1. Executive Summary

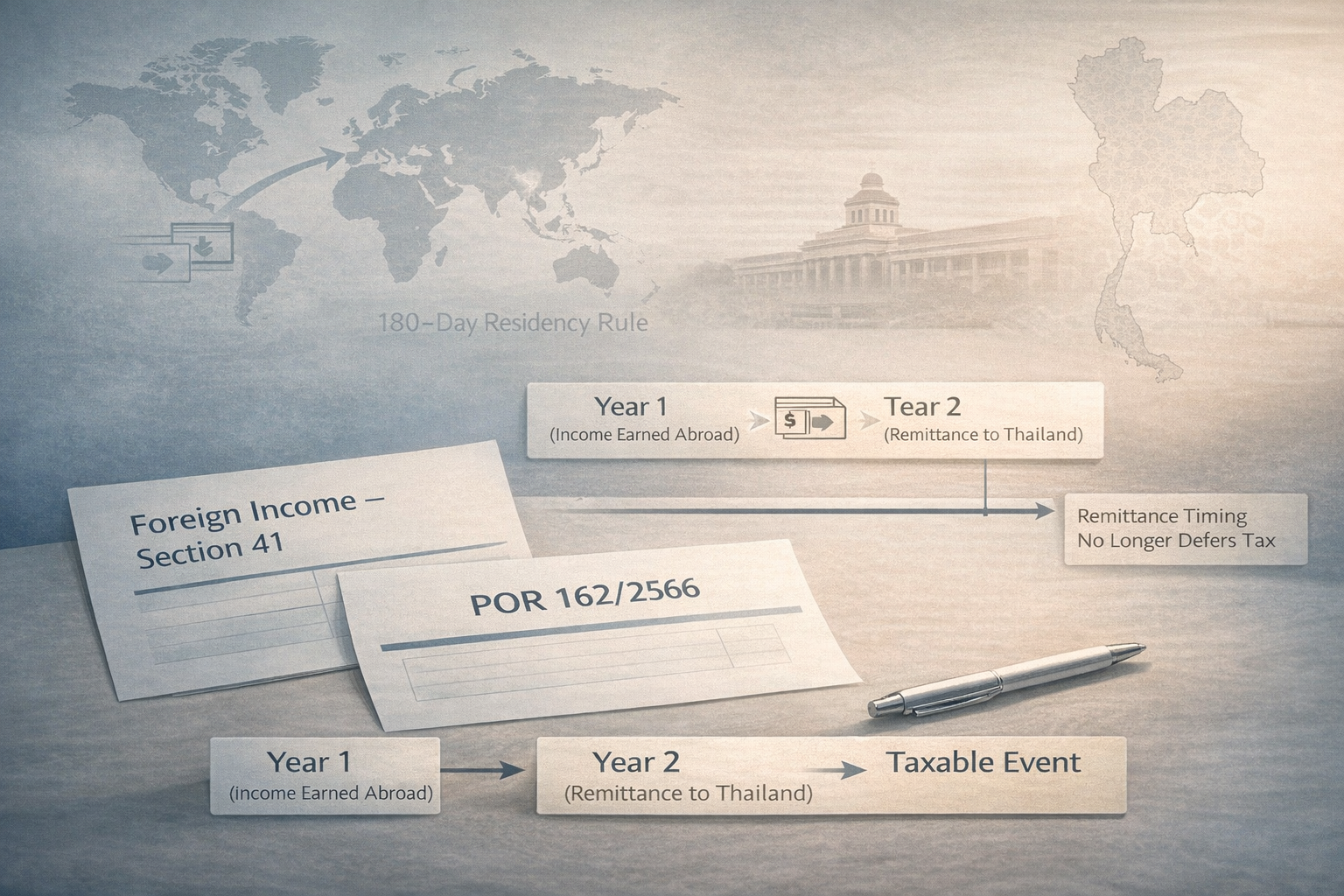

Departmental Instruction POR 162/2566 is a Revenue Department clarification issued on November 20, 2023, that defines the temporal scope of Thailand’s reformed foreign income remittance tax. It works in tandem with POR 161/2566 to create a watershed moment in Thai tax law: the elimination of the “same-year” remittance exemption for foreign-sourced income.

