Learn what cryptocurrency is, how blockchain technology powers it, how to trade strategically, and discover the best cryptocurrencies to invest in for 2026 – complete with portfolio management strategies and risk mitigation techniques.

What Is Cryptocurrency? A Modern Definition

Cryptocurrency is a decentralized digital currency that operates on blockchain technology without the control of any central bank or government authority. Unlike traditional money issued by central banks, cryptocurrencies are created, verified, and managed through a network of computers using cryptography – a mathematical process that secures transactions and controls the creation of new units.

The most straightforward way to understand cryptocurrency is to recognize what makes it fundamentally different from traditional money: it exists entirely in digital form, transactions are secured through complex mathematics rather than institutional trust, and its supply is typically limited by design rather than government decree. Bitcoin, the first cryptocurrency created in 2009, demonstrated that a decentralized currency could work without a trusted intermediary, sparking a revolution in how we think about money, value, and trust in the digital age.

Cryptocurrencies are powered by blockchain technology – essentially a decentralized ledger where every transaction is recorded across thousands of computers simultaneously. This distributed approach eliminates the need for a middleman like a bank, making transactions faster, cheaper, and more transparent. When you send cryptocurrency, the network validates the transaction through consensus mechanisms (most commonly Proof of Work or Proof of Stake), and once approved, it becomes permanent and unchangeable in the blockchain record.

Why Does Cryptocurrency Have Value? Understanding Price Drivers

The value of any cryptocurrency derives from several interconnected factors that sophisticated investors must understand before making investment decisions.

Scarcity and Supply Mechanics: Bitcoin’s fixed supply cap of 21 million coins creates inherent scarcity – similar to gold’s limitation in the earth’s crust. This built-in constraint, combined with the increasing difficulty of mining new coins, creates upward pressure on value as demand grows. Ethereum and other cryptocurrencies use different mechanisms but similarly control supply to maintain economic incentives.

Network Adoption and Utility: The more businesses, individuals, and institutions that accept and use a cryptocurrency, the greater its utility and value. Bitcoin’s acceptance by institutional investors and inclusion in major ETFs in 2024-2025 significantly increased its perceived legitimacy and demand. Ethereum’s massive ecosystem of decentralized applications (dApps), DeFi protocols, and NFT platforms creates constant demand for ETH to pay transaction fees.

Regulatory Clarity: The clarification of cryptocurrency’s legal status in major jurisdictions – including the SEC’s approval of Bitcoin and Ethereum ETFs in 2024 and regulatory developments across Asia and Europe – has dramatically increased institutional adoption. Ripple’s (XRP) settlement with the U.S. SEC in 2025 exemplifies how regulatory clarity unlocks value and creates investment opportunities.

Technological Development: Upgrades that improve transaction speed, security, and energy efficiency increase a cryptocurrency’s practical value. Ethereum’s transition to Proof of Stake reduced energy consumption by 99.95%, making it attractive to environmentally conscious investors and institutions.

Market Sentiment and Adoption Cycles: Like all asset classes, cryptocurrency prices are influenced by investor sentiment, macroeconomic conditions, and adoption cycles. Bitcoin’s historical price cycles show major bull markets following both technological breakthroughs and institutional adoption milestones.

Types of Cryptocurrencies: The 7 Major Categories

Not all cryptocurrencies serve the same purpose. Understanding these categories is essential for building a diversified portfolio aligned with your investment thesis.

1. Store of Value Cryptocurrencies

The most straightforward category, designed to preserve purchasing power over time. Bitcoin (BTC) is the primary example – often called “digital gold” because of its limited supply, security, and ability to serve as a hedge against inflation and currency debasement. These coins prioritize security and decentralization over speed and functionality.

