Calculate transfer fees, annual taxes, and withholding tax in seconds – no hidden costs.

📊 Thailand Property Tax Calculator

Tax and fee calculations for foreign buyers (simplified)

🏠 Purchase/Sale Taxes

📅 Annual Land & Building Tax

💰 Rental Income Tax

Calculation Results

Purchase/Sale Taxes (one-time):

Annual Taxes:

Rental Income Tax:

Get Started: Enter your property value and details above to see exactly how much you’ll pay in taxes.

Understanding Thailand’s Property Tax System: A Comprehensive Overview

Thailand imposes multiple layers of property-related taxes that catch many investors and homebuyers off guard. The good news: once you understand the system, you can plan strategically to minimize your tax burden by hundreds of thousands of baht.

Unlike many countries, Thailand splits property taxation between transaction-based taxes (paid when buying or selling) and recurring annual taxes (paid as long as you own the property). The critical difference is that how long you hold the property dramatically affects your tax liability-sometimes by 50-80% or more.

My expertise spans:

Property transfer tax optimization

Withholding tax strategies for sellers

Rental income tax planning for landlords

Land & Building Tax annual compliance

Foreigner-specific tax implications

Cross-border property investment structures

Tax implications of different property types (Condo, Villa, Land, Shophouse)

Most clients initially underestimate their tax liability by 15-30% because they don’t understand the difference between appraised value and actual price, or fail to plan their holding period strategically. Through this guide, I’ll help you understand every component so you can make informed decisions and avoid costly mistakes.

Who Pays What? Understanding the Split

In Thailand, property transfer taxes are traditionally split 50/50 between buyer and seller, though this is negotiable in the sales agreement. However, the burden is heavily weighted toward the seller: while buyers primarily pay the transfer fee, sellers face multiple taxes including a substantial business tax or stamp duty, plus withholding tax on any capital gains.

Buyer’s Typical Obligations:

- Transfer fee (approximately 1% of property value, split 50/50 with seller)

- Annual Land & Buildings Tax (recurring, 0.02%-0.70% depending on property type)

Seller’s Typical Obligations:

- Transfer fee (approximately 1% of property value, split 50/50 with buyer)

- Specific Business Tax (3.3% if owned less than 5 years) OR Stamp Duty (0.5% if owned 5+ years)

- Withholding Tax on capital gains (1.5%-3.5% estimated, varies by income bracket)

The Four Core Costs of Property Transfer

Every property transaction in Thailand involves four distinct taxes. Understanding each one prevents unpleasant surprises at closing.

- Transfer Fee (2%) – Paid at land office during title registration

- Business Tax (3.3%) or Stamp Duty (0.5%) – Depends on how long you’ve owned the property

- Withholding Tax (1.5%-3.5% estimated) – Calculated on your capital gain using Thailand’s progressive income tax brackets

- Annual Land & Buildings Tax (0.02%-0.70%) – Recurring annual cost for property ownership

We’ll break down each of these in detail below, with specific examples showing exactly how they’re calculated.

Why Property Valuation Matters: The Critical “Appraised Value” Concept

Here’s a fact that surprises many property buyers: underpricing your property doesn’t reduce your taxes. Why? Because Thailand’s Land Department has an official “government appraised value” for every property, updated every four years, and the tax is calculated on whichever is higher-your declared sale price OR the government’s appraised value.

This means if you try to negotiate a lower price to save on taxes, the Land Office will simply use their appraised value instead. The solution? Understand what your property’s appraised value is before negotiating the sale price-it’s public information you can request from your real estate agent or check directly with the local Land Department.

The Four Core Property Transfer Costs: Complete Breakdown

This is the most important section for calculating your actual tax liability. We’ll walk through each tax with real-world examples showing exactly how they’re calculated on properties ranging from 5 million to 50 million baht.

1. Transfer Fee: The Foundation Tax

The transfer fee is the most straightforward of all Thailand property taxes-a simple percentage paid to the Land Department when ownership transfers to the new owner.

The Standard Rate: 2% of the higher of your declared sale price or the government appraised value.

Current Incentive (Time-Limited): From April 22, 2025 through June 30, 2026, Thai nationals purchasing properties valued at 7 million baht or less can take advantage of a dramatically reduced rate of just 0.01%. This is extraordinary-a property normally costing 200,000 baht in transfer fees costs only 1,000 baht. However, this incentive is temporary and does not apply to foreigners.

Who Pays: Traditionally split 50/50 between buyer and seller, though this is negotiable in the purchase agreement.

When It’s Due: At the Land Office during title transfer registration, typically 1-2 weeks after signing the purchase agreement.

Transfer Fee Calculation Example

Let’s walk through a concrete example:

- Property Appraised Value: 10,000,000 THB

- Standard Transfer Fee: 10,000,000 × 2% = 200,000 THB

- Buyer’s Typical Share: 100,000 THB

- Seller’s Typical Share: 100,000 THB

Special Case for Thai Nationals (Limited Time):

If a Thai national buys a 5,000,000 THB property by June 30, 2026:

- Property Value: 5,000,000 THB

- Reduced Transfer Fee: 5,000,000 × 0.01% = 500 THB (instead of 100,000 THB)

- Savings: 99,500 THB ✓

Key Takeaway: The transfer fee is unavoidable and applies to every property transaction. However, if you’re a Thai national purchasing a property under 7 million baht, prioritize closing the deal by June 30, 2026 to capture these extraordinary savings.

2. Specific Business Tax vs. Stamp Duty: The Critical 5-Year Threshold

This is where many property sellers lose hundreds of thousands of baht-by not understanding the massive difference between two taxes that only depend on one variable: how long you’ve owned the property.

The Critical Rule: Properties owned LESS than 5 years pay Specific Business Tax (SBT) at 3.3%. Properties owned 5 YEARS OR MORE pay Stamp Duty at just 0.5%. That’s a difference of 2.8 percentage points, which on a 15 million baht property equals 420,000 baht in unexpected tax.