What POR 162/2566 Does:

It establishes that the new remittance rule (outlined in POR 161/2566) applies only to foreign income earned on or after January 1, 2024. Income earned before this date remains governed by the old interpretation and is permanently exempt from Thai tax when remitted, regardless of timing.

Who Is Affected:

Thai tax residents (individuals spending 180+ days in Thailand annually) who derive assessable income from foreign sources—employment, business, investments, property, pensions, or any other category under Section 40 of the Revenue Code.

What Changed in Practice:

Before 2024, residents could defer remitting foreign income to the following calendar year to avoid Thai tax. That loophole is now closed. Foreign income earned from 2024 onward is taxable in the year it enters Thailand, irrespective of when it was earned.

2. Background: Section 41 of the Revenue Code

Thai personal income tax operates on a hybrid territorial-remittance system. Section 41, Paragraph 2, of the Revenue Code is the statutory foundation for taxing foreign income.

The Legal Text

Section 41, Paragraph 2 states:

“A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax in accordance with the provisions of this Part.”

Historical Interpretation (Pre-2024)

For decades, the Revenue Department interpreted this provision narrowly. The phrase “in the previous tax year” was understood to mean that only foreign income earned in the prior calendar year and remitted in the current year was taxable. If you earned income abroad in Year 1 and waited until Year 2 or later to remit it, it was exempt.

This interpretation created a straightforward tax-planning strategy: simply delay the transfer of foreign funds by one calendar year.

The Shift

The Revenue Department concluded this interpretation was inconsistent with the statute’s plain language. Section 41 does not say “only income from the previous tax year,” but rather uses “previous tax year” as a temporal reference for determining residency status and income categorization. The law does not impose a time limit on when remittance triggers taxation.

3. What Is Departmental Instruction POR 162/2566?

Legal Status

POR 162/2566 is a Departmental Instruction (kham sang kan), not primary legislation. It does not amend the Revenue Code itself but provides binding interpretive guidance to Revenue Department officers on how to apply Section 41.

Relationship with POR 161/2566

The two instructions work together:

- POR 161/2566 (issued September 15, 2023) revokes prior guidance and establishes the new principle: foreign income is taxable upon remittance regardless of timing.

- POR 162/2566 (issued November 20, 2023) clarifies the effective date: the new rule applies only to income earned from January 1, 2024, onward.

Authority and Binding Nature

These instructions are binding on Revenue Department officials conducting audits and issuing rulings. While they do not carry the force of statute, they represent the official enforcement position of the tax authority. Taxpayers who deviate from these guidelines risk assessment, penalties, and interest upon audit.

4. What Actually Changed?

Practical Example: The Timeline Shift

Scenario: A Thai resident earns $10,000 in dividends from a US stock portfolio.

Case A: Dividends earned December 2023, remitted March 2024

- Old Rule: Different tax years → Exempt.

- New Rule: Earned before Jan 1, 2024 → Still governed by old rule → Exempt.

Case B: Dividends earned March 2024, remitted February 2025

5. Who Is Affected?

Thai Tax Residents

Any individual who stays in Thailand for 180 days or more in a calendar year is a tax resident.

- Days are counted cumulatively; they do not need to be consecutive.

- Nationality is irrelevant. A US citizen, Australian, or Malaysian is equally subject if they meet the 180-day threshold.

- Tax residency is determined separately for each calendar year.

Example: You stay in Thailand for 100 days in 2024 and 150 days in 2025. You are not a tax resident in either year. If you stay 200 days in 2026, you become a tax resident for 2026 only.

Non-Residents

Individuals who stay fewer than 180 days are non-residents. They are taxed only on Thai-sourced income. Foreign income remitted to Thailand is tax-exempt, even if earned after January 1, 2024.

Expats and Digital Nomads

- Traditional Expats (work permit holders, long-term residents): Almost always exceed 180 days and are subject to the new rule.

- Digital Nomads (tourists, short-stay visa holders): If you stay fewer than 180 days, you are unaffected. If you exceed 180 days (e.g., on a DTV or repeated tourist entries), you become a tax resident and foreign income remittances are taxable.

Retirees

Retirees who spend more than 180 days in Thailand and remit pension income, Social Security payments, or investment withdrawals from abroad are now subject to Thai tax on those amounts—unless they hold an LTR Visa with the Wealthy Pensioner category, which grants a specific exemption.

