compliance

Retain all documentation for 5 years:

- Original Certificate of Origin

- Supplier invoices

- Customs declarations

- Payment receipts

- Correspondence with Customs

Common FTA Mistakes (And Their Consequences)

| Mistake | What Happens | Penalty |

|---|---|---|

| Using CoO from wrong country | Ineligible for FTA; charged full duty | Full 10% duty + potential 25% surcharge |

| Invalid or expired CoO | Customs rejects preferential claim | Back-duty assessment + interest |

| HS code mismatch with FTA schedule | Product not on duty-free list | Standard rate applied; no FTA benefit |

| Not requesting FTA on customs form | Customs defaults to standard rate | Must appeal later (costly, time-consuming) |

| Missing or forged CoO | Fraudulent import declaration | Fines up to 500,000 baht + potential imprisonment |

FTA Savings Comparison Table

Compare your actual tax bill under different scenarios:

| Origin | Standard Duty | FTA Duty | Savings on 280k CIF | Final Unit Cost* |

|---|---|---|---|---|

| Non-FTA origin | 10% | 10% | 0 THB | 6,661 THB |

| China (ACFTA) | 10% | 5% | 14,000 THB | 6,326 THB |

| ASEAN (AFTA) | 10% | 3% | 19,600 THB | 6,117 THB |

| Japan (RCEP) | 10% | 0% | 28,000 THB | 5,591 THB |

*Per tablet calculation: (280,000 CIF + taxes) / 50 tablets; includes VAT recalculation at lower duty

Part 6: E-Commerce vs. Commercial Imports vs. Personal Use

Thailand recognizes three distinct import channels, each with different tax treatment:

Channel 1: E-Commerce Imports (1–5 tablets per order)

What it is: Direct purchase from Lazada, Shopee, TikTok Shop, AliExpress

Tax treatment:

- Tax threshold: 1 baht (all imports taxed effective Jan 1, 2026)

- Typical duty rate: 10% flat (e-commerce rate for most low-value imports)

- VAT: 7% mandatory

- Total tax: ~17% typically

How it works:

- Add tablet to cart on e-commerce platform

- See total price including tax at checkout

- Pay once; tax collected by platform

- No additional payment at customs delivery

- Parcel arrives with duties already cleared

Timeline: 2–5 days to delivery (Bangkok area); 5–10 days to provinces

Documentation needed: None (platform handles it)

Advantages:

- Simplest process

- No customs bureaucracy

- Transparent pricing upfront

- Instant gratification

Disadvantages:

- No FTA optimization possible

- Highest effective tax rate (10% duty)

- Per-unit prices highest

- No bulk negotiation ability

Best for: Individual consumers, emergency replacements, small quantities

Channel 2: Commercial Business Imports (50+ tablets per shipment)

What it is: B2B import via customs broker with proper commercial documentation

Tax treatment:

- Tax threshold: All imports taxed

- Typical duty rate: 5–10% depending on HS code (lower than e-commerce)

- VAT: 7% mandatory

- With FTA: 0–5% possible, reducing to 7% total tax (VAT only)

- Total tax: 12–17% without FTA; 7–12% with FTA

How it works:

- Supplier ships tablets to Thai ports/airport

- Customs broker submits e-Customs declaration

- HS code verified; duty assessed based on classification

- You pay duty + VAT to customs

- Cargo released for inland delivery

Timeline: 5–15 days depending on inspection requirements (Red Line vs. Green Line)

Documentation needed:

- Commercial invoice

- Bill of lading/airway bill

- Packing list with HS codes

- Certificate of Origin (if claiming FTA)

- Your company registration, tax ID, VAT certificate

- Power of attorney to customs broker

Advantages:

- Can apply FTA for major savings (0% duty possible)

- Lower per-unit duty rates

- Bulk pricing leverage with suppliers

- Professional customs handling

Disadvantages:

- Higher upfront complexity

- Customs broker fees (3,000–8,000 THB)

- Longer delivery timeline (5–15 days)

- Requires proper business licensing

- Potential for customs inspection delays

Best for: Business importers, resellers, distributors, high-volume operations

Channel 3: Personal Use Imports (Travelers)

What it is: Bringing tablets for personal use through airport/border

Legal status: Officially prohibited for new tablets

Reality: Customs enforcement is selective; used tablets in limited quantities may pass

Tax treatment:

- Restriction: Commercial quantities = seizure

- Exception: Used tablets (1–2 units) may be allowed

- Duty: Typically waived if clearly personal/used items

- VAT: Technically applies but rarely collected on personal items

How it works:

- Pack tablet in checked baggage or carry-on

- Declare to customs if asked (or don’t declare if unasked)

- If questioned, claim personal use

- Customs may ask questions about quantity and newness

- Likely outcomes: Pass through (most common) or confiscation (if commercial quantity detected)

Risk factors:

- Brand new sealed box = commercial appearance

- Multiple units = flagged as commercial

- High-value items = inspection likely

- No documentation = harder to justify personal use

Best for: Individual travelers bringing one personal device, replacing a broken tablet

Not recommended for:

- Commercial quantities (2+ new tablets)

- Bulk importing under “personal use” guise

- Undeclared high-value items

Part 7: Documentation & Compliance Framework

Complete Document Checklist for Commercial Tablet Imports

To successfully import tablets through customs, you’ll need two categories of documents:

Company-Level Documents (Valid for multiple shipments)

These must be current and on file with Thai Customs:

- Company registration certificate (valid within 3 months)

- Tax identification number (Identification of the Company/Organization for Tax Purposes)

- VAT registration certificate (Phor Phor 20 form or equivalent)

- Company affidavit (updated within 6 months, notarized)

- Bank account proof (statement showing company name, account number, recent activity)

- Seal registration (BAJ 3 form with official company seal impression)

- Power of attorney (authorizing customs broker to act on your behalf)