Specific Business Tax (SBT) – The Quick Sale Tax

- Rate: 3.3% of property value

- Applies When: Individual sells property owned less than 5 years

- Tax Base: Higher of declared sale price or government appraised value

- Who Pays: Seller exclusively (not negotiable)

- When Due: At land office during title transfer

Stamp Duty – The Long-Term Owner Tax

- Rate: 0.5% of property value

- Applies When: Property owned 5+ years OR used as primary residence for 1+ year

- Tax Base: Higher of declared sale price or government appraised value

- Who Pays: Seller exclusively (not negotiable)

- When Due: At land office during title transfer

- Primary Residence Exception: Even newly purchased properties qualify for the 0.5% stamp duty rate if registered as the owner’s principal residence

SBT vs. Stamp Duty Real-World Impact

The difference between selling too early and waiting five years is staggering:

Scenario A: Quick Sale After 2 Years

- Property Value: 15,000,000 THB

- Ownership Duration: 2 years

- Tax Type Applied: Specific Business Tax (SBT)

- SBT Amount: 15,000,000 × 3.3% = 495,000 THB

Scenario B: Long-Term Hold After 6 Years

- Property Value: 15,000,000 THB (same property)

- Ownership Duration: 6 years

- Tax Type Applied: Stamp Duty

- Stamp Duty Amount: 15,000,000 × 0.5% = 75,000 THB

- Difference: 420,000 THB in savings ✓

This is why timing property sales is one of the most powerful tax planning strategies available to property investors in Thailand. If you’re considering selling within the next 2-3 years, waiting until year five could put hundreds of thousands of baht back in your pocket.

Strategic Implication: The 5-year threshold is so important that many successful Thailand property investors specifically plan holding periods around this milestone. If you buy a property intending to hold it 3-4 years, you’re making an expensive mistake-holding just one more year saves significant tax.

3. Withholding Tax: The Complex Capital Gains Tax

This is the tax that trips up most sellers because it’s calculated in a complex, multi-step process and often exceeds expectations. Withholding Tax (WHT) is collected by the Land Office when you register the property transfer-it’s mandatory and immediate, though you can request a refund if you overpaid.

How Withholding Tax is Calculated (For Individual Sellers)

Withholding Tax is not a flat percentage. Instead, it’s calculated on your actual capital gain using Thailand’s progressive Personal Income Tax (PIT) brackets. This means the tax rate depends on:

- How much profit you made

- Your total income for that tax year

- Which tax bracket you fall into

Step-by-Step Withholding Tax Calculation Process:

Step 1: Determine Your Adjusted Cost Base

- Start with your original purchase price

- Add all deductible transfer costs (transfer fee paid, SBT/stamp duty paid)

- Result: Your adjusted cost base

Step 2: Calculate Capital Gain

- Sale price minus adjusted cost base

- Example: Sold for 10M, purchased for 5M, paid 150K in costs = 10M – 5.15M = 4.85M gain

Step 3: Apply Progressive Tax Brackets

Thailand’s Personal Income Tax uses these brackets (approximate, subject to annual changes):

- First 300,000 THB: 5% tax

- 300,001 – 500,000 THB: 10% tax

- 500,001 – 750,000 THB: 15% tax

- 750,001 – 1,000,000 THB: 20% tax

- Above 1,000,000 THB: 25-35% tax

Step 4: Sum Total Tax

- Result: Your Withholding Tax liability

Withholding Tax Calculation Example

Let’s walk through a realistic scenario:

Property Details:

- Original Purchase Price: 5,000,000 THB

- Transfer Fee Paid at Purchase: 100,000 THB

- SBT Paid at Purchase: 165,000 THB

- Sale Price: 10,000,000 THB

- Adjusted Cost Base: 5,265,000 THB

- Capital Gain: 4,735,000 THB

Progressive Tax Calculation on the 4.735M Gain:

- First 300,000 @ 5% = 15,000 THB

- Next 200,000 @ 10% = 20,000 THB

- Next 250,000 @ 15% = 37,500 THB

- Remaining 3,985,000 @ 20% = 797,000 THB

- Total Withholding Tax: 869,500 THB (approximately 8.7% of sale price)

Simplified Estimation Method

For quick estimates without doing full calculations:

- Capital gain as percentage of sale price × average PIT rate

- 4,735,000 / 10,000,000 = 47.35% gain ratio

- 47.35% × 15% (midpoint rate) = approximately 7.1% of sale price

- 10,000,000 × 7.1% ≈ 710,000 THB (close to actual)

Withholding Tax for Corporate Sellers

If the property is owned by a company instead of an individual:

- Rate: Flat 1% of the higher of sale price or appraised value

- Calculation: Much simpler-no progressive brackets

- Example: 10M property sold by company = 10M × 1% = 100,000 THB WHT

Important Notes About Withholding Tax:

- Withholding is mandatory-the Land Office collects it automatically at transfer

- You can apply for a refund if you overpaid

- Personal income tax returns must be filed after the property transfer

- Non-residents are taxed the same way as residents

- Foreigners follow the same PIT brackets as Thai individuals

Key Takeaway: Withholding Tax is often the largest single tax bill sellers face because it’s calculated on your entire capital gain, not just the transaction amount. Expecting to net the full difference between purchase and sale price? Don’t-reserve 7-10% for Withholding Tax.

