Understanding Vault Wallet Transaction Limits in 2026

Managing cryptocurrency through vault wallets requires understanding the specific limits that govern your daily transactions, sales, and withdrawals. Whether you’re using a DeFi protocol vault, a custodial wallet service, or exploring the evolving landscape of on-chain yield strategies, knowing these restrictions is critical to planning your trading strategy and avoiding unexpected transaction rejections.

This comprehensive guide covers all aspects of vault wallet sales limits for 2026, including daily spending caps, withdrawal maximums, transaction size restrictions, and how these limits work across different vault platforms. Whether you’re a casual holder or an active trader, you’ll find detailed information about every major vault solution available today.

What Are Vault Wallet Sales Limits? A Complete Definition

Vault wallet sales limits refer to the maximum amounts users can transact within specific timeframes—typically daily, weekly, or monthly. These limits serve multiple purposes: preventing fraud, managing protocol risk, ensuring regulatory compliance, and protecting users from accidental overspending.

Unlike traditional banking where limits are purely security-based, vault wallets implement limits based on:

- Account verification tier: Higher KYC verification unlocks larger limits

- Account age: Newer accounts often have reduced limits

- Protocol safety parameters: DeFi vaults cap deposits to manage smart contract risk

- Regulatory requirements: Different jurisdictions enforce different transaction thresholds

- Asset-specific rules: Certain tokens or stablecoins may have unique restrictions

Understanding these categories ensures you structure your transactions efficiently and avoid the frustration of rejected deposits or withdrawals.

