Japan’s government bond market has reached a historic inflection point. On January 20, 2026, the nation’s 40-year bond yield surged to 4%-a first in nearly 30 years and a watershed moment for an economy that has thrived on ultra-low borrowing costs for decades. This dramatic repricing reflects fundamental shifts in fiscal policy, monetary expectations, and global capital flows that demand serious attention from investors, policymakers, and anyone exposed to currency or bond markets.

This comprehensive analysis examines the forces driving Japan’s bond market transformation, the structural risks that persist, and the implications for your portfolio and business strategy.

The Record High: Context and Magnitude

Recent Yield Extremes

Japan’s bond market has experienced an unprecedented sell-off that fundamentally altered the risk landscape:

| Bond Maturity | Current Yield (Jan 20, 2026) | Historical Significance | Prior Record |

|---|---|---|---|

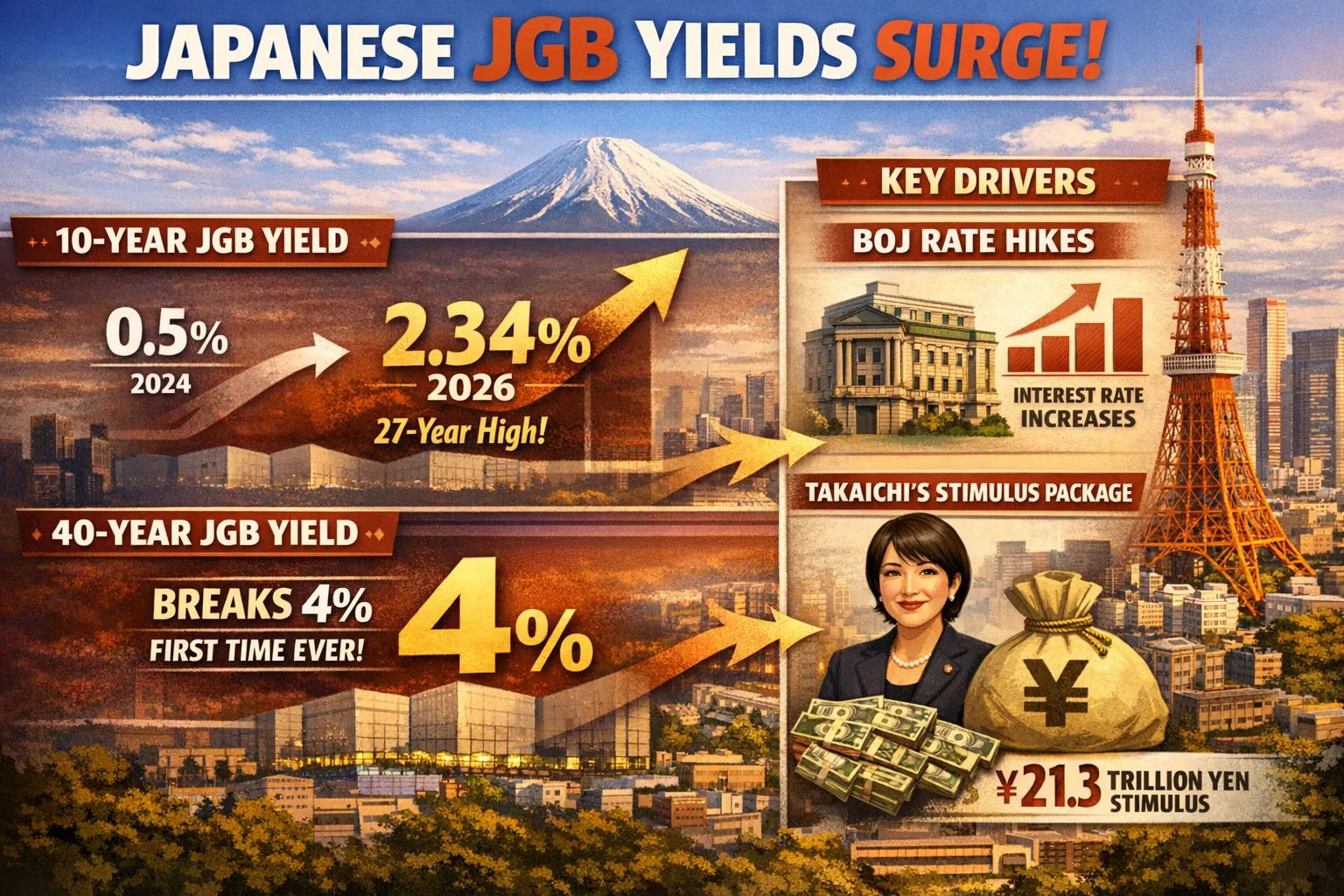

| 10-Year JGB | 2.34% | Highest since 1999 (27-year high) | 2.38% (Jan 2026) |

| 30-Year JGB | 3.68% | Now exceeds Germany’s 30-year yield (~3.5%) | 3.62% (Dec 2025) |

| 40-Year JGB | 4.00% | First time any JGB maturity reached 4% since 1995 | N/A (first time) |

The 40-year yield increase of 60 basis points since Prime Minister Sanae Takaichi took office in October 2025 reveals the market’s stark reassessment of Japan’s fiscal trajectory. To contextualize this volatility: before 2024, Japan’s long-term yields hovered in the 1.5–2% range. The current environment represents a structural regime change.

Why Record Highs Matter

Record highs signal that bond vigilantes-institutional investors who punish fiscal excess through selling-have awakened after years of dormancy. Japanese government bonds have long benefited from a structural buyer base: domestic pension funds, savings held by Japanese households ($14 trillion), and the Bank of Japan’s yield curve management. This embedded demand historically absorbed supply regardless of fiscal deterioration. That assumption no longer holds.

The Takaichi Effect: Fiscal Stimulus and Market Reaction

The 21 Trillion Yen Spending Package