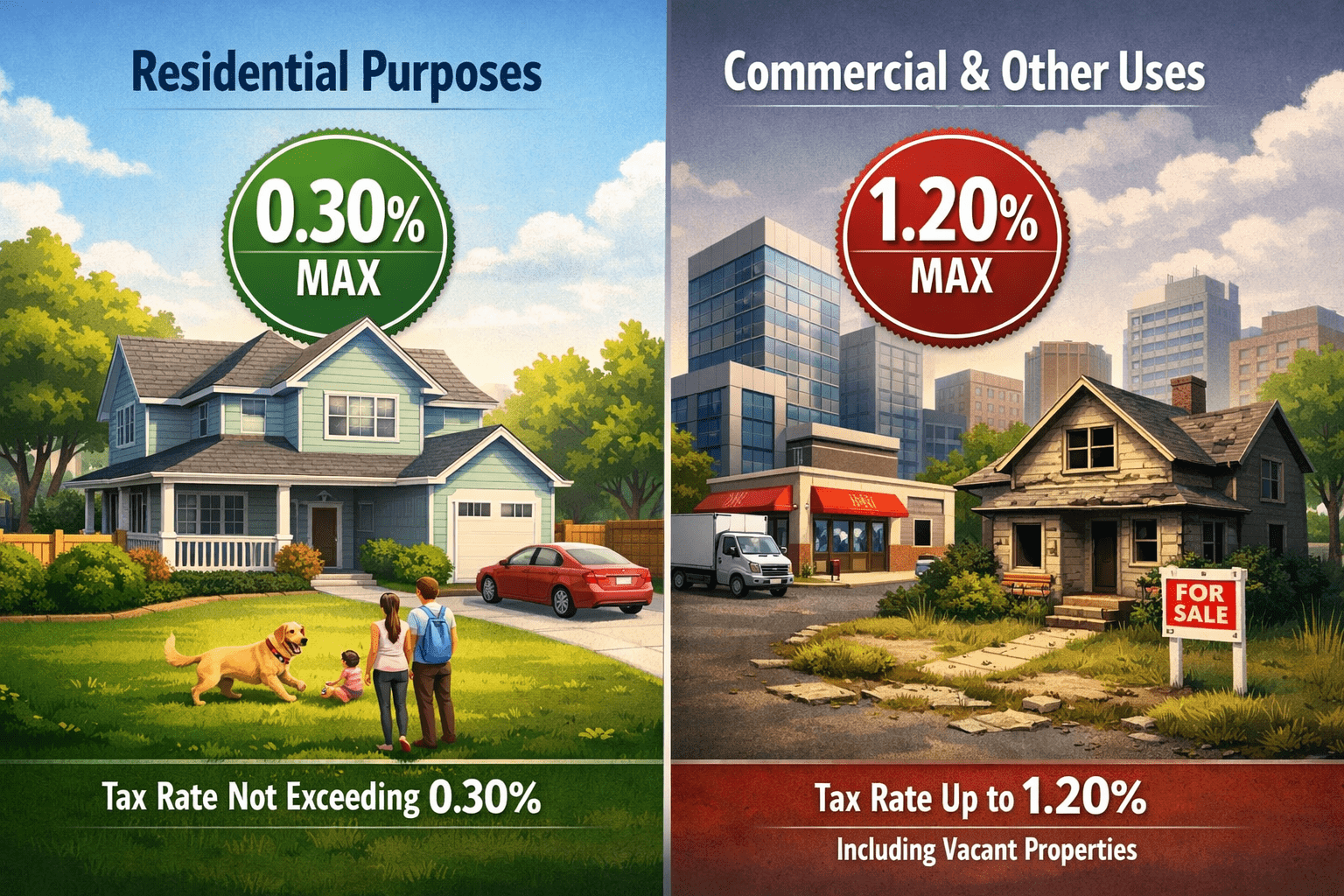

4. Land & Buildings Tax: Your Annual Recurring Cost

The only tax that continues year after year, the Land & Buildings Tax is calculated annually based on the government’s appraised value of your property. For long-term owners and investors, this compound cost matters significantly.

Tax Rate Structure by Property Type

The annual tax rate depends on two factors: (1) the appraised value of your property and (2) how you’re using it.

For Residential Properties (Primary Residence):

- Properties valued 0-10M THB: Exempt (0%) ✓

- Properties valued 10-50M THB: 0.02% annually

- Properties valued 50-100M THB: 0.03% annually

- Properties valued 100M+ THB: 0.10% annually

For Residential Properties (Secondary/Rental):

- Properties valued 0-10M THB: 0.02% annually

- Properties valued 10-50M THB: 0.02% annually

- Properties valued 50-100M THB: 0.03% annually

- Properties valued 100M+ THB: 0.10% annually

For Agricultural Land:

- Tiered rates from 0.01% to 0.10% depending on value

For Commercial/Industrial Properties:

- Flat rates: 0.30% to 0.70% annually (highest tax burden)

For Vacant/Unused Land:

- Base rate: 0.30% annually

- Escalation: Increases 0.30% every 3 years of non-use

- Maximum: 1.20% annually

- Planning Note: This high escalation incentivizes landowners to develop or use their property

When & Where Tax is Due

- Due Date: Typically by April 30th of each tax year

- Payment Location: Local municipality (Amphur office) in the district where the property is located

- Assessment Frequency: Property appraised every 4 years by the Treasury

Land & Buildings Tax Calculation Examples

Example 1: Primary Residence Exemption (BEST CASE)

- Property Appraised Value: 12,000,000 THB

- Property Classification: Primary residence (house)

- Annual Tax: EXEMPT (0%) – No tax owed

- 10-Year Savings: 0 THB ✓

Example 2: Rental Property

- Property Appraised Value: 15,000,000 THB

- Property Classification: Secondary residence (rented out)

- Tiered Calculation:

- First 10M @ 0.02% = 2,000 THB

- Next 5M @ 0.03% = 1,500 THB

- Annual Tax: 3,500 THB

- 10-Year Cost: 35,000 THB (only 0.23% of property value over decade)

Example 3: Commercial Property

- Property Appraised Value: 50,000,000 THB

- Property Classification: Commercial/industrial

- Annual Tax: 50,000,000 × 0.50% = 250,000 THB

- 10-Year Cost: 2,500,000 THB

- Critical Insight: Commercial property taxes compound significantly; businesses must factor this into return calculations

Important Exemptions

These property types are exempt from Land & Buildings Tax:

- Primary Residence (Land + House Combined): First 50 million THB appraised value

- Primary Residence (Building Only on Leased Land): First 10 million THB appraised value

- Religious Properties: Temples, monasteries, shrines

- Government Properties: State-owned buildings and land

- Charitable Organization Properties: If properly registered

Getting Your Primary Residence Exemption (How-To)

If you own a property valued under the exemption threshold, you must actively apply for the exemption-it’s not automatic:

- Register property in your name at the Land Office (obtain Chanote document)

- Establish residential registry with local district office (proof of residence)

- Contact the local municipality (Amphur) to register your property

- Submit exemption application within 30 days of property assessment

- Provide required documents: Chanote, ID, proof of residency (utility bills, etc.)

- Exemption is typically granted automatically if all criteria are met

Key Takeaway: Land & Buildings Tax is modest for residential properties and primary residences often pay zero tax-but it’s substantial for commercial properties and accumulates significantly over decades. First-time property buyers often forget this ongoing cost when calculating true ownership expenses.

Complete Tax Cost Summary: Real-World Scenarios

Here’s how all four taxes combine in realistic scenarios. Use these as benchmarks to estimate your own situation.

[CHART 30: Tax Comparison Table showing 5 scenarios]

| Transaction Type | Property Value | Transfer Fee | SBT/Stamp Duty | Est. Withholding Tax | Annual Land Tax | Total Cost |

|---|---|---|---|---|---|---|

| Buying 10M Condo | 10,000,000 | 100,000 (buyer share) | – | – | 3,500/yr | 103,500 first year |

| Selling After 2 Years | 10,000,000 | 100,000 | 330,000 (SBT) | ~250,000 | – | 680,000 |

| Selling After 6 Years | 10,000,000 | 100,000 | 50,000 (Stamp) | ~200,000 | – | 350,000 |

| 10-Year Ownership | 10,000,000 | – | – | – | 35,000 (× 10 yrs) | 35,000 total |

| Commercial Property | 50,000,000 | 500,000 | 990,000 (SBT) | ~1,200,000 | 250,000/yr | 2,940,000+ |

Key Insight from Table: Selling a property at year 6 instead of year 2 costs 50% less in total taxes-this is why timing property sales is one of the highest-leverage tax planning decisions available.

Thailand Property Taxes for Foreigners: What’s Different?