2. Smart Contract Platforms

These blockchains enable programmable applications, essentially serving as a foundation for the entire cryptocurrency ecosystem. Ethereum (ETH) dominates this space, allowing developers to build decentralized finance (DeFi) applications, NFT platforms, gaming ecosystems, and more. Solana (SOL) offers similar functionality with dramatically higher transaction throughput (65,000+ transactions per second versus Ethereum’s 12-15 per base layer).

3. Stablecoins

Cryptocurrencies pegged to stable assets – typically the US dollar. Tether (USDT) and USD Coin (USDC) function as the critical infrastructure enabling cryptocurrency trading by providing price stability. Stablecoins serve both practical functions (trading pairs, yield farming) and portfolio protection (maintaining purchasing power during market downturns).

4. Decentralized Finance (DeFi) Tokens

These tokens grant governance rights or provide essential functionality within financial protocols. Chainlink (LINK) operates as the industry-leading oracle network, providing reliable real-world data to blockchain applications – essential infrastructure increasingly critical as real-world assets (RWAs) enter the blockchain.

5. Cross-Border Payment Cryptocurrencies

Designed specifically for rapid, inexpensive international transfers. Ripple (XRP), following its 2025 regulatory clarity, has achieved real-world adoption through RippleNet with financial institutions across Asia, Latin America, and the Middle East. These currencies solve a genuine problem in the $150+ trillion global remittance market.

6. Interoperability and Layer-2 Tokens

Polkadot (DOT) and Polygon (MATIC) enable communication between different blockchains, solving the “siloed” problem where each blockchain operates independently. As the ecosystem matures, interoperability becomes increasingly valuable.

7. Governance and Utility Tokens

Tokens that provide voting rights and utility within specific ecosystems. Binance Coin (BNB) offers exchange fee discounts and ecosystem participation, while Uniswap (UNI) governs the largest decentralized exchange. These tokens derive value from network effects and adoption of their underlying platforms.

Top Cryptocurrencies for 2026 Investment: Comparison of Major Assets

How to Make Money from Cryptocurrency: 5 Primary Strategies

Cryptocurrency offers multiple profit mechanisms beyond simple price appreciation. Understanding these strategies helps you align your investment approach with your risk tolerance and time commitment.

1. Long-Term Investing (HODL Strategy)

Best for: Investors with 3+ year time horizons and belief in fundamental adoption trends

Buy established cryptocurrencies and hold through market cycles, collecting the long-term adoption premium. Bitcoin’s historical data shows that despite 80%+ drawdowns from peaks, long-term holders who maintained positions through multiple cycles achieved substantial returns.

Action step: Select 2-3 core holdings (typically Bitcoin and Ethereum) representing 50-70% of your crypto allocation, enable automatic purchases through “dollar-cost averaging,” and store in secure self-custody wallets.

2. Active Trading

Best for: Experienced investors with strong technical analysis skills and active market monitoring

Capture shorter-term price movements using technical analysis, identifying support and resistance levels, trend line breaks, and momentum indicators. Most successful traders specialize in specific trading pairs and timeframes rather than attempting to trade everything.

Action step: Start with spot trading on established exchanges (Coinbase, Bybit, Binance) before advancing to futures, use stop-loss orders on every trade, and never risk more than 1-2% of capital per trade.

3. Yield Farming and Staking

Best for: Passive income seekers comfortable with smart contract risks

Staking involves locking cryptocurrency in blockchain protocols (Ethereum, Algorand, Cosmos) to validate transactions and earn rewards – typically 3-15% annually depending on the asset and network. Yield farming involves providing liquidity to decentralized exchanges and earning trading fees plus governance token rewards – riskier but potentially higher-yielding.

Action step: Start with established protocols on major chains (Lido for Ethereum staking, Uniswap for LP farming), begin with small allocations to test the process, and understand “impermanent loss” risks in liquidity provision.

4. Mining

Best for: Technical users with specific hardware investments and access to cheap electricity

Bitcoin mining has evolved from home-based operation to industrial-scale operations requiring $1M+ in specialized equipment and access to electricity under $0.05/kWh. For most retail investors, this is impractical. However, cloud mining services and smaller-scale operations in regions with cheap renewable energy remain viable.

