Thailand has emerged as Southeast Asia’s premier hub for cryptocurrency regulation, offering a transparent legal framework and clear pathways for digital asset businesses seeking legitimate market entry. The Kingdom’s regulatory approach – balancing innovation with investor protection – has attracted over 40 licensed operators and positioned the country as a model jurisdiction for crypto enterprise establishment.

This comprehensive guide consolidates the complete regulatory landscape for obtaining a Thailand crypto license, incorporating 2025 amendments, capital requirements, compliance obligations, tax incentives, and the critical new rules governing foreign platforms.

Part 1: The Thailand Regulatory Framework for Digital Assets

The Legal Foundation: Emergency Decree on Digital Asset Businesses

Thailand’s primary cryptocurrency regulatory instrument is the Emergency Decree on Digital Asset Business B.E. 2561 (2018), supplemented by the Royal Decree on Digital Asset Businesses (No. 2), B.E. 2568 (2025). These decrees establish the legal basis for all cryptocurrency activities within Thailand’s jurisdiction.

Key Regulatory Bodies:

| Authority | Role | Responsibilities |

|---|---|---|

| Ministry of Finance (MOF) | Licensing Authority | Issues final licenses; enforces compliance |

| Securities and Exchange Commission (SEC) | Supervisor & Recommender | Reviews applications; conducts due diligence; enforces regulations |

| Bank of Thailand (BOT) | Monetary Policy & Stablecoins | Regulates stablecoin issuance; oversees financial institution participation |

| Office of the SEC | Administrative Support | Issues notifications; provides guidance; processes filings |

The SEC operates under the Anti-Money Laundering Act of 1999 and related counter-terrorism financing legislation, giving Thai digital asset regulations among the strictest compliance frameworks in Asia. Licensed operators are classified as financial institutions, subjecting them to banking-level AML/KYC requirements.

Scope of Regulated Activities

Thailand recognizes seven categories of digital asset business activities, each requiring separate licensing:

Core Trading Categories:

- Digital Asset Exchange – Operating a platform where buyers and sellers trade cryptocurrencies or digital tokens

- Digital Asset Broker – Acting as intermediary/agent in cryptocurrency transactions for commission

- Digital Asset Dealer – Purchasing and selling digital assets for own account on behalf of clients

Support & Management Services:

- Digital Asset Fund Manager – Managing investment portfolios of digital assets for clients

- Digital Asset Advisor – Providing investment advice on digital assets

- Digital Asset Custodial Wallet Service Provider – Storing and managing customer digital assets

- Digital Token Portal Service Provider – Facilitating initial coin offerings (ICOs)

Each business type has distinct capital requirements, licensing fees, and ongoing supervisory obligations. Operators cannot simultaneously hold licenses in competing categories (e.g., exchange and dealer licenses are mutually exclusive).

