Key Takeaways

- Effective Date: The new interpretation applies to foreign income brought into Thailand from January 1, 2024 onwards.

- The Core Shift: Order Por. 161/2566 mandates that Thai tax residents are liable for Personal Income Tax (PIT) on foreign income remitted to Thailand, regardless of the year it was earned (unless exempted by Por. 162/2566).

- The Exemption: Order Por. 162/2566 clarifies that foreign income earned before January 1, 2024, remains tax-exempt if remitted in a different tax year, preserving the old “loophole” for past earnings.

- Residency Rule: Liability falls on individuals residing in Thailand for 180 days or more in a calendar year.

Introduction

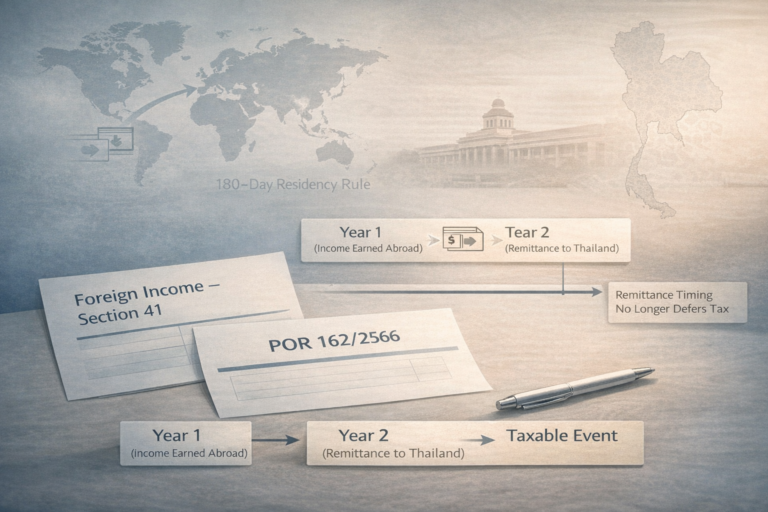

For decades, Thailand offered a distinct advantage to global citizens and expatriates: foreign-sourced income was only taxed if it was brought into the country during the same tax year it was earned. This allowed savvy residents to simply wait until January 1st of the following year to remit funds tax-free. On September 15, 2023, the landscape shifted dramatically.

The Thailand Revenue Department Orders Por. 161/2566 Por. 162/2566 represent a paradigm shift in how the Kingdom taxes foreign wealth. Issued under the guidance of Director-General Mr. Lavaron Sangsanit, these orders close the historical loophole while providing specific transitional relief. Understanding these regulations is no longer optional for tax residents; it is a critical component of financial compliance.

This guide deconstructs the legal text, the practical implications, and the strategic moves necessary to navigate this new era of Thai taxation. For a foundational understanding of the local system, you may also consult our Thailand Income Tax Guide.

Decoding Order Por. 161/2566: The Loophole Closer

Revenue Department Instruction No. Por. 161/2566, dated September 15, 2566 (2023), fundamentally reinterprets Section 41 Paragraph 2 of the Revenue Code. Historically, the Department interpreted the law to mean that taxability required two concurrent conditions: residency in the tax year the income was earned, and remittance in that same year.

Clause 1 of Por. 161/2566 strips away the timing condition. It states that persons residing in Thailand under Section 41 Paragraph 3 must include remitted foreign assessable income in their tax calculation for the year of remittance, regardless of when the income was originally earned.

According to Clause 3 of the Instruction, this new rule applies to income brought into Thailand from January 1, 2024, onwards. This effectively aligns Thailand’s remittance basis of taxation closer to global standards, targeting the growing pool of foreign-sourced wealth flowing into the Kingdom.

What Constitutes Assessable Foreign Income?

Under Section 40 of the Revenue Code, the targeted income types include:

* Employment: Salaries or wages from work performed abroad.

* Business: Profits from overseas enterprises or brokerage.

* Property: Rental income or capital gains from foreign assets.

If you are running a business involving digital assets abroad, understanding the corporate side via Thailand Crypto License Requirements is essential, though personal liability on profits falls under these new PIT rules.

The Relief Measure: Order Por. 162/2566

Following the initial panic caused by Por. 161/2566, the Revenue Department issued Instruction No. Por. 162/2566 on November 20, 2023. This order serves as a crucial grandfathering clause.

It clarifies that the new strict interpretation does not apply to assessable income earned before January 1, 2024.

Practical Implication:

If you earned $100,000 in dividends in 2023 (or any prior year) and you remit those funds to Thailand in 2024, 2025, or beyond, they remain tax-exempt, provided you can prove the income was earned pre-2024. This essentially locks in the old rules for your historical savings. For a deep dive into maximizing this benefit, see our Foreign Income Exemption Guide for Por. 162/2566.

