Thailand’s income tax system underwent significant reform effective January 1, 2024, fundamentally shifting how foreign-sourced income is taxed for residents. This comprehensive guide explains the 2025-2026 tax landscape, covering residency criteria, tax rates, foreign income rules, allowable deductions, and strategic planning opportunities including the proposed two-year remittance exemption and LTR visa benefits.

Part 1: What Thailand’s New Tax Law Means for Expats

The January 2024 Game-Changer

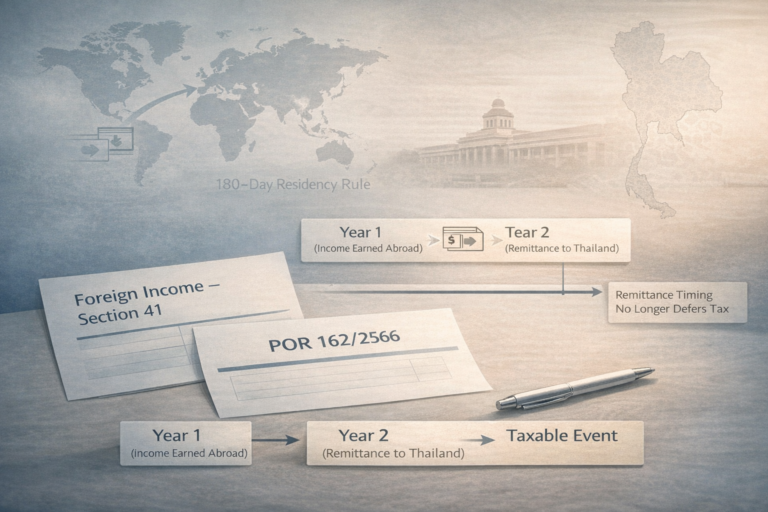

Effective January 1, 2024, Thailand’s Revenue Department fundamentally restructured how foreign income is taxed through Departmental Instruction Orders Por.161/2566 and Por.162/2566. These amendments shifted from a source-based system to a remittance-based system for residents, creating both risks and opportunities for expats.

Before January 1, 2024: Foreign income was tax-exempt in Thailand unless remitted in the same calendar year it was earned. This allowed expats to indefinitely defer taxation by holding income offshore.

From January 1, 2024 onward: Thai tax residents must now pay income tax on foreign-sourced income in the year it is remitted to Thailand, regardless of when the income was originally earned.

Critical Protection: Pre-2024 Income Remains Exempt

Order Por.162/2566 clarified that the new rules do not apply retroactively. Any foreign income earned before January 1, 2024 – regardless of when it is transferred to Thailand – remains permanently exempt from Thai income tax. This provides crucial protection for expats with overseas savings, investments, or prior employment income.

Example: If you earned a pension abroad in 2023 and transfer it to Thailand in 2025, no Thai tax applies. The tax year of remittance (2025) is irrelevant; what matters is that the income was earned before the 2024 reform.

Part 2: Tax Residency – The Foundation of Your Tax Obligations

Who Is Considered a Thai Tax Resident?

Thai tax residency is determined by a simple, objective test:

You are a Thai tax resident if you spend 180 or more cumulative days in Thailand during a calendar year (January 1 – December 31).

This rule applies equally to Thai nationals, foreign nationals, retirees, and business owners. Days need not be consecutive. Partial days of entry/exit may or may not count, depending on Revenue Department interpretation – maintaining clear travel records is advisable.

Why Tax Residency Matters

Your residency status determines the scope of income subject to Thai taxation:

| Status | Income Subject to Tax |

|---|---|

| Tax Resident (180+ days) | All Thai-sourced income PLUS foreign-sourced income remitted to Thailand (subject to exemptions) |

| Non-Resident (<180 days) | Only Thai-sourced income; foreign income is completely exempt regardless of remittance |

Residency Reset Each Year

Tax residency is assessed annually on a calendar-year basis. You may be a resident one year and non-resident the next. This flexibility allows some expats to manage tax exposure by carefully planning their Thailand days during border-crossing windows (e.g., the annual “Thailand Pass” runs).

Part 3: Understanding Foreign-Sourced Income

What Counts as Foreign-Sourced?

Foreign-sourced income is any assessable income arising outside Thailand. The source is determined by where the work, asset, or activity is located – not where the payment is received. This distinction is critical for digital nomads and remote workers.

