Retiring in Thailand offers exceptional value-affordable healthcare, world-class private hospitals, and a lifestyle that costs 40% less than Western countries. But one detail separates a smooth retirement transition from immigration complications: mandatory health insurance for your retirement visa.

Since October 2019, Thai immigration requires specific health insurance coverage that most travelers don’t understand. This comprehensive guide walks you through every requirement, cost scenario, and real-world strategy used by thousands of successful retirees.

Why Health Insurance Is Mandatory for Thailand Retirement Visa

Thai Government Policy & Legal Foundation

Thailand’s health insurance mandate stems from a Cabinet Resolution dated April 2, 2019, effective October 31, 2019. The Thai government introduced this requirement specifically for Non-Immigrant visa holders to ensure medical expenses don’t burden Thai public hospitals or become immigration enforcement issues.

The policy applies to foreigners age 50+ who obtain long-stay visas. Here’s why:

- Public Hospital Burden: Thailand’s public healthcare system prioritizes Thai citizens. Without insurance, uninsured foreigners create financial strain.

- Repatriation Risk: Medical emergencies can trigger costly repatriations. Insurance transfers this liability from Thailand to the insured.

- Visa Sustainability: Immigration offices use insurance as proof you won’t become a financial burden during your stay.

The Legal Requirement:

If you hold a Non-Immigrant O-A visa and stay in Thailand beyond your initial entry period, you must present valid health insurance at each renewal or face extension denial. This applies even if you’ve successfully extended your visa for years-non-compliance now results in visa refusal.

Immigration Enforcement & Real Consequences

Immigration enforcement on health insurance has intensified since 2020. Here’s what happens if you’re non-compliant:

| Scenario | Consequence |

|---|---|

| O-A visa renewal without insurance | Extension denied; forced to leave or switch visa type |

| O-A visa expired + overstay | Fines (500 THB/day), blacklist, deportation |

| Insurance expires mid-stay | Immigration can revoke permission to stay; required to exit |

| Wrong insurance type (travel vs. long-stay) | Immigration rejects it; extension delayed |

Real Example: A 62-year-old American with 10 years in Thailand purchased travel insurance instead of long-stay insurance for his O-A renewal. Immigration rejected it. He had to leave Thailand for 30 days, reapply for a new O-A from abroad, and lose rental income from his property-all because of a $400 mistake.

Thailand Retirement Visa Types & Insurance Rules (Complete Breakdown)

Not all retirement visas have the same insurance requirements. This confusion causes 40% of first-time applicants to purchase wrong coverage.

Non-Immigrant Visa O-A (1-Year Retirement Visa)

What It Is:

The O-A is a one-year, single-entry visa applied for at your Royal Thai Embassy before traveling to Thailand.

Key Facts:

- Age requirement: 50+ years old

- Duration: 1 year from date of entry

- Multiple entries allowed (but limited)

- Valid from any Royal Thai Embassy worldwide

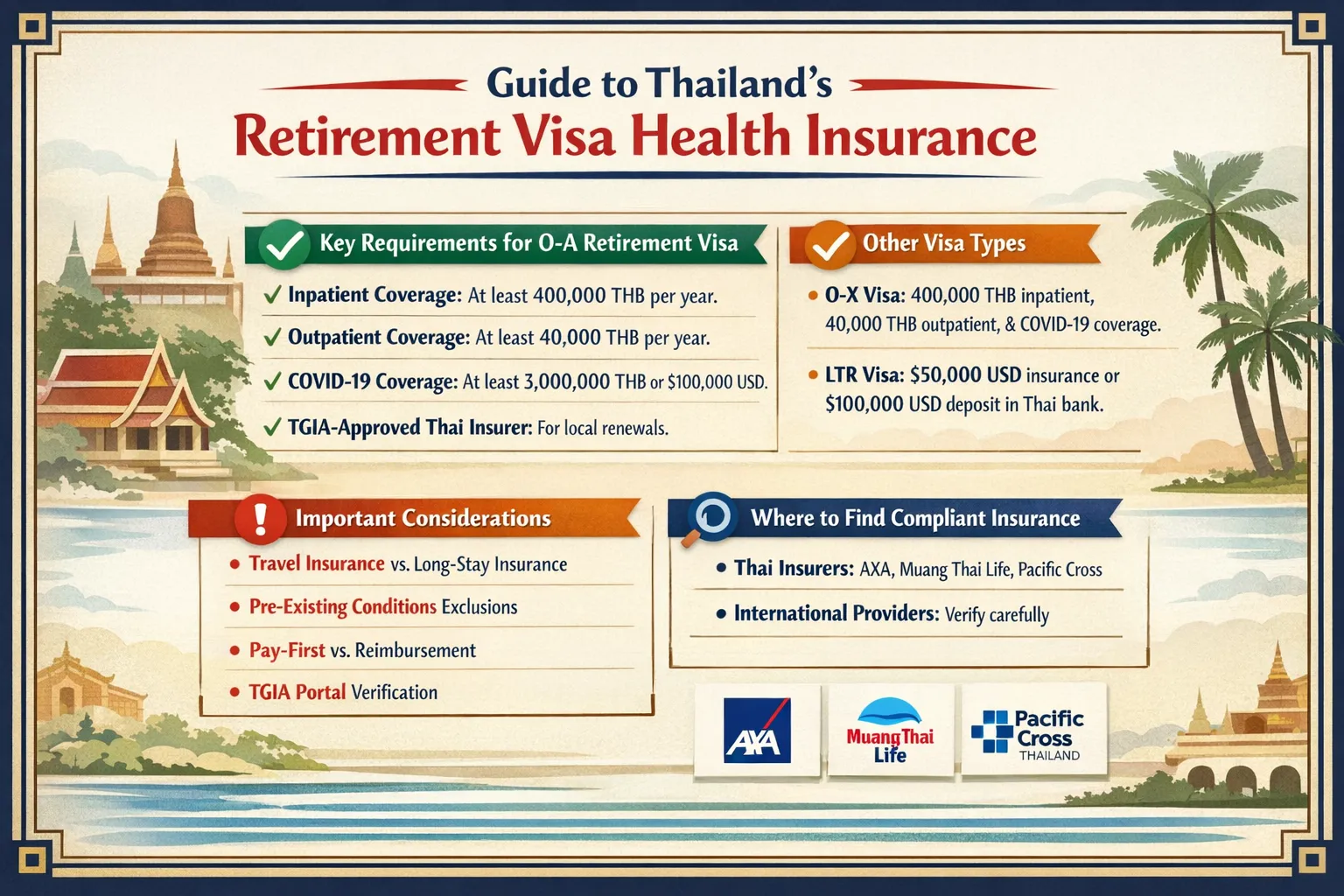

Mandatory Insurance Limits:

- Outpatient coverage: 40,000 THB minimum

- Inpatient coverage: 400,000 THB minimum

- COVID-19 coverage: Mandatory (as of Oct 2021)

- Policy must be from: Thai insurance company (foreign policies allowed only under specific circumstances)

Duration:

Insurance must cover the entire 12-month visa validity period. If your policy is only 6 months, renewal requires an additional insurance certificate.

Renewal Rules:

When your O-A expires, you must either:

- Apply for a new O-A from your Thai embassy abroad, OR

- Convert to a Non-Immigrant O visa (extends inside Thailand; no insurance required after initial entry)

⚠️ Critical Distinction: Many retirees don’t realize that converting to a regular Non-O visa inside Thailand eliminates the insurance requirement for future extensions-but you lose the convenience of the O-A’s multiple entries.

Non-Immigrant Visa O-X (5-Year Retirement Visa)

Updated Requirements (2025-2026):

The O-X visa recently underwent requirement changes. Current minimums are:

- Outpatient coverage: 120,000 THB (increased from 40,000)

- Inpatient coverage: 3,000,000 THB (increased from 400,000)

- Duration: Must cover entire 5-year period

- Provider: Thai insurance company required

Who Should Apply?