- Import license (if importing for commercial resale; obtained from Department of Foreign Trade)

Shipment-Specific Documents (Required for each import)

These documents accompany each tablet shipment:

- Commercial invoice (detailed product description, unit price, quantity, CIF value)

- Bill of lading (ocean freight) OR airway bill (air freight)

- Packing list (itemized by carton with HS codes for each product line)

- Certificate of Origin (if claiming FTA duty reduction; issued by exporter’s government body)

- Import declaration form (e-Customs system form filled out by importer/broker)

- Certificate of insurance (optional but recommended; proves goods insured during transit)

- Customs broker authorization letter (if using broker; power of attorney)

Step-by-Step Customs Clearance Process

Stage 1: Pre-Import Registration (One-time)

- Register with Thai Customs

- Visit Thai Customs office or use e-Customs system

- Provide company documentation

- Complete importer registration form

- Obtain digital certificate

- Necessary for e-Customs system access

- Valid 3 years

- Cost: 0–500 baht

- Apply for “paperless license” (if using e-Customs)

- Streamlines electronic documentation

- Valid 3 years

- Enables online duty payment

- Highly recommended

Stage 2: Shipment Arrival

- Carrier notifies you of arrival (7–10 days after shipping)

- You contact customs broker (if using one)

- Broker collects documents from you

Stage 3: e-Customs Declaration (24–48 hours after arrival)

- Broker submits import declaration via e-Customs system

- Includes: HS code, CIF value, importer details, origin country

- Declares FTA status if applicable

- System auto-calculates duties based on HS code

- Customs reviews (automated or manual)

- Most declarations approved automatically (Green Line)

- High-value or suspicious shipments flagged (Red Line)

Stage 4: Duty Assessment & Payment

- Customs confirms duty amount

- Import duty (calculated as CIF × duty rate)

- VAT (calculated as (CIF + duty) × 7%)

- Total payable

- You pay duties via:

- Online banking (e-Customs system)

- ATM transfer

- Bank counter

- Broker payment on your behalf

- Payment confirmation issued

Stage 5: Inspection (If Required)

Green Line (80% of shipments):

- No physical inspection

- Cargo released within 24 hours of payment

- Timeline: 2–3 days total

Red Line (15–20% of shipments):

- Physical inspection at customs warehouse

- Typically random or value-triggered

- Inspection items: HS code verification, value confirmation, quality check

- Timeline: 5–10 days

Risk factors triggering Red Line:

- High-value shipment (>500,000 baht)

- Undeclared value discrepancy

- First-time importer

- Suspicious origin documentation

- Prohibited items detected

Stage 6: Cargo Release

- Customs issues release authorization (สนค.7 form)

- Cargo transported to your warehouse/facility

- You receive tablets and can begin selling

Total timeline: 2–5 days (Green Line) or 7–15 days (Red Line)

Part 8: Special Restrictions & Regulatory Requirements

What Thailand Prohibits & Restricts

Tablets fall into several regulatory frameworks:

Personal Use Restrictions

- New tablets for commercial import via personal luggage: PROHIBITED

- Used tablets (1–2 personal units): Allowed if clearly for personal use

- Quantity enforcement: More than 2 tablets = commercial intent assumed

Technical Standards

- No FDA approval required: Unlike pharmaceuticals, tablets don’t need pre-approval

- Thai telecom compliance: WiFi-only tablets = unrestricted; LTE/cellular variants = must comply with Thai telecom standards (NBTC certification)

- No region-locking enforcement: Thailand doesn’t restrict region-locked devices

- Power standards: Check voltage (tablets typically 100–240V AC, compatible globally)

Licensing

- Import license: Required for commercial resale

- Wholesale license: May be required if selling to retailers

- Online seller registration: Required if selling via e-commerce platforms

What Thai Customs Actively Monitors

Thai Customs maintains sophisticated risk assessment systems:

HS Code Accuracy

- Compares declared codes against database of known imports

- Flags unusual product-code combinations

- Verifies weight/specifications match declared code

Value Underdeclaration

- Compares invoice CIF to market-rate benchmarks

- Flags suspiciously low declared values

- Red-flags invoices 30%+ below market rates

Origin Verification

- Validates Certificates of Origin against issuing body databases

- Checks for forged or invalid CoOs

- Verifies FTA eligibility of goods

Commercial Intent

- Monitors quantity patterns (frequent small shipments = evasion signal)

- Flags personal luggage imports with commercial quantities

- Tracks high-volume individuals claiming personal use

Prohibited Items

- Scans for restricted components (dual-use equipment, encryption, military applications)

- Checks for counterfeit or recalled devices

- Verifies no stolen goods

Penalties for Non-Compliance

Customs violations carry escalating penalties:

| Violation | Penalty | Example |

|---|---|---|

| HS code misclassification | 10–30% surcharge on duties | Tablets classified as 8517 instead of 8471 = 50–100% extra duty |

| Value underdeclaration | 25–100% penalty on undeclared amount | Declaring 100,000 when actual is 150,000 = 12,500–50,000 THB penalty |

| Fraudulent Certificate of Origin | Up to 500,000 baht fine + potential imprisonment | Using forged Japanese CoO for Chinese goods |

| Importation of prohibited goods | Seizure and auction of goods + fines | Importing restricted tech |

| Repeated violations | Import license suspension (6–24 months) | Multiple underdeclaration incidents |

Part 9: Four Tablet Import Strategies-Which One Is Right for You?

