Your Definitive Resource for Understanding Vehicle Import Costs, Regulations & 2026 Policy Changes

🚗 Thailand Car Import Tax Calculator

Calculate complete import taxes for vehicles in Thailand

Based on official customs regulations

Tax Breakdown

| CIF Price | ฿0 |

| Import Duty 80% | ฿0 |

| Excise Tax 0% | ฿0 |

| Interior Tax 10% | ฿0 |

| VAT 7% | ฿0 |

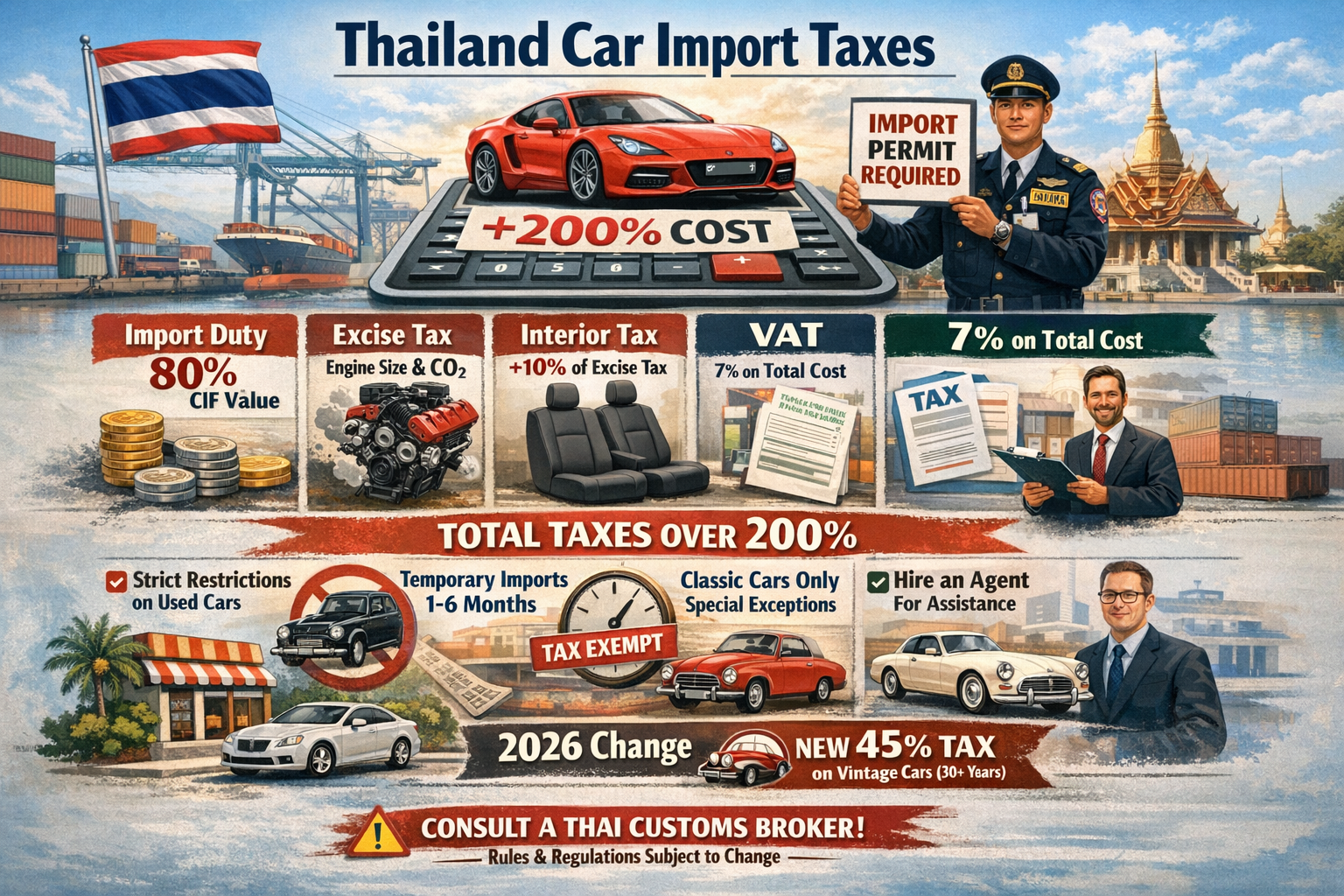

Why Thailand’s Car Taxes Matter (And What Changed in 2026)

A $25,000 USD car from Japan-a reasonable price for a reliable used sedan in most countries-becomes a $60,000+ purchase in Thailand after import taxes and duties. For expats relocating with personal vehicles, returning Thai nationals, or classic car collectors, this reality shapes every import decision.

Thailand’s automotive import policy reflects a deliberate government strategy: protect the local automotive industry, generate substantial tax revenue, and position the kingdom as a premium destination for select vehicle categories. For nearly seven years (2019-2025), personal vehicle imports were virtually impossible. That just changed.

Here’s what I’ve learned: most people approach this backward. They find a car they love, arrange shipping, then discover the taxes are 2-3× higher than expected. By then, it’s too late.

This guide is designed to help you avoid that exact situation.

Here’s what you’ll discover:

Real cost breakdowns: Not estimates-actual calculations from 4 different vehicle types (sedans, luxury cars, EVs, vintage classics)

2026 game-changers: The 45% vintage car rate that just opened classic car collecting. The 2% EV rate that makes electric vehicles suddenly competitive. The CO₂-based system nobody talks about.

Step-by-step process: Your 8-16 week timeline explained week-by-week, so there are no surprises

Who you actually are: Whether you’re an expat, Thai national, business, or collector-this guide has your specific pathway

What mistakes cost: Real examples of how 50,000-300,000 THB gets lost to simple oversights

Why this matters: I’ve seen clients save 300,000-500,000 THB just by understanding EV incentives early. I’ve seen others lose 2,500-30,000 THB in storage fees because they didn’t get permits first. The difference between success and costly regret often comes down to understanding the details before you commit.

This guide is where you get those details.

What’s New in 2026?

The Thai government rolled out the most significant automotive import reform in decades. Three game-changing updates:

- Vintage cars (30+ years old): 45% excise tax (down from 200%+, effective fiscal year 2026)

- Electric vehicles: 2% excise tax (down from 8%, part of broader EV incentive expansion)

- CO₂-based excise tax structure: Traditional combustion engines now taxed on emissions performance, not just engine size

For collectors and EV enthusiasts, this opens pathways previously closed. For traditional car importers, the math remains challenging but transparent.

This guide synthesizes official Thai Customs regulations, 2026 policy updates, and real-world cost scenarios to answer the question every potential importer asks: How much will this actually cost?

QUICK TAX CALCULATOR: UNDERSTAND YOUR ACTUAL COSTS BEFORE YOU COMMIT

The Mathematics: How Import Duty, Excise Tax & VAT Stack

Thailand’s import tax system is cumulative and compounding. Each tax layer builds on the previous one, creating a final cost that surprises unprepared importers.

