Thailand’s cryptocurrency market has witnessed remarkable growth in recent years, with the nation boasting one of the highest cryptocurrency ownership rates globally. As digital assets become an increasingly integral part of the investment landscape, individuals and businesses must navigate a rapidly evolving regulatory framework. The Thai government has made significant strategic moves to position itself as a global “Digital Asset Hub,” including a landmark five-year tax exemption on cryptocurrency capital gains (2025–2029) that fundamentally changes the taxation landscape for crypto investors.

Key Points

- Capital gains from crypto trading are tax-exempt (0%) for individuals when conducted through SEC-licensed platforms from January 1, 2025, through December 31, 2029, under Ministerial Regulation No. 399 (B.E. 2568).

- Withholding tax on crypto sales has been eliminated (previously 15%) for the exemption period, improving cash flow for investors.

- Crypto transactions remain exempt from the 7% Value Added Tax (VAT) when executed through licensed exchanges, brokers, and dealers.

- Companies are NOT eligible for the exemption and remain subject to corporate income tax at 20% on crypto gains.

- SEC-licensed platform requirement is critical – the exemption only applies to transactions through exchanges, brokers, and dealers licensed by the Thai Securities and Exchange Commission.

- Record-keeping is mandatory: Taxpayers must maintain detailed transaction records for at least five years, including cost basis documentation, especially for assets transferred from foreign platforms.

- Tax loss harvesting and strategic timing remain valuable planning tools for offsetting gains and managing overall tax liability.

What Is Crypto Tax?

Crypto tax refers to the taxation principles applied to revenues involving cryptocurrencies and other digital assets. The Thai Revenue Department classifies cryptocurrencies and digital tokens as “digital assets,” and tax treatment follows property taxation principles – similar to other capital assets. When you buy, sell, trade, or receive cryptocurrencies, specific tax events may trigger personal income tax, withholding tax on certain token rewards, or other compliance obligations depending on the transaction type and your residency status.

How Established Is Thailand’s Crypto Tax Landscape?

Thailand has demonstrated a progressive and increasingly stable stance toward cryptocurrency regulation. The government has implemented a clear regulatory framework under the Digital Asset Business Decree (B.E. 2561/2018) and multiple ministerial regulations, with the most significant update being Ministerial Regulation No. 399 (B.E. 2568), published in the Royal Gazette on September 5, 2025.

The Historic 5-Year Tax Exemption (2025–2029)

On June 17, 2025, Thailand’s Cabinet approved a groundbreaking five-year personal income tax exemption on capital gains from cryptocurrency and digital token sales. This exemption took effect January 1, 2025, and will remain in effect through December 31, 2029. The measure is designed to attract foreign investment, encourage domestic participation in regulated markets, and position Thailand as a regional leader in digital asset innovation.

Key conditions for the exemption:

- Transactions must occur through a Thai SEC-licensed digital asset business (exchange, broker, or dealer)

- Applies only to individuals – companies and corporate entities are excluded

- Exempts only the profit portion – calculated as sale proceeds minus purchase cost and direct trading fees