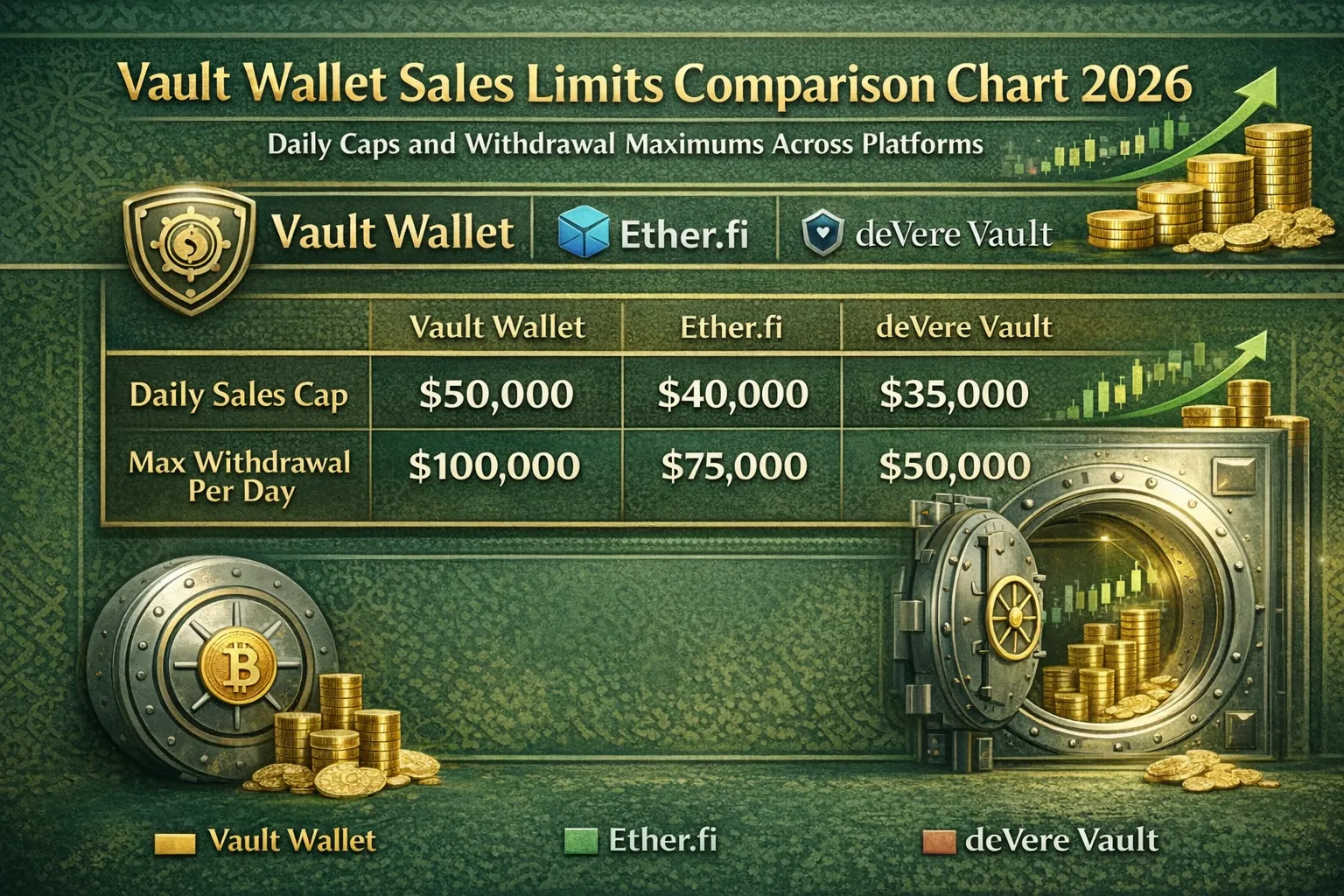

Vault Wallet Sales Limits by Platform: Detailed Breakdown

1. Vault Wallet (vaultwallet.com) – The Unlimited Internal Transaction Approach

Vault Wallet distinguishes itself through an innovative two-tier transaction system that fundamentally changes how users think about velocity limits.

Transaction Structure:

Internal Transactions (Vault-to-Vault Transfers)

- Daily Limit: UNLIMITED

- Monthly Limit: UNLIMITED

- Maximum Per Transaction: UNLIMITED

- Processing Time: Instant (typically under 2 seconds)

- Gas Fees: Never exceeds $8 USD

- Supported Assets: All cryptocurrencies on supported networks (BTC, ETH, USDT, USDC, SOL, etc.)

This unlimited approach is revolutionary because Vault Wallet maintains its own blockchain infrastructure, eliminating the need for costly layer-one transactions. When you send crypto to another Vault Wallet user, the transaction settles internally on Vault’s distributed ledger, not on public blockchains.

External Transactions (To Non-Vault Wallets)

- Daily Limit: Subject to blockchain network capacity

- Fees: Standard blockchain gas fees apply (NOT capped at $8)

- Processing: Depends on blockchain congestion (5 minutes to hours)

- Note: Users assume all risk when sending externally

Why This Matters:

The unlimited internal transaction structure is particularly valuable for:

- Active traders who execute multiple trades daily

- Frequent network participants moving capital between protocols

- High-volume merchants accepting cryptocurrency payments

- Institutional entities moving large positions without fragmentation

2. Ether.fi Vault – Tiered Daily and Monthly Caps

Ether.fi’s vault system implements a sophisticated dual-limit architecture designed for personal finance management with crypto assets.

Spending Limit Architecture:

Card-Level Limits

- Daily Per-Card Limit: $5,000 USD (customizable)

- Applies To: Individual virtual or physical cards only

- Reset: Every 24 hours from last refresh

- Customization: Full user control via Settings panel

Vault-Level Limits

- Daily Vault Limit: $10,000 USD (customizable across entire account)

- Monthly Vault Limit: $10,000 USD default (customizable)

- Multi-Card Impact: All cards contribute to single vault limit

- Example Scenario: If you have 3 cards with $3,500 daily limits each, your vault-level $10,000 daily cap is reached after the second card uses its allowance

Card Creation Restrictions:

Understanding Ether.fi’s card creation limits prevents frustration when trying to create additional cards:

| Account Tier | Virtual Cards | Physical Cards | Virtual Cooldown | Physical Cooldown |

|---|---|---|---|---|

| Core | 3 | 1 | 7 days | 6 months |

| Standard | 5 | 1 | 7 days | 6 months |

| Premium | 10 | 2 | 7 days | 6 months |

Critical Note: Even deleted cards count toward limits until cooldown expires. This prevents users from rapidly cycling through cards to bypass restrictions.

