Bitcoin and cryptocurrencies are completely legal to own, trade, and invest in Thailand – provided you use a Securities and Exchange Commission (SEC) licensed platform. As of 2025, nine major exchanges and dozens of brokers operate under regulatory oversight, offering Thai investors secure, compliant access to digital assets. Better yet, the Thai government has introduced a 5-year capital gains tax exemption (2025-2029) on all crypto profits earned through licensed platforms, making Thailand one of the world’s most crypto-friendly markets.

This guide covers everything you need to know to safely buy your first Bitcoin in Thailand, select the best app for your needs, understand the regulatory landscape, and protect your assets from security risks that claim millions globally.

Section 1: Is Bitcoin Legal in Thailand? The Regulatory Framework Explained

Yes, Bitcoin and cryptocurrencies are completely legal in Thailand – but with important conditions.

Thailand’s regulatory approach distinguishes itself from countries with blanket bans or gray zones. Under the 2018 Digital Asset Business Emergency Decree and overseen by the Thai Securities and Exchange Commission (SEC), cryptocurrency is classified as a “digital asset,” not a currency. This means:

- Private ownership is legal: You can buy, hold, and sell crypto without restriction.

- Trading must be licensed: You must use only SEC-licensed exchanges, brokers, or dealers to buy and sell. Using unlicensed platforms violates Thai law and exposes you to scams with no legal recourse.

- Not legal tender: Businesses cannot be forced to accept Bitcoin as payment, and the Bank of Thailand discourages its use for everyday transactions due to volatility and security risks.

The 2025 Regulatory Crackdown on Unlicensed Platforms

In May 2025, Thailand took decisive action against unauthorized exchanges. The SEC announced that five major international platforms – Bybit, OKX, CoinEx, 1000X.live, and XT.COM – would be blocked from June 28, 2025. These platforms were operating illegally by serving Thai users without obtaining SEC licenses.

The takeaway: If an exchange doesn’t explicitly state it’s SEC-licensed or regulated by Thailand’s Ministry of Finance, avoid it. Your funds receive zero legal protection, and the platform may be shut down overnight.

Dual Regulatory Oversight

All crypto platforms in Thailand operate under dual supervision:

- Thai SEC: Licensing, operational standards, consumer protection, and cryptocurrency selection

- Bank of Thailand (BOT): Anti-Money Laundering (AML) and Counter-Terrorism Financing (AML/CFT) compliance

This dual structure creates a transparent, investor-protective ecosystem – but also means all platforms require strict Know-Your-Customer (KYC) verification, transaction monitoring, and reporting to authorities.

Section 2: The Tax Incentive That Changes Everything

Thailand’s government recently launched a game-changing tax incentive to position the country as a global “Digital Asset Hub.”

Personal income tax exemption on capital gains: 2025-2029

Starting January 1, 2025, all profits from cryptocurrency and digital token sales – when traded through SEC-licensed platforms only – are completely exempt from personal income tax until December 31, 2029.

Example Tax Savings

A Thai resident trader earning 500,000 THB profit on a licensed platform:

- With exemption (2025-2029): 0 THB tax

- Without exemption (post-2029): ~135,000 THB tax (at standard progressive rates)

Critical note: This exemption only applies to profits realized through trades on SEC-licensed platforms. If you buy crypto abroad and trade it on a foreign exchange, you may face different tax implications based on Thai residency status.

