Thailand remains one of Southeast Asia’s most sought-after destinations, attracting millions of international travelers annually. Whether you’re exploring the temples of Bangkok, island-hopping in Phuket, or trekking through the northern mountains, Thailand holiday insurance is essential protection against unforeseen circumstances that could derail your trip or drain your finances. This comprehensive guide covers everything you need to know about travel insurance for Thailand, including coverage options, costs, what’s included, and critical questions answered.

Why Thailand Holiday Insurance Is Crucial

Thailand does not mandate travel insurance for entry. However, the financial risks of traveling without it are substantial. Thailand’s healthcare system, while excellent, operates on a pay-upfront basis for international tourists. Medical emergencies can be catastrophically expensive—emergency medical evacuation alone can cost hundreds of thousands of dollars if local facilities cannot provide adequate treatment.

Beyond medical concerns, Thailand travelers face other significant risks including flight cancellations due to monsoon seasons, baggage delays, trip disruptions, and unexpected personal emergencies requiring immediate return home. Travel insurance protects against these financial exposures while providing 24/7 emergency assistance and peace of mind throughout your journey.

Healthcare Costs in Thailand: What You Need to Know

While Thailand offers exceptional value compared to Western healthcare systems, costs for international tourists remain substantial. Private hospitals in major cities charge significantly higher rates than local Thai residents. Here are approximate costs for common medical scenarios:

Emergency Medical Expenses:

- Doctor consultation: $50-$150 USD per visit

- Hospital accommodation (private room): $200-$500 USD per night at premium facilities

- Diagnostic imaging (CT scan, MRI): $300-$1,000 USD

- Emergency medical evacuation: $50,000-$500,000 USD depending on destination

Surgical Procedures:

- Emergency appendectomy: $5,000-$15,000 USD

- Complex fracture repair: $8,000-$20,000 USD

- Medical evacuation to a neighboring country: $100,000+ USD

These figures illustrate why comprehensive travel insurance with adequate medical coverage (minimum $50,000-$100,000) and emergency evacuation coverage is non-negotiable for Thailand travel.

Types of Thailand Travel Insurance

Single-Trip Travel Insurance

Single-trip policies provide comprehensive coverage for one specific journey to Thailand. This option suits travelers who take occasional vacations and need tailored protection for their specific dates.

Ideal for:

- First-time Thailand visitors

- Infrequent travelers (less than two trips annually)

- Travelers with flexible budgets

- Long-duration trips (30+ days)

Coverage typically includes:

- Emergency medical expenses ($50,000-$200,000)

- Emergency medical evacuation ($100,000-$500,000)

- Trip cancellation reimbursement ($5,000-$10,000)

- Baggage loss/delay compensation ($2,500-$5,000)

- Flight delay reimbursement

- Personal liability protection

Advantages:

- Protection from the moment you book (can purchase up to 24 months in advance)

- Cancellation coverage for bookings made well ahead

- Customizable coverage limits

- No annual commitment required

Annual Travel Insurance Plan

Annual policies provide year-round coverage for unlimited trips, making them cost-effective for frequent travelers. Premium annual plans often include all single-trip benefits across multiple journeys without purchasing separate policies.

Ideal for:

- Multiple international trips per year (2+ trips)

- Regular business travelers to Thailand

- Frequent leisure travelers

- Those seeking convenience and potentially lower per-trip costs

Coverage typically includes:

- Same coverage as single-trip (medical, evacuation, baggage, etc.)

- Multiple trip activation within 12 months

- Simplified claims management across all trips

- Some plans include UK domestic travel coverage

Important limitations:

- Maximum days per trip typically capped at 35-50 days (varies by age)

- Some policies may require 30+ days between trips

- Higher upfront cost despite per-trip savings

Thailand Travel Insurance Costs (2025-2026)

Travel insurance premiums for Thailand are among the most affordable globally due to relatively low average trip costs and claim frequency in Thailand compared to other destinations.

