Building a cryptocurrency portfolio in 2026 requires more than just buying random tokens. With over 75% of institutional investors planning to increase crypto allocations this year and Bitcoin now treated as a legitimate reserve asset, the approach has fundamentally changed. This guide walks you through creating a diversified, risk-managed portfolio that works whether you’re a complete beginner or an experienced trader.

Why Building a Diversified Crypto Portfolio Matters in 2026

The cryptocurrency market has matured significantly. Bitcoin is no longer a speculative asset-it’s now part of the U.S. Strategic Bitcoin Reserve. Ethereum powers a trillion-dollar ecosystem of decentralized finance and real-world asset tokenization. Institutional capital is flowing in at record levels, and regulatory clarity is finally emerging.

Yet volatility remains. Bitcoin can swing 30-50% in months. Individual altcoins can lose 80% of their value overnight. The difference between success and catastrophic loss comes down to one thing: deliberate portfolio structure.

A well-diversified crypto portfolio reduces concentration risk without eliminating growth potential. It allows you to capture upside from emerging sectors-AI tokens, Layer 2 solutions, real-world asset tokenization-while anchoring your holdings in established assets that have proven themselves through multiple market cycles.

Understanding Crypto Market Capitalization Tiers

Before allocating your capital, you need to understand the three primary categories of cryptocurrencies:

Large-Cap Cryptocurrencies: The Foundation

Large-cap assets like Bitcoin (BTC) and Ethereum (ETH) dominate the market by value. Bitcoin alone represents over 50% of total crypto market capitalization. These assets have:

- Deepest liquidity pools (you can buy or sell massive amounts without drastically moving the price)

- Longest operational history and proven track records

- Strongest institutional adoption and regulated access through ETFs

- Lowest default risk (though not zero)

- Slower growth rates compared to smaller assets, but more stable

Bitcoin’s store-of-value narrative is strongest during Bitcoin-dominant market cycles, while Ethereum’s utility as the backbone of DeFi provides more consistent demand.

Mid-Cap Cryptocurrencies: The Growth Engine

Assets with market capitalizations between $1 billion and $100 billion represent the middle tier. Projects like Solana (SOL), XRP, Cardano (ADA), and Chainlink (LINK) have:

- Proven product-market fit and real user adoption

- Meaningful development activity and team credibility

- Sector leadership (Solana in high-performance blockchains, Chainlink in oracle infrastructure)

- Higher growth potential than large-caps without small-cap volatility

- More liquidity and exchange availability than small-caps

During altcoin seasons-when investor sentiment rotates from Bitcoin to alternative projects-these assets historically outperform large-caps. From 2019-2024, 75% of top-50 altcoins delivered 90-day outperformance over Bitcoin during identified altseason periods.

Small-Cap Cryptocurrencies: High Risk, High Reward

Assets under $500 million market cap represent the frontier. They offer:

- Explosive upside potential if the project succeeds (10x, 50x, or 100x+ returns are possible)

- Extreme downside risk (total loss of capital is realistic)

- Low liquidity (buying or selling large amounts moves the price significantly)

- High failure rate (the majority of small-cap projects fail or pivot)

Small-cap allocation should only come from capital you can afford to lose entirely.

