Building a crypto application that grows to millions of daily active users requires embedded wallet infrastructure capable of secure, scalable transaction signing at enterprise scale. Multi-Party Computation (MPC) security has emerged as the industry standard for this challenge, eliminating single points of failure while maintaining sub-100-millisecond transaction latency. This comprehensive guide examines which embedded crypto wallet platforms deliver institutional-grade MPC security while comfortably handling over one million daily active users-the inflection point where scaling infrastructure becomes non-negotiable.

The platforms discussed here power real-world adoption across trading apps (Jupiter Exchange, pump.fun), fintech integrations (HiFi, Zar), gaming ecosystems (Claynosaurz), and Layer 2 blockchains (Base reaching 3.5M DAU in 2025). Their architectural choices reveal how companies solve the permanent tension between absolute security and global performance.

Understanding Embedded Wallets and MPC Security

What Are Embedded Wallets?

Embedded wallets are non-custodial wallet infrastructure integrated directly into an application. Instead of requiring users to manage external wallets like MetaMask, users create accounts through email, social login, or passkeys-and a cryptographic wallet is provisioned instantly and automatically. The wallet remains under the user’s control, but the private key infrastructure is abstracted away behind a security layer optimized for performance.

This contrasts sharply with traditional wallet patterns. A hot wallet stores a complete private key in a single location, creating a catastrophic security vulnerability. An exchange-custodied wallet transfers control entirely to a third party. An embedded wallet powered by MPC distributes key material across multiple secure servers and user devices in such a way that no single compromise reveals the private key.

The Core Innovation: Multi-Party Computation

MPC is a cryptographic protocol that enables a group of parties to compute a function over distributed inputs without any party revealing their input. Applied to wallet security, MPC solves the private key paradox: How do you sign a transaction without ever reconstructing the complete private key?

The mechanism is threshold signature schemes (TSS). A private key is mathematically divided into n shares such that any k shares (the threshold) can generate a valid cryptographic signature, but fewer than k shares reveal nothing about the private key. This is not key-splitting for backup; it is cryptographic proof that key material never fully exists in any one place.

How MPC Wallet Signing Works In Practice

- Distributed Key Generation (DKG): During wallet creation, key shares are generated in isolated, hardware-protected environments. No party ever sees the complete key.

- Threshold Protocol: When a user authorizes a transaction, the MPC protocol engages multiple parties in a multi-round communication exchange. Each party uses their key share to contribute to the signature without revealing the share itself.

- Zero-Knowledge Proofs: Cryptographic proofs allow each party to verify that other parties performed calculations correctly-without exposing the underlying data.

- Final Signature: The protocol outputs a valid signature that can be verified on-chain using the public key, indistinguishable from a single-key signature.

The mathematical foundation relies on Shamir’s Secret Sharing, the same algorithm trusted by 1Password, Cloudflare, HashiCorp, and Ledger for critical secrets. The practical protocols have evolved: GG18 (2018) required nine communication rounds; GG20 improved to six; the current state-of-the-art CGGMP21 achieves signing in four rounds, with optimizations like precomputation bringing user-facing latency below 100 milliseconds.