Action step: For retail investors, skip traditional mining and instead allocate capital to established mining companies’ stocks or consider staking-based protocols that don’t require specialized hardware.

5. Airdrops and Governance Participation

Best for: Community-engaged users seeking distribution in new projects

Early cryptocurrency adopters often receive free tokens (airdrops) as communities distribute coins to new users or loyal followers. Governance participation in decentralized protocols can provide returns through fees or newly issued tokens.

Action step: Follow emerging protocols on Twitter/X and Discord, participate in testnet activities and governance votes, but maintain extreme caution about projects promising unrealistic returns – many are scams.

The Best Cryptocurrencies to Invest in for 2026

Based on 2025 developments, regulatory clarity, institutional adoption, and technological progress, these cryptocurrencies represent the most compelling 2026 investment opportunities across different risk profiles.

| Cryptocurrency | 2026 Thesis | Target Investor | Risk Level |

|---|---|---|---|

| Bitcoin (BTC) | Digital gold with institutional adoption (BlackRock, Fidelity ETFs), limited supply scarcity, and proven 15-year security track record | Conservative; all portfolios | Low-Medium |

| Ethereum (ETH) | Smart contract backbone of Web3; Layer 2 scaling solutions maturation; staking rewards; continued DeFi dominance | Core holdings; all portfolios | Medium |

| Solana (SOL) | Institutional legitimacy (CME futures); technical superiority (high TPS); mobile ecosystem expansion | Growth-oriented; balanced/aggressive | Medium-High |

| Ripple (XRP) | Post-regulatory clarity (2025); RippleNet institutional adoption in Asia/Latin America; solved remittance problem | Opportunity play; medium/aggressive | Medium |

| Chainlink (LINK) | Essential DeFi infrastructure; Real-World Assets (RWAs) requiring oracle data; enterprise partnerships | Altcoin allocation; balanced/aggressive | Medium-High |

| Polkadot (DOT) | Multi-chain future; Web3 adoption; governance participation; unique parachains architecture | Altcoin allocation; balanced/aggressive | Medium-High |

| Binance Coin (BNB) | Exchange ecosystem; institutional adoption; fee-generating network; gaming and blockchain integration | Core altcoin; balanced/aggressive | Medium |

| Algorand (ALGO) | Enterprise adoption; CBDC pilot programs; carbon-negative; institutional partnerships | Enterprise-focused; medium/aggressive | Medium-High |

