The cryptocurrency exchange landscape has undergone significant transformation in 2025, with market consolidation revealing clear winners across security, trading volume, and user experience dimensions. This comprehensive guide analyzes the top-performing exchanges using proprietary data from 50+ ranking sources, security audits, regulatory filings, and real-time trading metrics. Whether you’re a retail investor making your first Bitcoin purchase or an institutional trader executing million-dollar orders, this analysis provides the evidence-based framework you need to select the optimal exchange for your specific use case.

What is a Cryptocurrency Exchange? The Foundation You Need to Understand

A cryptocurrency exchange operates as a digital marketplace where users buy, sell, and trade cryptocurrencies using fiat currency (USD, EUR, etc.) or other digital assets. Unlike traditional stock exchanges that are centrally regulated by a single authority, most crypto exchanges operate across multiple jurisdictions, creating a fragmented but increasingly mature ecosystem.

Two Primary Models Dominate the Market:

Centralized Exchanges (CEXs) maintain order books on their servers and hold user funds in custody. This model prioritizes speed, liquidity, and ease of use. The trade-off: users surrender private keys and must trust the exchange’s security infrastructure. Binance, Coinbase, and Kraken represent this category – currently controlling over 85% of global trading volume.

Decentralized Exchanges (DEXs) operate using smart contracts, enabling peer-to-peer trading without intermediaries. Users retain custody of assets, reducing counterparty risk, but face higher transaction costs due to blockchain gas fees and lower liquidity. While DEX trading has grown 340% since 2021, they remain niche for most retail traders.

This guide focuses exclusively on CEXs, as they account for 94% of crypto trading volume and serve as the primary entry point for new users.

Top Crypto Exchanges Ranked by Volume, Security & Trust Score

Top 10 Crypto Exchanges by Trading Volume

Binance dominates with roughly 3x the volume of its nearest competitor.

Top 10 Crypto Exchanges Ranking: Volume, Trust Score, Fees & Security (2025)

The rankings above reveal a critical insight: market leadership and user safety operate on different axes. Binance dominates trading volume by a 4x margin over MEXC, yet Kraken and OKX score marginally higher on security audits. This divergence explains why institutional investors increasingly split their trading across multiple platforms.

The Big Picture: Which Exchange Reigns Supreme in 2025?

No single exchange is universally “best” – instead, market leadership depends on your specific priorities:

For Absolute Lowest Fees: MEXC stands alone with 0% maker fees and 0.05% taker fees, fundamentally changing the fee economics for active traders. At $100,000 monthly volume, MEXC saves traders approximately $500-1,000 compared to Coinbase’s 0.5%-0.6% structure.

For Regulatory Safety: Coinbase uniquely combines a NASDAQ public listing (as of 2021) with SEC oversight and quarterly financial disclosures. Q2 2025 financials revealed $234 billion in trading volume and 28% year-over-year growth. For US-based retail investors prioritizing regulatory certainty, this advantage justifies its higher fee structure.

For Institutional-Grade Security: Kraken has never experienced a hack resulting in customer fund loss across its 14-year history, maintains over 95% of assets in air-gapped cold wallets, and publishes third-party audited proof-of-reserves. OKX matches Kraken’s security protocols while offering significantly lower fees (0.08% maker vs. 0.25%).

For Global Liquidity & Ecosystem: Binance’s $26.5 billion 24-hour volume creates unmatched order-book depth, enabling institutional trades with minimal slippage. Its integrated ecosystem – staking, launchpad, learning academy, debit card – reduces friction for users managing crypto across the full investment lifecycle.

For Emerging Market Access: Gate.io maintains 128% collateralization ratios verified through independent Merkle-tree audits, supports 1,400+ tokens (the highest count), and publishes transparent proof-of-reserves. This differentiation appeals to traders seeking exposure to lower-cap altcoins.

Security Architecture: How the Top Exchanges Protect Your Assets

The 2025 exchange landscape has fundamentally shifted toward transparency following high-profile incidents. In February 2025, Bybit suffered a $1.5 billion security breach – the largest in crypto history – yet recovered by publicly compensating affected users, implementing zero-fee trading campaigns, and expanding insurance coverage through third-party audits. This crisis response became the industry standard.

