Muang Thai Life Assurance stands as Thailand’s most trusted life insurance institution, protecting millions of families across the kingdom for over seven decades. As a publicly listed company with a solid market share of approximately 11% by total premium income, Muang Thai Life represents stability, innovation, and unwavering commitment to customer financial security.

Whether you’re a young professional planning your future, a parent protecting your family’s financial legacy, or a retiree seeking comprehensive coverage, Muang Thai Life offers sophisticated insurance solutions tailored to every life stage. This comprehensive guide explores everything you need to know about the company, its product ecosystem, and why it has earned the trust of Thailand’s forward-thinking population.

What is Muang Thai Life Assurance?

Company Overview and Heritage

Muang Thai Life Assurance PCL (Thai: บริษัท เมืองไทยประกันชีวิต จำกัด (มหาชน)) is Thailand’s premier life and health insurance provider, officially established on April 6, 1951. Founded by visionary businessman Chulind Lamsam alongside government sector leaders, the company was created with a noble mission: to provide long-term financial security while supporting Thailand’s economic development.

The company’s journey reflects Thailand’s modern evolution. In a remarkable honor, Muang Thai Life became the first life insurance company appointed under the royal patronage of His Majesty King Bhumibol Adulyadej, granting it the prestigious right to bear the royal Garuda emblem on all company documents—a distinction that underscores its national significance and trustworthiness.

Market Position and Credibility

Based at 250 Ratchadaphisek Road in Bangkok’s Huai Khwang district, Muang Thai Life operates through a nationwide network exceeding 250 branches and agency offices. The company’s conversion to public limited status in October 2012 further solidified its commitment to transparency and good corporate governance, enabling public market scrutiny and ensuring alignment with international financial standards.

Recent performance data demonstrates the company’s robust market position:

- Total Premium Income: 70,978 million Baht annually

- Market Share: Approximately 11% of Thailand’s life insurance market

- Financial Strength: Consistent operational support from major shareholders including Kasikornbank and Ageas Insurance International

- International Recognition: Recipient of multiple World Branding Awards (2015-2024), affirming its status as a globally recognized Thai brand

Strategic Partnerships and Global Standards

Muang Thai Life’s strength derives from carefully cultivated partnerships with world-class financial institutions. In 2004, the company formed a transformative alliance with Ageas Insurance International (formerly FORTIS), bringing European expertise and modern technology to Thailand’s insurance landscape. This partnership catalyzed the development of bancassurance channels through Kasikornbank, Thailand’s leading financial institution.

By 2009, Kasikornbank expanded its shareholding stake, enabling the company to scale its bancassurance operations comprehensively. This structural alignment with one of Thailand’s most respected banks ensures that Muang Thai Life customers benefit from banking-grade security infrastructure and extensive distribution networks.

The Evolution of Innovation: From Traditional Insurance to InsurTech Leadership

Historical Milestones

1951-1998: Foundation and Growth

The company’s first 47 years focused on building trust through dependable products and personal agent relationships. Operating from Suapa Road initially, Muang Thai Life established itself as the reliable partner for Thai families’ financial protection.

1998: Strategic Restructuring

Muang Thai Life underwent significant organizational restructuring, separating life insurance (MTL) from non-life insurance operations (MTI), allowing specialized focus in each segment. The company rebranded with a modernized logo and adopted the forward-looking slogan “Company of Forward-Thinking People”—a positioning that has defined its culture ever since.

2004: Ageas Partnership and Smile Club Launch

International partnership with Ageas marked Thailand’s insurance industry’s globalization. Simultaneously, Muang Thai Life revolutionized customer relationship management by launching “Muang Thai Smile Club,” the first CRM program in Thai life insurance history, transforming how insurers engaged families.

2012: Public Company Conversion

Transitioning to public company status enabled the company to strengthen corporate governance structures and access capital markets, fueling innovation and expansion.

2017-2019: InsurTech Pioneer

Muang Thai Life established the “Fuchsia Innovation Centre” and “Fuchsia VC,” pioneering insurtech development in Southeast Asia. The launch of subsidiary company Aigen in 2019 demonstrated the company’s commitment to artificial intelligence integration, positioning it at the forefront of digital transformation in insurance.