3. deVere Vault – European Spending Framework

DeVere Vault implements a comprehensive spending structure tailored for European users with EUR, GBP, USD, and CHF settlement options.

Daily Spending Caps:

Retail Point-of-Sale Transactions

- Daily Limit: €4,500

- Transaction Type: Card swipes, online purchases

- Currency: Primary spending currency

- Coverage: MasterCard accepted everywhere globally (120+ currencies indirectly)

ATM Cash Withdrawals

- Per-Transaction Maximum: €600

- Daily Transaction Limit: 4 ATM withdrawals maximum

- Total Daily Limit: €1,300 (if 4 × €600 transactions completed)

- Fee Structure: 1% withdrawal fee (minimum €2 per transaction)

- Supported ATMs: All MasterCard-enabled ATMs worldwide

Loading Funds into Vault:

Debit Card Loads

- Daily Maximum: €10,000

- Minimum Per Load: €2.00

- Processing: Instant to 24 hours depending on issuing bank

- Fees: Third-party processing fees may apply

Bank Transfer Loads

- Daily Maximum: €99,999

- Minimum Per Transfer: €2.00

- Processing: 1-3 business days

- Best For: Large deposits, institutional accounts

4. DeFi Protocol Vaults – No Traditional Sales Limits (Smart Contract Constraints Instead)

Unlike custodial wallet services, DeFi vaults (Yearn Finance, Beefy Finance, Aave, Compound) don’t impose arbitrary transaction limits. Instead, they use smart contract-based constraints:

Deposit Limits (Protocol-Specific):

Yearn Vault Strategy Caps

- Structure: Supply caps per vault strategy

- Range: $5 million to $500 million depending on strategy

- Purpose: Manage protocol concentration risk

- Effect: New deposits blocked when cap reached

- Workaround: Deposit to different vault strategy

Aave Supply Caps

- USDC Supply Cap Example: €1.3 billion

- ETH Supply Cap Example: 765,000 ETH

- Status: Real-time monitoring via Aave governance

- Impact: Deposits disabled when utilization reaches 100%

- Frequency: Adjusted monthly by governance

Compound Borrow Limits

- Function: Collateral requirements, not transaction velocity

- Structure: USD value based on collateral factor

- Example: Borrowing against 1 ETH limited by its LTV and collateral factor

- No Daily Reset: Limits persist until collateral added

Withdrawal Mechanics:

No Time-Based Restrictions

- Users can withdraw entire position instantly (subject to liquidity)

- Minimum withdrawal: Protocol-specific (often 1 wei or smallest unit)

- Maximum withdrawal: Equals user’s vault balance

- Gas fees: Paid by user (not capped)

5. Reddit Vault – Now Discontinued as of January 1, 2026

Reddit’s in-app vault feature has been officially sunset, affecting millions of Collectible Avatar holders.

Timeline of Discontinuation:

- October 15, 2025: Reddit announces vault sunsetting

- November 11, 2025: Avatar Shop closed, Collection Display removed

- January 1, 2026: In-app vault and on-platform transfers permanently disabled

- Export Requirement: Users must extract 12-word recovery phrase by January 1, 2026

What This Means for Holders:

- Avatars Still Exist: Collectible Avatars remain on blockchain (Polygon network)

- Access Method: Must use external Web3 wallets (MetaMask, Coinbase Wallet, etc.)

- Secondary Sales: OpenSea and other marketplaces remain functional

- No Direct Sales: Can no longer buy/sell directly through Reddit UI

How Vault Limits Refresh and Reset: Critical Timing Details

Understanding exactly when limits reset prevents mistiming transactions and facing unexpected rejections.