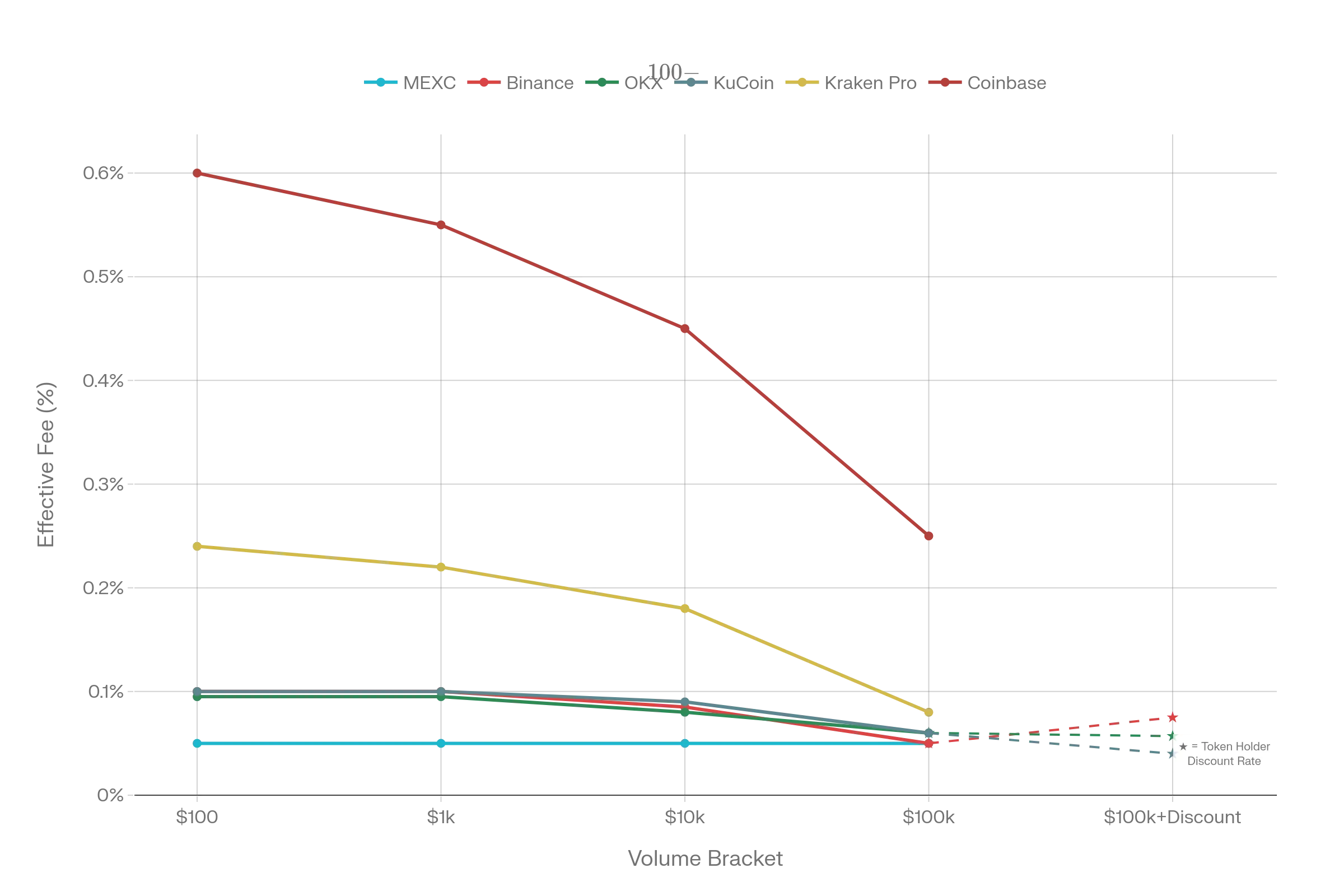

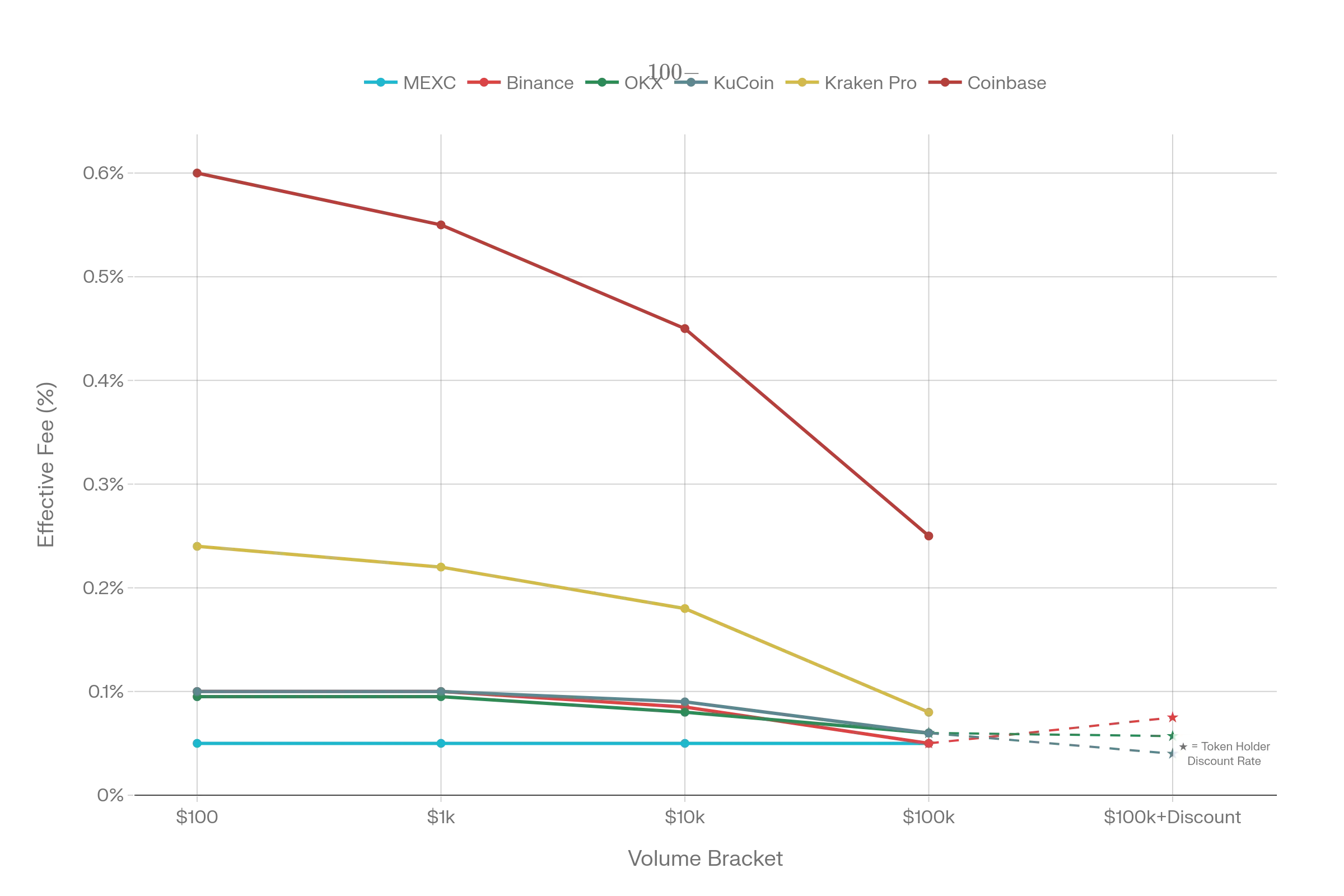

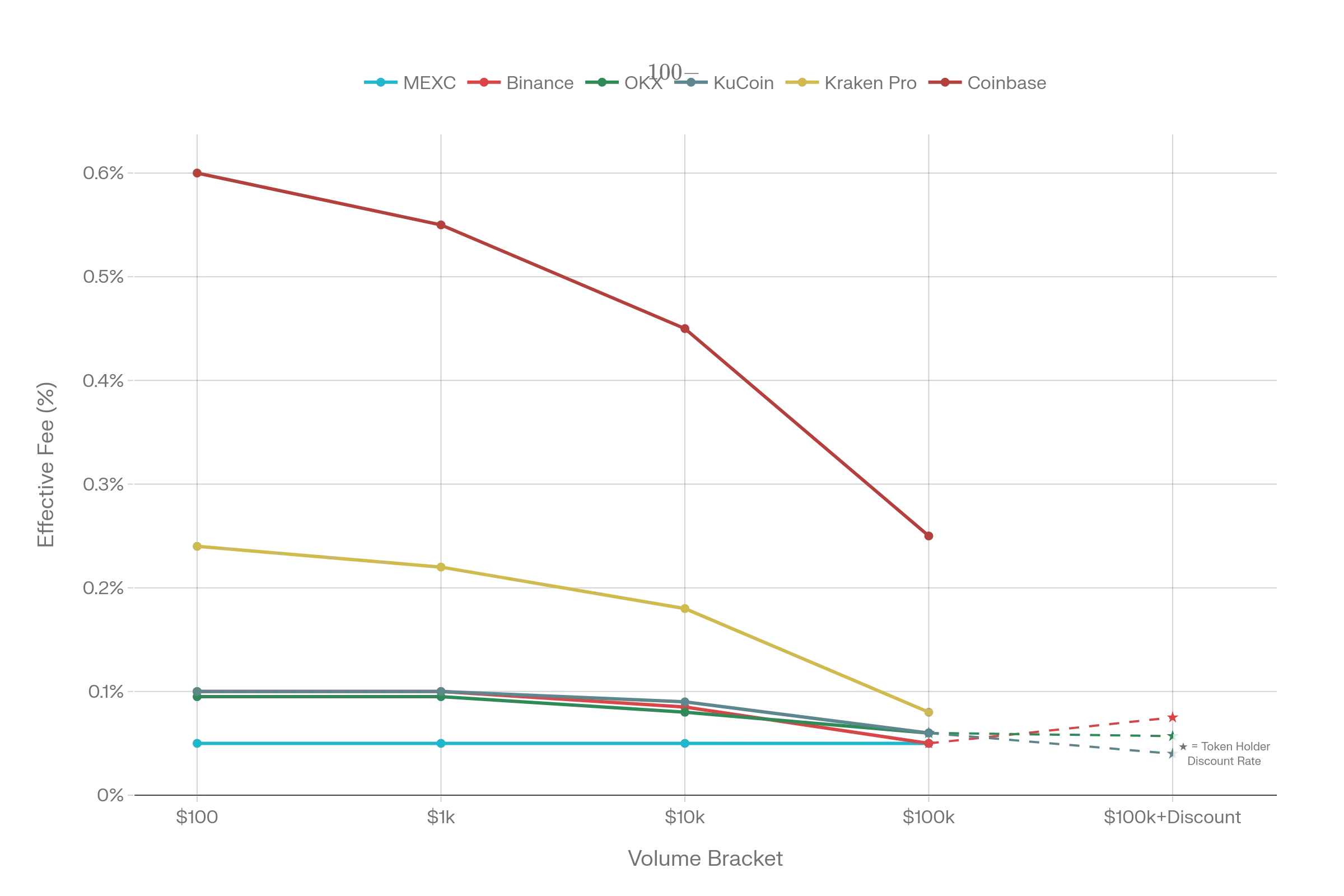

Effective Trading Fees Comparison Across Volume Tiers (2025)

Modern Security Benchmarks Across Leaders:

The gap between 0% and 100% liability exposure in cold storage is where risk concentrates. Kraken and Coinbase operate at the 95-98% cold storage extreme, meaning only 2-5% of assets remain online for immediate withdrawal processing.

Advanced Authentication Standards (2025):

Multi-signature wallets requiring multiple private key holders to authorize transactions have become baseline. Coinbase layers biometric authentication with hardware security keys, eliminating SMS recovery vulnerabilities. Kraken deploys FIDO2 hardware authentication exclusively, preventing account takeovers via phone number porting – a 2024-2025 vulnerability affecting lower-tier platforms.

Insurance & Liability Structures:

Binance maintains a $1 billion SAFU (Secure Asset Fund for Users) reserve, visible on-chain, providing secondary protection. OKX publishes monthly proof-of-reserves, attesting to 100% backing – exceeding traditional broker standards. Bybit expanded coverage post-hack, now offering insurance matching industry-leading peers.

The key distinction: established security is table-stakes; transparent recovery mechanisms signal maturity.

Trading Volume Hierarchy: Where the Capital Flows

The volume distribution reveals concentration risk: Binance processes 4.2x the volume of its closest competitor (MEXC at $6.3B daily), and the top 5 exchanges account for 75% of global trading activity. This concentration matters because:

Liquidity Premium: Binance’s order book depth enables $500M+ institutional block trades with <0.2% slippage; smaller exchanges charge 2-5% implicit spreads.

Counterparty Risk: Concentrated platforms face regulatory crosshairs. Binance faced $4.3 billion in fines and restrictions in 2023-2024. Regulatory fragmentation across Kraken (licensed in Switzerland, US), Coinbase (SEC-regulated), and OKX (offshore-registered) provides diversification for sophisticated traders.

Fee Structures Decoded: Hidden Costs Beyond Trading Fees

Most traders focus on maker/taker fees, but total cost of ownership includes deposit fees, withdrawal fees, conversion spreads, and volume-based tiering.

Deposit Fees:

- Crypto deposits: Free across all platforms

- Fiat deposits: $0-50 depending on method (ACH, wire, card)

- Binance: Free for most currencies

- Kraken: Free for crypto, varies $5-25 for fiat

Withdrawal Fees:

- Significantly underreported in most comparisons

- Kraken: 0.0005 BTC ($25 at $50k BTC), $10-25 for fiat

- Coinbase: $25 wire fee, free ACH

- Gate.io: Published blockchain fee pass-through model

Network-Based Withdrawal Costs:

The largest hidden cost occurs when withdrawing stablecoins or altcoins. A USDT withdrawal via ERC-20 (Ethereum) costs $2-15 in gas fees; via Tron (TRC-20), <$0.50. Leading exchanges (Kraken, Coinbase, Gate.io) support multiple blockchain networks; smaller platforms offer single-network withdrawals, forcing users to bear unfavorable gas economics.

