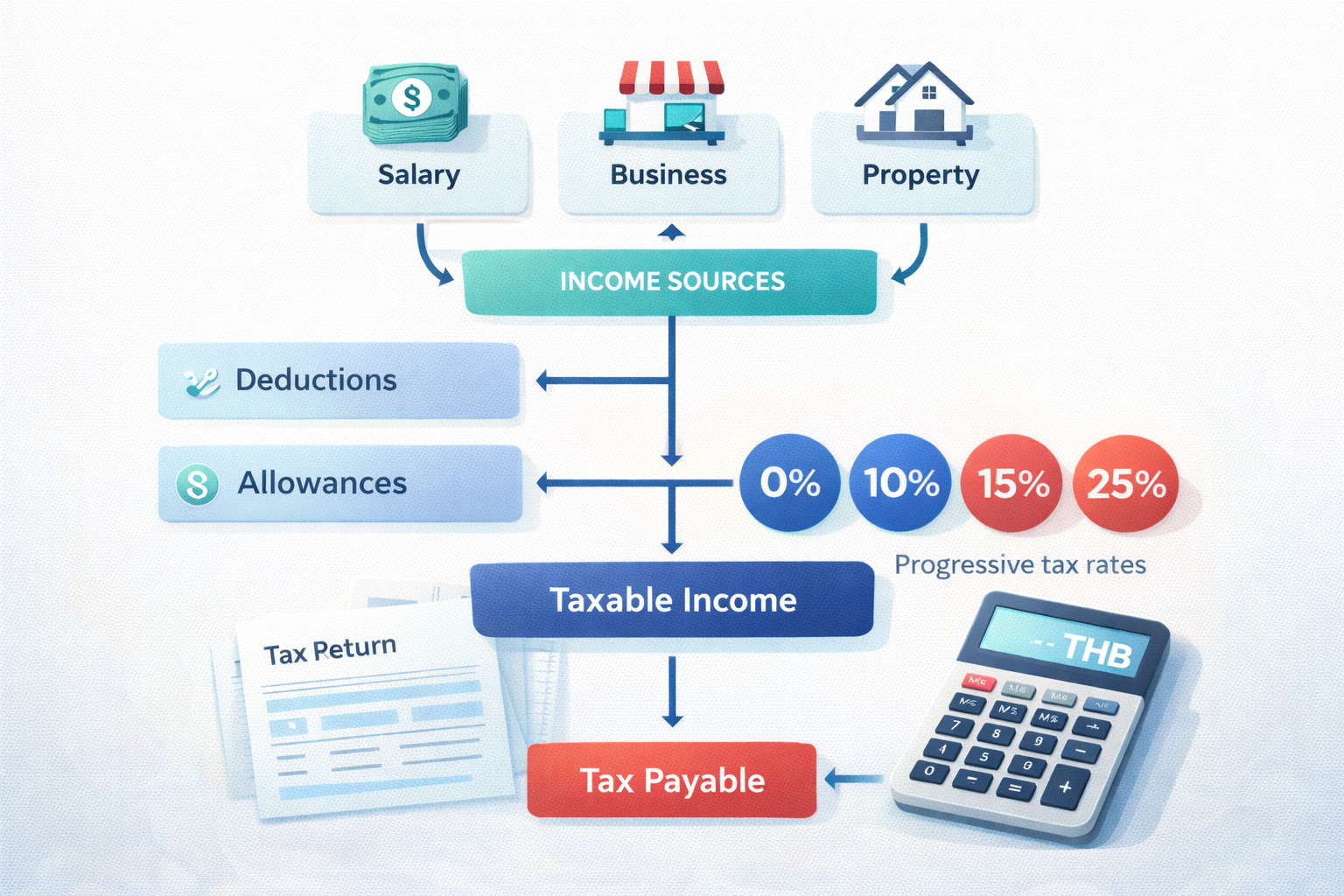

Key Highlights

- Thailand’s personal income tax system applies to both Thai nationals and foreigners who earn income in the country.

- Your tax obligations depend on whether you are a tax resident, which is determined by spending 180 or more days in Thailand during a tax year.

- As of 2024, tax residents must pay Thai tax on foreign-sourced income brought into Thailand, regardless of when it was earned.

- Taxable income is calculated using progressive tax rates ranging from 0% to 35%.

- The deadline for annual tax filing with the Thai Revenue Department is March 31 of the following year.

- You can reduce your taxable income through various deductions and allowances.

📊 Not sure how much tax you’ll pay in Thailand?

We’ve added an interactive personal income tax calculator below – scroll down and calculate your estimated tax in seconds.

