The Securities and Exchange Commission (SEC) is the federal agency responsible for regulating the U.S. securities industry and protecting investors from fraud and market manipulation. Operating since 1934, the SEC enforces federal securities laws, oversees financial market participants, and ensures that investors have access to accurate information about public companies and investment opportunities. Understanding the SEC’s role, structure, and functions is essential for anyone involved in investing, trading, or managing securities.

What is the SEC? Definition and Core Purpose

The SEC is an independent federal administrative agency created by the Securities Exchange Act of 1934, signed into law by President Franklin D. Roosevelt on June 6, 1934, in response to the catastrophic stock market crash of 1929 and the subsequent Great Depression. The agency was established with a clear mandate: restore investor confidence in securities markets, eliminate fraudulent practices, prevent insider trading, and create a universal registration system for all securities sold in America.

The SEC operates with a three-part mission that guides all its activities: (1) protect investors from fraudulent and deceptive practices; (2) maintain fair, orderly, and efficient markets where investors can trade with confidence; and (3) facilitate capital formation by helping businesses raise capital for growth and innovation. These interconnected objectives reflect the fundamental principle that healthy securities markets require both investor protection and business opportunity.

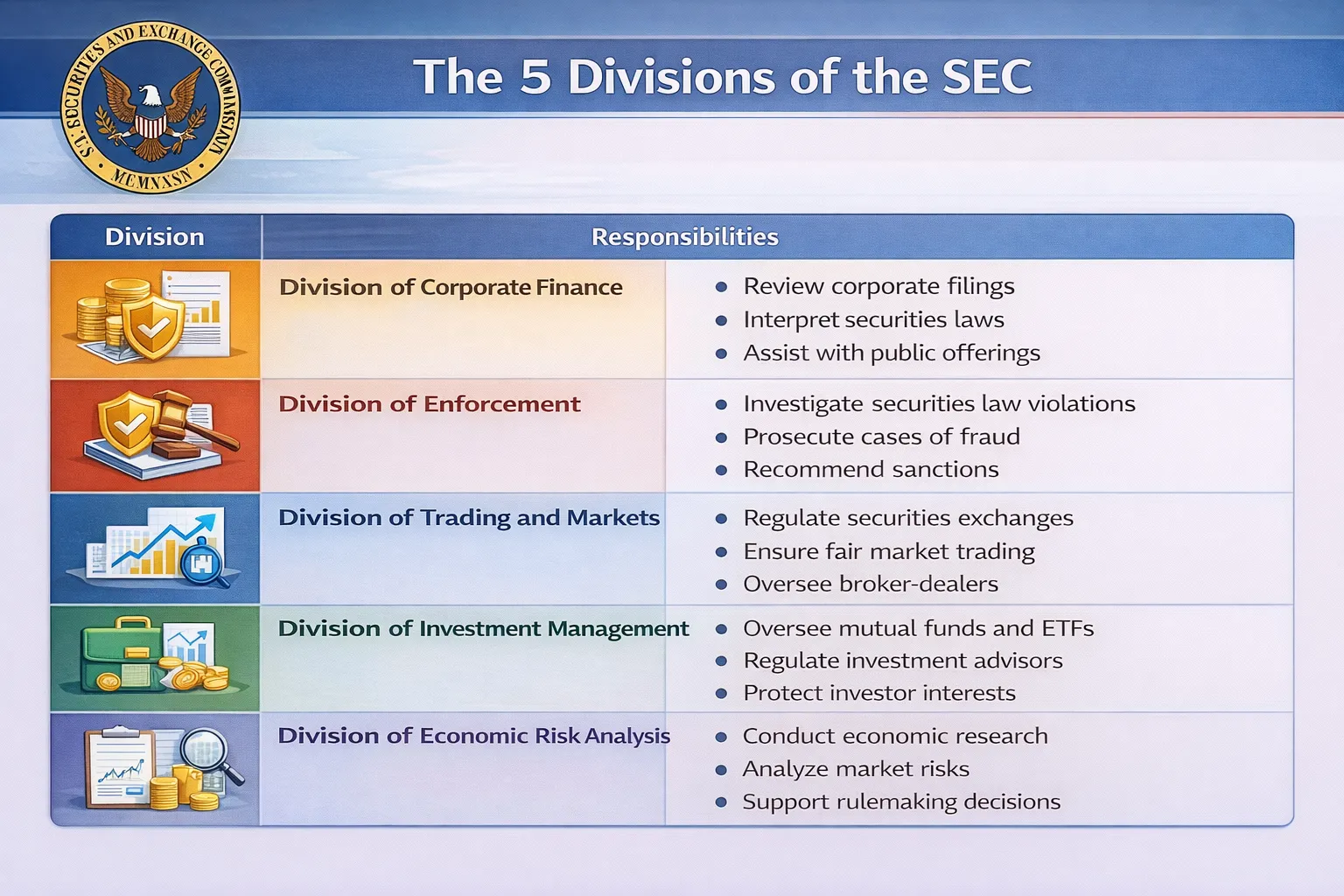

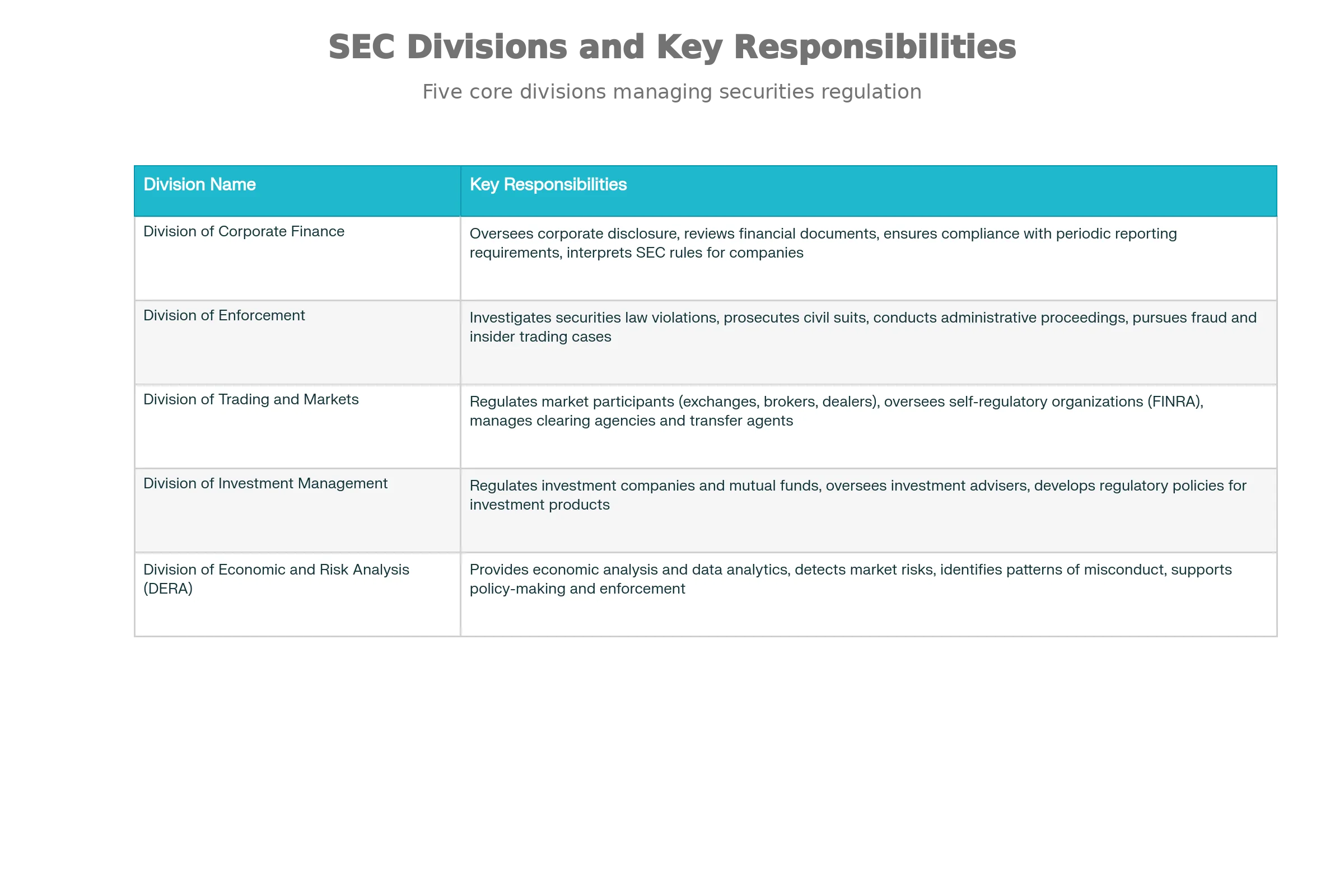