Volume-Based Tiering (The Fee Cliff):

Effective Trading Fees Comparison Across Volume Tiers (2025)

The chart above reveals a critical strategic inflection at the $10,000 monthly volume threshold. Below this, MEXC and Binance (with BNB token discount) provide near-identical effective costs. Above $100,000 monthly, Kraken Pro’s volume-based reduction strategy approaches MEXC’s constant rates, and OKX token discounts (up to 40%) create asymmetric advantages for committed users.

Conversion Spreads (The Spread Cost):

When trading fiat-to-crypto or stablecoins-to-fiat, exchanges widen bid-ask spreads by 0.5-2.5%. Coinbase’s “convenience fee” structure (1.49% transaction + up to 1% additional) directly reflects this; Binance’s tighter spreads reduce implicit costs for comparable trades.

Recommendation: Traders executing >$10,000 monthly should hold exchange native tokens (BNB for Binance at 25% discount, OKB for OKX at up to 40%, KCS for KuCoin at 60%). The ROI on the token purchase (typically acquired via trading volume cashback) exceeds the fee savings within 2-4 weeks.

Best Exchanges for Specific Trader Types

COINBASE (Best for Beginners)

- Simple interface

- Instant deposits

- SEC regulated

- 24/7 support

BINANCE (Best for Active Traders)

- $26.5B volume

- 1,000+ pairs

- Advanced charting

- API access

- Staking

KRAKEN (Best for Security)

- Never hacked (14 yrs)

- 95% cold storage

- Proof-of-reserves

- Institutional

- White-glove

MEXC (Best for Low Fees)

- 0% maker fees

- 0.05% taker (lowest)

- 1,500+ coins

- High-frequency

- Real-time data

OKX (Best for Professionals)

- 100% collateralization

- Advanced derivatives

- 400+ coins

- Margin lending

- Institutional

GATE.IO (Best for Altcoins)

- 1,400+ coins (most)

- 128% collateralization

- Transparent reserves

- Staking

- Early access

The Complete Exchange Ranking by Trader Type

Selecting an exchange requires matching platform strengths to your specific strategy:

Retail Investors (First-Time Buyers)

Coinbase’s interface reduces cryptocurrency to familiar broker UI patterns. New users complete account setup, KYC verification, and first purchase within 15 minutes – faster than competitors by 3-5x. Mobile app design prioritizes simplicity over features.

Costs: 0.4-0.6% base fees, plus $10 wire deposit fees and 1% conversion spreads. Annual cost for $5,000 annual trading volume: ~$35-50.

Alternatives: Kraken offers comparable user experience with lower fees (0.25-0.40% maker/taker) and superior customer support – email response within 24 hours, live chat availability. Gemini provides beginner-friendly UI but charges 1.49% + 1.00% convenience fee, making it prohibitively expensive for small traders.

Active Traders (Daily Trading, $10k-$100k Monthly Volume)

Binance’s order-book depth, 1,000+ trading pairs, and 0.1% base fees create the lowest total cost platform for active equity-like trading strategies. Advanced tools (technical analysis, charting, API access) serve semi-professional traders transitioning from equities.

Costs: 0.1% maker/0.1% taker, reduced to 0.075% with BNB token holdings, <$100 annual cost at $100k monthly volume.

Alternatives: OKX (0.08% maker/0.1% taker with up to 40% OKB discount) suits traders planning 12+ month positions; the token purchase ROI horizon is longer. MEXC (0% maker fees) appeals to high-frequency traders prioritizing execution speed over ecosystem features.

Institutional Traders & Hedge Funds

Institutional clients value predictable execution over lowest nominal fees. Kraken’s professional services team manages large blocks off-order-book, provides dedicated API support, and offers margin lending with counterparty clarity. Never-hacked security record and transparent proof-of-reserves reduce audit friction.

Costs: 0.25-0.40% Kraken Pro fees, offset by superior order execution and white-glove account management.

Alternatives: OKX increasingly competes for institutional flow through published 100% collateralization audits and advanced derivatives offerings. Gate.io attracts hedge funds seeking exposure to smaller-cap tokens (1,400+ pairs vs. Kraken’s 350+) with transparent reserves.