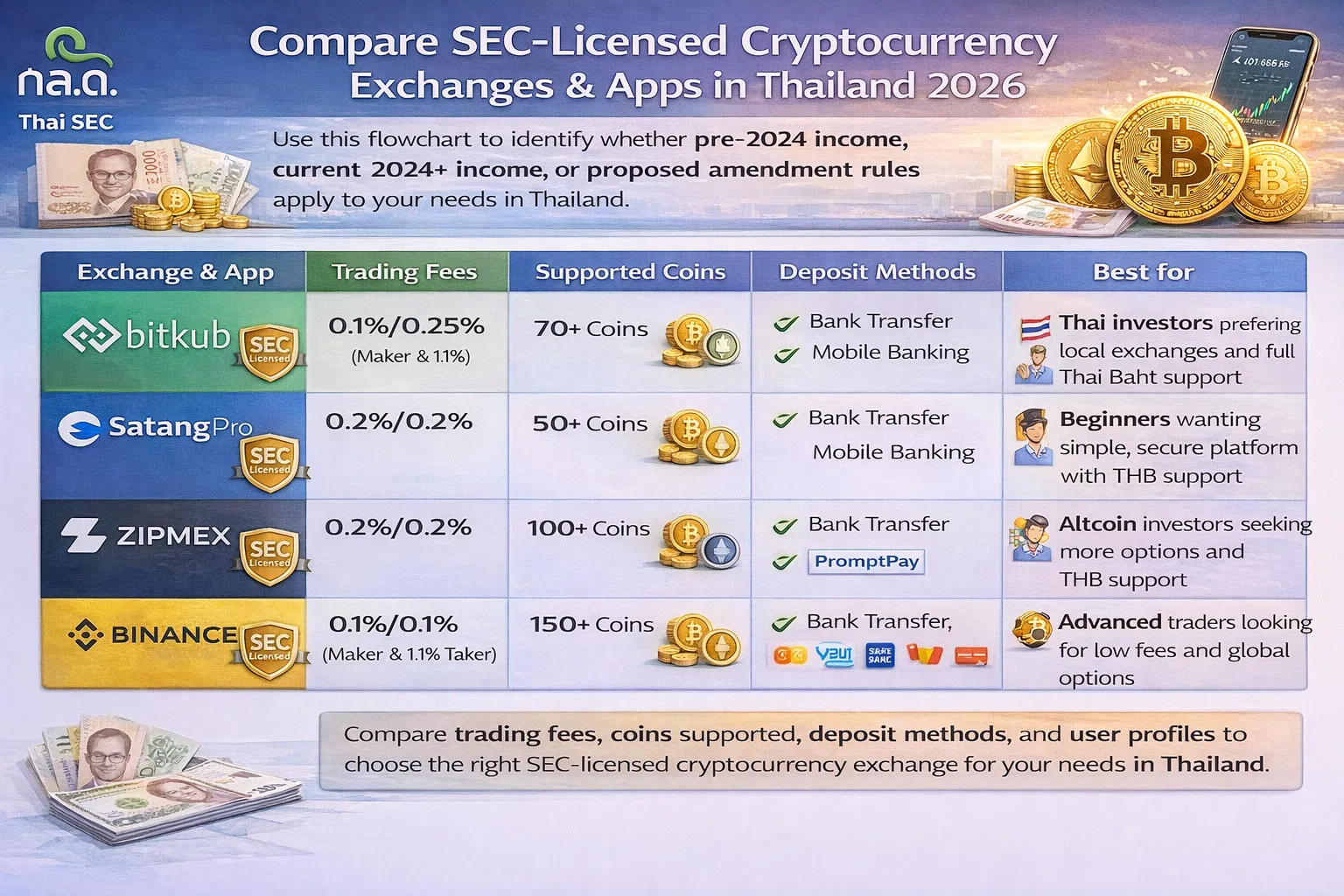

Section 3: The 8 Best SEC-Licensed Bitcoin Apps for Thailand

Top SEC-Licensed Bitcoin & Crypto Apps for Thailand (2025)

1. Bitkub – The Thai Market Leader

Best for: Established traders, large volumes, local community

[5M+ downloads | 220+ coins | 0.25% fees | Thai-native platform]

Bitkub is Thailand’s largest and most-used cryptocurrency exchange. It was among the first to receive an SEC digital asset license and boasts the country’s deepest liquidity and lowest barriers to entry.

