Understanding Thailand’s Progressive Tax System

Thailand’s tax landscape has evolved significantly to align with international standards while maintaining competitive advantages for foreign investors. Whether you’re establishing a business operation, planning an international expansion, or relocating as an expat, understanding Thailand’s tiered tax rates, filing deadlines, and compliance requirements is essential for effective tax planning and avoiding costly penalties.

This comprehensive guide covers Thailand’s personal income tax (PIT), corporate income tax (CIT), withholding tax (WHT), and value-added tax (VAT) structures, incorporating the OECD Global Minimum Tax (Pillar Two) implementation that took effect January 1, 2025. We’ve aligned this analysis with PWC tax summaries while providing practical guidance on deductions, allowances, and strategic tax planning opportunities.

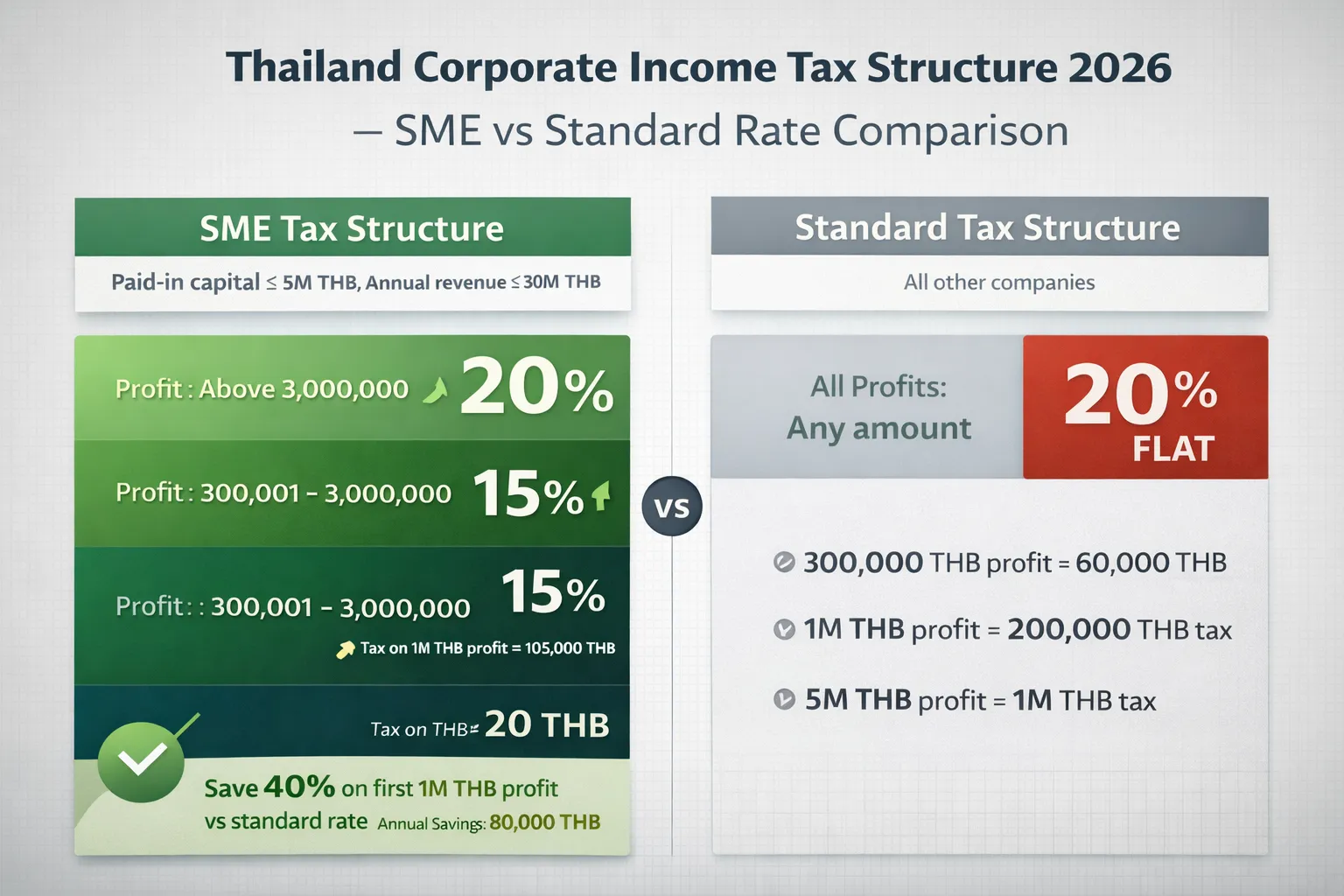

Corporate Income Tax (CIT) in Thailand

Standard Corporate Tax Rates 2025

| Profit Level | Tax Rate | Eligibility |

|---|---|---|

| Net profit up to 300,000 THB | 0% | SMEs with paid-in capital ≤ 5M THB |

| 300,001 – 3,000,000 THB | 15% | SMEs with annual revenue ≤ 30M THB |

| Above 3,000,000 THB | 20% | All companies |

| Standard rate (general) | 20% | All incorporated businesses |

Key Point: The progressive rate system applies exclusively to small and medium enterprises (SMEs) defined as companies with paid-up capital not exceeding 5 million baht and annual sales revenue not exceeding 30 million baht. Once either threshold is exceeded, the flat 20% rate applies to all net profits.

Corporate Tax Calculation & Filing Requirements

Thai corporate income tax is calculated on net profits (after deductible expenses) for each accounting period. Companies must file their annual corporate income tax return (Form PND 50) within 150 days of the fiscal year-end at the local revenue office where the business is registered.

Critical Compliance Dates:

- Half-year interim tax: Due within 2 months of the 6-month period ending

- Annual CIT return: Within 150 days of fiscal year-end

- e-filing extension: Additional 8 days if filed electronically

- Late filing penalties: THB 1,000-2,000 fine plus 1.5% monthly interest on underpaid taxes

Reduced Corporate Tax Rates for Specific Sectors

Petroleum Income Tax: Reaches 50% of annual net profits for oil and gas exploration companies-significantly higher than standard rates.

BOI-Promoted Companies: The Board of Investment (BOI) grants tax incentives to companies investing in priority sectors:

- Corporate income tax exemption: 3-8 years on profits from approved activities

- High-tech companies (Group A): Up to 13 years of tax exemption

- Additional incentives: 50% CIT reduction for subsequent periods, import duty reductions, and double deductions on operational costs

Critically, BOI exemptions apply only to income derived from promoted activities-all other business income remains subject to standard 20% taxation.