- Retirees planning 5+ years in Thailand

- Those wanting to avoid annual renewals

- Applicants with higher financial capacity

Challenge: The higher minimum coverage (3M THB) means annual premiums increase significantly-often 200–400% more than O-A insurance.

Non-Immigrant O Visa (90-Day Base / Annual Extension)

No Insurance Requirement

This is the visa most retirees actually use once in Thailand. Here’s why:

- Apply inside Thailand (at Immigration Bureau, not embassy)

- Valid 90 days; renewable annually

- Requires: 800,000 THB in Thai bank account OR 65,000 THB monthly income

- NO health insurance required for extensions

Strategic Advantage:

Many retirees enter on an O-A visa (with required insurance), then convert to Non-O inside Thailand. This locks you into a lower cost structure if you find insurance expensive.

Trade-Off: You lose the O-A’s international multiple-entry benefit and must handle renewals only inside Thailand.

5-Year Retirement Visa (Converted O-X)

If You’re on Non-O and Convert:

If you extend your Non-O visa 5+ times, you can sometimes convert to an official 5-year extension (special privilege). This still doesn’t require insurance-a major advantage.

Long-Term Coverage Strategy:

Rather than buying expensive 5-year O-X insurance upfront, many retirees:

- Start on Non-O (no insurance)

- Pay-as-you-go at private hospitals

- Buy catastrophic-only or when financially prudent

This is controversial but common among experienced expats.

Thailand Elite Visa

Health Insurance: Not Required

The Thailand Elite 20-year visa does not mandate health insurance for the visa itself. However:

- Entry to Thailand: Currently requires proof of travel insurance (COVID-related policy, but could change)

- Thai Elite Maxima Health: A premium package includes Pacific Cross insurance (optional upgrade)

Gray Area:

Elite members entering Thailand currently show travel insurance. Whether this becomes long-stay insurance is uncertain post-COVID.

LTR Visa (Long-Term Resident) – Wealthy Pensioner Track

Requirements:

- Age: 50+

- Health Insurance: $50,000 USD minimum (Thai or international provider)

- Alternative: $100,000 USD bank deposit (held 12 months minimum)

- Validity: Insurance must have 10 months remaining coverage at time of application

Best For:

- Retirees with $1,500+ monthly passive income

- Those with significant Thai investments ($250,000+)

- Applicants wanting to work part-time legally

Key Difference: LTR accepts international insurance, while O-A visa typically requires Thai insurers.

Comparison Table: All Retirement Visa Types

| Visa Type | Age Req | Duration | Insurance Required | Min Coverage | Monthly Cost | Best For |

|---|---|---|---|---|---|---|

| O-A (1-yr) | 50+ | 1 year | YES (Thai provider) | 400k THB inpatient | ฿2,500–4,500 | First-time applicants from abroad |

| O-X (5-yr) | 50+ | 5 years | YES (Thai provider) | 3M THB inpatient | ฿4,000–8,000 | Long-term planners |

| Non-O (annual) | 50+ | 90d+annual | NO | None | ฿100–200 (visa fee only) | Budget-conscious; pay-as-you-go |

| LTR (10-yr) | 50+ | 10 years | YES ($50k USD) | $50,000 USD | $50–150 (insurance) | Investors; work permission seekers |

| Elite (20-yr) | Any | 20 years | NO | None | $15,000–20,000 one-time | VIP fast-track; no paperwork |

Health Insurance Requirements (Official Rules Explained)

Minimum Coverage Amounts (Exactly What Immigration Asks For)

For Non-Immigrant O-A Visa:

| Coverage Type | Minimum Amount (THB) | USD Equivalent | What It Covers |

|---|---|---|---|

| Outpatient (OPD) | 40,000 | ~$1,240 | Doctor visits, clinic consultations, routine medications |

| Inpatient (IPD) | 400,000 | ~$12,400 | Hospital stays, surgery, ICU, bed & board |

| COVID-19 | Included in above | Included | Any COVID treatment (mandatory since Oct 2021) |

For Non-Immigrant O-X Visa (Updated 2025):

| Coverage Type | Minimum Amount (THB) | USD Equivalent |

|---|---|---|

| Outpatient | 120,000 | ~$3,720 |

| Inpatient | 3,000,000 | ~$93,000 |

Important: These are minimums. Most insurance companies offer plans with 2-10x these limits. Immigration doesn’t reject you for having more coverage-only less.

What Must Be Covered (Line-Item Breakdown)

Your insurance certificate must explicitly state coverage for:

- Hospitalization – Room, board, nursing care

- Surgical procedures – Operating theater, anesthesia, surgeon fees

- ICU/Intensive Care – Critical care unit stays (often 2x regular room rate)

- Emergency evacuation – Air ambulance to Bangkok or overseas if needed

- Diagnostic tests – X-rays, CT scans, blood work

- Pharmacy – Prescribed medications during treatment

- Physician consultations – Doctor’s fees for diagnosis and treatment planning

Red Flag: Some travel policies cover only emergency evacuation, not actual treatment. Immigration rejects these.

What Is NOT Accepted (Common Rejections)

Immigration specifically rejects these:

| Policy Type | Why It’s Rejected |

|---|---|

| Travel insurance | Designed for 2-week trips; insufficient limits; excludes pre-existing |

| Credit card medical coverage | Considered supplemental, not primary insurance |

| Short-term annual policies | “Annual” could mean renewal required; doesn’t guarantee 12-month continuity |

| Thai national health insurance (Social Security) | For Thai employees only; foreigners not eligible |

| Company group plans | Not verified as individual coverage; liability unclear |

| Policies without COVID rider | Mandatory since Oct 2021 |

Common Mistake: Retirees sometimes buy a 1-year travel policy thinking it’s the same as long-stay insurance. Immigration won’t accept it because it’s worded as “annual” renewable, not guaranteed 12-month coverage.

Immigration Certificate Format & Acquisition

What Immigration Asks For:

Immigration requires a Foreign Insurance Certificate (specific form) that includes:

- Full name, passport number, nationality

- Insurance policy number

- Insurance company name and registration number

- Exact coverage amounts: Outpatient and inpatient totals

- Policy validity dates: Start and end dates covering your entire stay

- Certified signature from the insurance company (stamped & dated)

- COVID-19 coverage confirmation

How to Get the Certificate:

- Purchase insurance from an approved provider (see provider list below)

- Contact the insurance company and request a “Foreign Insurance Certificate for Non-Immigrant O-A Visa” or “Visa certificate”

- Provide your details: Full name, passport number, visa dates

- Insurance company issues: Official certificate on letterhead, signed & stamped

- You submit to Immigration alongside other visa documents

Verification: Immigration can verify your policy online at longstay.tgia.org (Thailand General Insurance Association portal) if it’s a Thai insurer.

Timeline: Getting the certificate typically takes 3–5 business days after insurance purchase.

