Thailand’s Value Added Tax (VAT) refund program is one of the most generous in Southeast Asia, allowing eligible foreign tourists to reclaim a significant portion of taxes paid on their purchases. This comprehensive guide covers everything you need to know about claiming your VAT refund in Thailand, including recent regulatory updates, detailed step-by-step procedures, and answers to frequently asked questions.

What Is Thailand’s VAT Refund Program?

The VAT Refund for Tourists program is a government-administered initiative designed to boost tourism and shopping expenditure by allowing foreign visitors to recover taxes paid on eligible merchandise. Thailand’s standard VAT rate is 7%, though the actual refund you receive—typically 4% to 6% after administrative fees—depends on your refund method and purchase amount.

This program distinguishes Thailand as a competitive shopping destination compared to neighboring countries like Indonesia, Malaysia, and Singapore. The scheme is administered by Thailand’s Revenue Department (Grom Sarpbakorn) and operates at all international airports and designated refund centers throughout the country.

Who Is Eligible for Thai VAT Refund?

You are eligible to claim a VAT refund if you meet ALL of the following criteria:

Personal Status Requirements

- Non-Thai citizen or non-resident status – You must not be a Thai national or permanent resident of Thailand

- Valid passport holder – You must possess a valid passport from any country

- Not airline crew – Airport employees and airline staff are typically excluded

Purchasing Requirements

- Shop at participating stores – Purchases must be made exclusively at stores displaying the official “VAT Refund for Tourists” sign (look for the blue logo)

- Minimum purchase threshold – Spend at least 2,000 THB (including VAT) at a single store on the same day

- Aggregate spending – Your total eligible purchases across all stores should reach a minimum of 5,000 THB to make the claim worthwhile

Departure Requirements

- International airport exit – You must depart Thailand through an international airport. Land border crossings and seaports DO NOT qualify

- Goods export timeline – All purchased goods must physically leave Thailand within 60 days from the purchase date (day of purchase = day 1)

- Customs inspection compliance – Items must be available for inspection by Thai customs officials at the airport before departure

Understanding Thailand’s VAT System and Refund Mechanics

How VAT Works in Thailand

Thailand implements a standard 7% VAT on most goods and services. This tax is included in the displayed price at retailers. When you purchase items and complete the VAT refund process, you’re essentially reclaiming the government’s portion of this tax.

Important distinction: The VAT refund program applies only to retail purchases of goods intended for export, not to:

- Services (hotels, spa treatments, restaurant meals, tour guides, transportation)

- Consumables (food, beverages, alcohol, tobacco)

- Prohibited items (weapons, explosives, certain art and antiques)

- Gold bars and bullion

Actual Refund Percentages

While Thailand’s VAT is 7%, your actual cash refund will be lower (typically 4%-6%) because:

- Administrative fees (100 THB per form if claiming cash at the airport)

- Processing fees (varies by refund method)

- Exchange rate spreads (if converting to foreign currency)

Example calculation:

- Purchase amount: 10,000 THB (including VAT)

- Theoretical VAT portion: ~653 THB

- Actual refund (cash method): ~500-550 THB after fees

- Effective refund rate: ~5-5.5%

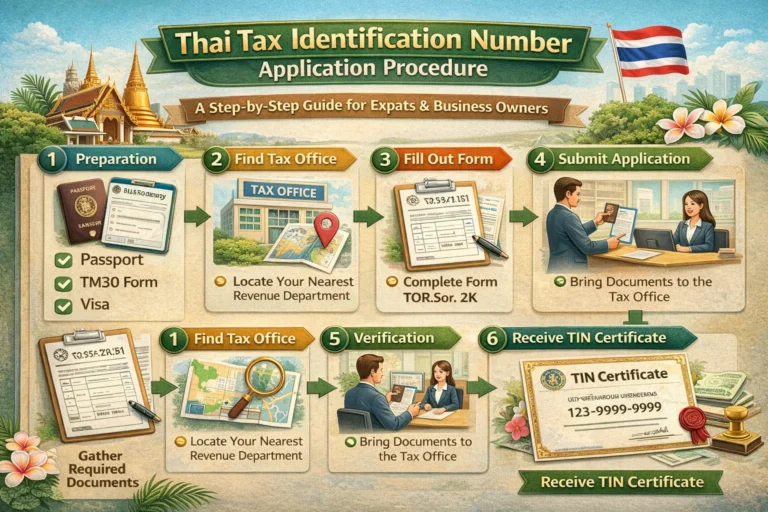

Step-by-Step: How to Claim Your Thai VAT Refund

Step 1: Shop at VAT Refund Participating Stores

The foundation of your refund claim begins at the point of sale.