Current Leadership and Vision

Under Chief Executive Officer Sara Lamsam’s 17-year leadership tenure, the company has evolved into a regional insurance leader combining traditional reliability with cutting-edge innovation. Lamsam’s philosophy emphasizes that “the most important thing in life insurance is trust and honesty”—values reflected in every product and customer interaction.

The company’s vision is unambiguous: to become Thailand’s No. 1 life insurance company delivering stability, strength, and innovative solutions for every life stage.

Muang Thai Life vs. Competitors: Why It Stands Out

Market Differentiation

While Thailand’s insurance market includes competitors like AIA Group, Thai Life Insurance, King Wai Insurance, and Viriyah Insurance, Muang Thai Life maintains distinct competitive advantages:

| Aspect | Muang Thai Life | Typical Competitors |

|---|---|---|

| Market Heritage | 75+ years, royal patronage | 30-70 years typically |

| Innovation Focus | Active InsurTech investment (Aigen, Fuchsia) | Limited digital initiatives |

| Distribution Channels | Direct agents, bancassurance (Kasikornbank), online, telemarketing | Primarily agent-based or bancassurance only |

| Product Customization | Dynamic pricing, extensive product variations | Standard pricing models |

| Tax Benefits | Up to 300,000 THB deduction for life insurance annually | Similar deduction limits |

| Financial Strength | 11% market share, public company oversight | Variable by competitor |

| Customer Engagement | Muang Thai Smile Club (industry-first CRM program) | Limited loyalty programs |

Key Competitive Strengths

Digital Leadership: Unlike competitors relying primarily on traditional distribution, Muang Thai Life invests aggressively in InsurTech infrastructure. The Aigen subsidiary demonstrates commitment to AI-powered underwriting, claims processing, and personalized risk assessment—capabilities that increasingly define modern insurance excellence.

Bancassurance Excellence: Strategic integration with Kasikornbank provides unparalleled accessibility. Customers can consult with insurance advisors at any Kasikornbank branch nationwide, combining banking convenience with insurance expertise in ways most competitors cannot replicate.

Product Innovation: Muang Thai Life’s dynamic pricing model—rare among Thai insurers—allows personalized premium calculations based on individual circumstances, ensuring customers pay fair prices reflecting their actual risk profiles.

Customer Loyalty Infrastructure: The Muang Thai Smile Club offers year-round engagement activities, exclusive benefits, and community experiences that transcend transactional insurance relationships, creating emotional brand loyalty competitors struggle to match.

Understanding Muang Thai Life Insurance Products

Life Protection Products

Muang Thai Life’s life insurance portfolio addresses every family situation and financial objective. These products represent sophisticated risk management tailored to diverse customer needs.

Whole Life Insurance Plans

Muang Thai Premier Legacy 99/1 (Fixed CV)

This innovative whole life product features a revolutionary fixed cash surrender value maintained throughout the contract term, enabling lower premiums while preserving coverage levels. Ideal for individuals not planning early policy surrender, this plan facilitates legacy wealth transfer to beneficiaries without court proceedings or taxation—ensuring financial security extends generationally.

Muang Thai Wai Gao AunJai HaiHuang (Senior Campaign)

Specifically designed for golden-age living, this comprehensive plan provides three simultaneous protections: life coverage, accident protection, and health security. Seniors can enjoy retirement activities with confidence, knowing their loved ones remain financially protected.

Muang Thai Premier Legacy Series

These whole life insurance plans emphasize legacy planning philosophy. By selecting desired sum-insured amounts, families ensure wealth properly accumulates and transfers according to their values and priorities. Single premium or regular payment options accommodate different financial situations.

Term Life Insurance Plans

Muang Thai Smile Saver 20/16

Combining affordability with comprehensive protection, this plan delivers maturity benefits up to 120% of initial sum insured alongside 120% life coverage. Customers receive lump sum payouts upon policy maturity, creating both death protection and wealth accumulation.

Term Insurance (1, 5, 10, 15 Year Options)

Muang Thai Life’s flexible term insurance provides high life coverage at remarkably low premiums. Designed for budget-conscious families prioritizing death benefit protection, these plans ensure dependents remain financially secure if tragedy occurs. Upon death, beneficiaries receive the full sum insured amount, providing the financial cushion families desperately need.