Best Insurance Providers for Thailand Retirement Visa (2026 Comparison)

Provider Comparison Table

| Provider | Age Limit | Outpatient Coverage | Inpatient Coverage | Price (Age 55) | Visa Approved | Best For |

|---|---|---|---|---|---|---|

| Pacific Cross Premier Plus | Up to 99 (renewable) | Paid in full | Up to 1M THB/yr | ฿55,000–75,000 | ✓ YES | Budget-conscious retirees |

| AXA Thailand EasyCare Visa | Up to 80+ | Paid in full | 3–10M THB options | ฿50,000–95,000 | ✓ YES | International familiarity seekers |

| Thai Health Insurance | Up to 99 (renewable) | 40,000–100,000 | 3–10M THB | ฿48,000–80,000 | ✓ YES | Direct visa compliance |

| Muang Thai | Up to 75+ | Partial/full options | 1–5M THB | ฿45,000–70,000 | ✓ YES | Local provider preference |

| Bangkok Health | Up to 70+ | Covered | 2–5M THB | ฿60,000–90,000 | ✓ YES | Premium private hospital access |

| Pacific Prime International | Up to 75 | Paid in full | Up to 5M THB | ฿85,000–150,000 | Varies | Global coverage + Thailand |

Pacific Cross Health Insurance (Market Leader)

Why It Dominates:

- 65+ years operating in Asia

- 5,500+ hospital/clinic network

- Cashless treatment at partner facilities

- Direct billing at hospitals (no upfront payment)

Plans for Retirees:

- Premier Plus – Most popular

- Inpatient: 1M–5M THB/year

- Outpatient: Paid in full

- No medical exam up to age 75

- Price: ฿55,000–75,000/year (age 50–65)

- Maxima Plus – High coverage

- Inpatient: 10M THB/year

- Outpatient: Paid in full

- Maternity, dental, optical included

- Price: ฿120,000–200,000/year

- Ultima Plus – Premium tier

- Inpatient: 50M THB/year

- ICU: 2x room benefits

- Psychiatric: Full coverage

- Price: ฿200,000–350,000/year

Best For: First-time O-A applicants; excellent English support; internationally recognized.

Contact: pacific cross.co.th

AXA Thailand (Global Insurance Giant)

Why Choose AXA:

- Recognized by Royal Thai Embassy worldwide

- Worldwide emergency assistance (Allianz Global backing)

- Claims processed in English

- Pre-existing condition acceptance

Plans for Visa Compliance:

EasyCare Visa 3M

- Coverage: 3M THB total

- Inpatient: 1.95M THB

- Outpatient: Included (emergency only)

- Price: ฿50,000–65,000/year

EasyCare Visa 5M

- Coverage: 5.6M THB total

- Inpatient: 2.6M THB + ICU coverage

- Outpatient: Emergency OPD included

- Price: ฿65,000–85,000/year

Best For: Retirees wanting international insurer + Thai compliance; overseas applicants before arriving.

Contact: axa.co.th

Thai Health Insurance (Local Expert)

Why It Matters:

- Thai insurance company (automatic TGIA approval)

- Specialized for Non-Immigrant visa holders

- Fastest certificate issuance (1–2 days)

- Competitive pricing

Visa-Specific Plans:

- 3 Million THB Plan: ฿48,000–60,000/year

- 5 Million THB Plan: ฿62,000–75,000/year

- 10 Million THB Plan: ฿85,000–110,000/year

All include:

- 400k+ outpatient minimum

- Emergency evacuation (USD 1M worldwide)

- Medical repatriation

- COVID coverage

Best For: Direct Thai insurance preference; fastest visa certificate processing.

Contact: thaihealth.co.th

Muang Thai Insurance

Strengths:

- Thai national insurer (government-backed)

- Wide agent network in provincial areas

- Flexible payment options (monthly available)

- Strong premium for ages 70+

Key Plans:

- Standard inpatient coverage: 1–2M THB

- Outpatient: Optional add-on

- Price: ฿45,000–70,000/year (age 50–75)

Best For: Retirees living outside Bangkok; prefer monthly payments over annual.

Bangkok Health Insurance

Profile:

- Hospital-backed insurance (Bangkok Hospital group)

- Direct access to Bangkok Hospital network (40+ locations)

- Premium room upgrades often included

- Slightly higher cost, premium feel

Plans for Retirees:

- Inpatient: 2–5M THB

- Outpatient: Partial/full options

- Price: ฿60,000–90,000/year

Best For: Preference for Bangkok Hospital-specific care; premium experience.

Insurance Costs Breakdown by Age

Age 50–59 (Early Retirees)

Typical Annual Premiums (OPD+IPD, meets visa minimums):

| Plan Level | Coverage | Annual Cost (THB) | Monthly Equiv. | Provider |

|---|---|---|---|---|

| Basic | 400k IPD / 40k OPD | ฿45,000–55,000 | ฿3,750–4,583 | Thai Health, Muang Thai |

| Mid-Range | 1M IPD / Full OPD | ฿60,000–80,000 | ฿5,000–6,667 | Pacific Cross Premier |

| Premium | 3M+ IPD / Full OPD | ฿90,000–120,000 | ฿7,500–10,000 | AXA, Pacific Cross Maxima |

Real Example: 55-year-old with clean health history, Pacific Cross Premier Plus: ฿62,000/year (~$1,700 USD).

Age 60–69 (Main Retiree Cohort)

Premiums Increase 15–25% Compared to Age 50s:

| Plan Level | Coverage | Annual Cost (THB) | Monthly Equiv. |

|---|---|---|---|

| Basic | 400k IPD / 40k OPD | ฿52,000–65,000 | ฿4,333–5,417 |

| Mid-Range | 1M IPD / Full OPD | ฿75,000–95,000 | ฿6,250–7,917 |

| Premium | 3M+ IPD / Full OPD | ฿110,000–150,000 | ฿9,167–12,500 |

Real Example: 65-year-old with hypertension controlled by medication, AXA EasyCare 5M: ฿82,000/year (~$2,300 USD).

Age 70+ (Critical Age Group)

Premiums Increase 40–80% From Age 60s:

This is where insurance pricing becomes controversial and restrictive.

| Plan Level | Coverage | Annual Cost (THB) | Monthly Equiv. | Availability |

|---|---|---|---|---|

| Basic | 400k IPD / 40k OPD | ฿75,000–95,000 | ฿6,250–7,917 | Limited |

| Mid-Range | 1M IPD / Full OPD | ฿120,000–180,000 | ฿10,000–15,000 | Very Limited |

| Premium | 3M+ IPD / Full OPD | ฿200,000–350,000 | ฿16,667–29,167 | Restricted underwriting |

Real Example: 72-year-old with pre-existing diabetes + hypertension:

- Pacific Cross offer: ฿185,000–220,000/year (with 6-month waiting period for diabetes complications)

- AXA offer: ฿155,000–190,000/year (pre-existing moratorium required)

- Some providers: Declined (age + health profile too risky)

Critical Issue: At 75+, many insurers stop accepting new applicants entirely. If you’re in your 50s or 60s, locking in insurance now before age 75 is strategic-renewal is almost always available even if new applications aren’t.

Monthly vs. Annual Payment Options

Annual Payment (Preferred by Insurance Companies):

- Full premium due upfront

- 3–5% discount vs. monthly

- Simpler claims processing

- Example: ฿60,000/year

Monthly Payment:

- Spread cost across 12 months

- Available through most Thai insurers

- Slightly higher total (2–3% markup)

- Example: ฿5,200/month = ฿62,400/year total

- Risk: Missing a payment can void coverage mid-year

Recommendation: Pay annually if possible. It’s cheaper and eliminates payment-date anxiety.

Hidden Fees & Extras (What Insurance Companies Don’t Advertise)

- Medical Underwriting Fee: 500–1,500 THB (if medical exam required)

- Visa Certificate Fee: 100–500 THB (for Foreign Insurance Certificate)

- Renewal Processing Fee: 200–500 THB (annual renewal admin)

- Exchange Rate Fluctuation: USD/THB rates affect premiums for international policies

- Inflation Adjustment: Annual premiums often increase 5–8% each year

- Co-Payment/Deductible: Some plans have 10–20% co-insurance on certain services

Example Hidden Costs for Year 1:

- Base premium: ฿60,000

- Medical underwriting: ฿1,000

- Visa certificate: ฿500

- Processing: ฿300

- Actual Year 1 Cost: ฿61,800 (not the quoted ฿60,000)

Health Insurance for Retirees 70+ (Special Solutions)

The 70+ demographic faces the most severe insurance challenges in Thailand. Here’s what actually works.