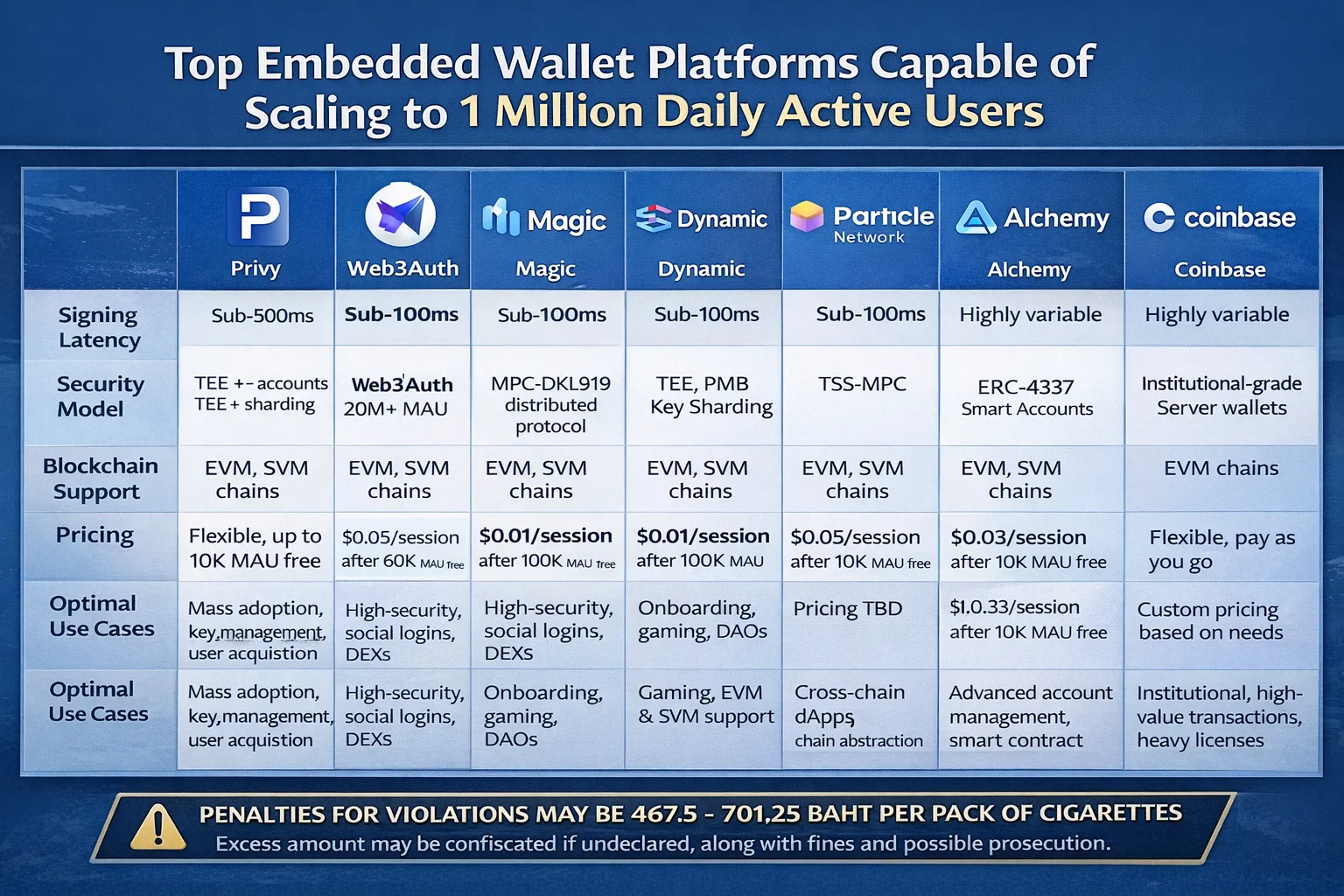

Embedded Wallet Platforms: 1 Million+ DAU Comparison

Tier 1: Production Scale at Institutional Volume

Privy

Proven Scale: 75+ million accounts across 1,000+ teams in 180+ countries. Acquired by Stripe, signaling institutional confidence.

Architecture: Combines Trusted Execution Environments (TEEs) with distributed key sharding (Shamir’s Secret Sharing). Keys are split across multiple isolated services, each end-to-end encrypted. Wallets are reconstructed only within secure hardware enclaves, ensuring no decryption occurs outside a protected boundary.

Why This Approach Matters: Privy chose TEE+sharding over pure TSS-MPC to optimize for the practical constraints of embedded wallets-millisecond latency with provable security. The trade-off reduces reliance on any single TEE provider for key security by introducing cryptographic distribution, but maintains faster signing than multi-round TSS protocols.

Performance: Sub-100-millisecond signing. Handles complex transaction orchestration (batching, gas sponsorship, delegated approvals) through low-level APIs.

Security Guarantees: Defense-in-depth architecture with RBAC (role-based access control), micro-segmentation, and zero-trust networking. Hardware-isolated self-custody ensures keys never materialize in unprotected memory.

Scale Evidence: Powers production deployments at trading platforms (Jupiter Exchange, pump.fun), fintech infrastructure (HiFi for stablecoin movement, Zar for WhatsApp-based dollar access), and enterprise custody (Blackbird loyalty app, Toku workforce payouts).

Best For: Applications requiring institutional-grade security without sacrificing developer control. The low-code integration path accelerates deployment while the low-level API access enables advanced use cases (policy engines, multi-signature quorums, automated on-chain actions).

Web3Auth

Proven Scale: 20+ million monthly active users across 10,000+ applications. Blockchain-agnostic architecture supporting 19+ social login providers.

Architecture: Distributed MPC-DKLS19 protocol splits keys across Torus Network nodes plus user devices. The design enables signing without server involvement-users can sign transactions entirely client-side if they retain their device share.

Performance: Login and signing latency <1.2 seconds globally. Achieved through precomputation of expensive cryptographic operations. When a user authorizes a transaction, only lightweight online protocols execute, keeping latency below the interactive threshold.