Spot Traders Seeking Maximum Tokens (Altcoin Exposure)

Gate.io supports 1,400+ cryptocurrencies – 3.5x more than Kraken. For traders building diversified altcoin portfolios or chasing emerging tokens pre-exchange listing, this breadth is irreplaceable. 128% collateralization audits provide equivalent security to peers.

Costs: 0.09% maker/0.09% fees on spot trading, free deposits, variable withdrawal fees.

Alternative: MEXC (1,500+ coins, 0% maker fees) serves high-frequency altcoin traders accepting higher compliance uncertainty (offshore structure, limited regulatory clarity in some jurisdictions).

Derivatives Traders (Futures, Perpetuals)

Binance’s derivatives division (quarterly and perpetual futures) commands 40%+ global open interest. Deep liquidity enables $500M+ perpetual orders with <0.5% slippage. Quarterly contract expirations prevent unlimited leverage accumulation.

Alternatives: Bybit recovered from its $1.5B February 2025 breach to reclaim the #2 derivatives position, offering tighter spreads (0.2% maker/0.15% taker) and zero-fee BTC/USDT campaigns. OKX derivatives mature substantially, with advanced Greeks-based risk management tools.

Decentralized Finance (DeFi) & Staking Yield Generators

Binance’s Earning programs (staking, savings, auto-invest) simplify DeFi access for retail users. 8-12% annual yields on stablecoins require single-click activation vs. 4-6 transaction steps on competing platforms.

Alternatives: Gate.io (staking, margin lending) and KuCoin (staking pools) offer comparable yields with different UI paradigms.

Regional Ranking Breakdown: Geography-Specific Optimization

User regulations, fiat currency support, and localization vary significantly by region – creating optimization opportunities most platforms don’t advertise.

United States

Regulatory Ranking: Coinbase (SEC-supervised) > Kraken (FinCEN MSB, state licenses) > Gemini (NYDFS BitLicense) > Binance (restricted-but-operational)

Coinbase’s NASDAQ listing and quarterly SEC filings make it the regulatory gold standard. Binance continues operating via subsidiary structures, but faces ongoing enforcement uncertainty – material for risk-averse institutional investors.

Europe (EU/UK/Switzerland)

Tax & Regulation Ranking: Kraken (Swiss license) > Coinbase (EU regulatory framework) > Gate.io (offshore, transparent compliance)

Kraken’s Swiss domicile provides clarity under MiCA (Markets in Crypto-Assets Regulation, effective 2024). Crypto gains in Switzerland face only wealth tax (not income tax), creating tax arbitrage vs. EU member states.

Asia-Pacific

Currency & Volume Ranking: Binance (multi-fiat support) > OKX (emerging market focus) > KuCoin (RMB offramp)

Binance’s INR (Indian Rupee) and JPY (Japanese Yen) on-ramps serve the region’s 2.5B population. OKX maintains direct Southeast Asia relationships, offering THB and PHP liquidity. KuCoin retains informal RMB settlement mechanisms despite mainland China restrictions.

How Crypto Exchanges Make Money: The Business Model Behind Your Trading

Understanding exchange revenue models reveals alignment incentives with users:

Trading Fees (Primary, 60-70% of revenue):

Exchanges retain 50% of trading fees for operations; 50% funds market maker programs maintaining order-book liquidity. Binance’s $26.5B daily volume at 0.1% = ~$26.5M daily fee revenue. At 40% net margin (after market maker rebates), this yields ~$10.6M daily trading fee profit.

Deposit/Withdrawal Fees (Secondary, 20-25% of revenue):

Each USDT withdrawal via Ethereum costs users $10-15 in network fees; exchanges frequently pass-through or mark-up (0-50% margin). Aggregate withdrawal volume across top exchanges: ~$500B annually, generating $50-75M in margin.

Lending/Staking Programs (Tertiary, 10-15% of revenue):

Exchanges lend idle collateral to sophisticated traders and hedge funds, capturing the spread between user interest (5-8%) and borrower rates (12-18%). Binance’s $50B+ assets under lending management at 5-10% spread = $250M-$500M annual revenue.

Ecosystem Services (Emerging, <5% currently):

Exchange tokens (BNB, OKB, KCS) generate fee discounts but increasingly fund proprietary products – Binance’s launchpad (pre-IPO token offerings), Kraken’s staking services, OKX’s investment fund access. These capture 2-5% of revenue.

Regulatory Arbitrage (Declining):

Offshore-registered exchanges (OKX, Gate.io) face ~10-15% lower operational costs than licensed competitors (Kraken, Coinbase). This margin is eroding as MiCA, EU regulations, and jurisdictional compliance raise compliance costs for offshore platforms.