The 2026 Crypto Allocation Playbook

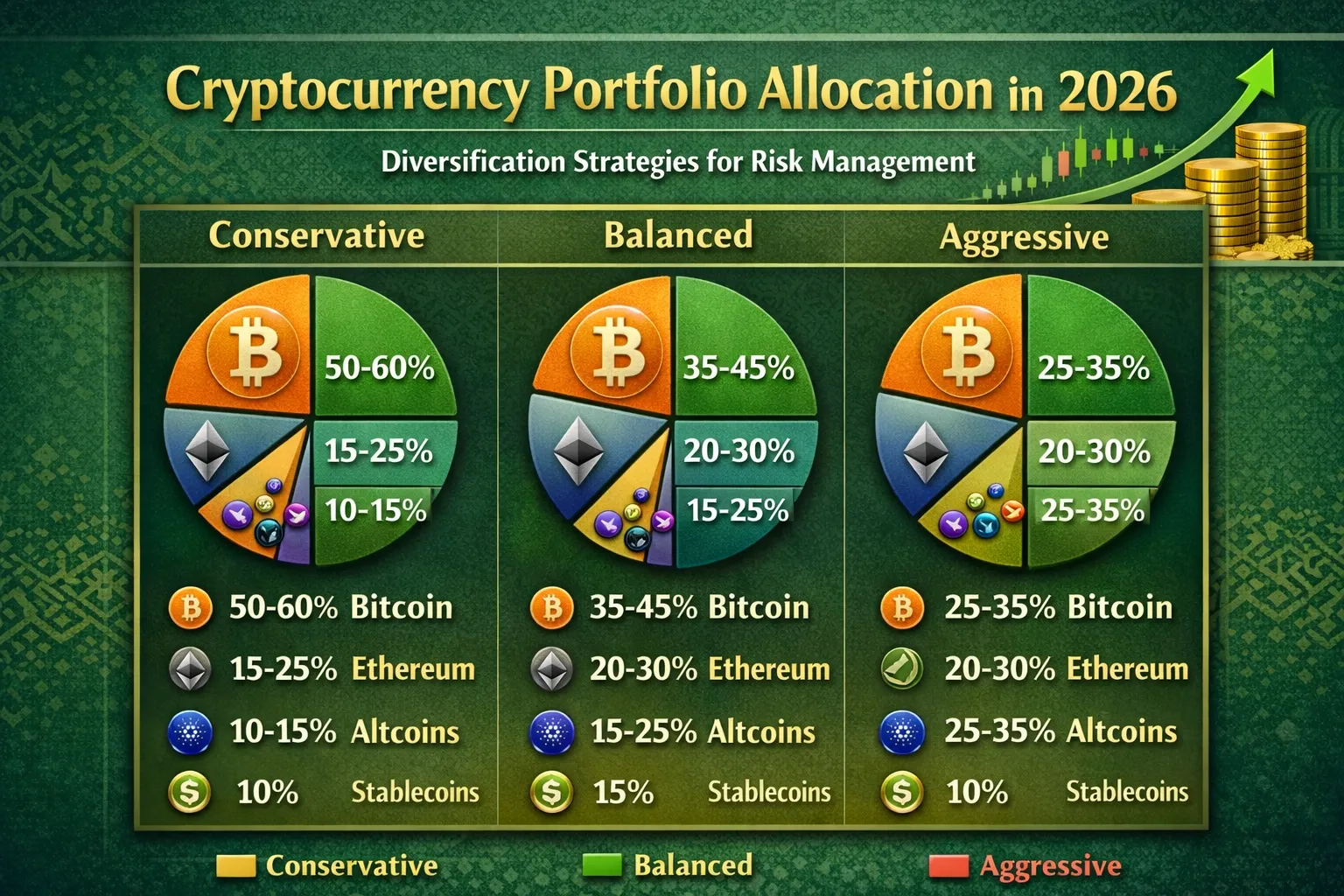

Your crypto portfolio structure should match your risk tolerance, investment timeline, and financial situation. Here are three proven frameworks:

Conservative Portfolio (Lower Risk Profile)

Best for: First-time investors, those nearing financial goals, investors with low risk tolerance

| Asset Class | Allocation | Examples |

|---|---|---|

| Bitcoin (BTC) | 50-60% | BTC only |

| Ethereum (ETH) | 20-25% | ETH only |

| Large-Cap Alts | 10-15% | SOL, XRP, ADA |

| Stablecoins | 10% | USDC, USDT |

Why this works: 70-85% concentrated in battle-tested large-cap assets reduces volatility while maintaining meaningful crypto exposure. The stablecoin cushion provides emergency liquidity and rebalancing capital without forcing you to sell winners. This structure mirrors the institutional “60/40 stocks/bonds” approach adapted for crypto.

Expected characteristics: Lower volatility (typically 15-25% daily swings), but also slower growth (averaging 20-40% annual returns during bull markets).

Balanced Portfolio (Moderate Risk Profile)

Best for: Investors with 3-5 year time horizons, moderate risk tolerance, those wanting growth with downside protection

| Asset Class | Allocation | Examples |

|---|---|---|

| Bitcoin (BTC) | 35-45% | BTC only |

| Ethereum (ETH) | 20-25% | ETH only |

| Mid-Cap Alts | 20-25% | SOL, XRP, ADA, LINK |

| Small-Cap / Emerging | 5-10% | High-potential projects |

| Stablecoins | 5-10% | USDC, USDT |

Why this works: This allocation balances Bitcoin’s store-of-value anchor with meaningful exposure to mid-cap growth opportunities. The small-cap sleeve allows speculative upside without betting the portfolio. Stablecoins provide liquidity without forcing emotional trading decisions.

