Understanding Altcoins in the Modern Crypto Landscape

The cryptocurrency market is much bigger than just Bitcoin. Bitcoin is still the top digital coin, but there are thousands of other cryptocurrencies called altcoins. These altcoins are made for different uses, help fix problems in the real world, and give people more ways to invest.

This guide will show you all you need to know about altcoins. You will read about how they are built, how to look at them, and good ways to get them.

Altcoins are an important step in the world of blockchain. They have brought in new ways for people to use money, work with others, keep things private, and use apps that Bitcoin did not think of at first. If you are an investor, trader, or someone who likes tech, you have to know about altcoins. This helps you get around in the world of crypto today.

What Is an Altcoin? Definition and Core Concept

An altcoin is any digital currency or blockchain token that is not Bitcoin. The word covers thousands of different kinds, from well-known coins like Ethereum to new ideas and tokens still being tested. While the meaning is wide, these altcoins have some things that are the same:

- Blockchain-based: The system works on shared ledger systems or private blockchain networks.

- Purpose-driven: Most are made to handle certain problems or allow special features.

- Token supply management: They often come with set rules on growing coin numbers, let users lock up coins, or have ways to remove coins.

- Governance capabilities: A lot let people in the group vote on changes to the system, while Bitcoin doesn’t change much.

- Smart contract support: Many altcoins let users build and work with programs that do more than just send coins around.

The difference between altcoins and Bitcoin is big. Bitcoin was made to be a way for people to send money to each other online. It focuses on things like security, being open for everyone, and not letting any person or group control it. Many altcoins give up some of these things to be more flexible, faster, or offer something more special that Bitcoin does not. This change is a key part of how people think about putting their money into altcoins and what kind of risks they might have.

Why Altcoins Exist: The Evolution of Blockchain Technology

Altcoins started to appear because Bitcoin has some clear limits in how it works. Bitcoin’s blockchain can handle only about 7 transactions each second. It uses proof-of-work, which takes a lot of energy from people and computers. Bitcoin also does not have built-in smart contracts. These things are not mistakes in the design of Bitcoin. Instead, the choices were made to keep Bitcoin safe and spread out the control among people.

Early altcoin developers saw there were chances to fix these limits. Litecoin (2011) let people have faster block times. Namecoin (2011) came up with the idea of using a system where domain names are not kept in one place but spread out. Peercoin (2012) was the first to use proof-of-stake, which helped to use less energy. These projects helped many new ideas grow in the crypto world.

The start of Ethereum in 2015 changed the way people make altcoins. Ethereum brought smart contracts. These are bits of code that can run by themselves. They work without a middleman, and are put on a system that is owned by many, not just one group. Ethereum let people build apps, called DApps, on the blockchain. Because of this, the kinds of altcoins and the ways you can use them grew fast.

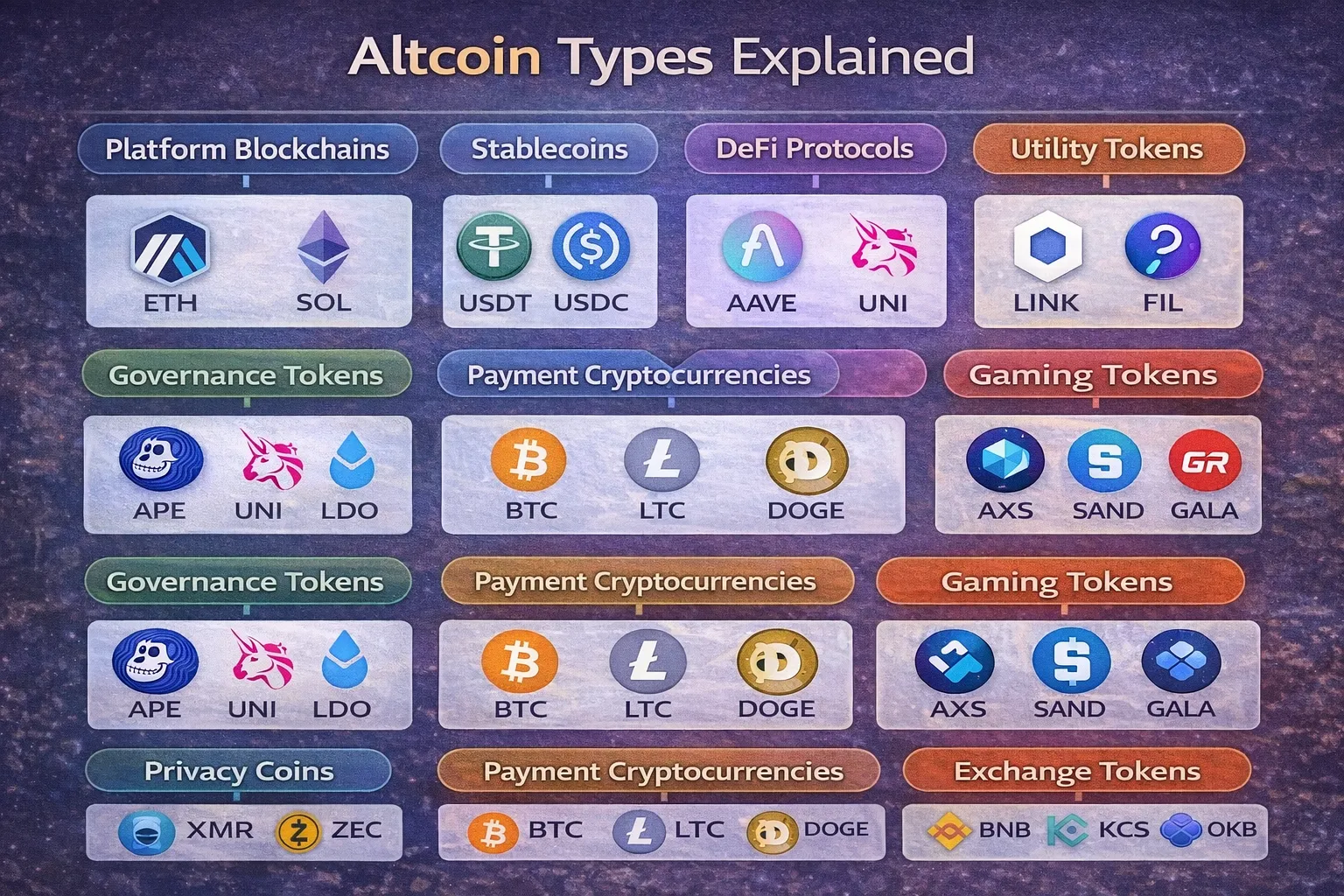

Types of Altcoins: A Comprehensive Classification

It is important to know about altcoin categories if you want to make smart choices when you put your money in. Each of these categories has its own job and comes with its own set of risks.