If you’re an expat or foreign investor, you pay the same transfer taxes as Thai nationals-but you face critical constraints that affect your long-term financial planning.

The Fundamental Constraint: Freehold vs. Leasehold

Thai Nationals: Can own both land and buildings freehold (indefinite ownership)

Foreigners: Cannot own land freehold. Your options are:

- Condominiums: CAN own freehold (indefinite ownership) ✓

- Houses & Villas: Must lease the land (30-year maximum leasehold) ✗

- Land Only: Cannot own freehold (must lease) ✗

This structural limitation has tax implications:

Buying a Condo (Foreigner): Best Option

Tax Treatment:

- Identical to Thai nationals

- All transfer taxes apply normally (2% transfer fee, SBT or stamp duty, WHT)

- Annual Land & Buildings Tax applies (0.02%-0.10% for residential)

- You can sell indefinitely; no reversion to landlord

Tax Example:

- Condo Purchase Price: 10,000,000 THB

- Transfer Fee (buyer’s share): 100,000 THB

- Annual Land Tax: 3,500 THB (indefinite)

- On resale after 6 years: Transfer fee (100k) + stamp duty (50k) + WHT (~200k) = 350k cost

Foreigner Advantage: Condos offer the same tax treatment and permanence as Thai nationals. This is your most straightforward real estate investment in Thailand.

Buying a House/Villa (Foreigner): Leasehold Complications

Critical Constraint: You cannot own the land. You can only lease it for up to 30 years. After the lease expires, the property (including any building you constructed) reverts to the Thai landowner.

Tax Treatment on Leasehold:

- Transfer taxes apply to the lease agreement (not land transfer)

- Lease registration fee: 1% of total lease rental value (paid once)

- Stamp duty on lease: 0.1% of total rental value

- Annual Land & Buildings Tax applies ONLY to the building portion (not land)

- After 30 years: Property reverts to landlord; you receive no compensation

Tax Example:

- Villa Purchase (30-year lease): 15,000,000 THB

- Lease Registration Fee: 1% = 150,000 THB

- Stamp Duty on Lease: 0.1% = 15,000 THB

- Transfer Fee (lease agreement): 2% = 300,000 THB

- Annual Land Tax (building only): 3,500 THB

- Total First-Year Cost: 465,000 THB

Critical Planning Note: If you’re considering a 30-year leasehold villa purchase, run the numbers carefully. After 30 years, your investment is gone-it’s more like a very long-term rental than an ownership investment.

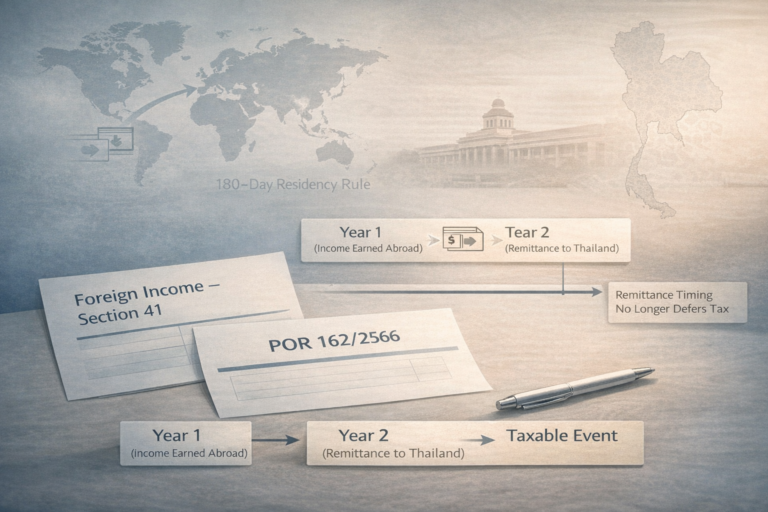

Rental Income Tax for Foreigners

Your Tax Status Matters:

Tax Resident Status (worked in Thailand 180+ days in tax year):

- Tax Rate: Progressive personal income tax (5%-35%)

- Example: 500,000 THB annual rent

- Deduction (30% standard): 150,000 THB

- Taxable Income: 350,000 THB

- Tax at 10% bracket: 35,000 THB (estimated)

- Effective Rate: 7% of gross rent

Non-Resident Status (less than 180 days in Thailand):

- Tax Rate: Flat 15% on rental income

- Example: 500,000 THB annual rent

- Withholding: 500,000 × 15% = 75,000 THB

- Effective Rate: 15% of gross rent

Strategy for High Earners: If you’re in the 25-35% tax bracket in your home country, maintaining non-resident status in Thailand (15% flat rate) saves significant taxes on rental income.

Capital Gains on Property Resale

Foreigners follow the same withholding tax rules as Thai individuals:

- Calculated on actual capital gain (sale price minus cost base)

- Progressive PIT brackets apply (5%-35%)

- The 5-year holding period matters equally (SBT vs. stamp duty)

- Estimated 7-10% of sale price in total seller taxes

Rental Property Income Tax: Calculate Your Exact Tax Bill

If you’re renting out your property, you’ll pay income tax on the rental revenue. The amount depends on your tax residency status and deductions.

Tax Rate Structure

Tax Residents (180+ days in Thailand):

Your rental income is taxed at the marginal rate within Thailand’s progressive tax brackets:

- 0 – 300,000 THB: 5%

- 300,001 – 500,000 THB: 10%

- 500,001 – 750,000 THB: 15%

- 750,001 – 1,000,000 THB: 20%

- 1,000,001 – 4,000,000 THB: 25%

- Above 4,000,000 THB: 30%-35%

Non-Residents (Less than 180 days):

- Flat 15% withholding on rental income

- Collected by property management company or tenant

- No deductions allowed (15% applies to gross rent)

Calculating Taxable Rental Income

Step 1: Calculate Gross Annual Rental Income

- Monthly rent × 12 months

Step 2: Apply Deduction

- Standard 30% deduction (OR itemize actual expenses if higher)

Step 3: Calculate Tax

- Taxable income × your applicable tax rate

Rental Income Tax Calculation Example

Scenario: Tax Resident Landlord

Property Details:

- Monthly Rent: 40,000 THB

- Annual Gross Rent: 480,000 THB

Tax Calculation:

- 30% Deduction: 144,000 THB (standard allowance)

- Taxable Income: 336,000 THB

- Tax Bracket: 10% (falls in 300,001-500,000 bracket)

- Estimated Tax: 33,600 THB annually

- Effective Tax Rate: 7% of gross rent ✓

With Itemized Deductions (If Higher):

Allowed deductions include:

- Mortgage interest

- Property management fees

- Maintenance and repairs

- Utilities paid by owner

- Land & Buildings Tax

- Insurance premiums

- Building depreciation (5% annually for 20 years)

Example with Depreciation:

- Annual Gross Rent: 480,000 THB

- Building Depreciation (5% of 5M building value): 250,000 THB

- Mortgage Interest: 150,000 THB

- Total Deductions: 400,000 THB

- Taxable Income: 80,000 THB only

- Tax at 5% bracket: 4,000 THB annually

- Effective Tax Rate: 0.8% of gross rent ✓

Key Planning Insight: Depreciation is the most powerful tax deduction for rental properties. By claiming building depreciation (separate from land value), you can legally reduce taxable income by 5% of the building value annually for up to 20 years. This can cut your rental income tax from 25-35% down to single digits.