Different importers have different needs. Here are four distinct strategies:

Strategy 1: E-Commerce Direct Purchase (Best for individual consumers)

Volume: 1–5 tablets per order

How it works:

- Browse tablet on Lazada/Shopee

- See tax-included price at checkout

- Pay once; duties handled by platform

- Wait 2–5 days for delivery

Tax impact:

- Duty: 10% of CIF

- VAT: 7% of (CIF + duty)

- Total effective tax: ~17%

Example: 10,000 baht tablet

- Duty: 1,000 baht

- VAT: 770 baht

- Total: 11,770 baht at checkout

Advantages:

- No documentation required

- Transparent pricing upfront

- Fastest delivery (2–5 days)

- No customs interaction

Disadvantages:

- Highest tax rate (10% duty)

- No FTA optimization

- Per-unit prices highest

- No bulk discounts available

When to use: Emergency replacement, personal use, trying before buying bulk

Strategy 2: Bulk B2B Import with FTA (Best for businesses)

Volume: 50–500 tablets per shipment

How it works:

- Source tablets directly from manufacturer (Japan, Vietnam, or China)

- Request Certificate of Origin proving FTA eligibility

- Import via customs broker with CoO documentation

- Claim preferential FTA duty rate (0–5%)

- Resell or distribute to retailers

Tax impact (Japan origin via RCEP):

- Duty: 0% (FTA rate)

- VAT: 7% of CIF only (no duty surcharge)

- Total effective tax: ~7%

Example: 50 tablets @ 5,000 baht CIF each

- CIF value: 250,000 baht

- Duty: 0 baht (RCEP benefit)

- VAT: 17,500 baht (7% on CIF)

- Broker fees: 3,000 baht

- Total tax: 20,500 baht

- Per-unit cost: 5,410 baht (vs. 6,661 e-commerce)

Advantages:

- Lowest tax rate if FTA applies (7% VAT only)

- Bulk discounts from suppliers

- Professional customs handling

- Can sell at competitive margin

Disadvantages:

- Requires business licensing

- More complex documentation

- 5–15 day clearance timeline

- Customs broker fees (3,000–8,000 baht)

- Upfront working capital needed

When to use: Regular resale business, sufficient volume (50+), access to FTA suppliers

Strategy 3: Dropshipping from China (Best for high-volume online sellers)

Volume: Variable; direct-to-consumer shipments from suppliers

How it works:

- Partner with Chinese tablet manufacturer

- Customer orders via your e-commerce storefront

- Supplier ships directly to end customer in Thailand

- Customer pays you; you pay supplier

- Thailand’s e-commerce tax system collects duty at checkout

Tax impact:

- Duty: 10% per shipment (e-commerce rate)

- VAT: 7% per shipment

- Total effective tax per unit: ~17%

Example: 100 customers ordering 3,500-baht tablets

- Cost to customer: 3,500 baht

- Duty (10%): 350 baht

- VAT (7%): 268 baht

- Customer pays: 4,118 baht total

Your margin breakdown (30% typical margin):

- Revenue per tablet: 3,500 baht (from customer)

- Your cost: 1,500 baht (from supplier)

- Your gross profit: 2,000 baht

- BUT: Suppliers typically charge 10–15% higher for dropship

- Adjusted cost: 1,650 baht

- Your net margin: 1,850 baht (35% of cost, but only 35% of customer price)

- After platforms take 10–15%: Your margin is 20–25% of revenue only

Advantages:

- No inventory holding

- Flexible order volumes

- Automated tax collection

- Low barrier to entry

Disadvantages:

- High tax burden (10% duty per item)

- Margin compression

- Need 35%+ markup to maintain profit

- No control over HS code classification

- Vulnerable to price competition

When to use: Starting online business, testing market, low capital availability

Strategy 4: Local Thai Distributor (Best for avoiding import complexity)

Volume: Any quantity available locally

How it works:

- Purchase tablets from authorized Thai distributor

- Tablets already in Thailand with tax embedded in distributor’s cost

- You buy at wholesale price (higher than CIF, but includes all taxes/clearance)

- No customs interaction

Tax impact:

- All taxes already paid by distributor

- Your purchase price includes: CIF + duty + VAT + distributor margin

- Effective cost: +25–35% above CIF

Example: Finding distributor for tablets

- Distributor selling price: 6,500 baht

- (vs. 5,410 baht all-in with FTA bulk import)

- Distributor markup: ~20% above FTA-optimized import

Advantages:

- Zero customs complexity

- Immediate inventory availability

- Warranty support from distributor

- Professional logistics

- No business licensing required

Disadvantages:

- Highest final cost (distributor margin adds 20–35%)

- Less control over product selection

- Limited negotiation power

- Dependent on distributor stock levels

- Longer payment terms may require credit

When to use: Avoiding complexity, immediate availability critical, small volumes, retail purchase

Part 10: 2026 Tax Scenarios-Real Numbers for Real Situations

Scenario A: Single Tablet Purchase via E-Commerce

Situation: You’re a student in Bangkok wanting a budget tablet for note-taking.

| Item | Details | Amount |

|---|---|---|

| Product | 10-inch tablet, Shopee price | 10,000 THB |

| Shipping | Platform shipping | 500 THB |

| CIF Value | (Taxable base) | 10,500 THB |

| Import duty (10%) | e-commerce rate | 1,050 THB |

| VAT base | CIF + duty | 11,550 THB |

| VAT (7%) | On total | 808.50 THB |

| Total tax | Duty + VAT | 1,858.50 THB |

| Final cost | Paid at checkout | 12,358.50 THB |

Tax burden: 17.7% markup

Timeline: 2–5 days to delivery

Your action: Add to cart, pay once at checkout, wait for delivery.

