Thailand has emerged as one of Asia’s premier destinations for expatriates, attracting digital nomads, retirees, and working professionals from around the globe. With a population of approximately 3 million foreign residents, understanding healthcare access and insurance requirements has become essential for anyone planning an extended stay or relocation. Unlike Thai citizens who benefit from the Universal Health Coverage (UHC) scheme, expatriates and foreigners must navigate a distinct healthcare landscape that requires careful planning, strategic insurance selection, and awareness of specific visa requirements.

The Thai healthcare system offers exceptional value, combining world-class medical facilities with some of the most affordable treatment costs in the region. However, accessing quality private healthcare-the preferred choice for most expats-requires adequate health insurance coverage. This comprehensive guide explores everything you need to know about Thai health insurance for expats, from understanding the healthcare system and identifying the best providers to navigating visa requirements and comparing insurance costs.

Understanding Thailand’s Healthcare System

Two Parallel Healthcare Systems

Thailand operates two distinct healthcare systems: public and private. Thai citizens and eligible residents access public healthcare through the Universal Coverage Scheme, a government-funded program established in 2001. For expatriates and foreigners without employment-based coverage, this pathway remains largely inaccessible. Instead, expats must rely on either direct out-of-pocket payments or private health insurance.

The public healthcare system, while affordable, presents challenges for English-speaking expats. Hospitals require Thai language proficiency, experience longer wait times, and operate primarily during business hours. Emergency services on weekends may be limited, and non-essential services often involve extended queues.

Why Private Healthcare Dominates for Expats

Private healthcare facilities in Thailand have become the default choice for expatriates for compelling reasons. Thailand’s private hospitals rival international standards, staffed with English-speaking physicians, specialists, and nurses trained at world-renowned institutions. Major metropolitan hospitals including Bumrungrad International, Samitivej, Bangkok Hospital, and Chiang Mai Ram operate 24/7 with cutting-edge diagnostic equipment and surgical capabilities.

The quality-to-cost ratio distinguishes Thailand from Western nations. A standard outpatient consultation costs between ฿1,500–3,000 ($50–100 USD), emergency room visits range from ฿5,000–15,000 ($170–500 USD), daily hospitalization costs ฿10,000–25,000 ($335–835 USD), and major surgery expenses fall between ฿100,000–500,000+ ($3,350–16,750+ USD). These prices represent a fraction of comparable North American or European treatment costs.

Public Healthcare Access for Expats

While complex, public healthcare remains an option for expats meeting specific criteria. Foreigners employed by private companies can access public hospital coverage through Thailand’s Social Security Scheme, funded by payroll contributions. However, this coverage does not extend to dependents, necessitating separate private insurance for family members. Civil service employment and long-term residency under specific visa categories may also provide public healthcare eligibility.

Uninsured foreigners in Thailand can access emergency services at public hospitals but will be billed directly after treatment. Most public hospitals require payment guarantees before admitting patients, creating significant barriers for truly emergent situations.

Navigating Visa Requirements and Insurance Mandates

Non-Immigrant O-A Visa (Retirement Visa)

The Non-Immigrant O-A visa, Thailand’s primary retirement visa for those aged 50 and above, carries mandatory health insurance requirements that have evolved significantly. As of October 1, 2021, the Thai government substantially increased requirements to strengthen financial safeguards for medical care.

Current O-A Visa Requirements:

- Minimum total coverage: ฿3,000,000 (approximately $100,000 USD)

- Minimum outpatient coverage: ฿40,000

- Minimum inpatient coverage: ฿400,000

- Policy must be valid for the entire duration of stay

- Coverage must be a specialized medical insurance policy; general travel insurance is not accepted

Importantly, these requirements apply specifically to those initially applying for O-A visas abroad. Those holding pre-October 2021 Non-Immigrant O visas (without the “A” designation) and renewing in Thailand are not required to maintain health insurance-a critical distinction for early arrivals.

