Layer 2 (L2) solutions used to be new ways to help Ethereum do more. Now, they are an important part of Ethereum’s system. The L2 solutions can handle over 300 transactions each second. In comparison, Ethereum alone can do 15 transactions per second. By January 2026, the Layer 2 networks hold $41.8 billion in value spread over many different groups. Arbitrum, Base, Optimism, and Polygon manage 90% of all market work in this area. This big change shows a shift in the way blockchains work. Instead of trying to let Ethereum itself handle more, people now use rollup technology. This means the order and checks are done off the main chain, but security is still watched over by Ethereum’s base system.

For investors, developers, and people who use cryptocurrency, it is now key to know about Layer 2 solutions. If you want to move around in the blockchain world, you need to learn this. This guide breaks down how it works and goes over the top projects in the market. It looks at how top projects compare with others. You will also find clear ways to make choices in this fast-changing space.

What Are Layer 2 Crypto Projects? Foundational Definition and Architecture

Layer 2 solutions are built on top of a main blockchain (this is Layer 1). These are made to handle transactions faster and at a much lower cost. You still get the same level of safety as the main network. These Layer 2 networks work with Ethereum’s mainnet. They do this by sending batches of transaction data over to it from time to time. They can also use something called zero-knowledge proofs, which check if things are correct without showing all the details.

Layer 2 solutions are not sidechains, because they still use the main security model from Ethereum.

The main change solves a big problem for Ethereum. Its way of handling transactions can only process about 15 of them every second. This slow speed makes it very crowded when lots of people want to use it. Fees can get so high that most people do not want to pay. In 2024, when the system was very busy, the main Ethereum chain charged more than $100 for just one transaction. But if you use Layer 2 solutions, things are much faster. These can handle thousands of transactions each second, and you only pay a tiny amount for each.

The Two Primary Architecture Classes

Optimistic Rollups (Arbitrum, Optimism, Base) work with a simple idea. All transactions are thought to be good unless someone says there is a problem in a 7-day window to check for fraud. This setup makes the system easy to use and helps it fit well with the Ethereum Virtual Machine (EVM). With this, developers can use old smart contracts with little change. The main catch is you need to wait for 7 days if you want to move assets back to mainnet.

Zero-Knowledge Rollups (zkSync, Starknet, Loopring, Immutable X) use special cryptographic proofs to check groups of transactions. The network does not run each transaction on Ethereum. These proofs are only a few kilobytes of data. They need much less space on the blockchain than the old way of checking transactions. ZK-rollups can also make things go faster. Instead of waiting weeks, you only wait a few hours or minutes for things to complete. Some people also like that these rollups offer stronger privacy for users.

In 2025, new changes have sped up how people use ZK-rollup. The ecosystem is moving to better ways of scaling. The Fusaka upgrade for Ethereum made it cheaper to put data on the mainnet. This made all L2 solutions more cost-effective. But, it helped ZK-rollups the most because their costs depend a lot on keeping data on chain as small as possible.

The Market Leader: Arbitrum’s Dominance in Layer 2 TVL and Ecosystem Development

Arbitrum is on top among Layer 2 solutions. It has $16.6 billion in total value locked as of January 2026. The platform holds about 41% of all money in the Layer 2 space. This strong position comes from the way the system works and the power of having so many users. It has attracted many DeFi protocols, lending platforms, and exchanges.

Technical Architecture: Arbitrum’s Competitive Advantages

Arbitrum made its system better with the Nitro upgrade in 2022. This helped to lower the cost of putting data on the blockchain by about 70%. The way Arbitrum works puts together Optimistic Rollup ideas and strong ways to save on costs. Because of this, making a normal transfer now only costs about $0.01 to $0.05.

The system has changed and is now more than just one large rollup. Arbitrum’s Orbit framework helps people build their own Layer 3 chains. They can shape these to fit what their app needs. This has brought about a wide network of different ways for programs to run. By the end of 2025, there are over 100 custom chains on Arbitrum Orbit. These include chains made just for trading, some for games, and some for businesses.

Market Concentration and Decentralization Roadmap

Arbitrum is on top when it comes to TVL, and that is not up for debate. But, there is some real criticism about the way it runs because it could be too central. Right now, Arbitrum runs with a sequencer that has too much control. This sequencer is the one node that lines up all the transactions. This setup could let someone block some transactions, or help a few people get more MEV (Maximal Extractable Value). To fix these issues, Arbitrum’s plan is to make the sequencer less central by 2026. At that time, more people will help with ordering transactions. That should lower these risks.

This change in governance shows how the whole ecosystem is growing. As Layer 2 solutions go from scaling tests to being a big part of the system, it is important to have strong decentralization. The way Arbitrum’s ARB token is set up for governance stands out from many other L2 tokens. It sets a new standard for a way to move towards more decentralization. Still, most of the token holder voting is done by only a few delegates.