Scenario B: Bulk Import from Japan (RCEP FTA)

Situation: You’re a tablet distributor importing 100 units from a Japanese manufacturer for resale.

| Item | Details | Amount |

|---|---|---|

| Unit cost | 100 tablets @ 5,000 THB each | 500,000 THB |

| Shipping | Airfreight, Tokyo to Bangkok | 50,000 THB |

| Insurance | 2% of goods value | 10,000 THB |

| CIF Value | (Taxable base) | 560,000 THB |

| Import duty (0% RCEP) | FTA rate with valid CoO | 0 THB |

| VAT base | CIF only (no duty added) | 560,000 THB |

| VAT (7%) | On CIF alone | 39,200 THB |

| Customs broker fee | For 100-unit shipment | 5,000 THB |

| Port handling | Cargo handling, paperwork | 1,500 THB |

| Total tax & fees | Duty + VAT + fees | 45,700 THB |

| Final cost per tablet | (560,000 + 45,700) / 100 | 6,057 THB |

Tax burden: 8.2% (VAT + fees only; no duty due to RCEP)

Timeline: 10–15 days (includes freight, customs clearance, inland delivery)

Comparison to e-commerce: You save 604 baht per tablet = 60,400 baht on 100 units

Your resale strategy:

- Cost per unit: 6,057 baht

- Resale margin target: 25%

- Wholesale price to retailers: 7,571 baht

- Retail price to consumers: 9,464 baht

Retail margin comparison:

- E-commerce retail: 12,359 baht (from Part 10 Scenario A)

- Your distributor price: 9,464 baht

- You’re 21% cheaper than direct e-commerce-market advantage secured

Scenario C: Dropship from China (No FTA)

Situation: You’re an online seller on Shopee reselling Chinese tablets as a dropshipper.

Setup:

- 100 customers order 3,500-baht tablets over one month

- Each ships individually from Chinese supplier

- Each subject to 2026 e-commerce tax system

| Per Unit | Amount | Notes |

|---|---|---|

| Customer pays | 3,500 THB | Your listed price |

| Duty (10%) | 350 THB | E-commerce rate |

| VAT (7%) | 268 THB | On 3,850 (CIF + duty) |

| Customer total | 4,118 THB | Paid at checkout |

| Your revenue | 3,500 THB | From customer |

| Your cost | 1,650 THB | Supplier cost (10% dropship premium) |

| Shopee commission | 525 THB | 15% typical rate |

| Your net | 1,325 THB | Per tablet |

Profitability analysis (100 tablets):

- Gross revenue: 350,000 THB

- Your profit: 132,500 THB

- Profit margin: 37.9% of cost; 37.9% of revenue

The problem:

- Tax burden on customer: 618 THB per tablet

- Your margin: 1,325 THB per tablet

- You’re profitable, but margin compression is real

- If supplier increases cost by 10%: Your margin drops to 850 THB (64% margin reduction)

- If Shopee raises commission to 20%: Your margin drops to 1,150 THB (13% margin reduction)

To maintain viability:

- Need 35%+ markup over supplier cost (you’re at 112%)

- Can sustain 15–20% commission

- Vulnerable to supplier price increases

- Need volume to offset competition

Scenario D: Family Travel-Bringing Used Tablet (Personal Use)

Situation: You’re relocating from Australia to Thailand with a 2-year-old iPad you use daily.

Scenario analysis:

- Device: iPad (2+ years old, clearly used)

- Quantity: 1 unit for personal use

- Packed in: Carry-on luggage

- Declaration: Likely none asked

Customs likely outcome:

- Used device ✓ Allowed

- Single unit ✓ Allowed

- Clear personal use ✓ Allowed

- Expected: Pass through without duty

If questioned:

- Explain: Personal tablet I’ve been using for 2 years

- Show: Device age, condition, personal files

- Expected: Released without payment

If flagged (unlikely):

- Argue personal use

- Show device is used (not new/sealed)

- Offer value declaration if needed (value =~5,000 baht for 2-year-old iPad)

- Estimated duty: 7% VAT only (~350 baht)

- Worst case: Pay 500 baht and proceed

The reality: Personal devices in used condition rarely incur duties; heavy enforcement focuses on new sealed items or bulk quantities.

Part 11: Platform-Specific Changes (Lazada, Shopee, TikTok Shop)

Lazada Thailand Tax Integration

Status: Complete integration as of January 1, 2026

How it works:

- You browse tablet on Lazada

- Tablet price + estimated duty and VAT displays at checkout

- You see breakdown: Product price | Import duty | VAT

- Pay total in one transaction

- Lazada remits tax to Thai Customs

- Parcel clears customs automatically

- Delivery to your address (no additional customs payment)

User communication:

- In-app notifications: “New tax rules effective Jan 1-see tax breakdown at checkout”

- Tax FAQs added to help center

- Seller communication: Required to list products with tax-inclusive pricing

Impact on prices:

- E-commerce prices increased 10–18% for imported goods

- Local products (Thailand-made) unaffected

- Seller pricing strategy: Some absorb tax; others pass to customer

Timeline clarity:

- 2–5 days delivery (unchanged; customs automated)

Shopee Thailand Tax Integration

Status: Complete integration as of January 1, 2026

How it works:

- Add tablet to Shopee cart

- Tax displays at purchase finalization (not checkout preview)

- Breakdown shows: Product | Duty | VAT

- Pay total upfront

- Shopee handles customs clearance

- Delivery within standard timeline

Seller impact:

- Sellers must use “tax-integrated” product listings

- Can’t list tax-hidden; must show all-in price

- Shopee provides pricing tools to help calculate taxes

- High compliance requirements

User experience:

- Transparent tax display at final payment

- No surprises at delivery

- Some customers upset by price increase at last step (even if taxes)

- Shopee’s solution: Show taxes earlier in product listings

TikTok Shop Thailand (Live since January 1, 2026)

Status: Fully integrated with 2026 tax rules from launch

How it works:

- Tab Shop app integrated with Thai e-commerce tax system

- Tablets listed with tax-included prices from day one

- No “legacy” tax-free threshold experience

- Users accustomed to tax from first purchase

Key difference:

- TikTok Shop is newest platform; users expect modern tax compliance

- No migration period confusion (unlike Shopee/Lazada migrating from tax-free)

- Pricing reflects full cost from launch

International Suppliers (AliExpress, eBay, Amazon Global)