Investors and High-Net-Worth Individuals

Anyone remitting foreign dividends, interest, capital gains, or rental income earned from 2024 onward is affected.

6. What Counts as Foreign Income?

Under Section 40 of the Revenue Code, assessable income includes eight categories. All are potentially subject to remittance taxation if derived from foreign sources.

Employment Income

Salaries, wages, bonuses, and allowances paid by foreign employers for work performed abroad.

Example: A UK-based software engineer works remotely from Bangkok for a London firm. His monthly salary is foreign-sourced income. Any portion remitted to Thailand is taxable.

Business and Professional Income

Income from services, consulting, freelancing, or trading conducted outside Thailand.

Example: A Thai tax resident operates a Shopify dropshipping business with suppliers in China and customers in the US. Profits are foreign-sourced and taxable upon remittance.

Dividends and Interest

Distributions from foreign stocks, bonds, or bank deposits.

Example: You hold shares in Apple Inc. and receive $2,000 in dividends in 2024. If you transfer these funds to Bangkok Bank in 2025, they are taxable in 2025.

Capital Gains

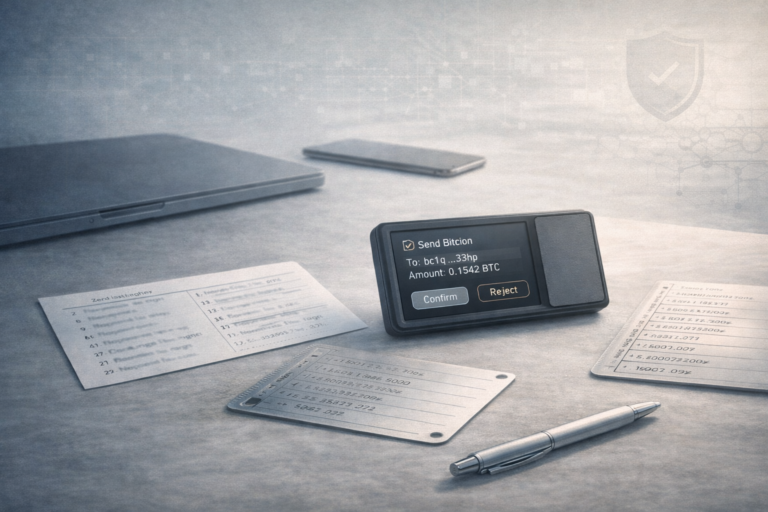

Profits from the sale of foreign assets, including stocks, bonds, real estate, and cryptocurrency.

Critical Note: Capital gains are taxable only when realized (i.e., the asset is sold) and when the proceeds are remitted to Thailand. Unrealized gains (paper profits) are not taxable.

Example: You buy Bitcoin in 2024 for $10,000. By December 2024, it’s worth $15,000. The $5,000 gain is not taxable because you haven’t sold. In 2025, you sell for $16,000 and remit the $6,000 profit to Thailand. The $6,000 is taxable in 2025.

Rental Income from Foreign Property

Income from leasing real estate located abroad.

Example: You own a condo in Singapore that generates SGD 3,000/month in rent. Each rental payment is assessable income when earned. If you remit the accumulated rent to Thailand, it is taxable.

Pensions and Social Security

Retirement benefits from foreign government or private pension schemes.

Example: A German retiree receives a monthly pension of €2,500 from the German state. If he remits it to Thailand, it is taxable unless he qualifies for an exemption under the LTR Visa or a Double Taxation Agreement provision.

Cryptocurrency

Gains from trading or selling digital assets are treated as capital gains under Section 40(4)(g).

7. Remittance Timing Explained

The core complexity of POR 162/2566 lies in the timing of income earning versus remittance.

Income Earned in Year 1, Remitted in Year 2

Under the new rule, this is taxable in Year 2 (the year of remittance).

Example: You earn $20,000 in freelance income in July 2024. You leave it in a US bank account. In March 2025, you transfer $10,000 to Thailand. The $10,000 is taxable in your 2025 tax return.

Savings Accumulated Pre-2024

Income earned before January 1, 2024 is governed by the old rule. It is permanently exempt when remitted, regardless of when you bring it to Thailand.

Example: You worked in Singapore from 2018 to 2023 and accumulated $200,000 in savings. You move to Thailand in 2025 and transfer the full $200,000. Because all of it was earned before 2024, it is tax-free.