Hybrid Protection Plans

Muang Thai Flexi Protection 99/20

This breakthrough “Buy 1, Get 2” product ingeniously combines life insurance with medical expense conversion capabilities. From age 65 onward, coverage flexibly converts to inpatient and outpatient medical expenses, addressing healthcare inflation in retirement years. Customers receive 100% coverage as sum insured upon death or contract maturity, with medical expenses calculated against benefits (if any).

Muang Thai Happy Return 99/7

This dual-benefit plan strikes an ideal balance for family protectors. Customers pay premiums for only seven years, yet receive lifelong coverage extending to age 99. Annual cash bonuses (1% from policy year 1 through age 98) plus 100% maturity benefits create both immediate financial rewards and long-term security.

Annuity and Retirement Solutions

Flexi Retire 90/5 (Tax-Deductible Annuity)

Designed for retirees optimizing income distribution across retirement decades, this plan allows annuity payment initiation at ages 55, 60, or 65. After completing a five-year premium payment period, customers can adjust retirement income start dates, accommodating changing life circumstances.

UL Plus Universal Life Insurance

Combining flexibility with guaranteed returns, UL Plus guarantees minimum 4% returns in year one while allowing customers to customize coverage levels and create long-term financial legacies. Tax deduction benefits enhance retirement planning efficiency.

Health Insurance Products

Muang Thai Life recognizes health security represents the foundation of comprehensive family protection. Modern health inflation demands sophisticated medical coverage, and Muang Thai Life delivers solutions addressing every wellness scenario.

Comprehensive Health Coverage

D Health Plus Coverage

Acknowledging that Gen Z faces unexpected health challenges at any age, D Health Plus provides accessible medical coverage before illnesses escalate. Young people gain confidence knowing comprehensive healthcare support exists when needed.

Elite Health Plus Rider

This superior health protection covers common diseases at every severity stage and includes epidemic coverage. Customers choose protection levels matching their specific health concerns, avoiding unnecessary costs for unneeded coverage areas.

Care Plus Coverage

Recognizing that critical illnesses like cancer and chronic kidney failure create devastating financial burdens, Care Plus provides specialized coverage supporting every disease stage. With coverage up to 5 million baht per disease annually, customers access advanced treatments without financial anxiety.

Specialized Health Solutions

Mao Chai Extra Campaign

Democratizing health coverage regardless of social welfare status, this plan ensures medical expenses never create financial hardship. Healthcare access becomes equitable across economic backgrounds.

Health Insurance for Seniors and Special Populations

Muang Thai Life recognizes that different age groups and health statuses require tailored approaches. Dedicated programs for seniors address age-specific health challenges while programs for children (including infants) protect vulnerable populations from conception forward.

Savings and Investment-Linked Products

Recognizing that modern families seek dual-purpose insurance combining protection with wealth accumulation, Muang Thai Life offers sophisticated savings-focused products.

Tax-Advantaged Savings Plans

Muang Thai Khuen Chat Tem 10/3

This revolutionary short-term savings vehicle delivers exceptional returns: customers save for only three years yet receive 333% total benefits. Combined with 100,000 THB annual tax deductions, this product creates efficient wealth accumulation while reducing tax burdens.

Muang Thai Perfect Saving 11/5

Optimizing tax planning, this product provides five-year premium payments coupled with 11-year coverage. Biennial payouts create consistent cash returns, transforming savings into reliable income streams.

Investment-Linked Insurance

Muang Thai Smart Linked 15/6 (Global Campaign)

This sophisticated 3-in-1 product merges life coverage, guaranteed cash bonuses, and dividend upside through GS Momentum Builder® Multi-Asset 5S ER Index. Regardless of economic cycles, customers benefit from diversified investment exposure alongside insurance protection.

mGrow 615

Offering steady portfolio growth, mGrow 615 requires six-year premiums yet provides 15-year coverage. Unit-linked structure enables participation in market upside while maintaining insurance security.

mOne: One-Time Payment Life Protection Plus Investment

This innovative single-premium product delivers lifetime coverage extending to age 99 combined with investment participation. Customers make one payment and receive decades of protection plus wealth building opportunity.

Eligibility, Coverage Limits, and Tax Benefits

Who Can Apply for Muang Thai Life Insurance?