The formula:

| Step | Component | Calculation | Notes |

|---|---|---|---|

| 1 | CIF Value | Purchase price + International shipping + Insurance | Starting point; “Cost, Insurance, Freight” |

| 2 | Import Duty | CIF × duty rate (typically 30-80% for cars) | Applied to CIF only |

| 3 | Excise Tax | (CIF + Import Duty) × excise rate (typically 13-34% for standard vehicles) | Excise bases include duty amount |

| 4 | Interior Tax | Excise Tax × 10% | Only applies when excise is triggered |

| 5 | VAT Base | CIF + Duty + Excise + Interior Tax + Broker fees | VAT applies to everything above |

| 6 | VAT (7%) | VAT Base × 7% | Mandatory since July 2024; no exceptions |

| 7 | Broker/Port Fees | Fixed + variable charges | Typically 2,000-3,000 THB |

| TOTAL LANDED COST | Sum of all above | Often 150-250% of CIF value | This is what you actually pay |

Real-World Scenario #1: Standard Japanese Sedan (1.5-2.0L)

Vehicle: Honda Civic or Toyota Corolla equivalent

CIF Value: 1,200,000 THB (from Japan)

Engine: 1,500 cc (standard sedan)

Tax Treatment: Standard excise (approximately 22% for CO₂ ~110 g/km)

| Step | Description | Calculation | Amount (THB) |

|---|---|---|---|

| CIF Value | Cost + shipping + insurance | Given | 1,200,000 |

| Import Duty (40%) | CIF × standard vehicle rate | 1,200,000 × 40% | 480,000 |

| Excise Tax Base | CIF + Duty | 1,200,000 + 480,000 | 1,680,000 |

| Excise Tax (22%) | Excise base × 22% | 1,680,000 × 22% | 369,600 |

| Interior Tax (10%) | Excise Tax × 10% | 369,600 × 10% | 36,960 |

| VAT Base | CIF + Duty + Excise + Interior + Fees | 1,200,000 + 480,000 + 369,600 + 36,960 + 2,500 | 2,089,060 |

| VAT (7%) | VAT Base × 7% | 2,089,060 × 7% | 146,234 |

| Broker/Port Fees | Fixed estimate | 2,500 | |

| TOTAL LANDED COST | Sum of all components | 1,200,000 + 480,000 + 369,600 + 36,960 + 146,234 + 2,500 | 2,235,294 |

| Total Tax/Duty Burden | Duty + Excise + VAT | 480,000 + 369,600 + 146,234 | 995,834 (86% markup) |

Bottom line: A car listed at 1.2M THB costs 2.24M THB after taxes. For a $40,000 USD purchase (roughly 1.3M THB CIF), expect final cost of 2.35M+ THB ($55,000+).

Real-World Scenario #2: Luxury Vehicle (3.0L+ Engine)

Vehicle: Mercedes C-Class or BMW sedan

CIF Value: 3,500,000 THB (from Germany)

Engine: 3,000+ cc (luxury segment)

Tax Treatment: Luxury rate (50% excise-fixed rate for engines >3.0L)

| Step | Description | Calculation | Amount (THB) |

|---|---|---|---|

| CIF Value | Cost + shipping + insurance | Given | 3,500,000 |

| Import Duty (80%) | Luxury vehicle rate | 3,500,000 × 80% | 2,800,000 |

| Excise Tax Base | CIF + Duty | 3,500,000 + 2,800,000 | 6,300,000 |

| Excise Tax (50%) | Excise base × 50% (fixed for >3.0L) | 6,300,000 × 50% | 3,150,000 |

| Interior Tax (10%) | Excise Tax × 10% | 3,150,000 × 10% | 315,000 |

| VAT Base | CIF + Duty + Excise + Interior + Fees | 3,500,000 + 2,800,000 + 3,150,000 + 315,000 + 3,000 | 9,768,000 |

| VAT (7%) | VAT Base × 7% | 9,768,000 × 7% | 683,760 |

| Broker/Port Fees | Variable estimate | 3,000 | |

| TOTAL LANDED COST | Sum of all components | 3,500,000 + 2,800,000 + 3,150,000 + 315,000 + 683,760 + 3,000 | 10,451,760 |

| Total Tax/Duty Burden | Duty + Excise + VAT | 2,800,000 + 3,150,000 + 683,760 | 6,633,760 (189% markup) |

Bottom line: Luxury vehicles in Thailand face punitive taxation. A $100,000 USD car (3.5M THB CIF) costs 10.5M THB ($245,000+) after taxes-nearly 3× the original price.

Real-World Scenario #3: Electric Vehicle (2026 Incentive)

Vehicle: Tesla Model 3 or BYD equivalent

CIF Value: 2,000,000 THB (imported from China or Tesla import)

Type: Battery Electric Vehicle (BEV)-fully qualified

Tax Treatment: 2% excise (down from 8%, plus enhanced incentives)

| Step | Description | Calculation | Amount (THB) |

|---|---|---|---|

| CIF Value | Cost + shipping + insurance | Given | 2,000,000 |

| Import Duty (40%) | Standard duty (vehicles) | 2,000,000 × 40% | 800,000 |

| Excise Tax Base | CIF + Duty | 2,000,000 + 800,000 | 2,800,000 |

| Excise Tax (2%) | EV incentive rate (qualified BEV) | 2,800,000 × 2% | 56,000 |

| Interior Tax (10%) | Excise Tax × 10% | 56,000 × 10% | 5,600 |

| VAT Base | CIF + Duty + Excise + Interior + Fees | 2,000,000 + 800,000 + 56,000 + 5,600 + 2,500 | 2,864,100 |

| VAT (7%) | VAT Base × 7% | 2,864,100 × 7% | 200,487 |

| Broker/Port Fees | Fixed estimate | 2,500 | |

| TOTAL LANDED COST | Sum of all components | 2,000,000 + 800,000 + 56,000 + 5,600 + 200,487 + 2,500 | 3,064,587 |

| Total Tax/Duty Burden | Duty + Excise + VAT | 800,000 + 56,000 + 200,487 | 1,056,487 (53% markup) |

Bottom line: EVs benefit dramatically from 2026 incentives. A 2M THB vehicle costs 3.06M THB-far more reasonable than traditional vehicles. For a $60,000 USD Tesla (2M THB CIF), expect 3.1M THB ($72,000) final cost. The 53% markup vs. 86-189% for traditional vehicles shows clear policy incentive.

Real-World Scenario #4: Vintage Classic Car (30+ Years Old, NEW 2026 Policy)

Vehicle: 1970s Porsche 911 or Jaguar E-Type

CIF Value: 5,000,000 THB (from Europe)

Age: 50 years old (qualifies as vintage)

Tax Treatment: 45% excise (new vintage car category, effective fiscal year 2026)

Special Note: Must meet 2M THB minimum value; eligible for weekend-only use; black license plates

| Step | Description | Calculation | Amount (THB) |

|---|---|---|---|

| CIF Value | Cost + shipping + insurance | Given | 5,000,000 |

| Import Duty (45%) | Vintage car duty rate | 5,000,000 × 45% | 2,250,000 |

| Excise Tax Base | CIF + Duty | 5,000,000 + 2,250,000 | 7,250,000 |

| Excise Tax (45%) | Vintage car excise (new 2026 rate) | 7,250,000 × 45% | 3,262,500 |

| Interior Tax (10%) | Excise Tax × 10% | 3,262,500 × 10% | 326,250 |

| VAT Base | CIF + Duty + Excise + Interior + Fees | 5,000,000 + 2,250,000 + 3,262,500 + 326,250 + 3,000 | 10,841,750 |

| VAT (7%) | VAT Base × 7% | 10,841,750 × 7% | 758,923 |

| Broker/Port Fees | Fixed estimate | 3,000 | |

| TOTAL LANDED COST | Sum of all components | 5,000,000 + 2,250,000 + 3,262,500 + 326,250 + 758,923 + 3,000 | 11,600,673 |

| Total Tax/Duty Burden | Duty + Excise + VAT | 2,250,000 + 3,262,500 + 758,923 | 6,271,423 (125% markup) |

Context: This same vehicle, if imported under the old pre-2026 rules, would have faced 200%+ excise tax, making the final cost 18-20M THB (effectively impossible). The new 45% rate reduces the final cost by 40%, opening the vintage car import market for serious collectors.