1. Platform Coins

Platform coins help run blockchain networks. These networks let third-party apps work on them. They act like computers that are not controlled by one person. Developers use these coins to put their code on the network.

Examples:

- Ethereum (ETH): This is the top smart contract platform. People use it for DeFi, NFT markets, and other special uses.

- Solana (SOL): This platform is fast and puts users first.

- Polkadot (DOT): This one focuses on how blockchains work together.

- Cardano (ADA): This project focuses on development checked by other people before use.

- Avalanche (AVAX): This is built for business apps and lets blockchains talk to each other.

These coins get their value when more people use them and when developers work on them. When there are many apps that people use, it makes more people want these coins. This also lets people use the token for more things.

2. Stablecoins

Stablecoins keep their value steady by backing them with assets, using math-based systems, or tying them to regular money. They help with the price changes in cryptocurrency. They also let people do fast and smooth transactions.

Examples:

- Tether (USDT): A stablecoin that is backed by the US dollar.

- USD Coin (USDC): A coin that follows regulations, is open about how it uses US dollars, and is backed by the dollar.

- DAI: A stablecoin where people use other cryptocurrencies to help keep its value.

- USDC: A stablecoin that meets regulations and is supported by big companies.

Stablecoins play an important role for traders. They let people move their money to cash quickly without holding assets that change value a lot. Stablecoins also help DeFi apps. They give these apps a steady way to measure value.

3. Utility Tokens

Utility tokens can let people use some features or parts of a system. If you have the tokens, you might get rights to use some items, save money, or help make choices in the group.

Examples:

- Uniswap (UNI): A governance token that helps run a decentralized exchange

- Aave (AAVE): A governance token that helps with lending in a decentralized way

- Filecoin (FIL): Gives people reasons to help store files in many different places

- The Graph (GRT): Runs data indexing in a decentralized set-up

These tokens get value when more people want them and when more users join in. If a project does not get people to use it, it can lose all value. So, it is very important to check everything well before you get involved.

4. Governance Tokens

Governance tokens let people vote on changes to the rules or settings in a project. People who have these tokens get to help decide which way the project will go.

Examples:

- MakerDAO (MKR): Controls DAI stablecoin settings

- Curve Finance (CRV): Manages how the decentralized exchange works

- Compound (COMP): Controls lending app settings

The value of a governance token is tied to how well the protocol does. If another protocol gives better features, it can lower demand for the governance token.

5. Security Tokens

Security tokens show that you own things in the real world like real estate, company shares, or goods. Most of the time, these tokens must follow rules for securities in many places.

Examples:

- Token-based real estate investments

- Ownership tokens in blockchain companies

- Asset-backed tokens

Security tokens are still hard to buy and sell because of rules set by the government. But now these tokens are becoming a new type of asset for big investors.

6. Privacy Coins

Privacy coins hide where a transaction starts and ends by using special codes. Many people talk about these coins because there is a lot of checking from those who make rules.

Examples:

- Monero (XMR): Uses ring signatures to make sure there is always privacy

- Zcash (ZEC): Lets you choose privacy with zero-knowledge proofs

Privacy coins are under rules and might get removed from some exchanges. But they are good for things like keeping money matters private and stopping control from harsh leaders in some places.

7. GameFi & NFT Tokens

GameFi tokens let people play to earn and take part in in-game economies.

Examples:

- Axie Infinity (AXS): NFT game token

- The Sandbox (SAND): Metaverse platform token

- Decentraland (MANA): Online world platform token

These tokens saw a lot of hype. Many projects did not keep people interested or explain why the tokens should be worth much. When checking these, you should look at if people still play and if the economy can last.

8. Meme Coins

Meme coins do not have much use in the real world. Their value comes from the excitement of people, who talk about them in their groups and on social media.

Examples:

- Dogecoin (DOGE): A cryptocurrency that is driven by the community

- Shiba Inu (SHIB): A dog-themed token that looks to have the community help make choices

- There are many tokens that come from meme hype and people use them to try new things

Meme coins are risky because their value comes from how much people talk about them. If the community stops being interested, the price can drop fast. Many times, the price goes up before people know what the coin can actually do. This can bring risk that is not the same for everyone.

9. Exchange Tokens

Exchange tokens give people special perks on trading platforms that use cryptocurrency.

Examples:

- Binance Coin (BNB): Lets people get discounts on trading fees on Binance.

- FTX Token (FTT): Gave perks like the ones with Binance before it got taken down when the exchange closed.

- Crypto.com Coin (CRO): Used on the Crypto.com site for things you want to do there.

The value of an exchange token is based only on if the platform can keep going. FTX’s fall showed people that even if an exchange is the top one, it does not mean it will last.

10. Payment Tokens

Payment tokens are made to be used in transactions.

Examples:

- Ripple (XRP): Cross-border payment system

- Bitcoin Cash (BCH): A form of Bitcoin made for payments

- Litecoin (LTC): A version of Bitcoin that has quicker confirmation times

Payment tokens try to take on Bitcoin and old ways of paying. They need to deal with the big effects of many people already using other ways and get merchants to accept them. Most of them have not been able to make it far in payments.

Key Differences: Altcoins vs. Bitcoin

Knowing how altcoins are not the same as Bitcoin helps people see what makes them special. This also shows the different risks and things they offer.

| Factor | Bitcoin | Altcoins |

|---|---|---|

| Consensus Mechanism | Proof-of-Work (PoW) | Varies (PoW, PoS, hybrid) |

| Transaction Speed | ~7 tx/sec | 100-100,000+ tx/sec (varies) |

| Smart Contracts | Limited | Native support (most) |

| Supply | Fixed 21M cap | Varies (inflationary to capped) |

| Use Case | Digital gold/currency | Platform, services, payments |

| Governance | Developer consensus | Token-based voting (often) |

| Energy Consumption | High (PoW) | Lower (PoS, DPoS variants) |

| Regulatory Status | Emerging clarity | Highly uncertain |

| Market Maturity | First-mover advantage | Competitive ecosystem |

Bitcoin has some strong points that come from many people using it. People also know its brand well. It is focused on being strong money. But there are some bad parts too. It does not do many things. People also worry about how much energy it uses.

Altcoins can give more options and useful features. But, they often have bigger price swings, less money moving in and out, and do not have strong rules from the government. The risk and reward with these coins is not the same on both sides. So, you need to use different ways when you invest in them.