Personal Income Tax (PIT) in Thailand

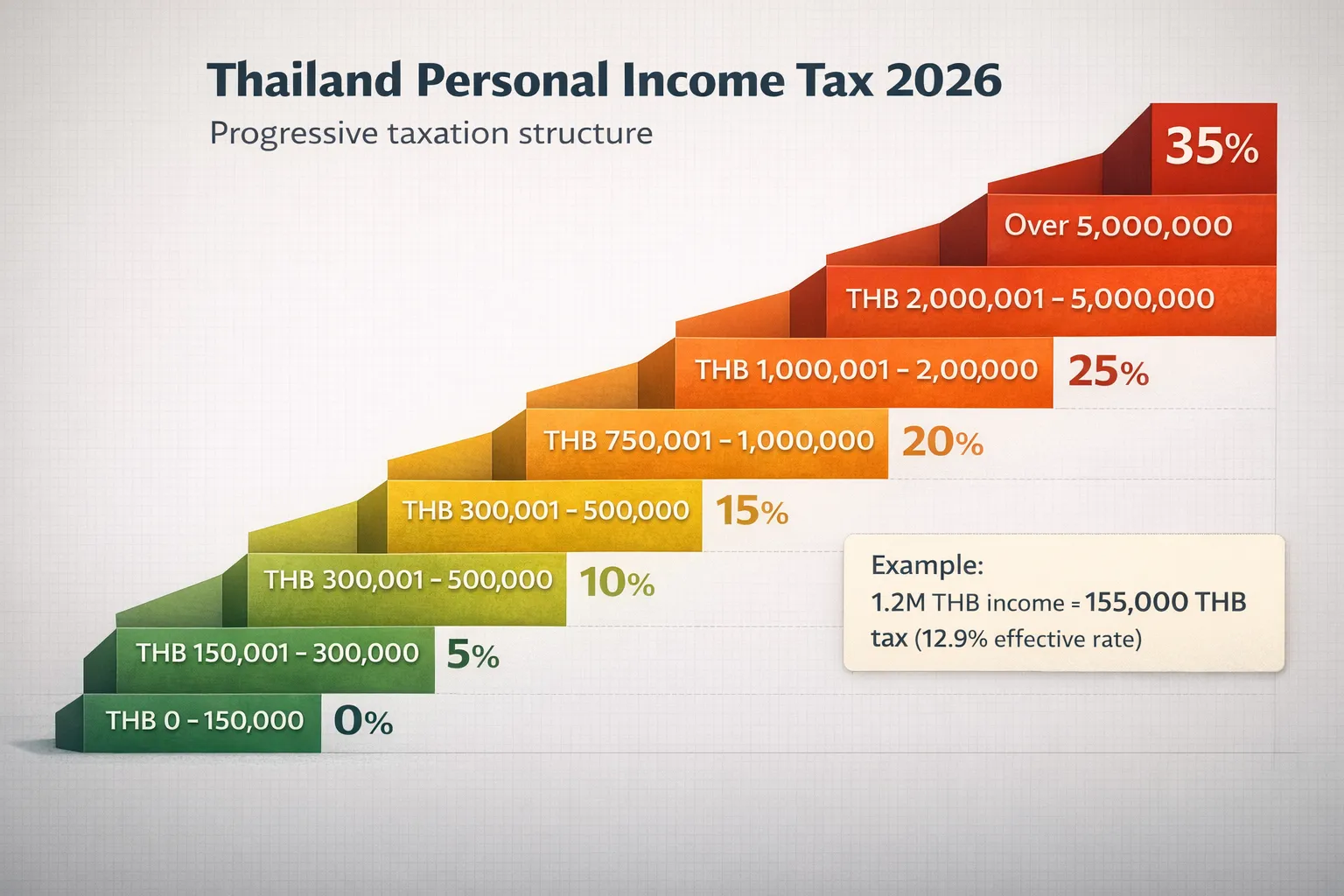

Progressive Tax Rate Structure 2025

Thailand employs a progressive tax system where rates increase with income level:

| Net Taxable Income (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | Exempt (0%) |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,000 | 35% |

Tax Calculation Example: An individual earning 1.2 million baht calculates tax as follows:

- First 150,000 THB: Tax-free

- Next 150,000 THB (150,001-300,000) @ 5% = 7,500 THB

- Next 200,000 THB (300,001-500,000) @ 10% = 20,000 THB

- Next 250,000 THB (500,001-750,000) @ 15% = 37,500 THB

- Next 450,000 THB (750,001-1,200,000) @ 20% = 90,000 THB

- Total tax liability: 155,000 THB (effective tax rate: 12.9%)

Employment Income & Service Fee Deductions

All employment and service-related income qualifies for a standard deduction of 50% of assessable income, capped at a maximum of 100,000 baht.

Example Calculation:

- Salary: 400,000 THB

- Standard deduction (50%): 200,000 THB

- Deduction cap applied: 100,000 THB (maximum)