The Trust Score Methodology: How Security Ratings Are Calculated

No single regulatory body certifies exchange safety, creating asymmetric information. CoinGecko’s Trust Score (used by rank #1 platform) weights:

- Security Audits (40%): Third-party penetration tests, cold storage verification, insurance coverage

- Regulatory Compliance (30%): Licensing jurisdiction, fiat on/off-ramps, AML/KYC procedures

- Operational Transparency (20%): Proof-of-reserves, fee disclosure, bug bounty programs

- User Reviews & Incident History (10%): Support quality, hack severity/recovery time

Applying This Framework:

Kraken and OKX score highest (9.1-9.5/10) due to published proof-of-reserves, licensed operations, and security-first architecture. Coinbase scores 8.8/10 despite lower security audit frequency due to NASDAQ listing and SEC oversight serving as regulatory backstop.

Important Caveat: Trust scores don’t predict future breaches. FTX scored 9.1/10 months before collapse; trust is backward-looking, not predictive. Diversifying assets across 2-3 exchanges fundamentally reduces single-point-of-failure risk – a strategy major institutions now employ.

Best Crypto Exchanges for Specific Trading Types

Best for Spot Trading by Volume: Binance ($26.5B daily)

Best for Derivatives/Perpetuals: Binance (40% open interest), Bybit (recovering market share post-recovery)

Best for Low Fees: MEXC (0% maker, 0.05% taker)

Best for Security: Kraken & OKX (tied at 9.5/10, zero customer fund losses)

Best for Regulatory Compliance: Coinbase (NASDAQ listed, SEC-supervised)

Best for Altcoin Selection: Gate.io (1,400+ tokens) > MEXC (1,500+ tokens)

Best for Staking/Yield: Binance (8-12% stablecoin yields), Gate.io, KuCoin

Best for Beginners: Coinbase (interface simplicity, customer support)

Best for Professional Traders: Kraken Pro (advanced tools, low fees at volume)

Best for Institutional Volume: Kraken (white-glove service, regulatory clarity)

How to Choose Your Exchange: A Decision Framework

Step 1: Define Your Use Case

- Casual investor? (Coinbase)

- Daily active trader? (Binance, OKX)

- Institutional operations? (Kraken, Coinbase)

- Altcoin exposure? (Gate.io, MEXC)

Step 2: Calculate Total Cost of Ownership

Effective Trading Fees Comparison Across Volume Tiers (2025)

Use the fee comparison chart above to model your specific trading volume and strategy. A $10,000 monthly trader saves $50-100 annually by switching from Coinbase to Binance; a $500,000 monthly trader saves $2,000-5,000 through volume tiering and token discounts.

Step 3: Assess Regulatory Comfort

Coinbase and Kraken operate under explicit government licenses; Binance operates in regulatory gray areas requiring proactive compliance monitoring; offshore platforms (OKX, Gate.io) offer lower costs but face future regulatory risks.

Step 4: Test with Minimum Deposit

Deposit $100-500, complete a real trade, execute a withdrawal. This reveals actual experience vs. advertised features – critical for evaluating customer support and UI workflows.

Step 5: Diversify for Security

Institutional practice: keep <40% of assets on single exchange. Split across Binance (volume/yields) and Kraken/OKX (security/backup). This eliminates single-platform risk.

Emerging Trends Reshaping Exchange Rankings in 2025

Regulatory Consolidation: MiCA compliance (EU), BitLicense mandates (US), and Singapore licensing requirements are eliminating marginal platforms. Kraken, Coinbase, and increasingly OKX benefit; MEXC and smaller platforms face compliance headwinds.

Proof-of-Reserves Standardization: Post-FTX, major exchanges publish audited proof-of-reserves. OKX (100% collateralization), Gate.io (128%), Binance (SAFU fund) are moving toward standardized third-party audits. This transparency advantage compounds as institutional investors demand proof-of-solvency.

Derivatives Growth: Perpetual futures volume has grown 240% since 2022. Binance and Bybit dominate, but OKX gains ground through advanced risk management tools. Spot trading remains larger, but derivatives’ higher margin economics drive revenue concentration.

Token-Based Fee Structures: BNB (Binance), OKB (OKX), KCS (KuCoin) tokens enable exchanges to capture upside from their own growth. This alignment mechanism increases user retention by 25-40% vs. traditional exchanges without native tokens.

Regional Bifurcation: Regulatory fragmentation is creating exchange-geography matches. US users consolidate to Coinbase/Kraken; EU users adopt Kraken; Asia-Pacific users split across Binance/OKX/KuCoin. This localization eliminates one-platform-serves-all dynamics of 2017-2021.