Non-Resident Rental Tax Example

Same Property, Non-Resident Owner:

- Monthly Rent: 40,000 THB

- Annual Rent: 480,000 THB

- Withholding Tax: 480,000 × 15% = 72,000 THB

- Effective Rate: 15% (no deductions allowed)

Strategic Insight: The difference between resident (7% with deductions) and non-resident (15% flat) taxation on rental income is significant. If you’re a non-resident foreigner collecting substantial rental income, consulting a Thai tax accountant might identify strategies to optimize your tax status.

Filing Requirements for Rental Income

- Annual income tax return (Form PIT) due March 31st following tax year

- Keep rental records: tenant names, monthly rent amounts, payment dates

- Maintain receipts: repairs, maintenance, property management fees

- Report all rental income; amounts withheld by property managers

- File even if tax was already withheld (may claim refund if you overpaid)

Capital Gains Tax on Property Sale: Understanding the Complex Calculation

Thailand has no standalone capital gains tax. Instead, property sale profits are taxed as ordinary income under the Personal Income Tax system-which means the tax rate depends on your income bracket and how much profit you made.

How Capital Gains Are Taxed

Step 1: Calculate Your Capital Gain

- Sale Price minus Adjusted Cost Base

- Cost base includes: purchase price + all deductible transfer costs (transfer fee, SBT/stamp duty)

Step 2: Apply Progressive Tax Brackets

- The gain is taxed using Thailand’s 5%-35% personal income tax brackets

- Higher gains face higher tax rates

Step 3: Withholding Tax at Land Office

- Tax is withheld automatically when you register the property transfer

- You can request a refund if you overpaid

- Must file personal income tax return after sale

The 5-Year Holding Period Impact

Critical Tax Planning Rule: The length of ownership determines whether you pay SBT or stamp duty, which dramatically affects your total tax bill.

Scenario: Sell After 2 Years (SBT Applies)

- Property Value: 10,000,000 THB

- Capital Gain (estimated): 4,000,000 THB

- SBT Tax: 330,000 THB (3.3%)

- Withholding Tax (progressive): ~250,000 THB

- Total Seller Tax: 580,000 THB (5.8% of sale price)

Scenario: Sell After 6 Years (Stamp Duty Applies)

- Property Value: 10,000,000 THB (same property)

- Capital Gain (estimated): 5,000,000 THB (likely more due to appreciation)

- Stamp Duty: 50,000 THB (0.5%)

- Withholding Tax (progressive): ~250,000 THB

- Total Seller Tax: 300,000 THB (3.0% of sale price)

- Difference: 280,000 THB in savings ✓

Cost Base Optimization

Every expense you incurred while purchasing the property reduces your taxable capital gain:

Deductible Purchase Costs:

- Transfer fee paid at purchase

- SBT paid at purchase (if purchased recently and reselling)

- Land & Buildings Tax paid during ownership

- Property transfer transaction costs

- Property improvement expenses (renovations, repairs)

Example Cost Base Calculation:

- Original Purchase Price: 5,000,000 THB

- Transfer Fee Paid: 100,000 THB

- SBT Paid: 165,000 THB

- Property Improvements: 50,000 THB

- Land Tax Paid (3 years): 10,500 THB

- Total Adjusted Cost Base: 5,325,500 THB

- Sale Price: 10,000,000 THB

- Capital Gain: 4,674,500 THB (instead of 5,000,000 if not documented)

Critical Action Item: Keep all property-related receipts and documentation. The difference between a documented cost base and an estimated one can be worth tens of thousands in tax savings.

Minimization Strategies

- Hold Property 5+ Years: Saves 2.8% in SBT vs. stamp duty

- Document All Expenses: Every improvement and cost reduces your gain

- Consider Primary Residence Status: Can reduce WHT calculation

- Timing Strategy: Sell in low-income year if possible (moves you to lower tax bracket)

- Understand Your Brackets: Know which tax bracket you fall into when calculating WHT

Tax Exemptions & Benefits: Significant Savings Most Owners Miss

Many Thai property owners pay more tax than necessary simply by not applying for exemptions they qualify for.

Primary Residence Exemptions (Major Benefit)

Land & Buildings Tax Exemption:

If your property is classified as your primary residence, you may qualify for a substantial exemption from annual Land & Buildings Tax:

- Land + House Combined: First 50 million THB appraised value is EXEMPT

- Building Only (on leased land): First 10 million THB appraised value is EXEMPT

Real-World Impact:

- Property appraised at 15 million THB (primary residence): EXEMPT (saves 3,500+ THB annually)

- 10-year ownership: saves 35,000+ THB total

- 30-year ownership: saves 105,000+ THB total

This is a simple benefit that requires one-time paperwork to claim.

How to Apply for Primary Residence Exemption

Timeline: Apply within 30 days of receiving property assessment notice from municipality

Required Documents:

- Chanote (certificate of ownership) copy

- National ID card

- Proof of residence (utility bills, lease termination, address registry)

- Marital status certificate (if applicable)

- Exemption application form (obtained from municipality)

Where to Apply:

- Local municipality office (Amphur) in the district where property is located

- Applications are usually granted automatically if criteria are met

Eligibility Criteria:

- Property registered in your name

- Used as your principal residence

- Appraised value under exemption threshold

- Not previously exempted (one primary residence per owner)

Other Property Tax Exemptions

Religious Properties:

- Temples, monasteries, shrines: Exempt from all property taxes

- Requires proper registration as religious institution

Government Properties:

- State-owned buildings and land: Exempt

- Includes public schools, government offices, etc.

Charitable Organizations:

- Registered charitable foundations: May be exempt

- Requires documentation of charitable status

Holding Period Tax Benefits

The 5-Year Advantage:

- Properties held 5+ years pay 0.5% stamp duty

- Properties held <5 years pay 3.3% SBT

- Difference: 2.8 percentage points

- On a 15 million THB property: 420,000 THB savings

Strategy: If you’re considering selling property you’ve owned 3-4 years, strongly consider waiting until the 5-year mark. The tax savings often exceed any foregone rental income.