- Taxable income after deduction: 300,000 THB

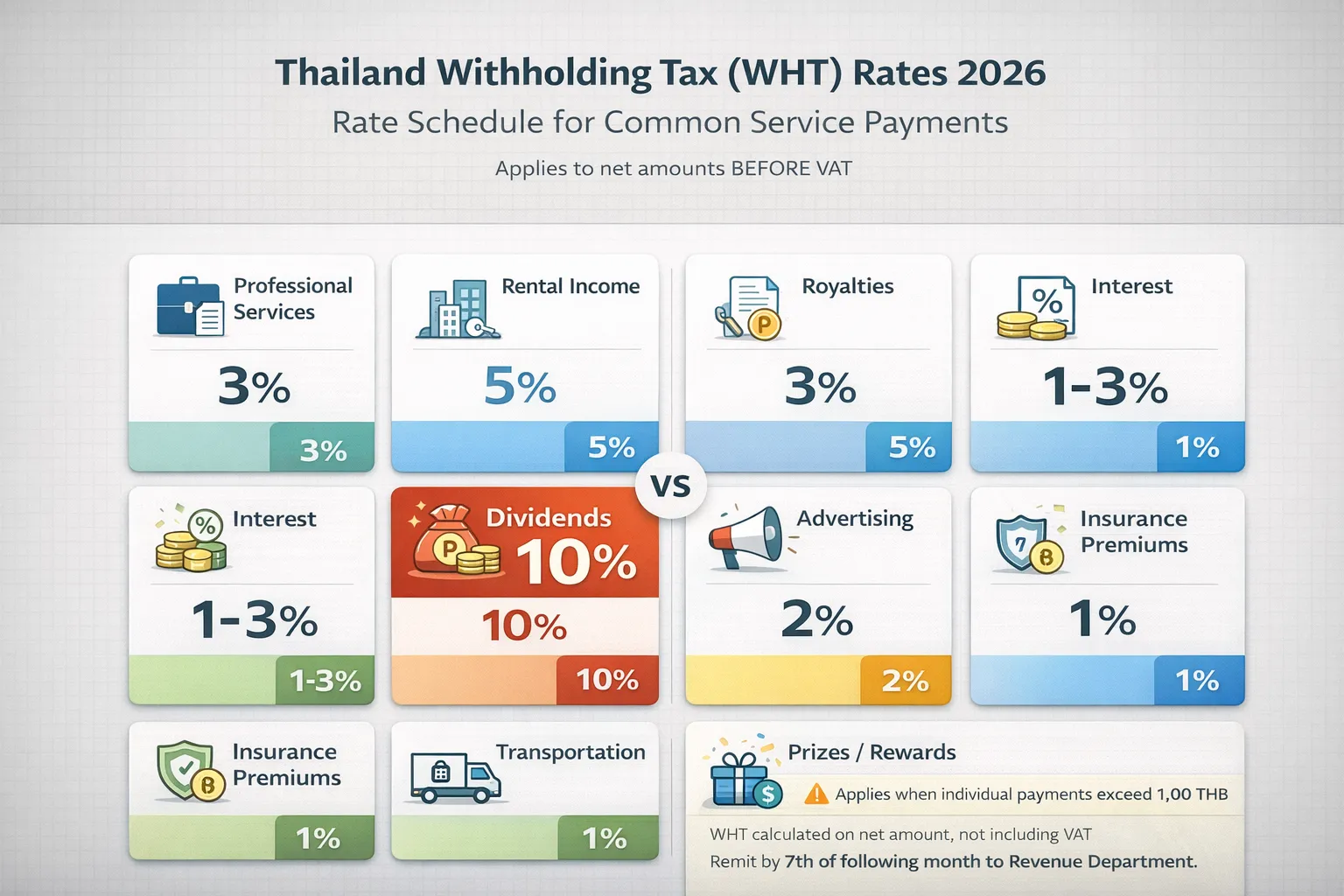

Withholding Tax (WHT) in Thailand

Withholding Tax Rates for Resident Companies & Individuals

Withholding tax is a critical compliance requirement imposed on payments for services, income, and certain transactions. WHT is calculated on net amounts before VAT:

| Payment Type | WHT Rate | Notes |

|---|---|---|

| Professional services | 3% | Legal, accounting, consulting |

| Rental income | 5% | Property, equipment, vehicles |

| Royalties | 3% | Intellectual property, patents |

| Interest | 1-3% | Varies by payment type |

| Dividends | 10% | Distribution to shareholders |

| Advertising | 2% | Media, promotional services |

| Non-life insurance | 1% | Insurance premiums |

| Transportation | 1% | Excluding public transport |

| Prizes & rewards | 5% | Competition winnings |

Withholding Tax Calculation Example:

- Professional service invoice (net): 100,000 THB

- VAT (7%): 7,000 THB

- Gross amount: 107,000 THB

- WHT (3% of net): 3,000 THB

- Amount payable to service provider: 104,000 THB

The withheld amount (3,000 THB) is remitted to the Revenue Department by the 7th of the following month and credited against the service provider’s annual tax liability.

Obligations & Threshold Requirements

Withholding tax obligations arise when individual payments exceed 1,000 baht. For long-term contracts where monthly payments fall below this threshold but accumulate over the year, WHT still applies once the annual total exceeds 1,000 baht.

Exempt payments include transactions with government entities, BOI-promoted companies, and purchases of goods (rather than services).

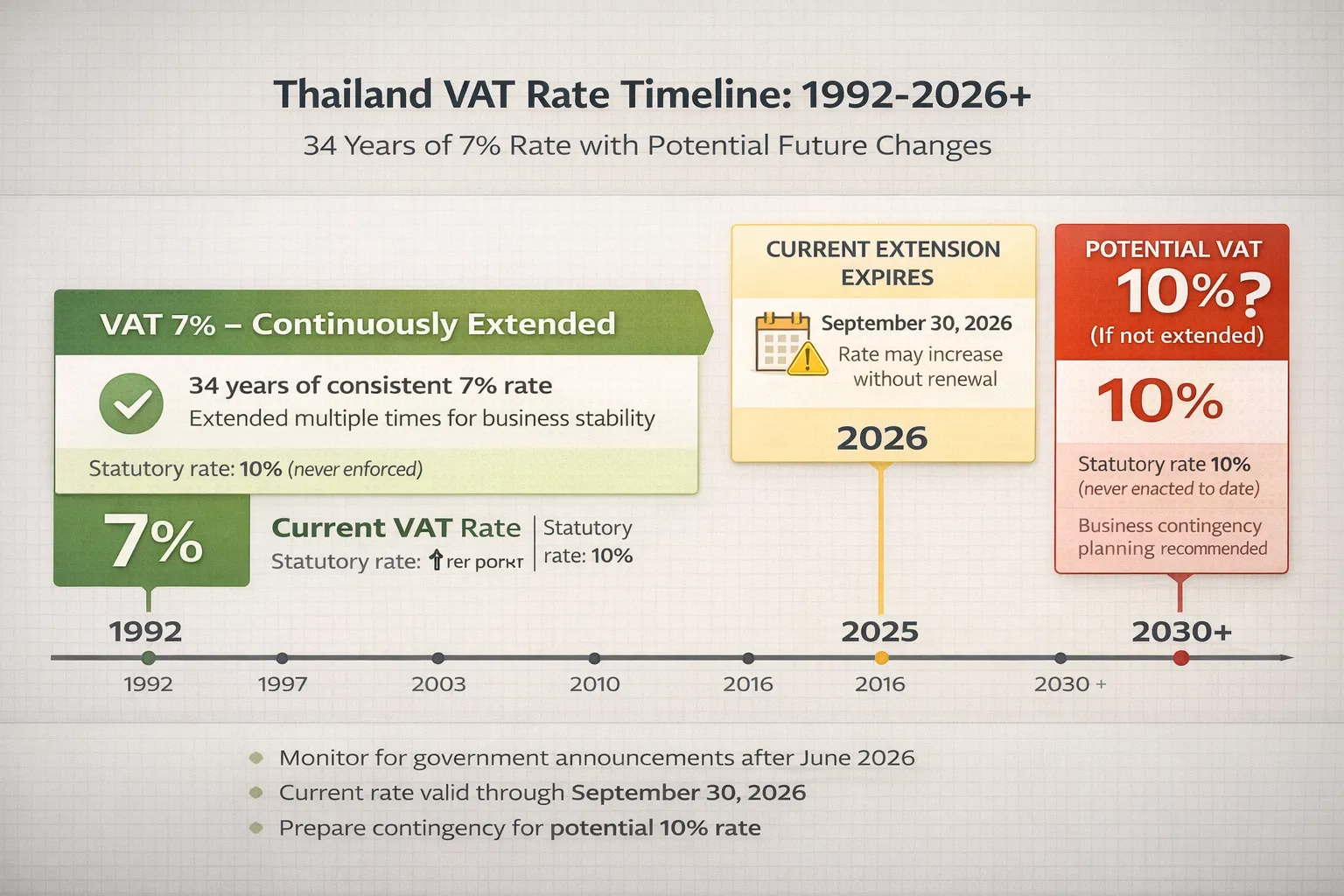

Value-Added Tax (VAT) in Thailand

Current VAT Rate & Timeline

Thailand maintains a 7% VAT rate that has been continuously extended since 1992. The rate remains in effect through September 30, 2026, after which the government may consider reinstating the standard 10% statutory rate depending on fiscal policy objectives.

| Rate | Status | Timeline |

|---|---|---|

| 7% | Currently applicable | Through Sept 30, 2026 |

| 10% | Statutory rate (dormant) | Potential reactivation after Sept 30, 2026 |

| 0% | Special rate (refundable) | Available for eligible export and business services |

VAT Registration & Filing Requirements

Businesses with annual revenue exceeding 1.8 million baht must register for VAT. Registered entities file monthly VAT returns by the 15th of the following month-even if no sales occurred during that month.

