1. Overview: What Changed in Thai Income Tax for 2026?

The Thai tax landscape has shifted fundamentally for expatriates. While the headline tax rates (0–35%) remain unchanged for the 2026 filing season (covering income earned in 2025), the enforcement mechanism for foreign-sourced income has tightened.

The pivotal change concerns Revenue Department Order No. 161/2023 and 162/2023. For decades, residents could avoid Thai tax on foreign income simply by delaying the transfer of funds until the following calendar year. This loophole is now closed for income earned after January 1, 2024.

For the 2026 tax year (and the filing occurring in early 2027), the rule is strict: if you are a Thai tax resident and you bring assessable foreign income into Thailand—at any time—it is subject to Personal Income Tax (PIT).

Key updates for 2026 also include:

- Social Security Cap Increase: The wage ceiling for calculations has risen to 17,500 THB, increasing the maximum monthly deduction to 875 THB starting January 2026.

- Thai ESG Fund: A new deduction allowance of up to 300,000 THB for eligible Environmental, Social, and Governance funds, with a reduced holding period of 5 years.

2. Who Must Pay Personal Income Tax in Thailand?

Liability in Thailand is determined by residency and source of income, not nationality or visa type (with the specific exception of the LTR Visa).

Thai Tax Residents

You are a tax resident if you spend 180 days or more in Thailand within a single calendar year (January 1 – December 31).

- Days Calculation: Days do not need to be consecutive. Any presence in Thailand counts toward the total.

- Liability: Residents are taxed on:

- All income derived from sources within Thailand (employment, business, property).

- All income derived from foreign sources, if remitted to Thailand.

Non-Residents

If you stay fewer than 180 days, you are a non-resident.

- Liability: You are taxed only on income derived from sources within Thailand. Foreign income remitted to Thailand is tax-exempt.

Specific Visa Categories

- LTR Visa Holders: Wealthy Pensioner, Global Wealthy Citizen, and Work-from-Thailand Professionals categories are exempt from tax on foreign-sourced income, even if remitted.

- Smart Visa / BOI: Generally subject to standard rules unless specific privileges apply.

3. Scope of Taxable Income in Thailand

Thai law classifies income into 8 categories (Section 40 of the Revenue Code). The category determines your deductible expenses.

| Category | Description | Standard Deduction |

|---|---|---|

| 40(1) | Salary, wages, bonuses, gratuity. | 50% (capped at 100,000 THB) |

| 40(2) | Commissions, service fees, meeting fees. | 50% (capped at 100,000 THB combined with 40(1)) |

| 40(3) | Goodwill, copyright, royalties. | 50% (capped at 100,000 THB) |

| 40(4) | Interest, dividends, crypto gains. | None (Final tax usually applies) |

| 40(5) | Rental income. | 10–30% (depending on property type) or Actual |

| 40(6) | Professional services (Doctors, Engineers, Lawyers). | 30–60% (depending on profession) |

| 40(7) | Contractor services (Labor + Materials). | 60% or Actual Expenses |

| 40(8) | Business, commerce, other income. | 40–60% or Actual Expenses |

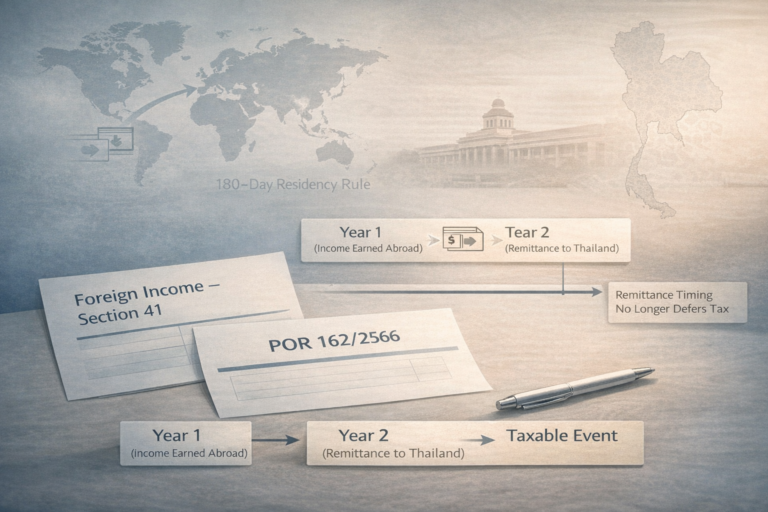

4. Foreign Income Rules (Critical Section)

This is the most misunderstood area of Thai tax law in 2026. The interpretation relies on the Remittance Principle.

