Selling a condo or house in Thailand comes with a hidden shock for many individuals: the Withholding Tax (WHT). Unlike in many Western countries where capital gains tax is filed at the end of the year, Thailand demands this tax upfront at the Land Department before the title deed can change hands.

If you are an individual seller (Thai or Foreigner), understanding exactly how this is calculated can save you from unexpected costs on transfer day. This guide breaks down the Revenue Department’s specific formula, clarifies the critical difference between “Appraisal Value” and “Selling Price,” and provides the exact tables you need to calculate your liability.

The Core Concept: What is Individual Withholding Tax?

In Thailand, Withholding Tax (WHT) on the sale of immovable property is essentially an advance payment of your Personal Income Tax (PIT).

When a company sells property, the tax is simple (1% of the higher of sale price or appraisal value). However, for individuals, the calculation is far more complex. It is a progressive calculation meant to simulate your income tax burden, but compressed into the transaction moment.

The “Golden Rule” of Individual Calculation

This is the most important factor that 90% of online guides get wrong or fail to emphasize:

For Individuals, Withholding Tax is calculated based on the Government Appraisal Value, NOT the Actual Selling Price.

Even if you sell your condo for 10 Million Baht, if the Treasury Department’s appraisal value is only 5 Million Baht, your withholding tax is calculated on the 5 Million Baht figure. This is distinct from the Transfer Fee (2%), which is calculated on the higher of the two values.

Step-by-Step Calculation Methodology

The Revenue Department uses a unique 5-step formula to determine your tax. You cannot simply apply a flat % rate.

Step 1: Determine the Appraisal Value

This is the official value assigned to your property by the Treasury Department. It is typically lower than the market price. You can check this at the local Land Office or sometimes online via the Treasury Department’s website.

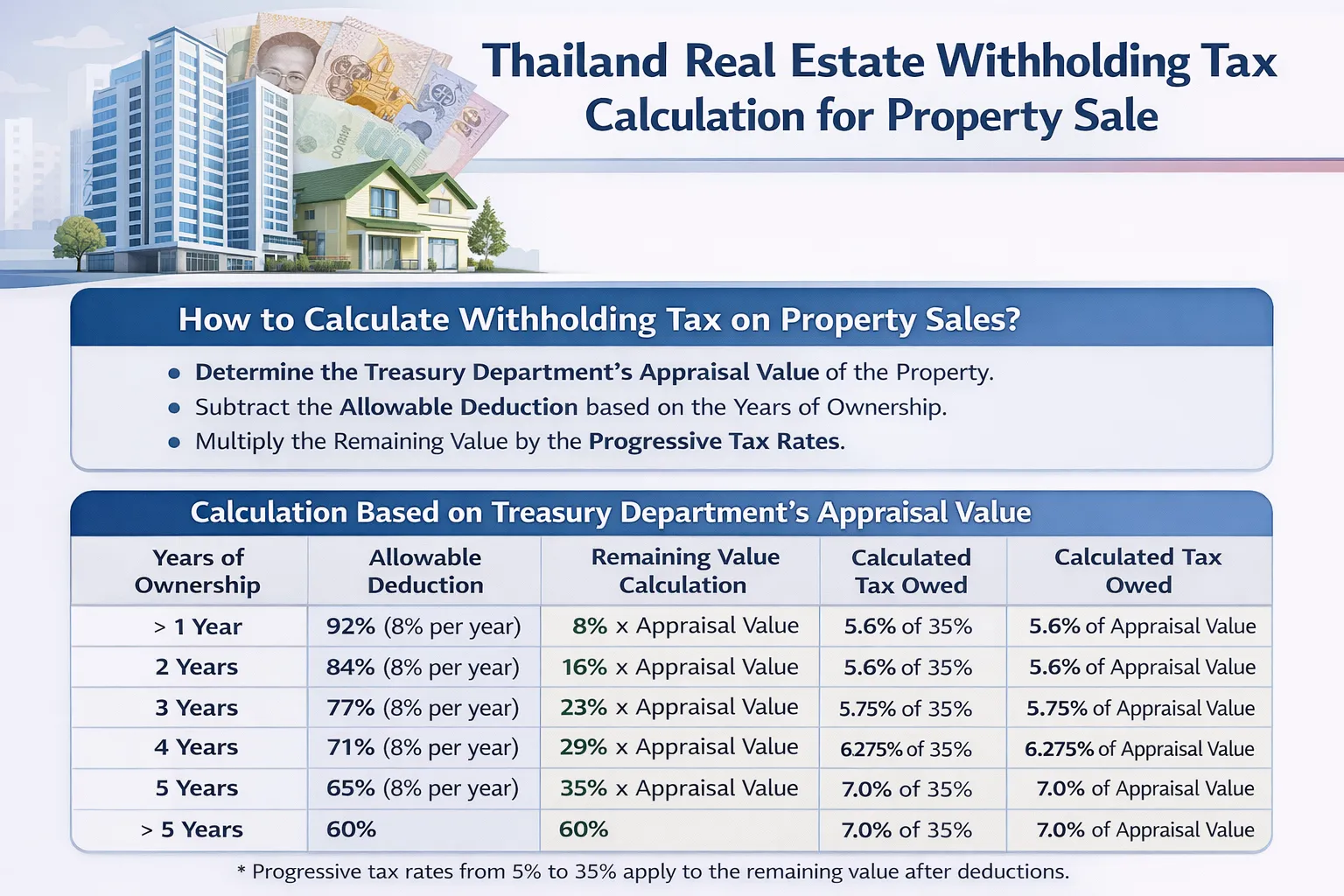

Step 2: Apply the Standard Deduction

Thailand allows you to deduct a “standard expense” from the appraisal value. The amount you can deduct depends strictly on how many years you have owned the property.