Expected characteristics: Moderate volatility (25-40% daily swings), balanced growth potential (averaging 40-80% annual returns in strong bull markets), meaningful recovery capital during corrections.

Aggressive Portfolio (Higher Risk Profile)

Best for: Experienced investors, long time horizons (5+ years), high risk tolerance, those who can afford significant drawdowns

| Asset Class | Allocation | Examples |

|---|---|---|

| Bitcoin (BTC) | 25-35% | BTC only |

| Ethereum (ETH) | 15-20% | ETH only |

| Mid-Cap Alts | 25-30% | SOL, XRP, ADA, LINK, ARB, OP |

| Small-Cap / Emerging | 15-20% | AI tokens, DeFi projects, L2s |

| Stablecoins | 5% | USDC, USDT |

Why this works: Reduced Bitcoin/Ethereum concentration captures altcoin volatility during growth phases. During historical altseason periods, this structure has delivered 200-400% returns while large-cap-heavy portfolios were still grinding 30-50% gains. However, the same structure can deliver 40-60% drawdowns when Bitcoin dominance increases.

Expected characteristics: High volatility (40-60%+ daily swings), maximum growth potential (100-300%+ annual returns during strong bull markets), but also maximum drawdown risk (50-70% corrections are possible).

How to Diversify Within Each Market Cap Tier

Allocating percentages is only the first step. How you select assets within each tier determines actual risk reduction.

The Sector Diversification Principle

Don’t simply pick the top assets by market cap. Instead, spread across different use cases and sectors:

- Layer 1 Blockchains: Bitcoin (store-of-value), Ethereum (smart contracts/DeFi), Solana (high performance), Avalanche (enterprise)

- DeFi Infrastructure: Uniswap (DEX), Aave (lending), Lido (staking)

- Real-World Assets (RWA): Emerging tokenization of treasuries, real estate, commodities

- Layer 2 Solutions: Arbitrum, Optimism (Ethereum scaling)

- AI & Machine Learning: Render, Fetch.ai, emerging compute networks

- Cross-Chain Infrastructure: Chainlink (oracles), protocols enabling interoperability

This sector-based diversification ensures that if one area faces headwinds, your portfolio continues to function. During 2024-2025, DeFi faced temporary challenges while AI tokens surged. A sector-diversified portfolio would have captured both.

Correlation Analysis: Avoiding Hidden Concentration

Many investors think they’re diversified when they own 10-15 tokens. If all 15 are highly correlated (move together), you effectively hold one leveraged bet disguised as diversification.

Use tools like CoinGecko or TradingView to check correlation matrices. Strong mid-cap diversification includes assets with correlation below 0.70:

- Bitcoin and Ethereum: ~0.75 correlation

- Bitcoin and Solana: ~0.82 correlation

- Bitcoin and Chainlink: ~0.71 correlation

- Bitcoin and stablecoins: ~0.05-0.15 correlation

Lower correlations provide better portfolio smoothing.

The Role of Stablecoins in Portfolio Architecture

Stablecoins (USDC, USDT, DAI) often seem boring compared to growth assets. Yet they’re essential infrastructure for several reasons:

Liquidity & Rebalancing Capital

When Bitcoin surges from 40% to 55% of your portfolio, you need cash to trim it back. Rather than selling winners into fiat (incurring taxes), you can rebalance into stablecoins held on-chain. This preserves the tax advantages of portfolio maintenance.

Emergency Buffer During Crashes

Stablecoins maintain value during market panics. During Bitcoin’s 33% crash from $126,000 to $84,000 in late 2025, stablecoin allocations provided psychological relief and buying power for disciplined investors.

Yield Generation

Top DeFi protocols offer 4-8% annual yields on stablecoin deposits (Aave, Curve, Compound). Your 5-10% stablecoin cushion can generate $200-500 annually on a $5,000 portfolio with minimal additional risk.

Gateway to Opportunities

Market bottoms create opportunity. With stablecoins on the sidelines, you’re ready to add positions when valuations are attractive-without needing to time when to move fiat into exchanges.

Allocation rule: 5-10% of portfolio in stablecoins minimum. More (up to 20%) if you’re actively trading or expect market corrections.