The New Rule (Post-2024 Income)

If you earn income abroad (e.g., US salary, UK dividends, crypto trading profits) on or after January 1, 2024, and you are a Thai tax resident, that income is taxable in the year you remit it to Thailand.

- Example: You earn $5,000 in June 2025. You transfer it to your Bangkok Bank account in February 2026.

- Old Rule: Exempt (different tax years).

- New Rule: Taxable in your 2026 return.

The “Legacy” Exemption (Pre-2024 Income)

Income earned before January 1, 2024, is still governed by the old interpretation. If you have savings from 2023 or earlier, you can remit these tax-free, provided you can prove the income was earned before 2024.

Recommendation: Keep separate offshore accounts for “Old Capital” (pre-2024 savings) and “New Income” to simplify audits.

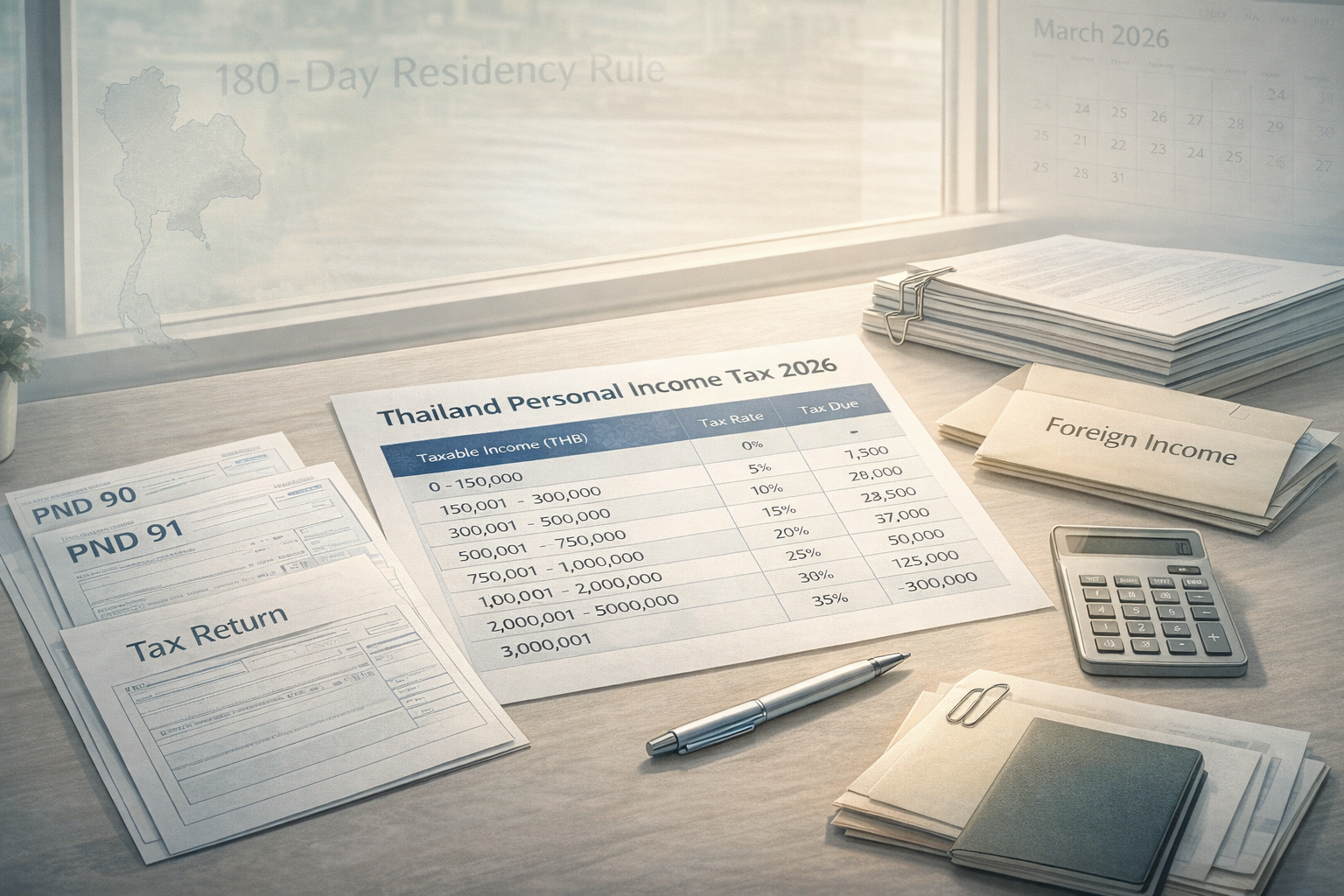

5. Thai Personal Income Tax Rates 2026

Thailand uses a progressive tax rate. The rates for the 2026 filing season are as follows:

| Net Assessable Income (THB) | Tax Rate | Tax Per Bracket | Cumulative Tax |

|---|---|---|---|

| 0 – 150,000 | Exempt | 0 | 0 |

| 150,001 – 300,000 | 5% | 7,500 | 7,500 |

| 300,001 – 500,000 | 10% | 20,000 | 27,500 |

| 500,001 – 750,000 | 15% | 37,500 | 65,000 |

| 750,001 – 1,000,000 | 20% | 50,000 | 115,000 |

| 1,000,001 – 2,000,000 | 25% | 250,000 | 365,000 |

| 2,000,001 – 5,000,000 | 30% | 900,000 | 1,265,000 |

| Over 5,000,000 | 35% | – | – |

Quick Salary Examples (Annual):

- 600,000 THB (50k/month): After deductions/allowances, tax is approx. 7,500 THB.

- 1,560,000 THB (130k/month): Tax is approx. 180,000 – 200,000 THB (effective rate ~12%).

- 2,400,000 THB (200k/month): Tax is approx. 450,000 THB (effective rate ~19%).

6. Allowances and Deductions

To lower your assessable income, maximize these legal deductions:

- Personal Allowance: 60,000 THB (automatic).

- Spouse Allowance: 60,000 THB (if spouse has no income).

- Child Allowance: 30,000 THB per legitimate child.

- Social Security: Actual amount paid (max ~9,000 THB/year under 2025 rules; higher in 2026).

- Life Insurance: Actual paid, up to 100,000 THB.

- Health Insurance: Actual paid, up to 25,000 THB (combined with Life Insurance max 100k).

- Mortgage Interest: Actual paid, up to 100,000 THB.

- RMF (Retirement Mutual Fund): Up to 30% of income (max 500,000 THB).

- SSF (Super Savings Fund): Up to 30% of income (max 200,000 THB).

- Thai ESG Fund: Up to 30% of income (max 300,000 THB).

7. Social Security and Payroll Withholding

If you are employed by a Thai entity, Social Security (SSO) is mandatory.

- Old Cap (Until Dec 31, 2025): Max contribution 750 THB/month (5% of 15,000 salary base).

- New Cap (From Jan 1, 2026): Max contribution 875 THB/month (5% of 17,500 salary base).

Your employer withholds this automatically, alongside the monthly income tax (PND 1).

8. How to File Your Tax Return in 2026

Filing is the responsibility of the individual, even if your employer withholds tax.

Step 1: Obtain a Tax ID

If this is your first year, you need a Tax Identification Number (TIN). Apply at your local Revenue Office with your passport and proof of residence.

Step 2: Choose the Right Form

- P.N.D. 91: For income from employment only (Section 40(1)).

- P.N.D. 90: For all other income types (freelance, business, investment, mixed income).

Step 3: E-Filing

The most efficient method is via the Revenue Department website (rd.go.th). The system is in Thai, but English guides exist. E-filing grants you an 8-day deadline extension.

9. Deadlines for 2026

For income earned in the previous tax year:

- Paper Filing: March 31, 2026.

- E-Filing: April 8, 2026 (or April 9, subject to official announcement).

Note: If you owe additional tax, it must be paid by these dates to avoid surcharges.

10. Common Mistakes Expats Make

- The “Savings” Myth: Believing that transferring money from a “Savings” account makes it capital, not income. If that money was earned in 2025, it is taxable income, regardless of which account it sat in.

- Assuming Non-Residency: Many stay for 179 days thinking they are safe, but miscount arrival/departure days. If you hit 180, you are liable for worldwide remitted income.

- Ignoring DTA Credits: If you paid tax in your home country (e.g., US/UK), a Double Taxation Agreement (DTA) may allow you to credit that tax against your Thai liability. You often still need to file to claim this.