Bottom line: Vintage cars now represent the most cost-effective import option for serious collectors. A $150,000 USD classic car (5M THB CIF) costs 11.6M THB ($270,000). Previously, the same car would have cost 18-20M+-or been impossible to import legally.

UNDERSTANDING THAILAND’S CAR TAX SYSTEM: WHY ARE TAXES SO HIGH?

The Government Policy Behind the Numbers

Thailand’s exceptionally high vehicle import taxes are not punitive accidents-they’re deliberate policy. The Thai government taxes car imports at 30-80% duty plus 13-50% excise specifically to:

1. Protect the Domestic Automotive Industry

Thailand hosts major manufacturing plants for Toyota, Honda, BMW, Mercedes, Nissan, and other brands. These manufacturers employ over 600,000 workers directly and indirectly. Without import barriers, cheaper imports would devastate local production.

The economics: A Japanese-made Honda Civic costs 800,000-950,000 THB locally because manufacturers benefit from preferential tariff treatment. If the same car could be imported duty-free, prices would drop to 600,000 THB, collapsing local assembly plant economics.

2. Support Japanese Manufacturers (Thailand’s Primary Auto Hub)

Japan is Thailand’s primary automotive partner:

- Toyota Assembly Thailand: ~500,000 vehicles/year

- Honda Manufacturing: ~300,000 vehicles/year

- Nissan and Isuzu: Combined ~250,000 vehicles/year

FTA implications: Japanese vehicles manufactured in Thailand receive preferential export rates to other ASEAN countries. If imports were easy, this advantage disappears.

3. Generate Government Revenue

Vehicle import taxes contribute ~30 billion THB annually to Thailand’s national budget-roughly 3% of all tax revenue. The 2026 vintage car policy alone is projected to generate 1-2 billion THB additional revenue.

4. Incentivize Environmental Compliance (2026 CO₂-Based System)

The 2026 excise tax overhaul shifts from “engine size only” to “CO₂ emissions performance,” explicitly incentivizing:

- Electric vehicles (2% excise)

- Hybrids (6-26% excise, depending on emissions)

- Eco-friendly ICE cars with low CO₂ (13% excise)

- Gas guzzlers with high emissions (34% excise)

This is Thailand’s primary climate policy tool for transportation.

5. Position Wealthy Expats/Collectors as Target Market (Not Mass Importers)

The vintage car policy and EV incentives show the government’s priorities: attract high-net-worth individuals (collectors, corporate expats) while discouraging average car purchases from being imported.

2026 TAX RATES: THE COMPREHENSIVE BREAKDOWN

Standard Passenger Vehicles (1.0L – 3.0L, Gasoline/Diesel)

Thailand’s 2026 excise tax structure for internal combustion engine vehicles is based on CO₂ emissions performance, not just engine size. This represents a fundamental shift from previous “engine displacement only” models.

| CO₂ Emissions (g/km) | Excise Tax Rate | Typical Vehicles | 2026-27 Timeline |

|---|---|---|---|

| ≤ 100 g/km (ultra-efficient) | 13% | Hybrid-like ICE, eco-optimized sedans | 2026-27: 13%, 2028-29: 14%, 2030: 15% |

| 101-120 g/km (efficient) | 22% | Standard sedans (1.5-2.0L with modern emissions) | 2026-27: 22%, 2028-29: 24%, 2030: 26% |

| 121-150 g/km (moderate) | 25% | Larger sedans, small SUVs | 2026-27: 25%, 2028-29: 27%, 2030: 29% |

| 151-200 g/km (high) | 29% | Sport sedans, large SUVs | 2026-27: 29%, 2028-29: 31%, 2030: 33% |

| > 200 g/km (very high) | 34% | Performance cars, large gas-heavy SUVs | 2026-27: 34%, 2028-29: 36%, 2030: 38% |

| > 3,000 cc (engine displacement) | 50% | Luxury cars: Mercedes, BMW, Porsche, Range Rover | Fixed rate regardless of year |

Key Insight: A 2.0L sedan with modern emissions control (~110 g/km CO₂) pays 22% excise. The same engine in a larger SUV with higher emissions (~170 g/km) pays 29% excise-a 7-percentage-point difference before import duty and VAT compound it further.

Hybrid & Plug-In Hybrid Vehicles (HEV & PHEV)

Hybrids receive significant tax advantages under 2026 rules, with rates 40-60% lower than comparable gasoline vehicles.

| Vehicle Type | Electric Range / CO₂ | Excise Tax Rate | Timeline |

|---|---|---|---|

| Hybrid Electric (HEV) | CO₂ < 100 g/km | 6% | 2026-27: 6%, 2028-29: 8%, 2030: 10% |

| HEV | CO₂ 101-120 g/km | 9% | 2026-27: 9%, 2028-29: 11%, 2030: 13% |

| HEV | CO₂ 121-150 g/km | 14% | 2026-27: 14%, 2028-29: 16%, 2030: 18% |

| HEV | CO₂ 151-200 g/km | 19% | 2026-27: 19%, 2028-29: 21%, 2030: 23% |

| HEV | CO₂ > 200 g/km | 26% | 2026-27: 26%, 2028-29: 24%, 2030: 28% |

| Plug-in Hybrid (PHEV) | ≥ 80 km electric range | 5% | Qualified only; non-compliant: 10-15% |

| PHEV | < 80 km electric range | 10% | Lower incentive for shorter range |

| PHEV | Engine > 3,000 cc | 30% | Luxury PHEV sport cars |

| Mild Hybrid (MHEV) | CO₂ < 100 g/km | 10% | If BOI-qualified; otherwise taxed as ICE |

Why it matters: A Toyota Prius (hybrid, ~90 g/km CO₂) pays 6% excise vs. a Honda Civic (ICE, ~110 g/km) paying 22% excise. On a 1.5M THB vehicle, this represents 240,000 THB savings before VAT and additional compounding.

Electric Vehicles (BEV): The 2026 Game-Changer

Battery Electric Vehicles receive the most aggressive incentives-a policy signal that Thailand is serious about EV adoption.

| Vehicle Type | Requirements (Qualified) | Excise Tax Rate | Notes |

|---|---|---|---|

| BEV (Battery Electric) | – Thai-made batteries (pack assembly minimum) – 3 of 6 ADAS systems – Meets safety standards | 2% | Most significant benefit; effective 2026 onwards |

| BEV | Non-qualified (imports without Thai battery/ADAS) | 10% | Still better than comparable ICE |

| BEV with > 3,000 cc equivalent | Luxury/performance EVs | 10% | No “super-luxury” rate; caps at 10% |

Example: A qualified BEV (Tesla, BYD, or locally-assembled Chinese EV meeting battery requirements) pays 2% excise. An equivalent 2.0L ICE vehicle pays 22% excise-an 11x difference. For a 2M THB vehicle, this saves 400,000 THB in excise tax alone, before VAT multipliers amplify savings further.

Vintage Cars (30-100 Years Old): New 2026 Category

This is the headline policy change that transforms classic car collecting in Thailand.

| Eligibility Criteria | Requirement | Details |

|---|---|---|

| Age | 30-100 years old | Vehicles manufactured between 1896-1996 (as of 2026) |

| Minimum Value | ≥ 2,000,000 THB | Must meet international valuation standard |

| Vehicle Type | Passenger car, station wagon, bus (≤10 seats), or racing car | Pickups, motorcycles excluded |

| Condition | Fully assembled; proper certification | No “project cars” in pieces |

| Excise Tax Rate | 45% | Down from previous 200%+ (effective fiscal year 2026) |

| Usage Restrictions | Weekend/public holiday use only | Black license plates; weekday driving prohibited without special permit |

| Special Use Option | Restoration workshops (2-year window) | Can import, restore, and re-export with partial tax refund |

Policy Context: Thailand aims to position itself as Asia’s premier vintage car hub, similar to how the UK and Switzerland serve Europe. The 45% rate generates revenue (~1-2B THB annually) while creating opportunities for:

- International collector events

- Restoration industry jobs (~2,000 estimated jobs)

- High-net-worth expat attraction

- Tourism (classic car exhibitions)

Real Impact: A classic 1970s Porsche 911 (5M THB CIF) previously cost 18-20M+ THB to import (often making it illegal). Now costs 11.6M THB-making serious collecting financially feasible.