The Mixed Funds Problem

If you have a single foreign bank account containing both pre-2024 and post-2024 income, the Revenue Department will require you to prove which portion of a remittance is “old” versus “new”.

Strategy:

- Maintain separate accounts for pre-2024 capital and post-2024 income.

- If separation is impossible, document the source and date of every deposit.

- Use a FIFO (First In, First Out) or LIFO (Last In, First Out) methodology with clear records to demonstrate which funds you are remitting.

Example: Your account has $50,000 from 2022 and $30,000 from 2024. You remit $20,000 in 2025. If you can prove the $20,000 came from the 2022 balance, it is exempt. Without documentation, the Revenue Department may assess the entire amount as taxable.

Practical Documentation Strategy

- Bank Statements: Show the date funds were received.

- Employment Contracts: Prove when salary was earned.

- Brokerage Statements: Document the sale date for capital gains.

- Transaction Records: Map every remittance to its source.

8. Practical Scenarios

Scenario 1: UK Expat Sending Salary to Thailand

Profile:

- Works for a Thai company but also does freelance consulting for a UK client.

- Thai salary: 80,000 THB/month (Thai-sourced).

- UK consulting: £2,000/month (foreign-sourced).

- Stays in Thailand 365 days (tax resident).

Action:

- Transfers £1,500/month from UK to Thailand for living expenses.

Tax Exposure:

- Thai salary: Fully taxable (Thai-sourced).

- UK consulting (£1,500 remitted monthly): Taxable at progressive rates (5–35%) as foreign-sourced income remitted in the year earned.

- The £500/month remaining in the UK account: Not taxable until remitted.

DTA Relief:

If the UK taxes the consulting income, the taxpayer can claim a foreign tax credit under the UK-Thailand Double Taxation Agreement, reducing or eliminating double taxation.

Scenario 2: Condo Purchase Using Overseas Funds

Profile:

- Thai tax resident planning to buy a 5,000,000 THB condo in Bangkok.

- Has $150,000 in a US bank account: $100,000 earned before 2024, $50,000 earned in 2024–2025.

Action:

- Transfers $150,000 to Thailand in 2025 to complete the purchase.

Tax Exposure:

- $100,000 (pre-2024 funds): Exempt.

- $50,000 (post-2024 income): Taxable in 2025 at progressive rates.

Strategy:

- Transfer the pre-2024 funds first to minimize tax.

- Obtain a Foreign Exchange Transaction Form (FET) from the Thai bank, clearly identifying the source as capital, not income. While this does not eliminate tax liability, it supports your documentation.

Scenario 3: Digital Nomad Receiving Foreign Freelance Income

Profile:

- Australian freelance graphic designer.

- Works for clients in the US, UK, and Australia.

- Stays in Thailand 220 days in 2025 (tax resident).

- Earns $60,000 in 2025, keeps it in an Australian bank.

Action:

- Transfers $3,000/month to Thailand for rent and expenses.

Tax Exposure:

- The $36,000 remitted ($3,000 × 12 months) is taxable in 2025.

- The $24,000 remaining in Australia is not taxable until remitted.

DTA Consideration:

Australia likely taxes the freelance income. The taxpayer can claim a foreign tax credit when filing in Thailand, reducing the Thai tax liability.

Scenario 4: Retiree Transferring Pension

Profile:

- US retiree with a $4,000/month Social Security pension.

- Stays in Thailand 300 days per year (tax resident).

Action:

- Transfers the full $4,000/month to Thailand.

Tax Exposure:

- Social Security income is foreign-sourced and taxable upon remittance.

- Annual remittance: $48,000 (~1,700,000 THB).

DTA Relief:

Under Article 19 of the US-Thailand DTA, Social Security benefits are taxable only in the US. The retiree can claim an exemption in Thailand by filing the appropriate DTA relief form with proof of US taxation.

Scenario 5: Crypto Investor

Profile:

- Thai tax resident.

- Trades Bitcoin on Binance (offshore exchange).

- Buys 1 BTC for $30,000 in 2024.

- Sells for $50,000 in 2025.

Action:

- Remits $20,000 profit to Thailand in 2025.

Tax Exposure:

- The $20,000 gain is taxable in 2025 at progressive rates.

