When importing a vehicle into Thailand, most foreign nationals encounter a complex multi-layered tax system that can transform a modest used car into a prohibitively expensive asset. An ordinary $20,000 sedan from Japan becomes a $35,000+ expense after Thai import duties, excise tax, local taxes, and VAT stack atop one another. Understanding this tax structure-and knowing whether temporary or permanent importation suits your situation-separates successful vehicle relocations from costly mistakes.

This comprehensive guide walks through every tax component, fee, and regulatory requirement, providing the practical clarity that competing articles overlook. Whether you’re an expatriate relocating to Thailand with a personal vehicle, a business importing commercial fleets, or a vintage car collector taking advantage of Thailand’s new 2026 policy changes, this guide provides the exact framework you need to budget accurately and navigate customs clearance.

Why Are Imported Cars in Thailand So Expensive? Understanding the Protectionist Tax System

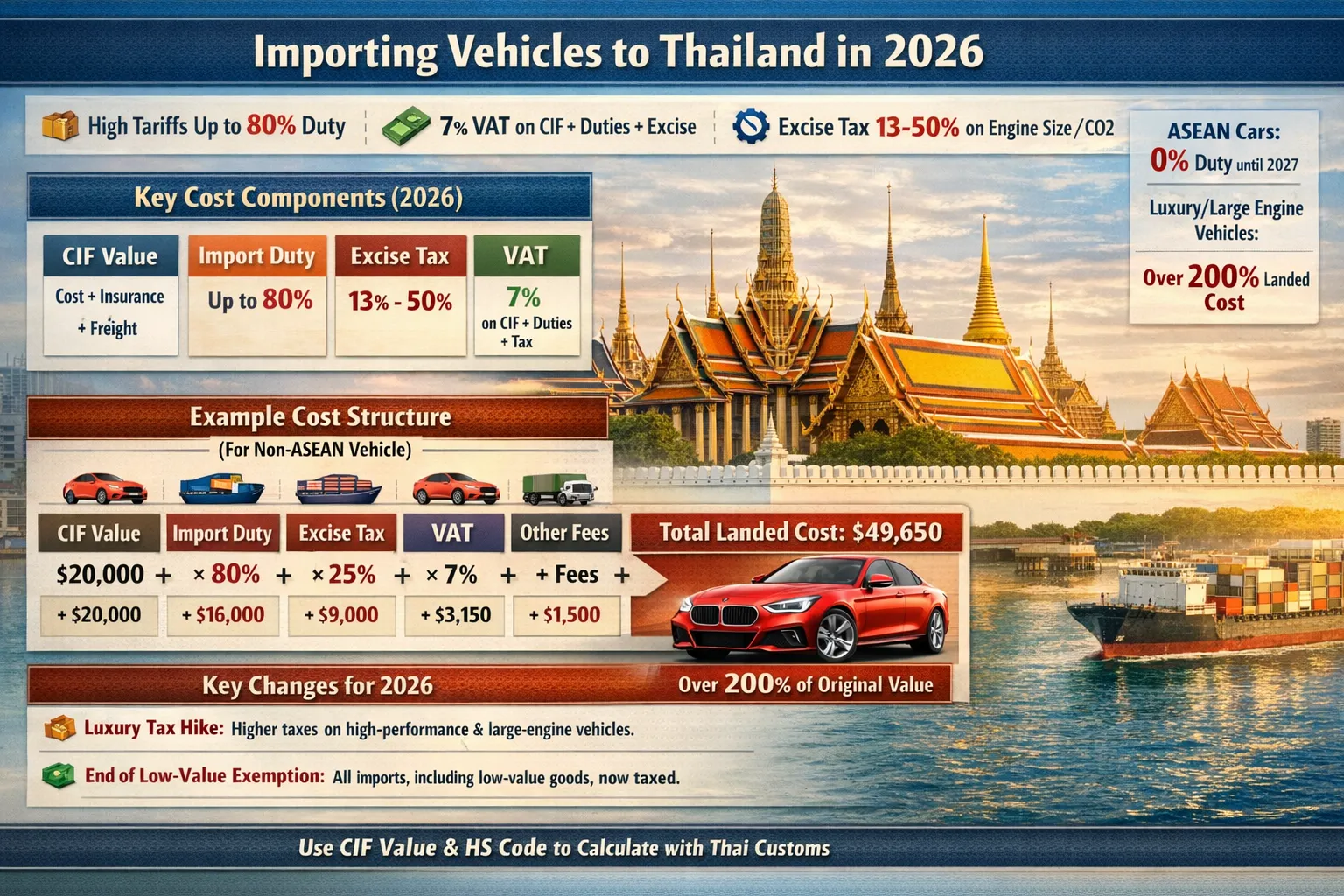

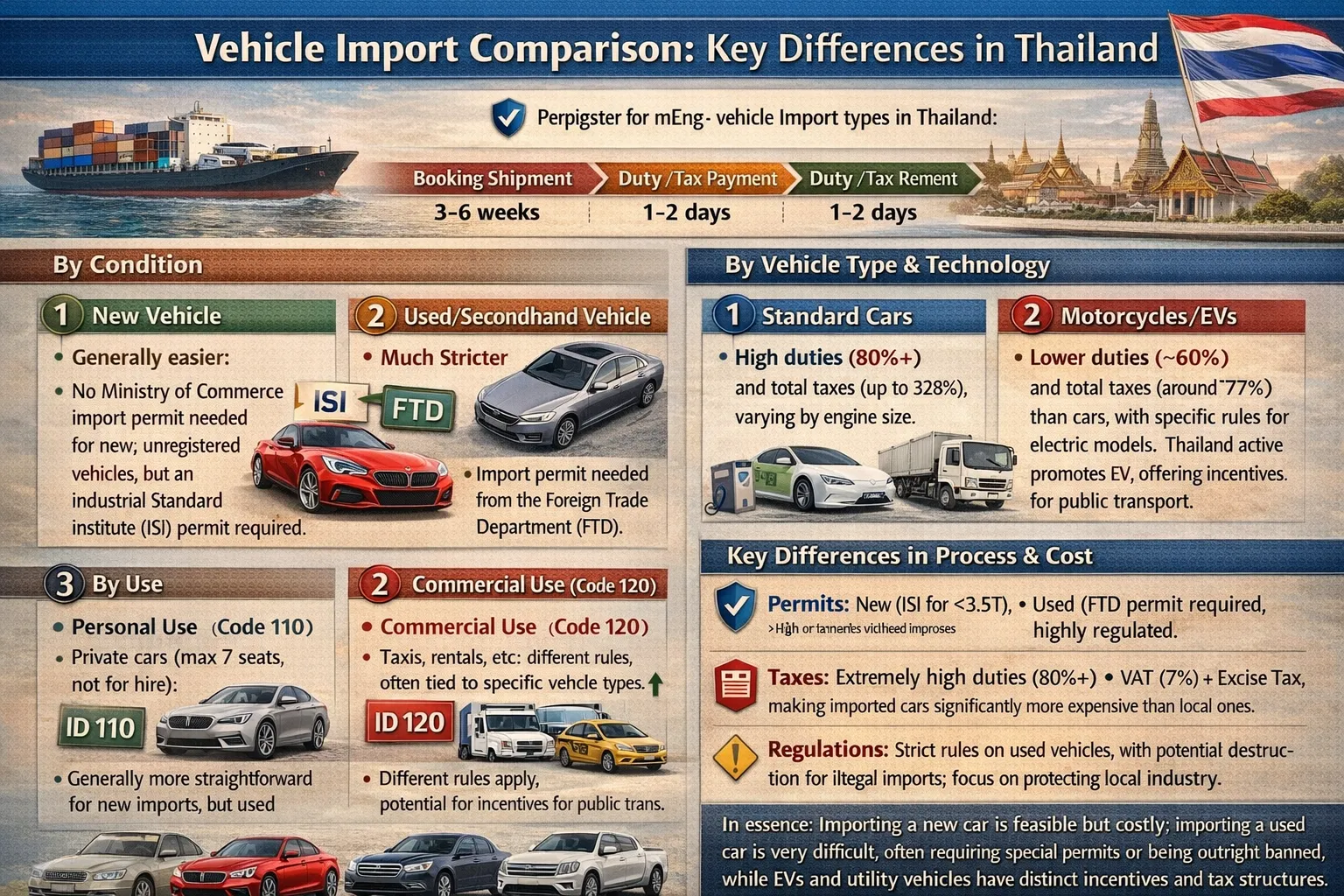

Thailand’s automotive industry receives aggressive government protection through one of the world’s most stringent import tax regimes. Unlike most developed nations where import duties on vehicles range from 10% to 25%, Thailand’s multi-tiered system can exceed 150% to 200% of a vehicle’s original value, depending on engine size, luxury designation, and import type.

The government’s policy rationale is straightforward: protect Thailand’s domestic automotive manufacturing base. Domestic producers (Isuzu, Toyota, Ford, Great Wall) employ over 800,000 workers and generate 15% of Thailand’s GDP. If imported vehicles entered at competitive prices, local manufacturers would face severe margin pressure. The high tax burden ensures Thai consumers choose locally-assembled vehicles, supporting factory employment and tax revenue.

This protectionism has consequences. Thailand currently ranks among the world’s most expensive markets for automobile ownership. A used Honda Accord that costs $20,000 in Japan or $22,000 in the USA requires a landed cost of approximately $35,000-$38,000 in Thailand after all taxes. Luxury vehicles face even steeper premiums-a $50,000 BMW carries taxes exceeding $75,000-$100,000 additional cost.