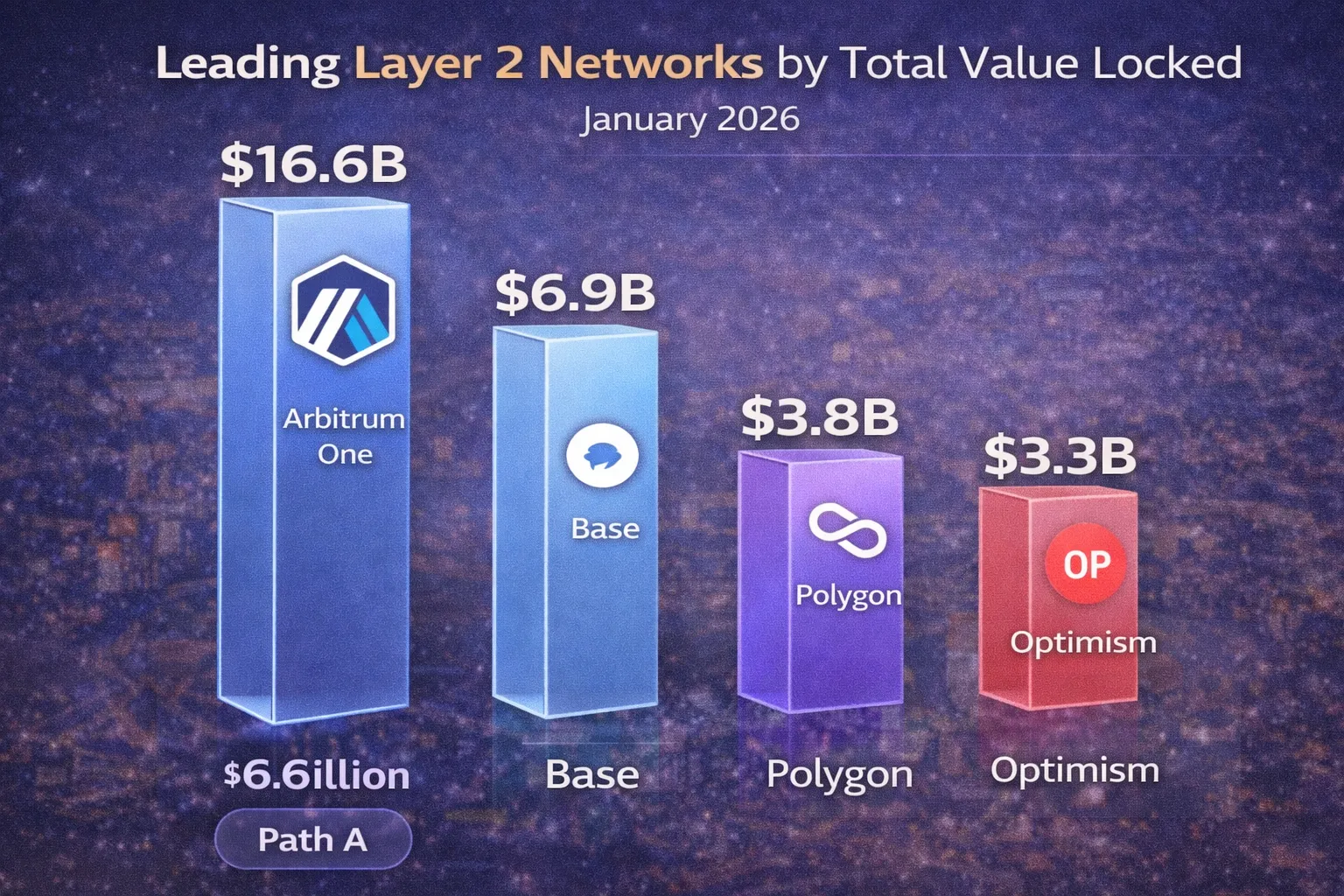

These are the Layer 2 networks with the most value locked in by January 2026.

The Interoperability Frontier: Optimism’s Superchain Vision and Base’s Consumer Dominance

While Arbitrum leads when it comes to TVL numbers, Optimism and Base each show a different plan for how Layer 2 systems can grow. Optimism puts focus on how all the parts of its Superchain can work together. On the other side, Coinbase-backed Base works to get more everyday people involved by joining with popular platforms.

Optimism: Reimagining Layer 2 Through Interoperability

Optimism wants to use technology to fix the problem of many Layer 2 chains being splitup in the system. This goal is not just about making things bigger or faster. The main idea is to link many Layer 2 chains together. This will be done by using the same set of rules or ways of talking to each other.

The “Superchain” vision means people, money, and messages can move easily between chains. There is no need for big middle steps or pools that hold money between different chains. Everything moves without using a center point.