The Five Divisions of the SEC and Their Primary Responsibilities

History and Evolution: From the Great Depression to Modern Markets

The founding of the SEC represents a pivotal moment in American financial history. Before the 1929 stock market crash, federal regulation of securities was minimal – the responsibility fell to individual states through “Blue Sky Laws,” which proved inadequate and allowed fraudulent practices to flourish across state lines. When the crash wiped out millions of investors and devastated the economy, Congress recognized the urgent need for federal intervention.

In response, Congress passed two landmark pieces of legislation: the Securities Act of 1933 and the Securities Exchange Act of 1934. The 1933 Act required companies to register securities with the government and provide detailed financial information before offering them for public sale. The 1934 Act went further, creating the SEC itself and granting it broad authority to regulate ongoing securities trading, oversee exchanges and brokers, and enforce securities laws.

President Roosevelt’s appointment of Joseph P. Kennedy (father of future President John F. Kennedy) as the SEC’s first chairman was a masterstroke of political pragmatism. Kennedy, despite his reputation as a shrewd financier, understood both the necessity of market regulation and the importance of balancing investor protection with business opportunity. His philosophy of “friendly enforcement” – strict rules coupled with cooperative implementation – helped establish the SEC as a respected institution.

Since its founding, the SEC has evolved significantly. Additional legislation expanded its authority, including the Investment Advisers Act (1940), the Investment Company Act (1940), and numerous amendments addressing emerging market risks. Today, the SEC operates 11 regional offices across the country and employs thousands of attorneys, economists, accountants, and investigators to fulfill its mission.

SEC Structure: How It Operates

The SEC is headed by five Commissioners appointed by the U.S. President with consent of the Senate. To ensure the agency remains independent and nonpartisan, federal law prohibits more than three commissioners from belonging to the same political party. One commissioner serves as the SEC Chair, the agency’s chief executive and primary spokesperson.

The SEC’s organizational structure includes five primary divisions, each with specialized responsibilities in regulating different aspects of the securities industry. These divisions work together with 25+ offices to implement the agency’s mission across all markets and sectors.

SEC Mission and Core Investor Protection Mechanisms

The Five Divisions of the SEC

1. Division of Corporate Finance

The Division of Corporate Finance ensures that public companies provide accurate, timely disclosure of financial and material information to investors. This division reviews and interprets disclosure documents filed by corporations, including annual reports (10-K filings), quarterly reports (10-Q filings), and other mandatory filings. The division helps companies understand SEC rules and provides interpretive guidance to ensure compliance. By requiring robust corporate disclosure, this division creates transparency that enables investors to make informed decisions about their investments.