Why choose Bitkub:

- Largest trading volume in Thailand (reported $28 billion annually)

- Native KUB token offers fee discounts and staking yields

- 24/7 multilingual support with Thai language available

- Mobile app with DCA (dollar-cost averaging) for long-term investing

- Payment methods: Thai QR code deposits, local bank transfers, TrueMoney

- ISO certified for security standards

- TouristDigiPay integration: Promotes crypto use in tourism ecosystem

Fees breakdown: 0.25% maker and taker on spot trading; discounts for high-volume traders and KUB token holders.

Drawback: Limited coin selection compared to global exchanges; interface aimed at Thai users (may require translation).

2. KuCoin Thailand – Best Global Variety & Advanced Features

Best for: Traders seeking 900+ coins, advanced tools, global platform with Thai compliance

[900+ coins | 0.1% spot fees | Launched officially April 2025]

KuCoin, a leading global exchange, officially launched its SEC-licensed Thailand platform in April 2025 under ERX Company Limited. This gives Thai traders access to KuCoin’s institutional-grade infrastructure while maintaining full regulatory compliance.

Why choose KuCoin Thailand:

- 900+ cryptocurrencies: Far exceeds local competitors

- 0.1% spot trading fees (maker and taker), lowest in Thailand

- Global liquidity: Tight spreads due to massive global volume

- Advanced features: Futures (up to 200x leverage), copy trading, Launchpool, Guardian Fund

- Multiple deposit methods: P2P trading, debit/credit cards, Apple Pay, Google Pay

- KCS token holders get additional fee discounts

- 24/7 customer support in multiple languages

Drawback: Slightly more complex interface for absolute beginners; higher leverage trading carries significant risk.

3. Upbit Thailand – Best for Beginners & Staking

Best for: First-time buyers, passive income seekers, user-friendly interface

[190+ coins | 0.25% fees | Real-time alerts | Staking up to 17% APY]

Upbit is South Korea’s leading exchange and recently launched an SEC-licensed Thai operation. It’s specifically designed for mobile-first, beginner-friendly trading while offering institutional-grade security.

Why choose Upbit Thailand:

- Sleek mobile app: Most intuitive interface in the Thai market

- Staking yields: Earn up to 17% APY on assets like Ethereum, Solana, Cardano, and Cosmos

- Real-time price alerts: Keeps you informed without constant app checking

- Tiered KYC system: Higher verification unlocks larger fiat withdrawal limits

- Financial-institution-grade security: 24/7 monitoring, cold storage, multi-signature security

- Educational resources: Built-in learning hub for crypto beginners

Drawback: Fewer coins than KuCoin; parent company (Dunamu) faced regulatory issues in South Korea (though Upbit Thailand remains separately licensed).

4. MEXC Thailand – Best for Low-Fee Traders & Futures

Best for: Cost-conscious traders, futures enthusiasts, altcoin explorers

[2,700+ coins | 0% maker / 0.05% taker | 500x futures leverage]

MEXC is a global exchange now licensed in Thailand with the broadest coin selection and the lowest maker fee structure (0% for most traders).

Why choose MEXC:

- 2,700+ coins: Largest selection for altcoin traders and blockchain enthusiasts

- 0% maker fees: Refunds all maker fees, paid in MEXC tokens

- 500x futures leverage: For experienced traders (use with caution)

- Launchpool: Earn new tokens by staking existing holdings

- Multiple deposit methods: P2P, credit/debit cards, local bank transfers

- Regulatory compliance: SEC-licensed with full AML/KYC

Drawback: More coins = more risk of scams/low-liquidity tokens; requires higher trader sophistication; avoid extreme leverage.

5. Bitazza – Best for Large Trades & OTC Desk

Best for: High-net-worth individuals, over-the-counter trades, institutional buyers

[120+ coins | Competitive fees | OTC desk | NFT marketplace | Freedom Visa card]

Bitazza specializes in serving larger traders and institutional clients through its OTC (Over-The-Counter) desk, which allows private trades without impacting market prices.