- Applies to income received between January 1, 2025, and December 31, 2029

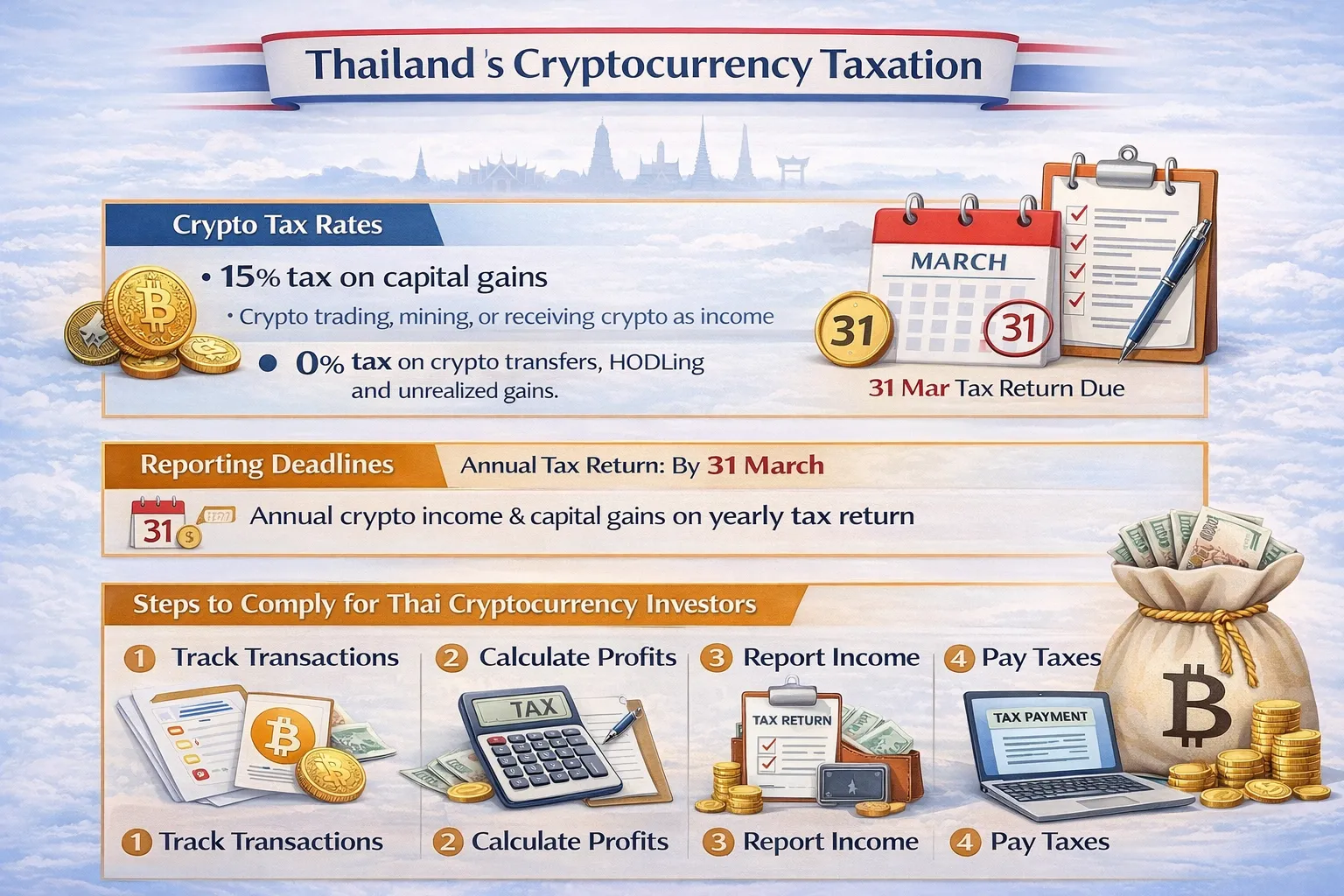

Capital Gains Tax Rates

For individuals trading via SEC-licensed platforms (2025–2029): 0% tax exemption on all qualifying capital gains.

For companies and other entities: 20% corporate income tax applies to crypto gains, regardless of platform.

Historical context (pre-2025): Individuals were subject to progressive personal income tax rates ranging from 0% to 35% based on total annual income, with the rate depending on the taxpayer’s income bracket.

Elimination of Withholding Tax (2025–2029)

Contrary to previous regulations, withholding tax on capital gains from crypto sales has been completely eliminated for the exemption period. This removes a significant compliance burden and improves cash flow for active traders.

Important distinction: While withholding tax on capital gains is eliminated, a 15% withholding tax still applies specifically to dividends or profit-sharing distributions from digital tokens (not from trading profits). This withheld amount can typically be credited against personal income tax liability when filing annual tax returns, preventing double taxation.

VAT Exemption

To encourage cryptocurrency adoption, the Thai government has maintained a permanent exemption from the 7% Value Added Tax (VAT) on cryptocurrency transfers conducted through SEC-licensed digital asset exchanges, brokers, and dealers (established in February 2024, ongoing through 2029 exemption period).

Important caveat: VAT at 7% continues to apply to crypto transactions conducted through unlicensed platforms or informal channels. This creates a strong incentive to use regulated, licensed operators.

What Is the Crypto Tax Declaration Process in Thailand?

Ensuring compliance with Thailand’s crypto tax regulations requires a methodical approach. Even during the exemption period (2025–2029), taxpayers must follow proper procedures to document their transactions and maintain compliance. Here are the steps:

Step 1: Record and Organize Your Transactions

Maintaining detailed records of all cryptocurrency transactions throughout the year is the foundation of the declaration process. This is critical not only for compliance but also for calculating the cost basis of your assets, especially if you transferred crypto from foreign exchanges or wallets to Thai platforms.