At checkout:

- Look for the blue “VAT Refund for Tourists” sign – This official logo indicates the store is registered with Thailand’s Revenue Department

- Present your passport – Store staff will request your passport for identification verification

- Request the P.P.10 form – This is the official VAT Refund Application for Tourists form. The store must provide it immediately at point of sale

- Verify all details – Confirm that the form includes:

- Your correct passport number

- Purchase date (must be current)

- Store name, address, and tax ID

- Complete description of purchased items

- Purchase amount (VAT included)

- Sales staff signature and store stamp

Pro tip: Never accept a P.P.10 form with blank fields or corrections. Request a new form if information is incomplete.

Step 2: Retain All Original Documents Until Departure

Keeping your purchase receipts and VAT forms organized is critical.

Documents you MUST keep:

- Original P.P.10 form(s) – One form per store, issued at time of purchase

- Original tax invoices/receipts – The official receipt from the store showing the VAT amount

- Boarding pass/flight information – Proof of your departure date

- Passport (original) – Required for final verification

- Purchased goods – Items must remain unused and available for inspection

Critical warning: If you lose any of these documents, your refund claim will be denied. There is no provision for claiming VAT refunds without the original P.P.10 forms.

Storage recommendation: Keep all documents in a dedicated envelope or folder, separate from your checked luggage. Store them in your carry-on bag.

Step 3: Visit VAT Refund Inspection Counter at Airport (Before Immigration)

This step must be completed before you pass through immigration control.

Timing is crucial:

- Arrive at the airport 3 hours before your flight departure (industry standard for international flights)

- Proceed directly to the VAT Refund Inspection Desk in the departure hall

- This counter is typically located before the security checkpoint or in the departure area, depending on the airport

What to present:

- All purchased goods (items must be accessible and unused)

- All original P.P.10 forms

- All original receipts

- Your passport (original)

- Boarding pass or flight confirmation

What happens during inspection:

- Customs officials will visually inspect items, especially:

- High-value goods (electronics, jewelry, watches)

- Items over 5,000 THB total value

- Luxury items (see luxury goods section below)

- They will verify that items are genuinely new and unused

- They will stamp your P.P.10 forms to confirm inspection completion

- They may remove the P.P.10 forms or return them—follow the officer’s instructions

At major airports (Suvarnabhumi Bangkok, Phuket International):

- Dedicated VAT refund inspection areas are well-signposted

- English-speaking staff are usually available

- Processing typically takes 10-30 minutes depending on queue length

For purchases under 20,000 THB: Some airports allow you to skip the physical inspection and submit forms directly at the VAT Refund Office after immigration (verify with signage at the inspection counter).

Step 4: Proceed Through Immigration Control

After customs inspection, proceed normally through passport control and security screening. Keep your stamped P.P.10 forms accessible.

Step 5: Claim Your Refund at VAT Refund for Tourists Office

After passing through immigration, locate the VAT Refund for Tourists Office in the departure hall (typically near the departure gates).

What to present:

- All stamped P.P.10 forms

- Boarding pass (final verification of departure date)

- Passport (original)

Choose your refund method:

Refund caps by method:

- Cash refund maximum: 30,000 THB per transaction

- Credit card maximum: No specified limit

- Refunds exceeding 30,000 THB automatically process as bank transfer or credit card credit

Luxury Goods Special Requirements

Certain high-value items require additional scrutiny and dual declaration.