Pickup Trucks (Commercial & Passenger)

Pickup trucks receive differentiated treatment based on type and emission performance.

| Pickup Category | CO₂ Rating | Excise Tax | Special Notes |

|---|---|---|---|

| No-Cab Pickup (commercial) | CO₂ ≤ 185 g/km | 3% (Gas/Diesel) / 2% (B20 Biodiesel) | Lowest tax category |

| No-Cab | CO₂ 186-200 g/km | 4% / 3% | |

| No-Cab | CO₂ > 200 g/km | 5% / 4% | |

| Space-Cab Pickup | CO₂ ≤ 185 g/km | 4% / 3% | Mid-tier commercial |

| Double-Cab Pickup (passenger-focused) | CO₂ ≤ 185 g/km | 8% / 6% (B20) | Higher rate (more passenger-oriented) |

| Double-Cab | CO₂ 186-200 g/km | 10% / 9% | |

| Double-Cab | CO₂ > 200 g/km | 13% / 12% | |

| Pickup (Any Type) | Engine > 3,250 cc | 50% | Fixed rate (luxury pickups) |

| BEV Pickup | Qualified | 2% | Follows BEV incentives |

Why the differentiation: No-cab pickups (pure commercial use) are taxed at 3-5%, while double-cab pickups (passenger use) face 8-13%. This discourages converting commercial pickups into passenger vehicles through aesthetic modifications.

STEP-BY-STEP IMPORT PROCESS: FROM DECISION TO REGISTRATION (8-16 WEEKS)

Phase 1: Pre-Import Preparation (Weeks 1-4)

Week 1-2: Verify Eligibility & Gather Documentation

Step 1: Confirm Vehicle Eligibility

Not all vehicles qualify for import. Verify:

- Age: Generally ≤ 5 years (except vintage 30-100 years)

- Emissions compliance: Must meet Thailand’s Euro standards (Euro 5 or ASEAN equivalent)

- Safety standards: Must be certified for original market

- Recall status: Vehicle must not be subject to major outstanding safety recalls in origin country

Action items:

- Obtain vehicle registration from country of origin

- Verify emission test results (Euro 5 minimum)

- Check manufacturer specifications for emissions rating

- Confirm no active safety recalls

Step 2: Gather Core Documentation (6 documents required)

| Document | Issued By | Timeframe | Cost |

|---|---|---|---|

| Vehicle Registration | Original owner’s country vehicle authority | Often already in hand | Usually included |

| Proof of Ownership (6+ months history) | Issuing authority (tax office, DMV, equivalent) | 5-10 business days if needed | Variable |

| International Driving Permit / Passport | Thai consulate or issuing country | At hand or 2-4 weeks | 300-800 THB or equivalent |

| Bill of Lading or Airway Bill | Shipping company | Issued upon shipment | Included in shipping cost |

| Commercial Invoice | Seller or dealer | At sale point | Part of transaction |

| Insurance Certificate | Insurer | Upon shipment | 3,000-8,000 THB (transit insurance) |

Cost summary (pre-import phase): 5,000-15,000 THB in documentation/fees

Week 2-3: Apply for Import Permit from Ministry of Commerce

Critical timing note: Import permit must arrive before the vehicle does. Failure to obtain pre-approval will result in shipment being held in customs (additional storage charges: 500-1,500 THB daily).

Process:

- Submit application to Thailand Ministry of Commerce, Department of Foreign Trade

- Contact: ขสมช (Thai abbreviation)

- Method: In-person at Bangkok office OR via customs broker (recommended)

- Required documents: Passport, vehicle registration, proof of residence in Thailand (if applicable)

- Application review (typically 2-4 weeks)

- Committee evaluates: Importer identity, vehicle specifications, import rationale

- For personal use: Simpler approval pathway

- For business: Additional documentation required

- Approval letter issued (permission to proceed with shipping)

Cost: 2,000-4,000 THB if handled through customs broker; free if DIY (but time-intensive)

Outcome: You receive import permit number, which is required to declare shipment at customs.

Week 3-4: Arrange Shipping

Shipping method options:

| Method | Duration | Cost (Japan to Bangkok) | Temperature Control | Best For |

|---|---|---|---|---|

| Sea Freight (Full Container) | 25-35 days | 150,000-250,000 THB | Standard | Multiple vehicles, budget-conscious |

| Sea Freight (LCL – Less Than Container Load) | 30-40 days | 100,000-180,000 THB | Standard | Single vehicles, cost-conscious |

| Air Freight | 7-10 days | 350,000-600,000 THB | Climate-controlled | Vintage cars, urgent situations |

| Roll-on Roll-off (RoRo) | 15-25 days | 120,000-180,000 THB | Minimal | Standard modern cars |

Recommended: Sea freight LCL (40-50 day total, reasonable cost, sufficient for non-perishable vehicles)

Key requirement: Obtain Bill of Lading (B/L) from shipping company. This document proves shipment and is mandatory for customs clearance.

Phase 2: Shipping & Transiting (Weeks 5-9)

Week 5-7: Vehicle in Transit

Your vehicle is in transit. Timeline varies:

- Sea freight: 25-35 days typical

- During transit: Continuously insured (transit insurance you purchased earlier)

- Shipping company provides: Tracking updates, container number, expected arrival date

What you do: Coordinate with customs broker to prepare electronic declarations

Week 8-9: Arrival at Thai Port

Vehicle arrives at Port of Laem Chabang (Bangkok Port) or alternative Thai port.

Customs notification: Shipping company notifies customs authority; your broker receives notification

Critical action: Broker must submit Goods Import Declaration (GID) to Thai Customs within 15 days of arrival or vehicle faces storage penalty (500-1,500 THB/day)

Phase 3: Customs Clearance (Weeks 10-12)

Week 10-11: Customs Assessment & Duty Calculation

Process:

- Broker submits GID (Goods Import Declaration via e-Customs system)

- Document includes: Bill of lading number, CIF value, vehicle specs, import permit number

- Cost: Included in broker fees (1,500-3,000 THB)

- Customs inspects vehicle (1-2 days)

- Physical inspection at port/warehouse

- Verification: VIN, engine number, specifications match documentation

- Customs photographs vehicle (standard procedure)

- Customs assesses CIF value (important: they may challenge your declared value)

- Customs has reference values database

- If your CIF seems too low, they reassess upward

- If you disagree: You can request “Binding Tariff Classification” ruling (costs 5,000-10,000 THB, takes 10-20 days)

- Tax calculation (automated by customs system)

- System applies: Import duty rate + excise rate + VAT + interior tax (if applicable)

- Breakdown provided to you

- You have 10 days to pay or file objection

Week 11-12: Tax Payment & Release

Payment options:

- Direct payment to Thai Customs

- Via bank transfer (Bangkok Bank, Kasikornbank, or Thai Military Bank)

- Customs provides account details with tax bill

- Broker handles payment (typical for non-DIY importers)

- You reimburse broker within 5 days of landing

- Broker submits payment receipt to customs

- Payment deadline: 10 days from tax assessment (penalty: 1.5% interest/month if late)

Upon payment: Customs releases vehicle

Release timeline: Same day or next business day after payment confirmed

Cost summary (customs phase): 500,000-3,000,000+ THB (depending on vehicle; see cost scenarios earlier)

Phase 4: Post-Clearance & Vehicle Registration (Weeks 13-16)

Week 12-14: Transport to Thailand & Final Documentation

What happens:

- Vehicle is released from customs custody

- Broker or shipping company arranges transport to your location (Bangkok, Chiang Mai, etc.)

