Executive Summary: In 2026, the convergence of Artificial Intelligence and blockchain has matured from experimental pilots to institutional-grade execution. This guide analyzes the top-performing AI trading bots (like Pionex, 3Commas, and Bitsgap) and high-potential AI cryptocurrencies (such as Render and Bittensor). Whether you are a beginner seeking automated passive income or a pro trader deploying reinforcement learning agents, this report provides the data-driven insights needed to outrank the market.

The State of AI Trading in 2026

By 2026, “AI trading” has evolved beyond simple rule-based triggers. The market is now dominated by Large Language Model (LLM) interfaces that allow traders to build strategies via natural language, and Reinforcement Learning (RL) agents that adapt to volatility in real-time.

Why Automation Matters Now:

- 24/7 Efficiency: Crypto markets never sleep; AI bots monitor opportunities while you rest.

- Emotionless Execution: Bots eliminate panic selling and FOMO buying.

- Speed: AI executes arbitrage and scalp trades in milliseconds, faster than any human.

Part 1: Top 5 Best AI Trading Bots for 2026

Based on feature depth, pricing value, and 2026 market performance, these are the top-rated platforms.

1. Pionex: Best for Beginners & Free Bots

Pionex remains the undisputed leader for accessible automation. Unlike competitors that charge monthly subscriptions, Pionex integrates its bots directly into its exchange with low trading fees (0.05%).

- Key Feature: GPT-Strategy Bot. Users can describe their risk tolerance, and the AI generates a backtested strategy instantly.

- Best For: Grid Trading (profiting from sideways markets) and Dollar-Cost Averaging (DCA).

- Cost: Free (Exchange fees only).

2. 3Commas: Best for Pro Traders & DCA

3Commas is the powerhouse for managing trades across multiple exchanges (Binance, Kraken, Bybit) from a single terminal. Its “SmartTrade” terminal allows for advanced trailing stop-losses that standard exchanges lack.

- Key Feature: Signal Bot Marketplace. Subscribe to algorithmic signals that automatically trigger trades in your account.

- Best For: Momentum trading and long-term accumulation via DCA bots.

- Cost: Pro tiers start ~$49/mo; Free limited plan available.

3. Bitsgap: Best for Arbitrage & High-Frequency Grid

Bitsgap specializes in generating profit from small price discrepancies. Its “COMBO” bot (Futures + Grid) is a favorite for hedging in 2026’s volatile market.

- Key Feature: Crypto Arbitrage. The bot identifies price differences between exchanges and executes risk-free profit trades.

- Best For: Low-risk consistent returns through high-frequency grid trading.

- Cost: Starts ~$29/mo.

4. Cryptohopper: Best for Custom AI Strategies

For those who want to build their own “Hedge Fund,” Cryptohopper offers the most robust strategy designer.

- Key Feature: AI Strategy Designer. You feed the AI historical data, and it “learns” which indicators (RSI, MACD, Bollinger Bands) predicted the last 50 pumps, building a weighted strategy for you.

- Best For: Intermediate traders who want a personalized edge without coding.

- Cost: Tiers from ~$29 to $129/mo.

5. Gunbot: Best for Privacy (Self-Hosted)

Unlike cloud-based bots, Gunbot is software you install on your own machine. This ensures your API keys and strategy logic never leave your control.

- Key Feature: Lifetime License. Pay once, use forever. No monthly subscriptions.

- Best For: Privacy-conscious traders and developers who want to code custom scripts.

- Cost: One-time payments (prices vary by license level).