Introduction

Navigating the personal income tax system in a new country can feel overwhelming. If you live, work, or earn income in Thailand, understanding your tax obligations is essential. The Thai tax rules have seen some important updates, especially concerning foreign income. This guide will walk you through everything you need to know about personal income tax in Thailand for the current tax year, from who needs to pay and what’s taxable to the rates and filing process. Let’s make sure you’re prepared and confident.

Overview of Personal Income Tax in Thailand

Thailand’s personal income tax system operates on a self-assessment basis, overseen by the tax authority known as the Revenue Department. Anyone earning income in Thailand, whether you are a Thai national or a foreign individual, may be required to file a tax return and pay Thai tax on their taxable income.

Your specific obligations depend on a few factors, mainly your tax resident status and the source of your income. The tax year in Thailand follows the calendar year, from January 1 to December 31. Understanding these fundamentals is the first step toward successful compliance. Now, let’s explore the key features and recent updates to the system.

Key Features of Thailand’s Income Tax System

One of the main characteristics of Thailand’s personal income tax system is its progressive tax structure. This means that the tax rate increases as your income rises. Individuals with higher taxable income fall into higher tax brackets, while those with lower earnings benefit from lower rates, including a tax-free threshold for the lowest income bracket.

Another key feature is how it defines taxable income. It’s not just about your monthly salary. The system considers both cash payments and benefits-in-kind, such as free accommodation or a company car, as assessable income. This broad definition ensures that all forms of compensation are accounted for when calculating your final tax bill.

Finally, the system relies on you to file a tax return and declare your income accurately. The tax authority provides guidelines and forms, but it is your responsibility to comply with the tax rules and deadlines for each tax year.

Recent Updates and Changes (Including income tax thailand 2022)

The most significant recent change to Thai tax legislation took effect on January 1, 2024. These updated rules primarily affect tax residents with income from foreign sources. Before this update, foreign-sourced income was only taxable if it was brought into Thailand in the same year it was earned.

Under the new law, any assessable income earned abroad on or after January 1, 2024, and brought into Thailand by a tax resident is subject to Thai tax. This applies whether the money is remitted in the same tax year it was earned or in any subsequent year. This change marks a major shift in how foreign income is treated.

It’s important to note that this rule is not retroactive. Any foreign income you earned before January 1, 2024, is not affected by this change, even if you bring it into Thailand now. Understanding this update is crucial for expats and Thai residents with international financial ties.

Understanding Tax Residency Status

Your tax residency status is the most important factor in determining your tax obligations in Thailand. The tax authority classifies individuals as either a “resident” or a “non-resident” for tax purposes, and this classification dictates which income is taxable.

Whether you are considered one of the many Thai residents for tax purposes has a direct impact on how your worldwide income is treated. Non-residents have a more limited tax scope compared to residents. Let’s look at what it takes to be a tax resident and what that means for your finances.

Criteria for Being a Tax Resident in Thailand

Becoming a tax resident of Thailand is based on a simple, time-based rule. Your nationality or visa type doesn’t automatically determine your tax residency status. Instead, it all comes down to the amount of time you spend in the country.

You are considered a tax resident if you meet the following condition:

- You are physically present in Thailand for a total of 180 days or more within a single calendar year.

These days do not need to be consecutive. The tax authority simply adds up all the days you were in the country during the tax year. If the total is 180 or more, your tax residency status is established for that year, and you will be subject to Thai income tax on a broader range of income. This status requires you to obtain a tax identification number and file a tax return.

Implications for Residents and Non-Residents

The implications of your residency status are significant. If you are a tax resident, you have broader tax liabilities. You are subject to Thai tax on any income you earn from sources within Thailand. Additionally, under the new rules, you are also taxed on any foreign income that you bring into the country.

In contrast, if you are classified as a non-resident (meaning you spent less than 180 days in Thailand), your tax obligations are more limited. A non-resident is only required to pay Thai tax on income that originates from a source within Thailand. Your foreign income is not subject to Thai taxation, even if you bring it into the country.

This clear distinction is why tracking your days in Thailand is so important. It directly determines the scope of your tax liabilities and whether your income from outside Thailand is part of the equation.

Who Must File Personal Income Tax in Thailand

Anyone who earns taxable income in Thailand may need to complete a tax filing. This includes both Thai nationals and any foreigner who qualifies as a resident of Thailand or earns income from a Thai source. The requirement to file a tax return is based on your total income exceeding certain thresholds.