- Transport cost: 5,000-25,000 THB (depending on distance)

Your actions:

- Arrange temporary vehicle storage (if needed)

- Begin Land Transport Office registration process

- Arrange insurance

Week 15-16: Land Transport Office Registration

Location: Land Transport Office (กรมการขนส่ง) – regional office in your province

Process:

- Prepare documents:

- Passport (copy + original for inspection)

- Customs release document (provided at clearance)

- Import permit (copy)

- Proof of residence (utility bill, rental agreement, company letter)

- Insurance certificate (pre-arranged)

- Vehicle inspection appointment confirmation

- Vehicle inspection by Land Transport Office (1-2 days)

- Inspector verifies VIN, engine number, color, features

- Inspector confirms emissions compliance (engine check)

- Inspector issues Inspection Certificate (Form 1)

- Registration at Land Transport Office (same appointment or next day)

- Submit all documents

- Pay registration fee (3,000-5,000 THB)

- Receive temporary registration (valid 30 days)

- Receive vehicle registration document (โฉนด)

- Receive license plates

- First tax payment (annual road tax)

- Calculated by engine size (1.5 THB per cc)

- Calculated by vehicle age (discount after 5 years)

- Example: 1.5L engine (1,500 cc) = 1,500 × 1.5 = 2,250 THB/year

Timeline: 7-14 days total (depending on office efficiency and appointment availability)

Total Phase 4 cost: 10,000-30,000 THB

Total Timeline Summary

| Phase | Duration | Key Activities | Cost |

|---|---|---|---|

| Phase 1: Pre-Import | Weeks 1-4 | Documentation, permits, shipping | 7,000-15,000 THB |

| Phase 2: Shipping Transit | Weeks 5-9 | Vehicle in transit, broker coordination | Shipping cost (100K-250K THB) |

| Phase 3: Customs Clearance | Weeks 10-12 | Import assessment, tax payment, release | Taxes (500K-3M+ THB) |

| Phase 4: Registration | Weeks 13-16 | Transport, Land Transport Office, plates | 15,000-30,000 THB |

| TOTAL TIMELINE | 8-16 weeks | From decision to driving legally | Shipping + Taxes + Fees |

Variables affecting timeline:

- Red Line customs flag (+5-10 days): If customs deems shipment “high-risk,” additional documentation requested

- Delayed imports permit (+2-4 weeks): If Ministry of Commerce approval delayed

- Land Transport Office backlog (+1-2 weeks): Busy seasons in Bangkok/Chiang Mai

- Vehicle inspection failures (+3-7 days): Rare, but equipment failures delay inspection

TEMPORARY VS. PERMANENT IMPORT: UNDERSTAND THE DIFFERENCE (CRITICAL FOR EXPATS)

Temporary Import (Maximum 6 Months)

Use case: You’re relocating temporarily, planning to take the car when you leave, or testing Thailand before committing to permanent import.

| Aspect | Temporary Import Details |

|---|---|

| Tax obligation | No import duty or excise tax; only minimal fees (5,000-8,000 THB) |

| Permit type | “Temporary Admission” or “ATA Carnet” (international transit document) |

| Duration allowed | Maximum 6 months continuously; renewable once (12 months total) |

| Requirements | Vehicle must be re-exported or duties paid within timeframe |

| Vehicle use | Restrictions depend on visa type; generally permitted for personal use |

| Insurance | Standard international transit insurance (3,000-8,000 THB) |

| Registration | Temporary registration only (no Thai license plates) |

| Cost advantage | Save 500,000-3,000,000+ THB in taxes if re-exporting |

Process:

- Apply for Temporary Admission permit at customs (Bangkok) – 2-5 business days

- Obtain ATA Carnet (if vehicle has international triptyque) – 1-3 days

- Import vehicle under bond (insurance guarantee)

- Drive with temporary registration; re-export or convert to permanent

Key restriction: You cannot register vehicle permanently while on temporary admission. If you decide to stay longer, you must either:

- Pay all import taxes to convert to permanent import, OR

- Re-export vehicle and receive refund of temporary import bond

Permanent Import (Long-term Residence)

Use case: You’re relocating permanently, planning to stay 1+ year, or establishing long-term residence.

| Aspect | Permanent Import Details |

|---|---|

| Tax obligation | Full import duty (30-80%) + excise tax (13-50%) + VAT (7%) – see cost scenarios |

| Permit type | Standard import permit from Ministry of Commerce |

| Duration | Permanent; vehicle remains in Thailand indefinitely |

| Vehicle use | Full legal use; can register with Thai license plates |

| Insurance | Standard vehicle insurance (3,500-8,000 THB/year) |

| Registration | Permanent Thai registration; license plates valid indefinitely |

| Cost impact | Pay full taxes upfront (500K-3M+ THB depending on vehicle) |

| Residency requirement | Helpful but not required; Thai work permit or extended visa preferred for approval |

Process:

- Obtain import permit (Ministry of Commerce) – 2-4 weeks

- Arrange shipping and declare at customs (GID) – 1 day

- Customs assessment and tax calculation – 2-3 days

- Pay taxes in full – 1 day

- Customs releases vehicle – 1 day

- Land Transport Office registration – 5-7 days

- Receive Thai license plates and permanent registration

Temporary vs. Permanent: Head-to-Head Comparison

| Factor | Temporary (6 months) | Permanent |

|---|---|---|

| Import taxes | ~1% of vehicle value | 40-190% of vehicle value |

| Process timeline | 3-5 weeks | 12-16 weeks |

| Use flexibility | Restricted by visa/permit | Full legal use |

| Registration | Temporary only | Permanent Thai plates |

| Exit strategy | Re-export with tax refund | Vehicle stays in Thailand |

| Cost if staying beyond 6 months | Must pay back taxes (often penalties) + conversion fees | Single upfront payment |

| Insurance complexity | International policy required | Standard Thai insurance |

Decision framework: Choose temporary if:

- You’re testing Thailand residence (< 1 year commitment)

- You plan to re-export vehicle when leaving

- You want to defer tax payment pending residency confirmation

Choose permanent if:

- You have 1+ year residency (education, work, marriage)

- You plan to drive in Thailand long-term

- You want to simplify ownership and insurance

IMPORTER TYPES: SEGMENTED GUIDANCE FOR YOUR SITUATION

Type 1: Foreign Expats / Visa Holders

Your situation: You’re relocating to Thailand on a non-immigrant visa (education, work, marriage, retirement) with plans to drive.