Taxable Types of Foreign-Sourced Income:

- Employment Income: Salary, wages, bonuses, consulting fees earned while working abroad

- Business & Self-Employment Income: Profits from a business located outside Thailand

- Rental Income: Earnings from property outside Thailand

- Investment Returns: Dividends, interest, capital gains from overseas assets

- Pensions & Annuities: Most foreign pensions are taxable on remittance (unless protected by a double tax treaty)

- Intellectual Property: Royalties, copyright, patent, or trademark income from abroad

- Trust Distributions: Payments from non-Thai trusts

- Digital Asset Income: Crypto gains, staking rewards, mining income, or proceeds from overseas digital platforms

Income Earned in Non-Resident Years Is Protected

If you earned income in a year when you were not a Thai tax resident (fewer than 180 days), that income cannot be taxed in Thailand even if remitted later. The residency condition is not met in the year income arose, so remittance does not trigger taxation.

Example: You worked in the UK throughout 2024 (non-resident year) earning £50,000. You moved to Thailand in February 2025 (now a tax resident). When you transfer the £50,000 to Thailand in July 2025, it is not taxable because the residency condition was not met when the income was earned.

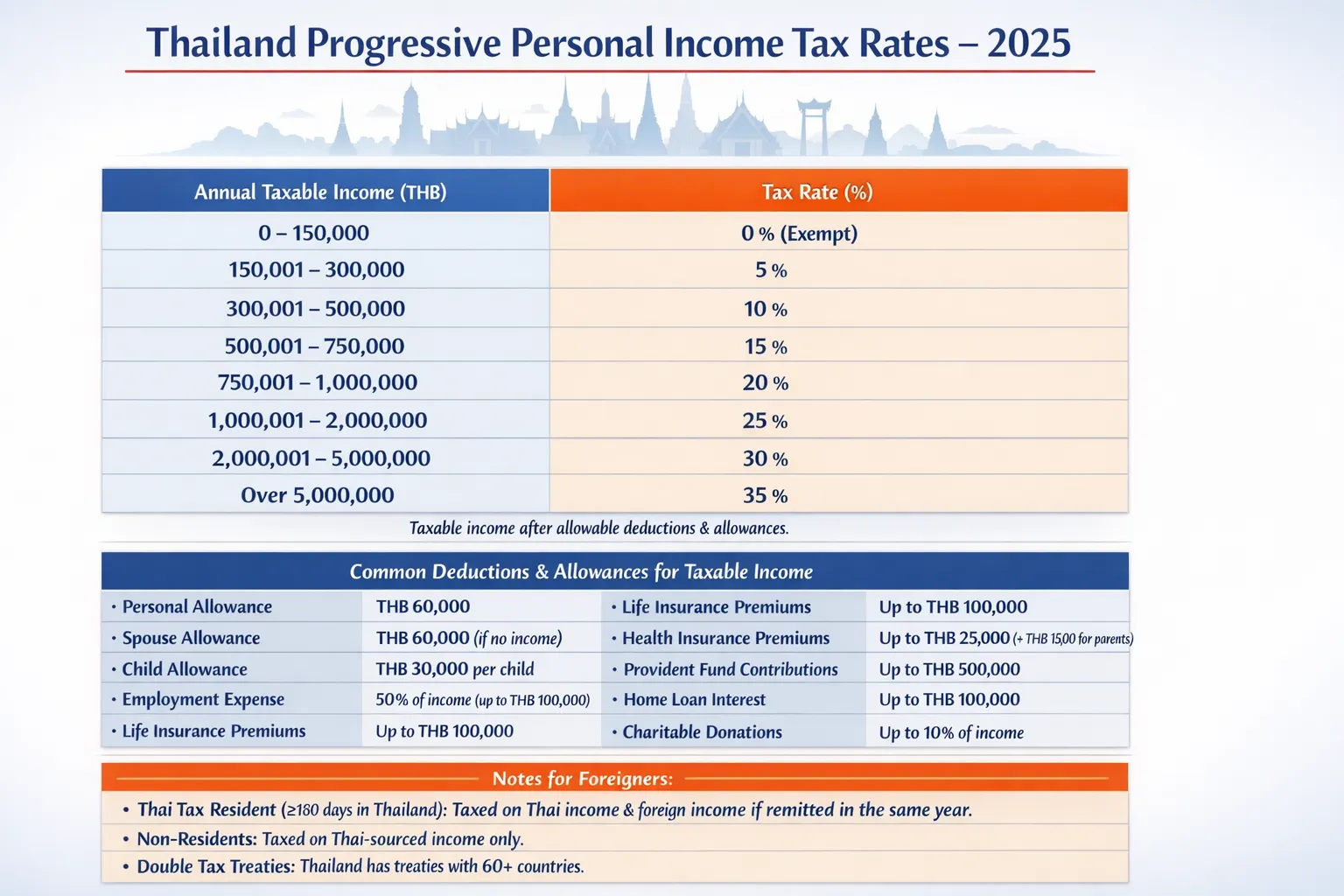

Part 4: Thailand’s Personal Income Tax Rates (2025-2026)

Progressive Rate Structure

Thailand applies progressive tax rates to residents and non-residents alike. Income up to 150,000 THB is tax-exempt; above this, rates escalate.

| Annual Taxable Income | Tax Rate |

|---|---|

| 0 – 150,000 THB | 0% (Exempt) |

| 150,001 – 300,000 THB | 5% |

| 300,001 – 500,000 THB | 10% |

| 500,001 – 750,000 THB | 15% |

| 750,001 – 1,000,000 THB | 20% |

| 1,000,001 – 2,000,000 THB | 25% |

| 2,000,001 – 5,000,000 THB | 30% |

| 5,000,001+ THB | 35% |

These rates have remained stable since 2013 and are expected to continue through 2026. The top marginal rate (35%) is among the highest in Southeast Asia, making tax planning essential for high-income earners.