However, having to file a return does not automatically mean you will owe tax. Many people who file a tax return end up having no tax liability after applying deductions and exemptions. Let’s examine the specific filing obligations for citizens and foreigners.

Filing Obligations for Thai Citizens

Thai nationals who earn income are generally required to handle tax filing. The obligation to file a return depends on the amount and type of income earned during the tax year. For an unmarried individual, if your total assessable income exceeds 60,000 THB, you must file. If your income comes only from employment, the threshold increases to 120,000 THB.

For married Thai nationals, the thresholds are higher. You must file if your combined assessable income exceeds 120,000 THB, or 220,000 THB if it’s solely employment income. These rules ensure that individuals earning a basic living wage are not burdened with tax filings.

To file, every taxpayer needs a tax identification number, which is used to track payments and returns. Fulfilling this annual obligation is a key civic duty for all income-earning Thai nationals.

Requirements for Foreigners and Expats

For foreigners and expats, the tax requirements are based on the same principles of residency and income source. You are generally required to file a tax return if you meet certain conditions during the tax year. The tax authority doesn’t differentiate based on nationality, only on your financial activities and presence in the country.

Key situations that trigger filing requirements for foreigners include:

- Being a tax resident by spending 180 or more days in Thailand.

- Earning taxable income from a Thai source, such as employment or a business, regardless of your residency status.

Many foreigners can benefit from a double taxation agreement (DTA) between Thailand and their home country. A DTA helps prevent you from being taxed on the same income in both countries. However, it does not exempt you from the obligation to file a return in Thailand if you meet the criteria.

What Types of Income Are Taxable in Thailand?

In Thailand, taxable income is officially referred to as “assessable income.” This is a broad term that covers many different ways you can earn money. The Revenue Department groups this income into several categories, but it can be simplified into two main types: domestic income and foreign income.

Common examples include employment income like salaries and bonuses, business income from your company’s profits, and rental income from property you own. Understanding which of your earnings fall into the assessable income category is the first step in calculating your tax.

Sources of Domestic and Foreign Income

Your assessable income is categorized based on where it originates. Domestic income is any income derived from a source within Thailand. This could be a job based in Thailand, a business operating in the country, or property located here.

Foreign income, on the other hand, is income derived from sources outside of Thailand. This could be salary from a remote job for a foreign company, profits from an overseas business, or dividends from foreign investments. The rules for taxing foreign income are different and depend on your residency status.

Examples of income sources include:

- Employment income, including salaries, wages, and bonuses.

- Business income, professional fees, and income from contracts.

- Investment income, including dividends, interest, and capital gains, as well as rental income. For those with foreign income, it’s also wise to check for treaties on double taxation to avoid paying tax twice.

Assessable vs. Non-Assessable Income Categories

When calculating your Thai tax, it’s important to distinguish between assessable and non-assessable income. Assessable income is what your taxable income is based on. It includes not only your salary but also any property or benefit that can be valued in money, such as a company providing you with free housing.

However, not all money you receive is considered assessable. The tax code provides for non-assessable income categories, which are specific types of earnings that are exempt from tax. For example, certain types of severance pay upon dismissal from a job or income up to 190,000 THB for residents over 65 are not taxed.

Understanding what is and isn’t included in your taxable income for the tax year is key. You only need to declare such income that is assessable, and correctly identifying it ensures you don’t overpay your taxes.

Personal Income Tax Rates in Thailand

Calculate Your Personal Income Tax in Thailand

Use this interactive calculator to estimate your personal income tax in Thailand based on your income, deductions, allowances, and the current progressive tax rates. The calculator is for informational purposes only and reflects the general rules described above.

Thailand PIT Calculator (simplified)

1) Income (Assessable income)

2) Allowances

3) Minimum tax rule (0.5%)

This calculator provides an estimate only and does not constitute tax advice. For official calculations, consult the Thai Revenue Department or a licensed tax advisor.

Thailand uses a progressive system of tax rates, which means the rate you pay increases as your income grows. Your total earnings are divided into different income tax brackets, with each bracket taxed at a different percentage. This structure is designed to be fair, placing a lower burden on those with less income.

Your final income tax liability is calculated based on your net income, which is your total assessable income minus all eligible deductions and allowances. Falling into a lower tax bracket can significantly reduce the amount of tax you owe in Thai Baht.

Current Tax Brackets and Rates (including updates since income tax thailand 2022)

The personal income tax system in Thailand has remained consistent since the updates for income tax Thailand 2022, applying a series of progressive tax brackets to your net taxable income. Whether you are a Thai national or a tax resident from another country, these are the rates that determine your tax liability.