Real Limitations for 70+ Applicants

The Hard Truth:

- Insurance becomes 3–5x more expensive than ages 50–65

- Pre-existing conditions become major denial factors

- Medical underwriting is mandatory (no “no exam” options)

- Coverage limits often cap at lower amounts despite higher premiums

- Waiting periods on pre-existing conditions: 6–12 months standard

Age 75+ Reality:

- New insurance applications often denied by major providers

- Only renewal-based insurers (those you’ve held with 5+ years) will continue

- Premiums can exceed $500–800 USD monthly

- Limited to Thai insurers only; international insurers typically reject

Insurance Companies That Accept 70+ Applicants

Still Writing New Policies at 70+:

- Pacific Cross – Accepts new applications up to age 75 (with medical exam)

- Premier Plus: ฿155,000–200,000/year at 70+

- Requires full health questionnaire + possible exam

- Pre-existing conditions: 6-month waiting period

- Thai Health Insurance – Accepts up to 99 with underwriting

- Full medical exam mandatory

- Price: ฿140,000–250,000/year

- Friendly to retirees; more flexible on health history

- AXA Thailand – Accepts age 75+ (underwriting-dependent)

- Medical exam required

- Specialist review on pre-existing conditions

- Price: ฿150,000–280,000/year

- International backing appreciated by expats

- Muang Thai – Accepts up to 75 with underwriting

- Less expensive than Pacific Cross

- Price: ฿120,000–180,000/year

- Local Thai company comfort factor

Age 76–80 Applicants:

- Applications very rare; some insurers will interview

- Typically require recent medical exam + cardiologist clearance

- Pre-existing conditions almost always rejected unless very minor

- Cost if approved: ฿250,000–400,000+/year

Age 80+:

- Almost no new insurance available

- Only option: Major cash deposit method (see below)

Alternative Solutions (When Insurance Isn’t Available/Affordable)

Option 1: Larger Bank Deposit (Immigration-Approved Alternative)

If you cannot get insurance (or price is unreasonable), immigration may accept a larger cash deposit instead:

- Non-Immigrant O-A Visa: Some officers accept ฿1,500,000–2,000,000 deposit in lieu of insurance

- LTR Visa: Officially allows USD 100,000 deposit as alternative to insurance

- Non-O Visa: No insurance required; only need 800,000 THB (which you’re keeping anyway)

Caveat: This is negotiated per officer; not guaranteed policy. Works better for Non-O extensions in Thailand than new O-A visas from embassies abroad.

Strategy for 75+ Retirees:

- Apply for Non-O visa (no insurance needed, based on 800k THB deposit)

- Extend annually inside Thailand (much simpler than international O-A renewal)

- Use private hospital savings to self-insure (pay-as-you-go)

Option 2: Thai Elite Visa (Insurance Bypass)

- Thailand Elite: 20-year visa; no mandatory insurance requirement

- Cost: ฿650,000–3,000,000 one-time fee (depending on package)

- Process: Fast-tracked; minimal documentation

- Benefit: 20-year permission to stay; work-arounds insurance entirely

Is It Worth It for 70+?

- If you have capital: Elite is excellent insurance backup

- If you’re budget-conscious: No; cost exceeds 10 years of insurance premiums

Option 3: Self-Insurance Strategy (Pay-as-You-Go)

Many experienced retirees adopt this at 70+:

- Skip insurance entirely – Use Non-O visa (no insurance needed)

- Build healthcare emergency fund: ฿2–3M in Thai bank account

- Pay hospital directly for most care (negotiate cash discounts: 10–30%)

- Use fund for emergencies: Major surgeries, prolonged stays

Risk: Single catastrophic event (stroke, cancer) could deplete fund. Not recommended unless net worth is substantial.

Real Example: 78-year-old retired engineer, no health issues, stays on Non-O visa with ฿2.5M in emergency fund. Over 5 years: saves ฿700k in insurance premiums, spends ฿400k on private healthcare = net savings ฿300k, no insurance stress.

Pre-Existing Conditions (What Gets Approved, What Doesn’t)

Pre-existing conditions are the biggest insurance obstacle for retirees. Here’s the exact criteria most insurers use.

What Counts as Pre-Existing

Insurance companies define pre-existing conditions as any diagnosis or treatment received before your policy start date, including:

✓ Typically Covered After Moratorium:

- Hypertension (high blood pressure)

- Type 2 diabetes (non-insulin)

- High cholesterol

- Arthritis

- Thyroid disorder

- Mild asthma (not requiring hospitalization)

✗ Often Rejected or Heavily Restricted:

- Cancer (any history) – 2–5 year waiting period

- Heart disease / stent placement

- Stroke or TIA

- Kidney disease (any stage)

- Major psychiatric disorders

- COPD or severe lung disease

- Severe obesity (BMI 35+)

What Gets Rejected Outright

Conditions Causing Automatic Denial:

- Active Cancer – Any ongoing treatment

- Terminal Illness – Prognosis < 1 year

- Severe Cognitive Decline – Dementia, Alzheimer’s

- Uncontrolled Psychosis – Active schizophrenia, bipolar without treatment

- End-Stage Renal Disease – On dialysis

- Uncontrolled Diabetes – HbA1c > 10% despite medication

These are “uninsurable” in standard markets.

How to Increase Approval Chances

Step 1: Full Medical Disclosure

- Complete health questionnaire honestly

- Don’t omit or downplay conditions

- Insurers discover hidden conditions later via claims; policy then becomes void (major disaster)

Step 2: Recent Medical Records

- Provide 1–2 year history of treatment

- Latest lab results (blood sugar, lipids, blood pressure readings)

- Medication list with dosages

- Specialist reports if applicable

Step 3: Demonstrate Control

- Show 6–12 months of stable treatment

- Good medication compliance

- Regular doctor visits (not sporadic)

- Example: “Patient’s blood pressure stable at 130/80 on Lisinopril 5mg daily for 18 months”

Step 4: Choose Specialty Insurers

- Pacific Cross “Expat Care” plans – Specifically designed for predetermined pre-existing conditions

- Thai Health Insurance – More flexibility on retirees with conditions

- Skip ultra-conservative insurers like Bangkok Health if you have history

Step 5: Accept Moratorium & Co-Insurance

- Moratorium: 6–12 month waiting period before pre-existing coverage kicks in

- Co-Insurance: Pay 10–20% of pre-existing condition claims (insurer pays 80–90%)

- Acceptance = Approval – These terms are negotiable; often indicate willingness to insure

Appeal Process (If Initially Denied)

If Insurance Company Rejects Your Application:

- Request Written Reason – Insurance company must state specific condition causing denial

- Provide Additional Information – If new medical records show improved control, resubmit

- Escalate to Underwriting Manager – Sometimes “reviewer 1” says no; escalation may reverse

- Try Alternative Insurer – Different companies assess risk differently

- Use Insurance Broker – Brokers have relationships with underwriters; can advocate on your behalf

Real Example Appeal Success:

- 68-year-old denied by AXA due to “uncontrolled diabetes” (HbA1c 7.8%)

- Provided 6 months of new lab results showing HbA1c declining to 7.1%

- Resubmitted with endocrinologist letter confirming compliance

- AXA approved with 6-month moratorium on diabetes complications

- Outcome: Insurance secured; cost ฿95,000/year with conditions

Timeline: Appeal process takes 2–4 weeks. Don’t assume initial rejection is final.

Step-by-Step Process (From Visa Application to Insurance Proof)

Following these exact steps prevents costly delays or rejections.

Step 1 – Choose Your Visa Type

Decision Tree:

Are you currently outside Thailand?

- YES → Consider Non-Immigrant O-A (requires pre-application, includes insurance requirement)

- NO (already in Thailand) → Consider Non-O Retirement Visa (no insurance, just extend annually)

Are you age 75+?