Required Documentation

| Document | Issued By | Timeframe to Obtain | Why Required |

|---|---|---|---|

| Non-immigrant visa (extension) | Thai Immigration Bureau | Already in hand | Proof of legal residence |

| Work permit (if employed) | Thai Ministry of Labor | 3-5 business days if renewing | Required for employment verification |

| Proof of residence | Utility company, landlord, employer | At hand (utility bill, rental agreement) | Establishes Thai address |

| Passport (copy + scan) | Your country’s issuing authority | At hand | Identity verification |

| Foreigner registration card (TM. 30) | Local Thai police station | 90 days after arrival | Legal residence documentation |

Special Privileges & Restrictions

Privileges:

- One personal vehicle import allowed (per importer, no limit per household)

- Temporary import available if testing residence

- Eligible for all 2026 incentives (EV, vintage cars)

Restrictions:

- Vehicle registered to you personally (not corporate)

- Cannot import vehicles for business/resale (requires commercial license)

- Some provinces (Bangkok) restrict vehicle registration for non-residents (you must have Thai address)

Timeline & Cost

- Timeline: 10-16 weeks (standard permanent import pathway)

- Documentation cost: 5,000-10,000 THB

- Shipping cost: 100,000-250,000 THB (depending on origin, method)

- Import taxes: 500,000-3,000,000+ THB (depends on vehicle)

- Registration & plates: 10,000-20,000 THB

- Total cost: 615,000-3,280,000 THB

Example: 40-year-old American expat on work permit imports 1.5L Honda Civic (1.2M THB CIF):

- Taxes: ~995,000 THB (from earlier scenario)

- Other costs: ~150,000 THB

- Total: ~1,145,000 THB (or ~$26,700 for a $40K car)

Type 2: Returning Thai Nationals

Your situation: You’re a Thai citizen who lived abroad and are returning with your own vehicle.

Special Advantages

| Advantage | Details |

|---|---|

| Streamlined documentation | Thai passport sufficient; no visa requirement |

| Proof of overseas residence | Utility bills, tax records, visa stamps serve as documentation |

| Embassy verification option | Can obtain letter from Thai embassy in origin country confirming residence |

| Often faster approval | Ministry of Commerce approval typically 1-2 weeks (vs. 2-4 weeks for foreigners) |

| One vehicle duty-free pathway | Some sources indicate Ministry of Commerce may waive import duty on one returning national vehicle (verify current policy) |

Required Documentation

| Document | Notes |

|---|---|

| Thai passport | Original + copies |

| Proof of overseas residence (6+ months) | Utility bills, tax records, rental agreement, work contract |

| Vehicle registration in your name | Foreign country registration |

| Embassy/consulate confirmation letter | Optional but helpful; confirms period of residence |

Typical Timeline

- Process: Slightly faster than foreign expats (1-2 weeks approval vs. 2-4 weeks)

- Total: 9-14 weeks (1-2 weeks saved in approvals)

Advantage: As a Thai national, you may face less scrutiny from Land Transport Office during registration.

Type 3: Business/Commercial Importers

Your situation: You’re importing vehicles for business purposes (company vehicle fleet, commercial imports, dealer operations).

Different Regulatory Pathway

Commercial imports follow different rules than personal imports:

| Aspect | Personal Import | Commercial Import |

|---|---|---|

| Permit type | Ministry of Commerce personal import permit | Department of Trade-registered commercial import license |

| VAT treatment | 7% VAT paid on import | VAT deductible (business input tax) |

| Resale restrictions | Cannot resell vehicle within 1 year (penalty: back taxes + fines) | Can resell immediately |

| Documentation | Personal visa + residence proof | Company registration, tax ID, import facility license |

| Import limit | 1 per person (though interpretations vary) | Multiple vehicles per company; limited by facility capacity |

Required Documentation

- Company registration (Ministry of Commerce)

- Tax ID certificate (Thai Revenue Department)

- Import facility license (if importing regularly) – 10,000-25,000 THB to obtain

- Company bank statements (proof of financial stability)

- List of authorized persons within company to conduct imports

- E-Customs registration (mandatory for all commercial imports)

VAT Advantage

If you’re a registered business, VAT on import duties becomes deductible input tax, potentially reducing your effective tax cost by 25-35% depending on your business VAT position. This is substantial for bulk imports.

Example: A 1M THB vehicle import (assuming 500K THB total duty + VAT):

- Personal importer: Pays full 500K THB + VAT

- Commercial importer: Pays 500K THB but recovers VAT (potentially 35K+ THB refund)

Timeline & Process

- Commercial license approval: 2-4 weeks (if new to importing)

- E-Customs registration: 1-2 weeks

- Per-vehicle import process: 10-14 weeks (similar to personal, but with different VAT tracking)

Type 4: Vintage Car Collectors (2026 NEW PATHWAY)

Your situation: You’re a classic car enthusiast with 1+ vintage vehicles (30-100 years old) meeting the 2M THB minimum value.

Special 2026 Vintage Car Import Advantages

Eligibility criteria (must meet ALL):

- Vehicle is 30-100 years old

- CIF value ≥ 2,000,000 THB

- Fully assembled (not project car/parts)

- Passenger car, station wagon, bus (≤10 seats), or racing car

- Proper certification of authenticity/history

Tax advantage:

- Excise tax: 45% (vs. 50-200%+ for standard cars of pre-2026)

- Import duty: 45% (vs. 80% for standard vehicles)

Usage restrictions:

- Black license plates (special vintage designation)

- Weekend/public holiday use only

- Weekday use prohibited unless special permit obtained

- Cannot be used for commercial purposes (no taxi, uber, rental)

Documentation Requirements

| Document | Details | Critical Notes |

|---|---|---|

| Vehicle registration (origin country) | Proof of 30+ year age | Must verify manufacturing date |

| Valuation report | International valuation (≥2M THB) | Must use certified appraiser; affects tax calculation |

| Authenticity certificate | Original receipts, provenance documentation | Helps justify minimum value |

| Shipping insurance | For high-value classics | Recommend full-value coverage (5K-10K THB) |

| Customs declaration | Special vintage car form | Ministry of Commerce processes separately |

Restoration Workshop Option (2-Year Window)

Special opportunity: If you operate a restoration workshop, you can:

- Import vintage car at 45% excise rate

- Restore/modify vehicle (2-year legal window)

- Re-export vehicle with partial tax refund

- OR convert to personal use (full tax paid)

This creates business model: Import classics, restore, sell to collectors (domestic or international).

Timeline & Costs (Vintage Car Example)

Vehicle: 1970 Jaguar E-Type (5M THB CIF)

| Component | Amount | Notes |

|---|---|---|

| Valuation/appraisal | 10,000-20,000 THB | Mandatory ≥2M threshold |

| Shipping | 180,000-300,000 THB | Vintage requires extra care |

| Import permit | 3,000-5,000 THB | Same as standard |

| Import taxes | ~6,271,000 THB | See earlier scenario |

| Transport (port to location) | 15,000-25,000 THB | Often longer distances |

| Registration & plates | 10,000-20,000 THB | Special black plates |

| TOTAL | ~6,488,000 THB | ~$151,000 for $150K car |

Comparison to pre-2026: Same car would have cost 18-20M THB under old policy-making it virtually impossible.

Collector Network & Events

Thailand’s vintage car policy aligns with major international collector networks:

- Pebble Beach Concours d’Elegance (USA) – Thai participants now viable

- Concours events in Thailand – Emerging market with growing interest

- Restoration industry – Estimated 2,000+ new jobs created by policy

COMMON MISTAKES THAT COST BIG MONEY

Mistake 1: Underestimating Total Landed Cost by Excluding VAT

The error: You calculate import duty + excise, multiply by vehicle cost, and think you have the final number.

What you missed: VAT applies to (CIF + Duty + Excise + Fees), creating a compounding effect.

Real example:

- Vehicle CIF: 1M THB

- Import duty (40%): 400,000 THB

- Excise (22%): 308,000 THB

- Subtotal: 1,708,000 THB

- VAT on 1,708,000 (7%): 119,560 THB ← You likely forgot this

- Actual total: 1,827,560 THB

Many importers calculate 1,708,000 and are shocked when customs bills them 1,827,560+. Cost impact: 50,000-150,000 THB surprise bill

How to avoid: Always include the full VAT multiplication. Use the calculator examples provided earlier.

Mistake 2: Declaring CIF Value Too Low (Customs Reassessment)

The error: You list CIF as 800,000 THB to reduce taxes, but customs has reference values database showing comparable models cost 1.2M+ THB.