After you subtract all your allowances and deductions, your remaining income is taxed according to the following structure. Remember, the first 150,000 Thai Baht of your net income is completely tax-exempt.

Here is a breakdown of the current tax rates:

| Taxable Income (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | Exempt |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,001 | 35% |

How Tax Rates Apply to Different Income Classes

It’s a common misunderstanding that if your taxable income falls into a higher bracket, your entire income is taxed at that rate. That’s not how Thailand’s progressive tax rates work. Instead, only the portion of your income within a specific bracket is taxed at that bracket’s rate. This is a much fairer approach for all income classes.

For example, imagine your net taxable income for the tax year is 600,000 THB. You would not pay 15% on the entire amount. Instead, the calculation would be: the first 150,000 THB is taxed at 0%, the next 150,000 THB at 5%, the next 200,000 THB at 10%, and the final 100,000 THB at 15%.

This marginal system ensures a smooth and gradual increase in your overall tax liability as your income grows. You never have to worry about a small raise pushing your entire income into a much higher tax payment, as you will always benefit from the lower tax bracket rates on the first part of your earnings.

Allowances, Deductions, and Exemptions

One of the best ways to legally reduce your tax bill is by taking advantage of the various tax deductions, allowances, and exemptions available. The tax rules in Thailand provide many opportunities to lower your taxable income, which in turn lowers the amount of tax you owe. These tax benefits are available to all eligible taxpayers.

From personal allowances and social security contributions to investments and insurance premiums, these items are subtracted from your gross income to determine your net taxable income. Some groups or income types also qualify for complete exemptions. Let’s explore some of the major ways you can save.

Major Personal Allowances and Deductions

Every taxpayer in Thailand is entitled to a range of personal allowances and tax deductions that provide significant tax benefits. These are standard deductions you can claim to reduce your taxable income for the tax year. Knowing which ones apply to you is essential for smart tax planning.

Some of the most common and valuable deductions include:

- A personal allowance of 60,000 THB for every taxpayer.

- A spouse allowance of 60,000 THB if your spouse has no income.

- A child allowance of 30,000 THB per child (or 60,000 THB for children born from 2018 onwards).

- Contributions to the Social Security Fund, which are deductible up to the actual amount paid.

Other popular deductions include payments for life and health insurance premiums, home mortgage interest, contributions to retirement funds, and charitable donations. Be sure to keep good records of these expenses, as they can add up to substantial savings.

Exemptions for Certain Groups or Incomes

Beyond deductions, Thai tax legislation also provides for complete tax exemptions or waivers for certain individuals and types of income. Unlike a deduction that reduces your taxable income, an exemption means that such income is not taxed at all. These tax benefits are targeted to support specific groups.

For instance, a Thai resident who is 65 years or older can claim an exemption on the first 190,000 THB of their income. The same exemption applies to residents with a disability. This provides important financial relief for vulnerable populations.

Additionally, every taxpayer benefits from the exemption on the first 150,000 THB of their net income, as it falls into the 0% tax bracket. The tax authority may also grant special waivers or exemptions to promote certain investments or support specific economic goals, so it’s always good to check for the latest updates.

Conclusion

In conclusion, understanding personal income tax in Thailand is essential for both residents and expats navigating the tax landscape. From recognizing your tax residency status to grasping the implications of various income sources and applicable rates, being informed can save you time and money. Make sure to stay updated on recent changes and utilize available allowances and deductions to optimize your tax obligations. As tax season approaches, it’s crucial to be proactive and ensure compliance with all filing requirements. If you have more questions or need personalized assistance, don’t hesitate to reach out for a free consultation to clarify any uncertainties and ensure you’re on the right track with your taxes in Thailand.

Frequently Asked Questions

How do foreigners file and pay personal income tax in Thailand?

Foreigners file personal income tax using Form PND 90 or PND 91. You can submit it online through the tax authority’s e-Filing portal or in person at a local Revenue Department office. If you are a tax resident, you must file annually for each tax year and will need a tax identification number.

What is the deadline for filing personal income tax returns in Thailand?

The deadline for filing your annual tax return is March 31 of the year following the tax year. For example, for income earned in 2024, the deadline is March 31, 2025. The tax authority often extends this deadline to early April for those who choose to file their Thai tax return electronically.

Are there penalties for late or incorrect tax filing in Thailand?

Yes, there are penalties. Late tax filing can result in a fine of up to 2,000 THB. If you underpay your tax, the tax authority imposes a surcharge of 1.5% per month on the outstanding amount. In cases of intentional tax evasion, you could face more severe penalties, including hefty fines and criminal charges.