Luxury goods definition (40,000 baht or more per item):

- Jewelry and ornaments

- Watches

- Eyeglasses and sunglasses

- Pens (luxury brands)

- Smartphones, laptops, tablets

- Designer handbags, wallets, and purses

- Belt buckles

- Excludes: Luggage and suitcases

Special procedures for luxury goods:

- Initial declaration at customs (before immigration)

- Items must be carried in hand luggage (not checked baggage)

- Second inspection at VAT Refund Office (after immigration)

- Both customs and refund office must stamp your P.P.10 form

For items exceeding 100,000 THB (carry-on declared goods):

- Must be declared to Thai customs

- Enhanced inspection procedures may apply

- Ensure items are in your carry-on and accessible at both checkpoints

Alternative Refund Methods

Downtown VAT Refund (Pre-Departure Option)

If you prefer to claim your refund before arriving at the airport, Thailand now offers downtown refund services in major cities.

Downtown VAT Refund features:

- Available at designated refund offices in Bangkok, Phuket, Chiang Mai

- Refund caps: Maximum 12,000 THB per transaction

- Timeline: Claims must be made within 14 days of purchase (not 60 days)

- Goods timeline: Items must leave Thailand within 14 days of the refund claim (more restrictive than airport claims)

When to use downtown refund:

- You’re leaving Thailand by land border or sea

- You want to avoid airport queues

- Your refunds don’t exceed 12,000 THB

Online VAT Refund (VRT Platform)

Thailand recently introduced digital claiming through the VRT (VAT Refund for Tourists) application.

TAGTHAi app advantages:

- Register refund claims digitally

- Track refund status in real-time

- Reduce paper documentation at the airport

- Available for iOS and Android

- Download the TAGTHAi or official Revenue Department app

- Register and create an account with passport information

- Upload P.P.10 forms and receipts digitally

- Submit claim before departure

- Complete final verification at airport VAT Refund Office

- Receive refund confirmation via app

Frequently Asked Questions: Thai Tax Refund

Eligibility Questions

Q: I work in Thailand on a long-term visa. Can I claim a VAT refund?

A: No. VAT refunds are exclusively for non-residents of Thailand. If you are employed in Thailand, hold a resident visa, or have residential status, you are not eligible, regardless of your nationality. The program is designed for temporary visitors only.

Q: I’m a Thai citizen living abroad. Can I claim a refund when visiting?

A: No. Thai citizens are never eligible for VAT refunds, even if they don’t reside in Thailand. You must be a non-Thai citizen to qualify.

Q: Can my spouse or friend who is a Thai resident participate in my refund claim?

A: Only the person whose name appears on the P.P.10 form can claim the refund. If a Thai resident purchased items, only non-resident companions can claim refunds on their separate purchases. Combined purchases are not transferable.

Q: I’m an airline crew member. Am I eligible?

A: No. Airline employees, pilots, flight attendants, and airport staff are typically excluded from the VAT refund program.

Purchase and Eligibility Questions

Q: What happens if I spend exactly 1,999 THB at a store? Can I still get a refund?

A: No. The minimum is 2,000 THB (including VAT) at a single store on the same day. Purchases of 1,999 THB or less do not qualify, and stores cannot issue a P.P.10 form.

Q: Can I combine purchases from multiple days or stores to reach the 2,000 THB threshold?

A: No. Each purchase must be 2,000 THB minimum on the same day at the same store. Purchases from different days or stores cannot be combined. However, you may make multiple purchases from the same store on the same day, and they can be combined toward the 2,000 THB threshold.

Q: Are services like hotels, restaurants, and spas eligible for VAT refund?

A: No. The VAT refund program applies exclusively to tangible goods. Services are permanently excluded:

- Hotel accommodations

- Restaurant meals and beverages

- Spa and massage treatments

- Tour guide services

- Transportation and taxi services

- Entertainment venue admissions

Even if your hotel bill exceeds 2,000 THB, no VAT refund is available.

Q: Are food and beverages eligible?

A: No. Consumables including food, drinks, alcohol, and tobacco are not eligible for refunds.

Q: Can I claim VAT refund on cosmetics, skincare products, and perfumes?

A: Yes, cosmetics and skincare products that are retail goods in their original packaging are eligible. Perfumes and colognes also qualify if purchased from participating stores and displayed with the VAT Refund for Tourists sign.

Q: Are electronics purchased at malls and department stores eligible?

A: Yes. Electronics including smartphones, laptops, tablets, cameras, headphones, and computer accessories are eligible if purchased from stores displaying the VAT Refund for Tourists sign.

Q: Can I claim VAT refund on items purchased at the airport?