How to Build and Manage Your Cryptocurrency Portfolio

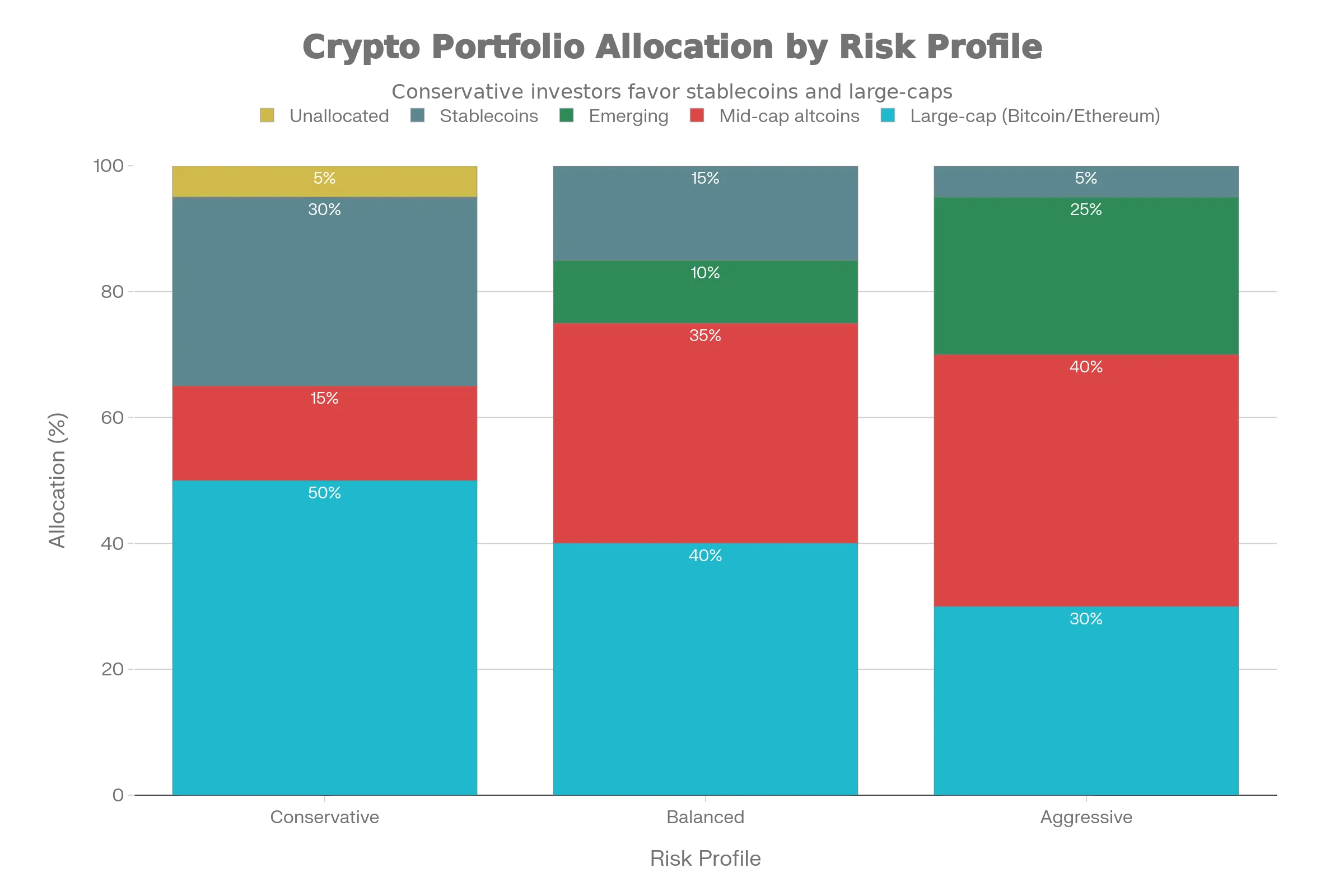

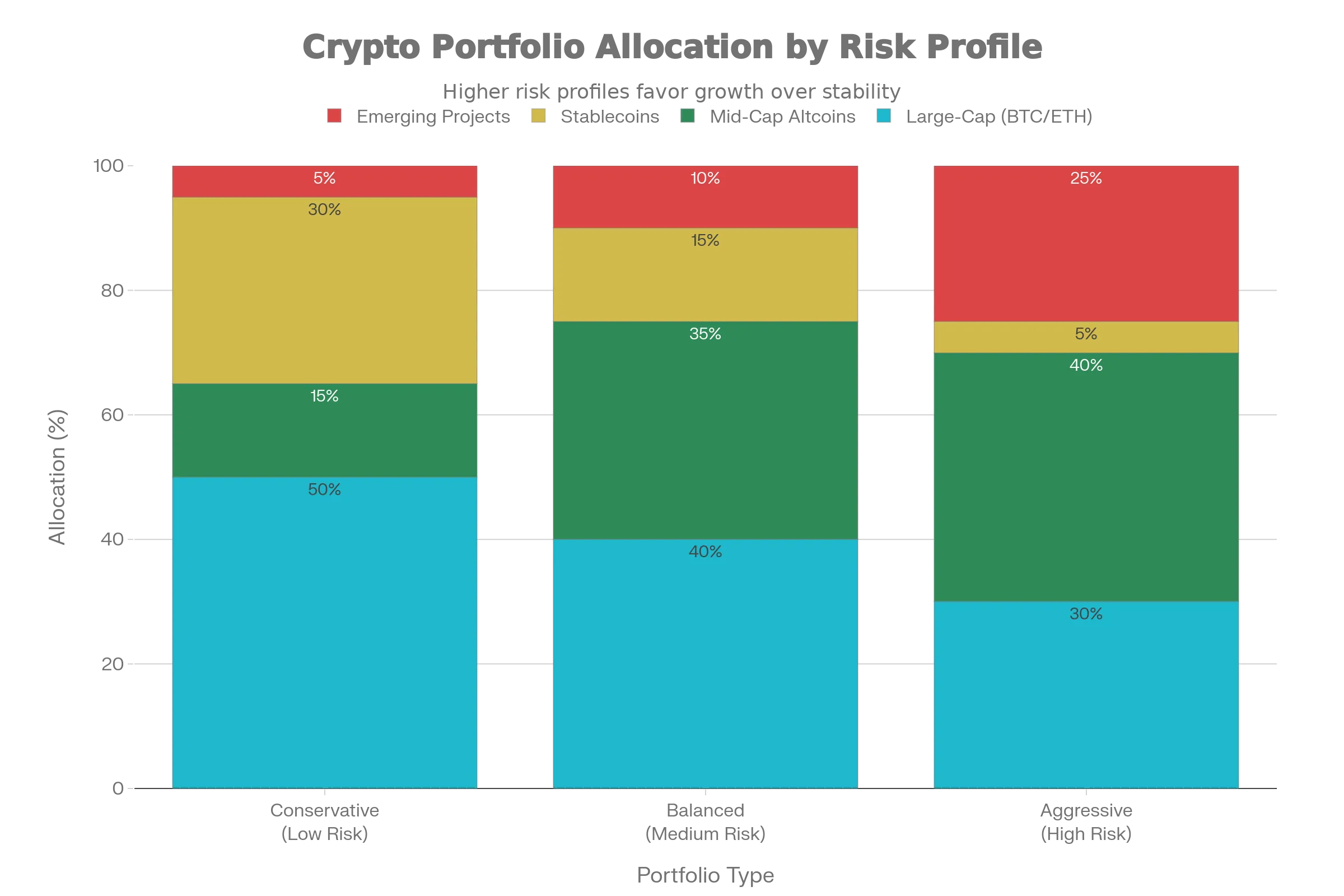

Cryptocurrency Portfolio Allocation Models by Risk Profile

Step 1: Define Your Investment Thesis and Risk Profile

Before purchasing any cryptocurrency, establish your time horizon and risk tolerance:

- Conservative (Low Risk): 3-5 year timeframe; capital preservation priority; focus on Bitcoin, Ethereum, and stablecoins (50-80% allocation)

- Balanced (Medium Risk): 2-3 year timeframe; balanced growth and protection; diversified across established coins and promising altcoins (40% large-cap, 35% mid-cap, 15% stablecoins, 10% emerging)

- Aggressive (High Risk): 1-2 year timeframe; accepting 50%+ drawdowns; heavily weighted toward emerging projects and altcoins (30% large-cap, 40% mid-cap, 25% emerging, 5% stablecoins)

Critical truth: Your allocation should match your emotional tolerance for volatility, not return expectations. An aggressive allocation means nothing if you panic-sell during inevitable 40% downturns.

Step 2: Asset Allocation Across Categories

Divide your investment capital across different cryptocurrency types to manage portfolio risk:

- Large-cap coins (40-50%): Bitcoin and Ethereum – the most proven cryptocurrencies with the strongest security and liquidity

- Mid-cap altcoins (25-35%): Established ecosystems like Solana, Chainlink, and Polkadot offering growth without emerging-coin risk

- Stablecoins (10-30%): USDC or USDT for liquidity, rebalancing opportunities, and downside protection

- Emerging projects (5-20%): Higher-risk, higher-potential-reward projects aligned with your conviction

This structure balances stability from established assets with growth potential from emerging opportunities while maintaining liquidity for rebalancing.