Mid-Year Tax on Specific Income

Certain types of income – rental income, dividend income, and other assessable income – may trigger mid-year withholding tax that differs from annual personal income tax rates. Consulting a Thai tax advisor on these nuances is recommended.

Part 5: Tax Deductions, Allowances & Credits

Personal & Family Allowances

| Allowance Type | Amount | Conditions |

|---|---|---|

| Personal Allowance | 60,000 THB | All residents |

| Spouse Allowance | 60,000 THB | Spouse has no income |

| Child Allowance | 30,000 THB per child | Under age 20 (or 25 if enrolled in university) |

| Additional Children (born 2018+) | 60,000 THB per child | Both parents can claim |

| Parent Allowance | 30,000 THB per parent | Parent aged 60+, Thai national, income ≤30,000 THB |

| Disabled Dependent | 60,000 THB per person | Including spouse, children, parents |

Employment Income Deduction

Employees may deduct 50% of gross employment income up to a maximum of 100,000 THB without requiring itemized expense documentation. This standard deduction applies even if actual expenses are lower.

Insurance & Pension Contributions

| Contribution Type | Maximum Deduction | Notes |

|---|---|---|

| Life Insurance Premiums | 100,000 THB | Policy must be ≥10 years with Thai insurer |

| Life Insurance (Non-Earning Spouse) | 10,000 THB | Must be legally married throughout tax year |

| Health Insurance | 25,000 THB | Personal coverage with Thai insurer |

| Health Insurance (Parents/In-Laws) | 15,000 THB | Parent income ≤30,000 THB |

| Pension Life Insurance | 200,000 THB (max 15% of income) | Combined with other retirement funds |

| Provident Fund | 500,000 THB (max 15% of income) | Employee and employer contributions |

| Retirement Mutual Funds (RMF) | 500,000 THB (max 30% of income) | Must hold ≥5 years, withdraw at age 55+ |

| Super Savings Fund (SSF) | 200,000 THB (max 30% of income) | Must hold ≥10 years |

Combined Limit: All pension-related contributions (provident fund, RMF, SSF, pension life insurance) cannot exceed 500,000 THB annually.