Prime Minister Sanae Takaichi, who assumed office in October 2025, proposed an ambitious 21.3 trillion yen ($135 billion) supplementary budget designed to stimulate growth, provide relief from inflation through subsidies and cash handouts, and boost defense spending. The scale is significant in absolute terms, but the concern runs deeper: it signals a deliberate shift away from fiscal austerity toward “responsible proactive fiscal policy” that prioritizes growth over debt reduction.

The market’s response was swift and severe. Yields spiked across all maturities as investors questioned:

- Revenue offsets: Takaichi’s proposal to cut the sales tax on food to 0% compounds fiscal concerns, as it is unclear how the government will offset the revenue loss.

- Debt issuance: The 183 trillion yen supplementary budget will be financed largely through new bond issuance, increasing supply in an already unsettled market.

- Sustainability: Japan’s debt-to-GDP ratio already exceeds 260%, the highest among developed economies. Additional spending widens deficits and raises long-term solvency questions.

The “Takaichi Trade” Reconvenes

Strategists at State Street and other major institutions have identified a distinct market pattern dubbed the “Takaichi trade”: a weaker Japanese government bond market paired with a stronger Nikkei index and a declining yen. This dynamic reflects investors’ rotation from defensive bonds into equities and international assets as fiscal expansion reduces the relative attractiveness of JGBs as safe havens.

This trade pattern, which emerged in October when Takaichi signaled her policy intentions, has now reasserted itself with amplified volatility. The yen has weakened toward 159 against the dollar-levels not seen since July 2024-adding currency headwinds for investors holding yen-denominated assets.

Monetary Policy: The Bank of Japan’s Balancing Act

Current Policy Stance

The Bank of Japan raised its policy rate to 0.75% in December 2025-the highest level in 30 years-but this remains deeply restrictive in real terms. With consumer inflation running above the BOJ’s 2% target for nearly four consecutive years, real interest rates remain negative, perpetuating incentives for carry trades and yen depreciation.