As of January 2026, Optimism (OP Mainnet) keeps $6.3 billion locked in. There are about 1.94 billion tokens that people can use. This is about 45% of all the tokens that will ever be out there. The OP token is used for running the group and also for rewards. The money made from the platform goes to people who hold tokens and stake them on the security layers.

The Superchain framework helps fix a big user problem. Right now, people have to move money in several places. They use many interfaces and hard bridge steps when they go between L2s. Optimism uses a shared system to sort out orders and puts proofs together in one place. This cuts down on these trouble spots. Still, the setup is hard to understand and most people have not started using it yet.

Base: Consumer-Oriented Scaling with Exponential Growth

Base is Coinbase’s own Layer 2 network. It started in 2023. This platform is made for regular people, not just for big groups or investors. It stands as another choice against Arbitrum, which focuses more on DeFi and has big players in it. While Base has $10 billion locked in, it is about 40% less than Arbitrum. But when you look at how many people use it and how many small trades are done, Base stands out. Base handles the same, or sometimes even more, transactions than Arbitrum. This shows that more everyday people use Base. A lot of the trades on Base are small and made for regular people who use apps.

This difference shows there is a clear split in the market. Arbitrum gets most of the big DeFi actions from big players. This includes things like trading with advanced tools, lending app votes, and moving large-value items. On the other hand, Base is number one for everyday users who want NFT trading, games, and apps for money and friends. Base also does well because it is the chain of Coinbase. You get easy ways to use real money, it works well with the exchange, and it has the trust that comes from Coinbase.

Average transaction costs on Base have gone down to about $0.01 for regular transfers. Sometimes, gas fees can get close to zero when the system is not busy. This setup helps make Base a good choice for small payments and games. Before, mainnet money rules made things hard for these uses.

Scaling Architecture Comparison: Optimistic vs. ZK-Rollups and Emerging Modular Designs

A Good Look at the Top Layer 2 Crypto Projects (2026)

The Layer 2 ecosystem shows basic changes in how its parts are built. This will shape how the market works through 2026. It is important to know these technical differences when you want to look at projects and decide where to put your money.

The ZK-Rollup Renaissance: Starknet, zkSync, and Privacy-First Scaling

Zero-knowledge rollups were thought to be too hard to use before, but now they work well and are starting to take a part of the market from optimistic rollups. Starknet uses StarkWare’s STARK proof system. In 2025, it set itself up as a Bitcoin DeFi layer. With this move, it brought native BTC staking and safe Bitcoin bridging. This way, you do not need to fully trust other people with your coins. This plan shows what is really happening in the market. People who support Ethereum are not as many as before. A lot of users look for different ways to use Bitcoin because its rules do not let them do everything developers want.

ZkSync stands out because it works with Cairo-style smart contracts and focuses on keeping fees low. You can do a transaction for about $0.02, and it is fully EVM-friendly. A lot of NFT platforms and gaming teams use this platform. They like that zero-knowledge proofs provide privacy.

The main ZK-rollup benefit is that it gives faster end points and costs less when putting data on Ethereum. This becomes even more useful as the way Ethereum handles data gets full. Ethereum’s Fusaka change fixed this for some time, but many people who study the market say that as more people use L2, ZK-rollup setup will be the top choice for scaling by 2027.

Modular Blockchains and the Dymension Paradigm

Dymension goes further than old rollup categories. It brings a new way of building things with RollApps. These are rollups made for different apps that run on Dymension’s Hub. Each one has its own security, way of doing things, and rules about money. You can change these to fit what you need. This setup is the next step in how people make Layer 2 solutions. Before, everyone had to use Ethereum’s system, even if they used Layer 2s. Now, modular designs let the apps be in charge of their own system but still stay safe when they settle things.

Dymension’s way of doing things solves a big problem in how people use Layer 2. Right now, users have to deal with many different things that don’t fit together well. There are different screens and wallet setups that don’t match. RollApps give app makers a way to change every part of how people use the app. They can do this while still counting on Dymension’s one main system for finishing deals.

Dymension’s TVL is still not high. It is about $3.33 million at the end of 2025. But the way this ecosystem is shaping the 2026 L2 development is huge and clear. Big protocols like Celestia, Avail, and Polygon now use modular ideas. This shows the industry may all move toward these systems.

Sector-Specific Layer 2 Leaders: Gaming, NFTs, DeFi, and Bitcoin Integration

The Layer 2 world has changed over time. Now there are special types of networks for certain jobs. Each one tries to do one thing well, based on what people need. This split makes sense for the way people work and what they want from these tools.

NFT and Gaming-Focused Solutions: Immutable X and Mantle

Immutable X is at the top of the NFT-focused Layer 2 group. It uses StarkWare’s zero-knowledge rollup. With this, you can mint and trade NFTs without paying gas fees. This is very important because it gets rid of high costs that have stopped many people from buying and selling digital collectibles.