What happens:

- Customs flags your shipment

- Customs reassesses CIF upward (to 1.2M THB in this example)

- You’re billed on higher amount

- Penalties added (0.5-1% per month overdue on back-taxes)

- Future imports scrutinized heavily

Cost impact: 150,000-300,000 THB in back-taxes + penalties

How to avoid:

- Declare accurate CIF reflecting fair market value

- If you think declaration is low-balled, request “Binding Tariff Classification” (delays process 10-20 days but prevents later disputes)

- Maintain receipts/invoices showing fair market pricing

Mistake 3: Arriving Without Import Permit (Shipment Held at Port)

The error: You arrange shipping before Ministry of Commerce approves import permit. Shipment arrives 25-30 days later; permit still pending.

What happens:

- Vehicle held in customs warehouse (port charges: 500-1,500 THB/day)

- Customs cannot clear until permit arrives

- Storage charges accumulate daily

- Best case: 5-10 day delay costing 2,500-15,000 THB

- Worst case: 20+ day delay costing 10,000-30,000 THB

Cost impact: 2,500-30,000 THB storage charges

How to avoid: Obtain import permit before scheduling shipment. Plan timeline: Permit (2-4 weeks) → Arrange shipping → Confirm arrival date

Mistake 4: Wrong Vehicle Classification (HS Code Affects Tax Rate)

The error: You classify a vehicle as “1.6L sedan” when it’s actually registered as an SUV, or you confuse CO₂ emissions category.

What happens:

- Customs identifies wrong classification

- Duty rate changes (could be 5-15% different)

- You’re reassessed with back-taxes + penalties

- Customs requires corrected documentation

Example: If you claim 1.5L sedan (22% excise) but it’s actually 1.8L SUV with high emissions (29% excise):

- On 1.5M THB vehicle: Difference = (1.5M × 1.08 × 7%) = ~113,000 THB additional

Cost impact: 50,000-200,000 THB reclassification back-taxes

How to avoid:

- Obtain official CO₂ emissions certificate from vehicle manufacturer

- Verify exact HS code with Thai Customs prior to import (costs 5,000 THB for binding classification ruling, saves 50,000+ THB in disputes)

- Use customs broker familiar with vehicle classifications

Mistake 5: Forgetting Temporary Admission Conversion Deadline

The error: You import vehicle on temporary admission (6 months), planning to convert to permanent later. You miss the 6-month deadline and assume you can just keep driving.

What happens:

- After 6 months, you’re driving illegally

- Police stop you; vehicle impounded

- You face back-taxes (full import duty + excise retroactively)

- Penalties: 2-5× original tax amount

- Vehicle confiscation possible if not resolved

Cost impact: 500,000-3,000,000+ THB penalties + legal fees

How to avoid:

- Calendar the 6-month deadline immediately upon temporary admission approval

- Decide by month 5 whether to: (A) Extend temporary admission 6 more months, (B) Pay taxes to convert to permanent, or (C) Re-export vehicle

Mistake 6: Not Budgeting for Broker Fees (Large Hidden Cost)

The error: You estimate vehicle cost + shipping + taxes, but forget customs broker fees which compound.

What’s typically included in broker fees (1,500-3,000 THB base):

- E-Customs declaration preparation: 500-800 THB

- Goods receipt processing: 300-500 THB

- Tax coordination: 300-500 THB

- Document handling: 300-500 THB

- Storage coordination: 300-500 THB

Additional services (often unexpected):

- Red Line inspection support: +2,000-5,000 THB

- HS code classification ruling: +5,000-10,000 THB

- Tax appeals/corrections: +3,000-8,000 THB

Cost impact: 2,000-8,000 THB underestimate

How to avoid: Get written quote from broker listing all services and fees upfront.

FREQUENTLY ASKED QUESTIONS

“How much will my car cost to import from the USA?”

Quick answer: Expect final cost to be 2.0-2.5× the original price for standard vehicles, 1.5-1.7× for EVs.

Breakdown for typical $40,000 USD sedan:

- Purchase price (USD): $40,000 (~1.3M THB)

- Shipping to Bangkok: +$7,000-12,000 (~250,000-400,000 THB)

- CIF value: ~1.6-1.7M THB

- Taxes (at ~86% effective rate): ~1.4M THB

- Final cost: ~3.0M+ THB (~$70,000)

Variables:

- If EV: Reduce tax rate by 30-40%, saving 300,000-500,000 THB

- If luxury (>3L): Increase tax rate by 100-150%, adding 500,000-1M THB

- If vintage (30+ years, 2M+ value): Reduce from 189% to 125% markup, saving 40% vs. new luxury car

“Can I import an electric vehicle at lower rates?”

Yes. BEVs (Battery Electric Vehicles) that meet 2026 qualification criteria pay 2% excise tax (vs. 13-34% for comparable gasoline vehicles).

Qualification criteria:

- Thai-made battery (minimum pack assembly level)

- 3 of 6 ADAS safety systems (AEB, FCW, LKAS, LDW, BSD, ACC)

- Meets Thai safety standards

Practical impact: A 2M THB Tesla or BYD pays only ~56,000 THB excise tax vs. 400,000+ THB for a comparable gasoline vehicle. Savings of 300,000+ THB translate to final cost of 3.1M THB vs. 3.8M for comparable gas vehicle.

Real advantage: If considering Tesla Model 3 (roughly 1.9M THB CIF), final cost ~3.0M THB. Comparable gasoline sedan (1.5M THB CIF) costs ~2.2-2.3M THB. EV is only ~500K-700K THB more despite similar CIF value.

“What’s the difference between temporary and permanent import?”

Temporary (6 months maximum):

- Tax: Only ~1% of vehicle value (minimal fees)

- Use: Restricted by visa type; generally personal use

- Timeline: 3-5 weeks

- Exit strategy: Re-export and avoid taxes, OR pay full taxes to convert to permanent

Permanent (indefinite):

- Tax: 40-190% of vehicle value depending on type

- Use: Full legal use with Thai license plates

- Timeline: 12-16 weeks

- Commitment: Vehicle stays in Thailand long-term

Choose temporary if: Testing Thailand residence, planning to re-export, uncertain about long-term stay

Choose permanent if: Staying 1+ year, need legal license plates, no plans to re-export

“Can I import a car older than 5 years?”

Standard answer: No. Thailand’s import rules generally restrict personal vehicle imports to cars ≤5 years old.

Exception: Vintage cars (30-100 years old) under 2026 policy. If your car is:

- 30-100 years old

- Valued ≥2M THB

- Fully assembled (not project car)

- Passenger car, wagon, bus, or racing car

Then yes, you can import at 45% excise rate.

Why the restrictions? Thailand protects: (a) local manufacturing plants (new cars), (b) domestic used car market (5-10 year old cars), and (c) wants to avoid dumping of old pollution-heavy vehicles.

“Is it cheaper to import or buy a car in Thailand?”

Almost always cheaper to buy locally. Here’s why:

Imported car scenario (1.5M THB CIF):

- Final cost: ~2.3M THB

Locally-assembled car scenario (same model):

- Thailand retail: ~1.8-2.0M THB (lower due to manufacturer protection)

- No import taxes (vehicle already assembled domestically)

Exception: EVs might break even

- Imported EV (2M THB): Final cost ~3.1M THB

- Locally-assembled EV (similar specs): ~2.8-3.2M THB

- Roughly equivalent; personal preference on model matters more

Bottom line: For standard vehicles, buy locally. For EVs, compare specific models. For vintage cars, importing is the only option.

“How long does the entire process take?”