2. Division of Enforcement

The Division of Enforcement is the agency’s investigative and prosecution arm. It conducts investigations into potential violations of federal securities laws and prosecutes civil suits in federal courts as well as administrative proceedings. The division pursues cases involving fraud, insider trading, market manipulation, disclosure violations, and other securities law breaches. In fiscal year 2024, the Enforcement division filed 431 stand-alone actions and collected a record $8.2 billion in financial remedies, including fines and disgorgement of illegal profits.

3. Division of Trading and Markets

The Division of Trading and Markets regulates the major participants in securities markets, including securities exchanges, broker-dealers, self-regulatory organizations (particularly the Financial Industry Regulatory Authority, or FINRA), clearing agencies, and transfer agents. This division develops and implements rules governing trading practices, market surveillance systems, and operational standards. It oversees both the electronic trading systems that execute trillions of dollars in transactions and the professional individuals and firms that facilitate these trades.

4. Division of Investment Management

The Division of Investment Management oversees the investment management industry, including investment companies (mutual funds and exchange-traded funds), investment advisers, and structured products. This division ensures that investment products are offered transparently, that fees and expenses are disclosed accurately, and that investment professionals meet fiduciary standards in managing client assets. With Americans holding trillions of dollars in investment accounts, this division’s work directly affects retirement security for millions of households.

5. Division of Economic and Risk Analysis (DERA)

The Division of Economic and Risk Analysis, established after the 2008 financial crisis, integrates financial economics and rigorous data analytics into the SEC’s decision-making. DERA staff develop sophisticated analytical tools to detect market risks, identify patterns of potential misconduct, and provide economic analysis to support policy-making and enforcement efforts. This division houses the SEC’s Chief Economist and works across all other divisions to provide evidence-based analysis of market trends and regulatory impacts.

How the SEC Protects Investors: Five Core Mechanisms

Investor protection is the cornerstone of the SEC’s mission. The agency employs five primary mechanisms to safeguard investors and maintain market integrity:

1. Regulatory Oversight and Inspections

The SEC continuously monitors securities markets and regulated entities through regular inspections, examinations, and reviews. The SEC’s Division of Examinations conducts risk-focused examinations of broker-dealers, investment advisers, investment companies, credit rating agencies, and other market participants. These examinations assess compliance with securities laws, identify risks, and detect potential violations. In 2025, the SEC announced it would focus examinations on fiduciary duties, cybersecurity, artificial intelligence integration, and emerging risks in alternative investments.

2. Mandatory Disclosure Requirements

Public companies must file comprehensive and accurate disclosures with the SEC, including annual financial statements, quarterly reports, executive compensation details, and descriptions of business risks. These disclosure documents – particularly the 10-K annual report and 10-Q quarterly reports – provide the information foundation that investors need to evaluate companies before investing. The SEC also requires insider filing requirements, ensuring that executives’ personal trading activity is disclosed to the public. This transparency creates a level playing field where all investors access the same material information.

3. Enforcement Actions and Legal Penalties

The SEC has extensive enforcement powers to deter securities law violations. When the SEC discovers violations, it can pursue civil actions in federal court or administrative proceedings, seeking remedies that include monetary penalties, disgorgement of ill-gotten gains, permanent industry bars, and injunctions preventing future violations. These enforcement actions serve a dual purpose: they hold wrongdoers accountable and create a deterrent effect that discourages others from engaging in illegal activity.

4. Anti-Fraud Measures and Market Surveillance

The SEC prohibits a range of fraudulent and manipulative practices, most fundamentally through Rule 10b-5 of the Securities Exchange Act, which prohibits fraud in connection with the purchase or sale of securities. The SEC also enforces strict rules against insider trading – using material nonpublic information to trade securities – and market manipulation. The SEC employs sophisticated data analytics and surveillance systems to detect suspicious trading patterns that may indicate illegal activity. In 2024, the SEC brought 35 insider trading actions and investigated complex schemes involving “shadow trading” and selective disclosure violations.

