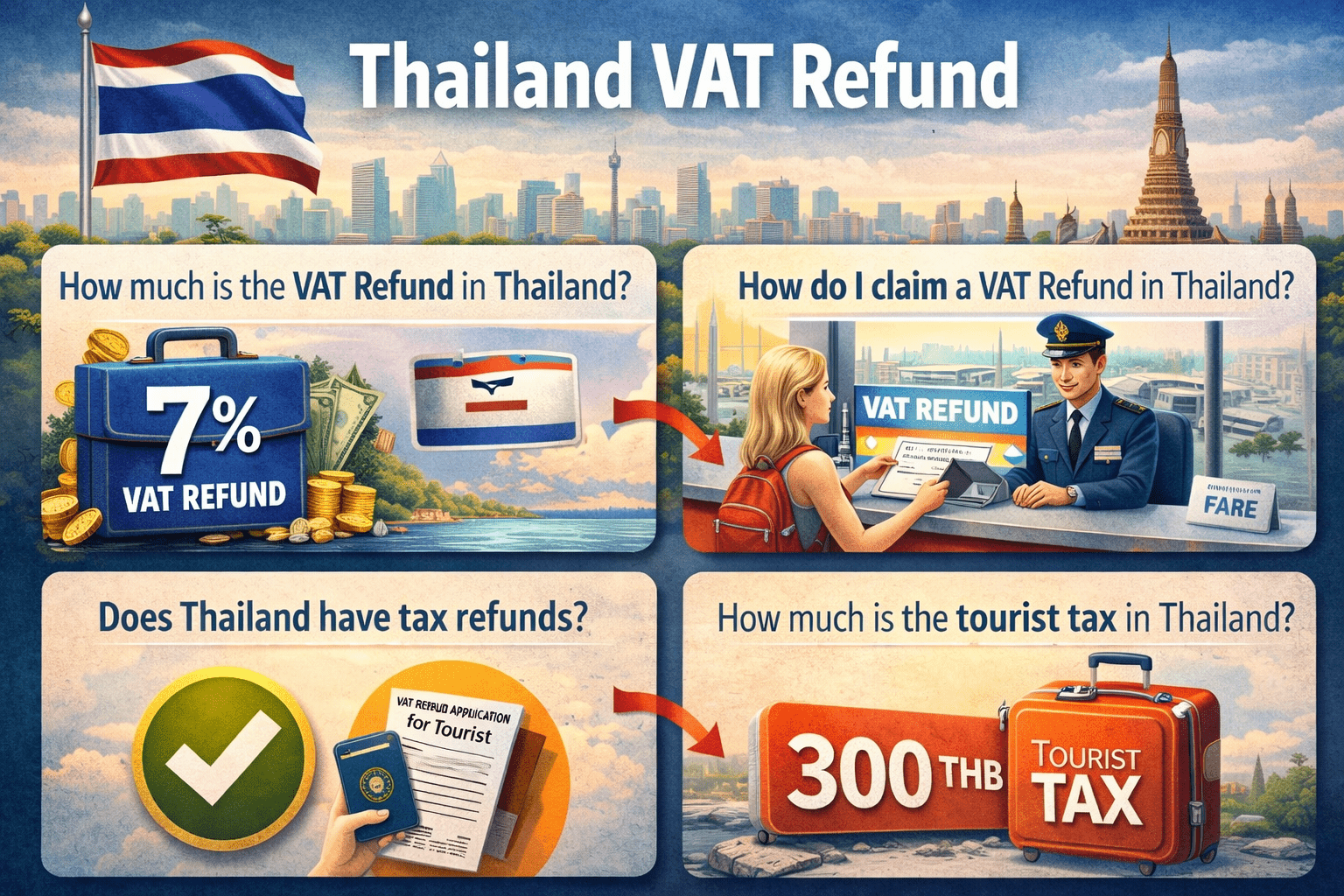

Thailand welcomes over 35 million visitors annually, and many return home wishing they’d recovered the taxes embedded in their purchases. Thailand’s VAT refund program exists precisely for this reason-it allows international tourists to reclaim a portion of the value-added tax they pay on goods.

Thailand’s standard VAT rate stands at 7%, but don’t expect a full 7% refund. After administrative fees, processing costs, and exchange spreads, tourists typically recover between 4% and 6% of their purchase price. On a modest 20,000 THB shopping trip (approximately $560 USD), this translates to 1,000–1,200 THB in actual cash back-roughly the cost of two days’ accommodation or a spa treatment.

This comprehensive guide is designed for international tourists, shopping enthusiasts, and budget-conscious travelers who want to maximize their purchases while shopping in Thailand. Whether you’re hunting for luxury electronics in Bangkok’s modern malls, bargaining for souvenirs in night markets, or investing in high-end jewelry, understanding the VAT refund process ensures you keep more of your money.

The key insight: 7% VAT collected at the store, 4–6% actual refund after fees. Understanding this gap is the foundation of smart shopping in Thailand.

This guide distills everything you actually need to know – from eligibility rules and receipt requirements to payment method comparisons and hidden fees – so you can plan your shopping strategy and walk away with the maximum possible refund.

2. Thailand VAT Refund: Basics at a Glance

Before diving into procedural details, establish the fundamental facts that determine whether you can claim a refund:

Standard VAT Rate: Thailand applies a uniform 7% value-added tax on most goods and services.

Actual Refund Rate: After processing fees, administrative charges, and exchange spreads, tourists receive between 4% and 6.1% of their purchase price. A 20,000 THB purchase yields approximately 1,000–1,200 THB-not the full 7%.

Who Can Claim: Non-Thai residents and non-Thai citizens visiting Thailand temporarily. Airline crew members and airport employees are excluded. Your residency status is verified through your passport.

Minimum Purchase Threshold: You must spend a minimum of 2,000 Thai Baht (including VAT) on a single receipt, per day, from one store. Purchases from multiple stores can be aggregated to meet the 5,000 THB total spending requirement, but each individual receipt must meet the 2,000 THB minimum.

Goods Usage Deadline: All purchased goods must leave Thailand within 60 days from the purchase date, unused and in original condition. Goods worn, consumed, or used in Thailand forfeit refund eligibility.

Refund Claim Location: VAT refunds can only be claimed at international airport departure halls-not at land borders or seaports. Thailand’s major airports include Suvarnabhumi (Bangkok), Don Mueang (Bangkok), Phuket International, Chiang Mai International, and regional airports.

Payment Methods Available:

- Cash (up to 30,000 THB maximum per transaction)

- Credit card (no limit)

- Bank draft (no limit)

- Digital wallet (emerging option through TAGTHAi app)

Understanding these basics prevents wasted effort on ineligible purchases and unrealistic refund expectations.

3. Who Is Eligible for Thailand VAT Refund?

VAT refund eligibility hinges on three factors: personal status, purchase characteristics, and goods classification. Understanding each category prevents common rejections at the airport counter.

Personal Status Requirements

Only non-Thai residents and non-Thai citizens can claim VAT refunds. Your passport is the primary proof of eligibility. Specifically:

- Non-Thai Citizenship: If your passport is not Thai, you’re eligible. Thai nationals cannot claim refunds, even if temporarily residing abroad.

- Valid Passport Holder: Your passport must be valid and will be inspected at multiple checkpoints (customs, VAT office). Expired or diplomatic passports create complications.

- Not Airport Personnel: Airline crew members, airport employees, and ground staff are explicitly excluded, as they have regular tax-exempt shopping privileges.

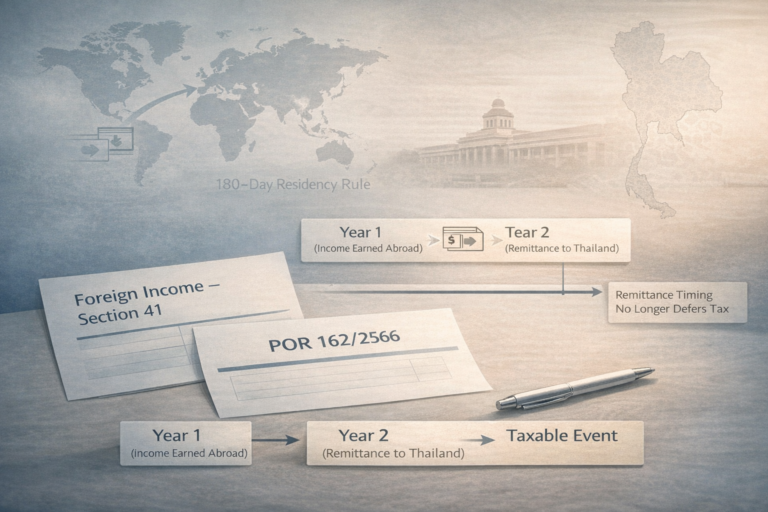

- Residency Duration: If you’re staying more than 180 days in Thailand during a calendar year, you’re considered a resident and lose eligibility. Tourists and short-term visitors maintain eligibility.