Muang Thai Life serves diverse customer segments:

Thai Citizens:

- No restrictive age requirements for many products

- Coverage available from birth through age 99

- Minimal documentation requirements for most plans

Foreign Residents and Expats:

- Must hold work permits OR be married to Thai nationals OR be retirees on Long-Stay visas

- Age coverage typically from 15 days to 70 years (varies by product)

- Additional documentation requirements may apply based on visa status

- Children under 18 must be included in parental policies

Family Structures:

- Parents and children coverage combinations available

- Spousal protection options

- Dependent coverage provisions

Coverage Limits and Benefits

Muang Thai Life products feature flexible coverage structures:

- Whole Life Insurance: Lifetime death benefits with accumulated cash values

- Term Life Insurance: Fixed-period coverage (1, 5, 10, 15 years) with 100% death benefit payouts

- Health Insurance: Hospitalization coverage from 500,000 to 5,000,000+ baht annually (depending on plan)

- Critical Illness Coverage: Up to 5,000,000 baht per disease annually

- Accidental Death: Enhanced death benefits for accident-related deaths

- Disability and Accident Protection: Income replacement during recovery periods

Tax Deduction Benefits

Thailand’s tax system significantly incentivizes life insurance protection:

Life Insurance Premiums:

- Deductible up to 300,000 THB annually

- Policies must feature minimum 10-year coverage periods

- Contributions accumulate as pre-tax deductions, reducing annual tax liability

Health Insurance Premiums:

- Combined deduction with life insurance not exceeding 100,000 THB annually

- Additional 25,000 THB limit for standalone health coverage

Annuity Insurance:

- Special deduction category with separate 200,000 THB annual limit

- Designed specifically for retirement income planning

Example Tax Savings Scenario:

A customer purchasing 300,000 THB in annual life insurance premiums at Thailand’s 20% marginal tax rate saves 60,000 THB in taxes annually. Over a 20-year period, this represents 1,200,000 THB in cumulative tax savings—a substantial financial advantage making insurance protection financially rational beyond pure risk management.

Policy Maturity and Surrender Benefits

Muang Thai Life products feature transparent benefit structures:

Whole Life Plans:

- Coverage extends to age 99 or death (whichever occurs first)

- Maturity benefits equal to sum insured at age 99 for surviving customers

- Death benefits payable immediately without probate proceedings

- Tax-free death benefits for named beneficiaries

Term Insurance:

- Coverage ends at policy expiration

- No maturity benefit for surviving customers

- Premium refund options available in specific plans

Cash Surrender Values:

- Customers can surrender policies prior to maturity

- Surrender values stated in policy schedules (may exceed or fall short of premiums paid)

- Flexible withdrawal options for certain products

Comparing Muang Thai Life with International and Local Competitors

Head-to-Head Competitive Analysis

Understanding how Muang Thai Life compares against major alternatives helps customers make informed decisions:

| Factor | Muang Thai Life | AIA Thailand | Thai Life Insurance | Viriyah Insurance |

|---|---|---|---|---|

| Years in Thailand | 75+ | 40+ | Established | 30+ |

| Product Range | Extensive (life, health, annuity, investment-linked) | Comprehensive (global focus) | Life-focused | Primarily non-life |

| Local Integration | Deep (Kasikornbank partnership) | Global structure | Thai-centric | Non-life specialist |

| Digital Innovation | InsurTech subsidiary (Aigen) | International digital platform | Limited innovation | Limited digital focus |

| Tax Benefits | Full Thai deduction eligibility | May have restrictions for foreign policies | Full eligibility | Non-life limited benefits |

| Claims Processing | Direct hospital billing with partners | Reimbursement model | Direct billing | Non-life claims focus |

| Customer Service | Nationwide branches + online | Limited branch presence | Regional presence | Specialist service |

| Price Range | Mid-to-premium | Premium | Mid-range | Mid-to-premium |

Why Expats Choose Muang Thai Life

While AIA and international insurers dominate expat conversations, Muang Thai Life attracts international residents through unique advantages:

Local Credibility:

- Royal patronage signals Thailand’s institutional trust

- Thai government alignment suggests regulatory priority

- Headquarters in Bangkok demonstrates commitment to Thai residents

Banking Integration:

- Kasikornbank partnership ensures accessibility

- Expats with Thai bank accounts can easily consult advisors

- Familiar banking relationships build confidence

Tax Efficiency:

- Full Thai income tax deduction eligibility

- Particularly advantageous for expat employees with Thai tax residence status

- Retirement visa holders benefit significantly from tax-deductible planning

Domestic Protection:

- Muang Thai Life specializes in Thai healthcare system integration

- Direct billing relationships with major hospitals nationwide

- Claims processed in Thailand without international repatriation complexity

Affordability:

- Local pricing reflects Thai market conditions

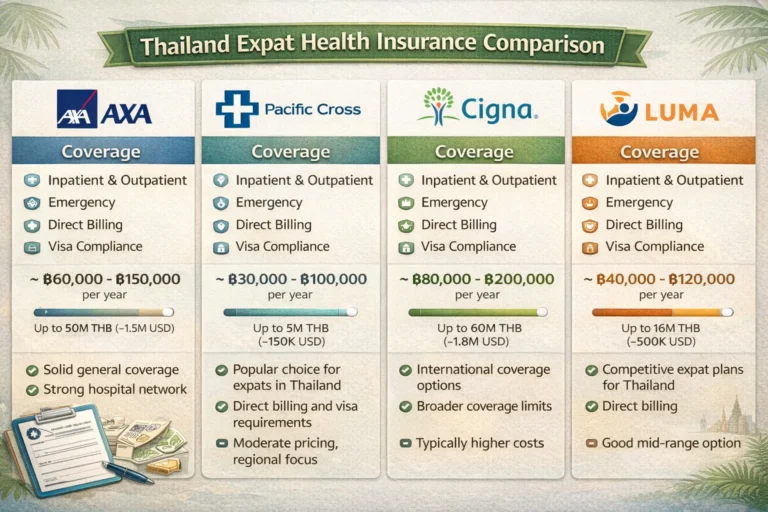

- Generally more affordable than international expat insurers (Cigna Global, AXA International)

- Coverage-per-premium ratio often exceeds international alternatives

How to Apply for Muang Thai Life Insurance

Application Process

Step 1: Needs Assessment

Contact a Muang Thai Life agent or visit any Kasikornbank branch nationwide. Free consultation services help identify coverage gaps and optimal product matches.

Step 2: Documentation Preparation

Gather required materials:

- Valid identification (Thai ID card, passport, or work permit)

- Proof of address (utility bill, rental agreement)

- Employment verification (for work permit holders)

- Marriage certificate (for expatriate spouses of Thai nationals)

- Medical history details (for health-related questions)

Step 3: Application Submission

Complete application forms either in-person at branch offices or online through Muang Thai Life’s digital platform. Digital applications increasingly streamline the process without branch visits.

Step 4: Medical Underwriting

- Simple questionnaires for basic coverage

- Medical examination may be required for higher coverage amounts

- Assessment period typically requires 2-4 weeks

- Underwriters verify health information and assess risk profiles

Step 5: Approval and Policy Issuance

Upon approval, customers receive comprehensive policy documents detailing:

- Coverage specifics and exclusions

- Premium payment schedules

- Benefit structures and payout conditions

- Customer service contact information

Step 6: Premium Payment and Activation

First premium payment activates coverage. Customers can authorize automatic bank transfers through either Muang Thai Life’s systems or direct bank arrangements for payment convenience.

Digital Application Options

Muang Thai Life increasingly offers streamlined online application processes:

- Mobile Applications: Manage policies, pay premiums, and file claims through dedicated apps

- Website Applications: Complete applications from home without branch visits

- E-Underwriting: Paperless approval processes reduce documentation requirements

- Digital Policy Delivery: Receive policies electronically with immediate digital access

Claims Process and Customer Support

Filing Claims

For Death Benefits:

- Notify Muang Thai Life within specific timeframes

- Provide certified death certificate

- Submit beneficiary identification and bank account information

- Company processes verification within standard periods

- Benefits transfer directly to beneficiary accounts

For Health Insurance Claims:

- Show Muang Thai Life insurance card at participating hospitals

- Hospital bills directly to insurance company

- Customers pay only amounts exceeding coverage limits

- Reimbursement processed automatically

For Critical Illness Claims:

- Obtain medical diagnosis documentation

- Submit diagnostic reports and specialist recommendations

- Underwriting reviews claims for coverage qualification

- Approved claims pay directly to insured parties

Customer Service Channels

Muang Thai Life provides multi-channel support accessibility:

- Hotline Services: 24/7 domestic and international call center support

- Nationwide Branches: 250+ locations offer in-person assistance

- Kasikornbank Integration: Bank tellers provide basic policy information

- Online Chat: Real-time digital support during business hours

- Email Support: Detailed inquiries receive comprehensive written responses

- Mobile Apps: Integrated customer service through digital platforms

Muang Thai Smile Club Benefits

The industry-pioneering Muang Thai Smile Club membership offers:

- Exclusive Activities: Year-round events for customer engagement and family bonding

- Loyalty Rewards: Points accumulation redeemable for premium reductions or merchandise

- Financial Planning Workshops: Educational seminars on retirement, taxation, and wealth building

- Community Building: Network with other policyholders sharing similar life stage circumstances

- Healthcare Partnerships: Discounts with network hospitals and wellness providers

Frequently Asked Questions (FAQ) About Muang Thai Life

Coverage and Eligibility Questions

Q: Can Thai nationals buy life insurance from Muang Thai Life?

A: Yes, absolutely. Thai citizens represent the company’s core market. Coverage is available from birth through age 99 with various product options designed specifically for Thai family circumstances. Children, working-age adults, and retirees all find appropriate coverage options.

Q: Can foreigners purchase Muang Thai Life insurance?

A: Yes, but eligibility requirements apply. Foreigners must hold one of the following: valid work permits, marriage certificates to Thai nationals, or long-term residential status (retirement visas, LTR visas, or Thailand Elite status). Age coverage extends from 15 days to 70 years typically, though specific products may have different age restrictions. Documentation requirements are more rigorous than for Thai citizens, typically requiring visa verification and residency proof.

Q: What age can I purchase life insurance from Muang Thai Life?

A: Coverage availability depends on product type. Newborns can be covered from 15 days old in some products. Working-age adults (18-60) enjoy maximum product selection and lowest premiums. Seniors up to age 70 can purchase coverage, though premiums increase with age and some products restrict older applicants. Even customers over 70 may qualify for simplified issue products with limited medical underwriting.

Q: Can I cover my family members under one policy?

A: Yes. Muang Thai Life offers family coverage options where parents can cover spouses and children under coordinated policies. This streamlines administration and often provides premium advantages versus individual policies. Children under 18 automatically require parental inclusion in family structures.

Q: Do I need medical examinations to purchase coverage?

A: Medical requirements depend on coverage amounts and personal health history. Basic coverage (1-2 million baht) typically requires only health questionnaires. Higher coverage amounts or applicants with significant health histories may require medical examinations including blood tests, EKGs, or specialist evaluations. Digital underwriting processes increasingly reduce examination requirements for standard applicants.

Q: What happens if I don’t renew my policy?

A: Coverage terminates upon renewal deadline if premiums remain unpaid. Most whole life plans include 30-day grace periods allowing late premium payments without coverage lapse. After grace periods expire, reinstatement requires new applications and potentially medical re-evaluation. Always prioritize premium payments to maintain continuous protection.

Product and Benefit Questions

Q: What is the difference between term life and whole life insurance?

A: Term life insurance covers specific periods (1, 5, 10, or 15 years) at lower premiums, providing death benefits if death occurs during the term. Whole life insurance extends coverage throughout life to age 99, offering lower premiums than term insurance for equivalent coverage and accumulating cash values over time. Term insurance suits young families prioritizing affordability; whole life suits wealth-building and legacy planning objectives.

Q: Can I convert my term insurance to whole life insurance?

A: Muang Thai Life’s “Flexi” products bridge this gap, allowing customers to start with affordable term coverage and transition to whole life protection without medical re-evaluation. Conversion options typically require premium adjustments and rider modifications, but enable evolution with changing life circumstances.

Q: What is a cash surrender value?

A: Cash surrender value represents the amount customers receive if they cancel policies before maturity. This value grows over policy duration as premiums accumulate and investment returns compound. Surrender values may exceed total premiums paid (particularly in whole life policies with strong investment performance) or fall short in early surrender years. Customers can access cash values through policy loans or surrenders depending on product terms.

Q: How much health insurance coverage do I need?