Income Tax Deductions (Rental Properties)

Standard Deduction:

- 30% of gross rental income (automatic, no documentation required)

Itemized Deductions (if higher than 30%):

- Mortgage interest payments

- Property management company fees

- Repairs and maintenance

- Utilities paid by owner

- Insurance premiums

- Land & Buildings Tax paid

- Building depreciation (5% annually, max 20 years)

Most Powerful Deduction: Depreciation

If you own the building (separate from land), you can claim 5% depreciation annually:

- Building Cost Basis: 5,000,000 THB

- Annual Depreciation (5%): 250,000 THB

- Depreciates over 20 years

- On 500,000 THB annual rent: 250,000 depreciation deduction reduces taxable income by 50%

- Saves 50,000+ THB annually in taxes

Key Takeaway: Proper deduction documentation can cut rental property taxes by 50-80% compared to simply paying tax on gross rental income.

Buying vs. Renting: Financial Comparison & Break-Even Analysis

One of the most important financial decisions is whether to invest in Thai real estate or remain a renter. The answer depends on your timeline, but the math is clear for investors planning to stay 5+ years.

Total Cost of Ownership Framework

Let’s calculate the true cost of property ownership including all taxes and expenses, and compare it to rental costs over a 5-year period.

Scenario: Bangkok Condominium, 10 Million THB Value

Purchase & Ownership Costs (5 Years):

| Cost Component | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total |

|---|---|---|---|---|---|---|

| Transfer Fee (buyer share) | 100,000 | – | – | – | – | 100,000 |

| Annual Land Tax | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 17,500 |

| Maintenance (estimated) | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 200,000 |

| Property Management (if applicable) | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 150,000 |

| Annual Subtotal | 173,500 | 73,500 | 73,500 | 73,500 | 73,500 | 467,500 |

| Sale Costs (Year 5) | – | – | – | – | 175,000 | 175,000 |

| TOTAL 5-YEAR COST | – | – | – | – | – | 642,500 (6.4%) |

Rental Costs (5 Years):

- Average Market Rent: 40,000 THB/month

- Annual Rent: 480,000 THB

- 5-Year Rental Cost: 2,400,000 THB

Financial Comparison:

- Buying 5-year cost: 642,500 THB

- Renting 5-year cost: 2,400,000 THB

- Buying saves 1,757,500 THB over 5 years ✓

- Buying breaks even at approximately 3-4 years

Break-Even Analysis

At what point does property ownership become cheaper than renting?

Using the Example:

- Annual ownership cost: ~100,000 THB (after initial purchase)

- Annual rent cost: 480,000 THB

- Annual net benefit of buying: 380,000 THB

Timeline:

- Year 1: -173,500 THB (purchase costs exceed rent savings)

- Year 2: 206,500 THB cumulative (break-even passed)

- Year 3: 586,500 THB cumulative

- Year 5: 1,347,500 THB cumulative

Critical Insight: Most Bangkok properties break even against renting within 2.5-3 years. If you’re planning to stay in one property 3+ years, buying is almost always cheaper than renting.

Additional Benefits of Ownership (Not Quantified Above)

- Capital Appreciation: Property typically appreciates 2-4% annually

- On a 10M property: 200,000 – 400,000 THB additional value per year

- Over 5 years: 1-2 million THB in appreciation

- Forced Savings: Property ownership forces you to build equity

- Rental payments build your landlord’s wealth, not your own

- Leverage: You can borrow 50-70% of property value at 2-3.5% rates

- Magnifies returns on your down payment

- Example: 30% down, 70% financed, can amplify returns

- Currency Hedge: If earning in baht, property locks in baht value

- Protects against currency fluctuations vs. other investments

Disadvantages of Ownership

- Illiquidity: Takes 2-3 weeks to sell; not quick to exit

- Maintenance: You’re responsible for repairs and upkeep

- Management: Need to handle tenant issues (if renting out)

- Vacancy Risk: If renting to others, periods of no income

- Foreigner Limitations: 30-year leasehold (for non-condos); reversion of property

Investment ROI Calculation

For serious investors, here’s how to calculate your expected annual return:

Formula: (Annual Rent + Capital Appreciation) / Total Investment = ROI

Example:

- Property Value: 10,000,000 THB

- Down Payment (30%): 3,000,000 THB

- Annual Rent: 480,000 THB

- Annual Appreciation (3%): 300,000 THB

- Total Annual Income: 780,000 THB

- ROI on Investment: 780,000 / 3,000,000 = 26% annually ✓

Note: Subtract 10-15% for annual taxes and maintenance to get net ROI (~20% annually in this example).

Common Mistakes & Strategic Tax Planning

Most property buyers and sellers make at least one expensive tax planning mistake. Here are the most common-and how to avoid them.

Mistake #1: Underpricing to Save on Transfer Taxes

The Problem:

Many sellers negotiate a lower purchase price hoping to reduce transfer taxes. This doesn’t work.

Why It Fails:

Thailand’s Land Office uses the higher of your declared sale price OR the government’s appraised value to calculate transfer taxes. If you price below the appraised value, the Land Office uses the appraised value instead.

Result: No tax savings, but now you have:

- Loan appraisal issues (bank won’t lend on inflated “official value”)

- Title registration delays (land office questions the transaction)

- Future capital gains complications (your cost base disputes)

Solution: Accept the appraised value and negotiate on other terms. The tax base is locked in whether you acknowledge it or not.

Mistake #2: Underestimating Withholding Tax Liability

The Problem:

Sellers budget for Specific Business Tax (3.3%) but forget that Withholding Tax can be equally large or larger.

Example:

- Expected SBT: 330,000 THB

- Actual WHT: 850,000 THB

- Total unexpected tax: 520,000 THB

- At closing: Insufficient funds, forced to hold sale proceeds in Thailand

Solution: Use the calculator in this guide to estimate total seller taxes BEFORE listing your property. Budget conservatively; estimate 7-10% of sale price as total tax burden.

Mistake #3: Not Planning for Annual Land & Buildings Tax

The Problem:

First-time property buyers are shocked to receive an annual tax bill they didn’t budget for.

Reality:

- On a 15M property (rental use): 5,250 THB annually

- Over 20 years: 105,000 THB in “surprise” annual costs

- If property appreciates 3% annually, these taxes are real costs that reduce net returns

Solution: Factor annual Land & Buildings Tax into your property purchase ROI calculations. Even small percentages compound over decades.

Mistake #4: Missing Primary Residence Exemption

The Problem:

Owners fail to apply for their exemption and pay 10-30 years of unnecessary property tax.