Standard timeline: 10-16 weeks

Breakdown:

- Weeks 1-4: Documentation & import permit (2-4 weeks typical)

- Weeks 5-9: Shipping & transit (25-35 days typical for sea freight)

- Weeks 10-12: Customs clearance & tax payment (3-5 days typical)

- Weeks 13-16: Transport & registration (5-7 days typical)

Fast track (if everything aligned): 8-10 weeks

Slow track (Red Line customs flag, permit delays): 16-20 weeks

Key delays to anticipate:

- Ministry of Commerce permit approval: 2-4 weeks (can’t skip)

- Red Line customs inspection: +5-10 days

- Land Transport Office appointment backlog: +1-2 weeks during busy season

“Do I need a customs broker or can I do it myself?”

You can DIY, but it’s not recommended. Why?

Required expertise:

- E-Customs system navigation (training required, 500 THB)

- HS code classification (one mistake costs 50K-200K THB)

- Tax calculation verification (mistakes = penalties)

- Import documentation requirements (varies by vehicle type)

- CIF valuation assessment (customs may challenge)

Typical DIY mistakes: Missing documents, wrong HS codes, undervalued CIF, missed deadlines

Broker cost: 1,500-3,000 THB (worth it to avoid 50K-100K THB in mistakes)

Recommendation: Use a broker for first import. If importing 2+ vehicles, consider learning the system and DIYing subsequent imports.

“What happens if I drive my imported car on a weekday with vintage car black plates?”

Fine and potentially vehicle confiscation.

Vintage cars imported under 2026 policy face restrictions:

- Permitted use: Weekends, public holidays, special events (with police permission)

- Prohibited use: Weekday commuting, commercial use

Penalties for violation:

- Police fine: 500-1,000 THB on-the-spot

- Potential vehicle impoundment pending compliance review

- Risk of registration revocation

Solution: If you need weekday use, apply for usage exemption (rare, granted only for special circumstances like car shows, restoration events)

“What’s happening with EV taxes after 2026?”

2026 rates (confirmed, in effect now):

- Qualified BEV: 2% excise

- PHEV (≥80 km range): 5% excise

- Unqualified EV: 10% excise

Future outlook (2027-2030):

- Likely increases to incentivize domestic manufacturing (rather than imports)

- Expected progression: 2% → 5-7% (by 2030) as local EV assembly scales

- PHEVs may shift toward higher rates (to encourage full-EV transition)

- Watch for: Government announcements (Thai Excise Department) typically in June-July each year for fiscal year updates

Action item: If importing EV in 2026, lock in 2% rate before rates rise. Monitor Thai government announcements for 2027-2028 rate changes.

YOUR IMPORT DECISION FRAMEWORK

Step 1: Confirm Your Importer Type

| You are… | Next step |

|---|---|

| Foreign expat on non-immigrant visa | Proceed to Step 2 (standard pathway) |

| Returning Thai national | Proceed to Step 2 (slightly faster approval) |

| Commercial importer | Apply for commercial import license first |

| Vintage car collector | Verify 2026 eligibility (age 30-100, value ≥2M THB) |

Step 2: Determine Vehicle Type & Tax Category

| Vehicle type | Estimated excise tax | Estimated final cost markup |

|---|---|---|

| Standard sedan (1.5-2.0L) | 22% | 85-90% |

| Luxury car (>3.0L) | 50% | 190-200% |

| Hybrid (HEV) | 6-14% | 50-60% |

| Electric vehicle (BEV qualified) | 2% | 50-55% |

| Vintage car (30-100 years, ≥2M THB) | 45% | 125% |

Use this to estimate: (Vehicle CIF × 1.5-2.0) = approximate final cost

Step 3: Calculate Your Actual Costs

Use the cost breakdown scenarios provided earlier (Scenarios 1-4) as templates for your vehicle:

- Match your vehicle type to closest scenario

- Adjust CIF value proportionally

- Add shipping cost (~200K-400K THB)

- Add broker fees (~2-3K THB)

Step 4: Decide: Temporary vs. Permanent Import

Temporary if:

- Unsure about long-term Thailand residence

- Testing Thailand before committing

- Returning home within 12 months

- Want to defer tax payment

Permanent if:

- Committed to 1+ year in Thailand

- Have work permit or extended visa

- Want Thai license plates for full use

- Ready to pay taxes upfront

Step 5: Begin Documentation (3-6 Months Before Arrival)

- Gather vehicle registration & ownership proof

- Arrange international shipping quotes

- Identify customs broker (reference networks, companies)

- Apply for import permit (Ministry of Commerce)

- Secure transit insurance

- Schedule shipment

Step 6: Budget Total Cost

| Category | Estimated cost |

|---|---|

| Import permit & documentation | 5,000-15,000 THB |

| Shipping | 100,000-400,000 THB |

| Customs broker fees | 2,000-5,000 THB |

| Import taxes (vehicles vary) | 500,000-3,000,000 THB |

| Port/transport/registration | 20,000-50,000 THB |

| TOTAL | 627,000 – 3,470,000 THB |

This is your realistic budget range. Anything less suggests you’ve missed a cost component.

RESOURCES & OFFICIAL CONTACTS

Government Agencies

Thai Customs (Royal Thai Customs Department)

- Website: customs.go.th

- Address: Bangkok, Samrong Road, Suanluang District

- Service: HS code classification rulings, tariff rate confirmation, appeals

- Cost: Binding tariff classification ~5,000 THB; takes 10-20 days

Ministry of Commerce (Department of Foreign Trade)

- Function: Import permit approvals for vehicles

- Website: dft.go.th

- Service: Personal vehicle import applications

- Timeline: 2-4 weeks approval

Land Transport Office (Department of Land Transport)

- Function: Vehicle registration and licensing

- Locations: Regional offices nationwide

- Service: Final registration, license plates

- Timeline: 5-7 days after customs release

Thai Excise Department

- Function: Excise tax policy, rate clarifications

- Website: excise.go.th

- Service: 2026 policy clarifications, vintage car inquiries

- Email: Available via website for formal requests

Recommended Customs Brokers (Bangkok-based)

Professional brokers typically charge 1,500-3,000 THB for standard vehicle imports; larger operations (5+ imports/year) may negotiate rates.

Selection criteria:

- Licensed with Thai Customs

- 3+ years experience with vehicle imports

- English-speaking staff

- Fixed fee quote (not percentage-based)

- References from prior vehicle importers

Online Tools & Calculators

Thai Customs Tariff e-Service

- Website: tariff.customs.go.th

- Function: Look up exact HS codes and duty rates

- Accuracy: Official government source; reliable

Thailand National Single Window (Thai NSW)

- Website: thainsw.com

- Function: E-customs system login, shipment tracking

- Access: Requires e-Customs trader registration

FINAL WORD: TIMING MATTERS

2026 is an exceptional year for vehicle imports:

- Vintage car policy (45% rate) – Opens classic car market for first time since 2019

- EV incentives (2% rate) – Dramatically favors electric vehicles

- CO₂-based excise system – Rewards efficient, low-emission vehicles

- Transparency improvements – Thai NSW system streamlines customs process

Future outlook: Rates will likely increase after 2027 as government generates revenue from 2026-27 and domestic EV manufacturing scales. The 2% BEV excise rate may rise to 5-7% by 2028-29.

Recommendation: If you’re seriously considering vehicle import, act within 2026. Rates and policies are optimal now. Delaying into 2027-2028 will cost more.

This guide reflects official Thai Customs regulations, 2026 government policy announcements, and verified cost scenarios as of January 2026. For final confirmation on specific vehicles or situations, verify with Thai Customs or a licensed customs broker before committing to import.

Your journey to Thailand with your car starts with understanding the real cost. This guide has given you the numbers. Now make your decision with full information.