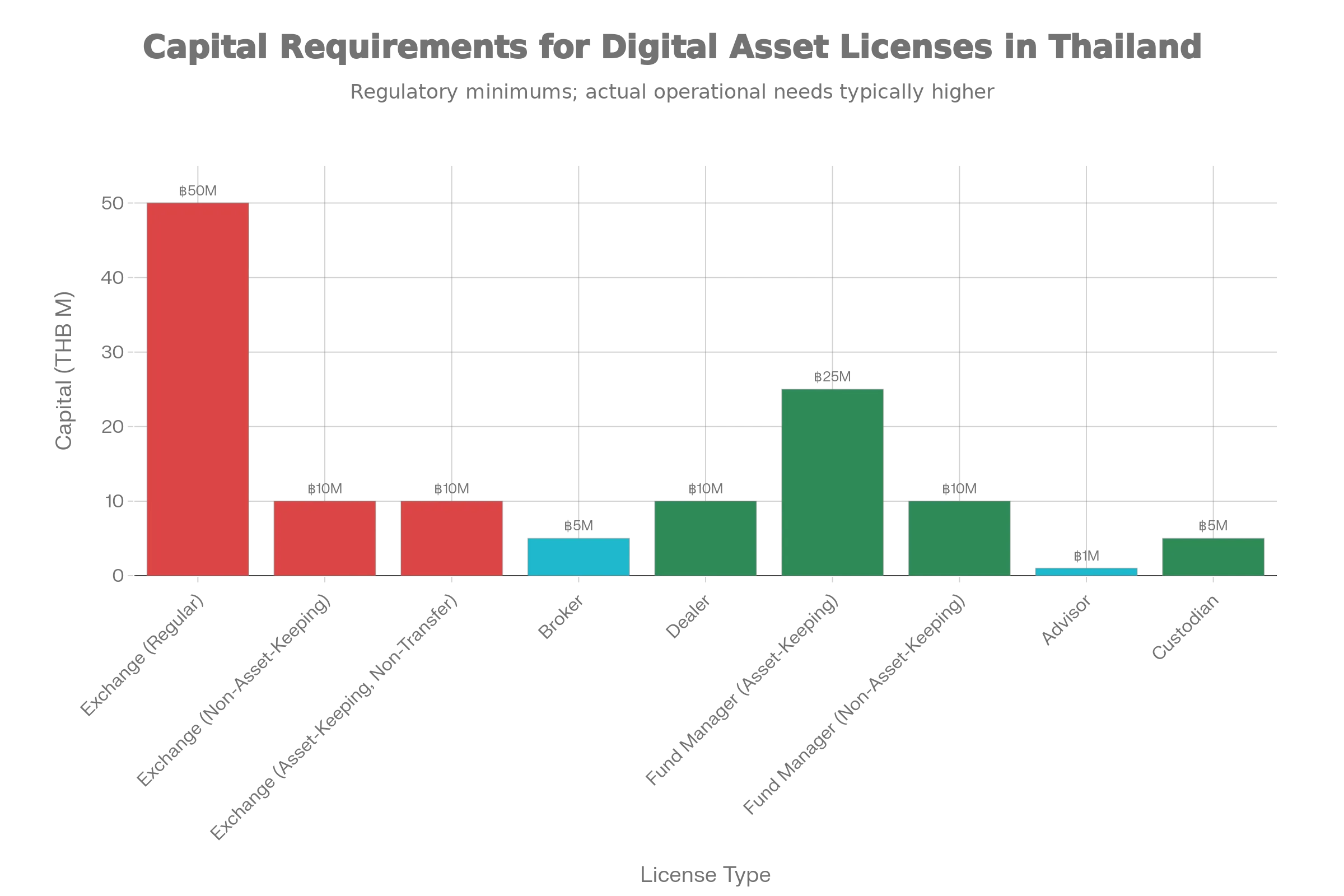

Thailand Digital Asset License Minimum Capital Requirements (in Millions of Thai Baht)

Part 2: Capital Requirements and Financial Qualification

Minimum Paid-Up Capital Requirements (2025)

Establishing a licensed digital asset business in Thailand requires substantial capitalization. The SEC specifies minimum paid-up registered capital amounts by business type:

| License Type | Minimum Capital | USD Equivalent | Regulatory Purpose |

|---|---|---|---|

| Digital Asset Exchange (Regular) | 50 million THB | ~$1,400,000 | Full trading platform with custody |

| Digital Asset Exchange (Non-asset keeping) | 10 million THB | ~$280,000 | Trading without custody operations |

| Digital Asset Exchange (Asset-keeping, non-transfer) | 10 million THB | ~$280,000 | Limited custody capacity |

| Digital Asset Broker | 5 million THB | ~$140,000 | Intermediary brokerage services |

| Digital Asset Dealer | 10 million THB | ~$280,000 | Principal trading in digital assets |

| Digital Asset Fund Manager (Asset-keeping, non-institutional) | 25 million THB | ~$700,000 | Client fund management with custody |

| Digital Asset Fund Manager (Non-asset keeping, institutional) | 10 million THB | ~$280,000 | Institutional advisory services |

| Digital Asset Advisor | 1 million THB | ~$28,000 | Investment advisory only |

| Digital Asset Custodian | 5 million THB | ~$140,000 | Asset custody services |

Capital Deposit Mechanics:

- Capital must be fully paid-up (not promised or pledged)

- Funds must be deposited in a Thai bank account before application submission

- Cannot be withdrawn during the licensing application or operational period

- Maintains financial buffer to cover operational losses, customer claims, and regulatory fines

Net Capital Maintenance Requirements

Beyond initial capitalization, licensed operators must maintain prescribed net capital ratios throughout their operational life. Net capital is defined as total assets minus liabilities and prescribed deductions. Falling below minimum net capital triggers enforcement actions, operational restrictions, and potential license revocation.

Regular audited financial statements (prepared by SEC-approved auditors per Thai Financial Reporting Standards) must document net capital compliance quarterly.

Part 3: Complete Fee Structure and Costs

One-Time License Fees

Obtaining a Thailand crypto license involves substantial upfront costs distinct from ongoing operational expenses:

| Fee Category | Amount (THB) | Amount (USD) | Payment Timing |

|---|---|---|---|

| Application Fee (per license type) | 30,000 | ~$840 | Upon application submission |

| Application Fee (custodians only) | 50,000 | ~$1,400 | Upon application submission |

| Digital Asset Exchange Granting Fee | 2,500,000 | ~$70,000 | Upon license approval |

| Digital Asset Broker Granting Fee | 1,250,000 | ~$35,000 | Upon license approval |

| Digital Asset Dealer Granting Fee | 1,000,000 | ~$28,000 | Upon license approval |

| Digital Asset Fund Manager Granting Fee | 500,000 | ~$14,000 | Upon license approval |

| Digital Asset Advisor Granting Fee | 15,000 | ~$420 | Upon license approval |

| Digital Asset Custodian Granting Fee | 1,000,000 | ~$28,000 | Upon license approval |

Companies applying for multiple license types (e.g., exchange + custodian) must pay separate application fees for each category.

Annual Supervisory Fees (Ongoing)

Once licensed, operators pay annual fees calculated on business metrics, creating ongoing operational costs:

Digital Asset Exchange

- Fee Structure: 0.002% of total trading value

- Minimum Annual Fee: 500,000 THB (~$14,000)

- Maximum Annual Fee Cap: 20,000,000 THB (~$560,000)

Digital Asset Broker

- Fee Structure: 0.001% of total trading value

- Minimum Annual Fee: 250,000 THB (~$7,000)

- Maximum Annual Fee Cap: 10,000,000 THB (~$280,000)

Digital Asset Dealer

- Fee Structure: 1% of trading profit (capital gains)

- Minimum Annual Fee: 100,000 THB (~$2,800)

- Maximum Annual Fee Cap: 5,000,000 THB (~$140,000)