Quick Comparison: Top AI Trading Bots

| Bot Platform | Best For | Pricing Model | Mobile App | AI Level |

|---|---|---|---|---|

| Pionex | Beginners / Free | Free (0.05% fees) | Yes (Excellent) | Mid (GPT-Assist) |

| 3Commas | DCA / Multi-Exchange | Monthly Subscription | Yes | High (SmartTrade) |

| Bitsgap | Arbitrage / Grid | Monthly Subscription | Yes | High (Algo-Grid) |

| Cryptohopper | Custom Strategies | Monthly Subscription | Yes | Very High (AI Training) |

| TradeSanta | Simple Automation | Monthly Subscription | Yes | Low (Template-based) |

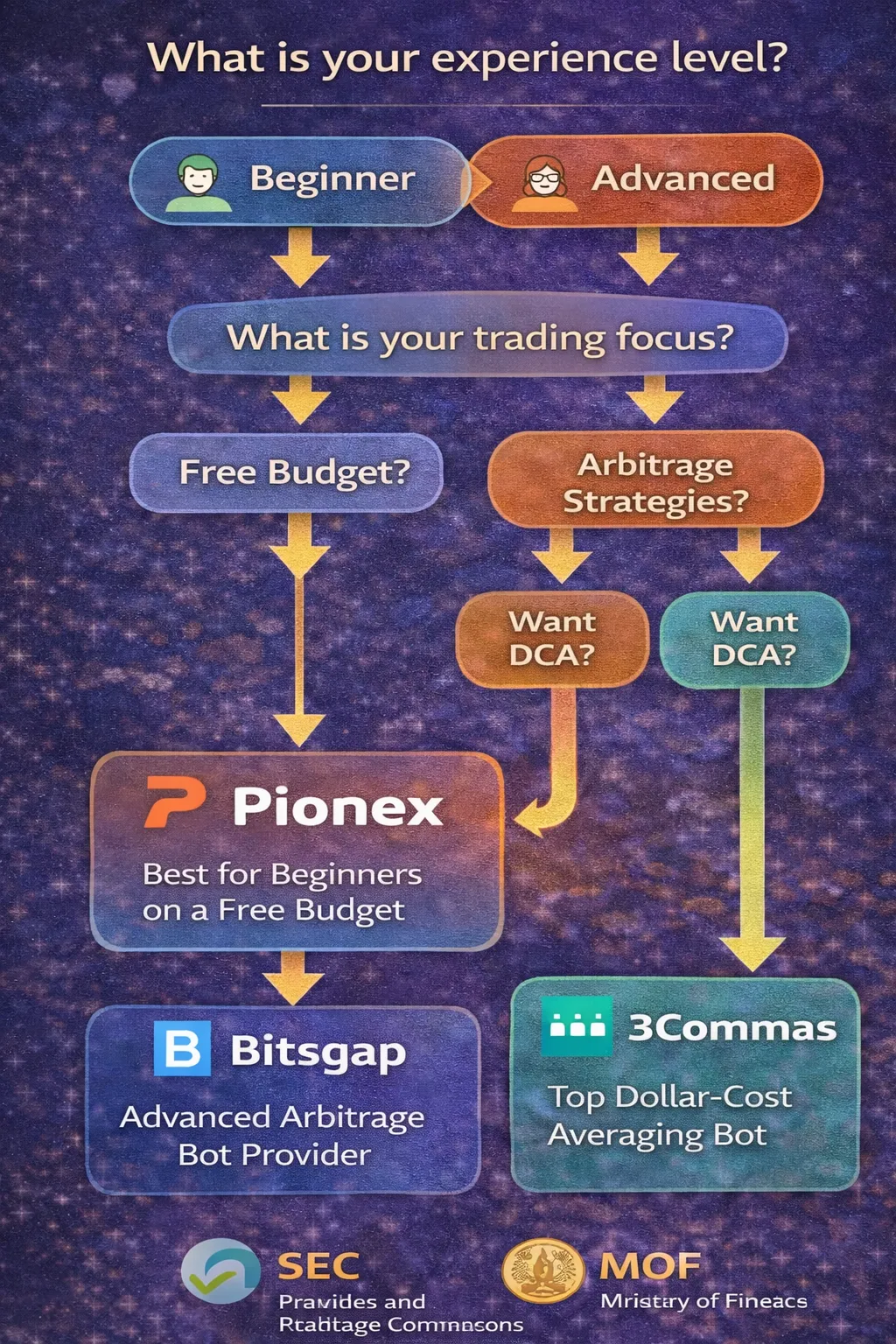

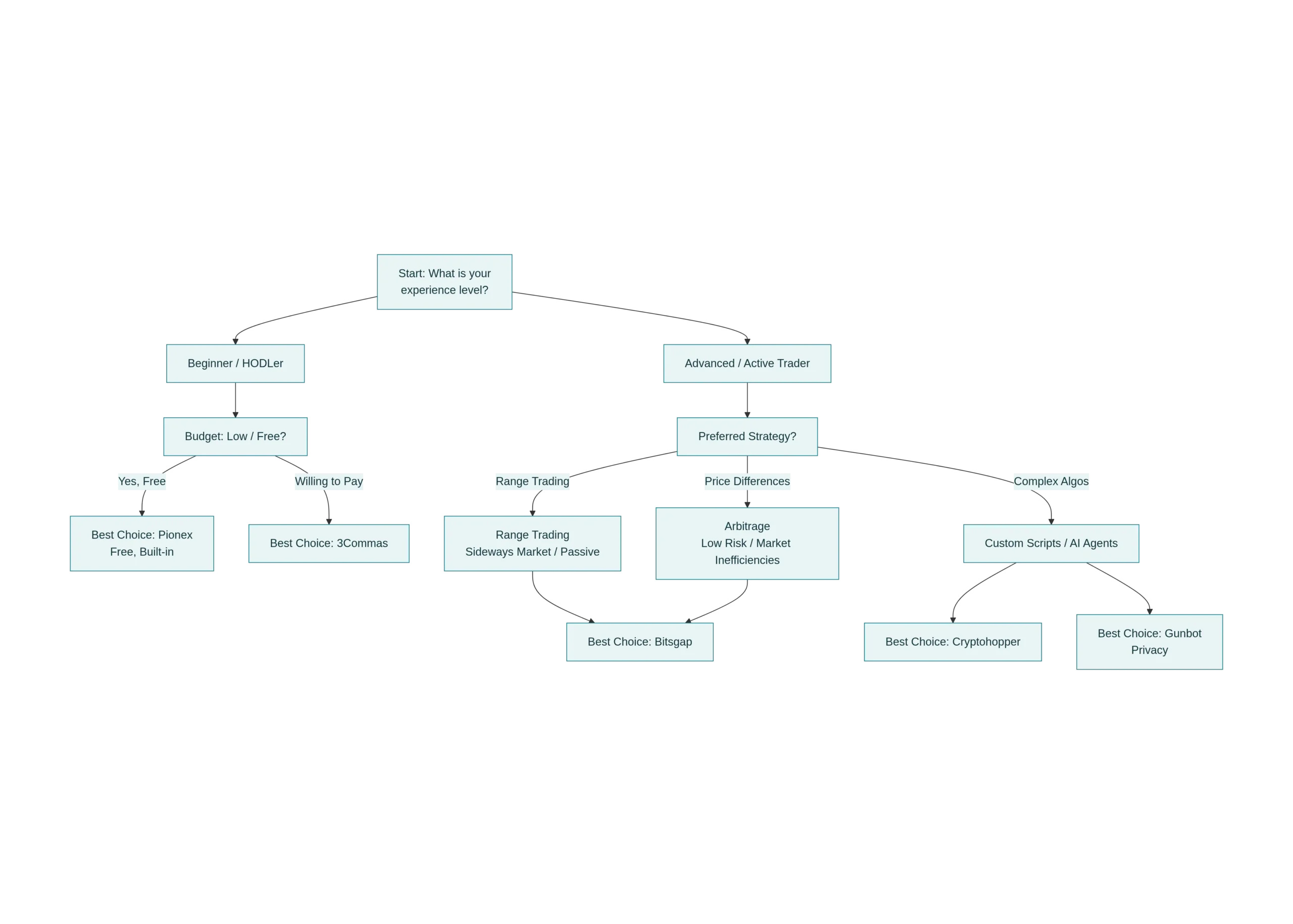

Decision Guide: Which Bot Fits You?

Flowchart: How to Choose the Right AI Trading Bot for Your Needs

Part 2: Top AI Cryptocurrencies to Invest In (2026)

While bots execute the trades, these are the assets driving the AI narrative in 2026. These projects provide the infrastructure for the decentralized AI economy.