Required transaction details:

- Date of transaction

- Type of transaction (purchase, sale, trade, swap, transfer, mining, staking reward, etc.)

- Cryptocurrency type and quantity

- Transaction amount in Thai Baht (using exchange rate at time of transaction)

- Counterparties (if applicable)

- Associated fees or costs

- Platform used (exchange name and licensing status if applicable)

- For transfers to Thai platforms: original acquisition date and cost (cost basis)

Practical tip: Most SEC-licensed exchanges in Thailand automatically provide annual transaction reports. Request a detailed export of all transactions and cross-reference with your personal records.

Step 2: Calculate Your Taxable Income

While the 2025–2029 exemption eliminates capital gains tax, you still need to calculate gains and losses for documentation and future compliance planning (post-2029).

Cost basis calculation methods: Taxpayers can choose between:

- First In, First Out (FIFO): Assets purchased earliest are assumed to be sold first

- Moving Average Cost (MAC): Calculated by averaging the cost of all units held

Capital gains calculation: Gain = Sale Price − Purchase Cost − Direct Trading Fees

Loss offsetting: Capital losses from one cryptocurrency can be offset against capital gains from other cryptocurrencies in the same tax year, provided transactions were conducted through SEC-approved exchanges.

Multi-year loss carryforward: If capital losses exceed capital gains in a tax year, excess losses can be carried forward for up to five consecutive tax years to offset future gains.

Step 3: Understand Your Tax Filing Requirements During the Exemption Period

For individuals with capital gains during 2025–2029:

If you made capital gains through SEC-licensed platforms, you are technically exempt from personal income tax on those gains. However, you may still need to file a tax return depending on other income sources. Check filing requirements based on your total income from all sources.

Filing forms for crypto-related income:

- PND.90: Main form for reporting general income, including capital gains from cryptocurrency sales, mining rewards, staking income, and salary paid in crypto. Used when you have diverse income sources.

- PND.91: Form for salaried employees or freelancers. Used if crypto is your primary work income (e.g., crypto salary payments).

- PND.94: Mid-year tax form filed July 1–September 30 for non-salary income earned January–June. Used specifically when non-salary income exceeds 60,000 THB in the first half of the year (such as mining or staking rewards).

Step 4: Submit Your Tax Declaration

For 2024 income (filed in 2025):

- Paper filing deadline: March 31, 2025

- E-filing deadline: April 8, 2025

For 2025 and later income:

- Paper filing deadline: March 31 of the following year

- E-filing deadline: Typically 8 days later (e.g., April 8)

Filing methods:

- Paper filing: Submit to your local Thai Revenue Department office in person or by mail

- E-filing: Submit electronically through the Thai Revenue Department’s official e-filing portal (more secure and convenient; digital documentation suffices)

Important note: Even though capital gains are exempt during 2025–2029, you may be required to file if you have other taxable income. Consult a tax professional if uncertain about your filing obligations.

Step 5: Maintain Records for Future Reference and Compliance

Retaining all records of cryptocurrency transactions and tax filings for at least five years is required by Thai law. These documents serve as critical evidence during potential audits and help ensure ongoing compliance as regulations evolve.

Records to retain:

- Exchange transaction confirmations

- Buy/sell order confirmations with timestamps

- Transfer records (wallet addresses, dates, amounts)

- Fair market values in Thai Baht at time of transaction

- Cost basis documentation (especially for assets acquired on foreign platforms)

- Bank statements showing deposits/withdrawals

- Any tax returns or compliance documents filed

- Communications with exchanges regarding transactions

What Are the Compliance Requirements for Crypto Tax Declaration in Thailand?

Satisfying compliance requirements established by the Thai Revenue Department and SEC is essential for maintaining transparency and avoiding penalties. These key measures include:

Transaction Reporting and Monitoring

All significant cryptocurrency transactions are monitored and must be reported by licensed platforms. The specific reporting thresholds are:

- Transactions exceeding 1.8 million THB (~$58,000 USD): Automatic reporting to Thai Revenue Department by the exchange or bank

- All transactions below this threshold: Still subject to record-keeping and potential audit review

- Reporting responsibility: Falls on the SEC-licensed exchange, broker, or dealer (not the individual taxpayer)

Strategic compliance note: Transactions executed through licensed platforms are automatically reported to authorities, creating a clear audit trail. This transparency supports compliance but also means all activity is tracked.