Purchase Requirements

Your purchases must meet specific criteria:

- Minimum Per Receipt: Each single receipt must total at least 2,000 THB (including VAT). A purchase of 1,999 THB does not qualify, even if paired with another purchase.

- Minimum Aggregate: Across multiple receipts, you must accumulate at least 5,000 THB total. This allows flexibility-you can shop at three stores, get three receipts of 2,000 THB each, and meet the aggregate requirement.

- Personal Use Only: Goods must be for personal consumption, not for resale or commercial purposes. Bulk purchases of goods intended for business violate the program.

- From Participating Stores: The store must display an official “VAT Refund for Tourists” sign. Not all retailers participate. Ask before shopping to confirm participation.

Goods Limitations

Not all purchases qualify. This category eliminates the most common rejection reasons:

- Services Excluded: Hotel accommodations, restaurant meals, spa treatments, haircuts, and airline tickets do not qualify, regardless of cost. Only tangible goods qualify.

- Consumables Excluded: Food, beverages, tobacco, and alcohol cannot be refunded. These are considered consumed in Thailand, not exported.

- Luxury Items Special Handling: Individual items valued over 40,000 THB require additional customs inspection and are scrutinized for authenticity and compliance.

- 60-Day Export Rule: All goods must physically leave Thailand within 60 days of purchase, unused and in original packaging. Once this window closes, goods are deemed “used in Thailand,” and refund eligibility expires permanently.

Eligibility Checklist for Self-Verification:

- ☑ Hold a non-Thai passport

- ☑ Staying in Thailand fewer than 180 days this year

- ☑ Not employed as airline or airport staff

- ☑ Spending minimum 2,000 THB per receipt

- ☑ Aggregate spending minimum 5,000 THB

- ☑ Purchasing from stores with “VAT Refund for Tourists” signage

- ☑ Buying only tangible goods (not services)

- ☑ Planning to export all goods within 60 days

If any box remains unchecked, reconsider your refund strategy.

4. Eligible vs. Ineligible Goods: The Complete Reference

The difference between a successful refund and a rejected claim often hinges on product category. Use this comprehensive reference:

| ✅ ELIGIBLE GOODS | ❌ INELIGIBLE GOODS |

|---|---|

| Clothing & apparel | Food & beverages |

| Electronics & gadgets | Alcohol & spirits |

| Jewelry & watches | Tobacco products |

| Footwear & shoes | Fuel |

| Luggage & bags | Hotel accommodation |

| Souvenirs & handicrafts | Restaurant meals |

| Cosmetics & skincare | Airline tickets |

| Artwork & decorations | Spa & beauty services |

| Sporting goods | Medical services |

| Books (non-educational) | Haircuts & salon services |

| Furniture & home decor | Mobile phone subscriptions |

Critical Exclusion Areas

Why Services Don’t Qualify: Services are intangible and consumed immediately in Thailand. A Thai massage cannot be “exported.” VAT refunds target goods transported internationally; services consumed domestically fall outside the program’s scope.

Why Consumables Are Excluded: Food and beverages disappear (eaten or drunk) during your stay. They’re inherently consumed in Thailand, so refund eligibility cannot be proven at departure. Tax authorities require proof of export; an empty bottle proves nothing.

The Cosmetics Gray Area: Cosmetics and skincare products are eligible-they’re tangible goods. However, items consumed (opened, used) become ineligible. Keep cosmetics in original, sealed packaging until inspection. A partially used mascara or opened face cream will be rejected.

Luxury Goods Special Handling: Items exceeding 40,000 THB (approximately $1,120 USD) per item undergo enhanced scrutiny. Customs officers inspect luxury items for authenticity, proper documentation, and compliance. Purchase luxury items exclusively from official brand boutiques and retain original documentation and receipts. A 100,000 THB luxury handbag from an unauthorized dealer risks rejection despite meeting threshold criteria.

The cardinal rule: If it can be consumed, worn out, or legitimately “used” in Thailand, it’s ineligible. If it can be exported in original condition, it likely qualifies.

5. Thailand VAT Refund Calculation Guide

This section answers the question every tourist asks: “How much money will I actually get back?” The answer involves arithmetic and fee structures that reduce the headline 7% VAT rate to a lower effective rate.

Thailand VAT Refund Calculator

How VAT Refund Calculation Works

The calculation process unfolds in stages:

Stage 1 – Calculate Embedded VAT: On a 10,000 THB purchase (inclusive of 7% VAT), the embedded tax is not simply 700 THB. Instead, it’s calculated as: VAT = (Purchase ÷ 1.07) × 0.07 = approximately 654 THB.

Stage 2 – Subtract Administrative Fees: The Thai government charges approximately 100 THB per form for cash refunds at the airport counter. This is a fixed fee, not a percentage.

Stage 3 – Subtract Processing Fees: Additional fees range from 1–3% depending on your chosen refund method and payment processing requirements.

Stage 4 – Account for Exchange Rate Spreads: If receiving a refund via credit card (with subsequent currency conversion), banks typically apply 0.5–2% exchange rate margins.

Stage 5 – Apply Payment Method Service Charges: Credit card processors charge merchants 1–2% for transaction processing, costs often passed to tourists through reduced refund amounts.

The net effect: A 10,000 THB purchase yielding 654 THB in VAT becomes approximately 500 THB in actual cash refund-a 5% effective rate, not 7%.

Why You Don’t Get the Full 7%

Thailand’s revenue department maintains these fees for legitimate operational reasons:

- Counter Staff & Operations: Personnel staffing the VAT Refund Office counter, managing paperwork, and processing thousands of daily transactions require compensation.

- Customs Inspection Labor: Trained officers spending 2–5 minutes per traveler inspecting goods and verifying authenticity represent real labor costs.

- System Processing & Record-Keeping: Electronic filing systems, record retention, audit trails, and compliance documentation infrastructure require ongoing investment.

- Security & Compliance Verification: Measures preventing fraud, verifying passport authenticity, and ensuring VAT revenue integrity cost money.

Rather than viewing fees as unfair, consider them the cost of accessing a government refund system that processes hundreds of thousands of transactions annually.

Refund Amount Reference Table

Use this table to estimate your refund before shopping:

| Purchase From (THB) | Purchase To (THB) | Rounded Refund (THB) |

|---|---|---|

| 2,000 | 2,499.99 | 80 |

| 2,500 | 2,999.99 | 100 |

| 3,000 | 3,499.99 | 120 |

| 3,500 | 3,999.99 | 150 |

| 4,000 | 4,499.99 | 180 |

| 4,500 | 4,999.99 | 220 |

| 5,000 | 5,999.99 | 250 |

| 6,000 | 6,999.99 | 300 |

| 7,000 | 7,999.99 | 350 |

| 8,000 | 8,999.99 | 400 |

| 9,000 | 9,999.99 | 450 |

| 10,000 | 10,999.99 | 500 |

| 11,000 | 11,999.99 | 550 |

| 12,000 | 12,999.99 | 600 |

| 13,000 | 13,999.99 | 650 |

| 14,000 | 14,999.99 | 700 |

| 15,000 | 15,999.99 | 750 |

| 16,000 | 16,999.99 | 800 |

| 17,000 | 17,999.99 | 850 |

| 18,000 | 18,999.99 | 900 |

| 19,000 | 19,999.99 | 950 |

| 20,000 | 21,999.99 | 1,060 |

| 22,000 | 23,999.99 | 1,170 |

| 24,000 | 25,999.99 | 1,280 |

| 26,000 | 27,999.99 | 1,390 |

| 28,000 | 29,999.99 | 1,500 |

| 30,000 | 31,999.99 | 1,610 |

| 32,000 | 33,999.99 | 1,720 |

| 34,000 | 35,999.99 | 1,830 |

| 36,000 | 37,999.99 | 1,940 |

| From | To | Refund |

|---|---|---|

| 38,000 | 39,999.99 | 2,050 |

| 40,000 | 41,999.99 | 2,160 |

| 42,000 | 43,999.99 | 2,270 |

| 44,000 | 45,999.99 | 2,380 |

| 46,000 | 47,999.99 | 2,490 |

| 48,000 | 49,999.99 | 2,600 |

| 50,000 | 51,999.99 | 2,710 |

| 52,000 | 53,999.99 | 2,820 |

| 54,000 | 55,999.99 | 2,940 |

| 56,000 | 57,999.99 | 3,060 |

| 58,000 | 59,999.99 | 3,180 |

| 60,000 | 62,999.99 | 3,370 |

| 63,000 | 65,999.99 | 3,560 |

| 66,000 | 68,999.99 | 3,750 |

| 69,000 | 71,999.99 | 3,940 |

| 72,000 | 74,999.99 | 4,130 |

| 75,000 | 77,999.99 | 4,320 |

| 78,000 | 80,999.99 | 4,510 |

| 81,000 | 83,999.99 | 4,700 |

| 84,000 | 86,999.99 | 4,890 |

| 87,000 | 89,999.99 | 5,080 |

| 90,000 | 92,999.99 | 5,270 |

| 93,000 | 95,999.99 | 5,460 |

| 96,000 | 99,999.99 | 5,720 |

| 100,000 | 103,999.99 | 5,980 |

| 104,000 | 107,999.99 | 6,240 |

| 108,000 | 111,999.99 | 6,500 |

| 112,000 | 115,999.99 | 6,760 |

| 116,000 | 119,999.99 | 7,020 |

| 120,000 | 123,999.99 | 7,280 |

| From | To | Refund |

|---|---|---|

| 124,000 | 127,999.99 | 7,540 |

| 128,000 | 131,999.99 | 7,800 |

| 132,000 | 135,999.99 | 8,060 |

| 136,000 | 139,999.99 | 8,320 |

| 140,000 | 143,999.99 | 8,580 |

| 144,000 | 147,999.99 | 8,840 |

| 148,000 | 151,999.99 | 9,100 |

| 152,000 | 155,999.99 | 9,360 |

| 156,000 | 159,999.99 | 9,620 |

| 160,000 | 163,999.99 | 9,860 |

| 164,000 | 167,999.99 | 10,100 |

| 168,000 | 171,999.99 | 10,340 |

| 172,000 | 175,999.99 | 10,580 |

| 176,000 | 179,999.99 | 10,820 |

| 180,000 | 183,999.99 | 11,060 |

| 184,000 | 187,999.99 | 11,300 |

| 188,000 | 191,999.99 | 11,540 |

| 192,000 | 195,999.99 | 11,780 |

| 196,000 | 199,999.99 | 12,000 |

Real-World Examples:

Example 1: Souvenir Shopping (5,000 THB Purchase)

- Purchase: 5,000 THB

- Embedded VAT: ~328 THB

- Fixed fee: -100 THB

- Processing fee: -20 THB

- Your refund: 208 THB (4.2% effective rate)

Example 2: Electronics Purchase (50,000 THB)

- Purchase: 50,000 THB

- Embedded VAT: ~3,271 THB

- Fixed fee: -100 THB

- Processing fee: -130 THB

- Your refund: 3,041 THB (6.1% effective rate)

Example 3: Luxury Item (100,000 THB)

- Purchase: 100,000 THB

- Embedded VAT: ~6,542 THB

- Fixed fee: -100 THB

- Processing fee: -260 THB

- Your refund: 6,182 THB (6.2% effective rate)

Note: Luxury items (above 40,000 THB per unit) trigger additional customs inspection, potentially delaying processing by 10–15 minutes but not reducing refund amounts.

Interactive Calculation Approach

To estimate your specific refund:

- Enter your total purchase amount (including VAT)

- Select your preferred refund method (cash, credit card, bank draft, digital wallet)

- Receive instant estimates of your refund amount and effective refund percentage

[Interactive Calculator Widget Placeholder]: Input purchase amount → Select payment method → Display estimated refund and percentage.

Calculator Transparency: Actual refunds may vary slightly based on individual store fees, specific bank processing charges, and any applicable promotions or discounts. Use this calculator for ballpark estimates, not guaranteed amounts.

6. Step-by-Step Process: How to Claim VAT Refund

This is the operational heart of your VAT refund strategy. Following these eight steps precisely maximizes approval odds and minimizes airport delays.

STEP 1: Shop at Participating Stores

Not every retailer in Thailand participates in the VAT Refund for Tourists program. Participation is optional and typically concentrated in:

- International Brand Boutiques: Official brand stores participate almost universally. Chanel, Louis Vuitton, Hermes, Rolex, Apple, Samsung, and luxury brands participate globally.

- Major Shopping Malls: Central World, Emporium, EmQuartier, Siam Square, and The Mall are participating venues. Individual boutiques within these malls display signage.

- Department Stores: Emporium, Paragon, and established Thai department store chains participate.

- Standalone Boutiques: Small independent shops may or may not participate-always ask.

How to Identify Participating Stores: Look for the official “VAT Refund for Tourists” signage displayed prominently near the register or customer service area. The sign features Thai and English text with the REFUND logo. When in doubt, ask explicitly: “Do you participate in the VAT Refund for Tourists program?”

Pro Tip: Plan your shopping itinerary around confirmed participating stores. A 5,000 THB purchase from a non-participating store yields zero refund, regardless of price.

STEP 2: Present Your Passport at Checkout

At the point of sale, inform the cashier you’re claiming a VAT refund and present your valid passport. This is not optional. The cashier needs:

- Your Passport: Original passport (not a photocopy) showing your name, passport number, and nationality.

- Verbal Confirmation: State clearly, “I would like to claim VAT refund. I’m a non-Thai resident.” Some stores have trained staff who ask automatically if they notice a foreign accent or non-Thai appearance.

Why This Matters: The store staff must verify non-residency status before initiating the VAT refund form. This verification prevents Thai nationals and permanent residents from fraudulently claiming refunds.

Information Recorded: Your name, passport number, nationality, and passport expiration date are transcribed onto the P.P.10 form. Accuracy here prevents rejections at the airport.

STEP 3: Obtain P.P.10 Form & Receipt

Request the VAT Refund Application Form, officially titled “P.P.10” (Application Form for a Refund of Value Added Tax for Tourists).

Critical Requirements:

- Completed at Point of Sale: The form must be completed immediately at checkout, not later. You cannot fill it out at home or modify it after purchase.

- Original Tax Invoice: The store provides an original tax invoice (receipt) showing itemized goods, prices, VAT amount, and store information. Photocopies are unacceptable.

- Store VAT Registration Number: The receipt must clearly display the store’s VAT registration number, a unique identifier enabling customs verification.

What the P.P.10 Form Contains:

- Store name and location

- Store VAT registration number

- Your passport information

- Purchase date

- Itemized list of purchased goods

- Individual item prices and VAT amount

- Your signature

- Store representative signature and stamp

Keep this form pristine. Creases, tears, or stains may trigger rejection.

STEP 4: Verify Receipt Details Before Leaving Store

Before exiting the store, conduct a final verification to prevent rejections:

Accuracy Check:

- ☑ Purchase price matches your receipt

- ☑ VAT amount is correctly calculated (should be approximately 6.5% of the pre-tax price)

- ☑ Purchase date is today’s date

- ☑ Your passport information is accurately transcribed

- ☑ Store name and contact information are complete and legible

- ☑ Store VAT registration number is present

- ☑ All signatures and stamps are present

Document Storage:

- Keep originals in your carry-on bag, not checked luggage. If luggage is lost, you lose your refund proof.

- Use a dedicated folder or envelope to prevent creasing or damage.

- Take smartphone photos of all forms as a digital backup. If physical forms are damaged or lost, photos can serve as supporting evidence.

STEP 5: Pre-Departure Customs Inspection (BEFORE CHECK-IN)

This is the critical step that many tourists skip or perform in the wrong sequence-and it costs them their entire refund.

Location: The “VAT Refund for Tourists” inspection counter is located in the airport departure hall, BEFORE the check-in counters. In Bangkok’s Suvarnabhumi Airport, the counter is prominently marked in English. Arrival time: Arrive at the counter at least 3 hours before your international flight.

What You Bring:

- All purchased goods (in original packaging if possible)

- All P.P.10 forms and receipts

- Valid passport

Inspection Process:

The customs officer will:

- Examine your goods for authenticity and original condition

- Verify that goods remain unused and in original packaging

- Cross-reference goods descriptions on your P.P.10 forms with the physical items

- Check that luxury items (over 40,000 THB) are from authorized retailers with proper documentation

- Validate your passport and confirm non-Thai residency

Duration: Most inspections take 2–5 minutes. High-value or questionable items may require 10–15 minutes of additional scrutiny.