How to Evaluate Altcoins: A Practical Checklist

To be good at altcoin investment, you need to check things step by step. This list covers the key things you should look at:

Fundamentals Assessment

1. Real-World Problem & Solution

- Does the project fix a real problem in the market?

- Is the answer better in a technical way compared to other choices?

- Is the problem big enough to use token economics?

Evaluation tip: Look at how the project’s value compares to others that do the same thing. If you do not see what makes it stand out, the token may not have ongoing demand.

2. Technical Innovation

- Is the basic idea new, or has it been made much better?

- Can people check the technical claims on their own?

- Does the team have work that has been reviewed and put out by others?

Evaluation tip: It is good to not trust marketing words right away. Ask for the technical papers. You should also get audit reports. Look at the changes to see if they are basic or just small updates.

3. Team & Development Track Record

- Do founders have real and checked experience with cryptocurrency or work in this field?

- Has the team made and sent out products before?

- Can you see who the main people writing the code are, and do they take part often?

- Can you see development work, for example on GitHub, with code written and tests done?

Evaluation tip: If a team is not named, there is a higher risk. Check what the founders say and see if their words match their profiles on LinkedIn, Twitter, and GitHub.

4. Tokenomics & Supply Schedule

- What are the total tokens made and how many are in use now?

- What part is with the founders, what part do investors have, and what has been given to the public?

- How will the number of tokens grow over time?

- Are there any plans to stop founders from selling their tokens all at one time?

Evaluation tip: Projects where one founder controls everything or where there is non-stop inflation can cause problems. These problems come from not having all the facts and odd setups that may not help everyone in the same way.

Market & Adoption Metrics

5. Liquidity & Market Cap

- Is there enough liquidity for your planned trade size?

- Do they trade this project on many exchanges?

- What is the distance between the buy and sell price?

- How much does the price change compared to how much risk you can take?

Evaluation tip: Low liquidity can make it hard to buy or sell. Make sure you choose how much to trade so that you can get out with only a 3-5% change in price.

6. Community & Network Growth

- Is the community getting bigger or smaller?

- Does the community feel a certain way because people really use it, or because they hope to make money?

- Are most people in the group builders and people who use it often?

- How good are the talks between the builders?

Evaluation tip: Large groups that do not feel real, like ones with comment bots or people who do not join in, are warning signs. Check out the talks on GitHub and read what people say in developer forums.

7. Real Usage Metrics

- What is the daily or monthly active user count?

- What is the true transaction volume compared to fake or forced volume?

- Are the numbers checked by others, or does the company share them on their own?

- Do users come back again and again?

Evaluation tip: Some projects make the numbers look better with rewards for taking part. Check any numbers they share by looking at on-chain data when you can.

Regulatory & Competitive Position

8. Regulatory Status

- In what places can people legally trade or hold the token?

- Are there any government actions or questions happening now?

- Has the team talked to the rules makers ahead of time?

- What are the rules for the token (is it seen as a security or something else)?

Evaluation tip: Regulatory uncertainty can bring risk. You need to be careful with projects in tough regulatory places, especially if they do not have a clear backup plan.

9. Competitive Landscape

- How many direct competitors are there?

- What things do direct competitors do better?

- Is there a big enough market for more than one winner?

- Does this project stand out in a way that others cannot copy?

Evaluation tip: Most categories, like L1 blockchains, DEXs, and lending protocols, have a lot of competitors. The main things that help one company beat the others are getting a head start and being one of the first in the space.

10. Sustainability Analysis

- Can the project keep growing without new tokens being given out?

- Do the founders’ rewards match what is best for the project over time?

- Is the way tokens are set up good for fees, growth, and other costs?

- What things are in place to help the project last?

Evaluation tip: Projects that depend on token prices always going up or on hype all the time cannot keep their value for long.

Red Flags & Risk Assessment

Critical warning signs:

- Promises that you will get guaranteed returns or very high profits that can’t be reached

- A lot of heavy marketing and focus on social media instead of technical skills

- Claims about the project or its partners that no one can check

- Changes in leaders or team members leaving

- Audit reports that point out big problems

- Actions taken or questions raised by the authorities

- Marketing that is not fair, such as comparing with Bitcoin’s 15-year record in a wrong way

- Not able to show clear, trackable use or purpose

Step-by-Step Guide: How to Buy & Trade Altcoins

To get altcoins, you need to choose the right exchange. You also need to keep your login safe. It is important to follow good steps every time you buy or sell.

Step 1: Choose a Reliable Cryptocurrency Exchange

Selection criteria:

- Regulatory compliance (licenses, audits, AML/KYC steps)

- Security setup (cold storage, insurance, 2FA)

- Trading pairs you get, and liquidity

- How fees work and if they are clear

- Where you can use it in your area

- How and when you can take out your money

Established exchanges (as of 2026):

- Binance: This one has the most coins and high liquidity. But there is some uncertainty about rules in some places.

- Coinbase: It follows the rules well, but there are fewer coins and the fees are higher.

- Kraken: This exchange is known for security and has good fees. There is also good liquidity here.

- OKX: There is a lot of liquidity and the company looks at the world market. Some regions look more closely at its rules.

- Bybit: This one focuses on trading with contracts. Its market for normal coin trades is also growing.

Important note: No exchange can be completely safe. You should use these exchanges just to hold your money for a short time. Move your money to safe wallets if you want to keep it for a long time.

Step 2: Complete Account Verification

Modern exchanges require:

- Set up your email address and password with 2FA. Use an authenticator app, not text messages.

- Prove who you are with a government ID. Sometimes you may need to take selfies too.

- Show where you live with a bill or an official paper that has your address.

- Show your money or income if you want to take out more than the normal limit.

Security best practices:

- Use a strong and hard-to-guess password

- Turn on two-factor sign in with an authenticator app (not text messages)

- Set up IP whitelist if it is there

- Save API keys in a safe password manager if you need to

- Never share your login details or recovery phrases

Step 3: Deposit Funds

Deposit methods vary by exchange and jurisdiction:

- Bank transfer (often the lowest fees, settles in 3-7 days)

- Credit or debit card (is instant, fees are 3-5%)

- Peer-to-peer (fees can change)

- Cryptocurrency (is instant, but you need to already have some)

Withdrawal limits:

- People who put in money for the first time often see limits from $1,000 to $10,000.

- Higher levels let you move more money as you go up.

- Finish all the steps to prove who you are to get the most from your account.