Regional comparisons underscore Thailand’s severity. Vietnam applies 40% import duty plus 10% VAT (50% total); Malaysia charges 40% import duty plus 6% VAT (46% total); Singapore permits personal vehicle imports at near-zero duties but restricts supply through quota systems. Thailand’s combined tax burden, while protectionist, remains the practical ceiling for importing personal vehicles into Southeast Asia.

However, 2026 has introduced significant exceptions-particularly the new 45% excise tax rate on vintage cars (30+ years old), which represents a dramatic reduction from the previous 200%+ regime. This policy shift creates the first realistic pathway for expatriates to import classic vehicles in decades.

Thailand Import Duty Tax: Complete Calculation Framework

Importing a vehicle into Thailand requires calculating four distinct tax components, each stacking upon the previous one. This section provides the exact formulas, current rates, and step-by-step worked examples that will allow you to predict your total cost with precision.

Component 1: Import Duty (ศุลกากร)

Import duty represents the first layer of taxation and applies to the CIF value (Cost, Insurance, Freight) of your vehicle.

Current Import Duty Rates (2026):

- Standard passenger cars: 80% of CIF value

- Pickup trucks and commercial vehicles: 50% of CIF value

- Electric vehicles (CBU imported, 2024-2025 period only): 40% import duty reduction available

Formula:

textImport Duty = CIF Value × 80%

The CIF value includes your vehicle’s purchase price, international shipping cost, and marine insurance during transit. If you purchase a used 2020 Honda Accord for $18,000, add $2,000 for shipping and $200 for insurance, your CIF value is $20,200.

Calculation example:

- CIF Value: $20,200

- Import Duty Rate: 80%

- Import Duty = $20,200 × 0.80 = $16,160

This single duty component now exceeds the vehicle’s original purchase price-a critical reality for budgeting.

Component 2: Excise Tax (ภาษีสรรพสามิต)

Excise tax is Thailand’s most complex vehicle tax, as the rate varies dramatically by engine displacement, CO2 emissions, vehicle type, and whether the vehicle is new or used. The calculation formula is notably unintuitive and commonly misunderstood.

For standard imported vehicles, the excise tax formula is:

textExcise Tax = (CIF Value + Import Duty) × {Excise Tax Rate / [1 - (1.1 × Excise Tax Rate)]}

This formula appears unnecessarily complex because it’s designed to ensure that excise tax + VAT together equal a target effective rate. The 1.1 multiplier accounts for VAT layering.