Home & Mortgage Deductions

- Mortgage Interest: Up to 100,000 THB (first home only)

- House Construction Expenses: Up to 100,000 THB (10,000 THB per 1,000,000 THB in construction cost; VAT-registered contractors only; applicable to homes built between April 9, 2024 – December 31, 2025)

Social Security & Charitable Giving

- Social Security Fund (SSF) Contributions: Amount actually paid (standard rate: 5% of salary, capped at 750 THB/month; temporarily reduced to 3% max 450 THB from Oct 2024–Mar 2025)

- Charitable Donations: Up to 10% of income after deductions (double deduction allowed for donations to government hospitals, schools, and approved charities)

- Donations to Political Parties: Up to 10,000 THB

- Social Enterprise Investment: Up to 100,000 THB

Foreign Tax Credits

If you paid income tax in a foreign jurisdiction on income that is also taxable in Thailand, you may claim a foreign tax credit to reduce your Thai tax liability, subject to the limits set by the relevant double tax agreement.

Example: You earned 50,000 USD in the United States, paid $10,000 in US federal income tax, and remitted the income to Thailand where it is taxed. You can credit the US $10,000 against your Thai tax, provided the income is actually taxable in Thailand and a treaty exists.

Part 6: Special Tax Benefits – LTR Visa & Double Tax Agreements

LTR Visa: The Premier Tax Haven Status

Thailand’s Long-Term Resident (LTR) visa, renewed in 2025 with enhanced accessibility, offers extraordinary tax benefits unavailable to standard visa holders:

Eligible LTR Categories & Their Tax Benefits

| LTR Category | Annual Income/Asset Requirement | Tax Benefit |

|---|---|---|

| Wealthy Global Citizen | Asset verification (approx. $1M+ global assets) | 100% exemption on foreign-sourced income remitted to Thailand |

| Wealthy Pensioner | Proven pension income (approx. $80,000+/year) | 100% exemption on foreign-sourced income remitted to Thailand |

| Work-from-Thailand Professional | Employer letter + salary (approx. $80,000+/year) | 100% exemption on foreign-sourced income remitted to Thailand |

| Highly-Skilled Professional | Employment in Thai company + professional credentials | Flat 17% tax rate on Thai-sourced income (vs. 5-35% progressive rates) |

Critical Distinction: The first three categories enjoy complete exemption from tax on foreign-sourced income, making them ideal for retirees, investors, and remote professionals. The 17% flat rate for Highly-Skilled Professionals applies only to Thai-sourced income earned from employment in Thailand.

LTR Foreign Income Exemption Scope: Covers business profits, investment returns, rental income, pensions, and other foreign-sourced earnings. This exemption is not subject to the remittance timing rules that affect standard residents.

Double Tax Agreements (DTAs)

Thailand has concluded tax treaties with 61 countries to prevent double taxation. These agreements determine which jurisdiction has the primary right to tax specific income types and allow foreign tax paid to be credited against Thai tax.

Key DTA Principles

- Pensions: Many DTAs protect government service pensions from Thai tax (e.g., US Social Security under the US-Thailand treaty).

- Investment Income: DTAs typically allow credits for foreign withholding tax on dividends and interest.

- Business Income: Allocates taxing rights based on permanent establishment rules.

Claiming Treaty Benefits Requires Documentation:

- Certificate of Tax Paid from the foreign jurisdiction

- Official tax return or assessment from the source country

- Proof of withholding taxes deducted at source

Part 7: The Proposed Royal Decree – Two-Year Remittance Exemption

Current Status: Pending Formal Enactment

In mid-2025, Thailand’s Revenue Department proposed a new Royal Decree to ease the foreign income tax burden introduced in January 2024. This proposal has not yet become law. However, understanding the proposed framework is essential for forward planning.

What the Proposal Would Allow

If enacted, foreign-sourced income earned on or after January 1, 2024 would be tax-exempt when remitted to Thailand within 12 calendar months of the year the income was earned, subject to the 180-day tax residency test.

Key Features of the Proposed Exemption:

- Applicable to: Thai tax residents only (180+ days in year of income earning)

- Income Eligible: Foreign-sourced income earned from Jan 1, 2024 onward

- Remittance Window: Within 12 months of the calendar year the income was earned

- Pre-2024 Income: Remains unconditionally exempt (unchanged)

Proposed Examples

| Scenario | Tax Outcome (If Enacted) |

|---|---|

| Income earned in 2025; remitted in 2025 or 2026 | Tax-exempt (within 12-month window) |

| Income earned in 2025; remitted in January 2027 | Taxable (exceeds 12-month window) |

| Income earned in 2024; remitted in 2026 | Tax-exempt (pre-2024 income, unconditional exemption) |

Why the Proposal Stalled

Following the January 2024 reforms, Thai revenue collections initially declined as residents delayed remitting foreign income or shifted funds offshore. The proposed exemption aims to restore economic confidence and encourage repatriation of capital. However, implementation has been paused pending further legislative action and Revenue Department guidance.