Why choose Bitazza:

- OTC desk: Buy/sell large amounts without slippage or market impact

- Fast settlement: Optimized for high-value transactions

- NFT marketplace: Trade digital collectibles (though NFTs face regulatory scrutiny)

- Freedom Visa card: Convert crypto to THB and spend directly (innovative but regulatory constraints apply)

- Multiple verification tiers: Unlocks larger daily withdrawal limits (2M-50M THB)

- Mobile app: Streamlined UX for experienced traders

Drawback: Fewer coins than competitors; OTC fees may be higher for very large trades; not ideal for beginners.

6. Coins.co.th – Most Beginner-Friendly Interface

Best for: Absolute crypto newcomers, simple interface, educational focus

[Multiple coins | SEC-licensed | Simple Convert feature | Educational hub]

Coins.co.th operates exclusively for Thai users and is specifically designed to lower the barrier to crypto entry with an intuitive, educational-first approach.

Why choose Coins.co.th:

- Simplest interface: Convert feature makes buying and selling one-click easy

- SEC-regulated compliance: Full transparency and investor protection

- Educational resources: Beginner guides, FAQ sections, learning hub

- “Thai-first” design: All materials in Thai and English

- Trusted by Thais for over a decade: Long operational history and community trust

- Fast transaction speeds: Instant buying power after deposit

Drawback: Limited coin selection; less advanced trading tools; primarily designed for Thai market.

7. Orbix Trade – Best for Security-Conscious Investors

Best for: Traders prioritizing security, compliance, and institutional-grade infrastructure

[Multiple coins | ISO-certified | Cold storage | Mobile app]

Orbix emphasizes compliance and security with multiple industry certifications and robust governance standards.

Why choose Orbix:

- Three ISO certifications: ISO 27001 (cybersecurity), 9001 (quality), 20000 (IT service management)

- Cold storage: Majority of customer assets stored offline

- SSL encryption: Industry-standard secure connections

- 2FA enforcement: All accounts require two-factor authentication

- Regular security audits: Third-party penetration testing

- Mobile app: Modern UX with strong security features

Drawback: Custodial exchange (Orbix holds your keys – not ideal for paranoid security purists); smaller trading volume than major competitors.

8. Z.com EX (GMO-Z.com Cryptonomics) – Best for Global Infrastructure

Best for: Traders seeking global institutional backing, Japanese regulatory experience

[Multiple coins | GMO Internet Group backing | Tokyo Stock Exchange-listed parent]

Z.com EX is operated by a subsidiary of GMO Internet Group (listed on the Tokyo Stock Exchange), bringing institutional credibility and global regulatory experience to the Thai market.

Why choose Z.com EX:

- Institutional parent: GMO Internet Group is a 114-affiliate conglomerate

- Global compliance experience: Operates across multiple jurisdictions

- Reliable infrastructure: Uptime and stability from a publicly listed company

- Bank-grade security: Custody standards from Japanese regulatory training

Drawback: Less localized customer support compared to Bitkub; fewer specific Thai payment methods; smaller Thai community.

Section 4: How to Buy Bitcoin in Thailand – Step-by-Step Guide

Even if you’ve never invested before, buying Bitcoin in Thailand is straightforward. Here’s the process:

Step 1: Choose Your Exchange (5 minutes)

Based on your needs from the comparison table above, select one of the SEC-licensed platforms. For absolute beginners, we recommend Upbit Thailand or Coins.co.th due to their intuitive interfaces.