Non-Immigrant O-X Visa (Long-Term Retirement)

The Non-Immigrant O-X visa offers a 10-year retirement solution for those aged 50 and above. Insurance requirements remain stringent:

- Minimum coverage: USD 100,000

- Must cover both inpatient and outpatient treatment

- Policy validity must extend throughout the visa period

Long-Term Resident (LTR) Visa

Thailand’s newest Long-Term Resident visa category, introduced in 2023, attracts qualified professionals, remote workers, and retirees. Health insurance mandates for LTR visa holders include:

- Minimum coverage: USD 50,000

- Coverage must include both inpatient and outpatient treatment

- Outpatient benefits are not subject to overall annual limits

- Policy must remain valid with at least 10 months of coverage

Financial Alternatives to Insurance

Expats facing insurance restrictions due to age or pre-existing conditions can substitute insurance requirements with bank deposits:

- O-A visa alternative: ฿3,000,000 deposit in a Thai bank, maintained for 12 months minimum

- LTR visa alternative: USD 100,000 deposit maintained throughout the visa period

This financial pathway requires maintenance of the deposit for the visa duration and prevents withdrawal without risking visa status.

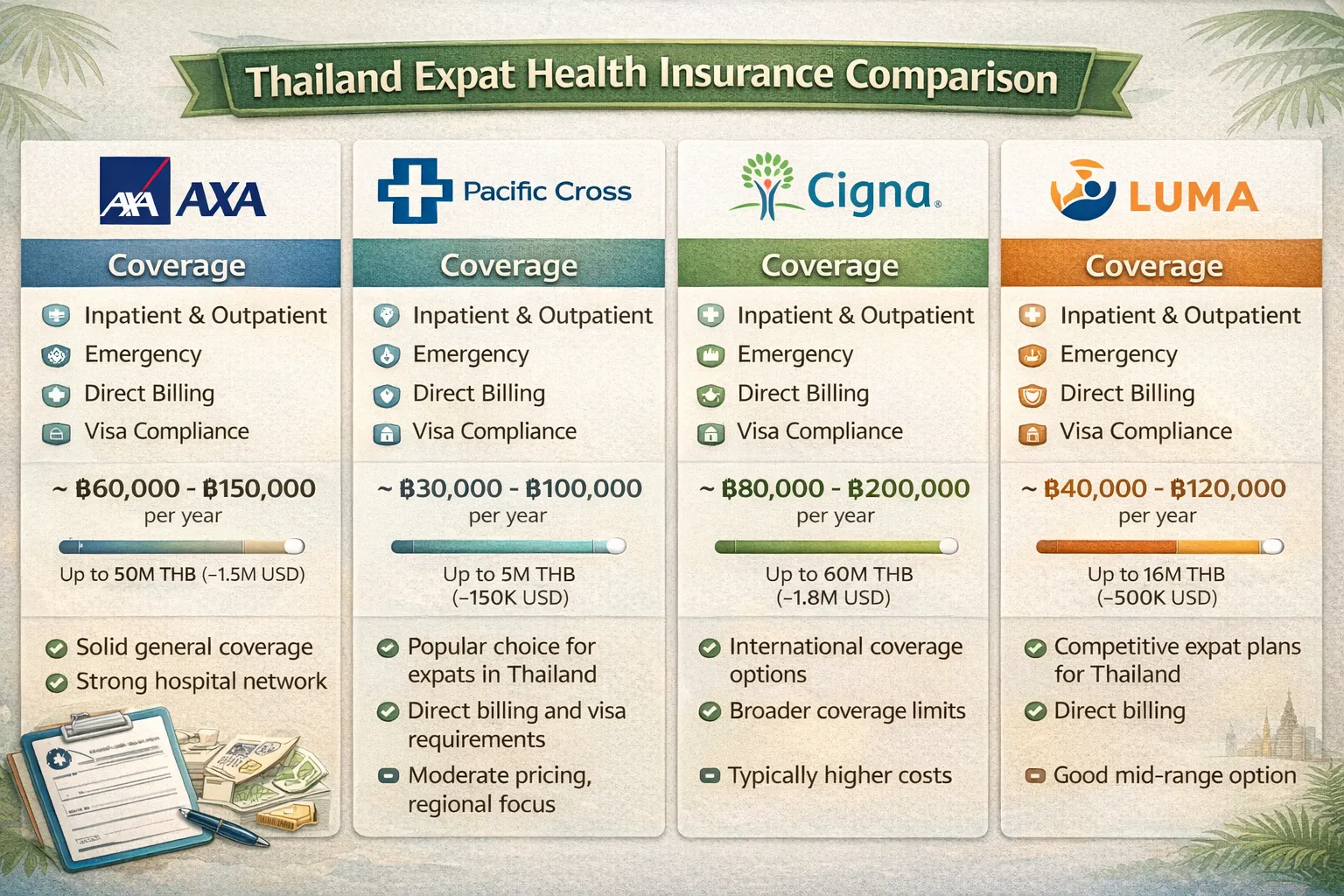

Top Health Insurance Providers for Expats in Thailand

AXA Insurance Thailand

Coverage Options:

- SmartCare Essential: Flexible plans from ฿1M to ฿10M coverage with customizable deductibles (฿0 to ฿200k)

- SwitchCare: Comprehensive Asia-wide coverage ranging from USD 105,000 to USD 900,000

- International Exclusive: Premium worldwide protection from USD 1,400,000 to USD 2,800,000

Strengths:

- Extensive hospital network across Thailand

- Strong brand recognition among expats

- Maternity and full outpatient benefits available in select policies

- Guaranteed renewability

Pricing: Basic plans start around ฿35,000 annually; comprehensive coverage ranges ฿60,000–120,000 per year

Pacific Cross Health Insurance

Coverage Options:

- Multiple plan tiers with flexible deductibles

- IPD (inpatient) and OPD (outpatient) coverage combinations

- Specialized plans for specific needs

Strengths:

- 65+ years of experience in Asian healthcare insurance

- 24/7 customer support

- Extensive in-network provider access

- Excellent reputation for claims processing

- Direct billing at partner hospitals

Pricing: Plans typically range from ฿50,000–120,000 annually depending on age and coverage level

Luma Health Insurance

Coverage Options:

- Personal and family packages

- Regional coverage for Southeast Asia

- Comprehensive international options

Strengths:

- Thailand-based headquarters with local expertise

- Extensive partnerships with Bangkok’s premier hospitals including Samitivej and Bumrungrad

- Multilingual customer support

- Second medical opinion benefit

- No advance payment required with network hospitals

Pricing: Competitive rates from ฿35,000–100,000 annually

Cigna Global

Coverage Options:

- Multiple policy tiers with customizable benefits

- Flexible coverage limits

- Optional benefits including wellness programs

Strengths:

- 24/7 global customer care

- Reliable access to Thailand’s private hospitals

- Customizable plans for individual and corporate needs

- Strong financial backing and global presence

Pricing: Plans range ฿50,000–150,000 annually

Allianz Ayudhya

Coverage Options:

- UltraCare: Full hospitalization worldwide (excluding USA)

- Travel Plus: Shorter-term coverage for temporary stays

Strengths:

- Maximum annual coverage up to USD 5,720,000

- Extensive worldwide network

- Schengen Visa-approved plans

- Emergency medical evacuation included

Pricing: Comprehensive plans start around ฿60,000 annually

April Thailand

Coverage Options:

- MyHealth Plans: Highly flexible modular benefits

- Customizable deductibles and coverage limits

- Individual family member variation in benefit levels

Strengths:

- Exceptional flexibility in plan customization

- Restricted network option for premium savings

- Full access to premium private hospitals

- Competitive pricing for comprehensive coverage

Pricing: Plans from ฿40,000–120,000 annually

Bupa Global

Coverage Options:

- Premium international health insurance

- Direct access to GPs, consultants, and specialists without referral

- In-hospital private room coverage

Strengths:

- World-class facilities and provider network

- Personal relationship manager support

- Children under 10 covered at no extra cost (subject to underwriting)

- Comprehensive dental and wellness options

Pricing: Premium plans typically ฿100,000–200,000+ annually

Generali Global Health

Coverage Options:

- Individual and family coverage

- Comprehensive and critical illness insurance

- Network of 550+ private hospitals throughout Thailand

Strengths:

- Superb rates for comprehensive coverage

- Easy-to-use member digital services

- Locally compliant policies

- Global medical network

Pricing: Plans from ฿50,000–120,000 annually

Cost Comparisons and Coverage Tiers

Basic Coverage Plans (฿20,000–40,000 / $670–1,340 annually)

Target Audience: Young expats, digital nomads, short-term visitors

Typical Coverage:

- Inpatient coverage: ฿1M–2M

- Outpatient coverage: Limited or excluded

- Minimal maternity and wellness benefits

- Higher deductibles (฿100k–200k typical)

Limitations: Narrow network, significant out-of-pocket requirements, pre-existing conditions excluded