- If the trader leaves the $20,000 in Binance and never remits it, there is no Thai tax liability (though unrealized gains may be taxable in the future if remitted).

9. Double Taxation Agreements (DTA)

Thailand has over 60 DTAs designed to prevent double taxation on the same income.

Relief Mechanisms

1. Exemption Method:

The country of residence (Thailand) does not tax income that is taxable in the source country. This creates a complete division of taxing rights.

2. Credit Method (Most Common):

Thailand taxes the foreign income as part of the resident’s global income but provides a foreign tax credit for taxes paid to the other country. This ensures the total tax does not exceed the Thai rate.

Formula:Thai Tax Due=Thai Tax on Total Income−Foreign Tax Credit

Example:

You earn $10,000 in the UK, taxed at 20% (£2,000). You remit it to Thailand. Thai tax on $10,000 at your marginal rate is 25% (£2,500). You pay £2,500 to Thailand but claim a £2,000 credit, so your net Thai tax is £500.

Common Mistakes

- Not Filing for DTA Relief: Relief is not automatic. You must file a Certificate of Residence from your home country and attach DTA forms to your Thai return.

- Assuming Exemption When Credit Applies: Many DTAs use the credit method, not exemption. You still pay tax—just less.

- Ignoring Treaty Overrides: Some DTAs have specific clauses (e.g., US “Saving Clause”) that limit relief for citizens.

10. Revenue Department Clarifications & Q&A

The Revenue Department issued an official Q&A document explaining POR 161/2566 and POR 162/2566. Key points:

Q: What if I transfer money abroad and then bring it back?

A: Transferring your own funds overseas and returning them is not assessable income and is tax-free.

Example: You send 200,000 THB to a foreign investment account, then close the account and remit 200,000 THB back. No tax.

Q: What if I deposit money in a foreign bank, earn interest, and remit both principal and interest?

A: The principal is not taxable (it’s your own capital). The interest is taxable if you were a tax resident in the year the interest was earned.

Q: Are unrealized stock gains taxable?

A: No. Only realized gains (when you sell) are taxable, and only when remitted to Thailand.

11. Common Myths vs Reality

Myth 1: “Thailand does not tax foreign income.”

Reality: Thailand taxes foreign income upon remittance if you are a tax resident. The myth likely arose from the old same-year rule, which created a practical exemption if you deferred remittance.

Myth 2: “If I transfer ‘savings,’ it’s tax-free.”

Reality: The character of the funds (savings, income, capital) is determined by when and how they were earned, not which account they sit in. Post-2024 income is taxable when remitted, even if it was in a “savings account”.

Myth 3: “I can just say the money is a loan.”

Reality: The Revenue Department will require documentation proving a genuine loan (loan agreement, repayment terms, etc.). Fictitious loans are easily identified during audits.

Myth 4: “Non-residents are taxed the same as residents.”

Reality: Non-residents (fewer than 180 days) are taxed only on Thai-sourced income. Foreign income is exempt.

Myth 5: “DTAs automatically exempt me.”

Reality: DTAs provide relief, not blanket exemption. You must actively claim the relief and file the appropriate forms. Most DTAs use the credit method, not exemption.

12. Risks & Compliance Issues

Audit Modernization

The Revenue Department is adopting data-driven enforcement. Audits increasingly use third-party data to identify discrepancies.

Common Reporting Standard (CRS)

Thailand joined CRS in 2023. Foreign banks automatically report Thai residents’ account balances, interest, dividends, and capital gains to the Revenue Department. If you remit funds, the Revenue Department may already know the source.

Documentation Gaps

The biggest audit risk is the inability to prove when income was earned. Without clear documentation, the Revenue Department will assess the entire remittance as post-2024 income.

Best Practice:

- Maintain a remittance log linking every transfer to source documentation.

- Store historical bank statements dating back to 2023.

- Segregate pre-2024 and post-2024 funds.

Penalties

- Late Filing: 2,000 THB fine.

- Underreporting: 1.5% interest per month on unpaid tax.

- Criminal Fraud: Imprisonment and fines up to double the tax evaded.

13. Strategic Considerations for 2026

Timing Planning

Goal: Minimize Thai tax by optimizing the timing and quantum of remittances.

Strategies:

- Remit Only What You Need: Leave excess income offshore to defer tax indefinitely.