Current Excise Tax Rates by Vehicle Category (2026):

| Vehicle Type | Engine/Specification | Excise Rate |

|---|---|---|

| Passenger Car (Sedan) | ≤2,000cc, ≤220 HP | 13% |

| Passenger Car | 2,000-2,500cc, ≤220 HP | 16% |

| Passenger Car | 2,500-3,000cc, ≤220 HP | 20% |

| Passenger Car | >3,000cc OR >220 HP | 50% |

| Luxury/Supercar | Any engine | 50% |

| Pickup (Single Cab) | ≤3,250cc | 4% (Gas/Diesel) |

| Pickup (Double Cab) | ≤3,250cc | 8% (Gas/Diesel) |

| Electric Vehicles | Any size | 2% (2026) |

| Plug-in Hybrid (PHEV) | ≥80km electric range | 5% |

| Plug-in Hybrid (PHEV) | <80km electric range | 10% |

| Vintage Cars (30-100 years old, qualified) | Any size | 45% (NEW 2026) |

Worked Example – Standard Sedan:

Continuing with our Honda Accord:

- CIF Value: $20,200

- Import Duty: $16,160 (calculated above)

- Vehicle Type: Sedan, 2.0L engine (falls into 2,000-2,500cc bracket)

- Excise Tax Rate: 16%

textExcise Tax = ($20,200 + $16,160) × {0.16 / [1 - (1.1 × 0.16)]}

= $36,360 × {0.16 / [1 - 0.176]}

= $36,360 × {0.16 / 0.824}

= $36,360 × 0.1942

= $7,061

Notice how the excise tax calculation base includes both the CIF value and the import duty already paid. This stacking is intentional-Thailand taxes the cumulative burden.

Component 3: Local Tax (ภาษีท้องถิ่น)

Local tax is a provincial-level charge, typically calculated as 10% of the combined import duty and excise tax. Rates vary slightly by province but average 10%.

Formula:

textLocal Tax = (Import Duty + Excise Tax) × 10%

Calculation:

textLocal Tax = ($16,160 + $7,061) × 0.10 = $2,322

Component 4: Value Added Tax – VAT (ภาษีมูลค่าเพิ่ม)

VAT of 7% applies to the combined base of CIF value, import duty, excise tax, and local tax. This is the final tax layer before vehicle release.

Formula:

textVAT Base = CIF Value + Import Duty + Excise Tax + Local Tax

VAT = VAT Base × 7%

Calculation:

textVAT Base = $20,200 + $16,160 + $7,061 + $2,322 = $45,743

VAT = $45,743 × 0.07 = $3,202

Total Import Tax Cost – Complete Example

| Component | Amount |

|---|---|

| CIF Value (vehicle + shipping + insurance) | $20,200 |

| Import Duty (80%) | $16,160 |

| Excise Tax (16% on CIF + duty) | $7,061 |

| Local Tax (10% on duty + excise) | $2,322 |

| VAT (7% on all above) | $3,202 |

| TOTAL TAXES | $28,745 |

| FINAL LANDED COST | $48,945 |

Your original $18,000 used car now costs approximately $48,945 in Thailand-a 172% markup driven entirely by taxes.

Cost Scenarios: Japan, USA, and EU Vehicle Origins

The landing cost varies dramatically based on origin country due to CIF differences (shipping distances). Here are three realistic 2026 scenarios:

Scenario A: Used Vehicle from Japan (Toyota Corolla, 2018, 1.6L)

- Vehicle purchase price: $12,000

- Shipping from Yokohama: $1,200

- Insurance: $120

- CIF Value: $13,320

- Import Duty (80%): $10,656

- Excise Tax (13%): $3,110

- Local Tax (10%): $1,066

- VAT (7%): $1,540

- TOTAL TAXES: $16,372

- LANDED COST: $29,692

Scenario B: Used Vehicle from USA (Honda Accord, 2020, 2.0L)

- Vehicle purchase price: $18,000

- Shipping from Los Angeles: $2,800

- Insurance: $280

- CIF Value: $21,080

- Import Duty (80%): $16,864

- Excise Tax (16%): $6,188

- Local Tax (10%): $2,305

- VAT (7%): $3,402

- TOTAL TAXES: $28,759

- LANDED COST: $49,839

Scenario C: Used Vehicle from EU (BMW 5-Series, 2019, 3.0L)

- Vehicle purchase price: $28,000

- Shipping from Hamburg: $3,500

- Insurance: $350

- CIF Value: $31,850

- Import Duty (80%): $25,480

- Excise Tax (50%): $14,385

- Local Tax (10%): $3,987

- VAT (7%): $5,568

- TOTAL TAXES: $49,420

- LANDED COST: $81,270

These scenarios illustrate why Japan-sourced used vehicles dominate Thailand’s import market-geographic proximity (shorter shipping) reduces CIF value, directly lowering all downstream taxes.

Temporary vs. Permanent Import: Making the Right Choice

Before committing to importation, you must determine whether temporary or permanent import status aligns with your situation. This decision affects tax obligations, vehicle usage restrictions, timeline, and cost-yet most competitors bury this critical decision framework deep in their articles.

Temporary Import for Personal Use

Eligibility: Foreign nationals relocating to Thailand with a personal vehicle for temporary residence (typically tourists, short-term expat assignments, or temporary workers with valid visa documentation).

Duration: Up to 12 months, extendable in some cases.

Tax Obligations: You pay a consumable tax (typically 5-10% of CIF value) as a deposit. If you re-export the vehicle before 12 months, you recover this deposit. If you later convert to permanent import, taxes adjust upward to permanent rates.

Documents Required:

- Valid passport and Thai entry visa

- Original vehicle title/registration from home country

- Insurance (Thai or international)

- Carnet ATA (international vehicle passport) or temporary import documentation

- Customs form submission

Vehicle Usage Restrictions: None (temporary imports are not subject to weekend-only driving rules).

Re-export Requirements: Vehicle must exit Thailand within the 12-month temporary import period. Procedures typically require 2-3 weeks advance coordination with Thai Customs.

Realistic Timeline: 3-5 business days for customs clearance if documentation is complete.

Permanent Import for Personal Use

Eligibility: Anyone (Thai national, foreigner with work permit, business owner, or investor) seeking to permanently register and keep a vehicle in Thailand.

Duration: Indefinite; vehicle registered in Thailand’s system.

Tax Obligations: Full import duty + excise tax + local tax + VAT as detailed above (no partial payments or deposit recovery).

Documents Required:

- Valid passport

- Original vehicle title/registration

- Pre-import inspection certificate (emissions/safety verification from origin country)

- Bill of lading (shipping document)

- Insurance policy covering Thailand

- Customs forms and import declaration

- For used vehicles: maintenance/service history records

Vehicle Usage Restrictions: None (only applies to designated vintage cars).

Registration: Vehicle receives Thai registration (pink book), Thai license plate, and Thai vehicle inspection certificate.

Realistic Timeline: 6-8 weeks from import clearance to full vehicle registration and road-legal status.