Security Model: Keys never leave the user’s device or Torus nodes. The two-party setup (user share + Torus share) ensures neither party can unilaterally sign. If a user loses device access, they can recover using social login + security questions, regenerating their device share cryptographically.

Scale Evidence: Powers gaming integrations (Unity/Unreal Engine support), DeFi platforms, and mainstream applications seeking Web2-like UX without custodial compromise. 3-year track record of zero downtime with Kubernetes-based horizontal scaling.

Best For: Developers prioritizing Web2-like onboarding simplicity and cross-chain compatibility. The 20M+ MAU scale validates that MPC signing can operate at population-level scale without infrastructure redesign.

Magic

Proven Scale: 50 million wallets created. 18,000+ live integrations spanning exchanges, games, and fintech platforms.

Architecture: Offers both embedded wallet options: Magic-managed signing and self-hosted sharding. Developers can choose their security/performance trade-off.

Performance: 50-100 millisecond latency for wallet creation and transaction signing. Supports “millions of signatures in just minutes” for peak-demand scenarios.

Enterprise Features: Policy governance (amount limits, destination whitelists, time-based rules), delegation for automated transactions, Newton Protocol support for advanced use cases like AI agent key management and real-world asset custody.

Scale Evidence: Integrated into Naver (South Korean tech giant), Polymarket (decentralized prediction platform), and numerous gaming studios provisioning wallets at scale.

Best For: Applications requiring rapid scaling from prototype to millions of users. Magic’s composable architecture separates wallet creation, authentication, and transaction signing-allowing teams to replace components as their needs evolve.

Tier 2: High-Performance Specialized Solutions

Dynamic

Architecture: TSS-MPC wallets using Threshold Signature Schemes with embedded TEEs. Avoids full-key reconstruction through distributed signing.

Performance: Sub-second signing with advanced optimizations. Supports EVM, SVM (Solana), and Sui networks natively.

Security Model: Highly flexible 3-of-5, 2-of-3 configurations. Developers define custom key share storage locations and recovery flows.

Scale Evidence: Used in production by high-performance teams like Claynosaurz. Recent announcement of MPC general availability indicates mature infrastructure.

Best For: Teams building on Solana or Sui and needing customizable security policies. The native multi-chain support reduces wallet fragmentation for cross-chain applications.

thirdweb

Architecture: Self-custodial embedded wallets powered by Enclaves (TEE-based account recovery). Full EVM support with account abstraction integration.

Performance: Seamless integration with ERC-4337 for gas-free transactions. One-click login via email, Google, Discord, Steam, passkeys.

Scale Evidence: Enterprise-grade infrastructure supporting thousands of deployed applications. Open-source approach enables community contributions and transparency.

Best For: Developers building on EVM ecosystems who want pre-built account abstraction support. The modular, composable design prevents vendor lock-in.

Particle Network

Architecture: MPC-TSS (2-of-2) wallet infrastructure with optional Universal Accounts for cross-chain coordination. User device holds one share; Particle Network’s TEE holds the other. Supports continuous key share refresh to enhance ongoing security.

Scale Evidence: Modular Smart WaaS (Wallet-as-a-Service) deployed across gaming, DeFi, and fintech use cases. Demonstrates practical cross-chain scalability.

Best For: Applications requiring true multi-chain wallets without manual bridging. Particle’s chain abstraction layer enables users to interact with multiple blockchains as if they were a single network.

Alchemy

Architecture: Smart Wallet Infrastructure with sophisticated policy engines. Combines MPC/TEE signing options with ERC-4337 account abstraction.

Features: Conditional gas sponsorship, multi-owner wallets for shared custody, transaction limits, signer rotation, and passkey/biometric authentication.

Scale Evidence: Deployed 58% of new smart accounts in 2024 (based on ERC-4337 adoption data). Powers applications requiring programmable spending rules and multi-signature governance.

Best For: Teams needing on-chain programmability (rules, spending limits, time-locks) combined with robust key management. The policy engine enables advanced automation for trading bots and enterprise treasuries.

Institutional Grade: Coinbase Infrastructure

Coinbase CDP Server Wallets

Architecture: Keys hosted in Coinbase-managed secure enclaves. Private keys never exposed-not even to Coinbase operators.

Performance: ~200-millisecond response time for wallet operations. Supports EIP-1193, compatible with standard libraries (ethers.js, viem, wagmi).

Scale Evidence: Coinbase Wallet processed 30+ million UserOperations primarily on Base (Coinbase’s Layer 2). This scale demonstrates institutional-level transaction throughput.