Critical Outcome: If inspection passes, the officer stamps your P.P.10 form. This stamp authorizes your refund claim. Without this stamp, the VAT office will reject your refund application.

Common Rejection Reasons:

- Goods showing signs of use (opened packaging, worn items, tested electronics)

- Missing original packaging or documentation

- Luxury items without proof of purchase from official retailers

- Passport issues or expired documentation

- Goods deemed inconsistent with VAT receipts

Pro Tip: Keep goods in carry-on luggage if physically possible. This allows easy inspection without retrieving checked baggage.

STEP 6: Check In Baggage & Pass Immigration

After customs inspection and approval, proceed to standard airport procedures:

- Check in your luggage at your airline’s counter. Your stamped P.P.10 forms now authorize refund claims, so goods in checked luggage are protected.

- Go through security screening normally.

- Pass immigration with your passport and boarding pass.

Document Accessibility: Keep stamped P.P.10 forms and your boarding pass easily accessible. You may be asked to present them during departure gate procedures.

STEP 7: Claim Refund at VAT Office (AFTER IMMIGRATION)

After passing immigration but before boarding, proceed to the VAT Refund for Tourists Office, typically located in the departure hall’s duty-free area.

Documents Required:

- Stamped P.P.10 forms (from customs inspection)

- Original tax invoices/receipts

- Valid passport

- Boarding pass

Office Process:

- Check in at the counter: Present all documents in an organized packet.

- Select refund method:

- Cash (fastest; limited to 30,000 THB per transaction)

- Credit card (7–14 day processing)

- Bank draft (7–30 day processing)

- Digital wallet (immediate via TAGTHAi app, emerging option)

- Complete final paperwork: Sign any remaining forms or authorizations.

- Receive refund: For cash, you receive money immediately. For other methods, processing timeframes vary.

Processing Duration: Expect 15–30 minutes total from check-in to refund receipt. Arrive early to avoid rushing.

STEP 8: Keep Proof & Depart

Once you’ve received your refund:

- Retain the receipt from the VAT Refund Office confirming your claim processing.

- Keep this receipt for at least one year in case the Thai government requires audit documentation.

- Present at departure gate if requested by airport staff (uncommon but possible).

- Board your flight with confidence that your refund is processed.

Post-Departure:

- If you chose credit card refund, the amount appears on your credit card statement in 7–14 days.

- If you chose bank draft, processing takes 7–30 days via international banking channels.

- Retain email confirmations or receipt numbers for tracking purposes.

7. Required Documents Checklist

Rejections at the VAT office counter often result from missing or incomplete documentation. Use this checklist to prevent delays:

Critical Documents

☑ Valid Passport (Original): A photocopy is unacceptable. Your original passport is inspected at customs, the VAT office, and potentially at departure gates. Ensure it’s not damaged and doesn’t expire within 6 months of your travel.

☑ P.P.10 Forms (Completed & Stamped): The customs inspection stamp is absolutely essential. Forms without this stamp are rejected outright. Keep all forms together, organized chronologically or by store.

☑ Original Tax Invoices/Receipts: Original receipts from point-of-sale, not photocopies. Receipts must display store name, VAT registration number, itemized goods, prices, and VAT amount.

☑ Boarding Pass or Airline Ticket: Final confirmation of your departure details (flight number, date, airline). This validates that you’re actually departing Thailand within the legal timeframe.

☑ Purchased Goods (For Inspection If Required): For high-value items (over 40,000 THB) or suspicious purchases, the VAT office may request to verify goods match receipt descriptions. Bring luxury items if they’re in carry-on luggage.

☑ Proof of Non-Resident Status: Your passport inherently provides this. Non-Thai nationality is confirmed through passport inspection.

Pro Tips for Document Organization

Separate Folder: Keep all VAT refund documents in a dedicated folder, separate from your travel documents. Label it “VAT Refund Documents” to prevent accidental disposal or confusion.

Digital Backups: Before heading to the airport, photograph all forms, receipts, and the front/back of your passport. Store these images on your phone or cloud storage. If physical documents are lost or damaged, photos provide supporting evidence for the VAT office.

Ziplock Bag Protection: Place all documents in a waterproof ziplock bag. Airport humidity and mishaps damage paper documents. A protected set of documents prevents rejection due to illegibility.

Chronological Organization: Organize receipts and P.P.10 forms chronologically by purchase date, then alphabetically by store name. This organization accelerates the VAT office’s processing and demonstrates preparedness.

8. Refund Payment Methods: Compare & Choose

Four refund payment methods exist, each with distinct advantages, limitations, and fee structures. Understanding these options allows you to choose the method maximizing your actual refund amount.

Payment Methods Comparison

| Method | Maximum Amount | Processing Time | Fees | Best For |

|---|---|---|---|---|

| Cash (THB) | 30,000 THB | Immediate | ~100 THB fixed | Quick travelers, amounts under 30,000 THB |

| Credit Card | No limit | 7–14 days | 1–2% | Large purchases, credit card rewards programs |

| Bank Draft | No limit | 7–30 days | ~200 THB fixed | Very large amounts, no credit card available |

| Digital Wallet | No limit | Immediate | Varies (0–2%) | Tech-savvy travelers, integration with TAGTHAi app |

Cash Refunds: Pros & Cons

Advantages:

- Immediate gratification-money in hand before departure

- No credit card fees or processing delays

- Tangible, physical confirmation of refund

Disadvantages:

- Capped at 30,000 THB per transaction

- Carrying large sums of cash increases theft/loss risk

- Money spends quickly; harder to save

Best For: Refunds under 30,000 THB, travelers wanting immediate cash for remaining purchases or tipping.

Fee Structure: Approximately 100 THB fixed fee per form.

Credit Card Refunds: Pros & Cons

Advantages:

- No upper limit on refund amount

- Funds appear on your credit card statement automatically

- Credit card rewards points accumulate if your card earns cash back

- Reduces cash handling and theft risk

- Easy to track via online banking

Disadvantages:

- 7–14 day processing delay before funds appear

- Card issuer typically applies 1–2% processing fees

- Bank exchange rates may be less favorable than market rates

Best For: Large purchases (above 30,000 THB), travelers wanting to avoid carrying cash, those wanting credit card rewards.

Fee Structure: Card issuer typically charges 1–2%; VAT office may charge an additional 50–100 THB.

Important Note: If you use a credit card issued by a non-Thai bank, verify that your card is accepted at the VAT office. Most Visa and Mastercard are accepted; some American Express cards are not. Call your card issuer before traveling if uncertain.

Bank Draft Refunds: Pros & Cons

Advantages:

- No upper limit on refund amount

- No credit card processing through international networks

- Acceptable by travelers without credit cards

- Lower fees than credit card processing

Disadvantages:

- Longest processing time (7–30 days via international banking channels)

- Requires providing international banking information

- Fixed fee (~200 THB) applies regardless of amount

- Requires international wire transfer or bank-to-bank coordination

Best For: Very large refunds (100,000+ THB), travelers without credit cards, business travelers expensing purchases.

Fee Structure: Approximately 200 THB fixed fee, plus potential bank wire transfer fees (typically 5–15 USD equivalent per transaction).

Digital Wallet Refunds: Emerging Option

Thailand’s Revenue Department has begun offering digital wallet refunds through integration with the TAGTHAi app and local payment platforms (Promptpay, OMise, etc.).

Advantages:

- Immediate or near-immediate processing

- Funds transfer directly to your registered mobile wallet

- Lower fees than credit card processing

- Aligns with Thailand’s digital payment infrastructure

Disadvantages:

- Only available at select airports (expanded coverage ongoing)

- Requires TAGTHAi app account or local wallet registration

- May not be available for all travelers or international cards

- Emerging service; documentation and support still developing

Best For: Tech-savvy travelers, those with Thai phone numbers and wallet accounts, testing Thailand’s digital refund infrastructure.

Strategic Selection Framework

Choose Cash if:

- Your refund is under 30,000 THB

- You want money immediately for final purchases

- You prefer simplicity over processing

Choose Credit Card if:

- Your refund exceeds 30,000 THB

- You value rewards points or cash back

- You trust your card issuer’s exchange rates

- You don’t need the money immediately

Choose Bank Draft if:

- Your refund significantly exceeds 30,000 THB

- You don’t have credit cards or prefer traditional banking

- Processing time delays don’t concern you

- You’re expensing the amount to an employer

Choose Digital Wallet if:

- The airport offers this option

- You have a registered Thai digital wallet or PromptPay account

- You want near-immediate processing

- You’re familiar with mobile payment platforms

9. Time Limits & Deadlines: Critical Dates

Missing Thailand’s VAT refund deadlines voids your claim permanently. No second-chance procedures exist. Mark these dates in your calendar:

Purchase to Export Timeline

The 60-Day Rule (Most Important): Goods must physically leave Thailand within exactly 60 calendar days from the purchase date. On day 61, goods are legally considered “used in Thailand,” and refund eligibility expires irreversibly.