Effective February 18, 2025, VAT also applies to digital services and e-commerce transactions, expanding the tax base to include online platforms and software subscriptions.

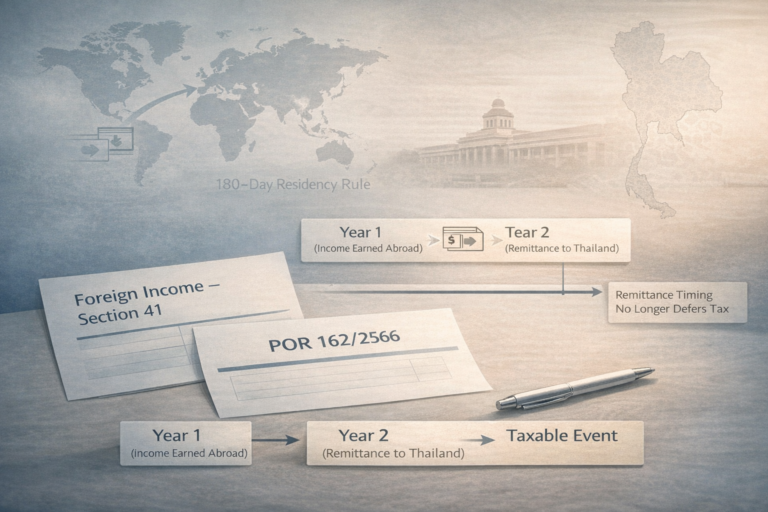

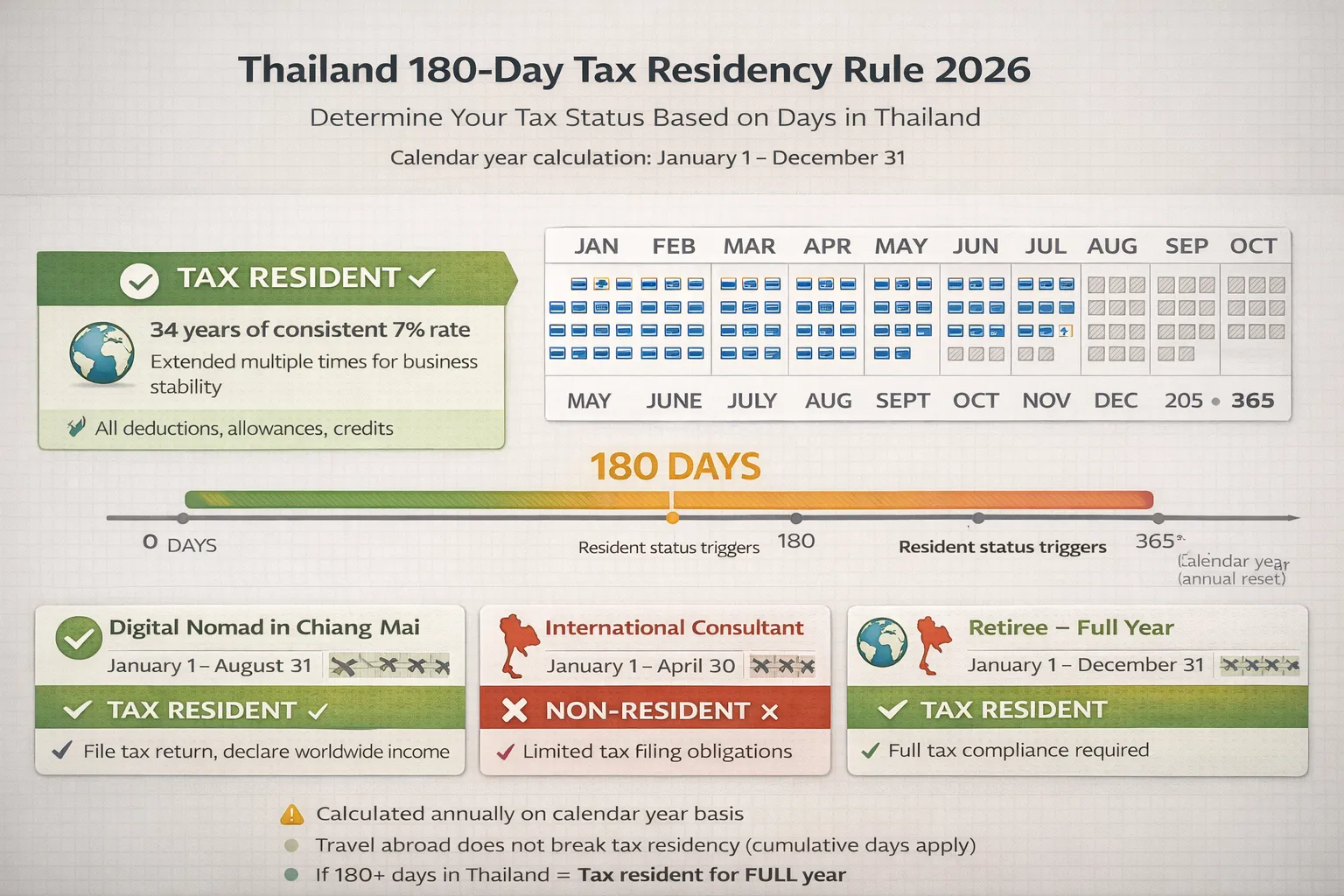

Tax Residency: Determining Your Tax Obligations in Thailand

The 180-Day Rule

Tax residency in Thailand is determined by physical presence, not visa classification. An individual becomes a Thai tax resident if they spend 180 days or more within a calendar year (January 1 – December 31), regardless of nationality, visa type, or purpose of stay.