Real-World Impact:

- Primary residence under 50M: Should pay 0 in Land & Buildings Tax

- Owner pays by default: 3,500+ THB annually unnecessarily

- 30-year ownership: 105,000+ THB wasted

Solution: Within 30 days of property assessment, apply for your exemption at the local municipality. It’s a one-time, 30-minute process that saves tens of thousands of baht.

Mistake #5: Not Using the 5-Year Holding Period Strategy

The Problem:

Selling property after 2-3 years of ownership triggers the 3.3% Specific Business Tax instead of waiting for the 0.5% stamp duty rate.

Example:

- Property value: 15M

- Sell after 2 years: 495,000 THB SBT

- Sell after 6 years: 75,000 THB stamp duty

- Cost difference: 420,000 THB

Solution: When buying property, make a realistic assessment of your holding timeline. If you think you’ll sell in 2-3 years, plan for it. If you might hold longer, waiting to year 5 has massive tax benefits.

Mistake #6: Not Deprecating Rental Property Buildings

The Problem:

Landlords report rental income without claiming building depreciation, inflating their taxable income unnecessarily.

Example:

- Gross Rent: 500,000 THB annually

- Without Depreciation: 350,000 THB taxable (after 30% deduction)

- Tax at 25% bracket: 87,500 THB

- With Building Depreciation (5% of 5M building): 250,000 additional deduction

- New Taxable Income: 100,000 THB

- Tax: 25,000 THB

- Annual Tax Savings: 62,500 THB

Solution: If you own the building (separate from land), claim 5% annual depreciation for up to 20 years. This is the most powerful tax deduction available to Thai property owners.

Mistake #7: Separating Land & Building Taxes Improperly

The Problem:

On leasehold properties, foreigner buyers sometimes overpay by not understanding that land and building have separate tax treatments.

Reality:

- Building (owned by foreigner): Taxed normally

- Land (leased from Thai owner): Not separately taxed to buyer

- Improper structuring can result in double taxation on land

Solution: Ensure your purchase agreement clearly separates land lease value from building value. Consult a property lawyer to verify tax treatment.

Step-by-Step Guides: How to Calculate Your Specific Taxes

Guide 1: How to Calculate Transfer Fees When Buying

Follow these steps to determine exactly how much you’ll pay in transfer fees:

Step 1: Obtain Your Property’s Appraised Value

- Ask your real estate agent for the government appraised value

- OR contact the local Land Office (Chanote) records

- Write down the appraised value in THB

Step 2: Determine Your Applicable Transfer Fee Rate

- Standard rate: 2%

- Thai nationals buying ≤7M through June 30, 2026: 0.01%

- Foreigners: Always 2%

Step 3: Calculate Your Transfer Fee Amount

- Formula: Appraised Value × Applicable Rate

- Example: 10,000,000 × 2% = 200,000 THB

Step 4: Determine Your Payment Share

- Negotiate in purchase agreement (typically 50/50)

- Your share (if 50%): 100,000 THB

- Confirm in writing before signing

Step 5: Add Transfer Fee to Your Acquisition Budget

- Total cash at closing = Loan amount + down payment + transfer fee

- Example: 7M loan + 3M down payment + 100k transfer fee = 10.1M cash required

Real-World Walkthrough:

- Property value: 12,000,000 THB

- Appraised value: 11,500,000 THB (often lower than market)

- Transfer fee (2%): 230,000 THB

- Split 50/50: Your share = 115,000 THB (add to closing costs)

Guide 2: How to Calculate Withholding Tax as Seller

This is complex, but essential for estimating your net proceeds from a sale:

Step 1: Gather Your Purchase Documentation

- Original purchase receipt or contract

- Transfer fee receipt paid at purchase

- Any SBT/stamp duty paid

- Land & Building Tax receipts

Step 2: Calculate Your Adjusted Cost Base

- Purchase price: ___________

- Transfer fee paid: +___________

- SBT/Stamp duty paid: +___________

- Improvements/renovations: +___________

- Total Adjusted Cost Base: ___________

Step 3: Calculate Your Capital Gain

- Sale price: ___________

- Minus adjusted cost base: -___________

- Capital Gain: ___________

Step 4: Find Your Tax Bracket

Use Thailand’s Personal Income Tax brackets:

- 0-300,000: 5%

- 300,001-500,000: 10%

- 500,001-750,000: 15%

- 750,001-1,000,000: 20%

- 1,000,001-4,000,000: 25%

- 4,000,001+: 30-35%

Break your capital gain into brackets and calculate:

Example:

- Capital Gain: 4,000,000 THB

- First 300,000 @ 5% = 15,000

- Next 200,000 @ 10% = 20,000

- Next 250,000 @ 15% = 37,500

- Remaining 3,250,000 @ 25% = 812,500

- Total WHT: 885,000 THB

Step 5: Verify at Land Office Before Closing

- They will recalculate independently

- May differ slightly from your estimate

- Confirm amount before signing final transfer

Step 6: Plan for Tax Payment

- Withholding is collected immediately at Land Office

- Cannot avoid or delay

- Account for this in your net sale proceeds

Guide 3: How to Apply for Land & Buildings Tax Exemption

If you own a primary residence, this one-time application can save you tens of thousands in annual taxes:

Step 1: Verify You’re Eligible

- Property must be registered in your name (you have Chanote)

- Property must be classified as primary residence

- Appraised value must be under exemption threshold (50M for land+house)

Step 2: Register Your Property at Land Office

- Obtain your Chanote (certificate of ownership)

- Verify your name is correctly listed

- Note the government appraised value

Step 3: Establish Residential Registry Locally

- Visit your local district office (Amphur)

- Register your address as your principal residence

- Provide proof of residency (utility bills, lease termination, etc.)

Step 4: Wait for Municipality Assessment

- Local municipality (Amphur) will assess your property

- This happens automatically within 60 days of ownership registration

- You’ll receive an assessment notice by mail

Step 5: Submit Your Exemption Application

- You have 30 days from assessment to apply

- Go to your local municipality office

- Bring: Chanote, ID, proof of residence, assessment notice

Step 6: Complete the Exemption Form

- Form is provided by municipality (no fee)

- Requires basic information: owner name, property details, use classification

- Submit with supporting documents

Step 7: Receive Confirmation

- Municipality will process within 1-2 weeks

- You’ll receive exemption confirmation

- Save this document; show to municipality annually with tax bill payment

Step 8: Claim Your Savings

- Your first annual tax bill should show exemption status

- If property valued under exemption threshold: Zero tax owed

- If above threshold: Only excess above 50M is taxed

Timeline Example:

- May 1: Property ownership registered (Chanote issued)

- May 10: Register residential address at district office

- June 15: Receive municipality assessment notice

- June 20: Submit exemption application

- July 1: Exemption confirmed

- April 2026: First tax bill arrives with $0 owed (exemption applied)

Frequently Asked Questions About Thailand Property Taxes

Q1: Does Thailand have annual property tax?