Building Your Portfolio: A Step-by-Step Framework

Step 1: Assess Your Actual Risk Tolerance

Risk tolerance isn’t what you think you can handle-it’s what you’ll actually handle when panic strikes. Ask yourself:

- Can I watch my portfolio drop 50% without panic selling?

- Do I have 5+ years before needing this capital?

- If my initial investment of $1,000 became $300, could I stay invested?

- Have I experienced a 30%+ drawdown before?

If you answered “no” to any question, don’t build an aggressive portfolio just because it sounds exciting. Behavioral mistakes from panic selling during corrections cause more losses than market risk itself.

Research shows investors who can’t emotionally handle volatility should limit crypto to 2-5% of total net worth and stick to conservative allocations.

Step 2: Define Your Dollar Amount & Time Horizon

Total portfolio size determines how granular your diversification can be. The mechanics:

- Under $500: Bitcoin + Ethereum only. Fees and complexity make small-cap allocation uneconomical. Use dollar-cost averaging (DCA) to build to $2,000-5,000 before adding altcoins.

- $500-5,000: Conservative or Balanced portfolio. Include 4-6 total positions across market caps.

- $5,000-50,000: All three frameworks viable. Balanced portfolio typically optimal (professional asset managers favor this sweet spot).

- $50,000+: Aggressive or custom portfolio. You can afford to segment into specialized positions (AI sector sleeve, RWA exposure, etc.).

Time horizon compounds this. If you need money in 12 months, even “conservative” allocations feel aggressive during downturns. A 3-5 year horizon allows recovery from the inevitable 40-60% corrections.

Step 3: Choose Your Entry Method: Lump Sum vs. Dollar-Cost Averaging

Lump-sum investing: Buy everything at once.

- Pros: Simplicity, maximum exposure if prices only go up

- Cons: You might buy at the peak; psychologically difficult

Dollar-cost averaging (DCA): Invest fixed amounts at regular intervals (weekly, monthly).

- Pros: Reduces impact of timing risk, psychologically easier, proven to match or exceed lump-sum over long periods

- Cons: Slower capital deployment, more transaction fees

Research from 2019-2024 shows weekly $10 DCA investments in Bitcoin yielded 202% returns, outperforming both traditional assets and single lump-sum buys made at random points. This remains the recommended approach for 2026, especially given macro uncertainty.

2026 recommendation: 60% DCA over 3-4 months, then 40% as a lump sum once you’ve calibrated your risk tolerance. This hybrid approach captures upside quickly while reducing timing risk.

Step 4: Select Specific Assets

Use this decision tree for each market-cap tier:

Large-Cap Selection:

- Bitcoin: Always include (store-of-value, institutional settlement asset)

- Ethereum: Always include (smart contract platform, DeFi backbone)

- Additional large-caps: Choose 0-1 additional (Solana if you believe in high-performance chains; Binance Coin if you use Binance ecosystem)

Mid-Cap Selection:

Research frameworks before buying:

- Is the project solving a real problem? (Not just speculation)

- Does it have active development? (Check GitHub commit activity)

- What’s the team’s track record? (Founders who’ve shipped before)

- Does it have sector leadership? (Chainlink dominates oracle infrastructure)

- Is liquidity strong on major exchanges? (Can you exit positions easily?)

Solid mid-cap choices across sectors:

- DeFi: Aave (lending), Uniswap (DEX)

- Layer 2s: Arbitrum, Optimism

- Interop: Chainlink (oracles), Polkadot (parachains)

- Performance: Solana (if not in large-cap slot)

- RWA: Emerging, but Centrifuge and Ondo showing promise

Small-Cap Selection:

Only allocate capital here that you can genuinely afford to lose. Selection criteria:

- Active GitHub development (commits within the last week)

- Smart contract audits by reputable firms (Trail of Bits, CertiK, OpenZeppelin)

- Clear tokenomics (fixed max supply, predictable emissions)

- Real user adoption (not just theoretical utility)

- Team with skin in the game (founders holding significant tokens)

Red flags to avoid:

- No security audits

- Centralized admin keys

- Aggressive promises (“guaranteed returns”)

- Massive recent token emissions/unlocks

Emerging opportunities for 2026:

- AI token infrastructure (Render for GPU rendering, Fetch.ai for autonomous agents)

- RWA tokenization (early-stage projects enabling treasury, real estate, commodities)

- L2 solutions and bridges (cross-chain interoperability remains nascent)

Step 5: Execute Your Purchases

Platform selection matters:

- Coinbase: Most beginner-friendly, widest asset selection, strong security

- Kraken: Better for advanced traders, excellent altcoin support

- Binance: Largest liquidity, most tokens available, but complex interface

- KuCoin: Small-cap projects, but lower regulatory clarity

Security from day one:

- Enable two-factor authentication (2FA) everywhere-SMS is minimum, authenticator app is better

- Use unique passwords for each exchange

- Never share seed phrases or private keys

- Move holdings off exchange after purchase (see security section)

Step 6: Store Your Holdings Securely

This is where most investors fail. An insecure portfolio structure exposes you to theft, exchange collapse, or personal security mistakes.