Average Pricing By Duration & Traveler Type

| Traveler Type | Trip Duration | Average Cost | Cost Per Day |

|---|---|---|---|

| Single traveler | 7 days | $35-$60 | $5-$8.50 |

| Single traveler | 14 days | $50-$90 | $3.50-$6.50 |

| Couple | 7 days | $60-$100 | $8.50-$14 per person |

| Couple | 14 days | $100-$160 | $7-$11.50 per person |

| Family (4 people) | 7 days | $80-$140 | $2.85-$5 per person |

| Family (4 people) | 14 days | $140-$230 | $2.50-$4 per person |

Factors affecting your premium:

- Age: Travelers over 50-65 often pay 50-200% more

- Trip duration: Longer trips cost more; weekly rates are lower than daily

- Departure timing: Last-minute policies (within 7 days) cost 20-50% more

- Coverage limits: Higher medical/evacuation limits increase premiums

- Adventure activities: Scuba diving, Muay Thai, mountaineering add $15-$50+

- Pre-existing conditions: Specialist policies cost 30-100% more but provide coverage

- Nationalities: Some insurers charge different rates by citizenship

Medical-Only vs. Comprehensive Coverage

Medical-Only Plans: Budget-friendly at $2.75-$5 per day, covering emergency medical expenses and evacuation only. Suitable for young, healthy travelers taking short trips. Missing: trip cancellation, baggage coverage, flight delays.

Comprehensive Plans: Premium tier at $8-$15 per day, covering medical, trip cancellation, baggage, delays, and more. Recommended for most travelers. Value increases substantially with trip cost and cancellation risk.

Complete Coverage Breakdown

Medical & Emergency Coverage (Essential)

All quality Thailand travel insurance includes emergency medical protection while traveling. Coverage activates immediately upon departure.

What’s covered:

- Emergency hospital and surgical treatment

- Doctor consultations and medications

- Dental pain relief (emergency only, not cosmetic)

- Ambulance services

- Post-trip medical treatment (for conditions that started during travel)

- Telemedicine consultations (increasingly common)

Emergency Medical Evacuation:

- Air ambulance to nearest appropriate medical facility

- Medical team and equipment during evacuation

- Repatriation to your home country if medically necessary

- Companion/family travel if you’re hospitalized

Critical notes:

- Pre-existing medical conditions are typically excluded unless specifically declared

- Coverage applies 24 hours daily to all locations during your travel dates

- Some plans require pre-approval for non-emergency procedures

- Recommended minimum: $50,000-$100,000 medical; $100,000-$250,000 evacuation

Trip Cancellation & Interruption Coverage

Protects your financial investment if you must cancel or cut short your trip for valid reasons.

Covered cancellation reasons:

- Serious illness or injury (yours or immediate family)

- Death of close relative

- Unexpected job loss

- Visa denial (with advance purchase)

- Natural disasters at your destination

- Airline strike or cessation of business

Typical compensation:

- Reimbursement for prepaid, non-refundable costs (flights, accommodations, tours)

- Maximum coverage typically $5,000-$10,000

- Must cancel within specified timeframe (usually 48-72 hours of discovering reason)

NOT covered:

- Cancellations due to personal change of plans

- Conditions existing before policy purchase (without declaration)

- Trips to areas under government travel warnings

Pro-tip: “Cancel for Any Reason” (CFAR) add-ons reimburse 50-75% of trip costs if you cancel for virtually any reason, including changed plans. Cost: additional $50-$200, but valuable for expensive, inflexible bookings.

Baggage & Personal Belongings Protection

Covers loss, theft, or damage to luggage and personal items during travel.

What’s covered:

- Lost or stolen baggage: $2,500-$5,000 typical limit

- Baggage delay (6+ hours): daily allowance for emergency clothing/essentials up to $200-$500

- Delayed baggage recovery: reimbursement for reasonable replacement purchases

- Personal belongings: covers items within baggage (clothes, electronics, jewelry)

- Damage to baggage: repair or replacement cost

- Travel documents: passport replacement costs

Exclusions:

- Items left unattended in public areas

- Valuables not secured in locked baggage

- Wear and tear or pre-existing damage

- Items in checked baggage with gaps between damage and claim

- Some policies exclude claims without airline incident reports

Strategic approach: Always report losses to airlines immediately and obtain written confirmation. Photographs of baggage and high-value items before travel support claims.

Travel Delay & Missed Connection Coverage

Compensates for unexpected delays to flights and connections.