Step 4: Research & Select Altcoins

Before placing orders:

- Go over the evaluation checklist above

- Look at the project next to direct competitors

- Read official whitepapers and documents

- Look at GitHub activity and technical talks

- Go over recent news, rules, and updates from the team

- Decide how much to put in based on risk you feel good with

Practical assessment approach:

- Choose 3-5 altcoins in the sector you want.

- Give a score to each coin using your key rules.

- Leave out projects that do not meet the main rules.

- Look at the top options and see what they do better than others.

- Pick the size for each by thinking about how sure you feel, and put less into coins you feel less sure about.

Step 5: Place Your Order

Order types:

- Market order: You get instant action at the price the market has right now (the price may slip a bit).

- Limit order: The order goes through only if the price hits the level you set (there is no promise it will go through, but you might get better rates).

Best practices:

- Start with limit orders. This helps you avoid slippage.

- For coins that move up and down a lot, work out the most slippage you can accept.

- Do not use market orders when things are moving fast.

- Never buy all you want at one time. Buy little by little over time.

- Write down the date you bought, the price, and how much you got for your taxes.

Step 6: Secure Your Holdings

Important step: The act of trading on an exchange brings risk from the other side. You should take your altcoins out as soon as you buy them and move them to your own wallet.

Storage options by security/convenience:

| Wallet Type | Security | Accessibility | Best For |

|---|---|---|---|

| Hardware Wallet | Highest | Lower | Long-term holdings |

| Software Wallet | Medium-High | High | Regular trading |

| Paper Wallet | Highest | Lowest | Extreme long-term |

| Multi-Signature | Highest | Medium | Large holdings |

| Custodial | Variable | Highest | Trading, not storage |

| Cold Storage | Highest | Lowest | Institutional holdings |

Hardware wallet options (most safe for your own use):

- Ledger Nano S/X: A top choice in the industry, supports more than 5,500 tokens

- Trezor: Open-source option, known for strong security

- SafePal: A hardware wallet you use with your phone

Important: You should buy hardware wallets only from the official makers. If you buy from other people, you might get a device that was already tampered with.

Step 7: Monitor & Manage Your Positions

Ongoing management activities:

- Set price alerts for when to get in and when to stop losses

- Track how your set of assets is doing compared to others

- Watch news and updates from the project and the team

- Check if there are any changes to how the tokens work and read new rules or changes

- Take another look at your main idea every few months

- Change your holdings based on how strong your belief is in them

Exit planning:

- Decide in advance when you want to exit. This can be a price you aim for, a time frame, or a change in the main reason you bought.

- Use limit orders, so you can sell at the price you want.

- Do not let your feelings take over when the market moves a lot.

- Keep a record of how much you paid and how much you gain. This helps with your taxes.

- If the value goes down, think about selling to take a loss for taxes.

Storage & Security: Protecting Your Altcoin Holdings

Cryptocurrency theft and loss can be very risky. It is important to have secure storage.

Hardware Wallet Best Practices

Purchase & Setup:

- Buy straight from the maker (Ledger.com, Trezor.io)

- Check the packaging seals and make sure it’s real

- Make your PIN code when you set it up (do not share it)

- Write down your recovery phrase (24 words) and keep it safe

- Do not take a picture or keep a digital copy of your recovery phrase

- Test the recovery with a small transfer before you put in a lot

Ongoing Security:

- Install the latest firmware updates right away

- Check addresses on the device screen before you say yes to any transfers

- Use a passphrase for more security if you want to

- Keep your hardware wallet in a safe place

- Store your recovery phrase in a different safe place

- Do not type your recovery phrase into the computer

Cold Storage for Large Holdings

Paper wallet creation (for extreme security):

- Make the keypair on a computer that is never online.

- Write the public address and the private key on a piece of paper.

- Take a photo for backup. Make sure you keep it in a different place.

- Keep the paper in a safe deposit box.

- Try getting your funds back with a small amount to see if the process works.

- Send your funds to the address.

Disadvantages: This way can be slow and hard when you want to trade often. If you lose something, you need to get it back yourself, and it is easy to make a mistake.

Multi-Signature Wallets

How they work:

- There must be more than one signature, or key, to let any transaction happen.

- For example, in a 2-of-3 setup, two out of three keys are needed to let money move.

- This way, there is not just one weak spot if something goes wrong.

Setup considerations:

- Give out keys to different physical places.

- Use a different hardware device for each key.

- Write down steps for what to do if you need to pass the keys on or get them back.

- Check the recovery process often to make sure it works.

Risks: Understanding Altcoin Investment Hazards

Putting money into altcoins comes with some unique risks. You need to deal with these risks carefully.

Technical & Operational Risks

Smart contract vulnerabilities: There can be bugs in code that is deployed. These bugs can lead to loss of funds. Even when someone checks the code, there can still be some risk. Constantiniple (Ethereum) had some problems in the code after audits.

Network forks & governance failures: Upgrades that people do not all agree on can break up the group and split what they have worked for. Fights between people who work on making the project can hurt how much trust people have in it.

If just one person is in charge of a project, the work can stop if that person leaves. There is a high risk the project will not get done if the main developer goes.

Market & Valuation Risks

Extreme volatility: Altcoins often go up or down by over 50%. You must think about this wild change when you decide how much to buy.

Liquidity crises: When markets are under stress, it gets hard to sell altcoins. Your chance to get your money back may go away right when you need it most.

Hype cycles & changes in the way people feel: The things people value can go from $10B to almost nothing when people feel differently about them.

Concentration risk: A lot of altcoins are owned by just a few people or groups. If these large holders sell the tokens, the price can go up or down very fast. This can cause the price to crash sometimes.

Regulatory & Legal Risks

Tokens that are now seen as commodities may soon be called securities. If that happens, it could lead to some tokens being taken off platforms. This can also cause problems with buying or selling them and may harm their value.

Geographic restrictions: The rules in some places may be strict. Your altcoin may not be allowed there in the future. This can make it hard for you to sell or get out of it.

Money laundering liability: Using altcoins in some ways can lead to legal trouble. Keep records for all deals.

Unclear rules on taxes: A lot of areas do not have clear rules for how to tax altcoins. Make sure you keep a good record of your coins and all your trades.

Competitive & Business Risks

Better options can make leading projects old and not needed. A new and better design can take over fast. Good technology does not stay best for a long time.

Network effect reversal: A first-mover like Ethereum can lose its lead if others give people much better use.

Market saturation: There are too many tokens like these in the market. You can find hundreds of “Ethereum killers.” Because of this, not all of them can do well or win.