SEC-Licensed Platform Requirement

The five-year exemption applies exclusively to transactions through SEC-licensed digital asset businesses. This is not optional – it is the gateway to the tax benefit.

How to verify licensing:

- Visit the official Thai Securities and Exchange Commission (SEC) website at www.sec.or.th

- Check the current list of licensed digital asset exchanges, brokers, and dealers

- Confirm the platform’s SEC license number and approval date

- Take a dated screenshot as evidence of verification for tax purposes

Risk of non-compliance: Using unlicensed platforms forfeits exemption eligibility and exposes transactions to full personal income tax liability (0–35% rates apply) plus potential penalties for non-compliance.

Record-Keeping Requirements

Effective record-keeping is both a legal requirement and a practical necessity for managing your crypto tax situation.

Required documentation:

- Transaction timestamps and dates

- Wallet addresses (for transfers and fund movements)

- Exchange records and order confirmations

- Fair market values in Thai Baht at time of transaction

- Receipts and documentation of associated costs or fees

- Proof of platform licensing (screenshots or records)

- Documentation of cost basis, especially for transferred assets

Retention period: Minimum five years from the date of transaction.

Audit preparation: Organize records chronologically and by transaction type. Be prepared to explain how you calculated gains and why you used specific cost basis methods.

Strategic Crypto Tax Planning for 2025–2029 (and Beyond)

To navigate the exemption period effectively and plan for post-2029 taxation, consider these strategies:

Timing of Platform Transfers and Trades

Current advantage: Trades executed on Thai SEC-licensed platforms through December 31, 2029, are tax-free. Plan to execute high-value sales during this window.

Cost basis planning: If you hold crypto on foreign platforms with significant unrealized gains, carefully plan the timing of transfers to Thai platforms. Once transferred to a Thai platform, gains may be calculated as of the transfer date, locking in cost basis on the Thai system.

End-of-Year Tax Planning (2025–2029)

While capital gains are exempt during this period, you can still strategically manage:

- Realization timing: Realize losses from poor-performing assets before year-end to document losses for post-2029 carryforward

- Portfolio rebalancing: Execute trades that improve portfolio composition without tax consequences during the exemption period

- Future loss documentation: Establish records of realized losses now that can offset gains after 2029

Tax-Loss Harvesting Strategy

Although gains are exempt during 2025–2029, the strategy of realizing losses has value:

- Carryforward benefit: Losses realized during 2025–2029 can be carried forward (up to five years) to offset gains after the exemption expires (2030+)

- Cost basis documentation: Creates clear records for future tax years

- Example: A loss realized in 2027 can offset up to 35% marginal-rate gains in 2030–2032

Planning for Post-2029 Taxation

The exemption ends December 31, 2029. Begin planning now for what happens next:

- Tax rate environment: Expect return to progressive rates (0–35%) or a new regulatory framework

- Grandfathering opportunities: Explore whether gains realized during exemption period will be protected if regulations change

- Diversification: Consider whether to consolidate positions before exemption expires

For Expats and Non-Residents

New resident strategy: If you plan to relocate to Thailand, timing your move before major crypto sales may allow you to benefit from the exemption if you become a tax resident during the 2025–2029 window.

Foreign income remittance planning: Recent rule changes (effective January 1, 2024) mean all foreign-sourced income earned by Thai tax residents is taxable, regardless of remittance year. However, a proposed exemption may allow foreign income brought into Thailand within two years of earning to be tax-free. Monitor legislative updates.

Can I Offset My Losses From Cryptocurrency Transactions to Reduce My Tax?

Yes, capital losses from cryptocurrency transactions can be strategically used to reduce overall tax liability under specific rules:

Capital Gains and Losses Treatment

- Gains and losses from sales/exchanges of cryptocurrencies are treated as capital gains or losses for tax purposes

- Gains from mining, staking, or payments in crypto are treated as ordinary income, not capital gains (different rules)

- Holding period: Thailand does NOT differentiate between short-term and long-term capital gains (no preferential rates for long-term holdings), unlike some jurisdictions

Offsetting Losses Against Gains

- Same-year offsetting: Capital losses from any cryptocurrency can be offset against capital gains from any other cryptocurrency in the same tax year