The Rate Hike Question: Timing and Magnitude

Expectations for further BOJ tightening are split:

- Consensus forecast (Bloomberg survey): One rate increase by July 2026, with 75% of analysts expecting rates to hit 1% or above by September.

- Hawkish scenario (Citigroup): The BOJ could raise rates as many as three times in 2026, potentially reaching 1.25% or higher, if the yen weakens beyond 160 against the dollar.

- Dovish scenario: The BOJ pauses indefinitely, prioritizing financial stability and growth over inflation, a possibility if equity markets decline or credit spreads widen.

The critical trigger is the yen. If persistent weakness continues (potentially driven by Trump administration tariff policies and differential US-Japan growth), the BOJ faces mounting pressure to defend the currency through rate hikes. A dollar-yen rate above 160 would likely precipitate an April hike, according to BOJ insiders.

Implications for Bond Holders

Rate hikes directly compress bond valuations. A 25-basis-point increase in the policy rate would likely push the 10-year yield toward 2.5% or higher, generating capital losses for existing bond holders. This creates a vicious cycle: as yields rise and valuations deteriorate, domestic pension funds and retail savers may reduce JGB holdings, requiring the BOJ to purchase more bonds to stabilize the market. This is precisely the opposite of the BOJ’s desired “gradual reduction in monetary accommodation.”

The Structural Problem: Demographics, Debt, and Demand

Japan’s Fiscal Arithmetic

Japan’s government debt exceeds 260% of GDP, by far the highest among developed economies. This burden is sustainable only under specific conditions:

- Low interest rates: At the current 2.34% 10-year yield, average debt service costs rise materially. If yields move to 2.75% or 3%, annual interest payments could exceed 20 trillion yen-consuming roughly 40% of all tax revenue.

- Domestic demand for debt: Japanese households and the BOJ have historically purchased most new issuance. If this buyer base shrinks-as it must if population ages and bond yields rise-then international investors must fill the gap. This is where the real risk emerges.

- Primary balance: Japan’s primary budget deficit (excluding debt service) is negative, meaning even before interest payments, spending exceeds revenues. This requires perpetual debt issuance to function.

The mathematical reality: without significant primary balance improvement or sustained real GDP growth above 3%, Japan’s debt ratio will expand indefinitely.

Demographic Headwinds

Japan’s population is declining by roughly 800,000 people annually. This reduces the tax base, increases healthcare and pension obligations, and shrinks the cohort of domestic savers who have historically funded government debt. By 2050, Japan’s working-age population will shrink by 30%, intensifying all of these pressures.

Global Capital Flows: The Spillover Question

Why Japanese Bond Yields Matter Globally

A poorly received auction of 20-year Japanese government bonds in 2024 led to sharp spikes in bond yields across the United States and Germany. This occurred because:

- Forced selling: As JGB yields rose, Japanese banks and insurers faced mark-to-market losses and reduced carry trade profitability, spurring them to sell foreign bonds to cover losses.

- Volatility transmission: Global investors rebalance portfolios as correlations shift, creating simultaneous selling pressure across bond markets.

- Expectations signaling: A major economy’s fiscal deterioration signals that global rates should be higher, a view that reverberates through international bond markets.

Today, Japan’s 30-year yield (3.68%) now exceeds Germany’s (3.5%), a historic reversal. This suggests the market prices higher fiscal and inflation risk in Japan relative to the eurozone, a significant repricing of relative value.

Currency Implications

A weaker yen-currently near 159-pressures the 900+ Japanese exporters and their supply chains. While weak currency temporarily supports exporters, it also increases import costs and consumer inflation. This dynamic is precisely what is pushing the BOJ toward rate hikes, creating a tightening bias that contradicts Takaichi’s fiscal expansion goals.