5. Whistleblower Protection and Incentive Programs

Recognizing that insiders often have the best visibility into wrongdoing, the SEC offers financial incentives for individuals who report securities law violations. The SEC’s Whistleblower Program provides monetary awards to qualified tipsters, with some recent awards exceeding $100 million. The program also includes strict protections against retaliation, ensuring that employees can report violations without fear of losing their jobs. In 2024, the SEC brought an enforcement sweep against companies attempting to impede employees and customers from reporting violations to the SEC.

SEC Regulations and Key Rules

The SEC implements its mandate through comprehensive regulations and rules that govern securities trading, disclosure, and market conduct. Key regulations include:

- Securities Act of 1933: Requires registration of securities before public sale, ensuring investors receive material information before purchasing

- Securities Exchange Act of 1934: Authorizes ongoing regulation of market participants and creates the framework for continuous market oversight

- Regulation FD (Fair Disclosure): Prohibits selective disclosure of material information to preferred investors

- Regulation Best Interest (Reg BI): Requires broker-dealers to act in customers’ best interests when making recommendations

- Rule 10b-5: The fundamental anti-fraud rule prohibiting deceptive practices in securities transactions

Recent SEC Activity and 2025 Priorities

The SEC remains actively engaged in protecting investors and regulating markets. In fiscal year 2024, the agency filed 583 enforcement actions, generating a record $8.2 billion in financial remedies. However, the number of standalone enforcement actions (431 in 2024) represented a decrease from recent years, reflecting shifts in enforcement priorities and agency resources.

For 2025, the SEC’s Division of Examinations announced priorities focusing on:

- Fiduciary duties of investment advisers, particularly regarding illiquid and hard-to-value assets

- Cybersecurity and operational resilience

- Artificial intelligence integration in financial services

- Cryptocurrency and digital assets regulation

- Anti-money laundering (AML) compliance

- Private fund adviser oversight

- Fee and expense practices

The SEC’s 2025 agenda reflects both enduring priorities (investor protection, anti-fraud enforcement) and emerging challenges (AI, cybersecurity, crypto assets) that pose new risks to investors and market integrity.

Why the SEC Matters: Impact on Investors and Markets

The SEC’s work affects virtually every American investor. The agency’s regulatory framework:

- Ensures market transparency by requiring public companies to disclose material information

- Prevents fraud through enforcement actions against bad actors

- Maintains market confidence by ensuring that market prices reflect legitimate supply and demand rather than manipulation

- Enables capital formation by creating a trustworthy environment where investors willingly provide capital to companies

- Protects retirement savings by regulating the investment companies and advisers managing Americans’ 401(k)s, IRAs, and other retirement accounts

Without the SEC’s oversight and enforcement, investors would lack confidence in market integrity, capital markets would be less efficient, and companies would struggle to raise capital at reasonable costs. The SEC effectively acts as a policeman, referee, and educator in American capital markets – a role that has only become more important as markets have grown larger and more complex.

Conclusion

The Securities and Exchange Commission stands as one of America’s most important financial regulators. Founded in response to the catastrophic stock market crash of 1929, the SEC has evolved into a sophisticated agency employing thousands of professionals across five divisions to protect investors, maintain fair markets, and facilitate capital formation. Through regulatory oversight, mandatory disclosures, enforcement actions, anti-fraud measures, and whistleblower incentives, the SEC works continuously to create securities markets that operate with integrity and transparency.

Whether you are an individual investor, corporate executive, investment professional, or market participant, the SEC’s rules and regulations affect your activities. Understanding the SEC’s structure, mission, and enforcement priorities helps stakeholders navigate securities laws effectively and maintain the trust that securities markets depend upon to function efficiently. As markets evolve and new risks emerge, the SEC continues to adapt its approach – from regulating cryptocurrency to overseeing artificial intelligence in financial services – to protect investors in the digital age.