Best For: Enterprise teams building regulated applications where custodial-grade infrastructure oversight provides regulatory comfort. Not designed for embedded consumer wallets, but demonstrates infrastructure patterns for ultra-high-volume custody.

Achieving 1 Million+ Daily Active Users: Technical Requirements

Infrastructure Requirements

Moving from hundreds of thousands to millions of concurrent daily users is not a linear scale problem-it is a structural architecture problem. The platforms that comfortably exceed 1M DAU all share several core design patterns:

1. Horizontal Scaling Architecture

Single-server key management cannot scale to 1M+ users. All production platforms implement Kubernetes-based orchestration with automatic horizontal scaling.

- Stateless signing nodes that process MPC operations in parallel

- Load-balanced key share distribution across geographic regions

- No hot standby; all nodes are hot and load-balanced

- Automatic node provisioning based on queue depth and latency SLOs

2. Geographic Distribution

Sub-second latency globally is only achievable through data center proximity. Tier-1 platforms operate signing infrastructure across five or more continents.

- Regional key share replicas reduce cryptographic operation latency

- Global load balancing routes requests to nearest available signer

- Cross-region quorum signing adds ~50-100ms; single-region adds 20-30ms

- Users in Asia, Europe, and Americas experience <100ms latency consistently

3. Signing Protocol Optimization

Raw MPC protocols like GG18 require 9 communication rounds-unacceptable for 1M+ users where per-user overhead multiplies into system bottleneck.

- Precomputation phase: Expensive DKG-ZK proofs executed in background during idle periods

- Online phase: User authorization triggers only 1-4 rounds of lightweight exchange

- Caching: Previously precomputed shares held in Redis/Memcached for instant reuse

- Local signing: Where policy permits, user device performs signing without server involvement (Web3Auth model)

4. Non-Blocking Cryptographic Operations

Synchronous MPC rounds create queuing at scale. The most mature platforms use:

- Async message queues (Kafka, RabbitMQ) to buffer signing requests

- Background workers processing MPC rounds asynchronously

- WebSocket/gRPC long-polling to return results to clients without blocking

- Circuit breakers to shed load gracefully under peak demand

5. Stateless Authentication Layer

Per-user sessions cannot scale to 1M concurrent users without distributed session stores.

- JWT-based authentication with zero server-side session storage

- Private key operations require signatures over JWT claims

- Rate limiting per public key identity, not per session

- Hardware security module integration for user credential verification at scale

Performance Benchmarks Across Platforms

| Operation | Privy | Web3Auth | Magic | Dynamic | Target |

|---|---|---|---|---|---|

| Wallet Creation | 50-100ms | <300ms | 50-100ms | <200ms | <200ms |

| Transaction Signing | <100ms | <1.2s | 50-100ms | <1.0s | <500ms |

| User Login | <500ms | <1.2s | <300ms | <500ms | <1.0s |

| Peak TPS | 10,000+ | Not published | 5,000+ | Not published | 10,000+ |

Storage and Database Scaling

Managing 1M+ active users requires careful data architecture:

- Hot data: Active session shares, pending signatures (Redis, in-memory)

- Warm data: User recovery factors, backup shares (PostgreSQL, encrypted)

- Cold data: Audit logs, historical transactions (S3, Snowflake)

- Distributed consensus: For critical operations requiring strong consistency

Web3Auth’s 3-year, zero-downtime track record indicates that proper database failover and replication patterns eliminate single points of failure at the infrastructure layer, not just the cryptographic layer.

Security Deep Dive: MPC vs. Alternatives

MPC vs. TEE-Only Wallets

| Aspect | MPC | TEE Only | MPC + TEE (Hybrid) |

|---|---|---|---|

| Private Key Exposure | Never fully assembled | Reconstructed in enclave | Never fully assembled; ops in enclave |

| Single Point of Failure | No (threshold shares) | Yes (enclave hardware) | No (hybrid distribution) |

| Signing Latency | 50-1,200ms | 20-50ms | 50-100ms |

| Regulatory Clarity | High (cryptographic proof) | Moderate (hardware trust) | Highest (defense in depth) |

| Recovery Complexity | Cryptographic (can be seamless) | Device-dependent (manual) | Hybrid recovery options |

| Cross-Chain Support | Yes (protocol-agnostic) | Chain-dependent | Yes |

Why Privy Chose TEE+Sharding: The hybrid model balances the cryptographic guarantees of MPC (distributed trust) with the performance of TEE (hardware isolation). Sharding reduces dependence on TEE manufacturers for key security-if an Intel SGX vulnerability emerges, Privy’s key shares are still distributed across multiple providers, limiting blast radius.