ICO/Token Offering Fees

Platforms facilitating initial coin offerings face additional regulatory costs:

| Fee Type | Amount | Basis |

|---|---|---|

| Filing Fee (registration statement & prospectus) | 0.05% | Of total token value offered |

| Minimum Annual Supervisory Fee | 10,000 THB | Applies regardless of offering size |

Part 4: Step-by-Step Licensing Process and Timeline

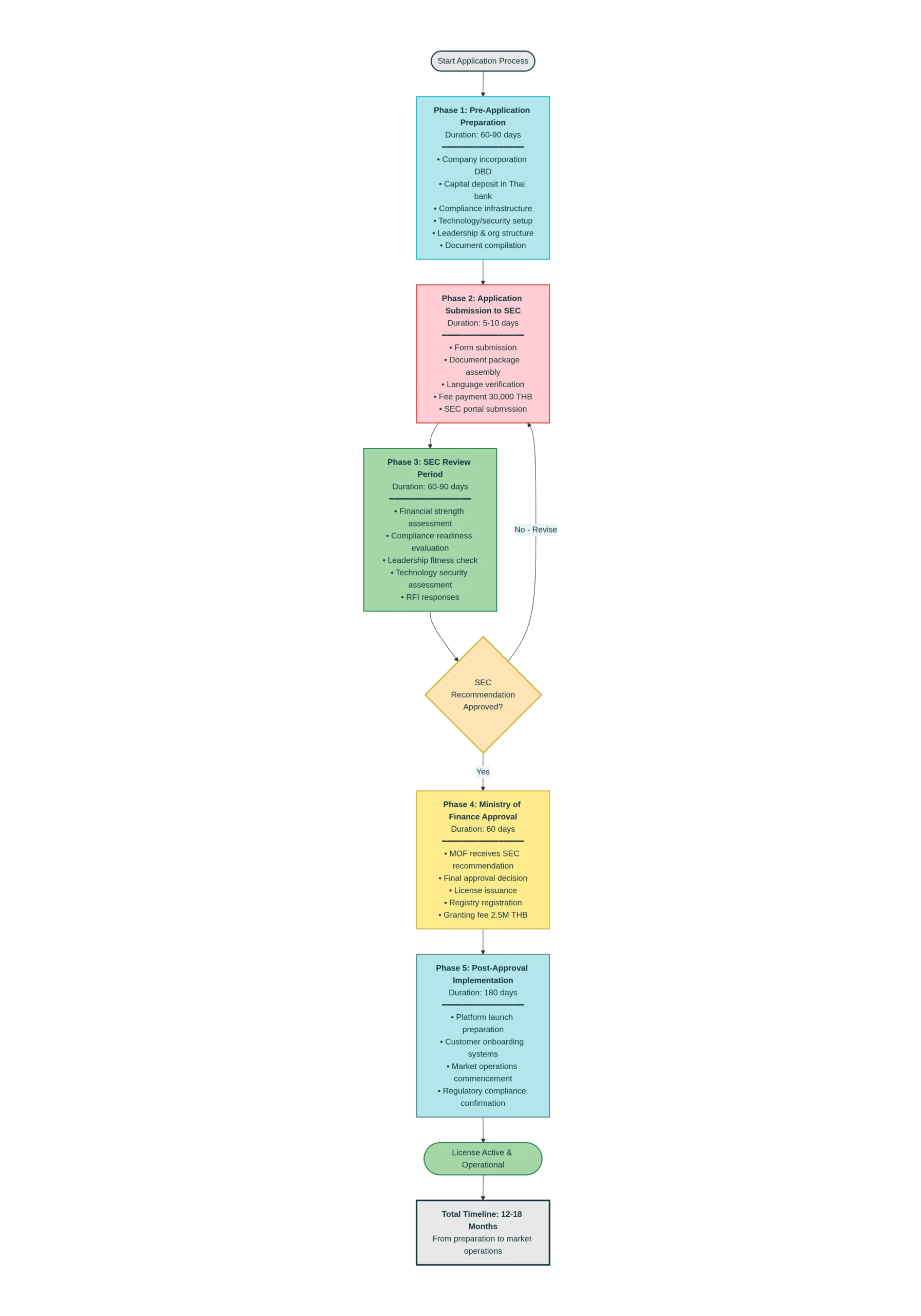

Five-Phase Application Pathway

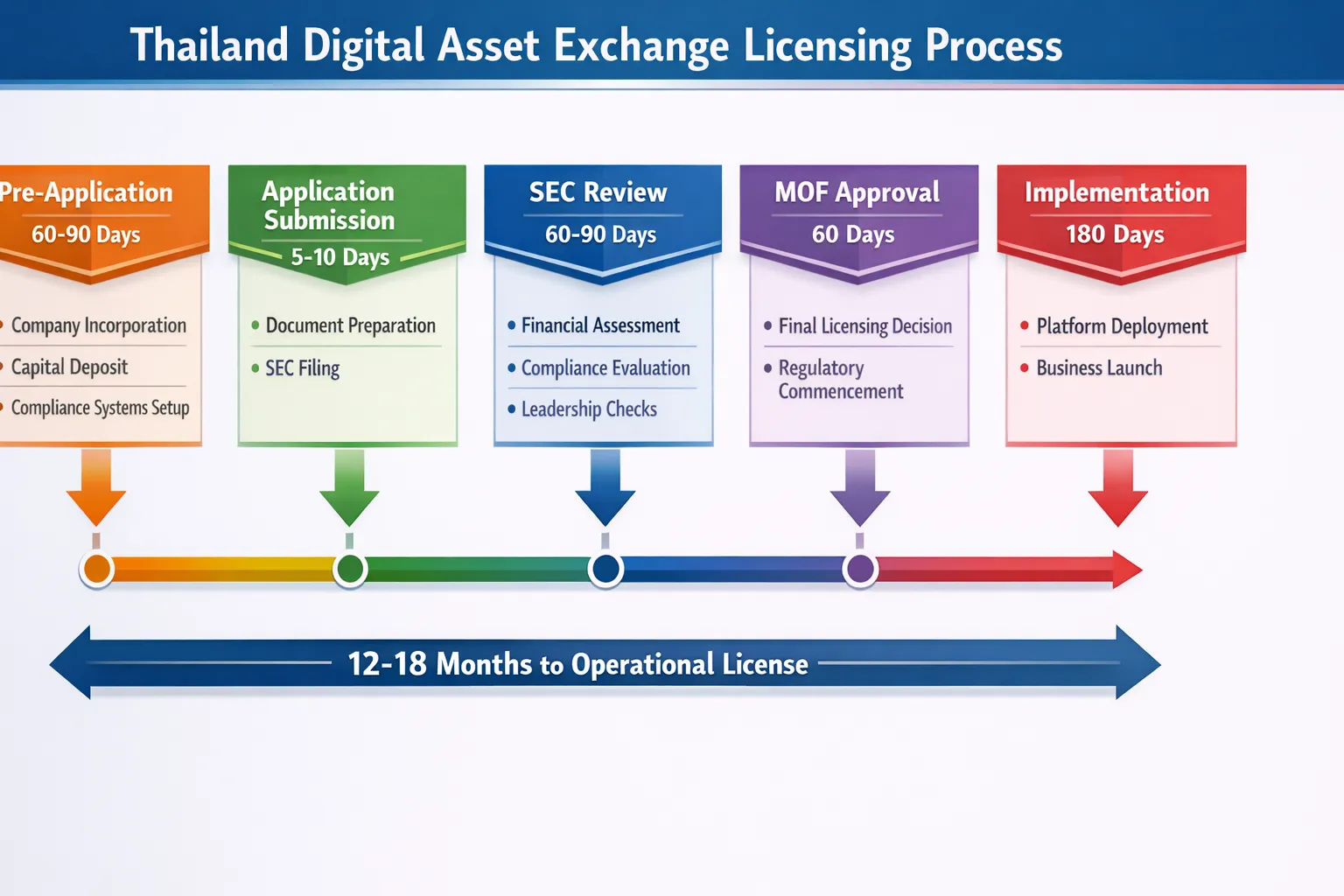

Thailand Crypto Exchange License Application Timeline: 5-Phase Process (12-18 Months Total)

The licensing process follows a structured five-phase progression from business planning through operational commencement.

Phase 1: Pre-Application Preparation (60-90 Days)

Step 1: Company Incorporation in Thailand

- Register a Thai-incorporated company with the Department of Business Development (DBD)

- Business type: Public Company Limited (PCL) or Private Company Limited (PLC)

- Appoint local Thai director (must be Thai citizen or permanent resident)

- Register physical office address in Thailand

Step 2: Capital Deposit and Bank Account

- Open a bank account at a Thai-licensed commercial bank

- Deposit minimum paid-up capital (e.g., 50 million THB for exchange)

- Retain bank statement confirming deposit for application submission

Step 3: Compliance Infrastructure Assembly

- Develop written AML/KYC policies compliant with SEC notifications

- Implement Know Your Customer procedures per SEC standards

- Create Customer Due Diligence (CDD) processes

- Design transaction monitoring and suspicious activity reporting procedures

- Document source of funds and beneficial ownership verification

Step 4: Technology and Security Assessment

- Select and configure trading platform technology

- Implement cybersecurity measures per SEC expectations

- Establish digital wallet management systems (if offering custody)

- Design cryptographic key management procedures

- Conduct security audit or penetration testing

Phase 2: Application Submission to SEC (5-10 Days)

The formal application process begins with submission of a comprehensive document package in Thai language to the Securities and Exchange Commission:

Application Requirements:

- Formal Application Form – SEC-provided form with business details

- Company Documents – Articles of association, DBD registration certificate

- Financial Documents – Bank statements, capitalization proof, financial projections

- Management Information – Director CVs, background checks, beneficial ownership declarations

- Business Plan – Market analysis, operational structure, revenue model, 5-year projections

- Compliance Documentation – AML/KYC policies, transaction monitoring procedures, sanctions screening protocols

- Technical Specifications – Platform architecture, wallet management, key management systems

- IT Security Plan – Cybersecurity measures, disaster recovery, business continuity procedures

Application Fee: Non-refundable 30,000 THB due upon submission.