1. Bittensor (TAO) – The “Bitcoin of AI”

Bittensor has established itself as the decentralized marketplace for machine intelligence. In 2026, it is the primary network where AI models share data and are rewarded in TAO tokens.

- Why Invest: It decentralizes the monopoly of big tech AI, creating an open-source “brain” for the internet.

2. Render Network (RNDR) – The “Nvidia of Crypto”

AI requires massive computing power. Render connects users who need GPU power (for training AI models) with miners who have idle GPUs.

- Why Invest: As AI models grow larger in 2026, the demand for decentralized, cheaper GPU compute skyrockets.

3. Fetch.ai / ASI Alliance (FET) – The Agent Economy

Part of the Artificial Superintelligence (ASI) Alliance, Fetch.ai focuses on “Autonomous Agents”-AI software that performs tasks like booking flights, managing supply chains, or trading DeFi automatically.

- Why Invest: The practical application of “agents” automating real-world economy tasks is a massive growth sector.

4. Akash Network (AKT) – The Airbnb for Cloud Compute

Akash provides a decentralized cloud marketplace. It is significantly cheaper than AWS or Google Cloud, making it the preferred hosting layer for many AI startups in 2026.

Part 3: Profitable Bot Strategies for 2026

To outrank the market, you must match the right strategy to the current market cycle.

1. Grid Trading (Best for Sideways Markets)

- How it works: The bot places buy orders below the current price and sell orders above it. As the price wiggles up and down, it captures the spread.

- When to use: When the market is “boring” or ranging (e.g., Bitcoin stuck between $90k and $95k).

- Recommended Bot: Pionex, Bitsgap.

2. DCA (Dollar-Cost Averaging) (Best for Bull Runs)

- How it works: The bot buys a fixed amount of crypto at regular intervals or when the price drops by a certain percentage.

- When to use: Long-term investing or during a market dip to lower your average entry price.

- Recommended Bot: 3Commas, Auto-Invest (Binance).

3. Arbitrage (Lowest Risk)

- How it works: The bot buys Ethereum on Exchange A for $3000 and instantly sells it on Exchange B for $3010.

- When to use: During high volatility when price discrepancies between exchanges widen.

- Recommended Bot: Bitsgap, Coinrule.

FAQ: Common Questions on AI Bots

Q: Are crypto trading bots safe to use?

A: Yes, but you must use API keys with “Withdrawal Permissions” disabled. This ensures the bot can trade for you but cannot steal your funds. Platforms like Pionex and 3Commas are industry standards with robust security, but always enable 2FA.

Q: Which AI bot is best for beginners in 2026?

A: Pionex is the best starting point. It requires no API key setup (since it’s an exchange) and offers “AI Strategy” templates that auto-fill settings based on backtested data, making it essentially “plug-and-play.”

Q: Can bots guarantee profit?

A: No. Bots are tools, not magic wands. A Grid Bot will lose money if the price drops below your grid range (impermanent loss). Profitability depends on choosing the right strategy for the current market direction.

Q: What is the most successful trading bot strategy?

A: Statistically, DCA (Dollar Cost Averaging) has the highest success rate for long-term investors because it removes emotional timing. For short-term cash flow, Grid Trading on high-volume pairs (like ETH/USDT) is the most consistent performer in non-trending markets.

Q: Do I need coding skills to use these bots?

A: No. Modern bots like Cryptohopper and 3Commas use “Drag and Drop” interfaces. You can also use “Copy Trading” to automatically mirror the settings of successful pro traders.

Q: What are the best stocks/crypto to look out for in 2026?

A: For Crypto: TAO, RNDR, FET. For Stocks (AI-related): NVDA (Nvidia), MSFT (Microsoft), and PLTR (Palantir) remain the infrastructure kings. Bots like StockHero can be used to trade these equity assets similarly to crypto.

Disclaimer: This guide is for educational purposes only. Cryptocurrency trading involves significant risk. Always do your own research (DYOR) before investing.