Implications for tax residents:

- Taxed on worldwide income remitted to Thailand within the same fiscal year

- Must file annual personal income tax returns (Forms PND 90/91)

- Eligible for all available tax deductions and allowances

Non-residents (fewer than 180 days in Thailand):

- Taxed only on Thai-sourced income

- Subject to different withholding tax rates

- Limited eligibility for deductions

- No obligation to report foreign income

Tax Residency Examples:

- Digital nomad in Chiang Mai for 8 months = Tax resident (must declare worldwide income)

- International consultant splitting time between Singapore and Bangkok for 4 months = Non-resident (only Thai-sourced income taxable)

Personal Income Tax Deductions & Allowances 2025

Thailand provides extensive deduction options that significantly reduce taxable income. The following allowances apply to tax residents:

Personal & Family Allowances

| Allowance Type | Amount |

|---|---|

| Personal allowance (self) | 60,000 THB |

| Spouse allowance (if dependent) | 60,000 THB |

| Child allowance (per dependent child under 25) | 30,000 THB each |

| Additional child born in 2018 or later | 60,000 THB each (up to 3 children) |

| Dependent parent (60+ years old) | 30,000 THB each |

| Disabled or incompetent dependent | 60,000 THB each |

Total potential family allowances: Up to 400,000+ THB depending on family structure.

Retirement & Insurance Savings Deductions

| Savings Type | Maximum Deduction |

|---|---|

| Life insurance premiums (Thailand insurer) | 100,000 THB |

| Health insurance premiums | 25,000 THB |

| Pension fund contributions | Up to 15% of income, max 200,000 THB |

| Provident fund contributions | Up to 15% of income, max 500,000 THB |

| National savings fund | Up to 15% of income, max 500,000 THB |

| Retirement mutual fund | Up to 30% of income, max 500,000 THB |

Combined insurance/savings cap: Total deductions for life insurance, health insurance, and pension funds cannot exceed 500,000 THB.

Investment & Support Deductions (2025 Updates)

| Investment Type | Deduction Limit | Notes |

|---|---|---|

| ESG Mutual Fund (through Dec 31, 2026) | 300,000 THB per year | Up to 30% of assessable income |

| ESGX Fund (May 1 – June 30, 2025) | 300,000 THB | Special conversion period for LTF portfolios |

| Social enterprise investments (annual) | 100,000 THB | From November 9, 2021 onwards |

| Visual art purchases (2025-2027) | 100,000 THB per year | Support for cultural sector |

New Tax Allowances for 2025

Shopping Allowance (January 16 – February 28, 2025):

- Purchases from non-VAT registered businesses: Up to 30,000 THB

- Additional purchases from OTOP/Community Enterprises: Up to 20,000 THB

- Total: Up to 50,000 THB

Domestic Tourism Deduction (October 29 – December 15, 2025):

- Travel expenses: 100% or 150% of actual costs

- Maximum deduction: 30,000 THB

Pillar Two: Global Minimum Tax in Thailand (2025)

Implementation & Scope

Thailand implemented the OECD Global Minimum Tax (Pillar Two) effective January 1, 2025, following the Emergency Decree on Top-Up Tax enacted December 26, 2024.

Key parameters:

- Minimum effective tax rate (ETR): 15%

- Applicability: Multinational enterprises (MNEs) with global consolidated revenue exceeding EUR 750 million

- Calculation period: At least 2 of the last 4 fiscal years must exceed the EUR 750M threshold

- GloBE return filing: Within 15 months of fiscal year-end

Top-Up Tax Mechanism

The top-up tax applies where a company’s combined effective tax rate across jurisdictions falls below 15%. The calculation is:

Top-Up Tax Liability = (15% ETR × Net GloBE Income) – Actual Taxes Paid

Example: A multinational group operating in Thailand with EUR 1 billion global revenue and a 12% effective tax rate across all jurisdictions must pay a top-up tax to bring the combined rate to 15%.

Affected Entities in Thailand

Companies likely subject to Pillar Two include:

- Thai-listed companies on the Stock Exchange of Thailand meeting the revenue threshold

- Financial institutions with consolidated revenues exceeding EUR 750 million

- Regional subsidiaries of multinational groups

- Digital and technology companies with substantial cross-border operations

OECD Pillar One: Allocation of Digital Services Tax

While Pillar Two establishes minimum taxation, Pillar One allocates taxing rights over high-revenue multinational digital businesses. Thailand benefits by gaining the ability to tax MNEs generating significant revenue from Thai consumers, even without physical presence in Thailand.

Cryptocurrency Taxation in Thailand (2025-2029)

Historic Shift: Five-Year Capital Gains Tax Exemption

Effective January 1, 2025, Thailand introduced a groundbreaking five-year personal income tax exemption on cryptocurrency capital gains. This initiative, established by Ministerial Regulation No. 399 (published September 5, 2025 in the Government Gazette), applies through December 31, 2029.

Exemption conditions:

- Individual investors only (companies not eligible)

- SEC-licensed platforms only: Transactions must occur on exchanges, brokers, or dealers licensed by Thailand’s Securities and Exchange Commission

- Applies to both residents and non-residents: Foreign investors can engage in Thai crypto trading without capital gains tax liability

- Withholding tax eliminated: Previous 15% WHT on crypto sales has been waived

Capital Gains Calculation Under the Exemption

| Component | Calculation |

|---|---|

| Capital gain | Sale price − Purchase cost − Direct trading fees |

| Loss offsetting | Losses from one crypto can offset gains from others in the same year |

| Loss carryforward | Excess losses can be carried forward for up to 5 consecutive years |

| Tax impact (2025-2029) | 0% capital gains tax rate |

Strategic implication: Assets transferred to Thai platforms before the exemption period commenced may have accrued pre-2025 gains that remain subject to progressive income tax rates (5-35% depending on total income), with exemption applying only to gains realized after January 1, 2025.

Non-Exempt Entities & Post-Exemption Planning

Companies trading in digital assets remain subject to 20% corporate income tax on capital gains, regardless of platform or exemption status.

With the exemption expiring December 31, 2029, individual traders must plan for future tax liability:

- Post-exemption gains return to progressive PIT rates (5-35%)

- Proper documentation during exemption period is essential for future compliance

- The Ministry expects crypto exemption to generate approximately $1 billion annually in indirect revenue through market activity stimulation and ecosystem growth

Specific Business Tax & Local Taxes in Thailand

Specific Business Tax (SBT)

Certain business activities are subject to specific business tax rates-a tax independent of corporate income tax:

| Business Type | SBT Rate | Additional Local Tax |

|---|---|---|

| Banking/finance/similar | 3.0% | 10% local tax (30% total) |

| Life insurance/pawnbroking | 2.5% | 10% local tax (27.5% total) |

| Real estate sales | 0.1% | 10% local tax (11% total) |

Businesses subject to SBT must:

- Register within 30 days of commencing operations (Form Por.Thor.01)

- File monthly returns (Form Phor.Th.40) by the 15th of following month

- Maintain records for at least 5 years

Land & Building Tax

Real property in Thailand is subject to annual land and building taxes assessed on estimated market values. Rates vary by property classification and location but typically range from 0.02% to 0.1% of assessed value.