Step 3: Implement Dollar-Cost Averaging

Rather than attempting to time market bottoms, invest fixed amounts on regular schedules (weekly, monthly):

- Advantage: Automatically purchases more coins during price dips and fewer during peaks, mathematically optimizing entry prices

- Discipline: Removes emotional decision-making during market panic or euphoria

- Timeline: 12-36 month DCA periods smooth out market cycles and reduce timing risk

Step 4: Secure Your Holdings Appropriately

Hot Wallets (5-10% of holdings): For active trading on exchanges; accept counterparty risk from exchange custody

Cold Wallets (85-95% of holdings): Hardware wallets (Ledger, Trezor) or paper wallets for long-term storage; you control private keys; extreme security

Critical rule: Never store significant cryptocurrency amounts on exchanges long-term. The history of exchange hacks and collapses (Mt. Gox, FTX, Celsius) demonstrates this repeatedly.

Step 5: Rebalancing Strategy

Market movements shift your allocation away from targets. Rebalance quarterly or semi-annually:

- Calculate current allocation percentages

- Identify positions above or below target allocation (e.g., Bitcoin grew from 40% to 55%)

- Sell overweight positions, buy underweight positions to return to targets

- This naturally forces you to “sell high, buy low”

Critical Risk Management: Understanding Cryptocurrency Dangers

Before investing, acknowledge these structural risks inherent to cryptocurrency:

Volatility Risk: Cryptocurrency can decline 50-80% from peaks. Bitcoin’s historical volatility (5-year standard deviation: 90%+) is 4-6x higher than stock market indices. Only invest money you can afford to lose entirely.

Regulatory Risk: Governments worldwide are still developing cryptocurrency frameworks. Major regulatory changes could dramatically impact valuations. Conversely, positive regulatory developments (like SEC ETF approvals) create upside surprises.

Technology Risk: While Bitcoin’s security is proven, emerging technologies carry implementation risks. Smart contract bugs or consensus mechanism flaws have caused billions in losses (Poly Network exploit: $611M, Wormhole bridge hack: $325M).

Scam and Fraud Risk: The cryptocurrency space attracts bad actors offering Ponzi schemes, fake projects, and outright fraud. Average crypto fraud victim loses $14,000. Never invest in projects you don’t understand, and be extremely skeptical of guaranteed return promises.

Custodial and Exchange Risk: Cryptocurrency exchanges have failed catastrophically (FTX: $8B customer loss; Mt. Gox: 850,000 BTC lost). Self-custody through hardware wallets eliminates this risk but requires discipline and security discipline.

Correlation Risk: During extreme market stress (2022 crypto winter), different cryptocurrencies move together, reducing diversification benefits. True portfolio diversification requires non-crypto assets.

Step-by-Step Guide: Making Your First Cryptocurrency Investment

For Complete Beginners:

1. Choose a reputable exchange

- Coinbase: US-regulated, beginner-friendly, higher fees, excellent security

- Kraken: Professional-grade tools, excellent security, moderate fees, global availability

- Bybit: Low fees, advanced features, good for active traders

- Binance: Largest exchange, lowest fees, widest coin selection, regulatory uncertainties in some jurisdictions

2. Complete account setup and identity verification

- Provide email, create strong password (30+ characters, unique)

- Enable two-factor authentication (2FA) on both email and exchange account

- Complete KYC (Know Your Customer) identity verification – required for fiat deposits

3. Deposit fiat currency

- Link bank account for electronic transfers (ACH in US)