Permanent Import for Commercial/Business Use

Businesses importing vehicles for fleet operations, rental services, or commercial purposes follow the permanent import path but face different rate structures and documentation requirements:

- Different tax brackets apply for commercial fleet vehicles

- Vehicles registered under business/company name

- May qualify for certain tax incentives depending on business classification

- Requires business registration documents and tax clearance

Comparison Matrix:

| Factor | Temporary Import | Permanent Personal | Permanent Business |

|---|---|---|---|

| Tax Payment | Deposit (5-10% CIF) | Full (80%+ combined) | Full (varies by class) |

| Duration Allowed | 12 months | Indefinite | Indefinite |

| Vehicle Usage | Unrestricted | Unrestricted | Commercial use only |

| Registration | Not registered in Thailand | Thai pink book + plates | Corporate registration |

| Cost (Honda Accord example) | ~$1,000-$2,000 | ~$49,000 | ~$45,000-$48,000 |

| Timeline | 3-5 days | 6-8 weeks | 6-8 weeks |

| Conversion Path | Can convert to permanent | N/A | N/A |

Decision Framework:

- Choose Temporary If: Staying <12 months, testing before commitment, or planning to re-export

- Choose Permanent Personal If: Long-term residence (1+ years), planning to register and sell later, or seeking Thai vehicle ownership

- Choose Permanent Business If: Operating a rental/fleet business, commercial transportation, or company vehicle acquisition

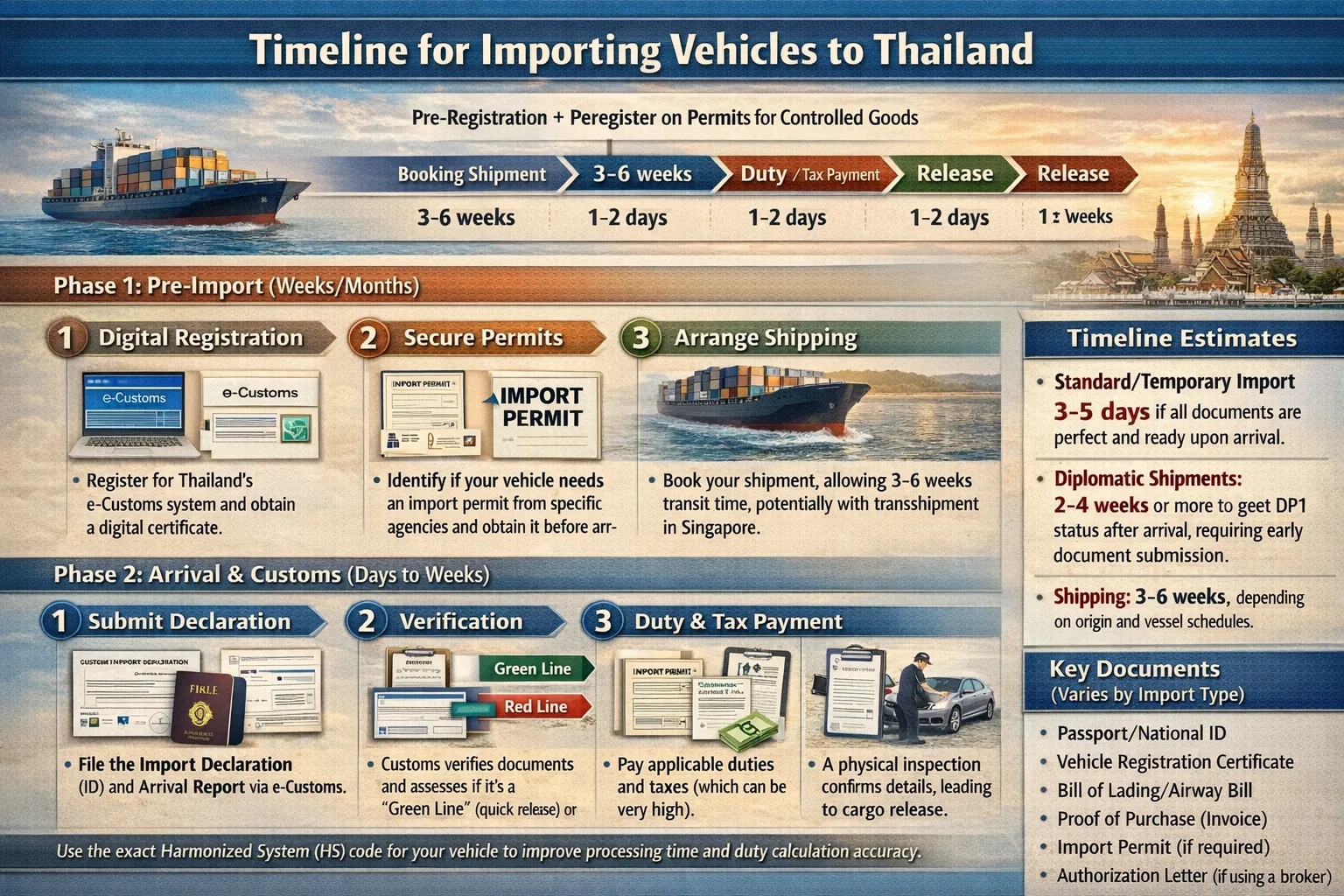

Step-by-Step Import Process: From Purchase to Road Registration (12-Week Timeline)

Importing a vehicle requires coordination across multiple parties-international shippers, Thai Customs, Department of Land Transport (DLT), insurers, and potentially customs brokers. The following week-by-week breakdown transforms this complexity into an actionable roadmap.