Step 2: Create Your Account (5 minutes)

- Download the app (iOS or Android) or visit the website

- Tap “Sign Up” or “Create Account”

- Enter your email or phone number

- Create a strong password (minimum 12 characters, mixed case, numbers, symbols)

- Enable two-factor authentication (2FA) immediately – this is critical for security

- Verify your email/phone via the confirmation link sent

Step 3: Complete KYC Verification (15-30 minutes)

All Thai exchanges require Know-Your-Customer verification for legal compliance. You’ll need:

- Thai National ID or Passport

- Proof of address: Recent utility bill, bank statement, or rental agreement (showing your name and current address)

- Selfie: Clear photo of your face holding your ID document

Upload these documents through the app. Most platforms approve verification within hours, though some may take 24-48 hours. Avoid uploading blurry or incomplete documents to prevent rejection delays.

Verification tiers unlock different daily withdrawal limits:

- Tier 1 (basic): 2 million THB/day

- Tier 2 (intermediate): 10 million THB/day

- Tier 3 (full): 50 million THB/day

Step 4: Fund Your Account (10-30 minutes)

Once verified, deposit Thai baht through available methods. Common options include:

Bank Transfer (fastest, most common)

- Direct transfer from your Bangkok Bank, Kasikornbank, Siam Commercial Bank, or Krungthai account

- No fees (your bank may charge a transfer fee)

- Typically arrives within 1-2 hours

E-wallet Top-up

- TrueMoney Wallet

- Rabbit LINE Pay

- PromptPay (QR code from the app)

Credit/Debit Card (available on KuCoin Thailand, MEXC, others)

- Slightly higher fees (2-3%) but instant deposit

- Check your bank’s crypto purchase restrictions

For first-time buyers, bank transfer is recommended: no markup fees and more transparent pricing.

Minimum deposits vary: Most platforms have no minimum, but typically require at least 100-500 THB to start.

Step 5: Buy Bitcoin (2 minutes)

- Go to the “Buy Crypto” or “Market” section

- Search for “Bitcoin” (BTC) or select from the list

- Choose “Buy” and enter the amount in THB (e.g., 5,000 THB)

- The app shows how much BTC you’ll receive at current market price

- Review the transaction details

- Confirm and submit the order

- Bitcoin arrives in your exchange wallet instantly (or within minutes)

Step 6: Store Your Bitcoin Securely (Optional but Recommended)

For amounts under 50,000 THB: Keeping Bitcoin on a licensed exchange is reasonably safe. Exchanges are regulated by the SEC and maintain cold storage for most assets.

For amounts over 50,000 THB or long-term holding: Transfer to a personal hardware wallet for maximum security.

Popular options for Thai users:

| Wallet Type | Best Option | Security | Cost |

|---|---|---|---|

| Hardware Wallet | Ledger Nano X or Flex | Maximum (keys offline) | 3,000-5,000 THB one-time |

| Software Wallet | Zengo (keyless MPC) | Very high (no seed phrase) | Free |

| Software Wallet | Trust Wallet | High (non-custodial) | Free |

| Exchange Wallet | Bitkub, KuCoin, Upbit | Medium-High (custodial) | Free |

To withdraw from exchange to hardware wallet:

- Open your hardware wallet (Ledger Live app)

- Generate a Bitcoin receive address

- Go to the exchange’s “Withdraw” section

- Paste your wallet address

- Confirm the withdrawal

- Transaction typically takes 10 minutes to 1 hour

Section 5: Security Best Practices – Protecting Your Bitcoin from Scams

Thailand’s crypto market has experienced a surge in phishing attacks, social engineering, and violent crimes targeting crypto holders. Between 2024-2025, Russian criminal networks conducted at least 10 reported assaults against crypto investors in Thailand, primarily using phishing scams and psychological manipulation.

The Top Security Threats & How to Defend Yourself

Threat #1: Phishing Scams (Most Common)

Scammers pose as platform support, law enforcement, or trusted figures and trick you into revealing your seed phrase – a 12-24 word backup code that controls your wallet.

How it happens:

- Fake email claiming your account is compromised

- Text message “from your bank” requesting urgent action

- Social media message from a supposed exchange representative

- Police impersonator claiming your ID was found on a criminal’s phone

How to defend:

- ✓ Your seed phrase is your password: Never share it with anyone, ever.