The platform has handled more than 270 million trades. It has also helped move $700 billion in trading since it started in 2020. At the same time, it keeps every transaction friendly for the environment because it is carbon-neutral.

The way Immutable X works uses the IMX token to hold value in its system by using it for votes and sharing fees. You can easily see how this value moves. The platform mainly looks at GameFi and Web3 gaming. Because of this, more gaming groups move in as it gives them a cheaper place to play. This helps the online community grow.

Mantle ($3.4 billion market cap), backed by Binance and BitDAO, is focused on metaverse and gaming. It uses a special virtual machine setup to help with many transactions. This makes deals fast and cheap, which is good for gaming.

Other Layer 2 choices are for broad use. But Mantle’s setup is designed for certain needs. These are fast state changes, how deals are placed in order, and the need for things to be finished in a very short time.

Bitcoin Layer 2 Explosion: Starknet, Stacks, and the Lightning Network

Bitcoin Layer 2 solutions have started to do well in 2025 and 2026. There are now many groups working to solve the programmability issues in the Bitcoin system. The Lightning Network is still the most used Layer 2 option for Bitcoin. It helps with fast payments by using private payment channels that are not on the main chain. But, because it can only use UTXO transactions, it cannot be used for smart contracts.

Stacks adds more features to Bitcoin by using smart contracts. It keeps the strong security that Bitcoin has. This is a different way to help Bitcoin handle more work. Stacks does not run on Bitcoin by itself. Instead, Stacks works with its own system that checks and saves things on Bitcoin from time to time.

Starknet is now working more with Bitcoin by adding native BTC staking and using BTCFi systems. This shows that the team knows Bitcoin’s value and strong name give special ways for people to invest. Starknet calls itself “the Bitcoin execution layer.” It lets you use apps that can be programmed, while Bitcoin is used to settle accounts and keep value safe.

Market Consolidation: The Great L2 Shakeout of 2025-2026

One of 2026’s biggest changes in the L2 ecosystem will be the way the market comes together. A lot of smaller rollup projects could be at risk because they do not have good ways to make money. The market also favors bigger groups, so these smaller projects may have a hard time growing.

The “Too Big to Fail” Oligopoly

Recent market data shows that three names – Arbitrum, Base, and Optimism – handle about 90% of all Layer 2 transaction volume. This is true even though there are many other choices. People use these platforms because of where people and money are already gathered. More money goes to groups that have the best trading spots, more options for apps, and a bigger pool of builders.

Analysts say that by 2026, less than 10 Layer 2 solutions will be able to keep transaction fees that make sense for money. More than 40 projects that we see now might turn into “zombie chains,” which means they will still work but have no real money moving through them. This coming together helps the people who use these chains because there will be less mess and split-up choices. But, it also gets rid of ways to put money into second-tier Layer 2 tokens.

Economic Viability Crisis and Sequencer Economics

The main economic issue for Layer 2 solutions is with sequencer money matters and MEV. Sequencers are nodes that take care of the order of transactions. They make money from MEV and from charging fees for making the order, but this is not enough to cover the costs to run everything. Without new tokens being created all the time, they may not get enough money to keep things going.

As Layer 2 solutions grow, the long-term plans for making money are still not clear. Arbitrum is now working to let more people be part of managing sequencers. It wants to keep good money rewards by sharing MEV gains. This is seen as the most advanced plan in the ecosystem for this problem. Still, no one knows if these ways will last or work over time.

Investment Analysis: Token Performance, Valuation Metrics, and 2026 Price Predictions

Layer 2 token prices are still high compared to basic numbers. This large gap is making a big difference between people who feel good and bad about prices in 2026.

Arbitrum (ARB) Price Dynamics and Market Sentiment

Arbitrum’s main token is now worth about $0.47. The total market cap is $4.48 billion. Experts have many different price guesses for 2026. Some say the lowest price could be $0.23. Others say it could go as high as $8.67. A lot of them think it will be close to $0.98.

This change shows there is real doubt about where Arbitrum stands among others. In the best case, the value locked in the system keeps going up. The system also spreads out who gets to verify the blocks, and more people start using Orbit. In a worse case, others like Base put a lot of pressure on Arbitrum. Some developers move to other L2s, and more tokens get added to the market as time goes on. Right now, Arbitrum has 5.15 billion tokens in use, which is 51% of all tokens there will ever be. As more locked tokens get released, this will slowly add more tokens into the market.

Optimism (OP) and the Governance Token Valuation Puzzle

The governance token for Optimism trades at $0.27. The market cap is $555 million. This is about four times less than Arbitrum, even when they both have close TVL and Optimism is stronger with working well across different blockchains. The price being lower shows that people have doubts about how soon the Superchain idea will catch on. There is, also, some worry about how the token will bring value to holders.