Phase 1: Pre-Import Planning & Documentation (Weeks 1-2)

Week 1 Activities:

- Determine import type (temporary vs. permanent based on framework above)

- Identify vehicle in source country; negotiate purchase

- Obtain pre-import inspection report (many mechanics provide this for $50-100)

- Verify vehicle eligibility: age (no restrictions in Thailand), emissions standards (typically any vehicle qualifies), left/right-hand drive considerations (Thailand drives on left; either drive configuration accepted)

- Request detailed invoice, title transfer documents, maintenance records from seller

Week 2 Activities:

- Obtain export clearance from source country (USA/Japan/EU customs)

- Secure international shipping quote (RoRo or container; typical cost $1,500-$3,500 depending on origin)

- Purchase marine shipping insurance ($200-$500)

- Arrange Thai customs broker contact (optional but recommended; cost $500-$1,500 for full service)

- Get preliminary insurance quote for Thailand (required at clearance)

- Calculate total landed cost using formulas above

Key Contacts to Establish:

- International freight forwarder (shipping company)

- Thai Customs broker or relocation specialist

- Thai insurance provider

- Port contact at origin (for export) and Thailand (Bangkok Port, Laem Chabang Port, or Rayong Port)

Phase 2: Shipping & Port Coordination (Weeks 3-5)

Week 3 Activities:

- Execute shipping contract and payment (typically 50% advance, 50% on delivery)

- Vehicle arrives at origin port for loading

- Obtain bill of lading (shipping document proving ownership in transit)

- Arrange port handling at origin ($300-$500)

Week 4 Activities:

- Vehicle in transit (10-14 days from Japan, 3-4 weeks from USA, 4-5 weeks from EU)

- Prepare Thai-side documentation package:

- Original or certified bill of lading

- Invoice/receipt from vehicle seller

- Original vehicle title/registration

- Passport copy (importer)

- Pre-import inspection report

- Marine insurance certificate

Week 5 Activities:

- Vehicle arrives at Thai port (typically Bangkok Port/Laem Chabang in Rayong Province)

- Notify Thai Customs of arrival

- Submit import declaration (Form 4 and supporting documents) to Thai Customs

- Thai Customs schedules vehicle inspection

Phase 3: Customs Clearance & Tax Payment (Weeks 6-7)

Week 6 Activities:

- Thai Customs inspects vehicle (typically 1-2 business days after declaration)

- Customs issues preliminary duty assessment (total taxes owed)

- Submit duty payment at Krung Thai Bank (authorized bank for customs payments)

- Bank fee: 30 baht ($0.90)

- Payment must clear before vehicle release

Week 7 Activities:

- Vehicle released from customs custody after payment confirmation

- Arrange port delivery and transport to your location or pre-registration facility

- Port clearance and vehicle collection: 1-2 business days

- Transport cost to Bangkok area: $200-$500; outside Bangkok: varies

Customs Clearance Timeline Reality:

According to Thai Customs Service Standards (2026), vehicle clearance achieves 90% target compliance within 3-5 business days if all documentation is complete at arrival. Common delays (adding 1-2 weeks) result from:

- Missing pre-import inspection certificate

- Discrepancies between declared value and market value

- Incomplete bill of lading

- Insurance documentation not provided at customs

- Vehicle damage during transit triggering extended inspection

Phase 4: Vehicle Registration & Road Legalization (Weeks 8-12)

Week 8 Activities:

- Schedule Thai vehicle inspection (Department of Land Transport – DLT)

- Required tests: Emissions compliance, safety systems verification, structural integrity

- Cost: 200-300 baht (~$6-9)

- Result: Inspection certificate valid for registration

Week 9 Activities:

- Submit vehicle registration documents to DLT:

- Thai vehicle inspection certificate

- Import customs clearance documents

- Insurance policy

- Vehicle identification documents

- Owner passport/ID

- DLT processes registration (typically 3-5 business days)

- Cost: Registration fee 800-1,200 baht (~$25-35)

Week 10 Activities:

- Receive Thai vehicle registration (pink book – “sathorn bai sii”)

- Receive Thai license plate issuance

- Pay license plate fee: 200-400 baht

Weeks 11-12 Activities:

- Mount Thai license plates on vehicle

- Purchase and activate motor vehicle insurance (mandatory for road use)

- Cost: Insurance typically 5,000-15,000 baht annually ($140-420) depending on vehicle value and coverage

- Vehicle now road-legal and fully registered

Total Timeline Summary:

- Standard import with complete documentation: 6-8 weeks

- Import with documentation issues: 8-12 weeks

- Expedited import with customs broker: 5-6 weeks (broker coordinates parallel processes)

Exemptions, Tax Breaks & Special Programs (2026)

Thailand’s tax system includes several exceptions and incentives that can dramatically reduce your import cost. Understanding eligibility is critical.

Vintage Car Program (NEW 2026)

The most significant policy change affecting vehicle importers is the new vintage car framework, representing the first major exception to Thailand’s prohibitive import tax regime in decades.

Eligibility Requirements (All Four Must Be Met):

- Vehicle age: 30-100 years old (measured from model year)

- Vehicle type: Passenger car, station wagon, bus (≤10 seats), or racing car (pickups and motorcycles excluded)

- Vehicle condition: Fully assembled with proper certification (no project/parts cars)

- Minimum value: ≥2 million baht (~$56,000 USD)

Tax Advantage:

- Excise tax rate: 45% (compared to 50%+ for modern luxury vehicles)

- This represents a reduction of 150-200 percentage points from the previous 200%+ regime

- Weekend-only driving restriction: Imported vintage cars may only be driven on Saturdays, Sundays, and public holidays (exemptions for special events available with police authorization)

- Usage does not apply to vintage motorcycles or vehicles already registered in Thailand before the law’s implementation

Worked Example – 1963 Ferrari 250 GT:

- Vehicle CIF Value: $80,000

- Import Duty (80%): $64,000

- Excise Tax (45%): $29,000

- Local Tax (10%): $9,300

- VAT (7%): $9,149

- TOTAL TAXES: $120,449

- LANDED COST: $200,449

While still substantial, this represents a dramatic reduction. The previous regime would have imposed 200%+ taxes, making importation prohibitively expensive.

Electric Vehicle Incentives (2026 Update)

Thailand actively subsidizes electric vehicle adoption through reduced tax rates and direct subsidies.