- Use Pre-2024 Funds First: Exhaust exempt capital before remitting post-2024 income.

- Spread Remittances Across Years: Lower your marginal tax rate by avoiding large single-year remittances.

Residency Management

Goal: Avoid crossing the 180-day threshold if possible.

Strategies:

- Track Days Precisely: Use apps or spreadsheets to monitor entry/exit dates.

- Plan Travel: Structure international trips to keep annual days below 180.

- Consider Split Residency: Spend part of the year in a tax-friendly jurisdiction like Malaysia or Singapore.

Record-Keeping Strategy

Goal: Create an audit-proof documentation trail.

Actions:

- Maintain a master spreadsheet showing:

- Date income was earned.

- Amount and currency.

- Source (employment, dividends, etc.).

- Date remitted to Thailand.

- Archive all bank statements, brokerage confirmations, and contracts.

- Obtain professional tax opinions for complex situations (e.g., mixed funds, crypto).

Risk Management

Goal: Reduce exposure to aggressive Revenue Department interpretations.

Actions:

- File Proactively: Even if you owe zero tax, filing establishes a compliance record.

- Seek Advance Rulings: For large or ambiguous transactions, request a written ruling from the Revenue Department.

- Use Professional Advisors: Engage Thai tax accountants familiar with expat issues and DTAs.

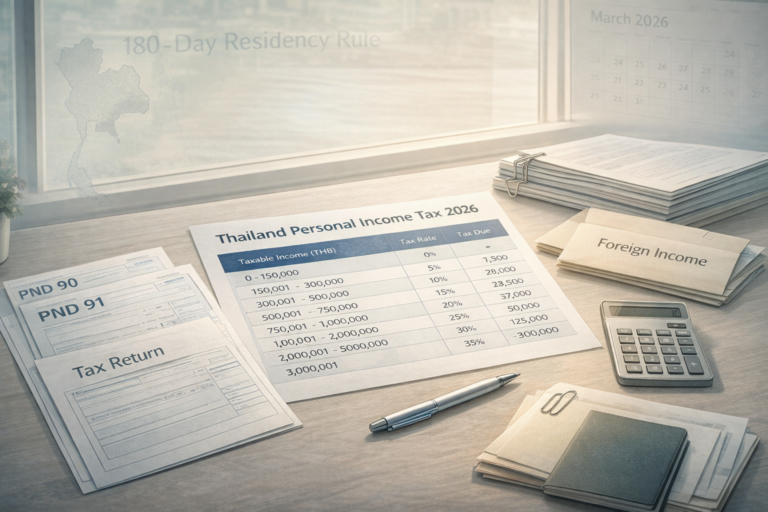

14. FAQ

What happens if Thailand taxes foreign income?

If you are a Thai tax resident and remit foreign income earned from 2024 onward, it is added to your assessable income and taxed at progressive rates (5–35%). You can claim foreign tax credits under DTAs to reduce double taxation.

If I remit money to Thailand for a condo purchase, do I pay tax?

It depends on the source and timing of the funds. If the money is capital earned before January 1, 2024, it is exempt. If it is income earned from 2024 onward, the income portion is taxable.

Example: You remit $100,000: $80,000 pre-2024 savings (exempt) and $20,000 post-2024 salary (taxable). Only the $20,000 is taxed.

Do I pay tax if I stay less than 180 days?

No. Non-residents are taxed only on Thai-sourced income. Foreign income is exempt, even if remitted.

How do foreigners pay tax in Thailand?

Foreigners must obtain a Tax Identification Number (TIN) from the local Revenue Office. They file an annual return (PND 90 or PND 91) by March 31 or April 8 (e-filing). Tax is paid at the time of filing.

How many ways can I pay tax?

- Withholding at Source: Employers deduct tax monthly (PND 1).

- Self-Assessment: Individuals file and pay annually.

- Advance Payments: For certain income types, quarterly payments are required.

- E-Payment: Via the Revenue Department website, bank transfer, or in-person at Revenue Offices.

Final Note:

POR 162/2566 represents a fundamental reinterpretation of Section 41 of the Revenue Code. Its impact is profound for expats, retirees, digital nomads, and investors. The key to compliance is meticulous documentation, strategic planning, and proactive engagement with Thailand’s Double Taxation Agreements. The era of simple tax deferral is over; the era of comprehensive foreign income reporting has begun.