Determining Tax Residency

Both orders hinge on the definition of a “Thai Tax Resident.” Under Section 41 Paragraph 3 of the Revenue Code, a resident is defined strictly by days present in the country.

- The Rule: Any individual staying in Thailand for one or more periods totaling 180 days or more in any tax (calendar) year is deemed a resident.

- The Consequence: Residents are liable for PIT on foreign income remitted to Thailand. Non-residents are generally only taxed on Thai-sourced income.

It is important to note that tax residency is separate from immigration status. You can be on a tourist visa, an LTR visa, or a Business visa; if you hit 180 days, you are a tax resident.

Comparison: Old Rules vs. New Enforcement

The shift is best understood through a direct comparison of how remittance is treated before and after the 2024 cutoff.

| Feature | Old Interpretation (Pre-2024 Practice) | New Rule (Por. 161/2566 & Por. 162/2566) |

|---|---|---|

| Trigger for Tax | Remitting foreign income in the same year it was earned. | Remitting foreign income in any year (if earned post-2023). |

| Loophole | Delay remittance to Jan 1 of the next year to avoid tax completely. | Closed. Delayed remittance is now taxable for post-2024 income. |

| Pre-2024 Income | Exempt if remitted in a later year. | Exempt (Grandfathered by Por. 162/2566). |

| Tax Rate | Progressive PIT rates (0-35%). | Progressive PIT rates (0-35%). |

| Applicability | Thai Tax Residents (180+ days). | Thai Tax Residents (180+ days). |

Calculating Your Liability

If you fall under the scope of Por. 161/2566, the remitted amount is added to your assessable income for the year. Thailand uses a progressive tax bracket system ranging from 0% to 35%.

For example, if you remit 2,000,000 THB of foreign earnings in 2025 (earned in 2025):

1. 0-150,000 THB: Exempt

2. 150,001 – 300,000 THB: 5%

3. 300,001 – 500,000 THB: 10%

4. …scaling up to 35% for amounts over 5,000,000 THB.

Proper documentation is key. When preparing your returns, ensure you follow the protocols outlined in our Thailand Tax Filing Guide.

Strategic Compliance and Documentation

To manage compliance effectively, taxpayers must maintain rigorous records. The burden of proof lies with the individual to demonstrate when income was earned to utilize the Por. 162/2566 exemption.

Essential Documentation:

* Bank Statements: Showing the date income was credited to your foreign account.

* Pay Slips / Dividend Vouchers: proving the source and date of earnings.

* Capital Gains Reports: For traders, distinguishing between principal and profit is vital.

Double Tax Agreements (DTAs):

Thailand has DTAs with over 60 countries. Mahanakorn Partners notes that tax paid abroad can often be credited against Thai tax liability, preventing double taxation. However, this requires the foreign tax to be final and properly documented.

Also, for those dealing in specific asset classes like cryptocurrency, be aware of domestic nuances such as Thailand’s 0% Crypto Tax Policy which applies to authorized exchanges, distinct from foreign crypto remittances.

FAQ Section

Q: Does Por. 161/2566 apply to savings I earned years ago?

No. Thanks to Order Por. 162/2566, income earned before January 1, 2024, is exempt from the new rule. You can remit these savings tax-free, provided you can prove they were earned prior to 2024.

Q: What if I stay in Thailand for only 179 days?

If you stay in Thailand for less than 180 days in a calendar year, you are not considered a Thai tax resident. Consequently, you are generally not liable for Thai tax on foreign-sourced income, regardless of remittance.

Q: Are credit card spendings considered remittance?

The Revenue Department has not issued specific guidance on whether using an offshore credit card in Thailand constitutes “remittance.” However, legal experts advise caution, as strict interpretations could view the settlement of Thai debts with foreign funds as a taxable event.

Q: Can I use foreign tax paid to offset Thai tax?

Yes, under most Double Tax Agreements (DTAs), tax paid in the source country can be used as a credit against Thai tax liability on the same income. You will need proof of tax payment from the foreign jurisdiction.

Conclusion

The issuance of Thailand Revenue Department Orders Por. 161/2566 and Por. 162/2566 marks the end of an era for tax-free foreign living in Thailand. While the “same-year” loophole is closed for new income, the grandfathering of pre-2024 wealth offers a significant window of relief for long-term residents.

Navigating these changes requires a shift from passive avoidance to active management. By maintaining clear records of income dates and understanding your residency status, you can ensure full compliance without overpaying. For specific filing procedures, refer to our Thailand Tax Filing Guide.

Sources

- Revenue Department Instruction No. Por. 161/2566. (2023). Subject: Payment of Income Tax under Section 41 Paragraph 2 of the Revenue Code.

- Revenue Department Instruction No. Por. 162/2566. (2023). Subject: Application of Por. 161/2566.

- KPMG Thailand. (2023). Tax News Flash Issue 146.

- Mahanakorn Partners Group. (2024). Comprehensive Overview of Order No. Por. 161/2566.