OP token vesting brings some challenges. Out of 4.29 billion total tokens, only 1.94 billion are in the market. This is about 45% of all tokens, and 161 million tokens are still locked. Tokens will be unlocked step by step until 2026. This can push people to sell, which may hold the price down. For the price to go up, more people must want the token than the number of new tokens released.

Polygon’s (POL) Strategic Positioning Following MATIC Rebranding

Polygon’s move from MATIC to POL tokens in September 2024 was more than just a name change. It helped make the system better for working with several blockchains at once. Now, how the POL token works is focused on use in Polygon 2.0’s AggLayer setup, not just going up and down in price.

POL’s rate of inflation is about 1.9% each year. This number should go down as validators get better at their work. The lower inflation helps the token when you look at other coins. Some others have to give out 5-7% more tokens each year. That means POL has a good setup for how the token works. On top of that, a lot of real companies use Polygon. A lot of that usage comes from the way businesses are getting on the blockchain. Because of this, people may put money in POL and keep it longer, while others may just guess about new L2 tokens.

Ethereum Scaling Integration: How Layer 2 Solutions Interact with Mainnet

It is important to know how Layer 2 solutions and the Ethereum mainnet work together. This helps people see if they will last over time and if they can grow.

Data Availability and the Rollup-Centric Roadmap

Ethereum’s current setup gives about 16 kilobytes per block for Layer 2 data posting. This is the on-chain space needed for rollups to finish settling. The Fusaka upgrade in 2025 raised this space by using better data structures. It also made costs lower for every L2 solution by making the system work better.

Vitalik Buterin and the group building Ethereum have given clear support for the “rollup-centric roadmap.” They know the main part of Ethereum will now act more as a layer for final settlement. It will not do all the work of running transactions like before. This plan changes the value of Ethereum. Instead of doing every transaction by itself, Ethereum will work as a safe place to settle many transactions that happen on several other layers like Layer 2 and Layer 3. These layers will handle most of the work now.

The Tower Stack: Layer 3 Proliferation and Hierarchical Scaling

Arbitrum’s Orbit framework lets people build Layer 3 solutions, which are rollups on top of Layer 2 networks. This helps create a way for blockchains to scale at several layers. Each one can have its own level of safety and cost. A Layer 3 chain for one app can make the cost for each trade go as low as $0.001 or less. But, you will lose some of the decentralization that you get with Arbitrum’s Layer 2.

This tower-like setup helps blockchain work well when lots of people use it. But, it can also break up how people move around the system. Users have to work their way through several steps to move between layers. They need to know the safety risks for each one. People also need to handle different token types and connect different wallets. Superchain from Optimism and AggLayer from Polygon try to hide some of these hard steps. Even so, most people still find it hard to get in and use the network.

Fee Structures and User Economics: Quantifying Layer 2 Cost Advantages

The main value of Layer 2 solutions is that they can make costs go down a lot. Showing how much money people can save is key when we think about who will use these solutions in the future.

Historical Fee Comparison: Ethereum Mainnet vs. Layer 2 Solutions

Ethereum mainnet transaction fees are now steady at around $0.16 to $0.50 as of January 2026. This is very low when you look at fees from the past. It happened because of Fusaka scaling improvements. But if you look back, mainnet fees were a big problem before. In times of high demand in 2024, the fee for each transaction went over $100.

Layer 2 solutions currently offer:

- Arbitrum: $0.01-$0.05 for each transaction (saves you 95-99% in fees)

- Optimism: $0.01-$0.05 for each transaction

- Base: $0.01 or less when many are not using it

- Polygon PoS: $0.001-$0.01 (but it does not have as much safety)

- zkSync/Starknet: $0.02-$0.05 (a bit higher than others like optimistic rollups, but you get money settled faster)

These cost benefits change things for how people use the app. NFT minting used to cost more than $50. Now, it costs less than one cent. This helps new types of digital items come up. Game transactions that were too expensive and hard before now happen with almost no problems.

Liquidity Fragmentation and Hidden Costs: The Trade-off Narrative

Even though the cost for each action is now very low, users still pay some hidden costs because of split money and moving money across blockchains. A user who has money on the mainnet and wants to use it on Arbitrum must do three things. First, they have to send funds to Arbitrum and pay bridge fees. Second, they pay feel to use Arbitrum. Third, they may need to move money back to mainnet and pay withdrawal fees.

These hidden costs, along with the need to know how gas tokens work and how bridges stay safe, make it hard for many people to get into this space. Fee numbers for each step do not always show these problems. Solutions like Polygon’s AggLayer and Optimism’s Superchain try to make things smoother, but the tools are still not fully ready.

Security Considerations: Evaluating Layer 2 Trust Assumptions

Layer 2 security models are not the same as mainnet. Because of this, users and developers need to know about different risk points.