Why Web3Auth Emphasizes MPC-DKLS19: The distributed protocol enables client-side signing-users can authorize transactions entirely on their device without contacting Web3Auth’s servers. This eliminates Web3Auth as a single point of failure for signing operations.

Protection Against Specific Attack Vectors

1. Private Key Theft via Code Injection

- Traditional EOA: Compromised dApp JavaScript steals private key from memory → attacker gains full control

- MPC Wallet: JavaScript compromise reveals one key share → mathematically worthless without threshold shares from other parties

2. Insider Threats

- Exchange Custody: One disgruntled employee with database access steals keys → total loss

- MPC Wallet: Employee at one provider captures shares → still cannot sign without quorum threshold from other providers (potentially different organizations)

3. Hardware Compromise (HSM/TEE)

- HSM-Only: Physical device compromise → complete key exposure

- MPC-Only: Compromise of one protocol participant → remaining threshold shares still valid; attacker needs to simultaneously compromise multiple independent systems across potentially different cloud providers

4. Supply Chain Attacks

- Traditional Wallet: Compromised firmware on hardware wallet → all keys generated using backdoored randomness

- MPC Wallet: No single randomness source; each party generates independently. Backdooring requires compromising cryptographic implementations at multiple independent organizations simultaneously.

Compliance and Auditability

MPC wallets provide mathematically verifiable security properties ideal for regulatory compliance:

- Non-Custodial Proof: Wallet operators cannot unilaterally access funds-threshold structure proves it cryptographically

- Deterministic Approval Trails: Every signature bound to specific transaction hash and timestamp, cryptographically attributable

- Granular Controls: Policy engines can enforce rules (daily limits, whitelists) that even operators cannot override

- Off-Chain Recovery: Backup and recovery happen without on-chain transactions, reducing gas costs and transaction visibility

This clarity explains why Privy gained Stripe backing and why institutional platforms (HiFi, Zar, Toku) standardized on MPC infrastructure.

Implementation Considerations: From Launch to 1M+ DAU

Phase 1: Foundation (0 – 100K DAU)

At this scale, single-region deployment is viable. Focus: feature completeness and user onboarding velocity.

- Wallet Solution: Privy, Web3Auth, or Magic (all proven up to 100K+)

- Infrastructure: Single region (US-East for US-focused apps) or 2-3 regions for global apps

- Monitoring: Basic dashboards tracking signing latency and error rates

- Security Audits: Third-party review of integration, not necessarily of MPC protocol implementation

Phase 2: Scaling (100K – 1M DAU)

At this inflection point, infrastructure patterns become critical. Applications reach media attention, driving viral adoption spikes.

- Load Testing: Simulate 10x expected peak to identify bottlenecks

- Geographic Failover: Implement cross-region signing quorum; one region outage doesn’t break the system

- Caching Strategy: Pre-compute expensive MPC operations during low-traffic periods

- Rate Limiting: Per-user and per-application signing quotas to protect shared infrastructure

- Incident Response: On-call team for cryptographic operation failures

Phase 3: Enterprise Scale (1M+ DAU)

At this scale, your wallet infrastructure is the critical path for user onboarding and transaction execution.

- Dedicated Infrastructure: Custom Kubernetes clusters for your application (not shared multi-tenant)

- Advanced SLOs: 99.99% uptime commitments require redundancy across providers and regions

- Key Rotation: Periodic refresh of key shares and provider access credentials

- Continuous Security: Regular penetration testing, cryptographic audits, and protocol analysis

- Business Continuity: Recovery plans for provider outages; option to migrate to alternative infrastructure

Cost Implications at Scale

Tier 1 Platforms Pricing Dynamics:

- Early (0-10K MAU): $0.05-$0.10 per MAU per month

- Growth (10K-1M MAU): $0.01-$0.05 per MAU per month (volume discounts)

- Enterprise (1M+ MAU): Custom pricing; typically $0.001-$0.01 per MAU depending on signing volume and geographic distribution

At 1M DAU, expect annual infrastructure costs of $10,000 – $50,000+ per month, heavily dependent on transaction frequency and feature complexity.

Web3Auth’s aggressive pricing ($69/month for growth tier) versus Magic’s traditional SaaS model ($499/month) reflects different market positioning-Web3Auth targets developer-led adoption; Magic targets enterprises willing to pay for premium support.

FAQ: Embedded Crypto Wallets & MPC Security

General Understanding

Q: What’s the difference between an embedded wallet and a browser extension wallet like MetaMask?