- Requirement: Transactions must be conducted through SEC-approved digital asset exchanges to qualify for loss offsetting

- No partial limitation: There is no limit to the amount of losses you can offset against gains in a single year

Carrying Forward Excess Losses

- Multi-year carryforward: If capital losses exceed capital gains in a particular tax year, the excess losses can be carried forward for up to five consecutive tax years

- Usage: The carried-forward losses offset capital gains realized in future years

- Expiration: Losses can be carried forward only through the fifth year; they cannot be used beyond that period

Important Limitation: No Offset Against Other Income

Critical restriction: Losses from cryptocurrency transactions cannot be offset against other types of income, such as:

- Employment salary

- Business income

- Rental income

- Investment dividends (non-crypto)

- Interest income

This means crypto losses are isolated to offset only crypto gains, not overall income.

Documentation and Compliance for Loss Offsetting

To claim loss offsetting, you must:

- Maintain comprehensive documentation:

- Trade records with purchase and sale dates

- Transaction amounts and valuations in Thai Baht

- Platform transaction confirmations

- Cost basis calculations using FIFO or MAC method

- Report on your annual tax return (Forms PND.90, PND.91, or PND.94):

- Clearly identify capital gains and losses

- Show the calculation methodology (FIFO or MAC)

- Document the offsetting calculation

- Explain any carryforward of excess losses

- Maintain records for five years:

- All trades and valuations

- Loss offsetting calculations

- Proof of SEC-licensed platform usage

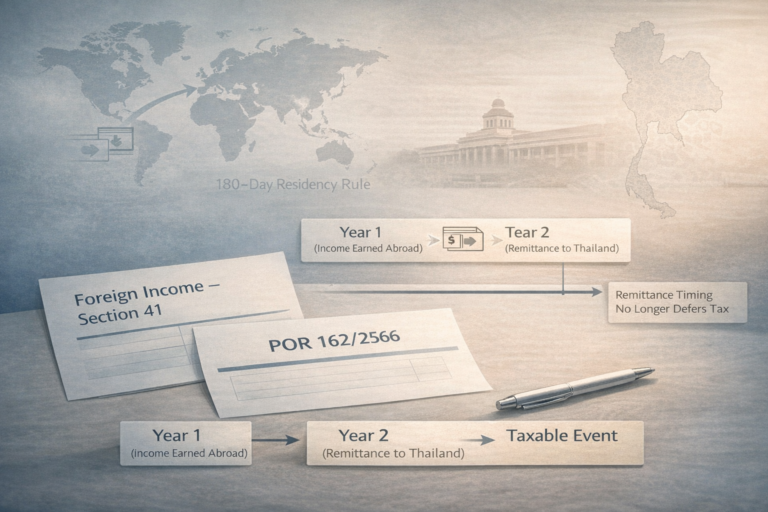

Foreign-Sourced Crypto Income and Remittance Rules

Thailand’s treatment of foreign-sourced cryptocurrency income changed significantly effective January 1, 2024, with potential further updates on the horizon.

The Remittance Rule and Crypto

Current rule (as of January 1, 2024):

- Foreign-sourced income is taxable in Thailand if earned by a Thai tax resident (180+ days in Thailand in the tax year)

- Taxability does NOT depend on when the income is remitted – it applies in the year earned

- Previously, foreign income was taxable only if remitted the same year earned; this restriction was removed

Practical Application to Crypto Holdings

Scenario A: Crypto sold on foreign exchange (e.g., Coinbase US) by Thai resident in 2025

- The gain is subject to Thai tax even if proceeds stay in the foreign account

- Bringing fiat into Thailand later doesn’t change taxability – it was taxable when earned

- Exception: If you were not a Thai tax resident when you sold (under 180 days), the income may not be taxable

Scenario B: Crypto transferred to Thai platform and sold in Thailand by Thai resident in 2025

- For the 2025–2029 exemption period: 0% tax if using SEC-licensed platform

- Cost basis issue: If the crypto was acquired outside Thailand at a gain, that gain is isolated to the Thai transaction calculation

Scenario C: Carrying forward foreign gains to Thai resident status (Post-2024 rule change)

- If you earned crypto gains in 2023 (as non-resident) and moved to Thailand as tax resident in 2024, the 2023 gains generally are NOT taxable in Thailand

- However, this is an area of recent regulatory change – consult a tax professional for your specific situation

Proposed Foreign Income Exemption (Pending Clarification)