Critical Caveat: Expats should not rely on this exemption for 2025 planning until formal enactment occurs. Current tax rules (income taxed in year of remittance) remain the binding standard.

Part 8: Tax Planning Strategies for Expats

Strategy 1: Leverage the Pre-2024 Income Exemption

All foreign income earned before January 1, 2024 is permanently exempt from Thai taxation.

Action Steps:

- Maintain detailed records of overseas bank accounts as of December 31, 2023

- Keep year-end account statements from 2023 and payslips from pre-2024 employment

- Segregate pre-2024 funds in a distinct offshore account to simplify documentation

- When remitting, reference the original account statements to prove source and timing

Tax Impact: A 100,000 USD balance accumulated before 2024 can be transferred to Thailand tax-free, regardless of timing.

Strategy 2: Timing of Remittances Around Tax Residency Changes

Non-residents are never taxed on foreign income, even on remittance. Time transfers strategically to optimize your residency status.

Example Scenario:

- You plan to move to Thailand in September 2025

- You will become a tax resident by November (180 days accumulated)

- Foreign income earned in 2024 (non-resident year) transfers tax-free anytime

- Foreign income earned in 2025 (resident year) becomes taxable only upon remittance

Action: Transfer 2024 income before establishing residency; defer 2025 income remittance pending clarity on the proposed exemption.

Strategy 3: Utilize Double Tax Agreement Credits

If you paid income tax in a source country, claim the foreign tax credit when remitting.

Steps:

- Obtain Certificate of Tax Paid from the source country’s tax authority

- Include this certificate with your Thai tax return

- Calculate the credit as the lesser of (a) foreign tax paid or (b) Thai tax on the same income

- Carry forward any excess foreign tax paid to future years (depending on treaty provisions)

Tax Impact: Foreign withholding tax of 15% can reduce Thai tax liability from 30-35% to 0-20%, depending on bracket and treaty rules.

Strategy 4: Optimize Deductions & Allowances

Thai expats often underutilize available deductions, inadvertently overpaying tax.

Quick Wins:

- Maximize insurance deductions: Life insurance (100,000 THB) + health insurance (25,000 THB) = 125,000 THB deducted

- Contribute to retirement funds: RMF/SSF up to 500,000 THB combined annually

- Claim all family allowances: Spouse (60,000 THB) + child (30,000 THB) + parent (30,000 THB)

- Donate to approved charities: Up to 10% of income (double deduction for government entities)

Tax Impact: These deductions can reduce taxable income by 400,000-600,000 THB for a middle-income expat, saving 40,000-180,000 THB in annual taxes.

Strategy 5: Apply for LTR Visa if Eligible

The LTR visa’s foreign income exemption is unmatched by any other visa category.

Eligibility Quick Check:

- Wealthy Global Citizen: $1M+ in verifiable assets

- Wealthy Pensioner: $80,000+/year verified pension income

- Work-from-Thailand Professional: Remote employment letter + $80,000+ annual salary

Tax Impact: Complete exemption on foreign-sourced income (eliminating the remittance tax entirely) can save 100,000-500,000+ THB annually for high-income earners.

Strategy 6: Keep Foreign Income Offshore

The simplest (and sometimes most tax-efficient) strategy is to avoid remitting foreign income entirely.

- Hold offshore account for living expenses abroad

- Bring only Thai-sourced income or pre-2024 funds to Thailand

- Use international credit cards for overseas spending

Limitation: This strategy is impractical for expats reliant on foreign income for Thailand living expenses.