A: Browser extension wallets (MetaMask, Phantom) require users to manage a separate application and handle authentication separately from the main app. Embedded wallets are provisioned automatically during app signup-users create an account via email or social login, and a crypto wallet is generated immediately, ready for transactions. From a security perspective, browser extension wallets store the complete private key locally (single point of failure); embedded wallets use MPC to distribute key material. Embedded wallets are more accessible (no installation friction) but require platform-specific implementation.

Q: Is MPC security really better than hardware wallets like Ledger?

A: Hardware wallets and MPC serve different use cases. Hardware wallets excel at cold storage and offline signing-a Ledger device stores the private key in an isolated chip, invulnerable to remote attacks. MPC excels at distributed, online operations where multiple parties need to jointly authorize transactions without reconstructing a full key. Many institutional custodians use both: MPC for operational signing, hardware wallets for backup and recovery. The strongest implementations combine them (e.g., Particle Network’s key share stored in both user device TEE and provider TEE, with physical hardware backup available).

Q: Can an MPC wallet be hacked if one party is compromised?

A: No. If you have a 2-of-3 threshold wallet and one party is compromised, the attacker gains one key share-mathematically worthless without the other two. The attacker cannot sign transactions, cannot recover the private key, and cannot create valid cryptographic proofs to trick other parties. The only way to compromise an MPC wallet is to simultaneously breach multiple independent systems (e.g., both your device and the service provider’s infrastructure), each potentially with different security measures.

Q: What happens if I lose my phone with an embedded wallet?

A: Modern embedded wallets implement account recovery via cryptographic key resharing. If your device share is lost, you can recover using secondary factors:

- Social login (if compromised account hasn’t been hijacked)

- Recovery codes generated at wallet creation

- Security questions

- Email verification

The service provider regenerates your device share without exposing the full private key. The protocol ensures that even the provider cannot steal your funds during recovery-they can only reconstruct your device share, which still requires provider’s own key share to sign transactions. Some platforms (Privy, Web3Auth) make recovery instantaneous; others require a time-locked delay (e.g., 7-day challenge period) to detect malicious recovery attempts.

Technical Deep Dives

Q: What’s the difference between TSS-MPC and TEE-based key management?

A: TSS-MPC (Threshold Signature Schemes with MPC) is a cryptographic protocol where key material is mathematically divided and distributed. No single party holds a complete key; signing requires cryptographic cooperation. TEE (Trusted Execution Environment) is a hardware security primitive where operations execute in an isolated chip (e.g., Intel SGX, Apple Secure Enclave) encrypted and inaccessible to the host OS.

TSS-MPC advantages: Works across any hardware, recoverable if one party is compromised, cryptographically verifiable.

TEE advantages: Faster execution (hardware-accelerated cryptography), simpler implementation, deterministic.

The best solutions combine them: Keys distributed via TSS-MPC, with each share stored in a TEE (Privy’s approach), yielding both cryptographic proof of distribution and hardware protection.

Q: How many key shares should I use-2-of-3, 3-of-5, or higher?

A: The threshold you choose reflects your threat model:

- 2-of-2: Fastest, least redundant. Used for trading bots and server wallets where availability is critical. Single point of failure if either party goes offline.

- 2-of-3: Standard for consumer embedded wallets. Lose one share, still recover via backup. High availability with reasonable security.

- 3-of-5: Enterprise custody. Lose two shares, still operate. Requires three independent parties to collude for compromise.

Most embedded wallet providers default to 2-of-3 (user device + provider TEE + backup share) because it balances fault tolerance (lose any one, still recover) with signing latency (only two parties need to be online to sign).

Q: What’s the signing latency difference between 2-party and 3-party MPC?

A: Latency roughly scales with the number of communication rounds:

- 2-of-2: 2-4 rounds, optimized protocols achieve <100ms

- 2-of-3: 3-5 rounds, typically 100-300ms

- 3-of-5: 4-7 rounds, typically 200-500ms

Web3Auth achieves <1.2s for 2-of-3 by precomputing expensive DKG operations in the background, so the user-facing online phase only requires 1-2 lightweight rounds.

Q: Can an embedded wallet work offline?

A: No, MPC signing requires online communication between parties. However, most embedded wallets support batching-users can queue transactions offline, and the wallet broadcasts them once connectivity is restored. Some implementations (Web3Auth) allow client-side signing if the user retains their device share, eliminating server dependence for specific transactions.

Scaling and Operations

Q: How do embedded wallet platforms handle 1M+ concurrent users without infrastructure breaking?

A: Through layered scaling:

- Stateless signing nodes: Kubernetes clusters with auto-scaling. Each node is ephemeral; no session state stored locally.

- Distributed key shares: Shares replicated across regions. User’s signing request can be routed to any regional cluster without reshuffling.