- YES → Strongly consider Non-O (easier) OR Thailand Elite (bypass insurance entirely)

- NO → O-A is fine if insurance budget allows

Do you want 5+ year stability?

- YES → Consider O-X (5-year visa; higher insurance cost) OR Non-O extensions (annual cost, total flexibility)

- NO → O-A annual or Non-O annual

Bottom Line Decision:

- Budget-conscious / 70+: Non-O Visa (extend in Thailand; no insurance ever required)

- First-time / stable: Non-Immigrant O-A (international apply; includes insurance)

- Premium option / any age: Thailand Elite (no insurance, peace of mind)

Step 2 – Select Insurance Provider

Do This Before Visiting Visa Department:

- Use official list: Visit longstay.tgia.org (Thailand General Insurance Association) – see all TGIA-approved providers

- Compare quotes: Get 3 quotes from different providers (same coverage tier)

- Check age acceptance: Confirm provider accepts your age (critical for 70+)

- Verify visa certificate availability: Confirm they issue “Foreign Insurance Certificate” for your visa type

- Read reviews: Check expat forums (Thai Visa Forum, ExpatForum) for current provider feedback

Recommendation for Most Retirees:

- Age 50–69: Pacific Cross Premier Plus (฿60–80k) – excellent value, recognized globally

- Age 70–75: Thai Health Insurance (flexible, underwriter-friendly)

- Age 75+: Non-O visa + pay-as-you-go (skip insurance entirely; much simpler)

Step 3 – Apply for Insurance

Online Application (Most Providers):

- Visit insurance company website

- Fill health questionnaire completely

- Provide:

- Full name (as on passport)

- Date of birth

- Nationality

- Passport number

- Visa dates (if known)

- Health history

- Current medications

- Select coverage level (choose one that exceeds visa minimums slightly)

- Submit & await underwriting response

Timeline: 3–7 business days for underwriting decision

If Approved: Proceed to Step 4

If Requested: Medical exam might be required (see booking details from insurer)

Step 4 – Medical Underwriting (If Required)

Who Needs Medical Exam?

- Age 70+: Almost always

- Age 60–69: Only if significant pre-existing conditions

- Age 50–59: Rarely; usually just questionnaire

Exam Process:

- Insurance company refers you to approved clinic

- Basic exam: Height, weight, blood pressure, blood tests (sugar, cholesterol)

- Cost: Usually free (included in policy); sometimes 500–1,500 THB

- Results sent directly to insurance company (not you)

- Underwriting decision within 3–5 days after exam

Step 5 – Get Insurance Certificate for Visa Application

Once Approved & Policy Active:

- Contact insurance company (phone or email) – request “Foreign Insurance Certificate for Non-Immigrant O-A Visa”

- Provide:

- Full name

- Passport number

- Visa entry date (and expected exit date if known)

- Receive via email or pick-up: Official certificate on company letterhead, signed & stamped

- Print or save: You need this for visa application

Certificate Contents (Exactly What Immigration Needs):

- Policyholder name, passport #, nationality

- Insurance policy number

- Coverage dates: From [policy start] to [policy end]

- Coverage amounts: OPD minimum 40,000 THB; IPD minimum 400,000 THB

- COVID-19 coverage confirmation

- Insurance company signature & stamp

- Date issued

Timeline: 1–3 business days

Step 6 – Submit to Immigration (Visa Application or Renewal)

For New Visa (at Embassy Abroad):

- Gather required documents:

- Passport

- Completed TM.86 form (O-A visa application)

- 4×4 cm photos

- Bank statement (showing 800k+ THB if financial requirement option)

- Medical certificate (from Thai physician)

- Insurance certificate (from Step 5)

- Criminal clearance

- Submit application at Royal Thai Embassy

- Interview (if requested)

- Await visa issuance (typically 2–4 weeks)

For Extension in Thailand (Annual):

- Prepare TM.47 form (extension application)

- Passport + TM.47

- Current insurance certificate

- Updated bank statement (if using financial option) OR proof of continued 800k balance

- Submit at Immigration Bureau

- Pay extension fee (1,900 THB)

- Get new 1-year stamp

Critical: Your insurance certificate must still be valid (not expired) at renewal time.

Step 7 – Renewal (Annual or Per Cycle)

For O-A Visa Annual Renewal:

- 3 months before expiry: Contact insurance company for renewal quote

- Rates may increase: Budget for 5–8% annual premium increase

- Purchase new policy year

- Request new visa certificate

- Submit extension application with new certificate

If You’re Not Renewing Insurance (Switching Visas):

- Convert from O-A to Non-O (done inside Immigration office, same day)

- No longer need insurance; pay simple annual extension fee

- Continue on Non-O indefinitely (as long as 800k balance maintained)

Thailand Healthcare System for Retirees (What Insurance Actually Covers)

Understanding where your insurance money actually goes is critical.

Public Hospitals (Government-Run)

Strengths:

- Extremely affordable: Consultation ฿100–300, surgery ฿5,000–20,000

- Standardized care; no overcharging

- Appropriate for non-emergencies; routine care

Weaknesses:

- Severe overcrowding (2–3 hour waits common)

- Staff speak minimal English outside Bangkok

- Basic facilities; no luxury amenities

- Long procedures: Month-long wait for specialist appointments

Insurance Coverage:

- Insurance rarely applies to public hospitals

- Often self-pay required, then request reimbursement from insurer

- Bureaucratic reimbursement process (30–60 days)

Reality for Retirees: Most retirees avoid public hospitals despite affordability. Language, comfort, and speed make private care preferable.

Private Hospitals (Recommended for Retirees)

Strengths:

- English-speaking staff

- Modern facilities; international accreditation

- Same-day or next-day appointments

- Cashless billing if insured

Major Networks for Retirees:

| Hospital Group | Locations | Specialties | Insurance Accepted |

|---|---|---|---|

| Bangkok Hospital | 40+ nationwide | All specialties; trauma centers | All major insurers |

| Bumrungrad International | Bangkok primarily | Orthopedics, cardiology, oncology | All major insurers |

| Samitivej | Bangkok, Pattaya | Premium private; excellent cardiac | All major insurers |

| Chiang Mai Ram | Chiang Mai | Full-service; retiree-friendly | Most insurers |

| Phuket International | Phuket | Trauma, general; medical tourism | Most insurers |

Costs (Private, without Insurance):

- Consultation: ฿1,000–2,000 ($27–54)

- MRI scan: ฿15,000–25,000 ($400–680)

- Appendectomy: ฿80,000–150,000 ($2,150–4,050)

- Cardiac catheterization: ฿200,000–400,000 ($5,400–10,800)

- Heart bypass surgery: ฿400,000–700,000 ($11,000–19,000)

With Insurance (Typical):

- Your copay: Usually $0 (covered in full by policy)

- Hospital bills insurer directly

- You receive itemized receipt; keep for records

Costs Comparison: Private vs. Public

| Procedure | Public Hospital | Private Hospital | Difference |

|---|---|---|---|

| Doctor consultation | ฿100–200 | ฿800–1,500 | 8–15x more |

| X-ray | ฿150–300 | ฿2,000–3,000 | 10–20x more |

| Blood work (full panel) | ฿500–800 | ฿3,000–5,000 | 6–10x more |

| Appendectomy | ฿15,000–30,000 | ฿80,000–150,000 | 4–8x more |

| Hospital room (per night) | ฿1,000–2,000 | ฿20,000–30,000 | 15–30x more |

With Insurance: Private costs become competitive with Western prices.

Medical Tourism (Strategy for Major Procedures)

Thailand is a top 5 medical tourism destination. Many retirees strategically plan major surgeries here.