A: Coverage requirements depend on family size, existing savings, and healthcare preferences. Thailand’s private hospital costs range from 500,000 to 3,000,000+ baht for major illnesses. Financial experts recommend coverage of at least 2-5 million baht for comprehensive family protection. Critical illness insurance adds another 2-5 million baht specifically for cancer, kidney disease, and cardiac conditions.

Q: Does Muang Thai Life cover pre-existing conditions?

A: Pre-existing condition coverage requires full disclosure during application. Conditions disclosed and accepted during underwriting receive coverage. Non-disclosed conditions may result in claim denial if discovered. Muang Thai Life’s underwriting team assesses acceptability on case-by-case basis. Customers should provide complete medical histories to avoid future claim complications.

Q: Is maternity covered under Muang Thai Life health insurance?

A: Maternity coverage availability depends on specific products selected. Many health plans offer maternity riders covering pregnancy complications, cesarean sections, and childbirth expenses. Pregnancy-related conditions existing before policy inception typically receive exclusions. Customers should specify maternity needs during product selection to ensure appropriate coverage.

Q: Can I increase coverage later without re-qualification?

A: Many Muang Thai Life products include guaranteed insurability options allowing coverage increases at anniversaries without medical re-evaluation. Limits on annual increases apply (typically 10-20% or fixed amounts per contract). Increases requested outside designated periods may require medical underwriting. Product documents specify exact reinstatement terms.

Premium and Taxation Questions

Q: How much do Muang Thai Life premiums cost?

A: Premiums vary dramatically based on coverage type, amount, and customer characteristics. Term life insurance premiums range from 500-2,000 THB monthly for 2 million baht coverage depending on age and health. Whole life insurance premiums typically range 2,000-5,000 THB monthly for equivalent coverage. Health insurance premiums range from 1,500-8,000 THB monthly depending on coverage scope. Premium calculators on Muang Thai Life’s website provide instant estimates for specific scenarios.

Q: Can life insurance premiums be deducted from my taxes?

A: Yes, life insurance premiums qualify for Thai income tax deductions up to 300,000 THB annually for policies with minimum 10-year coverage periods. This effectively reduces taxable income, creating tax savings of 60,000 THB annually at 20% marginal tax rates—making insurance protection financially rational purely from tax efficiency perspectives. Annuity insurance premiums receive separate deduction limits (200,000 THB). Tax deduction benefits apply to Thai tax residents only.

Q: Do I get refunds if I pay more premiums than claims paid?

A: Different product structures handle this differently. Term insurance provides no refunds—premiums are protection costs paid for coverage. Whole life insurance policies accumulate cash surrender values potentially exceeding total premiums paid, particularly with strong investment performance. Annual dividend distributions in some plans return excess earnings to customers. Customers should understand specific product structures before purchase.

Q: What happens to my insurance if I move out of Thailand?

A: Muang Thai Life policies remain valid for international relocation. Coverage typically continues under original terms provided premiums remain current. Some health insurance components may restrict Thailand-specific hospital benefits. Customers moving internationally should notify Muang Thai Life of address changes to ensure uninterrupted service. Premium payment arrangements can be modified for overseas customers (automatic bank transfers, international payments, etc.).

Claims and Service Questions

Q: How long does it take to receive death benefits?

A: Muang Thai Life prioritizes death benefit payouts. Upon receiving proper documentation (death certificate, beneficiary identification), standard claims typically process within 15-30 days. Straightforward claims involving no complicating factors may process within one week. Complex claims requiring investigation may require 30-60 days. Emergency advances are available for beneficiaries facing immediate financial hardship.

Q: What documents do I need for death benefit claims?

A: Required documents typically include certified death certificates, beneficiary identification (ID cards), bank account information for benefit transfers, policy documents, and proof of insured’s identity. Additional documents may be required if death circumstances involve accidents, crimes, or unusual circumstances. Muang Thai Life’s customer service team provides complete documentation checklists upon claim initiation.

Q: Can I access my policy online?

A: Yes. Muang Thai Life provides online policy management through its website and mobile applications. Customers can view coverage details, payment histories, premium schedules, and file claims digitally. Mobile app functionality enables policy purchases, premium payments, and customer service communication from smartphones. Digital accessibility continues expanding as the company prioritizes technological convenience.

Q: What should I do if I want to cancel my policy?