A: Yes, the Land & Buildings Tax. Every property owner in Thailand pays this recurring annual tax based on the government’s appraised value of their property. However, primary residences often qualify for exemptions that reduce the tax to zero. The tax is calculated by property type and appraised value, ranging from 0% (exempt primary residences) to 0.70% (commercial properties).

Key Point: Primary residence exemptions mean many homeowners pay zero annual tax, even though the system is mandatory for other property types.

Q2: How much will it cost to buy property in Thailand?

A: Purchase costs range from 2.5% to 3.5% of the property price in government fees and taxes. The largest component is the transfer fee (2% of appraised value, typically split 50/50 with the seller). Other costs include stamp duty, withholding tax, and documentation fees. Using the interactive calculator at the top of this page, you can get an exact estimate for your specific property value and situation.

Q3: How much does it cost to buy land in Thailand?

A: Same transfer taxes as buildings (2% transfer fee), but annual Land & Buildings Tax is significantly higher (0.30%-0.70% annually for raw land). Additionally, foreigners cannot own land freehold-you’re limited to 30-year leasehold only. For most foreign investors, buying a condo (which you can own freehold) is simpler than buying land.

Q4: Is it better to buy or rent in Thailand?

A: For timelines of 5+ years, buying is almost always cheaper. Most Bangkok properties break even against renting within 2.5-3 years when you factor in capital appreciation. If you’re planning to stay in one property for longer than 3 years, purchasing typically results in significant financial savings compared to renting. The calculator on this page can help you analyze your specific situation.

Q5: What taxes do Thailand residents pay on trading & investment profits?

A: Property sale profits are taxed under Thailand’s Personal Income Tax system at progressive rates (5%-35% depending on your income bracket). There is no separate capital gains tax. The tax is calculated on your actual profit (sale price minus cost base) and is withheld automatically when you register the property transfer at the Land Office.

Q6: How much does a condo cost in Thailand for foreigners?

A: Condo prices range from 2-3 million baht (Bangkok outer areas) to 50+ million baht (downtown/luxury). Foreigners can own condos freehold (indefinite ownership), making them the best real estate investment option for non-Thai nationals. Use the calculator to estimate taxes on any purchase price; transfer taxes apply uniformly regardless of condo cost.

Q7: Is there income tax in Thailand?

A: Yes. Thailand has a personal income tax system with progressive rates (5%-35%). Both salary/business income AND rental income are taxed. Non-residents pay a flat 15% on Thailand-source income. If you earn rental income from Thai property, you must file an annual tax return and pay taxes on that income (though you can deduct property expenses).

Q8: What are property transfer taxes in Thailand?

A: Every property transfer involves multiple taxes:

- Transfer Fee: 2% of property value

- Specific Business Tax (SBT): 3.3% if owned <5 years

- Stamp Duty: 0.5% if owned 5+ years

- Withholding Tax: 1.5%-3.5% on capital gains (progressive)

Total seller taxes typically range 5-7% of the property value.

Q9: Can foreigners own property in Thailand?

A: Partially. Foreigners can own condominiums freehold (indefinite ownership). However, foreigners cannot own land freehold-you’re limited to 30-year leasehold for houses, villas, and raw land. For most foreign investors, condo ownership in prime locations is the best real estate strategy in Thailand.

Q10: What is the capital gains tax in Thailand?

A: There is no separate capital gains tax. Property sale profits are taxed as Personal Income Tax at progressive rates (5%-35%). The tax is calculated on your actual capital gain (sale price minus cost base) and withheld automatically at the Land Office during property transfer. Higher gains face higher tax rates within the progressive bracket system.

Q11: How long do I need to hold property before selling to reduce taxes?

A: Five years. Properties owned less than 5 years pay the 3.3% Specific Business Tax. Properties owned 5 or more years pay just 0.5% stamp duty. On a 15 million baht property, this difference equals 420,000 baht in savings. This is the single most important tax planning variable for property investors.

Q12: Are there any tax exemptions for primary residences?

A: Yes, major ones. Primary residences are exempt from Land & Buildings Tax on the first 50 million baht (land + house) or 10 million baht (building only on leased land). This saves 1,000-50,000+ baht annually depending on property value. You must apply for the exemption within 30 days of receiving your assessment notice.

Take Action: Calculate Your Property Taxes Today

Now that you understand Thailand’s property tax system completely, use the interactive calculator at the top of this page to get your exact costs. Input your property details and see your buyer/seller tax breakdown instantly.

What to Do Next

If You’re Buying:

- Run your property price through the calculator

- Add the transfer fee and annual tax to your budget

- Plan to own 5+ years if possible (to benefit from lower stamp duty rates)

- Ask your agent about the temporary 0.01% reduced fee for Thai nationals (through June 30, 2026)

If You’re Selling:

- Calculate your total seller taxes (use the calculator)

- Understand your withholding tax liability (often larger than expected)

- If you’re within 5 years of purchase, consider waiting for the stamp duty rate

- Gather all purchase documentation to maximize your cost base and reduce capital gains

If You’re a Landlord:

- File your annual income tax return with rental income

- Claim the 30% standard deduction or itemize expenses

- If you own the building: claim 5% annual depreciation (most powerful deduction)

- Budget for annual Land & Buildings Tax (modest but real cost)

If You’re a Foreigner:

- Consider condo ownership (freehold) rather than leasehold houses

- If renting property: decide between resident (5-35% progressive tax) vs. non-resident (15% flat) status

- Understand that 30-year leaseholds revert to the landlord-plan accordingly

- Consult a Thai tax professional for your specific situation

Download Your Free Resources

- Download the Complete Thailand Property Tax Guide (PDF) – Print-friendly version of this entire guide with calculation worksheets

- Tax Calculation Worksheets – Step-by-step forms for buyers, sellers, and landlords

- Primary Residence Exemption Application Guide – Required forms and process walkthrough

Get Expert Help

For complex situations-large investments, company ownership, international tax implications-schedule a free consultation with a Thai tax professional. The right advice pays for itself many times over.

Last Updated: January 22, 2026

Sources: Thailand Revenue Department, Thai Land Department, Thai Banking Association

Disclaimer: This information is educational and accurate as of the date above. Tax laws change; consult a qualified Thai tax professional for your specific situation. Withholding tax calculations are estimates; the Land Office will calculate your exact liability at closing.