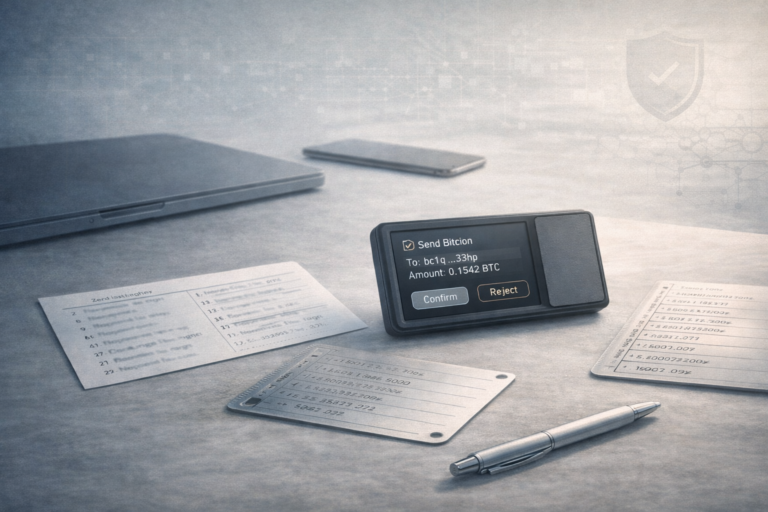

Best Hardware Wallets 2026: How to Choose the Safest Crypto Wallet for Cold Storage

The crypto landscape in 2026 is unforgiving. With phishing attacks becoming automated and supply chain risks rising, the “buy a Ledger and forget it” advice of 2022 is no longer sufficient. Your safety now depends as much on how you use the…