Status: Subject to 2026 rules; automated collection in progress

Timeline:

- AliExpress Thailand: Implementing automated tax collection; varies by seller

- eBay shipping to Thailand: Subject to 10–21 day customs clearance with new duties

- Amazon Global Thailand: Rolling out integration; some items still show old pricing

Process:

- Order tablet from international seller

- Item ships to Thailand

- Thai Customs intercepts (automatic e-Customs declaration)

- Duty assessed at 10% + VAT 7%

- Parcel held pending payment (unlike e-commerce platforms, you pay customs directly)

- You receive notice to pay; after payment, delivery proceeds

- Timeline: Total 10–21 days vs. 2–5 days for platform-integrated items

Cost impact:

- Duty: 10% (no FTA optimization for direct international purchases)

- VAT: 7%

- Total: 17% extra

- Direct payment to customs (not pre-collected)

Part 12: Customs Broker Selection & Management

When You Need a Customs Broker

You need a licensed customs broker if:

- Importing 50+ units per shipment

- Using FTA and need CoO validation

- Claiming duty drawback

- High-value shipments (>500,000 baht)

- Complex product classification

- First import to Thailand

- Expecting potential Red Line inspection

What to Look For in a Customs Broker

Licensing & Credentials

- Licensed by: Thai Customs Department (must verify license is current)

- Experience: Minimum 5+ years with HS 8471 tablet imports

- FTA expertise: Deep knowledge of RCEP, JTEPA, AFTA requirements

- References: Check 3–5 importers they’ve worked with

Operational Capability

- Direct e-Customs access: Must have their own e-Customs credentials

- Digital certificate: Valid 3-year certificate for system access

- 24/7 availability: Can handle urgent shipments

- Local presence: Office in Bangkok or Laem Chabang port area

Service Transparency

- Fee structure: Published rates (not hidden surprises)

- Turnaround time: Documented SLAs (standard 2–3 days for Green Line)

- Reporting: Regular updates on shipment status

- Dispute handling: Clear process if customs assessment is challenged

Typical Customs Broker Fee Structure

| Shipment Size | Typical Fee Range | Includes |

|---|---|---|

| Small (<50 units) | 1,500–3,000 THB | Basic documentation, e-Customs filing |

| Medium (50–500 units) | 3,000–8,000 THB | Detailed paperwork, possible FTA verification |

| Large (500+ units) | 8,000–15,000 THB | Complex classification, potential Red Line handling |

| Premium (expedited) | +50% of base fee | Guaranteed 24-hour clearance, priority handling |

Plus: 7% VAT applied to all broker fees

Hidden costs to watch:

- Port handling fees: 500–2,000 THB per shipment

- Warehouse storage (if Red Line inspection): 100–500 THB per day

- Cargo inspection surcharges: 500–1,500 THB if Red Line triggered

- Document corrections: 500–1,000 THB if you submit wrong paperwork

Red Flags in Customs Broker Selection

🚩 Avoid brokers who:

- Promise “guaranteed zero duty” (impossible; duty rates are law)

- Offer “gray market” import services

- Refuse to provide written fee quotes

- Have no current Thai Customs license

- Can’t provide client references

- Suggest underdeclaring values

- Want cash payments without receipts

Part 13: 13 Common Questions About Thailand Tablet Imports

Q1: “Will my tablet price on Shopee increase after January 2026?”

A: Yes, and it already has. E-commerce platforms automatically increased prices to reflect the new tax structure. If a tablet was 10,000 baht (with 1,500-baht exemption), it now costs 11,700–12,000 baht depending on platform’s cost absorption. The price increase varies by platform:

- Lazada: Showing tax-inclusive pricing; prices up 10–18%

- Shopee: Increased prices mid-Dec 2025 in anticipation

- TikTok Shop: Launched in 2026 with tax-inclusive pricing only

- Marketplace sellers: Those selling cheap may absorb some tax to stay competitive

Your action: The price increase is permanent; budget accordingly for future purchases.

Q2: “Can I import used tablets to Thailand for personal use?”

A: Technically restricted, but practically flexible. Here’s the reality:

The law: Personal importation of tablets is classified as “prohibited” in Thailand’s customs tariff. However, enforcement is selective.

What passes through:

- 1–2 used tablets clearly for personal use

- Devices showing wear (visibly used)

- Packed in personal luggage (not commercial packaging)

What gets flagged:

- New sealed-box tablets (commercial appearance)

- Quantities 3+ (implies commercial intent)

- High-value items without clear personal justification

- Undeclared in customs form

If confiscated: Thai Customs can seize the device and auction it; you rarely recover it.

Recommendation: If relocating to Thailand with personal tablets, pack 1–2 used devices in checked luggage and declare them if asked. The risk of seizure is low, and duty (if charged) would be minimal (~7% VAT on market value).

Q3: “My Chinese supplier won’t provide a Certificate of Origin. Can I still import?”

A: Yes, but you’ll pay full duty instead of FTA rates. Here’s the trade-off:

Without Certificate of Origin:

- Can’t claim FTA duty reduction

- Default to standard 10% duty rate

- Pay VAT on (CIF + 10% duty)

- Total tax: 17% of CIF value

If you get CoO from Chinese supplier:

- Can claim ACFTA (China-ASEAN FTA)

- Duty reduced to 5%

- Pay VAT on (CIF + 5% duty)

- Total tax: 12% of CIF value

- Savings: 5 percentage points per shipment

On 280,000 baht CIF:

- Without CoO: 47,600 THB total tax

- With ACFTA CoO: 35,600 THB total tax

- Savings: 12,000 THB per shipment

Action item: Request ACFTA Certificate of Origin from your Chinese supplier. Most professional manufacturers provide within 5 business days at no charge. If they refuse, consider finding a different supplier.

Q4: “How long does customs clearance actually take?”