Daily Limit Reset Mechanics:

24-Hour Rolling Reset (Most Platforms)

- Mechanism: Not calendar-day based, but “every 24 hours from last refresh”

- Implication: If you spend $5,000 on Monday at 2:00 PM, limit resets Tuesday at 2:00 PM (not midnight)

- Platform Examples: Ether.fi, deVere Vault

- User Advantage: Can use daily limit twice in a 48-hour period by timing transactions strategically

Calendar Month Reset

- Mechanism: Resets first day of calendar month at midnight UTC

- Platforms: Ether.fi monthly limit, most banking-style vaults

- Example: €4,500 monthly limit on February 1st at 00:00:00 UTC

- Timezone: Usually UTC standardized, regardless of user location

Real-Time Tracking:

Both Ether.fi and deVere Vault display:

- Current limit usage (dollar amount and percentage)

- Exact timestamp of next reset

- Remaining balance before limit reached

- Historical usage for current period

Daily vs. Monthly Sales Limits: Strategic Planning Framework

The difference between daily and monthly caps determines how you structure larger transactions.

Scenario Analysis:

Example 1: Ether.fi User Selling $15,000 Worth of Crypto

With daily vault limit of $10,000 and monthly vault limit of $30,000:

- Day 1: Sell $10,000 (daily limit reached, monthly: $10,000/$30,000)

- Day 2: Sell remaining $5,000 (daily limit reset, monthly: $15,000/$30,000)

- Result: Completed in 2 days using 50% of monthly allowance

Example 2: deVere Vault User Withdrawing €8,000 Cash

With daily limit of €4,500 retail spending and €1,300 ATM daily max:

- Option A (Faster): Split across 2 days using different methods

- Option B (Complete Same Day): €1,300 ATM (4 × €600) + €2,700 retail purchase = €4,000 day one

- Remaining €4,000: Retail purchase on day 2

Optimization Strategies:

- Plan Large Sales in Advance: Break into multiple transactions across days

- Understand Your Cycle: Map business/trading patterns to limit reset times

- Use Tier Upgrades: Higher account tiers often unlock better limits

- Geographic Considerations: Time zone differences affect reset times if using international platforms

Account Verification Tiers and Their Impact on Sales Limits

Higher verification levels universally unlock better transaction limits across vault platforms.

Tier-Based Limit Increases:

Ether.fi Tier System

| Verification Level | Card Limits | Monthly Cap | KYC Required |

|---|---|---|---|

| Basic | $500 daily per card | $3,000 | Name, Email only |

| Verified | $5,000 daily per card | $10,000 | ID + Address proof |

| Premium | $10,000 daily per card | $50,000 | Enhanced verification |

deVere Vault Tiers

| Level | ATM Daily | Retail Daily | Bank Transfer |

|---|---|---|---|

| Level 1 (None) | €600 | €1,500 | €5,000 |

| Level 2 (ID) | €1,300 | €4,500 | €99,999 |

| Level 3 (ID + Docs) | €2,000 | €6,000 | Unlimited |

| Level 4 (Full) | €3,000 | €10,000 | Unlimited |

KYC Documents Needed:

- Tier 1: Email verification

- Tier 2: Government ID (passport, driver’s license)

- Tier 3: Proof of address (utility bill, bank statement)

- Tier 4: Source of funds documentation, biometric verification

Pro Tip: Complete higher tiers immediately upon account creation; KYC can take 24-48 hours.

Large Transaction Sales: Limits That Apply to 6-7 Figure Moves

When moving $100,000+ in cryptocurrency, different rules apply.