- Consider starting with $500-1,000 for your first purchase

- Wire transfers available but typically cost $15-30

4. Purchase your first cryptocurrency

- Order types: “market order” buys immediately; “limit order” buys at target price

- For long-term investors: buy once and hold (HODLing)

- For traders: practice with 0.1-0.5 BTC before scaling up

5. Transfer to self-custody (for holdings over $5,000)

- Purchase hardware wallet (Ledger Nano S Plus: ~$50; Trezor Model One: ~$60)

- Transfer from exchange to wallet address – creates separate secure storage

- Keep recovery seed phrase (24-word backup) in safe location (safe deposit box, physical backup)

6. Set a rebalancing reminder

- Quarterly review of allocation versus targets

- Annual review of investment thesis – are your reasons for holding still valid?

Answering Your Most Critical Questions

Can I invest small amounts?

Yes. You can purchase fractional amounts of any cryptocurrency. Many exchanges allow purchases starting at $1. Dollar-cost averaging with $100-500 monthly investments is a proven beginner approach.

How much should I allocate to cryptocurrency?

Financial institutions recommend: 0-2% for conservative portfolios, 2-3% for balanced portfolios, 3-4% for aggressive growth portfolios. These allocations provide crypto exposure without portfolio concentration risk. For aggressive individual investors comfortable with volatility, 5-10% total financial asset allocation is reasonable.

Will cryptocurrency replace traditional money?

Unlikely in most developed economies in the next 10 years. However, cryptocurrency is establishing roles as store of value (Bitcoin), transaction settlement (Ethereum), and cross-border transfer (Ripple). Government central bank digital currencies (CBDCs) will likely coexist with decentralized cryptocurrencies.

Is cryptocurrency a scam?

The underlying technology and many established cryptocurrencies are legitimate. However, the cryptocurrency space attracts tremendous scam activity. Focus on cryptocurrencies with: 10+ year track records, transparent development teams, institutional adoption, and strong technical fundamentals. Avoid anything promising guaranteed returns.

What are the tax implications?

Tax treatment varies by jurisdiction. In most developed countries, cryptocurrency transactions trigger capital gains taxes, while staking and mining income are taxed as ordinary income. Consult a tax professional in your jurisdiction – tax errors carry penalties. Use tax software like CoinTracker or Koinly to track transactions.

The Bottom Line: Your 2026 Cryptocurrency Action Plan

- Educate yourself thoroughly before risking capital. Read cryptocurrency whitepapers for projects you’re considering. Bitcoin’s original whitepaper (9 pages) remains the best cryptocurrency introduction.

- Start small with established cryptocurrencies (Bitcoin, Ethereum, Solana) before exploring emerging projects. This approach lets you understand technology and markets while limiting downside risk.

- Build your portfolio systematically through dollar-cost averaging rather than trying to time market bottoms. Most successful long-term investors use regular purchase schedules regardless of price.

- Secure your holdings properly through hardware wallets for long-term storage and exchange accounts only for active trading. Take personal security seriously – lost private keys mean irretrievable losses.

- Manage your psychology, not just your portfolio. Accept volatility as part of cryptocurrency investing. Panic-selling near market bottoms is the most common retail investor mistake – decide your strategy before investing and commit to it.

- Focus on 2026 opportunities in established ecosystems with genuine utility: Bitcoin for institutional adoption, Ethereum for smart contract dominance, Solana for high-performance applications, and emerging altcoins like Chainlink and Polkadot for specialization.

Remember: The cryptocurrency market will experience 40-60% drawdowns in 2026. The question isn’t whether volatility will occur, but whether you’re positioned to profit from the resulting opportunities rather than lose from panic-driven decisions.

Your 2026 cryptocurrency investment success depends not on perfect timing or selecting the one winner, but on disciplined execution, proper risk management, and focus on fundamental drivers of value adoption. These principles, combined with the specific cryptocurrency recommendations above, position investors to capture the next decade of blockchain-enabled innovation.