Mid-Tier Coverage Plans (฿60,000–120,000 / $2,000–4,000 annually)

Target Audience: Working expats, families, mixed-term residents

Typical Coverage:

- Inpatient coverage: ฿3M–5M

- Outpatient coverage: Included with moderate limits

- Maternity benefits available

- Moderate deductibles (฿30k–50k)

Advantages: Balanced cost-benefit ratio, comprehensive hospital network, reasonable claims processing

Premium Coverage Plans (฿150,000–300,000+ / $5,000–10,000+ annually)

Target Audience: Senior expats, retirees, those requiring comprehensive protection

Typical Coverage:

- Inpatient coverage: ฿10M–20M+

- Outpatient coverage: No annual limits

- Full maternity and wellness coverage

- Low or zero deductibles

- Medical evacuation and repatriation included

Advantages: Highest coverage levels, premium provider access, comprehensive global coverage

Comparing Public vs. Private Healthcare

| Aspect | Public Healthcare | Private Healthcare |

|---|---|---|

| Cost | Minimal for insured residents; out-of-pocket for foreigners | Moderate to high; ฿100–500+ per consultation |

| Wait Times | Extensive (1–4 hours typical) | Minimal (typically 15–30 minutes) |

| Language | Thai only; limited English support | English-speaking staff standard |

| Hours | Standard business hours; limited emergency | 24/7 availability |

| Facilities | Basic to functional; crowded | Modern, world-class equipment |

| Insurance Requirement | Social Security Scheme contributions | Private health insurance required |

| Specialist Access | Referral-dependent; extended waits | Direct access, no referral needed |

| International Standards | Thailand-specific protocols | International standards compliance |

Selecting Your Optimal Insurance Plan: Step-by-Step Guide

Step 1: Identify Your Visa Category and Baseline Requirements

Begin by determining your current or planned visa status. Each visa category carries distinct insurance mandates:

- O-A visa holders: Minimum ฿3M total coverage

- O-X visa holders: Minimum $100k USD coverage

- LTR visa holders: Minimum $50k USD coverage with unlimited OPD

- Non-visa short-term visitors: No legal requirement, but highly recommended

If visa-related, obtain official documentation confirming minimum required coverage. This prevents future immigration complications.

Step 2: Assess Your Age, Health Status, and Medical History

Insurance quotes and eligibility depend critically on age and health. Most insurers accept applicants through age 70–75 for standard plans; older applicants face premium increases or coverage restrictions.

Pre-existing conditions require disclosure during underwriting. Some insurers offer specialized coverage for pre-existing conditions at higher premiums; others exclude them entirely. Never misrepresent health information-doing so constitutes grounds for claim denial and policy cancellation.

Step 3: Define Your Coverage Preferences

Consider your healthcare philosophy and financial capacity:

- Hospitalization-focused: Minimizes premiums by covering inpatient care; outpatient expenses covered out-of-pocket (suitable for young, healthy expats)

- Comprehensive coverage: Includes inpatient, outpatient, preventive, and wellness; optimal for families and those seeking stress-free healthcare access

- Network vs. worldwide: Local Thailand networks reduce premiums; worldwide coverage adds flexibility but increases costs

Step 4: Request Quotes from Multiple Providers

Obtain quotes from at least 3–4 insurers. Comparison shopping typically reveals significant price variations (20–40%) for equivalent coverage. Provide identical health information across requests to ensure accurate comparative analysis.

Step 5: Evaluate Claims Processing and Network Strength

Investigate each insurer’s claims processing efficiency:

- Cashless billing: Direct payments to partner hospitals eliminate reimbursement delays

- Claim turnaround: Standard processing should take 2–4 weeks

- Provider network: Ensure major hospitals (Bumrungrad, Samitivej, Bangkok Hospital) are in-network

- 24/7 support: Essential for after-hours assistance

- Language support: Confirm English-language claims assistance

Step 6: Complete Medical Questionnaire with Complete Transparency

Accuracy matters profoundly. Disclose all health conditions, medications, previous surgeries, and lifestyle factors (smoking, alcohol use, risky activities). Insurance companies investigate claims thoroughly; undisclosed information provides grounds for denial and potential fraud penalties.