Procedures Often Done in Thailand:

- Joint replacement (knee, hip): ฿400,000–600,000 (vs. $30,000+ USA)

- Spinal surgery: ฿300,000–500,000

- Coronary bypass: ฿400,000–700,000

- Cataract surgery: ฿50,000–80,000 (per eye)

- Dental (crown, implant): ฿5,000–25,000

Reality: Insurance covers these if medically necessary (not elective cosmetic). Cost savings vs. home country: 60–70%.

Example: 68-year-old American needs knee replacement. Cost comparison:

- USA (insurance + out-of-pocket): $35,000–45,000

- Thailand (private hospital): ฿450,000 ($12,150)

- Savings: $23,000–33,000; flight + recovery stay in Thailand: $3,000

- Net savings: $20,000+

Best Cities for Retirees & Healthcare Access

Choosing your retirement location affects healthcare convenience and costs.

Bangkok (Capital, Highest Healthcare Standards)

Healthcare Landscape:

- 20+ international hospitals

- Specialists in every field

- Most English-speaking staff

- Highest costs in Thailand

Best Hospitals: Bumrungrad International, Samitivej, Bangkok Hospital Sukhumvit

Suitability: Excellent if you have significant health needs or want premium care; expensive for simple living

Cost of Living: ฿70,000–120,000/month (including healthcare)

Chiang Mai (Northern Hub, Growing Medical Infrastructure)

Healthcare Landscape:

- 5–8 quality private hospitals

- Excellent orthopedic & general care

- English-speaking; retiree-friendly

- 30% cheaper than Bangkok

Best Hospitals: Chiang Mai Ram, Bangkok Hospital Chiang Mai

Retiree Appeal: Massive expat community (3,000+ retirees); excellent cost-of-living ratio

Cost of Living: ฿40,000–65,000/month (including healthcare)

Why Retirees Love It: Growing healthcare infrastructure meets budget-conscious living.

Hua Hin (Coastal, Growing Healthcare)

Healthcare Landscape:

- Private hospitals improving

- Bangkok is 3-hour drive (for major procedures)

- Excellent for basic/preventative care

- Retirement haven; peaceful

Best Hospitals: Bangkok Hospital Hua Hin, local clinics

Suitability: Perfect for healthy retirees; limitation for serious conditions (Bangkok backup needed)

Cost of Living: ฿35,000–55,000/month

Phuket (Resort Destination, Medical Tourism Hub)

Healthcare Landscape:

- International hospitals (medical tourism infrastructure)

- Tourism means excellent English support

- Expensive; caters to wealthy travelers

- Excellent trauma/emergency care

Best Hospitals: Phuket International, Bangkok Hospital Phuket

Suitability: High-cost destination; excellent if money isn’t constraint

Cost of Living: ฿70,000–150,000/month

Koh Samui (Island, Limited but Growing)

Healthcare Landscape:

- Bangkok Hospital Samui is main facility

- Serious cases: Ferry/flight to Phuket or Bangkok

- Excellent for routine care; limitation for emergencies

- International clinic infrastructure for tourists

Best Hospitals: Bangkok Hospital Samui

Suitability: Perfect for ultra-healthy retirees; not recommended if frequent medical care needed

Cost of Living: ฿50,000–90,000/month

Common Mistakes (Exactly What Not to Do)

Real examples of costly insurance errors.

Mistake #1 – Wrong Policy Type

The Error:

Retiree buys a travel/annual/tourist policy thinking it’s the same as long-stay insurance.

Why It Fails:

- Travel policies cover emergency medical evacuation, not ongoing treatment

- Limits are ฿100,000–500,000 total (way below Thai requirements)

- Immigration rejects it; visa extension denied

Real Cost: ฿30,000 wasted; visa extension delayed 2 months; had to buy new visa-compliant policy

How to Avoid:

- Explicitly ask: “Is this policy approved for Thai Non-Immigrant O-A visa?”

- Insurance company should answer “yes” in writing

- Check TGIA website list (longstay.tgia.org) before buying

Mistake #2 – Underinsured Coverage

The Error:

Buying bare minimum (400k IPD / 40k OPD) thinking it’s sufficient. Then getting hospitalized for serious condition.

Real Scenario:

- 64-year-old retiree with bare-minimum insurance

- Suffers stroke; hospital stay + ICU + surgery = ฿1,500,000 total

- Insurance covers ฿400,000; retiree pays ฿1,100,000 out-of-pocket ($30,000)

- Could have bought 3x coverage for just ฿20,000 more annually

How to Avoid:

- Buy at least 1 million THB inpatient coverage (not minimum 400k)

- Cost difference: Usually just 10–15% more premium

- Protects against major illness; tiny additional expense

Mistake #3 – Fake Certificates or Short-Term Workarounds

The Error:

Some agents offer “fast visa insurance” – essentially fake or short-term policies designed just to pass visa interview.

Real Consequence:

- Visa approved; retiree thinks done

- 6 months later: Insurance company folds or “policy never existed”

- Immigration checks TGIA database during renewal; certificate invalid

- Extension denied; forced to leave Thailand; blacklist possible

Red Flag Warnings:

- Insurance cost suspiciously low (฿10,000/year for full coverage?)

- Certificate issued immediately (should take 2–3 days)

- Insurance company not on TGIA list

- Agent pushes for cash payment; no paperwork

How to Avoid:

- Only buy from TGIA-listed providers

- Verify coverage on longstay.tgia.org personally

- Get written confirmation of policy active dates

- Keep all documentation 5+ years

Mistake #4 – Letting Policy Expire Mid-Year

The Error:

Insurance purchased January; assumed it covers entire year. But policy only good 6 months due to misunderstanding.

Real Scenario:

- Retiree bought insurance Jan 1 – June 30 (6-month term)

- Assumed it was 12-month annual policy

- July 1: Insurance expires; retiree has accident

- Hospital calls insurance; policy invalid

- Retiree pays ฿500,000 in medical costs out-of-pocket ($13,500)

- November: Tried to renew visa; immigration found policy gap

- Extension denied

How to Avoid:

- Get written policy document showing exact start/end dates

- Set phone reminder for 1 month before expiry

- Renew before expiration (don’t wait until after)

- Keep electronic record of all policy dates

Mistake #5 – Confusion Between O-A and Non-O Visa Requirements

The Error:

Retiree thinks “once I have O-A visa, insurance is one-time”-doesn’t know it must be renewed annually.

Real Scenario:

- Got O-A visa Feb 2023 with insurance

- Insurance valid Feb 2023 – Feb 2024

- Feb 2024: Tried to extend visa; assumed existing insurance sufficient

- Immigration office rejected extension; required NEW insurance for Feb 2024 – Feb 2025

- Retiree scrambled to buy new policy; extension delayed 3 weeks

- Missed business opportunity; lost rental income

How to Avoid:

- Know your visa type: O-A requires ANNUAL insurance renewal; Non-O does NOT

- Calendar reminder: 90 days before insurance expiry → contact insurer for renewal

- Non-O is simpler: Just keep 800k balance; no insurance burden ever

Myths vs. Facts (Featured Snippet Optimized)

Myth: “Credit Card Travel Insurance Satisfies Thai Visa Requirements”

FACT: No. Credit card medical coverage is considered supplemental insurance only. Thai immigration specifically requires primary health insurance with verified coverage. Credit card statements don’t meet visa criteria.

Myth: “I Can Use My USA/UK Health Insurance for Thai Visa”

FACT: Partially true for some international plans, but with caveats:

- International plan must explicitly cover Thailand hospitalization

- Must exceed Thai minimum requirements (400k THB IPD minimum)

- Must issue Thailand-compliant certificate

- Most home-country insurance doesn’t meet Thai requirements

- LTR visa accepts international insurance; O-A visa prefers Thai providers

Myth: “Once I’m on Non-O Visa, I Can Switch Back to O-A Anytime”

FACT: No. Once converted to Non-O inside Thailand, converting back to O-A is extremely difficult. Immigration requires re-application at embassy abroad. Most retirees stay on Non-O once established.