Example: If you purchase a watch on January 15, you have until March 15 (59 days later) to depart Thailand with the watch in your possession. On March 16, refund eligibility is null.

Implication: Plan your purchases strategically. Buying items on your last day before departure minimizes the export deadline pressure. Buying items on day 1 of a 60-day trip requires disciplined execution.

Refund Claim Deadlines

Process at Airport on Departure Day: Your only opportunity to claim a VAT refund is during your airport departure procedures on your final day in Thailand. The VAT office is open during airport hours, typically 6 AM to midnight at major international airports.

No Post-Departure Claims: Once you’ve left Thailand, refund claims are rejected. You cannot mail in forms or file claims remotely. Physical presence in Thailand during departure is mandatory.

Processing Timeline by Method

Cash Refunds: Immediate-you receive money before boarding.

Credit Card Refunds: 7–14 days from refund office processing to appearance on your credit card statement.

Bank Draft Refunds: 7–30 days due to international banking clearance procedures.

Digital Wallet Refunds: Immediate to 24 hours, depending on platform integration.

Record Retention

Keep Documentation for One Year: Retain your VAT refund office receipt, all P.P.10 forms, and original receipts for a minimum of one year. The Thai Revenue Department retains audit rights and occasionally requests documentation from tourists for compliance verification.

What Happens If You Miss the 60-Day Deadline?

Irreversible Forfeiture: Goods are legally considered “used in Thailand.” Refund claims are rejected permanently. No appeals process exists. The 60-day deadline is absolute.

The Risk: If you postpone your departure or extend your trip beyond 60 days from purchase, your refund is lost. Plan accordingly.

Mitigation Strategy: Purchase goods near the end of your stay, not the beginning. A purchase one week before departure triggers no deadline stress.

10. Fees & Actual Refund Breakdown: Understanding Why 7% ≠ 7% Refund

The most common source of tourist confusion is the discrepancy between the 7% VAT rate and the 4–6% actual refund. This section demystifies the fees eroding the refund.

Comprehensive Fee Structure

Fixed Administrative Fee: 100 THB per P.P.10 form (for cash refunds). This covers counter operations, paperwork processing, and administrative overhead.

Processing Fee: 1–3% of the refund amount, varying by refund method and processing complexity.

Exchange Rate Spread (if applicable): If receiving a credit card or international bank draft refund, currency conversion incurs 0.5–2% exchange rate margins-this is how banks profit from currency transactions.

Payment Method Service Charge: Credit card processors charge the VAT office 1–2% for transaction processing. These costs are often passed to tourists through proportionally reduced refunds.

Real-World Refund Calculation Example: 10,000 THB Purchase

Let’s trace the exact calculation for a 10,000 THB purchase (inclusive of 7% VAT):

Step 1 – Extract Embedded VAT:

Formula: VAT = (Purchase ÷ 1.07) × 0.07

Calculation: (10,000 ÷ 1.07) × 0.07 = 654 THB

Step 2 – Apply Fixed Administrative Fee:

Fee: -100 THB (cash refund method)

Remaining: 654 – 100 = 554 THB

Step 3 – Apply Processing Fee (1.5% for cash):

Fee: 554 × 0.015 = -8.31 THB

Remaining: 554 – 8.31 = 546 THB

Step 4 – Round Down:

Final Refund: 545 THB (rounded to nearest 5 THB)

Effective Refund Rate: 545 ÷ 10,000 = 5.45%

The Bottom Line: From an initial 7% VAT rate, fees reduce the effective refund to approximately 5.45%-a reduction of 1.55 percentage points.

Why Fees Exist: Operational Justification

Tourism boards and revenue agencies justify VAT refund fees through legitimate operational costs:

Counter Staff & Operations: The VAT Refund for Tourists Office employs full-time staff during airport hours, providing customer service, processing paperwork, issuing payments, and maintaining records. Staffing costs are substantial.

Customs Inspection Labor: Trained customs officers spend 2–5 minutes per traveler physically inspecting goods, verifying authenticity, preventing smuggling, and documenting inspections. This skilled labor isn’t free.

System Processing & Record-Keeping: Electronic filing systems, database maintenance, audit trails, compliance documentation, and government record retention infrastructure require continuous investment.

Security & Compliance Verification: Anti-fraud measures, identity verification, VAT revenue protection, and auditing mechanisms cost money to maintain.

International Banking: For credit card and bank draft refunds, international payment processing networks charge transaction fees.

These operational costs are real; fees are not arbitrary surcharges.

Comparison: Effective Refund Rates by Method

| Refund Method | Administrative Cost | Processing Fee | Effective Refund Rate |

|---|---|---|---|

| Cash (under 30,000 THB) | ~100 THB fixed | ~1–1.5% | ~4–5% |

| Credit Card | ~50–100 THB | ~1–2% | ~4–5.5% |

| Bank Draft | ~200 THB fixed | ~0.5% | ~4–5.5% |

| Digital Wallet | ~50 THB | ~0.5–1% | ~5–6% |

Strategic Implication: Digital wallet refunds (the emerging option) offer marginally higher effective rates due to lower processing costs, incentivizing adoption of Thailand’s digital payment infrastructure.

11. Common Mistakes to Avoid: Learning from Others’ Failures

Each year, thousands of tourists lose VAT refunds due to preventable mistakes. Learning from these failures saves you money and airport frustration.

Critical Mistake #1: Not Getting Form Stamped Before Check-In

The Mistake: Tourists skip the customs inspection counter or attempt to claim refunds after already checking luggage containing goods, or they show up at the VAT office without the customs stamp.

Consequence: Refund claim rejected outright. The customs stamp is non-negotiable proof that goods were inspected and verified.

Prevention: Arrive at the airport 3+ hours early. Immediately head to the “VAT Refund for Tourists” inspection counter (before check-in lines) with all goods and forms. Do not check luggage until after customs inspection.

Critical Mistake #2: Shopping at Non-Participating Stores

The Mistake: Buying from small independent shops, market vendors, or boutiques without the official “VAT Refund for Tourists” signage, assuming all stores participate.

Consequence: No refund is possible, regardless of purchase amount or documentation.

Prevention: Before entering any shop, look for the official signage. Ask explicitly: “Does this store participate in the VAT Refund for Tourists program?” If unsure, shop elsewhere.

Critical Mistake #3: Not Bringing Physical Goods to the Airport

The Mistake: Packing purchased goods in checked luggage, then claiming refunds without physically presenting goods for inspection.

Consequence: Customs cannot verify goods; refund is denied.

Prevention: Keep high-value items in carry-on luggage for easy inspection. If checked luggage must contain goods, inform the VAT office and offer to retrieve luggage from the baggage carousel for inspection (creates delays but allows refund processing).

Critical Mistake #4: Exceeding the 60-Day Export Deadline

The Mistake: Extending your trip beyond 60 days from purchase, intending to claim refunds on day 61 or later.

Consequence: Goods are legally “used in Thailand.” Refund claims are permanently voided. No exceptions exist.

Prevention: Calculate your 60-day deadline immediately after purchase. If extending your trip is likely, delay purchases until later in your stay. Or purchase items on your final week before departure.

Critical Mistake #5: Forgetting Passport or Boarding Pass

The Mistake: Leaving your passport at your hotel or boarding pass at check-in, arriving at the VAT office unable to verify identity or departure.

Consequence: Refund office cannot process claims without these documents.

Prevention: Keep your passport and boarding pass in your carry-on bag, easily accessible. Keep them together with VAT refund forms in a dedicated folder.

Critical Mistake #6: Losing or Damaging P.P.10 Forms

The Mistake: Carelessly storing forms, allowing creasing, water damage, or loss before reaching the VAT office.

Consequence: Without original forms, no refund is possible. Forms are the sole proof of purchase eligibility.

Prevention: Use a dedicated folder or ziplock bag to protect forms. Take smartphone photos as digital backups. Never put forms in checked luggage.

Critical Mistake #7: Purchasing for Someone Else

The Mistake: A friend makes a purchase, but you (the passport holder) attempt to claim the refund using your passport.

Consequence: Form is signed by the wrong person. Customs cannot verify purchase eligibility. Refund is rejected.