Optimistic Rollup Security: The Fraud-Proof Model

Optimistic rollups work because they act as if all transactions are valid. They accept them unless someone sends in proof that something is wrong during the challenge window. This time is usually about seven days. The system needs at least one honest person taking care of things and calling out bad moves. If all people start acting bad, wrong transactions can be allowed and go through. In that case, users do not have any way to fix it.

In practice, Arbitrum, Optimism, and Base lower this risk by doing a few things:

- They offer rewards to white-hat hackers who find problems with the system.

- They have several security companies check how the system is built.

- They start up new changes slowly, so if there are any problems, people can spot them before it impacts big money actions.

The 7-day time for withdrawal brings more risks. Users have to keep their records right about money they want to take back. A big move of money can cause problems with cash if not enough is in the pool for people to get out.

Zero-Knowledge Rollup Advantages and Implementation Complexity

ZK-rollups use math proofs to make sure everything is correct. They use special codes to check the work, so there is no need for extra time to check for fraud. With ZK-rollups, things are done and safe in just a few hours instead of taking days. This better security does mean the set-up is more complex and costs more because you need good equipment for proof.

But ZK-rollup ways can bring new risks. If there are hidden problems in the zero-knowledge proof system, the proofs might let in fake transactions. StarkNet’s STARK uses new ways to add more safety compared to older zk-SNARK types with its open features. Still, when put to real use, there have been some problems that the team needs to keep fixing.

Sequencer Centralization and Censorship Resistance

Current Layer 2 systems use central sequencers. This means one group is in charge of how transactions are lined up. This setup can lead to worries about blocking people from making transactions and focusing money in one place. A bad sequencer could get the most out of MEV by picking only high-fee transactions and pushing in front of others’ ideas. They can also refuse to add transactions from some users.

Arbitrum’s decentralization roadmap, and other plans like it in the ecosystem, know about this weakness. They plan to focus on shared sequencing in 2026. But, this kind of sequencing brings some new problems. These problems include more work to agree on things, keeping track of transaction order, and ways to lower MEV, which all get harder to manage.

Comprehensive FAQ: Answering Critical Questions About Layer 2 Crypto

1. What exactly are Layer 2 crypto projects and how do they work?

Layer 2 solutions work as their own blockchain networks built on top of Ethereum or another base layer. They handle transactions away from the main chain but keep things safe by sending updates to the mainnet from time to time. With this way of doing things, not every transaction needs to use Ethereum’s way of agreeing on changes, which usually keeps it at around 15 TPS. Layer 2 networks put thousands of transactions together, send a smaller proof of what happened to Ethereum, and get things settled there.

Optimistic rollups work by thinking every transaction is good unless someone points out a problem. ZK-rollups, on the other hand, show each transaction is good using cryptography. Both these ways help make the cost for each transaction much lower. They also let more transactions happen at the same time. With these methods, Ethereum keeps its decentralization and security.

2. Why are Layer 2 solutions critical to blockchain adoption in 2025-2026?

Ethereum’s Layer 1 can handle about 15 transactions each second. This is not enough for the big number of users that big payment systems have, as they do thousands of TPS. Ethereum needs Layer 2 help. Without it, blockchain stays used only in small areas. People in those cases have to pay high fees and wait longer for their transactions to go through.

Layer 2 infrastructure makes it possible to have better economics for:

(1) consumer apps like games, social finance, and NFTs, (2) high-speed trading, (3) big asset management platforms, and (4) apps that work with real-world businesses.

Projections show that more than 95% of Ethereum activity will be on Layer 2 networks by 2027.

3. How do Layer 2 solutions differ fundamentally from Layer 1 blockchains?

Layer 1 blockchains work by having many people join in to check each transaction. Every person who checks a transaction has to look at every single one. This can slow things down. But, doing things in this way keeps the system open and fair. No one can control the whole thing or stop others from using it.

Layer 2 solutions split up the work. A lot of it happens off-chain, so it is fast. There is also settlement, which is done on Layer 1. This does not happen as often, but it comes with full security. Because of this, Layer 2 can handle more work while still using Layer 1’s security for final settlement. This setup means off-chain ordering may be a bit less protected from being stopped. It also means you have to count on at least one honest person to say something if a bad transaction happens, like with optimistic rollups.

4. Are Layer 2 networks genuinely fast? What are realistic transaction speeds?

Layer 2 networks can handle transactions in one to two seconds, on average. This is much faster than Ethereum’s twelve-second block time and the other delays people can get when waiting for things to be confirmed. But these transactions are not finished right away – the time to finish them depends on how the Layer 2 is built.

- Optimistic Rollups: Withdrawals to mainnet need 7 days to be done.

- ZK-Rollups: Withdrawals can finish in 1 to 4 hours, based on how hard it is to make proofs.