Note: If you acquired the property by inheritance or gift, the deduction is always 50%, regardless of years owned.

Table 1: Standard Deduction Based on Years of Possession

| Years of Possession | Deduction Allowed (%) | Net Income for Tax (%) |

|---|---|---|

| 1 Year | 92% | 8% |

| 2 Years | 84% | 16% |

| 3 Years | 77% | 23% |

| 4 Years | 71% | 29% |

| 5 Years | 65% | 35% |

| 6 Years | 60% | 40% |

| 7 Years | 55% | 45% |

| 8 Years or more | 50% | 50% |

Source: Thailand Revenue Code, Section 48(4)

Step 3: Calculate the “Yearly” Net Income

This step is the “annualization” of your income.

- Formula:

(Appraisal Value - Deduction) ÷ Years of Possession

Step 4: Calculate Tax on Yearly Income

Now, apply the standard Personal Income Tax (PIT) progressive rates to the figure from Step 3.

Table 2: Personal Income Tax (PIT) Rates (2024-2025)

| Net Yearly Income (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | Exempt* |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,000 | 35% |

(Note: In the specific context of Property WHT calculation, the first 150k exemption is sometimes not applied in the rough manual calculation at the Land Office depending on the official interpretation at that specific branch, but strictly legally, progressive rates apply).

Step 5: Calculate Final Withholding Tax

Multiply the tax result from Step 4 by the number of years of possession.

- Formula:

Tax on Yearly Income × Years of Possession = Final WHT

Case Study: Selling a Condo in Bangkok

Let’s illustrate this with a real-world scenario to ensure you can replicate it.

- Property: 1-Bedroom Condo in Sukhumvit.

- Selling Price: 6,000,000 THB.

- Appraisal Value: 4,000,000 THB (Used for Tax Base).

- Ownership Period: 3 Years.

The Calculation:

- Tax Base: 4,000,000 THB.

- Deduction (3 Years): 77% Deduction.

- 4,000,000 – 77% = 920,000 THB (Remaining Net Assessable Income).

- Yearly Average:

- 920,000 ÷ 3 Years = 306,666.66 THB (Income per year).

- Tax on Yearly Average (Progressive Rates):

- 0 – 150,000 = Exempt (0 THB)

- 150,001 – 300,000 (150k @ 5%) = 7,500 THB

- 300,001 – 306,666 (6,666 @ 10%) = 666.66 THB

- Total Yearly Tax: 8,166.66 THB

- Final Withholding Tax:

- 8,166.66 × 3 Years = 24,500 THB

Result: You will pay 24,500 THB in Withholding Tax at the Land Department.

(Note: If this were a corporate sale, the tax would be 1% of the 6M Selling Price = 60,000 THB. In this case, the individual pays significantly less.)

Beyond WHT: Other Mandatory Fees

While WHT is the most complex, do not forget the other three costs that must be paid via cashier’s check at the Land Department.

1. Transfer Fee

- Rate: 2% of the Appraisal Value.

- Who Pays: By law, it is split 50/50 between buyer and seller, but this is negotiable.

2. Specific Business Tax (SBT)

This is a tax on “speculation.”

- Rate: 3.3% of the Appraisal Value OR Selling Price (whichever is higher).

- When it Applies: If you have owned the property for less than 5 years.

- Exemption: You are exempt if your name has been in the property’s “Blue Book” (Tabien Baan) for at least 1 consecutive year.

3. Stamp Duty

- Rate: 0.5% of the Appraisal Value OR Selling Price (whichever is higher).

- When it Applies: Only if you are EXEMPT from Specific Business Tax. (You never pay both).

Frequently Asked Questions (FAQ)

Can I claim a refund on this Withholding Tax?

Yes. Because WHT is an “advance” tax, you can choose to include it in your annual Personal Income Tax return (Form P.N.D. 90 or 91) filed at the beginning of the following year.

- Strategy: If your total income is low, filing the return might get you a refund because the actual tax liability might be lower than what was withheld.

- Risk: If you have significant other income, adding the property sale might push you into a higher tax bracket, resulting in more tax due. Most investors treat the WHT as a “Final Tax” and do not file it in their annual return.

Does the “Years of Possession” count start from the contract date?

No. It starts from the specific date transfer of ownership was registered at the Land Department (the date printed on the back of your Chanote title deed).

What if I am a foreigner?

The rules are exactly the same. Foreigners are subject to the same Withholding Tax, Transfer Fees, and taxes as Thai nationals. The Land Department does not distinguish by nationality for tax calculations.

How do I pay?

The Land Department does not accept cash for large amounts. You must prepare Cashier’s Cheques (Manager’s Cheques) payable to the “Department of Lands” or “Ministry of Finance” depending on the specific branch. It is highly recommended to have these cheques prepared in advance to match the exact calculation.

Key Takeaways for Sellers

- Ignore the Market Price for your WHT calculation; find the Appraisal Value.

- Check your Years of Ownership precisely. Crossing from 4 years to 5 years increases your deduction from 71% to 65% (increasing tax) but might save you the 3.3% Specific Business Tax.

- Prepare for Cash Flow. This tax is deducted before you receive the full proceeds from the buyer.

- Consult an Accountant before filing for a refund to ensure it won’t trigger a higher tax bill on your other income.