Step 7: Understand Policy Exclusions and Limitations

Review your policy’s exclusion clauses meticulously:

- Pre-existing conditions: Often excluded or covered with waiting periods (6–12 months)

- High-risk activities: Mountain climbing, professional sports, hazardous occupations

- Pregnancy-related complications: Some policies require notification before conception

- Mental health coverage: Often limited or excluded

- Dental and vision: Usually separate riders with additional costs

Step 8: Confirm Visa Compliance and Documentation

If visa-dependent, verify your selected policy meets specific government requirements. Obtain an official insurance certificate acceptable to the Thai Immigration Bureau. Some insurers issue specialized visa-compliant certificates; generic documentation may be rejected during extension applications.

Frequently Asked Questions

Coverage and Eligibility

Q: Can foreigners buy medical insurance in Thailand?

A: Yes, foreigners legally residing in Thailand can purchase health insurance from both local Thai insurers and international providers. Local insurers typically offer policies specifically tailored to Thai visa requirements and incorporate direct hospital billing arrangements. International providers offer worldwide coverage with options to include Thailand. Most insurers accept applicants through age 70–75 for standard plans; older applicants may face restricted options or premium surcharges.

Q: What is the best expat health insurance?

A: The optimal plan depends on individual circumstances including age, health status, visa requirements, family situation, and budget. For young, healthy digital nomads on short assignments, April Thailand or Luma offer excellent value with flexible benefits. Working expats seeking comprehensive family coverage benefit from Cigna Global or AXA’s SwitchCare plans. Retirees and older expats requiring maximum coverage should prioritize Pacific Cross or Allianz for their reputation and extensive networks. Evaluate your specific needs across cost, coverage limits, and provider networks before deciding.

Q: Which health insurance is best in Thailand?

A: Pacific Cross consistently ranks among the most trusted insurers for expats due to their 65-year regional presence, extensive hospital partnerships, and reliable claims processing. AXA Insurance Thailand and Cigna Global also maintain strong reputations for customer service and comprehensive coverage options. However, “best” remains context-dependent; thorough individual comparison is essential.

Q: Are there restrictions on age for health insurance eligibility?

A: Most expat health insurance policies accept applicants through age 70–75 for standard coverage. Beyond these thresholds, options become limited. Some specialized plans cater to older applicants (up to age 80+) but involve substantially higher premiums or reduced coverage limits. Those aged 60–70 should expect 10–30% premium increases relative to younger cohorts; age 70+ applicants face potentially 50%+ increases or coverage restrictions. Applicants with pre-existing conditions may face additional underwriting scrutiny.

Q: Can I buy health insurance in my home country and use it in Thailand?

A: Many international policies offer Thailand coverage, but verification is essential. Existing policies should specify “Thailand coverage” within their geographic scope; some exclude Southeast Asia entirely. Notify your home-country insurer before relocating to Thailand to ensure continuous coverage and claim validity. However, visa-dependent applicants (O-A, O-X, LTR) typically must obtain Thailand-specific policies or international policies explicitly endorsed by Thai immigration authorities, as standard travel insurance is insufficient.

Visa Requirements and Documentation

Q: What health insurance do I need for an O-A retirement visa?

A: Non-Immigrant O-A visa applicants must present proof of health insurance covering a minimum of ฿40,000 for outpatient expenses and ฿400,000 for inpatient hospitalization. As of October 1, 2021, the Thai government also requires total policy coverage of at least ฿3,000,000 ($100k USD). Your policy must be valid for your entire intended stay in Thailand. Insurance certificates must be accepted by Thai immigration authorities; standard travel insurance policies do not qualify.

Q: Why does the Thai government mandate health insurance for retirees?

A: Thailand’s mandatory health insurance requirement for O-A visa holders reflects government policy to ensure medical care accessibility while minimizing public healthcare burden. The requirement protects both retirees (by guaranteeing healthcare access during potential emergencies) and the Thai healthcare system (by preventing costly uninsured hospitalizations). This requirement, implemented in 2019, strengthens financial safeguards during extended retirements in Thailand.

Q: What is the difference between O-A and O-X retirement visas?

A: The Non-Immigrant O-A visa is a 1-year renewable retirement visa for those aged 50+, requiring ฿3M insurance or equivalent financial proof. The Non-Immigrant O-X visa is a 10-year renewable retirement option also for those 50+, requiring $100k USD insurance or financial proof. O-X visas offer greater long-term stability with longer renewal intervals; O-A visas require annual applications. Insurance requirements differ slightly between categories.