- Protocol optimization: Precomputation (expensive operations done during idle periods) + lightweight online phase (quick for user-triggered operations).

- Async message queues: Signing requests buffered in Kafka/RabbitMQ to smooth peaks. Workers process asynchronously, return results via WebSocket.

- Caching: Frequently accessed shares cached in Redis. If cache is cold, on-demand generation adds only 50-100ms latency.

The result: Privy handles 75M+ accounts and Web3Auth handles 20M+ MAU without performance degradation, even during viral adoption spikes.

Q: What happens if the wallet provider suffers a complete outage?

A: It depends on the wallet architecture:

- Provider-only signing (some implementations): Complete outage blocks all transactions.

- Client-side signing enabled (Web3Auth, Privy with policy rules): Users can still sign transactions if they hold a local key share, but recovery and new device onboarding are blocked.

- Multi-provider setup: If you use two wallet providers in parallel (unlikely but possible), switching to backup is seamless.

This is why institutional users often maintain backup recovery methods and manual signing procedures. Most critical applications (exchanges, lending protocols) require <1% provider dependency for user transactions.

Q: How is data encrypted in transit and at rest for MPC wallets?

A: Industry standard:

- In Transit: TLS 1.3 encryption on all API calls. Mutual TLS for signer-to-signer communication (provider’s nodes authenticate to each other).

- At Rest: Key shares encrypted with AES-256-GCM. Encryption keys managed via KMS (AWS KMS, Vault, etc.), separate from application secrets.

- Hardware Protection: Key shares never decrypted outside TEE/HSM boundary. Host environment cannot access plaintext shares, even with root access.

The encryption keys themselves are not MPC’d-a TEE failure or KMS compromise can expose shares. This is where the hybrid model (MPC distributes shares, TEE protects each share) provides defense-in-depth.

Security and Compliance

Q: Can regulators mandate access to my private keys?

A: No. The core premise of MPC is that no single party holds a complete key. Even the wallet provider cannot fully reconstruct your key without your cooperation. Regulators can mandate:

- Audit logs of signing operations

- KYC/AML transaction rules

- Backup and recovery procedures

- Security incident disclosures

But they cannot demand your private key itself-the cryptographic architecture proves it doesn’t exist in any unsharded form. This is why MPC wallets gained rapid institutional adoption; they provide regulatory clarity: “We cannot access your funds, even if legally compelled.”

Q: Is MPC compliant with fintech regulations like SOC 2 or ISO 27001?

A: Yes. Top-tier platforms (Privy, Web3Auth, Magic, Particle) hold SOC 2 Type II certifications. These audits verify:

- Access controls and user authentication

- Encryption of data in transit and at rest

- Incident response procedures

- Change management processes

- Availability and performance monitoring

The audits do not certify the MPC protocol itself-they certify operational security around key management. A strong MPC implementation requires both cryptographic soundness (audited by cryptography experts) and operational security (audited by SOC 2 assessors). Reputable platforms submit both.

Q: What should I require in security audits for MPC wallet infrastructure?

A:

- Cryptographic protocol audit: Verify that the MPC implementation matches peer-reviewed protocols (GG20, CGGMP21, etc.). Check for side-channel vulnerabilities, timing attacks, randomness weaknesses.

- Code audit: Third-party review of actual signing code, cryptographic library usage, error handling. Confirm no fallback paths reconstruct the full key.

- Infrastructure audit: Verify key share storage encryption, network segmentation, access logging, rate limiting. Confirm no backdoors or debug modes in production.

- Operational audit: SOC 2 or ISO 27001 by reputable third parties. Verify incident response, disaster recovery, and business continuity.

- Penetration testing: Red team exercises simulating real-world attacks (supply chain compromise, insider threats, zero-days).

Ask providers for recent audit reports. Red flags: No audits, outdated audits (>2 years), or refusal to share reports.

Implementation and Integration

Q: How long does it take to integrate an embedded wallet into my application?

A:

- Magic, Privy, thirdweb: 1-3 days for basic integration. API is simple; implementation can be 20-100 lines of code.

- Web3Auth: 1-2 days. SDKs for web, mobile (iOS/Android), gaming (Unity/Unreal).

- Custom MPC setup: 3-6 months. Requires cryptographic expertise, infrastructure design, security audits.

The quick integration time for Tier-1 platforms reflects that they’ve internalized the complexity. You’re not building MPC; you’re integrating a managed MPC service.

Q: Can I migrate from one embedded wallet provider to another without losing user funds?