Typical coverage triggers:

- Flight delay 6+ consecutive hours from scheduled departure

- Missed connections due to incoming flight delays

- Baggage arriving 6+ hours late at destination

Compensation amounts:

- Flight delay: typically 20% of trip cost per 6 hours, capped at sum insured

- Missed connections: reimbursement for reasonable alternative flights

- Essential item purchases during delays

Exclusions:

- Strikes or labor actions announced before purchase

- Weather-related delays (increasingly NOT excluded)

- Airlines canceling flights due to declared circumstances

Personal Liability Protection

Covers legal liability if you accidentally injure someone or damage their property.

Coverage:

- Medical expenses for injured third parties

- Damage to third-party property

- Legal defense costs

- Compensation awards (up to policy limit)

Typical limits: $1,000,000 (standard), amounts vary by insurer

Important: Basic liability typically covers accidental harm, not intentional actions or professional activities. Driving a motorbike requires verification of coverage, as liability varies significantly by insurer.

Adventure Activities & Sports Coverage

Thailand is a premier destination for adventure travel, but standard insurance may exclude high-risk activities. Specialized add-ons are critical for activity-based trips.

Activities Typically Covered Under Standard Policies

Low-risk activities (no add-on required):

- Snorkeling in supervised locations

- Swimming and beach activities

- Guided trekking (up to 4,500 meters altitude)

- Cycling on established roads

- Whitewater rafting (grade 2-3 rivers maximum)

- Banana boating

- Kayaking (calm water)

- Zip-lining (commercial operations)

- Muay Thai classes (training only, non-competitive)

High-Risk Activities Requiring Adventure Add-On Coverage

Activities requiring specialized coverage rider ($15-$75+ additional):

- Scuba diving (recreational to 30-40m depth, requires certification card)

- Freediving (variable depth limits)

- Cave diving/cavern diving

- Surfing and windsurfing

- Bungee jumping

- Skydiving (solo or tandem)

- Paragliding/parasailing

- Mountaineering (above 4,500m)

- Hang gliding

- Rock climbing (outdoor, above 100m)

- Professional sports training/competition

- Motorcycling over 125cc

- Professional sports competitions

Key Sports Coverage Recommendations

Scuba diving in Thailand (Koh Tao, Similan Islands, Krabi):

- Standard coverage: recreational diving to 30m depth

- Advanced coverage riders: deeper dives, advanced certifications

- Cost: $20-$50 additional for diving rider

- Pro-tip: Bring your certification card; policies require proof of qualification

Muay Thai training:

- Standard policies typically cover recreational training classes

- Professional competitions or heavy sparring may require add-on

- Cost: $15-$40 for sports rider

- Verify with insurer; some consider competitive Muay Thai extreme sport

Motorcycling:

- Coverage for motorbike riding varies dramatically by insurer

- Some exclude motorbikes entirely; others require separate rider

- 125cc limit often applies for personal accident benefits

- Cost: $20-$60 additional; strongly verify before renting

- Recommendation: Use authorized taxis or ride-sharing apps if coverage unclear

Water sports (jet skiing, parasailing, boat tours):

- Generally covered under standard policies for commercial operations

- Personal/self-rented equipment may have restrictions

- Cost: Usually included; check policy wording

Pre-Existing Medical Conditions

Critical disclosure requirement: Failing to declare pre-existing conditions can invalidate your entire policy, leaving you uninsured for all claims.

Understanding Pre-Existing Conditions

Pre-existing conditions include any medical condition diagnosed or treated before your policy start date, even if:

- The condition is stable or asymptomatic

- You haven’t required treatment recently

- You believe it won’t affect your trip

Examples requiring declaration:

- Diabetes, hypertension, asthma

- Heart disease, arthritis, thyroid conditions

- Anxiety, depression, any mental health condition

- Previous surgeries or joint replacements

- Allergies requiring medication

- Any ongoing medication

Coverage Options for Pre-Existing Conditions

- Standard policies: Most explicitly exclude pre-existing conditions. No coverage for related claims.

- Declared pre-existing condition coverage: Insurers accept your declaration of conditions and provide coverage after a waiting period (often 90 days) for worsening conditions or complications.