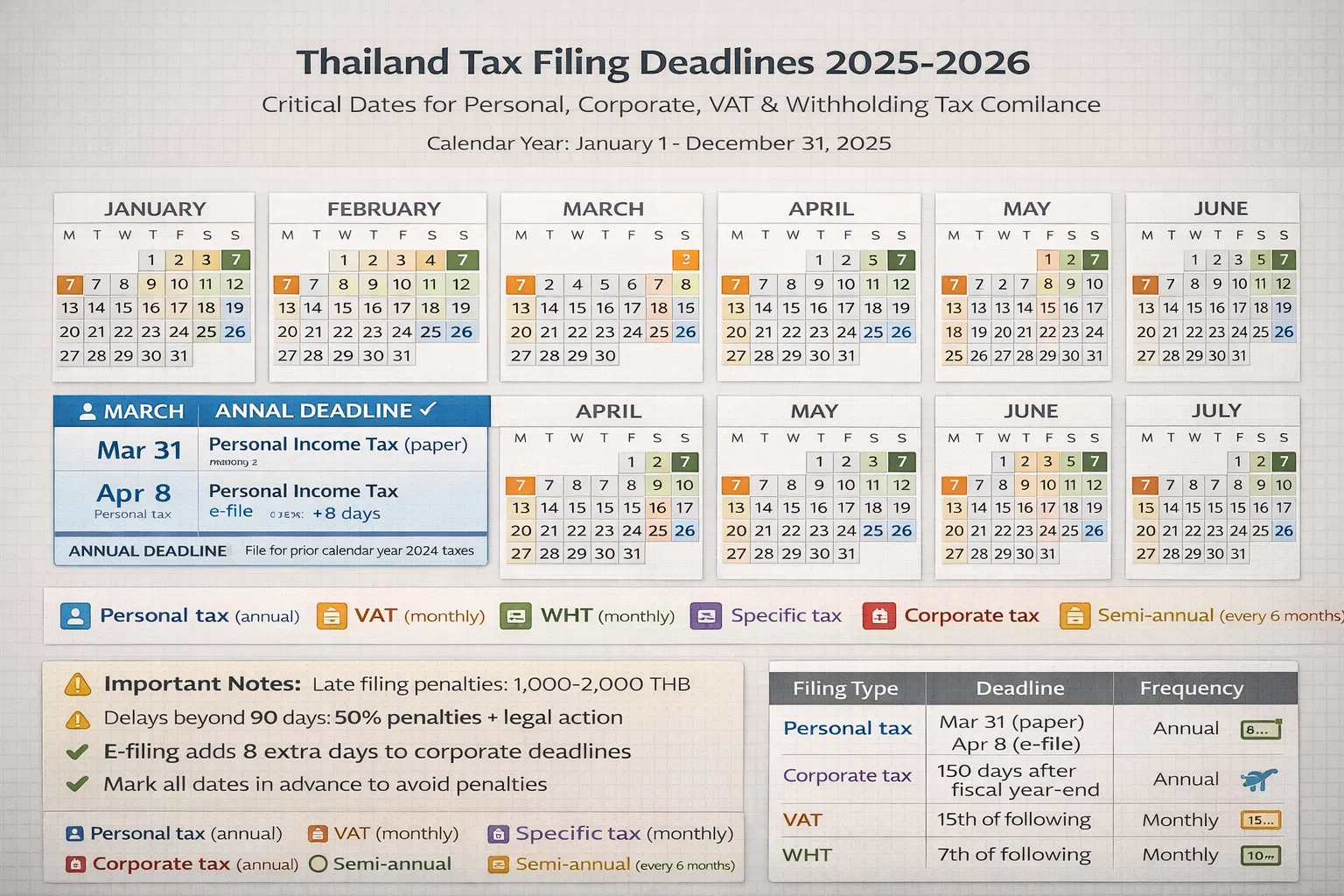

Tax Filing Deadlines & Compliance Calendar 2025

Personal Income Tax Filing

| Filing Method | Deadline | Applicability |

|---|---|---|

| Paper filing | March 31 | Manual submission to local tax office |

| Electronic filing (e-filing) | April 8 | Online submission through Revenue Department |

| Tax year | January 1 – December 31 | All individuals |

Both paper and electronic returns cover the previous calendar year (e.g., 2025 returns filed in March/April 2026).

Corporate Income Tax & Withholding Tax

| Filing Type | Deadline | Frequency |

|---|---|---|

| Corporate income tax return (PND 50) | Within 150 days of fiscal year-end | Annual |

| VAT return | 15th of following month | Monthly (even with zero sales) |

| Withholding tax remittance | 7th of following month | Monthly |

| Specific business tax return (Phor.Th.40) | 15th of following month | Monthly |

| Half-year interim tax | Within 2 months of 6-month period | Semi-annual |

E-filing advantage: Electronic submission adds 8 additional days to most corporate deadlines, providing more time before penalties apply.

Penalty Structure for Late Filings

| Filing Delay | Fine | Additional Consequences |

|---|---|---|

| 15-90 days late | 200% of tax due | Credit for voluntary disclosure |

| Beyond 90 days | 500% of tax due | Potential legal action |

| No filing extension | THB 1,000-2,000 | 1.5% monthly interest on unpaid tax |

Extensions are granted only under exceptional circumstances such as natural disasters or unforeseen events-standard business pressures do not qualify.

Employee Welfare Fund: New October 2025 Requirement

Effective October 1, 2025, employers with 10 or more employees who do not maintain a Provident Fund must contribute to the Employee Welfare Fund (EWF):

Contribution Rates

| Period | Employer Contribution | Employee Contribution | Total Rate |

|---|---|---|---|

| Oct 1, 2025 – Sept 30, 2030 | 0.25% of gross wages | 0.25% of gross wages | 0.50% total |

| Oct 1, 2030 onwards | 0.50% | 0.50% | 1.0% total |

| Wage ceiling | None (applies to entire wage) | None | Unlimited |

This represents a new payroll tax burden that businesses must factor into labor cost projections.

Thailand BOI Tax Incentives & Promoted Activities

Corporate Income Tax Exemption Framework

The Board of Investment (BOI) grants tax exemptions exclusively for income derived from promoted activities. All other business income remains taxable at standard rates:

Exemption duration by sector:

- High-tech companies (Group A): Up to 13 years

- Advanced manufacturing & automation: 8-10 years

- Digital services & software: 5-8 years

- Renewable energy & environmental management: 5-8 years

- Logistics & warehousing: 3-5 years

Additional incentive: A subsequent 50% corporate income tax reduction (effective CIT rate of 10%) for an additional period after the exemption expires.