A: No. Duty-free shops and airport retail stores do not participate in the standard VAT refund program. All purchases must be made at regular shops with the VAT Refund for Tourists sign.

Q: Is silk eligible for VAT refund?

A: Yes. Thai silk products, scarves, clothing, and souvenirs are eligible if purchased from participating stores.

Q: Are antiques and art pieces eligible?

A: Potentially, but with restrictions. Thailand prohibits the export of certain cultural artifacts and religious items. Only secular, non-protected art pieces purchased from authorized dealers qualify. Ask the store staff before purchasing whether items have any export restrictions.

Refund Amount Questions

Q: If VAT is 7%, why don’t I get a full 7% refund?

A: The 7% VAT is reduced by processing and administrative fees. Your actual refund depends on:

- Refund method chosen (cash incurs higher fees)

- Refund amount size (larger refunds have lower percentage fees)

- Exchange rate (if applicable for your method)

- Typical effective refund: 4%-6% of your purchase amount

Q: How is the exact refund amount calculated?

A: The calculation depends on your purchase total:

- 2,000–2,499 THB: ~80 THB refund

- 2,500–4,999 THB: ~150 THB refund

- 5,000–9,999 THB: ~300-400 THB refund

- 10,000–19,999 THB: ~600-800 THB refund

- 20,000–50,000 THB: ~1,200-2,000 THB refund

- Over 200,000 THB: Approximately 6.1% refund rate

Exact amounts vary based on the refund office’s calculation system and the specific fees applied.

Q: Is there a maximum refund amount per day?

A: Yes. The maximum daily refund is 12,000 THB per passport holder per day. If your eligible purchases exceed this, the excess cannot be refunded that day.

Q: If I make large purchases, does the refund percentage increase?

A: Yes, slightly. Larger purchases have lower percentage-based fees, so your effective refund rate increases:

- Small purchases (2,000-5,000 THB): ~4% refund rate

- Medium purchases (5,000-20,000 THB): ~5% refund rate

- Large purchases (20,000+ THB): ~5.5-6% refund rate

Refund Method Questions

Q: Which refund method should I choose?

A:

- Choose cash if you need immediate funds and are comfortable carrying Thai baht

- Choose credit card to avoid airport queues and fees (slightly longer processing time)

- Choose digital wallet if you use Alipay or WeChat Pay (instant, no fees)

- Choose bank transfer for refunds exceeding 30,000 THB (automatic for large refunds)

Q: Can I receive my refund in a foreign currency?

A: No. Refunds are issued exclusively in:

- Thai Baht (THB) for cash refunds

- Your credit card currency for card refunds

- Wallet currency for digital wallet transfers

If you need foreign currency, exchange your refund at a bank or currency exchange service after receiving it.

Q: How long does a credit card refund take?

A: Credit card refunds typically appear in your account within 10-30 business days. Processing time varies by:

- Your credit card bank’s processing speed

- International settlement delays

- The issuing bank’s refund procedures

Q: Can I claim multiple refunds on the same day if I reach the 12,000 THB daily cap?

A: No. The daily maximum is 12,000 THB per passport holder, regardless of the number of transactions. Once you reach 12,000 THB, additional eligible purchases cannot be refunded until the next day.

Documentation Questions

Q: What is the P.P.10 form?

A: The P.P.10 is the official “VAT Refund Application for Tourists Form” issued by participating Thai retailers. It’s a legal document required to claim any VAT refund. The store must complete it at the point of sale with:

- Your passport information

- Purchase details and amount

- Store information and tax ID

- Store staff signature and official stamp

Q: What happens if the P.P.10 form has errors or wrong information?

A: Forms with errors may result in refund denial. If you notice mistakes:

- Return to the store immediately and request a corrected form

- Never attempt to modify the form yourself

- If the store has closed or you’ve left, contact the VAT Refund Office—they may approve amendments if documentation supports the claim

Q: Can I claim a refund by mail if I didn’t claim at the airport?

A: Yes, but with significant limitations:

- You must depart by international airport only

- Mail claims require postal delivery to the Revenue Department

- Processing takes 60-90 days

- Refunds are issued via bank transfer only

- You must provide a copy of your passport and original receipts

Mail refund address:

VAT Refund for Tourists Office

Revenue Department

Bangkok, Thailand

(Exact address available at vrtweb.rd.go.th)

Departure and Timeline Questions

Q: If I buy something on June 1st, what is the final date I can export it?