A: Policy cancellation requires written notification to Muang Thai Life specifying cancellation effective date. Customers receive cash surrender values (if any) based on policy schedule. Tax consequences may apply to gains exceeding total premiums paid. Before canceling, customers should carefully consider whether alternative coverage exists and understand financial impact. Muang Thai Life’s advisors can explore alternatives if current products no longer meet needs.

Q: What is the Muang Thai Smile Club and how do I join?

A: Muang Thai Smile Club is the industry’s first CRM program providing year-round engagement activities, loyalty rewards, and customer benefits. Membership is automatic upon policy purchase—no separate enrollment required. Members accumulate points through premium payments, participate in exclusive events, and access special discounts. The program strengthens customer relationships while delivering tangible financial benefits beyond basic insurance protection.

Q: How do I make health insurance claims at hospitals?

A: Simply present your Muang Thai Life insurance card at the hospital or clinic during treatment. The provider verifies your coverage and bills Muang Thai Life directly. You pay only amounts exceeding coverage limits. No claim forms required in most cases—hospital billing departments handle all documentation. Direct billing arrangements eliminate reimbursement delays and patient balance uncertainty.

Q: Are preventive healthcare services covered?

A: Coverage depends on specific health products. Many comprehensive plans include wellness benefits covering annual health check-ups, vaccinations, dental cleaning, and preventive screenings. These services often have specific limits (annual allowances of 5,000-15,000 THB). Customers should review their specific products to understand preventive benefits and utilization limits.

Special Situations

Q: Can I purchase insurance for my elderly parents?

A: Yes. Muang Thai Life offers specialized products designed for seniors including coverage starting at age 60+. These plans typically feature simplified underwriting with reduced medical examination requirements. “Wai Gao” product lines specifically target senior needs with three-protection combinations. Age-appropriate premiums reflect increased mortality risks while remaining affordable for retirement-age applicants.

Q: What insurance does Thailand require for the retirement visa?

A: Thailand officially requires that retirement visa applicants hold health insurance covering medical expenses of at least 400,000 baht inpatient and 40,000 baht outpatient costs. However, recent Long-Term Resident (LTR) visa requirements specify 50,000 USD minimum coverage with no overall OPD limits. Muang Thai Life products can satisfy these requirements. Always verify current immigration requirements with Thai embassies as regulations evolve periodically.

Q: Can students purchase life insurance?

A: Students can purchase policies, though age restrictions apply. Coverage typically begins at age 15-18 depending on products. Student-focused products offer affordability and simplified underwriting appropriate for limited income circumstances. Student plans through bancassurance partners (Kasikornbank) provide competitive pricing. Parents often purchase coverage for children as part of family protection strategies.

Q: What happens if I lose my job—can I keep my policy?

A: Employment status doesn’t affect policy validity. Coverage continues provided premiums are paid regardless of employment changes. Muang Thai Life doesn’t require employment verification for ongoing coverage. Customers should maintain premium payments during employment transitions; grace periods typically provide 30 days buffer for payment delays. If employment loss creates financial hardship, customers can explore premium reduction options or temporary deferment possibilities.

Why Muang Thai Life Remains Thailand’s Insurance Choice

Muang Thai Life Assurance represents more than insurance products—it embodies Thailand’s commitment to financial security and family protection across generations. With 75+ years of unwavering dedication, royal patronage, and innovative leadership, the company has earned the trust of millions of Thai families.

Whether you’re beginning your financial journey, raising children, planning retirement, or protecting your legacy, Muang Thai Life offers sophisticated solutions addressing every life stage. The company’s investment in InsurTech innovation through the Aigen subsidiary demonstrates commitment to remaining relevant as Thailand’s insurance landscape modernizes.

The combination of local credibility, international partnership standards, comprehensive product selection, and competitive pricing positions Muang Thai Life as the logical choice for Thai residents and expats seeking dependable protection. With convenient nationwide accessibility through Kasikornbank partnerships, tax-advantaged planning opportunities, and customer-centric innovation, Muang Thai Life empowers families to face life’s uncertainties with confidence.

Begin your protection journey today by visiting any Kasikornbank branch or Muang Thai Life office. Free consultations help identify coverage gaps and match products to your unique circumstances. Your family’s financial security deserves Thailand’s most trusted insurer—Muang Thai Life.