A: It depends on which customs line your shipment gets:

| Timeline | Clearance Type | Likelihood | Reason |

|---|---|---|---|

| 2–3 days | Green Line (automated) | 80% | System auto-approves low-risk shipments |

| 5–10 days | Red Line (inspection) | 15% | Physical inspection required |

| 10–15 days | Red Line + delays | 5% | Inspection finds discrepancies requiring resolution |

Factors affecting speed:

- Your documentation quality: Correct HS codes, clear invoices = faster

- Shipment value: >500,000 baht = more likely Red Line

- FTA CoO: Valid Certificate of Origin = faster processing

- Broker experience: Experienced brokers get Green Line more often

- Customs workload: Busy seasons (Nov-Dec) = slower

Fastest clearance: Use experienced customs broker + correct documentation + standard 5,000–10,000 baht per tablet value = 2–3 days likely

Q5: “Are tablet accessories (cases, chargers) taxed the same as tablets?”

A: No. Accessories use different HS codes and face lower duty rates.

| Item | HS Code | Duty Rate | VAT | Total Tax |

|---|---|---|---|---|

| Tablet (8471.30) | 8471.30 | 10% | 7% | 17% |

| Charger/power adapter | 8504.40 | 5–7% | 7% | 12–14% |

| Protective case | 4202.21 | 10–15% | 7% | 17–22% |

| Screen protector (plastic) | 3923.30 | 5–10% | 7% | 12–17% |

Tax implication: If bundling accessories with tablets, separate declaration reduces taxes.

Example: 50 tablets + 50 cases as separate line items:

- Tablets only: 280,000 THB CIF @ 10% duty = 28,000 THB

- Cases only: 25,000 THB CIF @ 12.5% duty = 3,125 THB

- Combined 7% VAT: 21,287.50 THB

- Total: 52,412.50 THB

Vs. if wrongly classified all as tablets:

- Everything @ 10% duty = 30,500 THB + 21,350 VAT = 51,850 THB (closer, but incorrect)

Action: Declare accessories separately with distinct HS codes.

Q6: “What if Thai Customs disputes my HS code classification?”

A: You can challenge it, but it’s easier to prevent. Here’s the process:

Prevention (recommended):

- Request binding tariff classification ruling BEFORE importing

- Cost: 1,000–3,000 THB

- Timeline: 10–15 business days

- Benefit: Ruling is binding; no future disputes on same product

If customs reassesses after import:

- Request written explanation from customs officer

- Review the classification grounds (product definition, tariff structure)

- Consult with customs broker on grounds to appeal

- File formal appeal within 30 days of assessment

- Provide additional documentation (product specs, photos, technical details)

- Alternative: Engage tax lawyer if amount is significant (>50,000 THB)

Timeline: Appeal process takes 45–90 days; you typically pay assessed duty upfront while appealing.

Example: Customs reclassifies your tablet from 8471.30 (10% duty) to 8517 (20% duty) based on cellular connectivity. You can:

- Submit technical specs showing it’s WiFi-capable (not cellular-primary)

- Request binding ruling for future imports

- Appeal assessment if already paid

Q7: “Can I minimize tax by splitting a large order into small shipments?”

A: No. Attempting this is fraud and results in severe penalties.

The reality:

- Thai Customs tracks related shipments via shipper name, supplier, and product type

- Algorithm flags patterns (same supplier, 10+ shipments in 30 days, similar products)

- System automatically links related shipments

- Customs reassesses as single large import

- Penalties applied retroactively

Example of failed tax evasion:

- You plan to import 500 tablets

- Split into 50 shipments of 10 tablets each

- Each shipment under 50,000 baht (trying to avoid Red Line)

- Customs detects pattern after 5–10 shipments

- Retroactive reassessment: All 50 shipments combined into 1 large import

- Penalties: 25–100% surcharge on detected tax evasion

- Potential: Import license suspension for 6–24 months

The bottom line: If you have a 500-tablet order, import all 500 at once. It’s one Red Line inspection, one customs broker fee, and one clearance process. Splitting increases costs (multiple broker fees) and legal risk.

Q8: “How do I know if my tablet qualifies for RCEP zero duty?”

A: Check three things: manufacturer origin, valid CoO, and HS code.

Step 1: Verify manufacturer origin

The product must be manufactured or have substantial originating content in an RCEP member:

- ASEAN: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam

- Plus: China, Japan, South Korea, Australia, New Zealand

Check: Look for “Made in Japan,” “Made in South Korea,” “Assembled in Vietnam” on packaging or documentation.

Step 2: Confirm valid Certificate of Origin

- Request from supplier

- Should state: “Certificate of Origin under RCEP”

- Must show: Country of origin, HS code, manufacturer details

- Must be signed/certified by official issuing body

Step 3: Verify HS code match

- HS 8471 (tablets) is typically on RCEP duty-free schedule

- But check FTA-specific product list to confirm

- Some product variants might have safeguards

Action: Provide supplier with this exact request:

“Please issue RCEP Certificate of Origin for [tablet model], confirming Japan origin, for import to Thailand. We need it to claim 0% duty under RCEP.”

Most suppliers will comply within 3–5 business days.

Q9: “What’s the difference between import duty and VAT? Why do I pay both?”

A: They’re two separate taxes on different tax bases:

| Tax | What It Is | Applied To | Rate | Why |

|---|---|---|---|---|

| Import Duty | Tariff on foreign goods | CIF value only | 0–80% by product | Protects domestic industry; generates revenue |

| VAT | Consumption tax | CIF + Duty + all fees | 7% | Taxes final consumption; collected at import |

Why pay both?

Import duty is a protective tariff collected at border to protect local producers. VAT is a consumption tax that applies to all consumer spending in Thailand (even locally-made goods have 7% VAT).