Phase 3: SEC Review Period (60-90 Days)

The SEC conducts comprehensive due diligence examining:

Financial Strength Assessment:

- Verification of minimum paid-up capital requirements

- Analysis of capital sources and beneficial ownership

- Review of 3-5 year financial projections

- Assessment of financial sustainability

Compliance Readiness Evaluation:

- Detailed review of AML/KYC procedures against SEC notifications

- Verification of KYC screening software and databases

- Assessment of transaction monitoring systems

- Evaluation of suspicious activity reporting protocols

- Review of sanctions screening against FATF blacklists

Leadership Fitness & Propriety Check:

- Background investigation of all directors and major shareholders

- Verification of no prior license denials or revocations (6-month look-back)

- Assessment of director qualifications and experience

Technology Security Assessment:

- Evaluation of platform infrastructure and wallet security

- Review of cryptographic key management procedures

- Assessment of disaster recovery and business continuity plans

- Examination of data protection and customer privacy measures

The SEC typically issues one or more rounds of information requests (RFI) asking applicants to clarify, supplement, or provide additional documentation. Responding promptly and comprehensively is critical – delays in RFI responses extend the review timeline.

Phase 4: Ministry of Finance Approval (60 Days)

Upon SEC recommendation, the application is forwarded to the Ministry of Finance, which makes the final licensing decision. The MOF evaluates:

- SEC’s compliance recommendation

- Alignment with national financial policy objectives

- Market structure impacts

- Public interest considerations

MOF approval is typically granted within 60 days of SEC recommendation.

Phase 5: Post-Approval and Commencement (180-Day Window)

Licensed operators must commence business operations within 180 days of approval. This means:

- Going live with trading platform

- Accepting customer registrations

- Processing trades or transactions

- Beginning revenue generation

Non-Commencement Consequence:

Failure to commence within 180 days results in automatic license revocation without SEC/MOF reconsideration.

Overall Timeline Summary

| Phase | Duration | Key Activities |

|---|---|---|

| Pre-Application | 60-90 days | Company formation, capital deposit, compliance systems |

| Application Submission | 5-10 days | Document package completion and SEC filing |

| SEC Review | 60-90 days | Compliance evaluation, RFI responses, due diligence |

| MOF Review | 60 days | Final approval decision and license issuance |

| Implementation | 180 days | Platform launch and operational commencement |

| Total Timeline | 12-18 months | From initiation to fully operational license |

Part 5: Compliance Requirements and Operational Obligations

AML/KYC Framework: The Highest Standards

Thailand’s Anti-Money Laundering Act of 1999, combined with SEC notifications, imposes banking-sector-equivalent AML/KYC obligations on digital asset operators.

Customer Identification Program (CIP)

Initial KYC Requirements:

- Full legal name and aliases (if applicable)

- Date of birth and nationality

- Government-issued photo ID (passport, national ID, driver’s license)

- Permanent residential address (verified via utility bill or bank statement not older than 3 months)

- Occupation and employment details

- Beneficial ownership information (for corporate customers, identify 25%+ shareholders)

- Source of funds documentation (employment letters, business registrations, bank statements)

Enhanced Due Diligence (EDD):

For higher-risk customers, operators must conduct enhanced due diligence including:

- Verification of third-party sources (credit reports, sanctions screening, business registries)

- Investigation of beneficial owners and corporate structure

- Independent verification of source of wealth through multiple channels

- Ongoing monitoring with transaction pattern analysis

- Management approval before account activation

Ongoing Transaction Monitoring

Licensed operators must implement transaction monitoring systems that:

- Monitor all customer transactions against SEC-defined thresholds (typically 2 million THB aggregate monthly or 200,000 THB single transaction)

- Maintain detailed transaction records with timestamps, counterparty information, amounts, and transaction types

- Identify suspicious patterns including structuring, rapid movement between accounts, and unusual geographic concentrations

- Generate automated alerts for threshold breaches or pattern anomalies

- Trigger manual review by compliance teams for investigation

Suspicious Activity Reporting (SAR)

Operators must file Suspicious Activity Reports with the Thai Financial Intelligence Unit (FIU) within specific timeframes:

- Reporting deadline: Within 5-10 days of activity identification

- Report contents: Customer identification, transaction details, pattern analysis, and risk assessment

- Confidentiality: SARs are confidential; customers cannot be informed without regulatory authorization

- Record retention: SARs and supporting investigation files retained for minimum 5 years

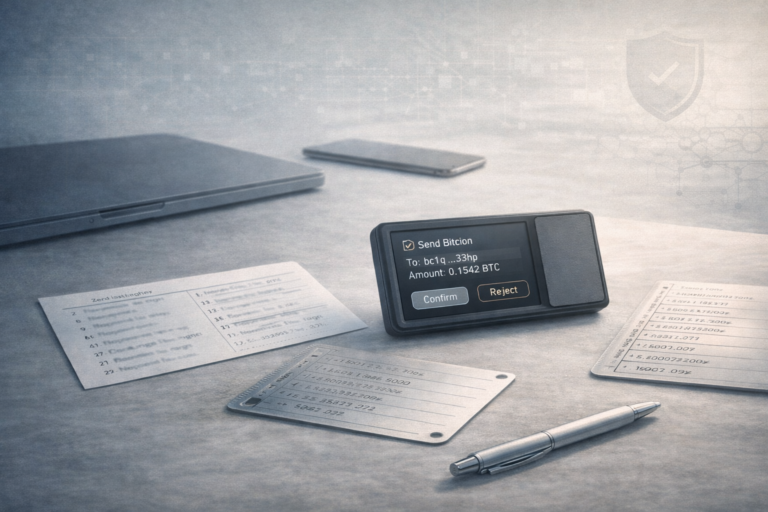

Cybersecurity and Digital Asset Custody Standards

Following SEC Notifications issued January 16, 2023, digital asset operators providing custody services must implement specialized security measures:

Risk Management Framework

Written Security Policy:

- Board-approved risk management policy covering all custody-related systems

- Annual review and updating (or immediately upon risk identification)

- Accessible to all employees involved in custody operations

- Documents threats, vulnerabilities, and mitigation procedures

Wallet Management Systems

Design and Development:

- Secure wallet creation and storage procedures

- Multi-signature authentication (requiring 2-of-3 or 3-of-5 authorizations for key operations)

- Regular security updates and patch management

- Penetration testing at least annually

- Code review and vulnerability assessment

- Segregation of customer wallets and operator wallets

Cryptographic Key Management

Key Generation and Storage:

- Keys generated in secure, isolated environments

- Private keys never exposed to internet or unsecured networks

- Hardware security module (HSM) storage recommended

- Key splitting or threshold cryptography for multi-signature requirements

- Secure destruction procedures for decommissioned keys

Incident Management and Response

Incident Management Procedures:

- Designated incident response coordinator

- Incident classification protocol (critical, high, medium, low severity)

- Escalation procedures and authorization thresholds

- Investigation documentation procedures

- Remediation and prevention action plans

- Annual testing and tabletop exercises of incident response procedures

Reporting Requirements:

- SEC notification within 1-5 days of incident discovery (depending on severity)

- Detailed incident documentation including timeline, root cause, affected customers/assets, and response actions

- Independent digital forensic investigation for significant incidents

- SEC remediation plan submission

Evidence Retention:

- Minimum 2-year retention of incident-related documentation

- Forensic reports, investigation logs, remediation records

- Customer notification records and compensation documentation

Part 6: Taxation Framework and Financial Incentives (2025-2029)

Historic Tax Incentive: Five-Year Capital Gains Exemption

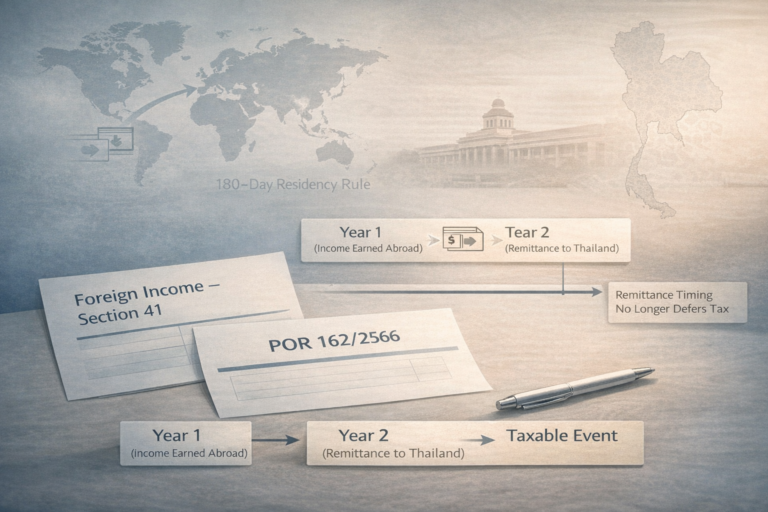

Effective January 1, 2025, Thailand implemented an extraordinary tax incentive designed to attract cryptocurrency investment. This measure, codified in Ministerial Regulation No. 399 (published Government Gazette September 5, 2025), fundamentally alters the economics of crypto trading in Thailand.

Individual Investors: Complete Capital Gains Tax Exemption

Tax Treatment:

- Capital gains tax rate on crypto disposals: 0% (previously 0-35% progressive)

- Applicable period: January 1, 2025 – December 31, 2029

- Eligibility: All individuals (Thai residents and non-residents)

- Condition: Transactions must occur on SEC-licensed crypto platforms (exchange, broker, or dealer)

Covered Assets:

- Applies to gains from sale or exchange of cryptocurrencies

- Applies to gains from sale or exchange of digital tokens

- Covers both spot trading and derivative trading (if platform offers derivatives)

- Does not apply to mining income (treated as ordinary income)

- Does not apply to staking rewards (treated as ordinary income)

Covered Platforms:

For exemption eligibility, transactions must occur through:

- Licensed Digital Asset Exchanges

- Licensed Digital Asset Brokers

- Licensed Digital Asset Dealers

- Does NOT cover decentralized exchanges, unregulated OTC desks, or peer-to-peer transactions

Tax Planning Implications:

This exemption creates powerful incentives for:

- Thai residents to relocate cryptocurrency holdings from offshore platforms to licensed Thai exchanges

- Foreign traders/investors to execute Thai-resident arbitrage and trading strategies on Thai platforms

- Long-term capital appreciation holdings to realize gains via Thai platforms

- Timing of capital gains realization before exemption expiration (end of 2029)

Corporate Entities: Continued 20% Corporate Income Tax

Tax Treatment:

- Corporate income tax rate: 20% on profits

- Exemption eligibility: NOT eligible for capital gains exemption

- Application: Applies to both domestic and foreign companies trading on Thai platforms

Withholding Tax: Eliminated 2025-2029

- Previous withholding: 15% on crypto income for foreign individuals and entities

- Current withholding: 0% (eliminated 2025-2029)

- Impact: Foreign investors realize 100% of capital gains without immediate withholding obligations

VAT Exemption (Permanent, Non-Time-Limited)

- VAT status: Exempt from 7% value-added tax

- Applicability: All transactions on SEC-licensed platforms

- Scope: Cryptocurrencies, digital tokens, trading services

- Effective Date: Permanent since 2024 decree

Part 7: Foreign Operators and Extraterritorial Jurisdiction

2025 Expansion: New Rules on Foreign Crypto Platforms

A significant shift in Thailand’s regulatory approach occurred with the Royal Decree on Digital Asset Businesses (No. 2), B.E. 2568 (2025) and the Emergency Decree on Prevention and Suppression of Technology Crime (No. 2) B.E. 2568 (2025), both effective April 13, 2025. These amendments dramatically expanded SEC jurisdiction over foreign digital asset service providers.