Myth: “Health Insurance is Optional If I Have Money in the Bank”

FACT: For O-A visa: Insurance is mandatory, not optional. For Non-O visa: Insurance not required, but catastrophic medical event could wipe out your savings. For LTR visa: Insurance mandatory unless you prove $100k USD deposit.

Myth: “Insurance Covers Pre-Existing Conditions Immediately”

FACT: No. Most pre-existing conditions have waiting periods of 6–12 months before coverage kicks in. For new applicants over 70, waiting period is usually 12 months minimum.

Myth: “All Insurance Companies Accept 75+”

FACT: Most major insurers stop accepting new applications at age 75. Some will consider age 75–80 with strict underwriting. Age 80+ is essentially uninsurable in standard market; cash deposit or Thailand Elite only options.

Myth: “Thailand Elite Visa is Just for Rich People”

FACT: Elite starts at ฿650,000 (5-year). Expensive? Yes. But if you’re 75+ and can’t get insurance, Elite removes the insurance problem entirely-could be worth it.

Myth: “If I Don’t Have Insurance, Immigration Won’t Notice”

FACT: Immigration increasingly checks TGIA database during extensions. If your certificate invalid, extension denied. Overstay fines are 500 THB/day; possible deportation. Not worth the risk.

Long-Term Healthcare Planning (Beyond Insurance)

Insurance is just one piece. Real retirees think 10+ years ahead.

Medical Evacuation Planning

Scenario: Major stroke or accident outside Bangkok.

Reality: Thailand has excellent hospitals in cities, but remote areas limited. Medical evacuation (air ambulance) costs ฿1–3 million; regular insurance covers this.

Action Items:

- Confirm evacuation coverage in your insurance policy (most include it)

- Identify nearest international hospital to your city

- Ensure policy covers evacuation to any hospital (not just pre-approved network)

- Keep emergency contacts (insurance, hospital, embassy) accessible

Power of Attorney & Medical Decisions

Critical at Retirement Age:

If you become incapacitated (stroke, dementia), medical decisions must be made. Without legal power of attorney, hospitals may refuse to treat.

Steps:

- Draft Thai power of attorney document (designate trusted person: spouse, adult child, friend)

- Register at local district office (amphoe)

- Provide copies to: Insurance company, hospital of choice, embassy

- Annual review; update if designee changes

Cost: 1,000–5,000 THB; worth every baht

Medication & Prescription Management

Challenge: Thai pharmacists require Thai prescriptions for many medications. Home-country prescriptions not recognized.

Solutions:

- Bring 1-year supply of chronic medications from home (legal for personal use)

- Get prescriptions from Thai doctor; refills easy at local pharmacy

- Many Western medications available over-the-counter in Thailand (surprising!)

- Pharmacists very helpful; speak English in urban areas

Common Medications & Thai Availability:

- Heart meds (atorvastatin, lisinopril): ฿100–200 per month

- Diabetes meds (metformin, glipizide): ฿80–150 per month

- Thyroid (levothyroxine): ฿50 per month

- Blood pressure meds: ฿100–300 per month

All significantly cheaper than USA/UK.

Mental Health Services

Often Overlooked by Retirees:

Expat retirement can trigger depression, isolation, anxiety. Mental healthcare is crucial.

Thai Resources:

- Bangkok has excellent psychiatrists ($60–100 per session vs. $200+ USA)

- Bumrungrad International has English-speaking psychologists

- Thai social worker community strong in Chiang Mai, Bangkok

- Online therapy via home country: Many insurances still cover remotely

Insurance Consideration: Check if mental health covered; some policies have annual limits (฿30,000–100,000).

End-of-Life Planning

Uncomfortable but Critical:

Where do you want to be when you pass? Cremation? Repatriation? These decisions affect family significantly.

Actions:

- Write will / testament (can be simple; have lawyer notarize)

- Designate executor (spouse, adult child, trusted friend)

- Communicate preferences: Cremation vs. repatriation cost ฿200,000–800,000

- Pre-arrangement: Some funeral homes offer “pre-need” plans (฿100,000–300,000)

- Life insurance: Small policy ฿500,000–1M for funeral/repatriation costs

Truth: Most retirees don’t think about this; families face chaos. Spending 2 hours on this now saves family $50,000+ stress later.

Action Checklist (Downloadable & Implementable)

Use this checklist to track your visa & insurance application:

Pre-Insurance Steps

☐ Choose visa type (O-A, Non-O, LTR, or Elite)

☐ Determine age at application

☐ Identify any pre-existing conditions

☐ Check current health insurance (if switching from existing policy)

☐ Gather medical records from last 12 months (if 70+)

Insurance Selection

☐ Visit longstay.tgia.org; review approved providers

☐ Get quotes from at least 3 providers

☐ Compare coverage (at same price tier)

☐ Confirm provider accepts your age

☐ Verify visa certificate issuance included

Application & Underwriting

☐ Complete health questionnaire honestly & fully

☐ Submit application (online or in-person)

☐ Await underwriting response (3–7 business days)

☐ If medical exam required: Schedule & complete

☐ Receive approval confirmation

Certificate & Visa Application

☐ Contact insurance company; request Foreign Insurance Certificate

☐ Provide: Full name, passport #, visa dates

☐ Receive certificate (email or pick-up)

☐ Print/save certificate

☐ Prepare all required visa documents

Visa Submission

☐ Complete visa form (TM.86 for new O-A)

☐ Gather: Passport, photos, medical cert, bank statement, insurance cert, criminal clearance

☐ Submit at Royal Thai Embassy

☐ Pay visa fee

☐ Track application status

After Visa Approval

☐ Receive visa in passport

☐ Plan travel to Thailand

☐ Confirm insurance is active on travel date

☐ Keep insurance certificate copy in wallet

Annual Renewal (If O-A)

☐ 90 days before insurance expiry: Contact insurer for renewal

☐ Request updated quote & renewal documents

☐ Purchase next year’s policy

☐ Request new visa certificate

☐ Prepare extension documents (TM.47, passport, insurance cert, bank statement)

☐ Submit extension at Immigration Bureau Thailand

☐ Get new 1-year entry stamp

Long-Term Management

☐ Set annual calendar reminders for renewal dates

☐ Keep all insurance documents (5+ years)

☐ Maintain 800k balance if on Non-O

☐ Establish power of attorney (if over 65)

☐ Create advance healthcare directive (end-of-life preferences)

☐ Review insurance annually; consider adjustments

💡 CTA: Save this checklist. Print it. Update it as you progress. Share with your spouse or family member.

FAQ (20+ Questions Optimized for Featured Snippets)

Do I Actually Need Health Insurance for Thailand Retirement Visa?

Short Answer (40 words):

Yes, if applying for Non-Immigrant O-A visa (mandatory since Oct 2019). Non-O visa in Thailand requires no insurance, just 800k THB bank balance. O-X requires insurance for 5-year duration. LTR visa requires $50k coverage. Check your specific visa type.

What’s the Minimum Health Insurance Coverage Thailand Requires?

Short Answer (45 words):

For O-A visa: Minimum 40,000 THB outpatient + 400,000 THB inpatient. For O-X visa: 120,000 THB outpatient + 3,000,000 THB inpatient. For LTR: $50,000 USD total coverage. Most retirees buy 2–3x minimums for better protection against major illness.

Can I Use Travel Insurance for My Thailand Retirement Visa?

Short Answer (35 words):

No. Travel insurance is rejected by Thai immigration. It covers emergency evacuation, not hospitalization treatment. You must purchase long-stay medical insurance specifically designed for Non-Immigrant visas. Travel insurance won’t satisfy requirements.