For holdings under $1,000:

Software wallet on your phone (MetaMask, Ledger Live) is acceptable. These remain in your control (you hold the keys) while staying user-friendly.

For holdings $1,000-10,000:

Hardware wallet (Ledger, Trezor) for long-term holdings. Keep 90-95% in cold storage, 5-10% in a mobile wallet for small trades or rebalancing.

For holdings over $10,000:

Multi-layer setup:

- Cold storage: 80-90% on hardware wallet, stored securely (safe deposit box, home safe)

- Warm storage: 5-10% on a second hardware wallet for quarterly rebalancing

- Hot wallet: 1-5% for active management on mobile/software wallet

Hardware wallet setup steps:

- Buy directly from manufacturer (Ledger.com or Trezor.io), never from third parties

- Initialize in an air-gapped environment if possible

- Generate seed phrase on the device itself (never exported)

- Write seed phrase on metal or acid-resistant plates (not paper)

- Store backups in two separate secure locations

- Test recovery on a spare device in a non-connected environment

- Only then transfer funds

- Store seed phrases in cloud storage (Google Drive, iCloud)

- Take photos of seed phrases with connected devices

- Share seed phrases or private keys with anyone

- Use exchange wallets for long-term storage

Portfolio Rebalancing: The Discipline That Separates Winners From Losers

Rebalancing sounds boring but is essential. Here’s why: without it, your portfolio naturally drifts away from your risk profile as winners grow.

When to Rebalance

Time-based rebalancing: Set a calendar reminder for quarterly reviews (every 3 months). Review allocation drift and make adjustments.

Threshold-based rebalancing: When any position deviates more than 5-10% from target, rebalance. Example: If Bitcoin target is 40% but it’s now 50%, trim 10% worth and redistribute.

Market-condition rebalancing: During major corrections (30%+ drops), consider moving stablecoin capital into discounted assets.

Rebalancing Example

Imagine you started with this balanced portfolio allocation:

| Asset | Target | After 6 Months | Action |

|---|---|---|---|

| Bitcoin | 40% | 52% | Sell 12%, reallocate |

| Ethereum | 25% | 22% | Buy 3% |

| Solana | 15% | 8% | Buy 7% |

| Small-caps | 10% | 13% | Sell 3% |

| Stablecoins | 10% | 5% | Buy 5% |

This process forces you to sell high (Bitcoin outperformed) and buy low (Solana underperformed). Over time, this discipline tends to improve risk-adjusted returns by 2-4% annually.

Tax Considerations

Rebalancing creates taxable events in many jurisdictions. Track all trades, monitor capital gains (short-term vs. long-term), and consider:

- Doing most rebalancing in tax-advantaged accounts if available

- Using losses to offset gains (tax-loss harvesting)

- Consulting a tax professional familiar with crypto

Risk Management: Beyond Diversification

Diversification isn’t enough. True risk management requires three additional disciplines:

1. Position Sizing: Never Go All-In on Any Single Asset

The worst crypto investors often make one catastrophic mistake: putting all capital into a single token that crashes 95%. Position sizing prevents this.

Rule: No single position should exceed 30% of your portfolio. Even Bitcoin-the most stable asset-should stay in the 30-60% range depending on risk profile, not 100%.

2. Stop-Loss Discipline (For Traders Only)

If you’re actively trading altcoins (not buy-and-hold), set stop-losses before entering positions. This prevents “bag holding” (holding onto a crashed position hoping it recovers).

Rule: Set stop-loss at -20% to -30% for altcoins, -10% to -15% for mid-caps. This cuts emotional decision-making out of the equation.

3. FOMO Avoidance: The Killer of Portfolios

Fear of Missing Out causes investors to chase explosive gainers. A 100x coin is exciting until it’s a 99x loss. Stick to your allocation.