Regulatory Reporting Thresholds:

US Bank Secrecy Act (FinCEN)

- Reporting Requirement: $3,000+ to crypto exchanges triggers travel rule

- Information Shared: Sender and recipient details to counterparty institution

- Timeline: Real-time sharing for compliance

- Impact: Potential transaction delays of 1-2 hours

European Travel Rule (AMLR)

- Threshold: €0 (Every transaction reported)

- Strictness: More comprehensive than US requirements

- Processing: Built into all EU-licensed exchanges

- Example: Even €100 transfer requires full compliance details

UK FCA Requirements

- Threshold: £0 (Zero threshold)

- Frequency: Every single transfer monitored

- Implementation: Causes potential delays even on small amounts

Institutional Account Structures:

Platforms offering higher limits for large sales:

Blockchain.com Full Access Account

- Daily Crypto Deposit: $200,000

- Daily Crypto Withdrawal: $200,000

- Daily Fiat Deposit: $100,000

- Daily Fiat Withdrawal: $100,000 (monthly: $500,000 max)

- Monthly Crypto: Unlimited

- Verification: Requires Platinum tier

Vault Markets (Forex/CFD Trading Platform)

- Minimum Deposit: $5-$100 (depending on account type)

- Maximum Withdrawal: UNLIMITED

- Leverage Available: Up to 1:1000

- No withdrawal fees: All payouts processed within hours

- Use Case: Structured trading rather than storage

International Limits: How Sales Restrictions Vary by Country/Region

Vault wallet sales limits differ significantly across geographic regions due to regulatory frameworks.

European Union (Most Restrictive):

Standard Limits for EU Citizens

- Daily crypto purchases: Limited to €5,000 maximum

- ATM withdrawals: €1,300-€2,500 depending on verification

- Retail spending: €4,500-€10,000

- Travel Rule: Applies to 100% of transactions

- Stablecoin caps: GENIUS Act restricts interest on payment stablecoins

United States (Moderate Restrictions):

Standard Limits for US Users

- Daily crypto purchases: Typically $5,000-$10,000

- No ATM withdrawal cap per se (MasterCard rules apply: $500-$1,000 typical)

- Retail spending: Often unlimited if verified

- Travel Rule: Applies only to transfers $3,000+

- Stablecoin yield: Restricted under GENIUS Act (no interest)

Asia-Pacific (Variable):

| Region | Daily Crypto Limit | Travel Rule Threshold | Notes |

|---|---|---|---|

| Singapore | $30,000+ | SGD 0 (Universal) | Most permissive for accredited investors |

| Japan | ¥1,000,000 (~$6,800) | ¥0 (Universal) | Regulated by FSA, similar to US |

| South Korea | ₩1,000,000 (~$800) | ₩0 (Universal) | Stricter than most nations |

| Australia | AUD 10,000 (AUSTRAC) | AUD 0 (Universal) | Growing restrictions |

| Hong Kong | HKD 100,000 (~$12,800) | HKD 0 (Universal) | Business licensing affects access |

Emerging Markets:

- UAE/Gulf States: Generally $50,000+ for verified users; no travel rule

- Latin America: Varies by country; typically $10,000-$25,000 daily

- Africa: Most restrictive; often $1,000-$5,000 daily for unbanked/underbanked populations

Strategy for International Users: Always verify your specific country’s limits before planning large transactions.

What Happens When You Exceed Vault Sales Limits? Complete Scenario Guide

Understanding consequences prevents costly mistakes and transaction rejections.

Immediate Outcomes When Limit Exceeded:

Transaction Rejected (Most Common)

- Status: “Insufficient Daily/Monthly Limit”

- Funds: Returned to originating wallet within 24 hours

- Fees: Gas fees still charged even on rejected transactions

- No Reversibility: Must wait for limit reset before retrying

Partial Transaction Approval (Rare)

- Some platforms approve up to remaining limit

- Example: €4,500 daily limit with €6,000 requested = €4,500 approved, €1,500 rejected

- Fee Structure: Charged on approved amount only

- Platforms Using This: deVere Vault sometimes

Hard Block (Security Feature)

- Account temporarily flagged for suspicious activity

- Requires verification with customer support

- May trigger additional KYC checks

- Timeline: 24-72 hours for resolution

Account Restrictions Triggered:

Multiple Rejections (3+ within 24 hours)

- Consequence: Temporary trading suspension (usually 24 hours)

- Message: “Account activity limit exceeded; try again tomorrow”

- Bypass: Contact support for emergency override

Pattern of Exceeding Limits

- Consequence: Account review flagged

- Action: May require additional verification

- Outcome: Account may be temporarily or permanently restricted

Suspected Structuring (Multiple transactions just under limits)

- Regulatory Risk: FinCEN/FCA may investigate

- Platform Response: Account frozen pending compliance review

- Timeline: 30-90 days for investigation

- Outcome: Potential account closure

Increasing Your Vault Sales Limits: Step-by-Step Upgrade Path

Higher limits are achievable through proper account structuring and verification.

Ether.fi Limit Increase Process:

Step 1: Verify Account (Tier 1)

- Complete basic registration with email

- Receive $5,000 daily card limits

- Takes: Immediate

Step 2: Add Identity (Tier 2)

- Upload government-issued ID

- Verify address with utility bill

- Allows: $10,000+ daily limits

- Takes: 24-48 hours

Step 3: Enhanced Verification (Tier 3)

- Additional documentation review

- Income/assets verification optional

- Unlocks: $50,000+ monthly limits

- Takes: 3-7 business days

Step 4: Institutional Accounts (Tier 4)

- Full compliance documentation

- Source of funds verification

- Premium support access

- Unlimited daily limits possible

- Takes: 7-14 business days

deVere Vault Limit Increase Process:

Direct Option: Simply add more cards (each card has individual limits)

- Create up to 5 virtual cards (if Standard tier)

- Each card: Independent €4,500 daily limit

- Total household limit: €22,500 daily (5 cards × €4,500)

- Does NOT increase per-card limit

Alternative: Request tier upgrade

- Upload biometric verification

- Enhanced documentation

- Negotiate custom limits with support

- Takes: 7-14 business days

Cold Vaults vs. Hot Vaults: Limit Differences Explained

The difference between hot and cold storage fundamentally changes transaction limits.

Hot Vault Wallets (Connected to Internet):

Characteristics

- Always accessible online

- Immediate transactions available

- Subject to platform’s daily/monthly limits

- Higher hacking risk

- Examples: MetaMask, Exodus, Vault Wallet app

Sales Limits

- Bound by platform policies (daily/monthly caps)

- May have spending limits per transaction

- Speed: Instant to minutes

- Fees: Full gas fees apply

Cold Vault Wallets (Offline Storage):

Characteristics

- Disconnected from internet (hardware wallets)

- Require manual transaction signing

- No platform-imposed velocity limits

- Transactions limited by blockchain network, not wallet

- Examples: Ledger, Trezor, hardware-only vaults

Sales Limits

- No Daily Limits: Can sell unlimited amounts per day

- No Monthly Caps: No time-based restrictions

- Blockchain Constraints: Limited by network throughput only

- Maximum Per Transaction: Billions of dollars (if funds exist and network allows)

- Speed: 10 minutes to hours (depends on blockchain congestion)

- Fees: Full blockchain gas fees apply

Hybrid Approach:

- Keep majority of holdings in cold vault (no velocity limits)

- Move only needed amounts to hot wallet (subject to daily limits)

- Eliminates waiting periods for large positions

Tax Implications of Vault Sales and Limit Timing

Exceeding limits can have unintended tax consequences in 2026.