Investment Implications and Edge

Portfolio Hedging Strategies

Rising JGB yields reduce the value of existing bond holdings. Investors holding Japanese government bonds should consider:

- Duration reduction: Shift from 30/40-year bonds toward shorter-dated 5/10-year paper to minimize interest-rate sensitivity

- Relative value trades: JGB yields are now competitive with eurozone sovereigns; consider rebalancing from duration-heavy portfolios into selective Asian credits

- Carry trade unwinds: As JGB yields rise, the profitability of borrowing yen to fund foreign assets declines. This may trigger forced selling, particularly in emerging-market currencies and commodities

Equity Sector Winners and Losers

- Beneficiaries: Companies with global revenue streams (exporters benefit from weak yen), financial services (higher rates improve lending margins), energy stocks (commodity prices may rise if capital flows shift)

- Under pressure: Domestic-focused consumer discretionary (higher borrowing costs reduce demand), utilities (capped returns on regulated assets), real estate (capitalization rates rise with bond yields)

Currency Dynamics

The yen has weakened to 159 against the dollar. If BOJ rate hikes materialize and fiscal concerns ease, the yen could strengthen 5–10% from current levels, providing a headwind for exporters but supporting import substitution. Monitor BOJ communications closely-they are the key policy variable.

Forecasting the Future: Scenarios and Probabilities

Base Case (60% probability, 2.75% 10-year yield by mid-2026)

The BOJ raises rates twice in 2026 (April and July), reaching 1.25%. This moderates yen depreciation, stabilizes inflation expectations, and reduces Takaichi’s political room for additional fiscal expansion. Yields drift toward 2.75–3.0%, pricing a more sustainable fiscal path. Equity markets are resilient as earnings growth offsets higher discount rates.

Bullish Case (25% probability, 2.3–2.5% range sustained)

The yen stabilizes despite political gridlock, domestic demand for bonds rebounds as the BOJ pauses rate hikes, and Takaichi’s snap election (scheduled for February 8) results in a coalition government that moderates fiscal expansion. Yields compress toward 2.3–2.5%, and the “carry trade” stabilizes. This favors bond holders and exporters.

Bearish Case (15% probability, 3.5%+ by end-2026)

Trump’s tariff policies trigger a global trade war, reducing Japan’s export growth and corporate earnings. Investors flee JGBs en masse, forcing the BOJ to purchase massive quantities to prevent a disorderly move. The yen weakens beyond 160, prompting emergency BOJ action. Yields spike to 3.5% or higher, triggering global bond market spillovers. Equities decline sharply as growth expectations collapse.

Why This Matters Now

Japan’s bond market has entered uncharted territory. For the first time in 30+ years, sustainable fiscal policies are being tested by vigilant markets. The outcomes will echo globally-through foreign exchange markets, bond prices in the US and Europe, and corporate earnings across the Pacific.

Your understanding of this inflection point determines your preparedness for the scenarios ahead. Whether yields stabilize at 2.5%, drift toward 3%, or spike to crisis levels remains uncertain-but the stakes are unmistakably high.

The February 8 snap election, the BOJ’s policy meetings in January and March, and the yen’s trajectory against the dollar are the key milestones to monitor. Position accordingly.

Key Takeaways

- Historic repricing: Japan’s 40-year yield hitting 4% for the first time reflects a fundamental shift in how markets price fiscal risk in developed economies.

- Takaichi’s fiscal expansion vs. BOJ’s tightening: The policy conflict between expansionary government spending and a hiking central bank is unsustainable long-term.

- Demographic and structural headwinds: Population decline and a negative primary budget balance mean Japan cannot escape the need for either higher growth or fiscal consolidation.

- Global spillover risks: A disorderly JGB market could trigger significant volatility in US Treasuries, eurozone bonds, and emerging-market currencies.

- Investment decision point: The coming six months will determine whether this is a temporary repricing or the beginning of a sustained regime change in Japanese fiscal and monetary policy.