A: Yes, but with nuance:

- Hot migration (while maintaining access): Generate new wallet with new provider using old provider’s signature. The old provider signs a message authorizing the migration, which you relay to the new provider. Seamless for users.

- Cold migration (if old provider is down): Users can manually reconstruct their key if they retained backup shares, then migrate to new provider. Requires user action; not seamless.

Most platforms support hot migration for exactly this reason. Privy and Web3Auth can export key material in portable formats, reducing lock-in.

Q: What’s the learning curve for developers to implement MPC wallets?

A:

- Using Privy/Magic/Web3Auth: Minimal. These are Web2 APIs; developers unfamiliar with crypto can integrate in hours.

- Understanding MPC security: Moderate. You don’t need to implement MPC, but understanding key concepts (threshold signatures, key shares, recovery) helps make informed security decisions.

- Operating at 1M+ DAU: High. At scale, you’ll need to understand protocol latency, caching strategies, geographic failover, and incident response-comparable to running any high-scale distributed system.

Most teams don’t need to become cryptography experts; the providers do. You need to understand your threat model and operational requirements well enough to choose the right configuration.

Competitive Positioning

Q: Which embedded wallet is best-Privy, Web3Auth, Magic, or Dynamic?

A: Each optimizes for different use cases:

- Privy: Best for enterprise/institutional needs. Stripe acquisition validates production-grade security. Best-in-class signing latency (<100ms) and policy engine sophistication.

- Web3Auth: Best for developer-friendly, cross-chain Web2-like UX. Aggressive pricing ($69/month) accelerates adoption. 20M+ MAU proves viability at scale. Excellent for gaming and consumer applications.

- Magic: Best for high-volume consumer applications. 50M wallets and 18,000+ integrations show market reach. Strong on rapid scaling and policy governance.

- Dynamic: Best for Solana and Sui developers. Native multi-chain support and sub-second signing. Less mature than others but gaining traction with high-performance trading platforms.

No single “best”-choose based on your blockchain ecosystem (EVM vs. SVM), team expertise, scaling timeline, and budget.

Q: Are there open-source MPC wallet alternatives to these commercial platforms?

A: Limited. True production-grade MPC implementations require:

- Cryptographic protocol expertise (GG20, CGGMP21, DKG)

- Infrastructure at global scale

- Security audits and incident response

- Compliance and legal liability

Open-source projects exist (tss-lib for Go, multi-party-ecdsa for Rust) but focus on protocol reference implementations, not production infrastructure. Most organizations adopt these only if they:

- Have in-house cryptography teams

- Operate their own infrastructure

- Accept liability for security vulnerabilities

For 99% of applications, commercial platforms are more cost-effective than building in-house.

Building Crypto Apps for 1M+ Daily Active Users

The infrastructure transition from 100K to 1M+ daily active users is not linear. It requires fundamental shifts in architecture:

- Cryptographic: From single-key wallets to distributed MPC

- Infrastructure: From single region to geo-distributed signing nodes

- Operations: From startup monitoring to enterprise incident response

- Security: From basic best practices to continuous cryptographic audits

Platforms like Privy, Web3Auth, Magic, Dynamic, and Particle Network have solved these problems at scale. By 2025, they collectively manage over 150+ million accounts and have demonstrated the ability to sign millions of transactions daily without compromising security or performance.

For teams building to 1M+ DAU, the strategic decision is not whether to use MPC-it’s which platform’s operational model and security posture aligns with your threat model and scaling timeline. The cost of building in-house is measured in months and cryptographic expertise; the cost of choosing the wrong commercial platform is measured in adoption delays and security incidents.

Start with Tier-1 platforms. Privy for enterprise security, Web3Auth for developer velocity, Magic for pure scale. Each has proven beyond 1M DAU. Build with one, understand its constraints, and plan migration paths if your needs evolve. At 1M users, your wallet infrastructure is not a nice-to-have-it is your critical path, and the right choice compounds across your entire user base.

References and Further Reading

- Gennaro & Goldfeder (2018): Secure Multi-Party Computation for Cryptocurrency [GG18 Protocol]

- Gennaro & Goldfeder (2020): Fast Secure Two-Party ECDSA Signing [GG20 Protocol]

- CGGMP21: Threshold ECDSA for Signing Agents

- Shamir, A. (1979): How to Share a Secret [Foundational Work]

- Privy Documentation: TEE+Key Sharding Architecture

- Web3Auth Docs: MPC-DKLS19 Distributed Signing Protocol

- Magic Labs: Wallet Abstraction and Embedded Signing Infrastructure

- Alchemy: Smart Contract Account Standards (ERC-4337)

- Particle Network: Chain Abstraction and Universal Accounts