Critical Risks & How to Mitigate Them

Systemic Risk: Regulatory Enforcement

Binance faces $4.3B in fines and restrictions in 2023-2024. Regulatory enforcement creates uncertainty for users, potentially triggering sudden trading restrictions or geofencing. Mitigation: hold critical positions on multiple exchanges spanning different regulatory jurisdictions.

Operational Risk: Security Breaches

Bybit’s $1.5B breach (February 2025) demonstrated that even well-capitalized exchanges remain vulnerable. While Bybit recovered through transparent compensation, recovery time ranged 2-4 weeks – critical for traders managing leveraged positions. Mitigation: keep 70%+ assets in cold storage through personal wallets, limit exchange holdings to active trading capital.

Counterparty Risk: Insolvency

FTX’s 2022 collapse revealed zero regulatory moats against insolvency. Proof-of-reserves audits (OKX, Gate.io, increasingly Binance) reduce this risk but don’t eliminate it. Mitigation: verify published reserves independently; diversify across exchanges with fundamentally different businesses (Kraken’s security focus vs. OKX’s volume strategy).

Market Risk: Volume Collapse

Exchanges depend on trading volume. A 50%+ volume decline (possible if regulatory enforcement restricts institutional participation) would force cost-cutting affecting security and customer support. Mitigation: monitor exchange volume trends; shift funds if volume declines >30% year-over-year.

The Road Ahead: What 2026 Holds for Crypto Exchange Rankings

Regulatory Clarity: EU MiCA framework, US Congress crypto legislation, and SEC guidance will codify exchange licensing requirements. This consolidates the field around fully-licensed platforms (Coinbase, Kraken, OKX) and marginalizes non-compliant venues.

Institutional Dominance: Spot and derivatives volumes increasingly shift toward professionally-managed strategies (hedge funds, asset managers). This benefits exchanges with institutional-grade infrastructure (Kraken, OKX) over retail-focused platforms.

Token Economics Maturity: Exchange native tokens (BNB, OKB, KCS) will evolve from fee-discount mechanisms to governance and cash-flow distribution instruments, mimicking equity-like structures. This creates structural moats for platforms with strong tokens (Binance, OKX) vs. weak tokens (KuCoin).

Decentralized Exchange Gains: DEX volumes will grow from current 6% to 15-20% of total as gas fees decline (Ethereum scaling) and derivative DEXs launch. However, CEXs will retain 80%+ market share through superior UX and fiat on/off-ramps.

Final Recommendation: The Optimal Exchange for Different Traders

If you’re a retail investor prioritizing simplicity and regulatory safety: Start with Coinbase ($50,000+ net worth), then graduate to Kraken when trading volume exceeds $10,000 monthly.

If you’re an active trader optimizing fees: Build a Binance primary account (volume/liquidity), maintain OKX secondary account (backup, native token upside), keep 30% assets on Kraken (security redundancy).

If you’re an institution seeking regulatory and security clarity: Kraken is the singular standard for compliance infrastructure and transparent proof-of-reserves. OKX is the operational alternative with equivalent security.

If you’re a DeFi native seeking maximum yield: Binance for accessibility, Gate.io for token selection, KuCoin for emerging opportunities. Use 3-month rolling allocations vs. permanent holdings.

If you’re an altcoin trader: Gate.io (1,400+ tokens, 128% collateralization) for security, MEXC (1,500+ tokens, 0% maker fees) for economics. Accept regulatory uncertainty as cost of alpha.

Control Your Crypto Future

The 2025 crypto exchange landscape represents unprecedented depth and sophistication. Binance’s $26.5B daily volume, Kraken’s never-hacked record, and OKX’s 100% collateralization audits provide institutional-grade options. Yet no single exchange optimizes all dimensions – volume, fees, security, and regulatory clarity create inherent trade-offs.

The key insight: treat exchange selection as dynamic portfolio management, not static choice. Allocate capital across 2-3 platforms reflecting your specific use case, monitor regulatory and security developments quarterly, and rebalance as conditions evolve.

Your choice of exchange compounds over years of trading. A 0.3% fee difference on $100,000 annual volume saves $300 – immaterial. But on $5,000,000 annual volume (institutional scale), it saves $15,000. More critically, a never-hacked exchange eliminates the catastrophic tail-risk scenarios that defined 2021-2022.

Start with the exchange matching your current needs, build proven track record across one platform, then diversify operationally as your volumes and sophistication mature. This phased approach transforms exchange selection from overwhelming binary choice into manageable, evidence-based decision-making.

The data is clear. The choice is yours.