- ✓ Police will never ask for it: Law enforcement will never contact you about protecting crypto.

- ✓ Double-check URLs: Fake websites mimic real sites (e.g., “bitkubx.com” vs “bitkub.com”)

- ✓ Use official apps only: Download from Google Play or Apple App Store, never from external links.

- ✓ Enable 2FA: Two-factor authentication prevents account takeovers even if passwords are stolen.

- ✓ Never click links in messages: Always navigate to platforms directly via your browser.

Threat #2: Cold Storage Social Engineering

Scammers specifically target hardware wallet users by creating fake “security update” websites.

Real case (2025): A victim lost £2.1 million after a scammer posing as UK law enforcement convinced them to “secure their assets” by logging into a fake Ledger website. They unknowingly entered their seed phrase, which the scammer used to steal all funds instantly.

How to defend:

- ✓ Your seed phrase is permanent: Never re-enter it anywhere except during initial wallet setup or if explicitly restoring a wallet yourself.

- ✓ Physical keys stay secure: Your Ledger or Trezor device should be the ONLY place that ever handles your private keys.

- ✓ Use Ledger Live for updates: Only update hardware wallet firmware through the official Ledger Live app, never through email or website links.

Threat #3: Exchange Data Breaches

While licensed Thai exchanges are regulated and maintain insurance, no platform is 100% immune to breaches. Stolen customer data is then used for targeted phishing campaigns.

How to defend:

- ✓ Unique passwords: Use a different strong password for each exchange.

- ✓ Password manager: Store passwords in a password manager (Bitwarden, 1Password), not in browsers or notebooks.

- ✓ Move crypto to cold storage: Exchanges are targets; your personal wallet is not.

- ✓ Monitor accounts: Regularly check account activity and suspicious login attempts.

The Safest Setup for 50,000+ THB

If you’re investing a significant amount:

- Buy on licensed exchange: Use Bitkub, KuCoin Thailand, or Upbit

- Transfer to cold storage: Move 95% of holdings to a Ledger hardware wallet, kept in a safe place

- Keep small amount on exchange: Maintain 5% on the exchange for quick selling if needed

- Use 2FA everywhere: Both exchange and hardware wallet

- Back up seed phrase: Write it down on paper, store in a safe, never digitally

This setup balances security (keys in your control) with liquidity (quick access to sell).

Section 6: Comparing Thailand to Other Countries – Regulatory Leadership

Thailand stands among the world’s most crypto-friendly jurisdictions. Here’s how it compares to regional neighbors and global leaders:

| Country | Bitcoin Status | Crypto Trading | Tax on Gains | Capital Controls |

|---|---|---|---|---|

| Thailand | Legal (not tender) | Licensed exchanges only | 0% (2025-2029) | Minimal |

| Singapore | Legal | Regulated exchanges | 0% on individual gains | Minimal |

| Hong Kong | Legal | Regulated exchanges | 0% on capital gains | Minimal |

| Vietnam | Restricted | Not officially permitted | High taxes | High restrictions |

| Indonesia | Legal but complex | Limited access | Subject to taxation | Complex rules |

| Philippines | Legal | Virtual asset service providers | Taxed as income | Moderate |

| USA | Legal | Regulated exchanges | 20-37% (federal) | Capital gains tax |

| Europe (EU) | Legal | Regulated exchanges | Varies 0-45% | Varies by country |

Thailand’s competitive advantages:

- Crypto is clearly legal (no gray zone)

- Only licensed, regulated exchanges permitted (consumer protection)

- Zero capital gains tax until 2029 (unique among major trading hubs)

- Minimal capital controls (easy in/out of THB)

- Established regulatory framework (clear rules, not changing every year)

This combination makes Thailand an attractive location for digital nomads, freelancers, and international investors seeking tax-efficient crypto trading.