How Much Does Health Insurance Cost for Retirees in Thailand?

Short Answer (50 words):

Age 50–59: ฿45,000–80,000/year. Age 60–69: ฿60,000–120,000/year. Age 70+: ฿120,000–350,000/year (significantly more; harder to obtain). Costs vary by coverage level, pre-existing conditions, and provider. Some insurers accept monthly payments (slightly higher total).

What Happens If My Health Insurance Expires Before My Visa Renewal?

Short Answer (45 words):

Immigration will deny extension. Your permission to stay technically becomes invalid. You must either renew insurance immediately (if still possible) or convert to different visa type. Risk: Overstay fines (500 THB/day), blacklist, deportation. Always renew before expiration.

Can I Get Health Insurance in Thailand with Pre-Existing Conditions?

Short Answer (50 words):

Yes, but with conditions. Most insurers require 6–12 month waiting period before pre-existing coverage activates. Some providers (Pacific Cross, Thai Health) more flexible. Higher premiums likely. Full medical disclosure required. Denial possible for severe conditions (active cancer, terminal illness).

What’s the Difference Between O-A and Non-O Visa Insurance Requirements?

Short Answer (55 words):

O-A visa (from embassy): Mandatory health insurance annually, minimum 400k THB inpatient. Non-O visa (in Thailand): No insurance ever required; only 800k THB balance. O-A offers international entry benefit; Non-O simpler renewals. Most retirees switch to Non-O after initial entry.

Do I Need Insurance Every Year for O-A Visa Renewal?

Short Answer (40 words):

Yes, if extending O-A from abroad. New insurance certificate required each year. If you convert to Non-O visa in Thailand, no insurance needed for future extensions. Most retirees recommend Non-O for this reason (avoids annual insurance cost).

Can I Switch from One Visa Type to Another if Insurance is Too Expensive?

Short Answer (50 words):

Yes. Most commonly: O-A → Non-O (inside Immigration, one transaction). Converts you to 90-day base; then extends annually without insurance requirement. Only works one-way generally. Cannot easily switch from Non-O back to O-A. Plan visa type carefully upfront.

What Insurance Do I Need for Thailand LTR Visa?

Short Answer (45 words):

Minimum $50,000 USD health insurance (Thai or international provider) OR $100,000 USD bank deposit held 12 months. Policy must have 10 months remaining validity at application. Much more flexible than O-A visa regarding coverage and provider choice.

Do Thailand Elite Visa Members Need Health Insurance?

Short Answer (40 words):

No, Elite visa doesn’t require mandatory health insurance. However, entry to Thailand currently may require travel insurance (COVID-related policy, subject to change). Optional Elite Maxima Health package includes Pacific Cross insurance (upgrade available for additional cost).

What Providers Are Actually Approved for Thailand Retirement Visa?

Short Answer (50 words):

Thailand General Insurance Association (TGIA) maintains official list at longstay.tgia.org. Main approved providers: Pacific Cross, AXA Thailand, Thai Health Insurance, Muang Thai, Bangkok Health. All are Thai-licensed companies. Always verify on TGIA before purchasing.

How Long Does It Take to Get Health Insurance Approved for Thailand Visa?

Short Answer (45 words):

Underwriting decision: 3–7 business days (faster for young/healthy; slower for 70+ or pre-existing conditions). If medical exam required: Add 1–2 weeks for exam scheduling and results. Certificate issuance: 1–3 days after approval. Total timeline: 2–4 weeks recommended.

Can I Buy Health Insurance After Getting My Thailand Visa?

Short Answer (50 words):

If O-A: You need insurance BEFORE visa approval (at embassy). If already in Thailand on Non-O: No insurance ever required. If converting to O-X: Insurance required before extension approval. Cannot backdate insurance for visa purposes. Insurance and visa must align timing-wise.

What Medical Exams Are Required for Thailand Retirement Visa Insurance?

Short Answer (45 words):

Age 50–69: Usually none (questionnaire only). Age 70+: Almost always required-basic blood pressure, weight, blood tests (sugar, cholesterol). Exam cost: Usually free; sometimes 500–1,500 THB. Results sent to insurance company; typically doesn’t delay approval significantly.

Do Pre-Existing Conditions Disqualify Me from Thailand Insurance?

Short Answer (50 words):

Not automatically. Insurers assess severity. Minor controlled conditions (hypertension, mild diabetes) usually approved with 6–12 month waiting period. Severe conditions (active cancer, kidney failure) may face denial. Full medical transparency required. Some specialists (Pacific Cross Expat Care) more flexible than others.

What Happens if Insurance Company Rejects My Application?

Short Answer (50 words):

Request written reason for denial. Consider alternative provider (different company, different assessment). Provide additional medical documentation showing improved control. Escalate to underwriting manager (appeal). Use broker to advocate. If all fail: Consider Non-O visa (no insurance needed) or Thailand Elite.

Can My Spouse Get Insurance on My Policy or Separately?

Short Answer (50 words):

Each family member needs separate policy with separate certificate. Family discounts available at some insurers (2–3% reduction per additional family member). Spouse must apply separately; undergo own underwriting. Both must meet requirements. Family plans: Research availability; not all insurers offer.

How Do I Cancel Insurance if I Leave Thailand Early?

Short Answer (45 words):

Contact insurance company; request cancellation with specific date. Most policies allow pro-rata refund for unused months (minus admin fee, roughly 10–15%). Keep documentation. If converted to Non-O visa: No cancellation needed; simply don’t renew. Leaving Thailand: Cancel before departure.

Is Health Insurance More Affordable Than Paying Medical Costs Directly in Thailand?

Short Answer (55 words):

Usually yes. Insurance ฿50,000–100,000/year. Major surgery without insurance: ฿400,000–700,000 out-of-pocket. Even single serious event exceeds years of premiums. However, healthy retirees sometimes self-insure (pay-as-you-go) successfully if they have substantial savings. Risk-dependent decision; insurance recommended for safety.

What Happens If I Get Sick Before Insurance Approval?

Short Answer (50 words):

If not yet approved: You pay out-of-pocket (no coverage). If approved but policy hasn’t started: You pay out-of-pocket; typically cannot backdate claims. Insurance starts on policy effective date only. Once active: Pre-existing conditions have waiting period (6–12 months) before coverage.

Can I Transfer My Existing International Insurance to Thailand?

Short Answer (50 words):

Maybe. If policy specifically covers Thailand hospitalization AND exceeds Thai minimums AND issues proper certificate: Possibly. Most international policies don’t meet Thai requirements (designed for emergency evacuation, not full hospitalization). Better to buy Thai-compliant policy. Consult provider directly before assuming.

Your Path Forward

Retirement in Thailand is achievable and rewarding. Health insurance-despite its complexity-is simply one organized step in a straightforward process.

The essential takeaway: Understand your visa type, know the requirements, select approved insurance early, and maintain continuity. Thousands of retirees over 50 have successfully navigated this system; you can too.

Next Steps:

- Decide visa type (O-A, Non-O, LTR, or Elite)

- Get 3 insurance quotes from longstay.tgia.org-approved providers

- Apply for insurance (process takes 2–3 weeks)

- Request visa certificate from insurance company

- Submit visa application with certificate

You’re now ready to retire in Thailand confidently, protected, and compliant.

Last Updated: January 2026 | Verified with Thai Immigration & TGIA Requirements | Medical Information: Sourced from Bangkok Hospital & Pacific Cross Health Insurance official guidelines

Need Help?

- Thai General Insurance Association: longstay.tgia.org

- Royal Thai Embassy Visa Support: [Your nearest embassy website]

- Thailand Immigration Bureau: immigration.go.th

- Professional Visa Assistance: Consider Baan Thai Immigration or Forbes & Partners (specialized Thailand visa firms)