Thailand’s Revenue Department has proposed a new exemption for foreign-sourced income that would allow:

- Foreign income earned from January 1, 2024, onwards to be exempt if remitted to Thailand within two calendar years of earning

- This could apply to crypto gains but requires legislative approval

- Status: Proposed but not yet enacted as of December 2025

Important Tax Dates and Deadlines for 2025 and Beyond

| Event | Deadline | Notes |

|---|---|---|

| Crypto gains from 2024 (paper filing) | March 31, 2025 | Submit to local Revenue Department office |

| Crypto gains from 2024 (e-filing) | April 8, 2025 | Submit via Thai Revenue Department online portal |

| Non-salary income threshold filing (PND.94) first half of year | July 1 – September 30, 2025 | File if non-salary income Jan–June exceeds 60,000 THB |

| Crypto gains from 2025 (paper filing) | March 31, 2026 | For income earned Jan–Dec 2025 |

| Crypto gains from 2025 (e-filing) | April 8, 2026 | For income earned Jan–Dec 2025 |

| Tax exemption period ends | December 31, 2029 | After this, capital gains tax rates return to progressive structure (0–35%) |

Common Misconceptions About Crypto Taxation in Thailand

Misconception 1: “Crypto gains are always tax-free in Thailand”

- Reality: Only if you are an individual trading via SEC-licensed platform during 2025–2029. Companies pay 20% tax. Trading on unlicensed platforms forgoes exemption.

Misconception 2: “Transfers between wallets are a taxable event”

- Reality: Moving crypto between wallets you own is not taxable. Tax is triggered only when crypto is sold or converted to fiat currency.

Misconception 3: “I don’t need to track cost basis if gains are exempt”

- Reality: You must maintain cost basis records for at least five years for audit purposes and for post-2029 planning. Also required for loss offsetting calculations.

Misconception 4: “Thai exchanges don’t report my transactions to authorities”

- Reality: SEC-licensed exchanges automatically report transactions exceeding 1.8 million THB and may report other significant transactions. All activity is tracked.

Misconception 5: “I can claim crypto losses against my salary income”

- Reality: Capital losses from crypto can only offset capital gains from crypto, not other income types.

Misconception 6: “The 5-year exemption applies to companies”

- Reality: The exemption applies only to individuals. Companies remain subject to 20% corporate income tax on crypto gains.

Our Thoughts

Thailand has positioned itself as one of the world’s most progressive jurisdictions for cryptocurrency taxation. By introducing a five-year capital gains exemption (2025–2029), eliminating withholding tax on capital gains, maintaining VAT exemption, and implementing clear SEC-licensed platform requirements, the government has created a highly attractive environment for both domestic and international crypto investors.

The regulatory framework is increasingly mature and transparent, with the Thai Securities and Exchange Commission providing clear licensing standards and the Revenue Department publishing detailed guidance. However, the exemption has a defined endpoint (December 31, 2029), and tax residents of Thailand must remain vigilant about compliance with other regulations, particularly regarding:

- Foreign income remittance rules (changed effective January 1, 2024)

- Mandatory use of SEC-licensed platforms to qualify for exemptions

- Five-year record-keeping requirements

- Potential future rule changes post-2029

Strategic takeaway: Investors should view the 2025–2029 period as a window of opportunity to consolidate positions and plan cost basis strategies, while simultaneously building compliant records that will support tax filings after the exemption expires.

Thailand’s approach demonstrates that clear regulation and reasonable tax incentives can encourage legitimate market participation, regulatory compliance, and innovation. Investors who adopt a compliant posture now – using SEC-licensed platforms, maintaining detailed records, and understanding the rules -are well-positioned to benefit from this strategic tax environment.

Disclaimer

This article is for informational purposes only and does not constitute legal or tax advice. Cryptocurrency taxation is complex and subject to change. Tax residency determination, treatment of foreign income, and specific transaction analysis require professional evaluation based on individual circumstances. Consult a qualified tax professional or legal advisor licensed in Thailand before making tax planning decisions or filing tax returns.

Last Updated: December 27, 2025

Regulatory Sources: Ministerial Regulation No. 399 (B.E. 2568), Thai Revenue Code, Thai Securities and Exchange Commission (SEC) Guidelines

For More Information: Visit www.rd.go.th (Thai Revenue Department) or www.sec.or.th (Thai Securities and Exchange Commission)