Q: What if I can’t obtain health insurance due to age or pre-existing conditions?

A: Several alternatives exist. First, contact specialized insurers accepting high-risk applicants; some providers cover applicants through age 80+ or with pre-existing conditions at higher premiums. Second, substitute insurance with Thai bank deposits: ฿3M for O-A visas or $100k USD for O-X visas, maintained for the visa period. Third, explore employment-based coverage through Thai Social Security if eligible. Finally, some retirees transition from O-A to standard Non-Immigrant O visas (without “A” designation) if originally issued before October 2021; these require no insurance for renewal in Thailand.

Coverage, Claims, and Healthcare Access

Q: How much does it cost to see a doctor in Thailand without insurance?

A: Without insurance, out-of-pocket medical costs at private hospitals vary: standard outpatient consultations cost ฿1,500–3,000 ($50–100 USD); emergency room visits range ฿5,000–15,000 ($170–500 USD); daily hospitalization costs ฿10,000–25,000 ($335–835 USD); major surgery ranges ฿100,000–500,000+ ($3,350–16,750+ USD). These costs represent a fraction of North American pricing; however, serious illness or injury can quickly exceed ฿500k. Insurance provides peace of mind and protects against catastrophic expenses.

Q: What does Thailand’s healthcare system cover under standard insurance policies?

A: Comprehensive expat policies typically cover: inpatient hospitalization with room, board, and medical expenses; outpatient consultations and procedures; diagnostic testing (lab, imaging); prescription medications; surgical procedures; specialist consultations; emergency services; and medical evacuation to Thailand or regional centers. Common exclusions include: pre-existing conditions (subject to waiting periods), maternity complications (unless covered with rider), dental (except emergency), vision, mental health (except crisis intervention), high-risk activities, and occupational injuries.

Q: Can I use my health insurance at any hospital in Thailand?

A: Most comprehensive health insurance policies in Thailand maintain extensive partnerships with major private hospitals, though direct billing (cashless) may be limited to in-network facilities. You can technically use any hospital, but non-network treatment typically requires upfront payment with subsequent reimbursement-often requiring medical documentation submission within 30 days. In-network hospital usage provides immediate cashless billing, eliminating reimbursement processes. Before hospitalization, confirm your provider’s network status to determine payment method and reimbursement timelines.

Q: Will my insurance cover me if I travel outside Thailand?

A: Policies vary significantly. Many comprehensive plans offer limited coverage outside Thailand or exclude certain countries. Some provide worldwide coverage with designated exclusions (commonly USA). Before traveling, confirm your specific policy’s geographic scope, coverage limitations in other countries, and required pre-approval procedures. Most insurers permit short international trips without prior notification; extended relocations typically require policy notification or modification.

Q: What is the process for filing a health insurance claim in Thailand?

A: In-network (cashless) claims: Present your insurance card at the hospital; the facility bills your insurer directly, eliminating immediate out-of-pocket payments. Out-of-network claims: Pay upfront, then submit original receipts, medical certificates, itemized bills, and a completed claim form to your insurer within 30 days (deadlines vary by insurer). Submit documentation via mail, email, or your insurer’s mobile app. Processing typically requires 2–4 weeks. Ensure all documentation is complete; missing items delay reimbursement substantially.

Costs and Comparisons

Q: How much does private health insurance cost in Thailand?

A: Costs vary by age, coverage level, and insurer. Basic plans: ฿20,000–40,000 annually ($670–1,340 USD); suitable for young, healthy individuals. Mid-tier plans: ฿60,000–120,000 annually ($2,000–4,000 USD); comprehensive coverage for most expat families. Premium plans: ฿150,000–300,000+ annually ($5,000–10,000+ USD); maximum coverage with low deductibles. Seniors (60+): Expect 10–50% premium increases; age 70+ may face additional surcharges or limited options.

Q: Should I buy health insurance for 25,000 baht per month or bank 2.5 million?

A: Monthly premiums of ฿25k ($835 USD) equal ฿300k annually ($10k USD)-substantially higher than typical comprehensive insurance. Banking ฿2.5M–3M addresses visa requirements but removes capital from productive use and requires maintenance throughout your visa period; withdrawals risk visa complications. Insurance typically offers superior value: lower annual costs (฿60k–120k), access to world-class healthcare, and no capital lockup. Insurance generally provides better economics for most expats planning extended stays.