Operational Benefits of BOI Promotion

Beyond tax exemptions, promoted companies receive:

- Import duty reductions on machinery, raw materials, and essential goods

- Export duty exemptions on finished products

- Double deductions for transportation, electricity, and water supply costs

- R&D tax deduction: Up to 200% of research expenses plus 40% accelerated depreciation on R&D equipment

- Expatriate support: Unlimited foreign staff hiring (no quota restrictions) and streamlined work permits

- Land ownership: Ability to own land for business operations (unusual under Thai law)

- Currency remittance: Transfer of profits and dividends in foreign currency offshore

Strict Compliance Requirements

Critical compliance notes:

- Exemptions apply only to promoted income-segregated accounting is mandatory

- Revenue Department and BOI frequently audit income allocation

- Failure to properly segregate promoted vs. non-promoted income results in disqualification

- Continued compliance with BOI conditions required throughout exemption period

International Tax Compliance & Double Taxation Agreements (DTAs)

Withholding Tax Reduction Under DTAs

Thailand maintains double taxation treaties with numerous countries that provide reduced withholding tax rates for cross-border payments:

Typical DTA rates (significantly below standard WHT):

- Dividends: 5-10% (vs. standard 10%)

- Interest: 5-10% (vs. standard 3%)

- Royalties: 5-10% (vs. standard 15% for foreign companies)

- Technical service fees: 5-10% (vs. standard 15% for foreign companies)

Eligible entities must provide tax residency certificates and beneficial ownership documentation to claim DTA benefits.

Foreign Earned Income & Remittance Rules

Tax residents working abroad can access a two-year foreign income remittance exemption:

- Foreign-earned income brought into Thailand within the same tax year is tax-exempt for two calendar years

- Begins in the year the individual first remits foreign income to Thailand

- Applies to employment income, business profits, and investment returns

FAQ: Answers to Commonly Asked Questions About Thailand Taxation

Personal Income Tax Questions

Q: What is the tax-free threshold for personal income in Thailand?

A: The first THB 150,000 of annual net income is completely exempt from tax. Income above this threshold is taxed progressively at rates from 5% to 35% depending on the bracket.

Q: Can I claim deductions for working from home in Thailand?

A: Employment income qualifies for a standard deduction of 50% of assessable income (maximum THB 100,000). Home office expenses are typically covered under this standard deduction. Self-employed individuals can claim actual business expenses with substantiation up to 60% of income.

Q: Do I have to pay taxes on income earned outside Thailand?

A: Only if you are a tax resident (180+ days in Thailand annually). As a resident, you must declare all worldwide income remitted to Thailand. Non-residents pay tax only on Thai-sourced income.

Q: Is there a foreign income exemption in Thailand?

A: Yes. Tax residents can claim a two-year foreign earned income remittance exemption starting in the year income is first remitted. The exemption covers employment income, business profits, and investment returns from abroad.

Corporate Income Tax Questions

Q: What is the corporate tax rate for a new business in Thailand?

A: For SMEs (paid-in capital ≤ THB 5M, annual revenue ≤ THB 30M), the rate is 0% on first THB 300,000 of profit, 15% on THB 300,001-3M, and 20% above that. For other businesses, the standard rate is 20%.

Q: How is net profit calculated for corporate tax purposes?

A: Net profit = Total revenue minus all legitimate business expenses (salary, rent, utilities, depreciation, etc.). Companies must maintain detailed accounting records and file annual financial statements within 150 days of fiscal year-end.

Q: Are BOI tax exemptions permanent?

A: No. BOI exemptions last 3-13 years depending on the activity and sector. After exemption expires, a 50% corporate income tax reduction typically applies for an additional period. All income must be properly segregated in accounting records.

Q: What penalties apply for late corporate tax filing?

A: Late filing incurs THB 1,000-2,000 fines plus 1.5% monthly interest on underpaid taxes. Delays beyond 90 days may trigger 500% penalties and legal action.

Withholding Tax Questions

Q: When do I have to withhold tax on professional services?

A: Withholding tax applies when individual service payments exceed THB 1,000. For recurring services (like monthly consulting fees), WHT applies once the annual total exceeds THB 1,000, even if monthly amounts are below the threshold.

Q: Is withholding tax calculated before or after VAT?

A: Before VAT. WHT is calculated on the net service amount, and VAT is added separately. For example, a THB 100,000 professional service (net) with 3% WHT and 7% VAT results in 3,000 THT withheld on the net amount.

Q: Can I claim a withholding tax credit on my tax return?

A: Yes. WHT withheld is credited against annual tax liability when you file your income tax return. The issuer must provide a withholding tax certificate (Sor.Bor.1) as evidence.

VAT & Business Tax Questions

Q: Do I need to register for VAT if my business is small?

A: VAT registration is mandatory when annual revenue exceeds THB 1.8 million. Below this threshold, registration is optional but may provide benefits for input tax refunds if you export goods/services or operate specific businesses.

Q: What is the current VAT rate in Thailand?

A: The current rate is 7%, in effect since 1992 but continuously extended. The rate remains valid through September 30, 2026, after which the government may reinstate the statutory 10% rate depending on fiscal conditions.

Q: Are digital services subject to VAT in Thailand?

A: Yes. Effective February 18, 2025, VAT applies to digital services and e-commerce transactions, including software subscriptions and online platform services. This expanded the taxable base significantly.

Q: What happens if I file a VAT return late?

A: Late VAT filings can result in penalties ranging from 1% to 5% of unpaid VAT, plus interest charges. Monthly filing is required even if no sales occurred, so ensure timely submission by the 15th of the following month.

Cryptocurrency & Digital Asset Questions

Q: Are cryptocurrency capital gains taxed in Thailand?

A: Until December 31, 2029, capital gains from crypto and digital token sales are 100% tax-exempt for individuals trading via SEC-licensed platforms. After 2029, gains revert to progressive personal income tax rates (5-35%).

Q: Do companies trading crypto get the same exemption?

A: No. The crypto capital gains exemption applies only to individuals. Companies remain subject to 20% corporate income tax on all crypto trading gains.

Q: What happens to my pre-2025 crypto gains?

A: Gains accrued before January 1, 2025, remain taxable at progressive personal income tax rates (5-35%) even if the asset is sold during the exemption period. Only gains realized after January 1, 2025, qualify for the exemption.

Q: Must I use Thai exchanges to qualify for the crypto exemption?

A: Yes. To claim the exemption, transactions must be conducted through platforms licensed by Thailand’s Securities and Exchange Commission (SEC). Offshore exchanges do not qualify.

Tax Residency Questions

Q: How is tax residency determined in Thailand?

A: Individuals staying in Thailand for 180 days or more in a calendar year are considered tax residents, regardless of visa type or nationality. The rule is based on physical presence, not visa classification.

Q: Do short-term visitors pay income tax in Thailand?

A: Only on Thai-sourced income. Non-residents (fewer than 180 days annually) are not taxed on foreign income or wages earned abroad. Tax residency status is determined annually on a calendar-year basis.

Q: What if I travel abroad during the year? Does it affect my tax residency?

A: No. The 180-day rule counts total days present in Thailand during the calendar year, including periods when you leave for travel. As long as total presence exceeds 180 days, you are a tax resident for that year.