- Layer 3s: You get near-real-time confirmation, but the final settlement happens later.

For most things like trading, payments, or gaming, people get almost instant results. This works much like old payment systems and takes about one or two seconds. But for the blockchain, it takes some more time to be fully done.

5. Are Layer 2 blockchains secure? What risks remain?

Layer 2 security depends on the type of setup used. Optimistic rollups have risks with how finished the process is. Bad transactions could go through if all the people checking it decide to cheat. There are also problems if one group or person does most of the work in sending through transactions. ZK-rollups use strong math checks to keep things safe, but it can be hard to set these up and run them the right way.

All Layer 2 solutions deal with risks that come from using bridges for security. People have to trust the bridge setup to move their money and tokens in the right way between Layer 1 and Layer 2. There have been bridge hacks. Bridges Across lost more than $100 million. This shows that even if Layer 2 works in a safe way, moving money or tokens between different layers is still a big risk for them.

Most people agree that Layer 2 solutions can give good security. In some cases, it can be even better than some Layer 1 blockchains. But you need to know that each one has its own kind of risk. It is important to understand the details of how they work.

6. What does the future of Layer 2 look like in 2026-2027?

Layer 2 development will focus on these areas: (1) Decentralization – a wide network of sequencers and validators helps to lower the risk of censorship; (2) Interoperability – bridges that follow set standards and bringing pools of money together can help stop splitting of assets; (3) Modular architecture – rollups made for single apps work best for special needs; (4) Institutional adoption – RWA token use and safe ways to hold assets will bring in people from the old finance world.

Market consolidation will cut down the number of more than 50 Layer 2 solutions. It will bring the count to about 5 to 10 networks. These networks will have good enough economics to work well. Arbitrum, Base, and special platforms like Starknet for Bitcoin apps and Immutable X for NFTs, will be the main players.

7. Which Layer 2 crypto project should investors choose?

Investment selection depends on your plan and how much risk you can take.

- Highest TVL/Most Mature: Arbitrum (ARB) is best for DeFi-focused groups.

- Consumer Growth Play: Base does not have its own token, but there is a big chance to join its ecosystem.

- Interoperability Vision: Optimism (OP) is good for those who want to help the system work together for a long time.

- Multichain Infrastructure: There is a lot of use for Polygon (POL) when it comes to real business and everyday use.

- Specialized Verticals: Starknet works with Bitcoin, and Immutable X is for NFT games.

There is no one “best” choice out there. The choice you make will depend on your own ideas, how much risk you can handle, and how you see the market.

8. How do I move crypto to Layer 2 networks and what are bridge mechanics?

Users send their money to Layer 2 by using bridge smart contracts. Here’s how it works: (1) they lock money from the Ethereum mainnet, (2) they wait for bridge checkers to say the lock is done, and (3) they get the same tokens on the Layer 2 chain. To get money back, they do the steps in the other way. There can be a wait of seven days for safety with optimistic rollup.

Major bridges include official ones like the Arbitrum Bridge and the Optimism Bridge. There are also some made by others, such as Across Protocol and Stargate. You can also move the tokens by using a centralized exchange, for example, by sending money straight from Coinbase to Base.

9. What’s the actual cost difference between Layer 2 and Ethereum mainnet transactions?

Current mainnet fees (about $0.16 to $0.50) may look low right now, but you should keep a few things in mind. In the past, fees went over $100. When you make more detailed transactions, like smart contract or DeFi actions, it can often be $50 to $200 on mainnet. Layer 2 fees are still 10 to 100 times less for the same type of transaction.

For a user doing a DeFi swap that has slippage, MEV, and state changes, the mainnet can cost $150. Using Layer 2, it can cost only $0.05. So, you pay 3,000 times less on Layer 2. This can make it possible for people to make money.

10. Which Layer 2 solution is best for specific use cases?

- Gaming & Metaverse: Arbitrum Orbit (custom chains), Mantle, Immutable X

- NFTs & Digital Collectibles: Immutable X, Loopring, Polygon

- DeFi & Derivatives: Arbitrum, Dydx (v4), zkSync for advanced protocols

- Bitcoin Applications: Starknet, Stacks, Bitcoin Lightning Network

- Enterprise RWA: Polygon, Avalanche Subnets, Dymension

- Consumer Payments: Base, Optimism, Arbitrum Stylus (WASM)

Each one is good at different things. The best choice will depend on what you need it for.

Navigating the Layer 2 Landscape in 2026

The Layer 2 crypto world has grown up. It started as a test space to make things quicker. Now, it is a big part for how blockchains work. Arbitrum’s high level of total value locked, Base’s way of getting more people to use it, and Polygon’s big step with businesses all show different but smart moves in this space. There is space for many to do well here.