Founder/team departures: When a key developer leaves, it shows people have less trust in the project now.

Risk Mitigation Strategies

Position sizing: Put more money into ideas you feel less certain about. High-conviction spots should be no more than 5-10% of the total. Try not to put more than 1-2% into risky ideas.

Diversification: It is good to put your money into 5 to 10 different altcoins that do not move in the same way, instead of only having one token. Different parts of crypto, like DeFi, gaming, privacy, and layer-2s, do not always go up or down together. This gives you a better chance if some of them get more value while others do not.

Time horizon matching: Hold your investment for a time that matches your own plan. If you trade for a short time, you should be ready for drops of 30% to 50% and make your trades based on that. If you hold for a long time, you should not worry much about price changes over one year.

Profit taking: Sell some of the winning investments to take your profit. This also helps to lower how much you have in one stock. You can also slowly make your investment smaller in a company if the price goes up.

Stop losses: Set the biggest loss you are ready to take before you start (usually it is around 30-50% for growth tokens). When it is time, stick to it. Do not let your feelings get in the way.

Dollar-cost averaging: Instead of putting in all your money at one time, buy more over many days or months. You can do this once a month or every three months. This helps lower the risk of bad timing in the market.

Rebalancing: Changing your investments every few months or two times a year helps you be steady with taking profits and buying when prices are low.

The Future of Altcoin Investment: 2025-2026 Outlook

Many big trends will shape how altcoins will grow.

1. Increased Blockchain Adoption

Enterprise blockchain use keeps growing. More companies now track supply chains, tokenize things they own, and use decentralized identity. These ideas are not just in tests, but are being used for real. This is why people want more utility tokens.

2. Decentralized Finance Maturation

DeFi protocols are going from being tests to becoming ready for real use. More big investors are coming in, and spot Bitcoin ETFs have already helped make that happen. This will help speed things up for DeFi. DeFi tokens that help with key things like lending, swaps, and derivatives should see good results.

3. Layer-2 & Scaling Solutions

Ethereum and Bitcoin layer-2 solutions help to cut down on the cost of sending money. This helps developers work faster and makes it easy for people to start using these services. Layer-2 tokens like Arbitrum and Optimism give us good options for growth.

4. Sustainability Focus

Many people worry about the climate. This worry is making the development move toward proof-of-stake and other ways that use less energy. Proof-of-work coins, except for Bitcoin, may have some big problems to face.

5. Regulatory Clarity

MiCA (European Markets in Crypto-Assets Regulation) and rules like this give clear rules for the crypto world. This helps cut down legal risk for projects that follow the rules. But it can make things harder for those that do not follow the rules.

6. Institutional Participation

When more money from big companies comes into cryptocurrency, it helps big, popular coins to grow. This is good for the top-10 altcoins, but it puts smaller coins with less trading at risk.

7. Integration with Traditional Finance

When banks and payment networks start using stablecoins and crypto rails, more people join in. This helps everyone see the value in using it for payments and settlements. As more users join, it grows even faster.

8. Diversification of Use Cases

The use of blockchain is not just for money matters. People now use it for things like identity, voting, keeping track of data, and checking where products come from in the supply chain. This helps new altcoins solve more focused problems.

Common Mistakes to Avoid

1. Buying because of social media hype

- FOMO-driven buys often happen when the market is at its highest point.

- Don’t pay attention to what you see on social media. Look at the basics instead.

- Most projects that people push on Twitter are very risky.

2. Failing to take profits

- When you feel too connected to winners, you might not get your profits.

- Make profit goals before. These can be getting back 2x, 5x, or 10x what you put in.

- Take out some of your money as the price goes up each time.

3. Insufficient position sizing

- Using too much borrowed money can make you need to sell when prices drop.

- Only put 1-3% of your money into any one trade.

- Choose the size of each trade in the opposite way of how sure you feel.

4. Neglecting security

- Exchange hacks and user mistakes can lead to big losses.

- Use hardware wallets if you plan to hold your spot for more than one month.

- Do not keep large amounts of money on exchanges.

5. Chasing losses

- When you keep buying more while losing, you take on more risk.

- It’s better to take losses and put your money in better trades.

- Do not try to get back money fast after big losses.

6. Ignoring tax implications

- Trading often can lead to high tax bills.

- Keep good records of your trades.

- Think about legal ways to lower taxes in your area.

7. Failing to understand the project

- Buying tokens without knowing what they are for can cause big problems.

- If you can’t tell someone what the project is about in two minutes, you don’t know it well.

- You should read the whitepapers and technical papers before you buy anything.

8. Overestimating your ability to time the market

- Most people who invest do not do better than buy-and-hold plans.

- Do not trade a lot. Put your money in and keep it there as cycles come and go.

- Know that timing luck is a big part of this, sometimes even more important than doing everything right.

Comprehensive FAQ: Answering Your Altcoin Questions

Understanding Altcoin Basics

If you are new in crypto, you may want to know about some of the top altcoins. These coins are different from Bitcoin. A few of the most well-known ones are:

- Ethereum (ETH): This is very popular. Many people use it to build things on the blockchain.

- Binance Coin (BNB): A lot of people use this coin to pay fees on Binance, which is a big crypto exchange.

- Cardano (ADA): A lot of people like Cardano for its different ways to make things work on the blockchain.

- Solana (SOL): Many people talk about this coin. It is known because it lets things run fast and does not use a lot of money.

- Polygon (MATIC): A lot of people use this coin to help Ethereum work faster and for less money.

There are many other altcoins too. But if you are just starting out, these are some of the most important ones for you to know about.

A: The top 10 well-known altcoins by how much money they are worth and what you can use them for are Ethereum (smart contracts), Binance Coin (on the exchange), Solana (fast platform), XRP (for sending money across borders), Cardano (a platform that focuses on research), Polkadot (a coin that helps different blockchains talk to each other), Litecoin (a coin for paying), Uniswap (a place to swap coins that is not run by one person), and Avalanche (a platform for big companies).

However, the word “important” means different things based on what you want from your investment plan. If you want to get into DeFi, you should look at Ethereum, Aave, and Uniswap. If you want to focus on payments, Litecoin and XRP are the top choices. If you are new, you should start with the biggest five projects by market value. Then, you can check out smaller ones later.

Q: What exactly are altcoins, and how do they differ from Bitcoin?