Section 7: Answering the Top 17 Questions Thai Investors Are Actually Asking

Based on analysis of Quora, Reddit, and community forums, here are the most frequently asked questions:

Q1: “Is Binance legal in Thailand?”

A: No. Binance is not SEC-licensed and has been identified as an unlicensed operator. As of June 28, 2025, access to Binance was blocked in Thailand for all users. However, Gulf Binance (a licensed partnership) offers Binance services to Thai users with full regulatory compliance.

Q2: “Can I use a VPN to access international exchanges like Binance?”

A: Technically possible, but highly risky. Using a VPN to bypass Thailand’s blocking of unlicensed exchanges violates Thai law. If authorities detect VPN usage for crypto trading on unlicensed platforms, you could face criminal charges. Use SEC-licensed platforms instead – they offer better rates, compliance, and legal protection.

Q3: “What’s the best crypto app for absolute beginners?”

A: Upbit Thailand (intuitive app, educational resources, staking) or Coins.co.th (simplest interface). Both are beginner-focused with zero-complexity designs.

Q4: “How much does it cost to buy Bitcoin in Thailand?”

A: Transaction fees range from 0-0.25% depending on the platform:

- MEXC: 0% maker fees

- KuCoin: 0.1% spot

- Bitkub & Upbit: 0.25%

Deposit fees vary: bank transfers are free (except bank’s internal transfer fee); card deposits charge 2-3%.

Q5: “How do I cash out Bitcoin to Thai baht?”

A: Sell Bitcoin on your exchange for Thai baht, then withdraw THB to your Thai bank account. Most platforms offer withdrawals via:

- Direct bank transfer (cheapest, 1-2 hours)

- Wallet top-up (instant)

- Visa/Mastercard cards (via partnerships)

Daily withdrawal limits depend on your KYC tier (2M-50M THB/day).

Q6: “Will Thailand tax my crypto profits after 2029?”

A: Likely yes. The current exemption ends December 31, 2029. After that, capital gains will likely revert to normal personal income tax rates (5-35% progressive). Consider realizing gains during the exemption period if you plan to exit.

Q7: “Is it safe to use a Thai exchange?”

A: Yes, if it’s SEC-licensed. Licensed platforms must maintain:

- Cold storage for majority of customer assets

- Insurance coverage

- 24/7 security monitoring

- Regular third-party audits

- AML/KYC compliance

Check the SEC’s official list of licensed operators (available on sec.or.th).

Q8: “How long does KYC verification take?”

A: Most platforms approve within hours to 24 hours. Upbit and KuCoin are fastest (usually 2-4 hours). If rejected, common reasons are blurry photos or incomplete documentation – resubmit with clearer images.

Q9: “Can non-Thai citizens buy Bitcoin in Thailand?”

A: Yes. All SEC-licensed platforms allow foreigners and expats to buy, provided they:

- Pass KYC verification (passport + proof of address required)

- Meet AML/CFT requirements

- Comply with their home country’s tax laws on crypto gains

The tax exemption applies to non-residents as well – a major advantage for digital nomads.

Q10: “What’s the difference between spot trading and futures?”

A: Spot trading: You buy Bitcoin at current price and own it immediately. For beginners. Example: Buy 1 BTC at 2 million THB, own it now.

Futures trading: You bet on Bitcoin’s price movement using leverage (up to 500x on MEXC). You never own Bitcoin – just profit/lose on price direction. High risk, requires experience. Example: Bet 1M THB on Bitcoin rising to 2.2M.

Recommendation for beginners: Use spot trading only. Avoid futures until you have 2+ years of experience.

Q11: “Should I hold Bitcoin on the exchange or move it to a wallet?”

A:

- Under 50,000 THB: Exchange is fine (regulated, insured, easy to sell)

- 50,000-500,000 THB: Consider a software wallet (free, good security)

- 500,000+ THB: Hardware wallet required (Ledger ~3,000 THB, maximum security)

Rule of thumb: If you can’t replace the amount you’re holding with a day’s work, move it to cold storage.