- Specialist pre-existing condition policies: Specialized insurers (MSIG Pre-Ex plans, Tiq by Etiqa, specific UK providers) offer coverage after proper health screening. Additional cost: 30-100% premium increase.

- Waiver-based coverage: Some providers offer limited waiver of pre-existing exclusions for travelers over 65 or with specific conditions. Requires detailed health questionnaire.

How to Declare Pre-Existing Conditions

- Complete health questionnaire accurately and comprehensively

- List ALL conditions, even if minor or controlled

- Provide medication names, dosages, and prescribing doctor details

- Document recent medical visits and test results if requested

- Keep proof of declaration with your policy

Recommendation: If you have significant pre-existing conditions, consult an insurance broker specializing in medical tourism before purchasing to ensure adequate coverage options.

Thailand Entry Requirements 2025-2026

Visa Requirements by Nationality

Visa-exempt entry (60 days, no visa required):

Citizens of 93 countries including Australia, Canada, European Union nations, Japan, New Zealand, USA, and others can enter Thailand visa-free for tourism up to 60 days. Extension of stay (additional 30 days) available at Thai Immigration offices.

Thailand Digital Arrival Card (TDAC):

Mandatory as of May 1, 2025, for all international visitors. Requirements:

- Complete online at tdac.immigration.go.th within 72 hours before arrival

- Applies to visa-exempt visitors AND visa holders

- No fee required

- Streamlines airport immigration processing

Visa-on-Arrival (VOA):

For nationalities not eligible for visa exemption:

- Applied at Thai embassy/consulate before travel or at airport upon arrival

- 60-day tourist visa

- Requires: completed form, passport photo, financial proof, onward ticket

- Cost: approximately $40 USD

Tourist eVisa:

- Apply online through Thai government system (available since January 2025 globally)

- 60-day validity

- Requires: 6+ month passport validity, 4x6cm photo, flight proof, financial proof ($700 USD equivalent minimum)

- Cost: $40 USD approximately

Recommended Insurance Timing

Purchase travel insurance within 7-14 days of booking your flight to maximize coverage. Benefits:

- Cancellation coverage protects full trip cost if circumstances change

- Pre-existing condition declarations processed before travel

- Coverage activates immediately upon purchase for booking protection

- Latest-minute purchases (within 7 days) available but cost 20-50% more

Thailand-specific timing advantage: Most travelers book 4-8 weeks in advance, providing optimal window for insurance purchase.

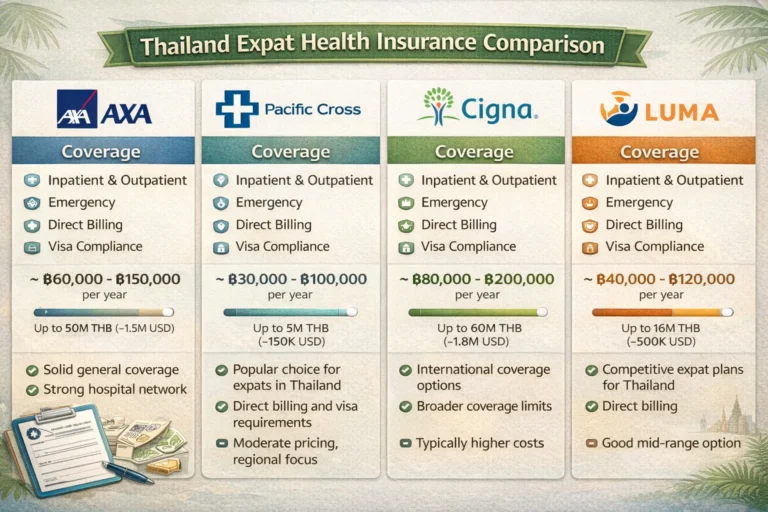

Top Thailand Travel Insurance Providers Comparison

Based on 2025-2026 market analysis of major insurers covering Thailand:

| Provider | Best For | Medical Cover | Trip Cancellation | Baggage | Adventure | Approx. Cost (14 days) |

|---|---|---|---|---|---|---|

| MSIG (Thai-based) | Comprehensive coverage | $5,000,000+ THB | Excellent | Good | Good | $60-$120 |

| Allianz | Worldwide reliability | $200,000 USD | Excellent | Good | Good | $55-$110 |

| World Nomads | Adventure travelers | Good | Excellent | Good | Excellent (200+ activities) | $70-$140 |

| AXA | Thai-specific | Good | Good | Good | Limited | $45-$90 |

| AIG Travel Guard | Comprehensive | Good | Good | Good | Good | $65-$125 |

| SafetyWing | Budget travelers | Basic | Limited | Limited | Limited | $40-$50 |