Excise Tax Reduction for EVs:

- Battery electric vehicles (BEVs): 2% excise tax (vs. 13%+ for gasoline equivalents)

- Plug-in hybrids (PHEV) with ≥80km electric range: 5% excise tax

- Plug-in hybrids (PHEV) with <80km range: 10% excise tax

Direct Purchase Subsidies (2026 rates – locally assembled only):

- Electric cars (≤2M baht, ≥50kWh battery): 50,000-100,000 baht (reduced from 100,000 baht in 2025)

- Electric cars (≤2M baht, <50kWh battery): 25,000-50,000 baht

- Important: Subsidies only apply to locally manufactured EVs, not imported CBU (completely built-up) vehicles

Import Duty Reduction (2024-2025 period only – expiring):

- Imported CBU electric vehicles: 40% reduction in import duty rates during 2024-2025 (expiring at end of 2025; verify current status for 2026)

Cost Example – Imported Tesla Model 3 (CBU):

- Vehicle CIF Value: $45,000

- Import Duty (80% → 40% with 2024-2025 subsidy if still available): $18,000

- Excise Tax (2%): $1,260

- Local Tax (10%): $1,926

- VAT (7%): $3,659

- TOTAL TAXES: $24,845

- LANDED COST: $69,845 (vs. $85,000+ without incentives)

Government EV Subsidy Program

Thailand has allocated 11.2+ billion baht in government subsidies for EV purchases (as of early 2026), with the government targeting 233,000+ EV registrations. While direct purchase subsidies apply primarily to locally-assembled vehicles, the tax incentive structure applies to all EVs meeting specifications.

Insurance, Shipping & Hidden Costs: Building Your True Budget

The tax calculation above represents only one component of your total importation cost. Professional importers budget for shipping, insurance, broker fees, customs handling, and registration-costs that can add 15-25% to the tax total.

Itemized Cost Breakdown (Using Honda Accord Example)

| Cost Component | Typical Range | Notes |

|---|---|---|

| Shipping Costs | ||

| Japan → Thailand | $1,200-$1,800 | ~10-14 day transit |

| USA → Thailand | $2,500-$3,500 | ~3-4 week transit |

| EU → Thailand | $3,000-$4,500 | ~4-5 week transit |

| Marine Insurance | $150-$400 | 0.3-0.8% of CIF value |

| Port Handling (Origin) | $300-$600 | Loading + documentation |

| Customs Clearance | ||

| Customs Broker Fee | $500-$1,500 | Optional; handles documentation |

| Bank Payment Fee | $30 | Fixed Thai bank fee |

| Port Delivery/Handling (Thailand) | $200-$500 | Unloading + storage if needed |

| Pre-Import Inspection (Foreign) | $50-$150 | Emissions/safety verification |

| Registration & Legal | ||

| Thai Vehicle Inspection (DLT) | $6-$10 | Emissions + safety tests |

| Registration Fee (DLT) | $25-$50 | Pink book issuance |

| License Plate Cost | $20-$50 | Physical plate fabrication |

| Insurance | ||

| Thai Motor Insurance (Year 1) | $150-$500 | Depends on vehicle value/coverage |

| Transport | ||

| Port to Your Location (Bangkok) | $150-$400 | Local delivery |

| Port to Your Location (Province) | $300-$800 | Longer distance delivery |

| TOTAL HIDDEN COSTS | $3,100-$8,800 | Varies by origin and location |

Realistic All-In Landed Cost (Honda Accord, Japan Origin)

| Component | Cost |

|---|---|

| Vehicle Purchase Price | $12,000 |

| International Shipping + Insurance | $1,350 |

| CIF Value | $13,350 |

| Import Taxes (calculated above) | $16,400 |

| Customs Broker Fee | $800 |

| Port Handling | $350 |

| Thai Vehicle Inspection + Registration | $35 |

| Transport to Location | $250 |

| Thai Motor Insurance (Year 1) | $300 |

| TOTAL HIDDEN COSTS | $1,735 |

| TOTAL ALL-IN COST | $31,485 |

| Cost Multiplier | 2.62x original purchase price |

This 2.62x multiplier-pushing a $12,000 used car to $31,500 final cost-is the typical reality for Japan-sourced imports. USA and EU imports reach 3.0x-3.5x multipliers due to higher shipping costs.

Thailand Import Regulations, Compliance & Legal Framework

Successfully importing a vehicle requires compliance with Thai Customs regulations, Department of Land Transport (DLT) requirements, and emissions/safety standards. Violations result in customs holds, vehicle seizure, fines, or denial of registration.

Regulatory Bodies & Authority

Thai Customs Department (สำนักงานสรรพสามิต)

- Primary authority for import duty assessment and vehicle clearance

- Issues import duty assessment (Form 4 determination)

- Conducts physical vehicle inspection

- Official website: customs.go.th

- Contact: Thai Customs hotline available at ports

Department of Land Transport (กรมการขนส่งทางบก – DLT)

- Issues Thai vehicle registration (pink book)

- Conducts emissions/safety inspections

- Issues Thai license plates

- Enforces registration requirements

- Regional offices in all provinces

Ministry of Finance

- Sets excise tax rates and policy

- Updates vehicle classification standards

- Announces tax changes (typically in Royal Gazette)

Ministry of Transport

- Establishes vehicle safety and emissions standards

- Coordinates with DLT on technical requirements

Compliance Requirements by Category

Emissions Standards:

- Thailand accepts vehicles complying with Euro standards or equivalent

- Pre-import inspection certificate must verify emissions compliance

- Vehicles failing emissions inspection require catalytic converter upgrades or rejection

Safety Standards:

- Vehicles must pass DLT safety inspection (brakes, lights, structural integrity)

- Left-hand vs. right-hand drive: Both accepted (Thailand drives on left)

- No requirement for specific model or year restrictions (older vehicles acceptable if mechanically sound)

Documentation Requirements (Complete Checklist):

- ☐ Original or certified copy of vehicle title/registration from source country

- ☐ Bill of lading (shipping document)

- ☐ Invoice from vehicle seller

- ☐ Pre-import inspection certificate (emissions + safety from origin country)

- ☐ Marine insurance certificate

- ☐ Importer passport (valid and with Thai entry visa/stamp)

- ☐ Importer Thai address (or representative address in Thailand)

- ☐ Vehicle identification number (VIN) verification

- ☐ Maintenance/service history records (helpful for customs value verification)

- ☐ Customs entry form (prepared by broker or importer)

- ☐ Import duty payment receipt (from Thai bank)

Common Compliance Mistakes (and How to Avoid Them):

- Undervaluing vehicle on invoice: Thai Customs compares declared CIF value against reference prices. Significant undervaluation triggers extended inspection and potential fraud investigation. Solution: Use market-rate pricing on all documentation.

- Missing pre-import inspection: Some importers skip this step to save $100. Customs then delays release pending independent inspection. Solution: Always obtain certified inspection before shipment.

- Insurance gap: Vehicle arrives before insurance is arranged. Thai law prohibits uninsured vehicle operation on roads; customs may hold release. Solution: Coordinate insurance activation with customs clearance timeline (insurance can be backdated to clearance date).