When you see a token pumping 50% in a day:

- Don’t panic-buy

- Ask: Does it fit my allocation thesis?

- If not, let it pass

- Remember: Your strategy should work 80% of the time, not catch 100% of pumps

Research shows 87.5% of retail investors exhibit FOMO bias, yet only 50% use stop-losses or disciplined strategies. This gap explains why most retail investors underperform.

2026-Specific Themes: Where to Find Allocation Opportunities

Real-World Asset Tokenization (RWAs)

The RWA market surged from $15.2 billion in December 2024 to over $24 billion by June 2025. Projections suggest $50 billion by end of 2025, with potential to reach $100 billion+ by 2026.

What’s happening: Treasury bonds, corporate debt, real estate, and commodities are being tokenized onto blockchains. Institutions like BlackRock, JPMorgan, and Franklin Templeton are building tokenization product lines.

For your portfolio: 2-5% allocation to RWA infrastructure and early tokens (Centrifuge, Ondo Finance, Tokeny). This provides exposure to one of 2026’s largest narratives without concentrated bets.

AI & Machine Learning Integration

AI agents, autonomous decision-making, and GPU-intensive computation are becoming blockchain-native. Render (RNDR) provides distributed GPU rendering. Fetch.ai focuses on autonomous agents.

For your portfolio: 1-3% to emerging AI tokens in the small-cap allocation. High risk, but potential 10-50x returns if the narrative accelerates.

Layer 2 Scaling Solutions

Arbitrum and Optimism have moved from experimental to production. Transactions cost $0.05 instead of Ethereum’s $5-50. Developer activity is accelerating.

For your portfolio: 2-5% allocation to leading L2 tokens as part of mid-cap diversification. These have moved from tiny to multi-billion market cap but remain undervalued vs. potential.

Stablecoin Expansion in Emerging Markets

Stablecoins are becoming the de facto currency in markets with weak fiat. Adoption is accelerating in Latin America, Africa, and Southeast Asia.

For your portfolio: Stablecoin allocation stays 5-10% regardless. The increase in utility improves safety, making higher stablecoin allocation defensible.

Common Mistakes That Destroy Crypto Portfolios

Mistake 1: Insufficient Diversification (“Bitcoin Only” or “Shitcoin Roulette”)

Holding only Bitcoin or Ethereum misses growth opportunities. Holding 50 different microcap tokens creates hidden concentration risk if you don’t understand correlation.

Fix: Use the frameworks provided. 4-10 positions across market caps provides maximum diversification benefits without analysis paralysis.

Mistake 2: Wrong Portfolio For Your Risk Profile

Building an aggressive 20-position portfolio when you have low risk tolerance guarantees panic selling during the inevitable 40% correction.

Fix: Honest self-assessment first. Then select the appropriate framework.

Mistake 3: Leaving Holdings on Exchanges

FTX’s collapse in 2022 taught this lesson expensively. Exchange failures, hacks, or regulatory action can freeze or eliminate your holdings.

Fix: Move to hardware wallets after 1-2 months of holding. Non-custodial is non-negotiable for amounts over $1,000.

Mistake 4: Chasing Hype Into Scams

Rug pulls, honeypots, and straight-up fraud plague the crypto space. Projects with no audits, no development, no team credibility are especially dangerous.

Fix: Require: (1) security audit by reputable firm, (2) active GitHub development, (3) founder doxxing or proven track record, (4) clear utility.

Mistake 5: Panic Selling at Bottoms

The psychological worst moment to hold crypto is when Bitcoin drops 30% in a week and news is universally negative. That’s often the best time to hold or add if you’re DCA-ing.

Research from 2024 shows investors who stuck to their DCA during the $60,000-$70,000 Bitcoin lows in mid-2024 were up 80%+ by year-end. Those who panic-sold lost 100%.

Fix: Automate your DCA. Remove emotion via automation. Don’t check prices daily.

FAQ: Answering Your Biggest Questions

What percentage of my total portfolio should be in crypto?

Most financial advisors recommend 1-5% of total net worth. Morgan Stanley suggests:

- Aggressive growth portfolios: up to 4%

- Moderate growth portfolios: 2-3%

- Balanced portfolios: 1-2%

- Conservative portfolios: 0%

Hashdex, a major crypto fund manager, recently raised its recommendation to 5-10% for qualified investors, citing institutional adoption and regulatory progress. However, only allocate amounts you can genuinely afford to lose.