Altcoins are any digital coins that are not Bitcoin. These coins use the same kind of computer code as Bitcoin does but can often work in different ways. Most of them try to do some things better or faster than Bitcoin. People make altcoins to give more choices in the digital money world. While Bitcoin is the first and most known digital coin, there are many altcoins out there now. Each one has its own goals and ways to work. Some can be used for lower fees or to move money faster. When you hear someone say “altcoin,” they mean all other coins besides Bitcoin.

Altcoins are any cryptocurrencies that are not Bitcoin. Bitcoin was made to be used as digital money. On the other hand, each altcoin usually has its own goal. For example, Ethereum lets people build apps. Ripple helps with sending money from one country to another. Dogecoin is more about the community. There are many other altcoins, and every one has something different to offer.

Key differences: Bitcoin uses proof-of-work, which needs a lot of computer power. Many altcoins use proof-of-stake, and that takes much less energy. Bitcoin has a hard limit of 21 million coins. Altcoins can have a different number of coins. Bitcoin puts security and being spread out first. On the other hand, many altcoins focus on speed or how things work, even if they are not as spread out as Bitcoin.

Q: Are altcoins better than Bitcoin?

A: This depends on the situation. Bitcoin is better for:

- Save value for a long time. It has very strong safety, and is the oldest group.

- Send money between countries without others blocking it.

- Few changes to how money is made. There will only be a set amount.

Altcoins excel for:

- There are special uses for some coins. For example, Ethereum is used for contracts and Ripple is good for payments.

- Some blockchains can move money fast. Solana and Avalanche are much quicker than Bitcoin, which can do only 7 transactions each second.

- Proof-of-stake coins cost less energy. These coins are better for the earth.

A good mix of coins should have both Bitcoin and different altcoins. You can put about 60% to 70% in Bitcoin, and 30% to 40% in altcoins. Bitcoin was the first, and it is hard for other coins to beat it because many people use it. But, some other coins are good because they do things that Bitcoin can’t do.

Investment Selection & Strategy

Q: What are the best altcoins to invest in?

A: This will be up to what you believe and how much risk you want to take. But, some clear points are:

- Market leadership: Ethereum, BNB, Solana, and Polkadot are at the top when you look at market cap and how much they have grown.

- Real use: Picks projects that have real people using them and a good number of transactions, not just buzz or talk.

- Strong base: A team with a lot of skill and work. They keep working and improving, and money matters are steady.

- Manageable competition: Chooses to stay away from areas that are too full, like coins which try to be the next “Ethereum killer”.

Don’t just listen to what others say. Instead, use the evaluation steps talked about in this guide. The best altcoins are the ones that fit with what you want and how much risk you are okay with. Top coins can change every year. A coin that does well in 2024 may not do so well in 2025.

Q: Can I make $100 a day from crypto?

A: In theory, yes, you can. But for most people, no, it’s not likely. Let me help you see the math. If you get $100 each day, that adds up to $36,500 in a year. To do this, you need:

- You need to have at least $100,000 to make $100 each day.

- You must get returns of 36% or more each year. This is much more than what the stock market has given in the past.

- You need better timing and you must manage risk well.

- You must have more skill than 95% of people who trade for a living.

Most people who say they make $100 a day are either selling courses instead of trading, using too much leverage that can’t last, or just getting lucky for a short time. Building real and lasting wealth takes steady gains over many years, not just in a few days.

Do not try to make money every day. It’s better to aim for steady gains of 30-50% each year. To do this, you need to size your trades with care and adjust them often. A $10,000 investment can grow to $1 million in 12 years if you earn 50% per year. This is much better than trying to make all your money by trading every day, which does not last.

Q: What is the best strategy for buying and selling altcoins to maximize profits?

The best way to buy and sell altcoins and make the most money is to do your homework first. Get to know the altcoin you want to buy. Look at the price, read about the project, and understand the risks. Try not to put all your money into just one coin. Spread your money in different altcoins.

Watch the market all the time. If you see that prices are going up fast, you can think about selling a part of what you have. This way, you make sure you are getting some gains. If the price falls down, do not feel panic or sell right away. Take a breath and check the news to find out why.

Have a plan to set the price where you want to sell, even before you buy. This will help if there is much change in the market, and you do not feel pressure when there is fear or greed. Use stop-loss to help you stop your losses if the price goes too low.

You want to check your goals, the fees for trades, and how strong the coin is before you use your money. In the end, the most important thing is to stay safe and not use money that you cannot lose in altcoins. Prices can go up and down fast, so be ready for those changes.

A: Studies show that there are several ways, based on strong proof, that can help:

- Momentum + mean pullback: Buy coins that have done well in the last 6 months, and sell when your gains go over 30-50%.

- Dollar-cost averaging: Put your money in over 3 to 6 months, instead of putting it all in at once.

- Trend following: Buy coins when the price is going up, sell when it is dropping; do not try to buy at the lowest point.

- Diversification: Put your money into several coins that do not move like each other, and not just into one or two coins.

- Tax loss harvesting: Sell some coins that have lost money to lower what you owe from coins that made money, so you pay less tax.

What consistently fails:

- Day trading is hard, because exchange fees and slippage will beat you every time.

- Chasing hype can get you in trouble. You buy when things are too high and sell when they are too low.

- There are no sure returns. Every strategy can fail at some point.

- Using too much leverage can wipe out all your money when things go down.

The harsh truth is this: most people who trade often do not do as well as those who just buy and hold coins. You can try a simple way. Put your money in the top 10 altcoins and hold them for more than 4 years. Adjust your holdings every few months. This way often gets better returns than what 90% of active traders get. It also takes much less of your time.

Q: Which coin has 1000x potential?

A: Be very careful with projects that say you will get 1000x profit. The math shows why:

A $100 altcoin with a $100M market cap would need to hit a $100B valuation to reach 1000x. This can happen, but it means it has to do better than Ethereum, which is now about $300B. Ethereum took 9 years to get here, and back then, the other coins were not as strong.

Coins with theoretical 1000x potential are likely:

- Early-stage L1 blockchains working in big markets (2-3 could win)

- New DeFi tokens at the start (if they get a lot of value)

- Projects that no one knows yet (they have a high chance to fail)

To be honest, getting 1000x returns needs a lot of luck. People also have to find a really big change early. Most of those who feel they “should have” bought these 1000x winners say they could not have kept going while the price dropped by 90% on the way.

Try to get returns that are 5 to 10 times higher over 3 to 5 years. You can do this if you choose well and have patience with your money. You do not need special luck for this to happen.

Q: What is the 1% rule in crypto?

A: The “1% rule” is about managing your risk in trading. It says you should not put more than 1% of your money on one trade. This means:

- If you have $100,000, you should not risk more than $1,000 for each trade.