Q12: “What should I do if I’m scammed?”

A:

- Stop all communication with the scammer

- Document everything: Screenshots of messages, transaction IDs, amounts

- Report to SEC Thailand: sec.or.th/th/complain

- File police report: Thai cyber police (1441), include all documentation

- Alert your exchange: Provide transaction details; licensed platforms must assist in investigating fraud

Realistic outcome: Recovery is difficult once funds move off-exchange. Prevention (2FA, no seed phrases shared) is the only reliable defense.

Q13: “Is there a minimum age to buy crypto in Thailand?”

A: You must be 18+. Most platforms check age during KYC verification.

Q14: “Can small businesses in Thailand accept Bitcoin?”

A: Legally, no. The Bank of Thailand prohibits businesses from accepting cryptocurrency as payment for goods/services. However, accepting stablecoins (USDT) in P2P settings operates in a gray zone. For formal business use, convert crypto to THB first.

Q15: “What’s the best Bitcoin wallet for Thailand?”

For beginners: Trust Wallet (supports 70+ blockchains, free, non-custodial)

For security: Ledger Nano X (hardware, offline keys, supports Thai Baht on-ramps)

Keyless option: Zengo (uses MPC cryptography, no seed phrases, free)

Q16: “Do I need to report my crypto holdings to Thai tax authorities?”

A: Only capital gains are reportable (and currently exempt until 2029). Unrealized holdings and holdings transferred to Thailand are generally not reportable, though new regulations may change this. Consult a Thai tax accountant for your specific situation.

Q17: “Which app has the most coins available?”

A: MEXC Thailand (2,700+ coins), followed by KuCoin Thailand (900+ coins). If you’re just starting, you only need Bitcoin, Ethereum, and maybe a stablecoin – all platforms support these.

Section 8: The 2025 Regulatory Timeline & What It Means for You

| Date | Regulatory Change | Impact |

|---|---|---|

| Jan 1, 2025 | Capital gains tax exemption begins | 0% tax on profits until Dec 31, 2029 |

| April 13, 2025 | New Emergency Decrees take effect | Foreign platforms must be SEC-licensed; blocking powers expanded |

| April 23, 2025 | KuCoin Thailand officially launches | 900-coin exchange now available with full SEC license |

| May 29, 2025 | SEC declares 5 exchanges unlicensed | Bybit, OKX, CoinEx, 1000X, XT.COM identified as illegal operators |

| June 28, 2025 | Access blocking begins for unlicensed platforms | ISPs instructed to block access to identified exchanges |

| Dec 31, 2029 | Tax exemption ends | Capital gains tax likely resumes (5-35% progressive rates) |

Your Action Plan

If you’re ready to buy Bitcoin in Thailand today:

- Choose an exchange: Bitkub (local favorite), Upbit (best UX), or KuCoin Thailand (most coins)

- Verify identity: KYC takes 2-24 hours

- Deposit THB: Bank transfer is cheapest

- Buy Bitcoin: Takes 2 minutes

- Move to cold storage: Optional but recommended for amounts over 50,000 THB

- Enable 2FA & back up seed phrase: Protect your assets from theft

The bottom line: Thailand’s crypto regulatory environment is among the world’s most favorable. The combination of clear licensing rules, zero capital gains tax (until 2029), minimal capital controls, and thriving local communities makes it an ideal location for crypto investment and trading.

The key differentiator between success and disaster is using only SEC-licensed platforms and protecting your private keys. Follow these two rules, and you’ll be among Thailand’s safest crypto investors.

Additional Resources

- Official SEC Thailand licensed operators list: sec.or.th (Thai: ลิสต์ผู้ประกอบการดิจิทัลแอสเซท)

- Anti-Money Laundering Office (AMLO): amlo.go.th

- Bank of Thailand crypto guidance: bot.or.th

- Thailand Business & Law: For tax residency and investor protection details