Key considerations:

- Thai-based insurers (MSIG, Allianz Thailand) often provide better local network and faster claims processing

- International providers (World Nomads) excel in adventure coverage and claims for non-Thai residents

- Medical-only plans: SafetyWing, Zoom from $2.75/day

- Comprehensive plans with adventure: World Nomads, Allianz from $5-$8/day

Common Exclusions to Understand

Standard travel insurance excludes:

- Travel to areas with government travel warnings: Policy void for countries under official “do not travel” advisories from your government

- Trips booked after policy purchase: Some policies exclude trips booked after activation date

- Non-emergency medical procedures: Elective surgeries, cosmetic treatments, dental cleanings (emergency dental pain only)

- Pregnancy-related claims: Most policies exclude pregnancy complications after 24-28 weeks gestation

- Alcohol/drug-related incidents: Claims arising from being under influence

- High-risk countries during cover period: Addition of new excluded countries during your travel period

- Claims from illegal activities: Any claim connected to criminal activities

- Extreme sports without rider: Competitive sports, professional activities, extreme sports without add-on

Frequently Asked Questions About Thailand Holiday Insurance

Do I Really Need Travel Insurance for Thailand?

Short answer: Yes, absolutely. While technically not mandatory, the financial risks are substantial. Thailand healthcare operates on cash-upfront basis for tourists. Emergency evacuation alone could cost $100,000-$500,000. Single medical emergency could financially devastate an uninsured traveler.

Thailand tourism regularly experiences disruptions (monsoon flooding May-October, occasional protests, flight delays). Trip cancellation without insurance forfeits thousands in non-refundable bookings. Insurance typically costs less than 1-2% of trip cost for comprehensive coverage—exceptional value for peace of mind.

What’s the Best Travel Insurance for Thailand?

Answer: It depends on your specific needs:

- Best overall: Allianz or MSIG for comprehensive, reliable coverage with strong Thailand-specific networks and fast claims processing

- Best for adventurers: World Nomads (covers 200+ activities including scuba diving, Muay Thai, trekking)

- Best budget option: SafetyWing medical-only at $2.75/day or Zoom medical plan

- Best for frequent travelers: Annual policies from Allianz, AXA, or Pacific Cross

- Best with pre-existing conditions: MSIG Pre-Ex plans or specialist providers like Tiq (Etiqa)

Recommendation process:

- List your trip duration and planned activities

- Assess medical needs (pre-existing conditions, medication requirements)

- Determine budget ($35-$150 for 14 days typical)

- Compare 3-4 top options using online quote tools

- Read policy wording for exclusions relevant to your activities

- Purchase within 7-14 days of booking flights for best coverage

Is Travel Insurance Required for Thailand Visa?

Answer: No. Thailand does not require proof of travel insurance for visa applications (tourist visa, visa-on-arrival, or visa-exempt entry). However:

- Some airlines may require proof before allowing boarding

- Some hotels/tourism companies may ask for verification

- Travel insurance demonstrates financial responsibility to visa officers (helpful if questioned)

Recommendation: While not required, purchasing insurance immediately after booking flights ensures protection and avoids later complications.

How Much Coverage Do I Need for Medical Expenses?

Answer: Minimum $50,000-$100,000; ideally $100,000-$200,000.

Reasoning:

- Basic emergency room visit + overnight hospital: $2,000-$5,000

- Moderate hospitalization (2-3 days): $10,000-$25,000

- Serious injury/surgery requiring evacuation: $50,000-$100,000+

- Emergency repatriation flight: $100,000-$500,000 (separate limit)

Most comprehensive policies include $100,000-$200,000 medical and $250,000-$500,000 evacuation as standard. Budget options may offer only $50,000 medical coverage—acceptable for young, healthy travelers but concerning for older travelers or those with health conditions.