- The size of your trade should be set so if your stop loss hits, you lose only 1% of your total money.

- With this rule, even if you lose on 100 trades in a row, you will still have your money.

This rule helps you not get too sure of yourself or let your feelings guide your trades. But, it is better for people who hold for a long time. A different way: if you trade a lot, risk 1% each time. If you want to hold the asset for more than 12 months and feel sure about it, you can put 5-10% in that trade.

The main idea is clear. You must always pick the right size for your trades to stay safe. This rule cannot change.

Practical Buying & Trading Questions

Q: How can I buy cryptocurrency? Which ones should I recommend?

To buy cryptocurrency, you first need to make an account on a trusted exchange. Some popular choices are Coinbase and Binance. After you sign up, you can add money to your account using a bank card or transfer. Then, look for the type of cryptocurrency you want to buy. You can start with big names like Bitcoin or Ethereum, as they are well known. Choose the amount you want to get and finish the order. Before you start, read as much as you can and stay safe while buying online.

A: Step-by-step process:

- Pick an exchange. You can use Coinbase if you want more safety, or Binance if you want more choices.

- Finish verifying who you are. You will need your government ID and something that shows your address.

- Put money in using your bank or a credit card.

- Set limit orders to buy the altcoins you want.

- Take your coins out right away and put them on a hardware wallet.

For people who are new, it is good to start with these top 5 altcoins: Ethereum, BNB, Solana, XRP, and Cardano. They be the biggest ones, with many people using them. This means they do not fail often and can be sold fast. Do not buy smaller altcoins until you feel ready and know how things work.

If you want to start trading cryptocurrency, there are some simple steps you can take. First, do a lot of research about the market. Know what you are getting into, and read about the risks. Second, only use money you can afford to lose. Some people lose their savings because this market can go up and down fast.

Get advice from several sources before you make a choice. You can look up how trading works on websites like Investopedia. Try to practice with a demo account before using real money. That way, you see how things work without the risk.

Keep your money safe. Store your crypto on safe wallets if you do not plan to trade it right away. Be careful of scams and fake offers. It is good to start slow, learn from your mistakes, and not rush. Over time, you will get better and feel more sure about your decisions. Remember, it takes patience and practice to do well.

A: Start with education before capital deployment:

- Spend 1-2 months to learn about blockchain basics, how everyone uses cryptocurrency, and how to judge a project.

- Try out paper trading for 1 month. Here, you make practice trades without using real money.

- Put in a small amount of money ($1,000-$5,000) so you can see how you feel when you use your own cash.

- Keep a 2-year plan in mind. Do not worry about price changes that happen every day or every week.

- Know that losing more than 50% is normal. Do not feel the need to sell fast when prices go down.

Critical success factors:

- Position sizing practice: Never put more than 5% of your money into one trade.

- Security worry: Use hardware wallets. Do not trust exchanges for keeping your coins for a long time.

- Emotional balance: Most people lose money when they let feelings guide them (like when they feel FOMO or they sell in fear).

- Tax tracking: Keep detailed notes from the first day.

- Planned approach: Follow your set rules. Ignore what people on social media say.

Most traders do not do well because they do not see how hard trading can be for your mind. It is very hard to see your $10,000 become $5,000. If you do not have your rules set from the start, most people give up when things look their worst.

You may want to learn what crypto is before you start to trade. There are many online sites where you can learn about crypto. A good way is to read easy guides, blog posts, or watch some videos. This will help you know how crypto works and how to use it in the real world.

Some common places to learn are beginner guides on popular crypto websites, YouTube channels, and free online courses. You can also read forums to find out what other people say about new trends every year. Before you use your money, take your time to read a lot and ask questions. With this knowledge, you will feel better about how you buy or sell in the crypto world.

A: Quality learning resources:

Foundational knowledge:

- “The Bitcoin Standard” by Saifedean Ammous (how money and Bitcoin work)

- “The Age of Cryptocurrency” by Paul Vigna (a good place to start for new people)

- Andreas Antonopoulos YouTube channel (deep look at how it works)

Technical resources:

- CoinMarketCap & CoinGecko (market data, project info)

- Project whitepapers (main idea, technical details)

- GitHub repositories (work by team, code quality)

- Blockchain explorers (on-chain data, checking transactions)

Community learning:

- r/CryptoCurrency on Reddit (talks are balanced, stay away from hype subreddits)

- Twitter accounts of project teams (for official news)

- Podcasts: The Pomp Podcast, Bankless (good and trusted analysis)

Avoid:

- YouTube traders who say you will always make money

- “Crypto signals” Telegram groups (these are scams every time)

- Anonymous influencers who talk about tokens (they are often early investors selling off theirs)

Plan to spend 6-12 months learning before you start using a lot of your money. If you miss this time, you will usually lose money.

Q: How to start making money from cryptocurrency investments?

To start making money with cryptocurrency, you will first need to know about the market. Learn what the top coins are and see how they go up and down. You can open an account on a trusted platform where people buy and sell crypto. Make sure you use money that you can handle to lose because there is risk in this market. At first, it is good to start small and see how things work. Over time, as you learn more, you might feel ready to put in more money. Always keep checking the news about the market. This can help you make better choices.

A: Five evidence-based approaches:

- Long-term appreciation: Buy and keep good altcoins for more than 4 years. In the past, these have given back returns of about 40-60% a year when the market is good.

- Yield farming: Put your tokens in DeFi projects and get 5-20% a year as returns. A higher return means there can be more risk.

- Staking: A few altcoins like Ethereum, Cardano, and Polkadot give staking rewards (5-12% a year) if you join in.

- Dollar-cost averaging: Put the same amount of money in every month, no matter what the price is. This lets you take advantage of price changes and removes guessing about timing.

- Rebalancing on a schedule: Every few months, sell some of your coin that has gone up, and buy some that has gone down. Doing this can give around 1-3% better returns each year.

What doesn’t work:

- Day trading (fees and slippage can take away profits)

- Technical analysis (markets have become hard to read)

- Following “signals” (all are scams)

- Leverage trading (90% of people who use leverage lose their money)

In real life, you can get about 15-30% returns each year when you look at the full cycle. Bitcoin and altcoins can go up more than stocks. But you need to be patient and deal with ups and downs in the market.

If you want to invest in altcoins, you need to do a lot of research before you start. Look for projects that feel strong and products you think people will use for a long time. Try not to put all your money in one altcoin. It is good to spread your investment. Keep in mind that prices for altcoins can go up and down fast, so only put in what you can risk to lose. There are new coins coming every year, so make sure you use trusted sources for news before you make any move.