Prevention: Only claim refunds for purchases made with your own passport presented at checkout. If buying gifts, have each recipient present their own passport and claim their own refund (if non-Thai residents).

Critical Mistake #8: Not Reading Exclusions List

The Mistake: Purchasing services (spa, hotel, massage), consumables (food, alcohol), or fuel, assuming they qualify for refunds.

Consequence: Refund office rejects these items immediately upon inspection.

Prevention: Before shopping, review the “Eligible vs. Ineligible Goods” section (Section 4). Commit to memory: services and consumables never qualify.

Critical Mistake #9: Claiming Refund at Wrong Counter/Location

The Mistake: Asking airport staff for the VAT office, being directed to the wrong counter, or attempting to claim refunds at the wrong airport location.

Consequence: Processing delays, redirects, or rejection.

Prevention: Ask airport staff specifically: “Where is the VAT Refund for Tourists Office?” Not just “VAT office”-many airports have multiple tax-related counters. Get specific directions before heading to any counter.

Critical Mistake #10: Presenting Damaged or Opened Goods

The Mistake: Goods show signs of use (opened packaging, worn items, tested electronics, or applied cosmetics).

Consequence: Inspection officer rejects goods as “used in Thailand,” voiding refund eligibility.

Prevention: Keep all goods in original, sealed packaging until the inspection counter. Don’t test electronics, open cosmetics, or wear clothing before inspection. Maintain pristine condition.

12. Digital Solution: Online VAT Refund via App

Thailand’s tax administration is modernizing the VAT refund process through digital platforms, particularly the TAGTHAi app (Automatic Tax Refund – Thailand). This emerging option offers convenience that traditional paper-based refunds cannot match.

New Digital Process: TAGTHAi App & VRT Platform

The TAGTHAi app streamlines refund claims through:

Download & Registration: Download the official TAGTHAi app from the Apple App Store or Google Play Store. Create an account using your passport number, email, and contact information.

In-Store Digital Form: Participating stores equipped with QR code terminals allow you to scan your passport QR code at checkout, initiating a digital P.P.10 form. No paper forms are printed; the process is entirely digital.

Document Upload: After scanning or purchasing, upload scanned images of your receipts and form directly through the app. Digital uploads reduce paperwork and create automatic backups.

Pre-Departure Digital Submission: Before arriving at the airport, submit your claim digitally through the app. This pre-processing reduces airport counter wait times significantly.

Real-Time Refund Tracking: After submission, track your claim status in real-time through the app. Notifications alert you when your refund is processed and dispatched.

Immediate Notification: Upon final verification and approval, the app notifies you, providing confirmation numbers and refund amounts.

Advantages Over Traditional Paper Method

Reduced Airport Wait Times: Pre-submitting digital claims means your paperwork is already in the system when you arrive. Airport counter interactions reduce from 30 minutes to 10–15 minutes.

Digital Backup: Uploads create automatic backups. If physical items are damaged or lost, your app submissions serve as secondary evidence.

Real-Time Tracking: Know your refund status in real-time instead of wondering about processing delays.

Environmental Benefit: Paperless claims reduce environmental impact-appeals to eco-conscious travelers.

Faster Processing: Digital submissions enable parallel processing, accelerating refund times from 7–30 days to 5–14 days for most methods.

Integration with Payment Platforms: TAGTHAi integrates with PromptPay and other Thai digital wallets, enabling instant refund transfers to mobile wallets.

Current Limitations

Customs Inspection Still Required: Despite digital preprocessing, goods still require physical inspection at the airport customs counter before check-in. You must present physical items.

Final Verification at VAT Office: The VAT Refund Office still verifies your physical passport and provides final approval. Complete airport visit is still necessary.

Limited Retailer Adoption: Not all stores have integrated digital terminals yet. Adoption is expanding but remains concentrated in major malls and upscale boutiques.

Emerging Service: As a relatively new initiative, documentation, support, and standardization are still developing. Technical glitches or integration issues occasionally occur.

Geographic Limitations: Digital refund options are primarily available at major airports (Bangkok, Phuket, Chiang Mai). Regional airports offer limited digital options.

Step-by-Step Digital Refund Process

Step 1 – Install & Register App:

- Download TAGTHAi from App Store or Google Play

- Create account with passport number, email, phone

- Verify email and phone number

Step 2 – Shop at Digitally-Integrated Stores:

- Confirm store has digital VAT refund QR terminal

- Present passport at checkout

- Scan passport QR code into digital terminal

- Receive digital receipt via email

Step 3 – Upload Documentation:

- Open app

- Photograph or scan receipt

- Upload receipt image to app

- Photograph or scan P.P.10 form

- Upload form image to app

Step 4 – Submit Digital Claim:

- Review submission for accuracy

- Click “Submit Claim”

- Receive confirmation number via email and app

- Save confirmation number

Step 5 – Arrive at Airport & Clear Customs:

- Head to customs inspection counter with physical goods

- Officer inspects goods and stamps P.P.10 form

- Proceed through standard airport procedures

Step 6 – Final Verification at VAT Office:

- Proceed to VAT Refund Office after immigration

- Present passport and boarding pass

- Officer verifies your digital submission status in their system

- Confirm refund method and payment details

Step 7 – Receive Refund:

- Cash: Receive immediately (if selected)

- Digital wallet: Transfer completes immediately

- Credit card: Transfer initiates (7–14 days to card)

- Bank draft: Processing initiates (7–30 days)

Step 8 – Retain Confirmation:

- Save email confirmation

- Screenshot app notification of refund approval

- Keep confirmation number for 1-year record retention

Adoption Trajectory

Thailand’s Revenue Department is aggressively promoting digital refunds. Projections indicate:

- 2026: 30–40% of major retailers digitally integrated

- 2027: 60–70% of retail locations offering digital options

- 2028+: Potential for fully digital refunds with integration of passport e-gates and biometric verification

Recommendation: If TAGTHAi app is available and your stores are integrated, adopt it. You’ll experience faster processing and reduced airport friction. If not yet available or integrated, traditional paper methods remain fully functional and reliable.

13. Frequently Asked Questions: Addressing Your Concerns

Thousands of tourists raise similar questions about VAT refunds. These FAQs address the highest-frequency concerns:

Eligibility Questions

Q: Can Thai citizens claim VAT refunds?

A: No. Thai nationals are ineligible, regardless of whether they hold a second passport or dual citizenship. Your primary passport determines eligibility. Only non-Thai citizens qualify.

Q: Can permanent residents of Thailand claim refunds?

A: No. Permanent residents are treated as residents, not tourists, and lose eligibility. If you hold Thai permanent residency (a rare status), you cannot claim VAT refunds.

Q: Are expats working in Thailand eligible for VAT refunds?

A: Only if you maintain non-resident status. Most expats working in Thailand and holding a Thai work permit are considered residents and forfeit eligibility. However, expats with “Non-Immigrant” visas who work remotely for foreign companies may maintain non-resident status-consult the Thai Revenue Department for your specific situation. This is a gray area; assume ineligibility unless explicitly confirmed.

Q: Can I claim VAT refunds if I’m staying in Thailand longer than 180 days?

A: No. The program limits eligibility to short-term visitors (under 180 days per calendar year). If you stay beyond 180 days, you’re classified as a resident, and refund eligibility is forfeited for that calendar year.

Calculation & Amount Questions

Q: If Thailand’s VAT is 7%, why don’t I get 7% back?

A: Fees reduce the effective refund to 4–6%. Administrative fees, processing costs, and system operations account for the ~1.5–2% reduction from the 7% headline rate.

Q: How is the refund calculated if I buy from multiple stores?

A: Each receipt is calculated independently. A 2,000 THB receipt at Store A and a 3,000 THB receipt at Store B generate two separate P.P.10 forms, two separate refund calculations, but both are processed in one airport visit. Refunds are summed: you’re not charged per-form fees twice necessarily (depending on your selection), but calculations are separate.

Q: Do I get a larger refund percentage if I spend more?

A: Yes, slightly. Larger purchases have lower percentage-based fee impacts. A 200,000 THB purchase yields ~6.1% effective refund, while a 2,000 THB purchase yields ~4%. The fixed 100 THB fee becomes negligible as purchase amounts increase.

Q: Can I combine purchases from different days to meet the 2,000 THB minimum?

A: No. The 2,000 THB minimum must be per receipt, per day, per store. You cannot aggregate a 1,500 THB purchase from Monday with a 1,500 THB purchase from Tuesday to meet the threshold. However, you can accumulate multiple 2,000+ THB receipts from different stores to meet the 5,000 THB aggregate minimum.