How many different cryptocurrencies should I own?

Quality matters more than quantity. Research shows 5-10 well-researched assets across different tiers outperforms 30+ random tokens. The reason: if you don’t deeply understand an asset, you can’t make intelligent rebalancing or holding decisions. You’ll panic sell when it dips or hold too long when it’s time to take profits.

Is Bitcoin enough diversification, or do I need altcoins?

Bitcoin alone is legitimate if your goal is pure store-of-value. Bitcoin’s 4-year cycle and halving pattern has delivered returns outpacing most assets. However, 60-100% Bitcoin allocations sacrifice growth potential during altcoin seasons, where mid-cap assets often 3-5x Bitcoin’s returns over 6-12 month periods.

Recommendation: Bitcoin + Ethereum minimum (60-70% combined). Add 1-2 mid-cap positions for diversification.

What’s the best way to start with only $500?

Don’t try to build a diversified portfolio. Instead:

- Buy 60% Bitcoin, 40% Ethereum only

- Use dollar-cost averaging: $50-100 monthly buys

- Once you reach $2,000-5,000, add one mid-cap (Solana or Chainlink)

- Move holdings to a software wallet (MetaMask) for security

- At $5,000+, move to hardware wallet

Small accounts have higher relative fees, so minimize transaction complexity.

Should I invest in memecoins for diversification?

No. Memecoins (Dogecoin, Shiba Inu) lack real utility and are pure speculation. They might spike 500% temporarily, but 99% of investors buy after the spike and hold 90%+ losses.

If you want exposure to “community-driven” projects, Solana (which has genuine technical merit) is more defensible. Dogecoin trades mostly on nostalgia and Elon tweets.

Never let a 10x meme opportunity distract you from a disciplined portfolio structure.

When should I sell crypto during rebalancing?

Sell when:

- A position exceeds its target allocation by 5-10% (forced selling of winners captures gains)

- You’ve hit your time horizon and need capital

- Fundamentals deteriorate (dev team abandons project, key partnerships end)

- You need emergency funds

Don’t sell because:

- Price dropped (selling after losses locks in losses and violates DCA discipline)

- A new hype token emerged (stick to allocation)

- News is negative (contrarian signal often indicates bottom)

- You get emotional

How do Bitcoin ETFs fit into diversification?

Bitcoin ETFs (Spot BTC ETF, Bitcoin Trust) provide:

- Regulatory custody and insurance

- Tax efficiency (you can hold inside IRA or 401k in some cases)

- Easier entry than managing wallets

- Potentially lower fees (0.19%-0.25% annually)

However, you lose sovereignty (not your keys, not your coins). For allocations under 5% of net worth, ETFs are fine. For larger allocations, pair ETFs with direct holdings in hardware wallets.

What’s the best way to rebalance to minimize taxes?

- Track cost basis carefully (use CoinTracker or similar)

- In taxable accounts, harvest losses (sell losers, buy similar assets)

- Use high-basis coins first when selling (FIFO might not be optimal)

- Rebalance more in years with big gains (offset with losses)

- In tax-advantaged accounts (IRA, 401k), rebalance freely

Consult a crypto tax specialist if your portfolio is over $10,000.

What if I miss the timing and buy at the peak?

Don’t panic. Dollar-cost averaging is designed for this. If you bought $1,000 at Bitcoin’s $126,000 peak:

- It dropped to $84,000 (33% loss)

- But Bitcoin has historically recovered 80%+ within 12 months

- If you DCA additional $100 monthly during the recovery, you’re now buying at discount prices

Research shows DCA investors who stayed disciplined through the 2022 crypto crash (Bitcoin dropped 65%) recovered all losses within 18 months and captured the 2023-2024 rally.

Should I invest now or wait for a crash?

Time in market beats timing the market. Bitcoin has generated positive returns over every 4-year period in history. Even investors who bought at the $19,000 peak in 2017 saw gains by 2020.

If markets crash 50% tomorrow, your DCA buys those cheaper prices automatically.

The worst decision is waiting on the sidelines in cash, then panic-buying at the peak. Deploy capital steadily over 2-4 months and stop worrying about perfect timing.

How should I handle crypto during bear markets?

Bear markets (40-80% corrections) are part of crypto cycles. During bear markets:

- Don’t panic sell. Every major bear market recovery (2014-2015, 2017-2018, 2022-2023) has been followed by 5-10x returns within 18 months.