Q: How do expat insurance costs compare between Thailand and other Southeast Asian countries?

A: Thailand typically offers competitive insurance pricing relative to Singapore, Malaysia, and Vietnam. A comprehensive plan in Thailand costs approximately ฿60k–120k annually; comparable Singapore coverage runs S$2,000–3,500 (฿48k–84k USD equivalent) but with more restrictive networks; Malaysian plans cost RM4,000–8,000 (฿35k–70k USD equivalent) with similar limitations. Thailand’s abundant private hospital infrastructure drives competitive pricing while maintaining high quality, benefiting expats seeking cost-effective comprehensive coverage.

Long-Term Considerations and Renewability

Q: Is health insurance renewable indefinitely in Thailand?

A: Most comprehensive policies offer guaranteed renewability, permitting lifetime coverage provided you maintain premium payments. However, terms may change at renewal: premiums typically increase annually (5–15% increases are common), coverage limits may adjust, and new exclusions occasionally appear. Pre-existing conditions, once accepted, typically remain covered in subsequent renewals. Review renewal documentation carefully, as some insurers modify benefit structures or impose new conditions. Reading annual renewal notices prevents unwanted surprises.

Q: Do I need to report all my health changes to my insurance company?

A: Yes, absolutely. Significant health changes-new diagnoses, medications, surgeries, or lifestyle modifications (smoking cessation, new occupations)-should be reported to your insurer. Failure to disclose material health changes constitutes misrepresentation and provides grounds for claim denial or policy cancellation. Most insurers request periodic health updates during renewal. Complete transparency protects both your coverage validity and your insurability for future policies.

Q: What happens if I develop a pre-existing condition after enrolling?

A: Conditions developing after your policy’s effective date are typically covered under “new chronic conditions” provisions. Pre-existing conditions carry different treatment: conditions existing before enrollment generally exclude coverage until waiting periods elapse (typically 6–12 months, sometimes longer). New conditions developing after enrollment are typically covered immediately. Your policy’s terms document specifies the exact treatment; review this section during enrollment to understand coverage mechanics.

Q: Can my health insurance coverage change if I stay in Thailand longer than planned?

A: Staying longer than anticipated does not automatically alter coverage, provided you renew your policy annually before expiration. However, failure to renew creates gaps where new incidents become “pre-existing conditions” in any subsequent policy-a costly consequence. Additionally, some insurers impose coverage modifications for extended stays (e.g., requiring higher deductibles after 5+ years). Maintain continuous coverage by renewing well before expiration dates.

Healthcare System Navigation

Q: What is the difference between public and private healthcare in Thailand?

A: Public healthcare is government-funded, free or minimal-cost for Thai citizens under Universal Health Coverage; foreigners can access only through employment-based Social Security or specific visa categories. Public facilities operate standard business hours, have limited English support, involve long wait times (1–4+ hours), and provide functional but basic medical services. Private healthcare is fee-for-service with costs ranging ฿1.5k–3k per consultation at world-class facilities; operates 24/7 with English-speaking specialists, minimal wait times, and cutting-edge diagnostics. Most expats prefer private healthcare for speed, quality, and English accessibility.

Q: How does healthcare in Thailand compare to the US, especially for retirees needing more medical attention?

A: Thailand offers significant advantages for senior expats: medical costs are substantially lower (50–75% less expensive), quality private hospitals rival US standards with English-speaking staff, minimal bureaucracy accelerates care, and insurance premiums are dramatically cheaper. A hip replacement costing $35,000+ in the USA runs ฿300k–500k ($10k–17k) in Thailand. However, highly specialized procedures (certain cancer treatments, complex cardiac surgery) may require US or European medical centers. Healthcare costs, accessibility, and quality integration make Thailand exceptionally attractive for retirees requiring ongoing medical attention.

Q: Can I receive emergency medical care in Thailand without insurance?

A: Yes, emergency care is generally accessible regardless of insurance status. Thai hospitals cannot legally refuse emergency treatment due to insurance absence. However, hospitals require payment guarantees before admission and will aggressively pursue payment collection. Uninsured patients typically face substantial out-of-pocket costs and may face deportation if unable to pay. Having health insurance eliminates these complications and provides peace of mind during emergencies.

Q: What can social security insurance cover in Thailand?