When you import, you’re both:

- Paying duty to protect Thai industries

- Paying VAT because you’re consuming goods in Thailand

Example:

textTablet CIF: 10,000 THB

↓

Import Duty (10%): 1,000 THB [Protects Thai tablet industry]

↓

Subtotal: 11,000 THB

↓

VAT (7%): 770 THB [Taxes your consumption]

↓

Total: 11,770 THB

If you buy a Thai-made tablet at retail:

- No import duty (it’s local)

- Still 7% VAT (consumption tax)

- So: 10,000 THB product + 700 THB VAT = 10,700 THB

The insight: Import duty protects local producers; VAT ensures fair taxation across imports and local goods.

Q10: “Do I need special permits to import tablets to Thailand?”

A: Not really, with important caveats:

What you DON’T need:

- FDA approval (unlike medicines/supplements)

- Broadcasting license (unlike TVs/radios)

- Government pre-import permission

- Technical testing certification (standard electronics compliance assumed)

What you DO need:

- Business license if importing for commercial resale

- Tax ID and VAT registration if importing regularly

- Import license from Department of Foreign Trade (if commercial importer)

- Customs broker license (if you’re the broker, not if you hire one)

- Standard import documentation (commercial invoice, bills of lading, etc.)

For cellular tablets (LTE/4G):

- Must comply with Thai NBTC (National Broadcasting and Telecommunications Commission) standards

- Rarely an issue for major brands (Apple, Samsung, Lenovo already certified)

- If buying off-brand or Chinese no-name: Contact NBTC for compatibility

The reality: If you’re a business importer, you likely already have tax ID and business license. Tablets don’t require special pre-import permits like food or pharmaceuticals do.

Action: Confirm with customs broker that your product doesn’t require additional approvals. 99% of standard tablets don’t.

Part 14: Compliance, Risk Management & Audit Readiness

Pre-Import Compliance Checklist

Before your first shipment, complete these steps:

Documentation Phase

- Verify company registration (current, within 3 months)

- Confirm tax ID registration with Thai Revenue Department

- Obtain VAT certificate (Phor Phor 20)

- Register with Thai Customs (get importer code)

- Get digital certificate from customs (for e-Customs access)

- Apply for “paperless license” from customs (3-year validity)

Product Preparation Phase

- Identify tablet HS code (8471.30.10 standard)

- Request binding HS classification if first import (optional but recommended)

- Verify tablet weight and specs match HS classification

- Confirm no prohibited components (encryption, military, restricted tech)

Supplier Verification Phase

- Identify supplier country of origin

- Request Certificate of Origin (if FTA-eligible)

- Validate CoO against FTA issuing body database

- Get commercial invoice with HS codes from supplier

- Confirm CIF value is market-reasonable (not undervalued)

Customs Broker Selection Phase

- Verify customs broker license (current, with Thai Customs)

- Review 3–5 reference clients

- Confirm broker has recent HS 8471 experience

- Get written fee quote (including all charges)

- Ensure broker has e-Customs system access

Shipping Phase

- Book shipping with reputable carrier (DHL, UPS, FedEx, or ocean freight company)

- Obtain bill of lading/airway bill

- Provide broker with shipping details (tracking number, ETA)

- Confirm all documentation (invoices, CoO, packing lists) are with broker before arrival

Record Keeping for Audit Readiness

Thai Customs can audit any importer. Maintain these records for 5 years minimum:

Company-Level Records

- Tax registration certificate (photocopy)

- VAT registration (Phor Phor 20)

- Business license

- Importer registration with customs

Per-Shipment Records

- Commercial invoice (original, signed)

- Bill of lading / airway bill

- Packing list with HS codes

- Certificate of Origin (if applicable)

- Customs declaration form (signed copy)

- Duty payment receipt

- Customs broker invoice and services rendered

- Correspondence with customs (if any)

- Email exchanges with supplier

- Bank transfer receipts (payment proof)

Business Operations Records

- Internal inventory system (quantity in, sold, remaining)

- Sales records (invoices to customers)

- Profit/loss accounting for imported tablets

- Supplier payment records

- Product-level traceability (batch numbers, serial numbers where applicable)

Audit Defense Documents

- Binding HS classification rulings (if obtained)

- Correspondence challenging any customs assessments (if disputed)

- Legal opinions on compliance (if needed)

- Photos of products (showing condition, specs, packaging)

Red Flags That Trigger Customs Inspection (Red Line)

Avoid these patterns to reduce inspection probability:

🚩 Pattern-Based Red Flags

- Frequent small shipments (attempting to avoid duty evasion detection)

- Multiple shipments same supplier, same product, same weight ranges

- Shipments on exact same date each month (too regular pattern)

🚩 Value-Based Red Flags

- CIF declared 30%+ below market rate for product

- Declared value inconsistent with carrier’s assessment

- Invoice unit price lower than competitor benchmarks

🚩 Documentation Red Flags

- Mismatched HS codes vs. product specification

- Missing or obviously forged Certificate of Origin

- Incomplete commercial invoices

- Seller and buyer same person (suspicious)

🚩 Quantity Red Flags

- First import, large quantity (50+ units)

- Quantities match market scarcity (tablets when shortage reported)

- Quantity mismatch between invoice and bill of lading

🚩 Supplier Red Flags

- Supplier has no established customs history

- Supplier location doesn’t match product origin

- Unknown or low-credibility supplier

Dispute Resolution if Customs Issues Assessment

If customs reassesses your duty higher than expected:

Stage 1: Written Explanation (Days 1–3)

- Request written explanation from customs officer

- Ask: Exact HS code used, duty rate applied, calculation method

- Response timeline: Should receive within 3 working days

Stage 2: Broker Consultation (Days 3–7)

- Share customs assessment with your customs broker

- Broker reviews: HS code grounds, comparable products, FTA eligibility

- Broker identifies: Appeal grounds (classification error, data entry mistake, FTA eligibility missed)

Stage 3: Formal Appeal (Days 7–30)

- Submit appeal within 30 days of assessment

- Include: Original assessment letter, product specifications, HS classification evidence, comparable products

- Attach: Photos, technical specs, binding rulings (if any), industry precedent

Stage 4: Administrative Review (Days 30–60)

- Customs reviews appeal

- May request additional documentation

- Issues revised assessment or upholds original

Stage 5: Further Appeal (if needed, Days 60–90)

- If unhappy with Stage 4, escalate to higher customs authority

- Consider: Tax lawyer engagement (cost 10,000–50,000 baht)

- Arbitration or administrative court (if amount significant)

Timeline: Full process = 60–90 days

During appeals: You typically pay the assessed duty upfront; if appeal successful, you receive refund.