For people who invest money, it is important to see that how Layer 2 groups compete is not like what we see in older tech businesses. There is not just one winner taking over everything. Many groups can still do well. They do this by doing a few key things: (1) they get more people on board in certain user groups, (2) they focus on special tech skills for clear needs, and (3) they join with big payment systems already running, like Coinbase’s Base, Binance’s Mantle, and also through their work with Polygon’s partners.

The years 2026 and 2027 will show if Layer 2 solutions grow to match the industry’s idea of easy, smooth use across many blockchains. These years will also show if Layer 2 solutions split into many small groups where users must pick chains and handle bridge steps on their own. For things to work well, the industry must solve how fast users can get real blockchain settlement. It is also important to keep things safe as systems get bigger and harder. There needs to be a way to keep money coming in, so Layer 2 can have strong support over time.

For developers, Layer 2 solutions are no longer just experiments about scaling. They are now strong tools that support real money activity. There is still a good time for Layer 2 platforms to stand out by using better design, cheaper costs, or by focusing on a certain area. But, this time is going away fast because top players are becoming stronger and more people are using their setup.

Investors need to be smart when they pick Layer 2 tokens. They should look at how Layer 2 tokens are valued, how they are tied to bigger market moves, and how each stands out among others in their use. There are a lot of money and activities in just three or four main platforms. Because of this, other Layer 2 tokens can struggle if they do not offer something special that people want or use.

The Layer 2 scaling story is still a big development in the world of cryptocurrency. It will help decide if blockchain can reach regular people or if it stays used only for big things that do not happen often. Because of this, it is important for anyone serious about crypto to understand Layer 2 solutions.

References and Source Attribution

Web:11 – Mudrex, “Top 10 Crypto Market Predictions for 2026″

Web:4 – ArXiv, “Fast and Secure Decentralized Optimistic Rollups Using Setchain”

Web:6 – ArXiv, “SoK: Bitcoin Layer Two (L2)”

Web:11 – Mudrex, “Top 10 Crypto Market Predictions for 2026”

Web:12 – MEXC, “Top 10 Layer-2 Crypto Projects: ZK, Linea, and Starknet”

Web:13 – Crypto Adventure, “How Layer 2 Scaling Solutions Reduce Ethereum Gas Fees”

Web:14 – Across Protocol, “Arbitrum vs. Polygon: Choosing the Best Ethereum L2 in 2025”

Web:15 – DropsTab, “Top Layer 2 Tokens Ranked by Market Cap”

Web:16 – MEXC, “Ethereum Fees Decline Amid Layer-2 Shift, TVL Remains Stable”

Web:17 – PayRam, “Arbitrum vs. Optimism vs. Base: The Best Layer 2 for Crypto”

Web:22 – 3 Comma Capital, “Ethereum’s Ultra Low Transaction Fees in February”

Web:25 – Binance, “Ethereum’s Layer-2 Scaling Strategy Sparks Debate”

Web:29 – Trading View, “Most Ethereum L2s May Not Survive 2026”

Web:40 – CoinGecko, “Arbitrum One Blockchain”

Web:41 – DropsTab, “Optimism OP Token Unlocks and Vesting Schedule”

Web:43 – DeFiLlama, “Arbitrum”

Web:44 – Coin Law, “Optimism Statistics 2025: TVL, Users & Big Moves”

Web:45 – Binance, “Polygon (POL): Rebuilding the Core of Web3 Scalability”

Web:46 – FlitPay, “Latest Arbitrum Price Prediction 2025, 2026, 2027, 2030”

Web:47 – CoinMarketCap, “Optimism (OP) Price Today”

Web:48 – Oak Research, “Polygon (POL): A comprehensive overview of Ethereum scaling”

Web:52 – L2BEAT, “Total Value Secured”

Web:57 – CoinMarketCap, “Arbitrum (ARB) Price Prediction For 2025 & Beyond”

Web:59 – ArXiv, “Benchmarking GNNs Using Lightning Network Data”

Web:60 – ArXiv, “Data Availability and Decentralization: New Techniques for zk-Rollups”

Web:62 – ArXiv, “Towards a Formal Foundation for Blockchain Rollups”

Web:66 – Starknet, “The Bitcoin DeFi Layer – Supercharged by ZK Tech”

Web:67 – Rapid Innovation, “What is Immutable X”

Web:68 – WhisperUI, “Dymension DYM Guide – RollApp and Modular Rollups Explained”

Web:69 – Starknet Blog, “Starknet in 2025: Upgrades, Decentralization, BTCFi & Beyond”

Web:70 – Immutable, “ImmutableX: Scaling Web3 Games with StarkWare”

Web:72 – KuCoin, “Top Bitcoin Layer-2 Projects to Know in 2025”

Web:74 – Onchain, “Web3 Predictions for 2025: Modular Blockchains”

Web:78 – CoinGape, “Best Layer 2 Crypto Projects In 2026”