11. Practical Case Studies

Scenario A: The UK Teacher (Bangkok)

- Status: Thai Tax Resident (365 days).

- Income: 60,000 THB/month salary + £10,000 UK dividends kept in Lloyd’s Bank.

- Tax Liability:

- Salary: Taxed normally via PND 91.

- UK Dividends: Not Taxed because they were not remitted to Thailand.

Scenario B: The US Remote Worker (Chiang Mai)

- Status: Thai Tax Resident (200 days).

- Income: $4,000/month transferred directly to a US Bank. Transfers $1,500/month to Bangkok Bank via Wise for living expenses.

- Tax Liability:

- The $1,500/month remitted is Taxable Income (40(8) or 40(2)).

- The $2,500 kept in the US is Not Taxed.

- Strategy: Ensure transfers are clearly documented.

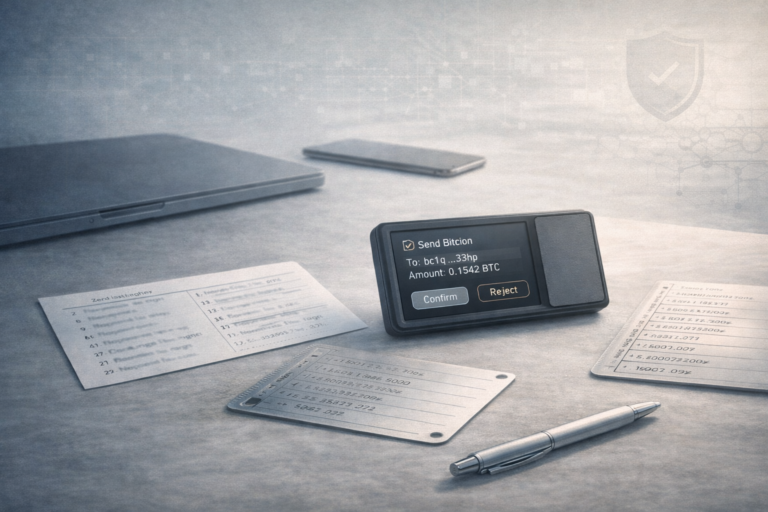

Scenario C: The Crypto Trader (Phuket)

- Status: Thai Tax Resident.

- Income: Profits from Bitcoin trading on Binance (Global).

- Action: Cashed out 1,000,000 THB to a Thai bank account in 2026 (profits earned in 2026).

- Tax Liability: The full 1,000,000 THB is added to assessable income. No capital gains exemption exists for individuals trading on offshore platforms.

Scenario D: The LTR Pensioner

- Status: LTR Visa Holder.

- Income: $80,000 pension remitted fully to Thailand.

- Tax Liability: 0 THB. The LTR visa specifically exempts remitted foreign income.

12. Frequently Asked Questions

What is the last date for income tax in 2026?

The strict deadline is March 31 for paper forms and April 8 for online filing.

Do I pay home country tax if I live in Thailand?

This depends on your citizenship. US citizens must file with the IRS regardless of residence. UK/Australian citizens generally become non-residents for tax purposes once they leave permanently, but must inform HMRC/ATO.

Is salary of 100,000 THB “good” after tax?

Yes. On 100k/month (1.2M/year), your effective tax rate is only roughly 8–10% after deductions. You keep the vast majority of your earnings.

Do I need a Thai Tax ID if I have no Thai income?

Technically, if you reside in Thailand and remit foreign income, you are required to have a Tax ID to file PND 90. Banks now often require a Tax ID to open accounts for foreigners due to CRS (Common Reporting Standard) data exchange.

13. Penalties and Compliance Risks

The Revenue Department is modernizing. Thailand has joined the Common Reporting Standard (CRS), meaning they automatically receive data on your overseas bank accounts.

- Late Filing Fine: 2,000 THB (criminal fine).

- Surcharge: 1.5% interest per month on unpaid tax (capped at the amount of tax due).

- Audit Risk: High for those with large visible spending (cars, condos) but zero filed tax returns.

14. Key Takeaways for 2026

- Residency Rule: 180 days in Thailand = Tax Resident.

- Foreign Income: Taxable if remitted. The “wait one year” loophole is dead for new income.

- Social Security: Monthly contribution cap rises to 875 THB.

- Filing Window: January 1 – April 8, 2026.

- Golden Rule: Document the source and date earned of every transfer entering Thailand.