Recommendation: Choose medical coverage at least 10% of your total trip cost to ensure adequate protection.

Can I Buy Travel Insurance After I Arrive in Thailand?

Short answer: Yes, but limitations apply.

- Most insurers allow “already overseas” policies purchased after arrival

- Cancellation coverage is NOT available for trips already in progress

- Coverage applies from purchase date forward, not retroactively

- Pre-existing conditions declared after arrival may face tighter restrictions

- Cost typically higher (20-50% premium increase)

Best practice: Purchase before departing home. If you didn’t, buy within 48 hours of arriving in Thailand while coverage still applies. Many Thai travel agents and hotels can assist with immediate policies.

Will My Home Health Insurance Cover Me in Thailand?

Answer: Probably not.

- Most US health insurance plans do NOT cover international medical care outside home country

- Some international health plans (expat policies) provide coverage but with restrictions

- Medicare and government-funded healthcare schemes rarely cover international travel

- Thai hospitals require upfront cash payment and direct billing to Thai insurers

Critical verification step: Contact your health insurance provider before traveling to confirm:

- Does it cover international travel?

- What destinations are covered?

- What is your out-of-pocket responsibility?

- Does insurer require pre-authorization for Thai hospitals?

Even if some coverage exists, gaps are likely. Travel insurance supplements domestic health insurance, providing essential coverage for areas where home insurance doesn’t apply.

How Much Does Thailand Travel Insurance Cost?

Answer: $2.75-$15+ per day depending on coverage level.

Cost breakdown by coverage type:

- Medical-only policies: $2.75-$4 per day (basic emergency medical + evacuation)

- Budget comprehensive: $4-$6 per day (limited cancellation, basic medical)

- Standard comprehensive: $6-$10 per day (balanced coverage recommended for most)

- Premium comprehensive: $10-$15 per day (high limits, adventure sports, CFAR option)

Real-world examples (2025 pricing):

- Single traveler, 7 days: $35-$60 total

- Couple, 14 days: $100-$160 total

- Family of 4, 10 days: $120-$200 total

- 30-day digital nomad trip: $150-$300 total

Factors increasing cost:

- Age over 55-65: +50-200%

- Pre-existing conditions: +30-100%

- Adventure sports add-on: +$15-$75

- Last-minute purchase (within 7 days): +20-50%

- Higher coverage limits: +10-30%

What’s Covered During COVID-19 or Pandemic Situations?

Answer: Policies vary significantly; verification required.

Current 2025-2026 coverage:

- Most insurers now include COVID-19 medical treatment (test costs, treatment, hospitalization)

- Some cover quarantine hotel costs if required by local authorities

- Trip cancellation due to confirmed positive test typically covered

- Cancellation due to destination lockdowns: varies by policy and notification timing

Usually NOT covered:

- Cancellation due to fear of pandemic without government restrictions

- Travel to areas with known outbreaks if you proceed anyway

- Claims related to variant developments after purchase

Recommendation: Verify pandemic coverage explicitly with insurer when purchasing. Some policies offer optional pandemic riders for additional cost.

Is Travel Insurance Valid if I Get Injured While Intoxicated?

Answer: Generally no; intoxication clauses apply.

Most policies exclude claims where alcohol or drug intoxication was a contributing factor:

- Accident occurred while under influence

- You ignored safety warnings due to intoxication

- Injury claimed was result of intoxicated behavior

Important distinction: Having alcohol in your system doesn’t automatically void claims. Most policies cover accidents that would have happened regardless of alcohol consumption. However, if intoxication was a material contributing factor (fell down stairs while drunk, got injured in fight), claims may be denied.

Recommendation: Review specific policy wording on intoxication clauses. Some adventurous-activity insurers are more lenient.

Can I Claim if I Get Food Poisoning in Thailand?

Answer: Yes, in most comprehensive policies.