A: The 60-day timeline starts from the purchase date (day 1). If you purchase on June 1st, the final export date is July 30th (59 days later). Items must physically leave Thailand by the end of day 60 to qualify.

Q: What if my flight departs at 3 AM? Can I get my forms stamped the night before?

A: Yes, you can get customs clearance the evening before if your flight departs before dawn. Inform the customs officer of your early departure time, and they will stamp your forms the previous evening. This is a standard accommodation.

Q: Can I claim a VAT refund if I’m departing by train (land border)?

A: No. VAT refunds are available exclusively for international airport departures. Land border crossings (Malaysia, Cambodia, Laos), cruise ports, and train departures do not have VAT refund facilities and cannot process claims.

Q: What if I change my travel dates and depart later than expected?

A: As long as the goods leave Thailand within 60 days of purchase, you can depart whenever you choose. The key requirement is that items are exported (leave the country) within the 60-day window, not that you depart on your originally planned date.

Q: If I extend my stay, can I still claim my refund?

A: Yes, absolutely. You can extend your visa or extend your stay without affecting your VAT refund eligibility. The 60-day timeline for goods export remains unchanged from the purchase date.

Common Complications and Issues

Q: I lost my P.P.10 form. Can I still claim a refund?

A: Unfortunately, no. The P.P.10 form is the legal document required for all refund claims. There is no provision for claiming VAT refunds without the original form. The Revenue Department cannot recreate lost forms, even if you have receipts. This is non-negotiable.

Prevention: Keep P.P.10 forms in a separate, secure folder in your carry-on luggage.

Q: The store name on my P.P.10 form doesn’t match my receipt. Can I still claim?

A: Probably not. Major discrepancies between the form and receipt will cause refusal. Minor errors (abbreviations, different name formats) might be acceptable if you can verify at the airport. Contact the VAT Refund Office before departure if you notice errors.

Q: I used my product before departure. Can I still claim?

A: No. Customs officers may request to inspect items and verify they’re unused. If items show signs of use (opened packaging, missing tags, visible wear), your claim will be denied. Exceptions are rarely made for used goods, especially electronics.

Q: I packed my purchases in checked baggage. Can I still claim?

A: It depends on the value. For purchases under 5,000 THB and non-luxury items, checked baggage may be acceptable if the items are declared and can be presented for inspection at the customs counter. However, for items exceeding 5,000 THB or luxury goods, items must be in your carry-on so they can be inspected and re-inspected after immigration. To avoid complications, always carry valuable purchases with you through security.

Q: Can I claim VAT refund on purchases made by someone else for me?

A: No. The person named on the P.P.10 form—the person who made the purchase and presented their passport—must claim the refund. Refunds cannot be claimed on behalf of friends or family members.

Q: What if my passport expires during my stay?

A: Your passport must be valid when you purchase items (to issue the P.P.10) and when you claim the refund (for identity verification). If your passport expires between these dates, you may have issues. Always ensure your passport has adequate validity for your entire trip.

Q: I’m a resident returning home. Does my residential status matter?

A: Yes. If you have a residential permit or long-term status in Thailand, you are not eligible for VAT refunds, even if you’re leaving the country temporarily. Eligibility is based on residential status, not citizenship.

Specialty Scenarios

Q: Can I claim a VAT refund on an engagement ring or jewelry I’m purchasing as a gift?

A: Yes, as long as the items are purchased from a participating store and the ring/jewelry is genuinely for export (taken out of Thailand). There’s no restriction on the purpose of the purchase—gifts are eligible. However, luxury jewelry items (over 40,000 THB per item) require dual inspection.

Q: I purchased an iPhone at an Apple Store in Thailand. Can I claim a VAT refund?

A: This is a complicated issue. Some Apple Stores participate in the VAT refund program, while others—particularly authorized Apple retailers—may not. The determining factor is whether the specific store displays the official “VAT Refund for Tourists” sign. Check at the point of sale. If the store doesn’t participate, no refund is available, even though Apple is a major retailer.