A: Thailand’s Social Security Scheme, available to private sector employees and their employers, provides comprehensive coverage including: inpatient hospitalization, outpatient treatment, preventive care, maternity services, and rehabilitation. However, coverage is limited to public hospital networks, does not extend to dependents (separate insurance required), and excludes expatriates not meeting employment requirements. Social Security contributions are significantly lower than private insurance but offer less flexibility and provider choice.

Practical Considerations

Q: What documents are required to obtain health insurance in Thailand?

A: Document requirements vary by insurer and visa type, but typically include: valid passport, current visa or residency documentation, proof of income/financial stability (employment contract, bank statements, pension documents), medical history questionnaire, and sometimes a signed health declaration. For visa-dependent applicants (O-A, LTR), additional documentation confirming immigration requirements may be requested. Obtain specific requirements from your chosen insurer before beginning applications to expedite processing.

Q: Do I need to disclose my smoking status when applying for health insurance?

A: Yes, absolutely. Smoking status significantly affects insurance pricing (smokers pay 15–50% premiums higher than non-smokers) and coverage terms. Misrepresenting smoking status constitutes material fraud and grounds for claim denial. If you quit smoking, inform your insurer; most policies reduce premiums after 12 months of documented non-smoking status. Honesty during application protects coverage validity and prevents future complications.

Q: What happens if my insurance company denies a claim?

A: Review the denial letter explaining reasons thoroughly-most denials involve policy exclusions, insufficient documentation, or pre-existing condition exceptions. Contact your insurer’s customer service requesting detailed explanation and appeal procedures. Provide additional medical documentation if available. Thailand’s insurance regulatory body (OIC-Office of Insurance Commission) mediates disputes if company communication proves unsatisfactory. Maintain documentation of all claims and communications for regulatory complaints if necessary.

Q: Should I keep my home country health insurance while living in Thailand?

A: This depends on your policy and circumstances. Many home-country policies exclude international residents or exclude Thailand specifically. If your policy maintains Thailand coverage, keeping both policies provides backup coverage-useful for rare situations where Thai claims face complications. However, duplicate coverage often proves unnecessary; comprehensive Thailand-based insurance typically provides superior local coverage. Verify your home policy’s exclusions before abandoning it; if it excludes Thailand, cancellation is appropriate.

Q: Can my family members access healthcare through my policy?

A: Most comprehensive policies offer family or group coverage extensions. Spouses and dependent children (typically under 18–25) can be added to policies, though family coverage typically costs 20–40% more than single coverage. Each family member may have individually tailored coverage levels. Confirm family inclusion options during quote requests; some insurers charge per-family-member additions, while others use simplified family rates. Dependent coverage requires proof of relationship and, for spouses, marriage documentation.

Conclusion

Securing appropriate health insurance represents one of the most critical decisions expatriates make when relocating to Thailand. The combination of visa requirements, quality healthcare access, and diverse insurance options can seem overwhelming; however, systematic evaluation following this guide simplifies the process substantially.

Thailand’s private healthcare system offers exceptional value paired with world-class quality, positioning the country as one of Asia’s premier healthcare destinations. The most significant advantage-and a consideration that often distinguishes Thailand from competitors-is the cost structure. Comprehensive insurance premiums averaging ฿60k–120k annually ($2,000–4,000 USD) provide access to hospitals exceeding US standards while remaining a fraction of comparable North American costs.

For retirees, digital nomads, and working professionals, selecting insurance aligned with individual health profiles, visa requirements, and coverage preferences ensures not merely compliance with immigration mandates but genuine peace of mind. The competitive insurance landscape, featuring established international providers alongside specialized local insurers, creates opportunities for discerning expats to secure exceptional coverage at attractive rates.

Begin your insurance journey by identifying your visa category and baseline requirements, assessing your age and health status, and obtaining quotes from multiple providers. Invest time in understanding policy exclusions, claims procedures, and provider networks. Prioritize transparency during underwriting-complete honesty protects coverage validity when emergencies inevitably arise.

Thailand awaits not as a destination requiring reluctant healthcare compromises but as a location where comprehensive, affordable, accessible healthcare enhances retirement, professional, and nomadic lifestyles. By approaching health insurance selection with the strategic mindset detailed in this guide, expatriates position themselves for healthy, secure, and fulfilling tenures in the Land of Smiles.