Food poisoning claims are covered as medical emergency conditions if they:

- Result in hospitalization or emergency treatment

- Occur during your covered travel period

- Are documented by medical provider with diagnosis

Coverage includes:

- Emergency medical treatment, medications, doctor visits

- Hospitalization if required

- Repatriation if condition is serious

Requirements for successful claim:

- Seek medical treatment within reasonable timeframe (24-72 hours of symptoms)

- Obtain medical records documenting diagnosis

- Keep receipts for all medical expenses

- File claim with supporting documentation

Note: Food poisoning lasting 24-48 hours without hospitalization typically won’t generate significant claim value. Claims matter when requiring emergency room visits or hospitalization.

Do I Need Visa Travel Insurance as an Add-On?

Answer: Only if you book your trip well in advance.

“Visa travel insurance” is coverage for visa denial compensation:

- Reimburses visa application fees if embassy denies your visa

- Reimburses some trip costs if denied entry

- Typically only available if purchased 14-20+ days before visa application

Who needs this add-on:

- Visa-required travel (India, China, Russia, some African countries)

- First-time travelers to visa-required countries

- Those with high visa application costs ($100-$300+)

- Trips booked 4+ months in advance

Who doesn’t need it:

- Thailand visa-exempt travelers (60 days free entry for 93 nationalities)

- Visa-on-arrival users

- Those purchasing insurance less than 20 days before departure

Recommendation: Thailand visitors rarely need visa denial coverage due to generous visa exemption policies.

How Quickly Can I Get Travel Insurance for Thailand?

Answer: Instantly, but with timing considerations.

Immediate purchase (same day):

- Online quotes available in seconds

- Policy activation instant upon payment

- Full coverage (including some cancellation) applies immediately for online purchases

Important timing caveat: Many insurers have restrictions on cancellation coverage:

- “Cancellation cover applies to insured events occurring 14 days after purchase”

- This means booking must be made 14 days before policy purchase for full protection

- Same-day purchase + same-day booking = reduced cancellation protection

Optimal timeline:

- Book flights/accommodations

- Wait 3-7 days

- Purchase travel insurance (allows 7+ days for cancellation window)

- Continue planning with full coverage

Last-minute options: Insurance available up to departure day, but costs 20-50% more and may have restricted coverage.

Can I Extend My Travel Insurance While in Thailand?

Answer: Limited; purchase before departing home.

Extension options:

- Single-trip policies: Limited extensions possible (additional 15-30 days) with most insurers, requires advance request

- Already-overseas policies: Can purchase after arrival for remaining trip duration

- Cost: Higher than pre-departure purchase (20-50% premium increase)

Limitations on extensions:

- Original trip duration must be specified when purchasing

- Extensions may not cover pre-existing conditions with same generosity

- Some insurers refuse mid-trip extensions (requires repatriation to home country)

- Coverage gaps likely if policy lapses and you attempt re-purchase

Recommendation: If planning 30+ day trip, purchase multi-week policy upfront rather than relying on extensions. Easier, cheaper, and more reliable coverage.

What Should I Do If I Need to Make a Claim in Thailand?

Step-by-step process:

- Report immediately:

- Medical emergency: Contact insurer’s 24-hour hotline (number on policy card)

- Other claims: Report within 24-48 hours of incident

- Seek medical treatment (if applicable):

- Go to reputable hospital (Bumrungrad, Bangkok Hospital, or insurer’s network)

- Inform hospital of insurance and request direct billing if available

- Obtain itemized medical records and receipts

- For baggage/travel delay:

- File incident report with airline or relevant service provider

- Obtain written confirmation of loss/delay/damage

- Keep all receipts and documentation

- Gather supporting documentation:

- Original receipts and invoices

- Medical records and prescriptions (if applicable)

- Proof of payment (credit card statements, booking confirmations)

- Photographic evidence (damaged baggage, receipts, etc.)

- Identification (passport copy)

- Submit claim:

- Contact insurer’s claims department

- Complete claim form (available online or via email)

- Attach all supporting documents

- Submit within policy timeframe (typically 30-90 days of incident)

- Follow up:

- Track claim status via insurer’s online portal

- Respond promptly to any requests for additional information

- Expect processing time: 2-4 weeks for straightforward claims, 6-8 weeks for complex claims

Helpful resources:

- Save insurer’s 24-hour hotline number in your phone

- Take photos of policy documents and emergency contact info

- Screenshot confirmation emails upon policy purchase

- Carry insurance card or policy number details

Are Annual Travel Insurance Plans Worth It for Thailand Trips?