Goods & Purchases Questions

Q: Can I claim VAT refunds on jewelry?

A: Yes, if the jewelry is under 40,000 THB per item. Items at or above 40,000 THB trigger enhanced customs inspection. Luxury jewelry over this threshold is eligible but subject to additional scrutiny.

Q: Are cosmetics eligible for VAT refunds?

A: Yes, cosmetics and skincare products are eligible as tangible goods. However, opened, used, or partially consumed cosmetics are ineligible. Keep cosmetics sealed and unused until inspection.

Q: What about luxury branded items? Are they eligible?

A: Luxury goods are eligible if purchased at official brand boutiques with proper documentation and receipts. Counterfeit goods, gray-market items, or goods from unauthorized dealers may be rejected during inspection. Ensure all luxury purchases include official receipts from recognized retailers.

Q: Can I claim VAT refunds on services like spa treatments or hotel accommodations?

A: No. Only tangible goods qualify. Services are consumed immediately in Thailand and cannot be exported, so they’re ineligible by design.

Process Questions

Q: What happens if I lose my P.P.10 form?

A: Your refund claim cannot be processed. The P.P.10 form is your proof of purchase eligibility and is required for final refund processing. Lost forms mean lost refunds-there is no recovery process. Keep forms in a secure folder and take digital backups.

Q: Do I need to keep the original product packaging?

A: Not strictly required, but strongly recommended. Original packaging proves items are unused and new. Goods in used packaging face rejection during inspection. Keep all packaging until after customs inspection.

Q: What if my goods get damaged during the customs inspection process?

A: Minor wear or accidental damage during inspection does not void refunds. However, significant damage or evidence of use will result in rejection. Inspectors use care, but minor scratches or marks are not grounds for rejection.

Q: Can I claim a VAT refund if I’m departing by land or sea?

A: No. VAT refunds are exclusively processed at international airport departure halls. Land border crossings and seaports have no VAT refund facilities. Only air departures qualify.

Timing Questions

Q: What if I make a purchase on my final day before departure?

A: No problem. You can purchase items on your departure day and still claim refunds at the airport before boarding. This actually minimizes your 60-day export deadline risk.

Q: How long does it take to receive a refund after I claim it at the airport?

A: Immediate if you choose cash. If credit card, 7–14 days for the amount to appear on your statement. If bank draft, 7–30 days via international banking channels. Digital wallet transfers are typically immediate.

Payment Method Questions

Q: What if my refund exceeds 30,000 THB?

A: You must choose credit card, bank draft, or digital wallet. Cash is capped at 30,000 THB maximum per transaction. For amounts above 30,000 THB, credit card is the most convenient option.

Q: Can I receive my refund in a foreign currency (USD, EUR, GBP)?

A: No. Refunds are exclusively in Thai Baht. You must convert Thai Baht to your home currency yourself, using ATMs, banks, or currency exchange services. Plan accordingly if you need foreign currency.

Q: Are there additional fees for credit card refunds?

A: Yes. Card issuers typically charge 1–2% processing fees. This is determined by your specific bank, not the Thai Revenue Department. Check with your bank before selecting credit card as your refund method.

Special Situations

Q: Can I claim VAT refunds on purchases made by family members traveling with me?

A: Only if family members hold their own valid passports and claim refunds under their own names. Each traveler must present their own passport, have their own P.P.10 forms, and make separate refund claims. Parents cannot claim refunds on children’s purchases.

Q: What if I’m traveling with items I purchased on a previous visit?

A: Only items purchased during your current trip, with P.P.10 forms and receipts from your current visit, qualify. Items from previous trips, even if they meet other eligibility criteria, cannot be refunded.

Q: Can business purchases be refunded?

A: Only if purchased as a tourist for personal use. Bulk purchases intended for business or resale violate the program. The VAT refund system targets personal tourist spending, not commercial transactions. If questioned about bulk purchases, be prepared to explain personal use justification.

14. Tips for Maximizing Your Refund

Refund maximization requires strategic shopping, timing, and execution. These tips boost your effective refund rate and reduce airport friction.

Strategy 1: Plan Purchases Before Arrival

Pre-Arrival Research: Before leaving home, research participating stores and shopping locations. Major Bangkok malls (Central World, Emporium, EmQuartier) guarantee VAT refund participation. Small boutiques and street vendors offer no guarantees.

Set Spending Targets: Determine your spending budget and identify purchases that meet the 2,000+ THB per receipt threshold. A 4,500 THB laptop qualifies; a 1,500 THB scarf does not.

Budget Airport Time: Allocate 1–2 hours for VAT refund processes (inspection, queue, processing). Arriving early at the airport eliminates time pressure.

Calculate Expected Refunds: Using the reference tables in Section 5, pre-calculate expected refunds. A 50,000 THB electronics purchase yields ~2,750 THB refund-use this knowledge to set trip spending expectations.

Strategy 2: Shop at Major Malls for Guaranteed Participation

Strategic Location Choice: Central World, Emporium, EmQuartier, Siam Square, and The Mall are confirmed VAT refund participants. Shopping at these locations guarantees processing.

Verify Participation: If shopping elsewhere, confirm participation before entering stores. Don’t assume; always ask.

Plan Shopping Route: Map a route through multiple participating stores to minimize travel time and consolidate shopping efforts.

Strategy 3: Get One Receipt Per Store Per Day (Hit the 2,000 THB Threshold Efficiently)

Receipt Consolidation: Bundle purchases at a single store on a single day to generate one receipt totaling 2,000+ THB. This approach minimizes paperwork and P.P.10 forms.

Example: Instead of purchasing a 1,500 THB item and a 600 THB item separately, buy both together at the same store for a single 2,100 THB receipt. This generates one P.P.10 form instead of two and saves processing time.

Time Efficiency: Fewer forms mean fewer airport processing steps and faster refund claims.

Strategy 4: Combine Purchases to Reach Higher Refund Tiers

Tiered Refund Advantage: Review the refund table in Section 5. Purchases at the 50,000+ THB tier yield 5.5–6.1% effective refund rates, compared to 4% for smaller purchases.

Coordination with Travel Companions: If traveling with friends or family, consider pooling purchases. If a friend reaches 15,000 THB and you reach 15,000 THB, you both process separately. However, if you collectively reach 50,000+ THB with one person claiming the entire amount, that person gets a higher refund percentage on the larger amount (though this requires all purchases to be under one person’s name-possible only if that person made all purchases with their passport presented).

Luxury Item Strategy: High-value electronics, jewelry, and designer goods push you into higher refund tiers naturally. Targeting luxury goods shopping increases your refund percentage automatically.

Strategy 5: Choose Refund Method Strategically

Cash for Quick Trips: If your refund is under 30,000 THB and you leave within days, select cash refunds for immediate gratification.

Credit Card for Large Amounts: For refunds exceeding 30,000 THB, credit card is mandatory (cash is capped) and convenient. If your card earns cash back or airline miles, credit card refunds are additionally rewarding.

Bank Draft for Very Large Amounts: If purchasing extremely high-value items (over 150,000 THB), bank draft refunds may offer slightly lower fees than credit card processing, justifying the 7–30 day wait.

Digital Wallet for Tech-Savvy Travelers: If the TAGTHAi app is available at your airport, digital wallet refunds offer immediate transfers and emerging platform discounts.

Strategy 6: Keep Goods in Original Packaging

Inspection Success Rate: Goods in original, sealed packaging pass inspection on first attempt without delays or questioning.

Risk Reduction: Opened or damaged packaging triggers additional scrutiny, potentially delaying inspection by 10–15 minutes.

Resale Value: Sealed packaging preserves goods’ value if you later decide not to keep purchases.

Proof of “Unused” Status: Sealed packaging provides undeniable proof that goods are new and unused-the inspection officer’s primary concern.

Strategy 7: Arrive at Airport Early for Refund Process

Customs Queue Management: Customs inspection queues grow exponentially in peak hours (10 AM–2 PM at major airports). Arriving early secures shorter queues.

Contingency Buffer: Early arrival provides buffer time for unexpected complications, damaged forms, or additional inspection requirements.

Flight Risk Mitigation: If you arrive late and encounter queue delays, you risk missing your flight. Early arrival eliminates this risk.

Recommended Schedule: For a 6 PM flight, arrive at the airport by 2 PM. Head to customs inspection by 2:15 PM (before check-in lines). Complete refund claim by 4 PM, leaving 2 hours before boarding.