- Incorrect duty payment: Bank payment must match customs assessment exactly. Payment shortfalls or overpayments create administrative delays. Solution: Use customs broker to verify payment amount before submission.

- Vehicle damage during transit: Damage discovered at Thai port inspection may trigger liability disputes or customs holds. Solution: Inspect vehicle before shipping; ensure marine insurance includes damage coverage.

- Documentation in non-Thai language: While English is often accepted, critical documents should have certified Thai translation. Solution: Prepare certified Thai translations for vehicle title and key documents.

2026 Policy Updates & Recent Changes

January 1, 2026 – VAT on All Imports:

All imports now subject to 7% VAT from first baht of purchase price. Previously, parcels under 1,500 baht were VAT-exempt. This change increases effective import cost by approximately 0.5-1% for vehicle imports.

September 2025 (Effective Fiscal Year 2026) – Vintage Car Tax:

New 45% excise tax rate for qualifying vintage cars (30-100 years old). Includes weekend-only driving restriction (Saturdays, Sundays, public holidays). This represents the first material change to vehicle import policy in decades.

2026 Excise Tax Restructuring:

Thailand shifted from engine-size-based excise tax (30-50% bands) to CO2 emissions-based structure (13-50% bands). Electric vehicles now taxed at 2%, plug-in hybrids at 5-10%, and hybrid vehicles at 6-14% depending on emissions. This incentivizes cleaner-burning vehicles.

2026 EV Subsidy Reduction:

Government EV purchase subsidies reduced from 100,000 baht to 50,000 baht (50% cut) for locally-manufactured vehicles. Import-only electric vehicles receive no direct subsidy (only tax incentives). This change reflects government budget constraints and shift from EV 3.0 (subsidy-heavy) to EV 3.5 (tax-incentive-focused) policy.

Frequently Asked Questions: 18 High-Intent User Queries Answered

1. “How much does it cost to import a car into Thailand?”

Total cost depends on vehicle origin and type. For a used 2020 Honda Accord from Japan ($12,000 purchase price):

- Vehicle + Shipping: $13,350 CIF

- Taxes (import + excise + local + VAT): $16,400

- Hidden costs (broker, insurance, registration): $1,735

- Total: ~$31,500 (2.6x multiplier)

USA-sourced imports reach $50,000+; EU imports reach $60,000+.

2. “What is the tax on cars in Thailand?”

Four-layer tax structure:

- Import Duty: 80% of CIF value

- Excise Tax: 13-50% depending on engine size (2-2% for EVs, 45% for vintage cars)

- Local Tax: 10% of import duty + excise tax combined

- VAT: 7% applied to CIF + duty + excise + local tax combined

Total effective tax: 120-150% of CIF value for standard vehicles; 55-65% for electric vehicles.

3. “What is the import tax rate in Thailand?”

Standard import duty: 80% of CIF (Cost, Insurance, Freight) value

This is among the world’s highest rates. For comparison: USA (2.5%), Singapore (0%), Malaysia (40%), Vietnam (40%).

4. “Why are car taxes so high in Thailand?”

Government protectionism. Thailand’s automotive sector employs 800,000+ workers and contributes 15% of GDP. High import taxes ensure consumers choose locally-assembled vehicles, protecting factory employment and government tax revenue. This policy predates 2020 and reflects long-term industrial strategy.

5. “Can I import a used car from the USA to Thailand?”

Yes. Process: Purchase vehicle → Export clearance in USA → International shipping → Thai Customs clearance (3-5 days) → Vehicle registration with DLT (2-3 weeks) → Road-legal.

Cost: $18,000 purchase price + $2,800 shipping = $20,800 CIF → $28,800 taxes → $49,600 total (~2.75x multiplier).

6. “How long does car import take to Thailand?”

- Customs clearance (best case): 3-5 business days

- Full import with registration: 6-8 weeks

- With documentation issues: 8-12 weeks

- With customs broker (expedited): 5-6 weeks

Timeline assumes complete documentation at arrival. Missing pre-import inspection, insurance, or title verification adds 1-2 weeks.

7. “What documents do I need to import a car?”

Essential documents (all required):

- Original vehicle title/registration from source country

- Bill of lading (shipping document)

- Invoice from seller

- Pre-import inspection certificate (emissions/safety)

- Marine insurance certificate

- Passport with Thai entry visa/stamp

- Customs entry forms (broker prepares these)

- Import duty payment receipt (from Thai bank)

Optional but recommended: Maintenance records, customs broker representation letter.

8. “Is it cheaper to import a car or buy locally?”

Importing: $12,000 used car (Japan) = $31,500 landed cost

Buying locally: Same 2018-2020 Japanese used car = $18,000-$22,000 retail

Verdict: Buying locally is 30-40% cheaper.

Exception: Specific models unavailable in Thailand or significantly older vehicles (20+ years) unavailable for local purchase sometimes justify importing despite cost premium.

9. “Do I need insurance before importing a car to Thailand?”

Yes. Marine insurance required during shipping (covers theft/damage in transit). Thai motor insurance required for road operation after registration.

- Marine insurance: Obtain before shipment ($200-$500)

- Thai motor insurance: Can arrange at any point before/after registration ($300-$500 annually)

- Cost if missing: Customs delay waiting for insurance documentation; vehicle cannot be driven uninsured

10. “What about motorcycle/truck imports?”

Motorcycles: Same tax structure applies; excise tax typically 30-50% depending on engine displacement; popular for expats; smaller cost multiplier (~2.0x) due to lower base values.

Trucks/Commercial Vehicles: Different excise rates; import duty 50% (vs. 80% for cars); commercial use classification may qualify for different tax treatment.

Vintage motorcycles: Do NOT qualify for the new 45% excise tax; subject to standard 30-50% rates.

11. “Can expats import cars to Thailand?”

Yes, if:

- Valid passport with Thai entry visa (tourist visa, ED visa, retirement visa, or work permit acceptable)

- Permanent or temporary address in Thailand

- Ability to pay import taxes and duties

Temporary import (12 months): Easiest path; no permanent registration required; lower upfront cost.

Permanent import: Requires longer-term commitment; full tax payment; Thai registration.

12. “What’s new about the 45% vintage car tax in 2026?”

Previous regime: Vintage cars faced 200%+ effective tax rates (making import virtually impossible).