Answer: Yes, if taking 2+ trips annually; otherwise single-trip is better.

Break-even analysis:

- Single trip insurance (14 days): $50-$90

- Annual insurance: $300-$600

- Break-even point: 4-6 trips to Thailand annually

Annual plan benefits:

- Convenience: one purchase covers entire year

- Potentially lower per-trip cost: $50-$100 per trip if taking 4+ trips

- No need to remember to purchase for each trip

- UK domestic trips often included

Annual plan drawbacks:

- Higher upfront cost ($300-$600 vs. $50-$90 per trip)

- Limits on days per trip (usually 35-50 days maximum)

- Must plan all trips within calendar year

- Less flexibility if plans change

Recommendation: Annual plans make sense if you take 3+ international trips yearly. For 1-2 trips, single-trip insurance is cheaper and more flexible.

What Happens if I Cancel My Thailand Trip After Buying Insurance?

Answer: Most comprehensive policies cover cancellation if purchased early enough.

Covered cancellation reasons:

- Your serious illness or injury

- Close family member’s death or serious illness

- Unexpected job loss

- Visa denial (if purchased before applying)

- Natural disaster at destination

- Airline strike or bankruptcy

Typical reimbursement:

- Flight costs: 100% of prepaid, non-refundable amount

- Accommodations: 100% of prepaid, non-refundable amount

- Tours/activities: 100% of prepaid, non-refundable amount

- Coverage limit: typically $5,000-$10,000 total

Not covered:

- Change of mind or personal circumstances

- Cold feet about traveling

- Better travel opportunities elsewhere

- Work schedule changes

How to claim:

- Contact insurer within 48-72 hours of cancellation

- Provide documentation of reason (medical letter, death certificate, employer letter, etc.)

- Submit all refund-denied confirmations from vendors

- Complete claim form with supporting documents

- Receive reimbursement within 2-4 weeks

Pro-tip: “Cancel for Any Reason” (CFAR) add-on covers cancellations without stated reason, but reimburses only 50-75% of costs and costs extra ($50-$200).

Should I Buy Insurance Through a Travel Agent or Directly?

Answer: Either option works; compare on value not channel.

Buying directly from insurer:

- Pros: Transparent pricing, direct customer service, no intermediaries

- Cons: Must research multiple insurers yourself, limited guidance

Buying through travel agent:

- Pros: Professional guidance, bundled with travel booking, sometimes group discounts

- Cons: Potential commission markups, less control over selection

Buying through online comparison sites:

- Pros: See multiple quotes simultaneously, easy comparison

- Cons: May exclude some niche insurers, aggregation delays

Recommendation: Use comparison sites to see 3-4 options, then purchase from insurer directly if no added cost. This ensures lowest pricing and direct relationship with insurer for claims.

Making Thailand Travel Insurance Work for You

Thailand travel insurance is non-negotiable for international visitors. The financial risks—from medical emergencies ($50,000-$500,000 evacuation costs) to trip disruptions (lost flights, canceled accommodations)—far outweigh insurance costs ($35-$150 for typical 14-day trip).

Key action steps:

- Purchase insurance within 7-14 days of booking flights for optimal cancellation coverage

- Select coverage matching your activities: standard comprehensive for most travelers, adventure riders for divers/Muay Thai enthusiasts

- Verify pre-existing condition coverage if you have any medical conditions

- Review policy wording carefully for activity exclusions relevant to your itinerary

- Save policy details (number, hotline, PDF) in multiple locations accessible during travel

- Inform your insurer of any significant changes to trip dates or activities before departure

Thailand’s combination of affordable insurance premiums, world-class healthcare infrastructure, and comprehensive policy options makes protecting your trip an obvious investment. The small upfront cost—typically under 2% of total trip expenses—provides invaluable peace of mind for exploring this spectacular destination.

Whether you’re lying on pristine beaches, exploring temples, training in Muay Thai, or scuba diving in crystal-clear waters, travel insurance ensures unexpected circumstances won’t transform your dream Thailand holiday into a financial nightmare.