Q: Can I claim VAT refund on beauty treatments like hair, makeup, or nails?

A: No. Any personal services, including beauty treatments, hair styling, makeup application, and nail services, are categorized as “services” and explicitly excluded from the VAT refund program.

Q: What if I purchase items from a 7-11 or convenience store?

A: Most 7-11 and convenience stores do not participate in the VAT refund program and will not issue P.P.10 forms. Only larger retailers, department stores, malls, and specialty shops typically participate. Check for the official sign before purchasing.

Q: Can I buy items, return them before departure, and claim a refund on the returned amount?

A: No. Returns are subject to individual store policies and do not create VAT refund eligibility. If you return items and receive a refund from the store, that transaction is separate from the VAT refund program. VAT refunds are only available for goods you’re exporting, not for refunded purchases.

Q: If I buy a laptop worth 50,000 THB, does it require luxury goods inspection?

A: Yes. Electronics items valued at 40,000 THB or more per unit are classified as “luxury goods” and require:

- Customs inspection before immigration

- Re-inspection at the VAT Refund Office after immigration

- Declaration in your carry-on luggage

- Double stamping of documentation

Tourist Experience Questions

Q: How long does the entire VAT refund process take at the airport?

A:

- Customs inspection: 10-30 minutes (depending on queue length and item complexity)

- Immigration: Standard time (15-45 minutes, depending on airport congestion)

- VAT Refund Office claim: 5-15 minutes (usually faster than customs)

- Total time: Plan for 45-90 minutes from entering the VAT refund process to leaving the refund office

Tips to reduce time:

- Arrive early (3+ hours before flight)

- Have all documents organized and readily accessible

- Ensure items are easily presented and inspected

- Choose credit card refund method (less paperwork at the office)

Q: Which Thai airports have the best VAT refund facilities?

A: Major international airports with excellent VAT refund infrastructure:

- Suvarnabhumi Airport (Bangkok) – Largest volume, shortest average queues, best signage

- Don Mueang International Airport (Bangkok) – Domestic + international, modern facilities

- Phuket International Airport – Well-organized, dedicated refund area

- Chiang Mai International Airport – Shorter queues than Bangkok

Q: Is there a particular time of day when VAT refund offices are less crowded?

A: Early morning departures (5-7 AM) typically have shorter queues. Afternoon/evening peak hours (2-8 PM) see longer lines. Avoid 4-6 PM if possible.

Q: Can my family members or traveling companions wait with me during the refund process?

A: Generally yes, but they cannot enter the customs inspection area. Only the passenger with the purchases can approach the inspection counter. Companions can wait nearby.

2025-2026 Regulatory Updates

Q: What changed in the 2025 VAT refund regulations?

A: Recent updates include:

- Increased customs declaration threshold: Raised from 5,000 THB to 20,000 THB

- New payment methods: Alipay and WeChat Pay now available at major airports

- Digital refund platform: TAGTHAi app introduced for pre-registration

- Luxury goods values: Adjusted to 40,000-100,000 THB thresholds

- Downtown refund expansion: More cities now offer pre-departure refund claims

Q: Are there any new restrictions on goods I should know about?

A: Recent additions to the excluded/restricted list include:

- Certain wildlife products (due to CITES protections)

- Traditional medicines with specific ingredients

- Previously, all carry-on goods over 100,000 THB require customs declaration

Your Complete Thailand VAT Refund Roadmap

Thailand’s VAT refund program represents genuine value for international tourists, offering one of the most accessible tax recovery schemes in Southeast Asia. By understanding the eligibility requirements, following the precise procedural steps, and preparing your documentation in advance, you can confidently claim your entitled refunds.

Key takeaways:

- You need non-resident status and a valid passport

- Spend minimum 2,000 THB at participating stores

- Collect P.P.10 forms immediately at purchase

- Get customs inspection before immigration at the airport

- Claim your refund after immigration

- Expect to recover approximately 4-6% of purchase amounts after fees

The process, while seemingly complex, becomes straightforward once you understand each component. Thousands of international visitors successfully claim VAT refunds annually, and with proper preparation, you can do the same. Your Thai shopping experience just became significantly more economical.

For official updates and confirmation: Visit vrtweb.rd.go.th or contact the Revenue Department directly.