New regime (effective fiscal year 2026): 45% excise tax rate for qualifying vehicles (30-100 years old).

Qualifications: Passenger car/station wagon/racing car (not pickups); ≥30 years old; fully assembled; ≥2M baht value.

Usage restriction: Weekend/holiday-only driving (Saturdays, Sundays, public holidays; special event exceptions available).

Impact: First realistic pathway for vintage car collectors to import classic vehicles in decades; opens market for 1960s-1990s American muscle cars and European classics.

13. “Why does Thailand have 0% tariff on Chinese cars?”

Trade agreement leverage. China recently negotiated favorable trade terms with Thailand as part of broader regional trade alignment (CPTPP, RCEP considerations). 0% tariff on Chinese-manufactured vehicles supports Chinese automotive brands’ market entry in Southeast Asia while providing Thai government goodwill for other trade negotiations. However, Chinese EV imports (BYD, etc.) still subject to excise tax (2% for EVs), so true landed cost is not zero.

14. “How do I calculate excise tax?”

Formula:

textExcise Tax = (CIF Value + Import Duty) × {Excise Rate / [1 - (1.1 × Excise Rate)]}

Simpler method: Use the worked examples in Section 3. For your vehicle’s engine size, find excise rate in the table, then apply formula with your CIF value and import duty (80% of CIF).

Example: 2.0L sedan, 16% excise rate, $20,000 CIF value

- Import Duty: $20,000 × 0.80 = $16,000

- Excise Tax: ($20,000 + $16,000) × {0.16 / [1 – 0.176]} = $7,061

15. “What’s the difference between import duty and excise tax?”

- Import duty: Tax on bringing goods into the country; calculated on CIF value only; 80% rate for cars; paid to Thai Customs

- Excise tax: Tax on manufacture/consumption within the country; calculated on CIF + import duty (not just CIF); rate varies by vehicle type; paid to Thai Excise Department

Example distinction: $20,000 CIF vehicle

- Import duty: $20,000 × 80% = $16,000

- Excise tax base: ($20,000 + $16,000) = $36,000 (includes duty)

- Excise tax at 16%: $6,176

Excise tax base is larger because it includes duty already paid.

16. “What’s the carnet ATA and do I need one?”

Carnet ATA: International vehicle passport allowing temporary importation without paying duties, with guarantee that vehicle will be re-exported within specific period.

Who needs it: Temporary vehicle imports (typically). Cost: $200-$500 through automobile association (AAA in USA).

Do I need it: For temporary imports (12 months), carnet streamlines documentation. For permanent imports, not required (you’ll pay full duties instead).

Alternative: Temporary importation without carnet is possible; you pay consumable tax (5-10% deposit) instead.

17. “Can I get a customs duty refund if I re-export?”

Permanent imports: No refund available; duties are final payment.

Temporary imports with carnet: Yes; if vehicle re-exported within carnet validity period, guarantee refunded by automobile association (your deposit returned).

Temporary imports without carnet: Partial refund of consumable tax possible if re-export occurs within 12-month window; requires customs documentation of re-export.

18. “Are there any EV import incentives I’m missing?”

2026 EV incentives for vehicle imports:

- Excise tax reduction: 2% for battery electric vehicles (vs. 13-50% for gasoline)

- Import duty reduction (2024-2025 period, verify status): 40% reduction on import duty for CBU electric vehicles

- No direct subsidy for imported EVs: Subsidies (50,000-100,000 baht) only apply to locally-manufactured electric vehicles

Total EV cost advantage vs. gasoline equivalent: 15-20% reduction due to tax incentives (not including direct purchase subsidies, which don’t apply to imports).

Related Imports & Cluster Content: Expand Your Knowledge

Understanding Thai vehicle import taxation is foundational; related topics provide deeper expertise for specific situations:

Import Motorcycles to Thailand – Separate tax rates (30-50% excise vs. 13-50% for cars); popular with budget-conscious importers; faster customs clearance.

Thailand Customs Import Process: Complete Guide – General import procedures applicable to all goods; useful for understanding customs clearance broader context.

Vehicle Registration in Thailand: Expat Guide – DLT registration requirements, pink book (sathorn bai sii) process, annual vehicle inspection, address change procedures.

How to Get a Thai Driver’s License – License requirements for foreigners; converting international license; written and practical exam procedures.

Thailand Relocation Checklist – Comprehensive guide for expatriates moving to Thailand; includes vehicle import as one component of larger relocation process.

Taking Action on Your Vehicle Import

Importing a vehicle to Thailand requires navigating a deliberately complex tax system designed to protect domestic automotive manufacturers. Your total cost will likely reach 2.5-3.5x your vehicle’s original purchase price after all taxes, shipping, and fees-a financial reality that makes local vehicle purchase more economical for most users.

However, specific situations justify importing despite the cost premium:

- You have an emotional/historical attachment to a specific vehicle (vintage car, family car, etc.)

- You cannot find the specific model locally (niche European sports cars, classic American muscle cars)

- You’re staying 1-2 years temporarily and want familiar transportation from home

- You qualify for EV incentives (2% excise tax creates meaningful savings vs. gasoline equivalents)

- You’re importing a vintage car and can meet the new 45% excise tax qualification (dramatic improvement from previous 200%+ regime)

Next Steps:

- Calculate your exact cost using the three scenarios (Japan, USA, EU origin) and the complete tax formulas provided

- Determine import type: temporary (12 months, lower cost, easier process) vs. permanent (indefinite, full taxes, full registration)

- Secure three shipping quotes from international freight forwarders; compare total landed costs

- Connect with a customs broker (optional but recommended; $500-$1,500 investment streamlines 6-8 week process)

- Obtain pre-import inspection in source country to prevent customs delays

- Arrange Thai motor insurance quote before shipment to verify final cost

Thai vehicle import is achievable with proper planning, realistic budget expectations, and understanding of the regulatory framework. The 2026 policy updates-particularly the vintage car 45% rate and electric vehicle excise reductions-create new opportunities for specific importers. Use this guide as your roadmap to navigate these opportunities successfully.

Document Date: January 2026

Regulatory Status: Current 2026 tax rates and policies; verify with Thai Customs Department for any mid-year policy updates

Disclaimer: This guide provides general information for planning purposes. Consult with Thai Customs brokers and DLT officials for definitive regulatory guidance specific to your vehicle and situation.