A: Investment (not trading) approach:

- Put 5-15% of your money into crypto: Do not risk money you cannot lose. Crypto is risky. So, keep 85-95% of your money in other things.

- Get in little by little: Do not buy everything at once. Use your money over 6 to 12 months. This helps lower your risk over time.

- Spread your money across different types: Do not just buy one kind, like DeFi or only layer-2s. It is good to have platforms, payments, government tokens, and more.

- Look at the top 20-30 coins or projects: They get support from big groups and follow the rules. They are used for real things. Stay away from new tokens that nobody knows.

- Have real goals: Aiming for 30-40% a year is good. Most people who hope for 100% or more in a year will lose money.

- Stay strong in your plan: Know your buying price, how much to put in, and how you will get out before you begin. Stick to your plan, even if prices move a lot.

- Do not try to guess the best time to buy or sell: Most people who try to guess do worse. Put your money in bit by bit following your plan, do not let the price change your mind.

Advanced Strategic Questions

Q: How do I find and pick good altcoins that can make money?

A: Systematic screening process:

Step 1: Size the opportunity

- Is the target market big enough to support the value of the token?

- Is the project trying to solve big problems, with a lot of money on the line?

- Are more people using it fast, or is growth slowing down?

Step 2: Evaluate competitive position

- How many direct competitors are there?

- What special advantages does this project have?

- Can other companies easily copy the advantage?

- Is the chance to keep ahead getting better or worse?

Step 3: Analyze on-chain metrics

- Transaction volume: Is it going up or going down?

- Active users: Is the group getting bigger?

- Gas spent: Are users taking real action, or are they just guessing what will happen next?

- Whale activity: Are big holders buying more, or are they selling?

Step 4: Review financial sustainability

- What is the way this project makes money?

- How much time can the project keep moving forward?

- What part of the money set aside is for running things?

- Can the token model last (with things like inflation, burning, and more)?

Step 5: Assess team quality

- Do founders have a good track record?

- Are key developers still working on the project?

- Has the team been able to ship products well?

- Is the organizational structure decentralizing (a good sign)?

Use this framework when you look at the investments. If a project does not pass step 1 or step 2, you can stop thinking about it right away. Most choices that pass the first checks do not go past step 4 or 5.

Q: How do I select cryptocurrencies for investment?

To pick the best cryptocurrencies to invest in, you need to do some research first. Look at how each coin works and what it is used for. Check who made it, and see if there is a team behind it that people trust. Make sure to read news, get updates, and watch how much the price goes up and down over time. You should read what other people say about the coin on well-known sites, too. Think about how much money you want to put in and know your risks before you buy any coin. It is always a good idea to look for news, read more, or talk to someone you trust if you are not sure.

A: Use the multi-factor framework in this article:

- Analysis of basic factors (8-10 things mentioned above)

- Technical analysis (trend is happening, support or push-back levels)

- How people feel about it (is the group growing, are developers active)

- Value check (is price fair compared to what people do with it, how big it is compared to how often people use it)

Then apply conviction scoring:

- 100% conviction: Put 10-15% of your altcoin money here.

- 80% conviction: Put 5-10% of your money in these.

- 50% conviction: Use 2-5% of what you have for these.

- 20% conviction: Only put 1-2% of your money here.

This way of putting money into different things helps not to put too much in risky choices. A group of investments made like this will often have 8 to 12 different picks. This gives a good mix for risk.

Q: Should I buy altcoins before Bitcoin halving events?

When you hear people talk about Bitcoin halving, you may wonder if now is a good time to buy altcoins. A lot of people think that crypto prices can go up around this time. There are times when Bitcoin goes up first, and then altcoins may follow. But it can also go the other way. The price may not move the way people think. You need to do your research first.

There may be more news and hype before a halving. This can bring in new people who want to buy crypto. Prices can go up when more people want to buy. Still, the market for crypto can change very fast. The value of your coins can go up and down, so you should only put in money that you feel be okay to lose.

It is good to keep up with what is going on. A lot of people look for tips and read up on how Bitcoin changes at these times. But no one can say for sure what will happen. Do what is right for you and keep track of the latest news about Bitcoin and altcoins before you make your choice.

A: Research suggests nuanced conclusions:

Before halving:

- Altcoins usually do not do as well as Bitcoin. At this time, Bitcoin rises in price compared to others.

- This is not a good time to keep your money in altcoins. Most money goes into Bitcoin now.

After halving:

- If Bitcoin goes up a lot, altcoins can grow very fast.

- This is the best time to collect altcoins. It is after Bitcoin halvings, when things get back to normal.

Strategy: Move your money from altcoins to Bitcoin about two to three months before the halving. After the halving, move your money back to altcoins if Bitcoin has gone up a lot-at least 40% or more. This helps you use patterns that happen most years.

However, this is a big-picture timing strategy. For people who hold for a long time, you can skip halving cycles. You can keep the same amounts by readjusting your holdings again and again.

Building a Sustainable Altcoin Strategy

Altcoin investment is not the same as investing in Bitcoin. Bitcoin is like digital gold. People see it as a way to store value. You need to be patient with bitcoin and hold on to it over time. Altcoins are different. They act as engines that drive work. These are platforms and tools that try to get value by being used more and by coming up with new ideas.

Success in altcoin investment requires:

- A deep understanding of technology, how the market works, and where you can use these things.

- A step-by-step way to check and sort out the best ways to invest.

- Careful sizing of each choice to keep from having big losses.

- A steady mind by following rules set before and thinking long-term.

- A focus on safety that keeps you safe from the other party’s risk.

- Knowing about taxes and keeping good records.

- A humble view that nobody can pick the right time in the market, and the market always goes up and down.

The cryptocurrency market will keep changing. Layer-2 scaling solutions, tokenized real-world assets, and big company adoption will make new chances and get rid of old projects. Your job is not to say which projects will win, but to keep ways that let you adapt fast as things shift.

Look at altcoins as an investment for over 10 years. You should know that 70-90% of your picks can do worse or even go away. This is normal in markets that change because of new ideas. The main thing is that the ones that do well make enough profit to cover the ones that do badly. Also, be careful with your money and use good risk steps to keep your funds safe.

The best advice is to start small. Take time to learn as much as you can. Spread your money over different things. Wait to put in more money until you can go through several market changes without acting on your feelings. People who do this usually build a lot of wealth. People who do not follow this path often lose a lot of money.

Your edge is not about being better at guessing the outcome. It is about having more patience and staying steady.