Part 9: Compliance, Penalties & Common Tax Traps

Filing Requirements & Deadlines

| Form | Deadline | Purpose |

|---|---|---|

| PND 90/91 | March 31, 2026 (or April 8, 2026 e-filing) | Annual personal income tax return for 2025 income |

| PND 1 | 7th of following month (paper) or 15th (e-filing) | Monthly withholding tax reporting by employers |

| SPS 1-10 | 15th of following month | Social Security Fund contributions |

Penalty Structure for Non-Compliance

| Violation | Penalty |

|---|---|

| Late filing | 200 THB fine + 1.5% monthly surcharge on unpaid tax |

| Underreporting income | Additional tax + 1.5% monthly surcharge |

| Intentional evasion | Up to 200,000 THB fine + imprisonment up to 1 year |

| Failure to respond to audit request | Deemed acceptance of assessed tax |

Six Costly Tax Traps & Solutions

Trap 1: UK Pensions & Double Taxation

The Problem: The UK-Thailand DTA does not include a pensions article. UK pension income remitted to Thailand is treated as newly derived income taxable under Section 40, potentially at higher rates than UK withholding.

Example: A UK State Pension of £12,000/year with £1,440 withheld in the UK enters Thailand. Thailand taxes the full £12,000 at its progressive rates (potentially 15-25%), resulting in total tax of £1,800-3,000 – despite prior UK withholding.

Solutions:

- Claim foreign tax credit for UK tax withheld

- Stage remittances across multiple years to stay within lower Thai brackets

- Consider holding pension income offshore and remitting selectively

- Explore offshore portfolio bond vehicles for income deferral

Trap 2: ISA & Brokerage Gains Are Taxable in Thailand

The Problem: The UK ISA (Individual Savings Account) enjoys tax-exempt status in the UK but receives no special treatment in Thailand. Capital gains realized within a UK ISA are fully taxable when the proceeds are remitted to Thailand.

Example: A UK ISA with £50,000 in investments appreciates to £75,000. When you remit the proceeds to Thailand, the £25,000 gain is treated as income taxable at 30% = 7,500 THB tax liability (Thai equivalent).

Solutions:

- Restructure pre-migration: Invest through offshore portfolio bonds (offer deferral benefits)

- Time remittances: Hold ISA gains offshore for 12+ months if the proposed exemption is enacted

- Use pension vehicles: Transfer ISA holdings to a SIPP (Self-Invested Personal Pension) for tax deferral

Trap 3: Timing of Portfolio Bond Withdrawals Is Critical

The Problem: Offshore portfolio bonds held by UK expats have favorable tax treatment in the UK (5% annual allowances), but gains are fully taxable in Thailand upon remittance if earned in a tax-resident year.

Example: A portfolio bond purchased in 2022 with £100,000 grows to £115,000. If you withdraw in 2025 (a year when you become a Thai tax resident), the £15,000 gain is taxable.

Solutions:

- Withdraw before establishing Thai tax residency (non-resident year = no Thai tax)

- Hold offshore ≥12 months, then remit in separate calendar year if proposed exemption passes

- Use life insurance contracts held offshore for income deferral

Trap 4: ‘Tax-Free’ UK Pension Lump Sums Trigger High Thai Rates

The Problem: UK Pension Commencement Lump Sums (PCLS) – 25% of pension value taken tax-free in the UK – are fully taxable in Thailand, potentially pushing recipients into the 20-35% brackets.

Example: You take a £50,000 PCLS (tax-free in UK). Remitted to Thailand, it is taxable income. Combined with other retirement income, it may push your Thailand tax rate from 10% to 25%, resulting in tax of 12,500 THB.

Solutions:

- Defer PCLS until after you become non-resident or reach age eligibility for exemptions

- Spread remittance over multiple years to mitigate bracket creep

- Receive lump sums while still non-resident (<180 days) for complete exemption

- Coordinate timing with other income sources

Trap 5: Pre-2024 Cash Must Be Documented

The Problem: Foreign income deposited before January 1, 2024 is exempt from Thai tax, but only if you can prove it. Undocumented transfers may be treated as taxable income.

Example: You have 200,000 USD in a Bangkok bank account with no clear source documentation. Revenue Department audit presumes it is taxable 2024+ income. Burden of proof falls on you.

Solutions:

- Obtain pre-2024 account statements showing fund balances

- Keep payslips, tax returns, investment statements from source country

- Maintain a separate ‘legacy account’ for pre-2024 funds

- Use First-In-First-Out (FIFO) analysis for mixed accounts: oldest funds presumed withdrawn first

Trap 6: CRS Reporting Eliminates Secrecy

The Problem: Over 120 jurisdictions (including Thailand) participate in the Common Reporting Standard (CRS). Foreign financial institutions automatically report Thai residents’ account balances annually. Thai audits can examine 5-10 years of historical records.