Part 15: Future Outlook-What’s Coming in 2026 and Beyond

Regulatory Evolution Expected in 2026+

Thailand’s import tax system is evolving rapidly. Anticipate these changes:

E-Commerce Expansion (2026)

- Likely: Platform tax collection expanding to Tokopay, Grab Commerce, other marketplaces

- Platform fee: May increase due to tax compliance costs

- Price impact: Further normalization of tax-inclusive pricing

RCEP Implementation Acceleration (2026–2028)

- Tariffs continue phase-down; electronics duty going from 0–5% toward 0% for all

- Opportunity: More duty-free options across suppliers

- Action needed: Monitor tariff changes and update supplier sourcing

AI-Driven Customs (2026+)

- Automated classification: Machine learning assigns HS codes based on product images and specs

- Benefit: Faster clearance for standard products (tablets = already optimized)

- Risk: Algorithmic error could trigger Red Line

- Mitigation: Maintain perfect documentation to contest errors

Real-Time Tariff Updates

- System will become more dynamic; tariffs may change with FTA updates

- Tracking: Subscribe to Thai Customs bulletin

- Impact: Import planning must be flexible

Tech Localization Incentives

- Government may incentivize tablet assembly in Thailand (parts import, assembly local)

- Opportunity: Reduced duty on components vs. finished devices

- Watch for: Special economic zone incentives

How to Prepare for Future Changes

Immediate actions (Now-Q1 2026):

- Establish relationships with suppliers in multiple FTA countries (don’t rely on one source)

- Develop flexible supply chain (can pivot sourcing if tariffs change)

- Document current processes and costs (baseline for comparison)

- Subscribe to Thai Customs email alerts

Medium-term (Q2–Q4 2026):

- Monitor RCEP tariff elimination schedule (more products going duty-free)

- Evaluate sourcing geography: Japan 0% duty may become more competitive vs. China 5%

- Build automation: Use e-Customs API for bulk imports (if available)

- Train team on latest tax rules

Long-term (2027+):

- Consider local assembly: Import components (lower duty) vs. finished tablets

- Evaluate merger with local distributors (integrate tax and logistics)

- Build brand partnerships with manufacturers for direct imports

- Invest in trade compliance infrastructure

Your Action Plan

If you’re importing tablets to Thailand in 2026, here’s your priority action plan:

For Individual E-Commerce Buyers

- Accept the new reality: Budget 17–18% extra for imported tablets

- Shop smart: Use Lazada/Shopee for transparent pricing; avoid international sites (slower, less clear on taxes)

- Plan ahead: Buy when needed, not on whim (tax is permanent)

For Dropshippers & Online Sellers

- Recalculate margins: Adjust pricing to maintain 20–25% profit after 10% duty + VAT

- Find FTA suppliers: Source from Japan/ASEAN for RCEP benefits (0% duty possible)

- Communicate transparently: Show customers tax-inclusive pricing; build trust with honesty about cost structure

For Business Importers

- Hire customs broker: Essential for FTA optimization and compliance

- Get Certificate of Origin: Request from supplier; worth 28,000 THB savings per 280k shipment

- Build compliance infrastructure: Maintain records, understand HS codes, monitor regulations

- Volume strategy: 50+ units per shipment to justify logistics and broker costs

For Retailers & Distributors

- Evaluate sourcing: Bulk imports with FTA = 21% cheaper than e-commerce

- Partner locally: Build relationships with Thai distributors for immediate availability

- Strategic pricing: Tablet margins compress 2–5% due to taxes; adjust wholesale pricing accordingly

Final Word:

Thailand’s 2026 import tax changes aren’t going away. The smartest importers are those who understand the system deeply, optimize within its rules, and build flexibility into their supply chains. HS codes matter. Certificates of Origin matter. Customs broker expertise matters. A 30-minute conversation with a broker about FTA optimization can save 28,000 baht per shipment.

Thailand’s market is vibrant and competitive. The importers who thrive are those who master the details. This guide is your roadmap to doing exactly that.

Appendix: Essential Glossary

HS Code: Harmonized System code (6-digit globally; 8-digit in Thailand’s AHTN)

CIF Value: Cost + Insurance + Freight (taxable import value)

AHTN: ASEAN Harmonized Tariff Nomenclature (Thailand’s official tariff structure)

FTA: Free Trade Agreement allowing preferential duty rates

RCEP: Regional Comprehensive Economic Partnership (largest Asia-Pacific trade bloc)

JTEPA: Japan-Thailand Economic Partnership Agreement

AFTA: ASEAN Free Trade Area

CoO: Certificate of Origin proving product manufacturing origin

e-Customs: Electronic customs declaration system (Thai Customs)

Green Line: Automated customs clearance (no physical inspection)

Red Line: Manual customs review (physical inspection required)

De Minimis: Previous tax exemption threshold (1,500 THB, now abolished)

VAT: Value Added Tax (7% in Thailand)

Excise Tax: Additional tax on luxury items, alcohol, tobacco

Binding Classification: Official HS code ruling before import (prevents future disputes)

Tariff Decree: Thailand’s official duty rate schedule (updated annually)