- Continue DCA if possible. Buying during crashes at 70% discounts compounds returns massively.

- Rebalance aggressively. If Bitcoin drops from 40% to 20% of portfolio, the discount creates buying opportunity.

- Avoid over-trading. The worst crypto investors make more trades during crashes, locking in losses.

History shows disciplined investors who ignored bear market noise and held their allocations saw 100x+ returns over full market cycles (2011-2021, 2015-2021, 2019-2021, 2021-2024).

What if I need to sell urgently?

Keep 10-20% of holdings in stablecoins or liquid exchange wallets for emergency access. This prevents forced selling of long-term positions at bad prices.

If you must sell:

- Sell stablecoins first (no price risk)

- Sell winners next (harvest gains)

- Sell losers last (avoid locking in losses if you can avoid it)

- Maintain your core allocation (don’t liquidate everything)

How often should I review my portfolio?

- Daily: No (creates emotional trading)

- Weekly: Check prices but don’t act (information only)

- Monthly: Rebalance threshold check (do any positions need trimming?)

- Quarterly: Full review and rebalancing

- Annually: Deep dive on your strategy

The best investors review quarterly and otherwise let positions compound.

What’s the role of AI and machine learning in crypto investing?

AI-powered portfolio tools are emerging (portfolio optimization algorithms, sentiment analysis from news/social media, risk modeling). However:

- These tools are nascent and unproven

- They don’t replace fundamental analysis

- They often have bugs (Black Swan events aren’t predictable)

For 2026, stick to disciplined human decision-making. Use AI tools for data compilation and reporting, not core strategy.

Should I use leverage or margin trading?

No. For most investors, leverage:

- Amplifies both gains and losses

- Triggers emotional decisions at worst times

- Often leads to liquidation (forced selling at losses when margin requirements spike)

Crypto is volatile enough without leverage. Build positions slowly, let compounding work, and avoid the temptation to use margin.

99% of retail leverage-users underperform unleveraged portfolios.

What about crypto staking and yield farming?

Staking (locking coins to earn rewards) and DeFi yield farming offer 4-20%+ annual yields on select assets. However:

- Smart contract risk: bugs can drain funds (learned from 2023 hacks)

- Impermanent loss: providing liquidity can cause losses during volatility

- Tax complexity: staking rewards are taxable as income

- Only pursue if you deeply understand the protocol

For beginners: stick to simple staking on large-cap assets (Ethereum 3-4% APY via Lido is relatively safe). Avoid complex DeFi strategies.

How do I know if I have the right allocation?

Your allocation is right if:

- You can hold it during 40-50% corrections without panic. This is the only true test.

- You understand every position. If you can’t explain why you own something in 2 sentences, you own too much.

- It matches your timeline. If you need money in 12 months, you shouldn’t be 100% in small-cap altcoins.

- Rebalancing feels sustainable. If the process is complex or expensive, simplify.

- It’s boring after the first month. If you’re constantly tweaking, the strategy isn’t right.

The Bottom Line: Building Wealth Through Disciplined Crypto Investing

Building a simple and perfect crypto portfolio isn’t about finding hidden gems or timing peaks. It’s about:

- Starting with your risk tolerance, not your FOMO

- Diversifying strategically across market caps and sectors

- Using dollar-cost averaging to remove emotional timing

- Storing assets securely so they remain yours

- Rebalancing quarterly to maintain your allocation

- Holding through cycles and letting compounding work

The institutions managing trillions are allocating 2-10% to crypto. The infrastructure is maturing. Regulatory clarity is improving. 2026 is the year when crypto transitions from speculation to legitimate asset class.

Those who build disciplined portfolios now-rather than chasing hype-will look back at 2026 as the inflection point where their long-term wealth accelerated.

Start small, DCA steadily, automate what you can, and ignore the noise. Your portfolio will reward patience far more than it rewards performance-chasing.

Recommended Reading for 2026

To deepen your crypto expertise, research these topics:

- How Bitcoin halving affects market cycles (next halving: 2028)

- Ethereum’s scalability roadmap and Layer 2 solutions

- Real-world asset tokenization and DeFi convergence

- Regulatory frameworks in your jurisdiction

- Portfolio tracking tools (CoinTracker, Koinly, Blockpit)

- Your country’s crypto tax rules

The institutions are moving fast. The infrastructure keeps maturing. The window for building your portfolio before 2026 peaks is closing. Start now, start small, and let time do the heavy lifting.