Strategy 8: Collect All P.P.10 Forms in One Envelope

Organization Benefit: Present all forms in a single, organized packet. Organized presentation accelerates processing.

Reduced Form Loss Risk: Keeping forms together prevents accidental loss of individual forms, which would void those specific refunds.

Professional Impression: A well-organized packet demonstrates preparedness and seriousness, potentially accelerating VAT office processing.

Tracking Aid: An organized packet allows you to track which stores and items you purchased, simplifying any questions from officials.

Backup Strategy: If one form is damaged or lost, the organized packet makes the loss immediately obvious, allowing recovery attempts before processing begins.

15. Comparison: Thailand VAT Refund vs. Other Countries

Understanding Thailand’s VAT refund program in international context reveals whether Thailand’s offer is competitive, generous, or restrictive.

International VAT Refund Comparison

| Country | VAT Rate | Tourist Refund Rate | Minimum Purchase | Eligible Goods | Refund Venue |

|---|---|---|---|---|---|

| Thailand | 7% | 4–6% | 2,000 THB (~$56) | Most goods (services/food excluded) | Airport only |

| Singapore | 7% | 5–6% | SGD 100 (~$75) | Most goods | Airport only |

| Malaysia | 6% | ~5% | RM 300 (~$64) | Most goods | Airport/land border |

| Vietnam | 10% | ~8% | VND 3 million (~$120) | Goods for export | Airport only |

| Indonesia | 10% | ~7% | IDR 500,000 (~$31) | Goods for export | Airport/seaport |

| Japan | 10% | 8–10% | ¥5,000 (~$35) | Most goods | Airport/counters |

| South Korea | 10% | 8–9% | KRW 30,000 (~$23) | Most goods | Airport/counters |

| UK | 20% | 15–17% | £15 (~$19) | Most goods | Airport/points of sale |

Why Thailand’s Refund Program Is Competitive

Lower VAT Rate Than Neighbors: At 7%, Thailand’s VAT is among the lowest in Southeast Asia. Vietnam, Indonesia, Japan, and South Korea all charge 10%+. Singapore matches at 7%. Thailand’s low baseline VAT makes refunds less critical than in higher-tax countries.

Relatively Low Minimum Purchase Threshold: 2,000 THB (~$56) is accessible for casual tourists. Vietnam’s 3 million VND (~$120) and Malaysia’s RM 300 (~$64) are higher, excluding smaller purchases from refund eligibility.

Multiple Refund Payment Options: Thailand offers cash, credit card, bank draft, and emerging digital wallet options. Many countries limit payment methods to cash-only or credit card-only.

Wide Goods Eligibility: Except for services and consumables, nearly all tangible goods qualify. Some countries restrict refunds to certain categories (electronics, luxury goods) or require purchases from specific store types.

Efficient Airport Processing: Major Thai airports (Suvarnabhumi, Phuket, Chiang Mai) have dedicated, well-organized VAT Refund Offices. Processing is generally smooth, though queues can form during peak hours.

Where Thailand’s Refund Program Lags

Higher Effective Fees Than Japan or UK: Japan’s 8–10% effective refund rate and the UK’s 15–17% rate (on 20% VAT) substantially exceed Thailand’s 4–6% rate. However, these countries’ higher base VAT rates partially offset the comparison.

More Bureaucratic Than Singapore: Singapore’s refund process is marginally less complex than Thailand’s, though both require customs inspection and airport processing.

Goods Export Deadline (60 Days): Some countries (Japan, Singapore) allow refund claims for goods shipped to international addresses or claimed remotely. Thailand requires goods to be physically exported on your person, and strictly enforces the 60-day window.

Airport-Only Processing: Thailand processes refunds exclusively at airports. Land borders and seaports have no facilities. Indonesia allows seaport processing; Malaysia allows land border processing.

Lower Refund Rate Than Higher-Tax Countries: On a percentage basis, 4–6% is lower than 8–10% (Japan) or 15–17% (UK). However, absolute refund amounts vary based on purchase prices and base tax rates.

Strategic Perspective

Thailand’s VAT refund program is competitive and straightforward-not exceptionally generous, but not restrictive either. The program targets tourists making substantial purchases. Small souvenir purchases yield modest refunds (~5% × cost of item), but luxury goods shopping generates meaningful savings (5.5–6.1% × purchase cost).

Comparison Strategy: If you travel frequently across Asia, Thailand’s program is middle-of-the-road. Japan’s and the UK’s are more generous. Indonesia’s lower minimum threshold makes refunds more accessible to budget travelers. Use this context to set refund expectations and shopping strategies.

16. Conclusion & Next Steps

Thailand’s VAT refund program represents a meaningful opportunity for international tourists to reclaim a portion of their purchase costs. On a 50,000 THB shopping trip, expect to recover 2,500–3,000 THB-sufficient for a nice dinner, spa day, or additional experiences.

Key Takeaways

Program Basics: Thailand applies 7% VAT on most goods. Tourists receive 4–6% back after fees-roughly $56 minimum purchase threshold per receipt.

Eligibility Essentials: Non-Thai citizens visiting for under 180 days qualify. Shop at stores displaying “VAT Refund for Tourists” signage. Export goods within 60 days.

Eight-Step Process: Shop → Present passport → Get P.P.10 form → Verify details → Customs inspection (critical!) → Check in → Claim at VAT office → Keep proof.

Strategic Maximization: Plan purchases in advance, shop at major malls, consolidate receipts, reach higher refund tiers through larger purchases, and choose your refund method strategically.

Common Pitfalls: Don’t skip customs inspection, don’t shop at non-participating stores, don’t bring goods without packaging, and don’t miss the 60-day export deadline.

Digital Future: TAGTHAi app adoption is accelerating. If available at your airport, digital refunds offer faster processing and real-time tracking.

Expected Savings

- Modest Shopping Trip (5,000 THB): 250–300 THB refund (~5%)

- Average Shopping Trip (20,000 THB): 1,000–1,200 THB refund (~5.5%)

- Luxury Goods Trip (100,000 THB): 6,000–6,200 THB refund (~6%)

These refunds add meaningful value to your Thailand experience.

Immediate Action Items

Before Your Trip:

- Identify participating stores and shopping locations in your itinerary

- Calculate your expected refund based on anticipated spending

- Download the TAGTHAi app if interested in digital refunds

- Set a smartphone reminder for your 60-day export deadline

During Your Trip:

- Present your passport at checkout for VAT refund program purchases

- Verify receipt details before leaving the store

- Keep P.P.10 forms and receipts organized in a dedicated folder

- Take digital photos of all forms as backup

At the Airport:

- Arrive 3+ hours early

- Proceed to customs inspection counter BEFORE check-in

- Present goods and forms for inspection

- Ensure your P.P.10 forms are stamped

- Proceed to VAT Refund Office after immigration

- Select your refund method and claim your money

- Keep your receipt for the records

Trust Signals & Authority

This guide references data and procedures from Thailand’s Revenue Department (Suan Dusit), official VAT refund program documentation, and 2026 current procedures. Process updates occur annually; verify current regulations before traveling if your trip is in 2027 or later.

Supporting Elements: Interactive Tools & Resources

Interactive VAT Refund Calculator

[Calculator Widget Placeholder]: Input purchase amount (THB) → Select refund method → Display estimated refund and percentage.

Printable Quick Reference Card

Eligibility Checklist:

- ☑ Non-Thai citizen with valid passport

- ☑ Staying fewer than 180 days in Thailand

- ☑ Not airline or airport employee

- ☑ Shopping at stores with “VAT Refund for Tourists” signage

- ☑ Spending minimum 2,000 THB per receipt

- ☑ Aggregate spending 5,000+ THB

- ☑ Purchasing tangible goods (not services/consumables)

- ☑ Exporting goods within 60 days

Airport Locations:

- Suvarnabhumi Airport: Terminal Building (Departure Level 2, Zone A & B)

- Don Mueang Airport: Domestic Terminal (Departure Level 2)

- Phuket International: International Terminal (Departure Level 2)

- Chiang Mai International: Check with information desk for exact location

Process Summary Flowchart:

Shop → Present Passport → Get P.P.10 → Verify Details → Customs Inspection → Check In → VAT Office → Claim Refund → Keep Proof

Final Word: Thailand’s VAT refund program rewards thoughtful shopping with meaningful savings. By understanding the process, avoiding common mistakes, and planning strategically, you’ll reclaim 4–6% of your purchases-money that extends your trip or funds additional experiences. Apply this guide’s frameworks, and your Bangkok shopping becomes not just an expense, but an investment in memorable experiences funded partially by recovered VAT.