The Extraterritorial Trigger: Section 26/1

Foreign Operator Jurisdiction Test:

A foreign-registered crypto platform is deemed to be operating in Thailand – and must obtain an SEC license – if it exhibits ANY of the following characteristics:

Service Delivery Indicators:

- Offering services in Thai language (website, mobile app, customer service)

- Accepting payment in Thai baht (via Thai bank accounts, mobile payment, or crypto-to-baht services)

- Providing customer service in Thai language

- Marketing through Thai-language media or Thai-targeted advertising

- Directing advertisements to Thailand

Legal/Contractual Indicators:

- Including Thai law as governing law in terms of service

- Specifying Thai jurisdiction for dispute resolution

- Addressing Thai regulatory requirements specifically in agreements

Operational Indicators:

- Maintaining Thai office or local personnel

- Employing Thai staff or contractors

- Operating Thai bank account

- Maintaining local regulatory representation

Consequences of Non-Compliance

Criminal Penalties:

- Imprisonment: 2-5 years

- Fine: 200,000-500,000 THB (~$5,600-$14,000)

- Continuing violation penalty: Additional 10,000 THB (~$280) per day of continued violation

- Non-settable: Violations cannot be settled through negotiation or settlement committees

Platform Blocking:

- SEC can issue blocking orders under Cybercrime Law

- Internet service providers and website hosting services must comply with blocking orders

- Thai users unable to access unlicensed platforms (DNS blocking, IP blocking, etc.)

- Multiple major platforms blocked in June 2025 affecting user access

Licensing Path for Foreign Operators

Foreign crypto platforms wishing to legally serve Thai users must:

Step 1: Incorporation in Thailand

- Establish a Thai-registered subsidiary or direct entity

- Apply licensing under the same framework as domestic operators

- Register with Department of Business Development

- Establish physical office in Thailand

Step 2: Complete Local Compliance

- Appoint Thai directors (minimum one Thai citizen/resident)

- Deposit minimum paid-up capital (50 million THB for exchange)

- Implement full AML/KYC and cybersecurity infrastructure

- Hire Thai compliance and operational staff

Step 3: License Application

- Submit application to SEC through Thai legal counsel

- Provide all standard documentation (business plan, compliance procedures, etc.)

- Follow standard 150-day review process

- Pay all applicable fees

Part 8: Penalties for Non-Compliance

Criminal Offenses and Penalties

Operating Without a License

Offense: Offering digital asset business services without required SEC license

Penalties:

- Imprisonment: 2-5 years

- Fine: 200,000-500,000 THB (~$5,600-$14,000)

- Daily Continuing Violation: Additional 10,000 THB (~$280) per day of continued violation

- Non-Dischargeable: Cannot be settled through regulatory settlement committee

Unlawful Account Use

Offense: Allowing digital asset account to be used for money laundering, fraud, or cybercrime

Penalties:

- Imprisonment: Up to 3 years

- Fine: Up to 300,000 THB (~$8,400)

- Application: Extends to knowingly permitting illicit use

Regulatory Administrative Penalties

License Non-Commencement

Violation: Obtaining license but failing to commence operations within 180 days of approval

Consequence: Automatic license revocation (no grace period, no appeal)

Net Capital Breaches

Violation: Falling below minimum net capital requirements

Regulatory Response Timeline:

- SEC notification of breach immediately upon discovery

- Operator has 10 business days to submit remediation plan

- Remediation plan must restore capital within 30 days (or specified shorter timeframe)

- Failure to achieve remediation triggers license suspension/revocation

AML/KYC Violations

Specific violations triggering penalties:

- Failure to implement adequate AML/KYC systems

- Inadequate customer due diligence on high-risk customers

- Failure to file SARs or filing late

- Ineffective transaction monitoring

- Inadequate sanctions screening processes

Enforcement Approach:

- Usually begins with written violations and corrective action orders

- Escalates to monetary fines (typically 500,000-5,000,000 THB)

- May include license restrictions or revocation for egregious violations

Part 9: Practical Roadmap for Prospective Operators

12-Month Implementation Timeline

Months 1-2: Foundation Setting

- Engage legal counsel and compliance advisors

- Conduct market research and competitive analysis

- Develop preliminary business model and financial projections

- Assess technology options (build vs. buy platform)

- Identify capital sources and funding partners

Months 3-4: Company Formation and Planning

- Incorporate Thai company (DBD registration)