Q: Can I obtain a Certificate of Residency to prove non-resident status?

A: Yes. The Thai Revenue Department issues Certificates of Residency (CoR) to support claims of non-resident status, backed by passport and visa documentation. This is useful for withholding tax certificate claims.

Global Minimum Tax (Pillar Two) Questions

Q: Does the 15% global minimum tax apply to all businesses?

A: No. Pillar Two applies only to multinational enterprises (MNEs) with global consolidated revenue exceeding EUR 750 million in at least 2 of the last 4 fiscal years. Smaller businesses and domestic companies are not affected.

Q: How is the 15% minimum tax calculated?

A: The top-up tax applies where the effective tax rate (ETR) across all group jurisdictions falls below 15%. The calculation uses the Net GloBE Income method, subtracting actual taxes paid from the 15% threshold amount.

Q: Must Thai companies with foreign subsidiaries comply with Pillar Two?

A: Only if the consolidated group revenue exceeds EUR 750 million. Below this threshold, Pillar Two does not apply. Companies must track global ETR and file GloBE returns within 15 months of fiscal year-end if threshold is met.

Q: What is the difference between IIR and QDMTT under Pillar Two?

A: Income Inclusion Rule (IIR): Parent company collects top-up tax where subsidiary ETR is below 15%. Qualified Domestic Minimum Top-Up Tax (QDMTT): Host country (Thailand) collects top-up tax on resident entities. Thailand has chosen to implement QDMTT.

Employee & Payroll Tax Questions

Q: What is the Employee Welfare Fund requirement effective October 2025?

A: Employers with 10+ employees who don’t maintain a Provident Fund must contribute 0.25% of gross wages (employee also contributes 0.25%) through September 30, 2030, increasing to 0.50% thereafter. No wage ceiling applies.

Q: How do I calculate withholding tax on employee salaries?

A: Salary WHT is calculated using progressive personal income tax rates, not flat percentages. The employer remits withheld amounts monthly to the Revenue Department using Form PND 1.

Q: Are foreign employees subject to the same tax rates as Thai nationals?

A: Yes, tax residents (180+ days annually) are taxed identically regardless of nationality. However, some special incentives apply to expatriates in promoted businesses or regional headquarters roles.

SME-Specific Questions

Q: What qualifies as a small and medium enterprise (SME) for Thai tax purposes?

A: SMEs are defined as companies with paid-up capital ≤ THB 5 million AND annual sales revenue ≤ THB 30 million. Once either threshold is exceeded, standard 20% corporate tax applies.

Q: Can an SME qualify for the 0% tax on first THB 300,000 profit?

A: Yes. The 0% rate applies to profit up to THB 300,000 for qualifying SMEs. Then 15% applies to profit from THB 300,001 to THB 3 million, and 20% above that.

Q: Are new startups automatically considered SMEs?

A: New startups qualify for SME rates if they meet the capital and revenue thresholds. However, once startup capital injections exceed THB 5 million (paid-up capital) or annual revenue exceeds THB 30 million, the standard 20% rate applies immediately.

Practical Tax Planning Strategies for Thailand

Corporate Tax Optimization

- Leverage SME tax brackets if your business qualifies (capital ≤ THB 5M, revenue ≤ THB 30M)-the 0% and 15% rates provide substantial savings compared to the 20% standard rate

- Investigate BOI promotion for eligible business activities-tax exemptions lasting 3-13 years can reduce effective corporate tax rates to 0-10%, with additional benefits like import duty reductions

- Segregate promoted vs. non-promoted income meticulously using separate accounting codes-Revenue Department audits income allocation extensively, and improper segregation results in full tax disqualification

- Accelerate deductible expenses into the current fiscal year when cash flow allows-timing of entertainment, office, and operational expenses affects annual net profit calculations

Personal Income Tax Optimization

- Maximize deduction allowances: Claim all eligible personal allowances (THB 60,000), spouse (THB 60,000), dependent children (THB 30-60,000 each), and employment income deduction (50% up to THB 100,000)

- Invest in tax-advantaged savings: Direct funds to provident funds (up to THB 500,000) or retirement mutual funds (up to THB 500,000) to reduce taxable income while building retirement security

- Leverage temporary incentives: Maximize ESG fund investments (up to THB 300,000 annually through 2026) and cryptocurrency exemptions (0% capital gains through 2029)

- Plan foreign income remittance timing: If applicable, use the two-year foreign earned income exemption by controlling when and how foreign income is brought into Thailand

Withholding Tax Management

- Consolidate service payments where possible-if monthly consulting payments total THB 1,000+, WHT applies regardless of monthly invoice size

- Negotiate DTA benefits for cross-border payments-double taxation agreements reduce withholding rates by 50-75%, saving significant amounts on dividend remittances and management fees

- Obtain withholding tax certificates (Sor.Bor.1) from all service providers-proper documentation ensures WHT credits are claimed on annual tax returns

Compliance Best Practices

- Maintain detailed accounting records for minimum 5 years-Revenue Department and Excise Department conduct frequent audits of corporate and individual returns

- File returns early rather than at deadline-electronic filing adds 8 days to corporate tax deadlines and demonstrates good faith compliance

- Monitor Thailand’s evolving tax landscape-Pillar Two implementation, VAT rate changes, and cryptocurrency regulation continue shifting frequently

Conclusion

Thailand’s tax system has evolved into a sophisticated, multi-layered framework designed to remain competitive while aligning with international standards. Understanding progressive personal income tax rates, tiered corporate rates, withholding obligations, and recent Global Minimum Tax compliance requirements is essential for individuals, businesses, and multinational enterprises operating in Thailand.

Key takeaways:

- Personal income tax ranges from 0% to 35% with substantial deduction and allowance opportunities reducing effective rates

- Corporate income tax offers SME advantages, with 0% and 15% brackets for qualifying small businesses

- Pillar Two global minimum tax (15%) applies to large multinationals, requiring strategic ETR management

- Cryptocurrency capital gains enjoy a five-year exemption (2025-2029), positioning Thailand as an emerging digital asset hub

- Compliance deadlines are strict, with penalties ranging from 200-500% for late filings

- BOI incentives remain Thailand’s most valuable tax tool, offering exemptions up to 13 years for promoted activities

Whether you’re establishing a startup, planning international expansion, or relocating as an expatriate, professional tax advice aligned with PWC standards and current regulations is critical. Thailand’s Revenue Department increasingly applies sophisticated audit techniques and technology-enabled compliance monitoring, making proper planning and documentation essential.

The opportunities for tax optimization in Thailand are substantial for those who understand the system’s nuances and plan proactively. By aligning your business structure, accounting practices, and filing procedures with Thailand’s tax requirements, you can maintain compliance while maximizing legitimate deductions and incentives available under Thai law.

Last Updated: January 15, 2026 | Regulatory Status: Current with Thailand Revenue Code amendments and OECD Pillar Two implementation