Example: A Bangkok Bank account linked to a UK bank account in your name receives regular deposits from the UK. CRS reports this to Thai Revenue Department, triggering an audit. Failure to declare the income invites penalties and criminal exposure.

Solutions:

- File accurate returns even if tax is nil

- Maintain detailed documentation of all overseas accounts and transactions

- Disclose all foreign income (source, amount, tax paid) on annual tax return

- Keep evidence of foreign tax paid for credit claims

- Consider automated compliance tools or tax advisor for ongoing management

Part 10: Frequently Asked Questions

Q: Do I have to file a Thai tax return if my foreign income is already taxed in my home country?

A: Yes. Thai tax residents must file a return (PND 90/91) annually and declare all foreign income remitted to Thailand, even if taxed at source. However, you can claim a foreign tax credit for taxes paid overseas, which may eliminate or substantially reduce your Thai tax liability.

Q: What happens if I don’t file or declare?

A: Penalties include:

- Late filing fine: 200 THB + 1.5% surcharge per month of unpaid tax

- Underreporting: Full tax reassessment + surcharge

- Intentional evasion: Up to 200,000 THB fine + 1 year imprisonment

Q: Which Thai allowances and deductions can reduce my tax bill?

A: The largest reductions come from:

- Retirement fund contributions (RMF/SSF): Up to 500,000 THB combined annually

- Insurance premiums: Up to 100,000 THB (life insurance)

- Family allowances: Up to 210,000 THB (spouse + children + parents)

- Employment deduction: 50% of salary, capped at 100,000 THB

Q: How are property sales and rental income treated?

Rental Income:

- Non-residents: Flat 15% tax on rental receipts

- Residents: Taxed at progressive rates after deductions

Capital Gains on Property:

- Generally not subject to income tax (treated as non-recurring business income)

- May trigger specific gains tax depending on nature of transaction

Q: Are government or civil-service pensions treated differently?

A: Yes. Many countries (US, UK, Canada) have DTAs protecting government pensions from Thai tax. US Social Security and UK government pensions are common examples. Non-government pensions are typically taxable on remittance. Check the specific DTA for your pension source.

Q: Will I need a Thai Tax ID for visa renewals?

A: Generally, Thai Tax ID is not mandatory for visa renewal, though some immigration offices may request a tax return or certificate as proof of income/residency. Non-working retirees (aged 50+) need to show proof of income or savings for retirement visa renewal.

Q: Can I avoid tax by using Western Union or carrying cash in my suitcase?

A: No. Thailand’s Revenue Department:

- Requires disclosure of all foreign income regardless of transfer method

- Monitors large cash movements (Currency Control Act: >220,000 THB must be declared)

- Tracks CRS reporting from foreign banks

- Presumes undisclosed large cash transfers are taxable income pending proof otherwise

Risk: Criminal penalties for deliberate non-disclosure far exceed tax savings.

Key Takeaway

Thailand’s income tax system offers both risks and opportunities for expats. The January 2024 reforms closed traditional deferral strategies but introduced flexibility through the remittance rule and favorable LTR visa benefits. Success depends on understanding your residency status, documenting pre-2024 income, leveraging available deductions, and planning remittances strategically.

The proposed two-year exemption – while pending – signals Thai authorities’ willingness to balance revenue collection with economic competitiveness. Expats who maintain meticulous records, file accurate returns, and engage qualified tax advisors will navigate compliance confidently while minimizing unnecessary tax burden.

About This Guide

This guide reflects Thai tax law as of December 2025. The proposed Royal Decree on foreign income remittance exemptions has not yet been enacted and remains subject to change. Personal tax circumstances vary significantly based on visa status, income source, nationality, and family structure. Readers should consult a qualified tax advisor in Thailand before making significant financial or residence decisions. This guide does not constitute legal or tax advice.

References & Further Resources

- Thailand Revenue Department Official Website: rd.go.th

- PND 90/91 Tax Forms (Annual Personal Income Tax Return)

- Double Tax Agreement Database: Thailand’s 61 active DTAs

- LTR Visa Program: boi.go.th (Long-Term Resident Visa)

- Expat Tax Thailand: expattaxthailand.com (Detailed foreign income analysis)

- Thai Tax Compliance Calendar: Filing deadlines and payment schedules