- Secure office space in Thailand

- Develop detailed business plan and financial model

- Begin platform architecture and security design

- Identify compliance officer and key personnel

Months 5-6: Capital and Infrastructure

- Deposit minimum paid-up capital in Thai bank account

- Finalize platform technology selection

- Conduct preliminary security assessment

- Develop AML/KYC policies aligned with SEC notifications

- Hire compliance officer and initial compliance team

Months 7-8: Documentation and Testing

- Conduct security audit/penetration testing by qualified firm

- Refine all compliance policies and procedures

- Develop incident response and business continuity plans

- Prepare comprehensive compliance documentation

- Begin regulatory pre-consultation with SEC (optional but recommended)

Month 9: Application Preparation and Submission

- Finalize all application documentation

- Translate documents into Thai (if necessary)

- Quality assurance review of application package

- Address pre-consultation SEC feedback (if pre-consultation completed)

- Submit application to SEC with non-refundable 30,000 THB fee

Months 10-11: SEC Review and RFI Response

- Respond to SEC information requests within 5-7 days

- Conduct independent platform security certification

- Finalize hiring of compliance and operational staff

- Implement full AML/KYC system in production environment

- Prepare for MOF approval stage

Month 12: Approval and Go-Live Preparation

- Receive SEC recommendation and MOF approval

- Pay license granting fee (2.5M THB for exchange)

- Complete final platform testing and security validation

- Implement institutional banking relationships (on/off-ramp partners)

- Launch soft launch with limited customer base

Estimated Budget for Digital Asset Exchange Startup

| Category | Low Estimate | High Estimate | Notes |

|---|---|---|---|

| Regulatory Capital | 50,000,000 THB | 50,000,000 THB | Regulatory minimum, non-refundable |

| Licensing Fees | 2,530,000 THB | 2,530,000 THB | Application + granting fees |

| Legal & Consulting | 1,500,000 THB | 3,000,000 THB | Regulatory experts, compliance counsel |

| Platform Technology | 2,000,000 THB | 5,000,000 THB | Build custom vs. white-label |

| Security & Audit | 500,000 THB | 1,500,000 THB | Penetration testing, security certification |

| Office & Infrastructure | 1,000,000 THB | 2,500,000 THB | Lease, equipment, IT systems |

| Personnel (Year 1) | 3,000,000 THB | 8,000,000 THB | Compliance, operations, technology staff |

| Marketing & Go-Live | 500,000 THB | 2,000,000 THB | Brand launch, customer acquisition |

| Working Capital Buffer | 2,000,000 THB | 5,000,000 THB | Operating runway before profitability |

| TOTAL Year 1 Investment | 63,030,000 THB | 79,530,000 THB | $1.76M – $2.23M USD |

| Year 2+ Annual Operating Cost | 10,000,000 THB | 20,000,000 THB | Staffing, infrastructure, licenses |

Positioning for Success

Thailand’s digital asset regulatory framework offers unprecedented clarity and a transparent pathway for legitimate operators. The combination of comprehensive legal certainty, substantial tax incentives for individual investors, and competitive market opportunity creates a compelling case for establishing Thai crypto operations.

Success requires commitment to regulatory excellence, capital adequacy, customer protection, operational readiness, and market execution. The path from business concept to operational license typically requires 12-18 months and investments of 1.5-2.3 million USD, but the resulting competitive position, regulatory protection, and market access make Thailand an increasingly attractive jurisdiction for digital asset businesses entering or expanding in Southeast Asia.

For entrepreneurs and established crypto enterprises alike, Thailand represents the gold standard for regulated digital asset operations – combining investor protection, operator flexibility, and favorable economic incentives into a unique ecosystem designed to attract world-class crypto infrastructure and institutional capital.

Citations:

Coredo.eu – Crypto in Thailand 2025 New Rules

Coredo.eu – Crypto in Thailand 2025 New Rules and Market Regulation

Go Law Phuket – Digital Asset Business License in Thailand

Thai Company Formation – Open a Cryptocurrency Company in Thailand

Legal Bison – Thailand Crypto License – Costs and Process in 2025

Mahanakorn Partners – LinkedIn – Digital Asset Licenses in Thailand

AIM Bangkok – Crypto License in Thailand: Regulations, Requirements, and How to

Tilleke & Gibbins – New Digital Asset Business Requirements for Businesses in Thailand

Baker McKenzie – A Complete Guide to Digital Asset Law in Thailand 2025

SilkLegal – Licensing and Market Entry for Digital Asset Businesses in Thailand

AIM Bangkok – Thailand Regulates Foreign Crypto Platforms

Mahanakorn Partners – Digital Asset Regulations in Thailand: A Comprehensive Overview

Belaws.com – Navigating the World of Digital Asset Licences in Thailand

Lightspark.com – Is Crypto Legal in Thailand? Regulations & Compliance in 2025

VBA Partners – Understanding Crypto Tax Declarations in Thailand 2025

Nishimura – New Thai Licensing Requirements for Provision and Provision

Benoit & Partners – Crypto in Thailand: New Tax Rules from 2025

Tilleke & Gibbins – Thailand Offers Income Tax Exemption on Cryptocurrency Capital Gains

SilkLegal – Thailand to Block Access to Five Unlicensed Crypto Platforms

Global Legal Insights – Blockchain & Cryptocurrency Laws 20262026 | Thailand

Tilleke & Gibbins – Thailand’s SEC Sets Security Measure Requirements for Digital Asset Custody

Tilleke & Gibbins – Thailand’s SEC Sets Security Measure Requirements for Digital Asset Custody (continued)

Frank Legal Tax – Thailand Tightens Regulations on Foreign Digital Asset Platforms