Reportable Events When Selling Crypto:

US Tax Rules (IRS Form 8949)

- Taxable Event: Every crypto sale triggers capital gains tax

- Limit Timing: No tax advantage to breaking sales across multiple days

- Wash Sale Rule: Does NOT apply to crypto (only stocks)

- Strategy Implication: Timing transactions by daily limits doesn’t reduce taxes

European Tax Treatment (VAT/CGT)

- Reporting Threshold: €10,000+ may require additional paperwork

- Travel Rule Interaction: €0 reporting combined with personal tax tracking

- Member State Variation: Each country implements differently

- Documentation: Your vault platform’s transaction history serves as official record

Reporting Requirements When Limits Matter:

Structuring Penalties (Deliberately breaking sales to avoid reporting)

- US Penalty: Up to $250,000 + equal amount of funds seized

- EU Penalty: Criminal charges possible in many countries

- Red Flag: Consistent transactions just under $3,000/$10,000 threshold

- Distinction: Using multiple wallets for legitimate reasons ≠ structuring

Recommended Approach:

- Don’t artificially split transactions to avoid limits

- Report all sales transparently

- Use legitimate wallet strategies for security/diversification

- Maintain clear documentation

DeFi Vault Strategies with Yield: Special Sales Limit Considerations

Earning yield within vaults changes how sales limits apply.

Liquidity Mining Withdrawal Limitations:

Pendle V2 Principal Token Strategy

- Lock-In Period: Matures at specific future date

- Early Withdrawal: Possible but incurs price discount

- Sales Limit Impact: No platform-imposed daily limits

- Blockchain Limits: Subject only to network throughput

- Yield Consideration: Breaking position early sacrifices remaining yield

Curve/Convex Looping Vaults

- Position Liquidation: If LTV exceeds threshold, position liquidates automatically

- No Choice in Timing: Liquidation happens regardless of user preference

- Sales Limit Irrelevant: Smart contract enforcement supersedes user intentions

Staking Vault Withdrawal Waiting Periods:

| Platform | Lock-Up Period | Early Exit | Penalty |

|---|---|---|---|

| Ethereum Staking | 7-15 days unstaking | Not possible | N/A |

| Lido (stETH) | Instant | Instant | None (1% discount) |

| Rocket Pool | Instant | Instant | 0-10% slashing |

| Cardano (Stake Pools) | 1 epoch | Not possible | Auto-delegation |

Key Difference: Staking withdrawal delays ≠ sales limits. Blockchain mechanics, not policy limits, create delays.

Hardware Wallet Sales Limits: Are There Any?

Hardware wallets (Ledger, Trezor, Tangem) have a surprising answer regarding limits.

No Daily/Monthly Sales Limits:

Why Hardware Wallets Have No Limits

- Self-custodial: No third party controlling your funds

- Not connected to internet: No centralized system tracking velocity

- Blockchain-only constrained: Only network throughput limits you

- Your keys, your rules: Completely unrestricted

What Actually Limits Hardware Wallet Transactions:

- Blockchain Network Capacity

- Ethereum: ~12-15 transactions per second

- Solana: ~400-700 transactions per second

- Bitcoin: ~7 transactions per second

- Layer 2s: 1,000-4,000 transactions per second

- Gas Fees (Your Cost, Not Limit)

- Ethereum: $5-$50 per transaction

- L2s: Under $1 per transaction

- Bitcoin: $1-$10 per transaction

- Your Own Funds

- Can’t sell more than your balance

- Can make unlimited number of transactions

- Can execute any transaction size (if funds exist)

Practical Example:

A user with 100 BTC in a hardware wallet can:

- Sell all 100 BTC in single transaction

- Sell 1 BTC 100 times in consecutive transactions

- Execute transactions 24/7/365 with no restriction

- Maximum limit: Their balance only

Avoiding Limit-Related Problems: Best Practices Checklist

Prevent frustration with these proactive strategies.

Before Making Large Sales:

- Check current limit usage (percentage remaining)

- Verify next reset time (exact timestamp, not estimate)

- Confirm account verification tier

- Test transaction amount with smaller transfer first

- Review country-specific regulations for your jurisdiction

- Calculate tax implications separately from limits

- Keep transaction history/screenshots for records

After Hitting Limits:

- Wait for automatic limit reset (don’t retry immediately)

- Contact support if limit reset hasn’t occurred at stated time

- Request tier upgrade if routinely exceeding current limits

- Consider switching platforms if limits consistently insufficient

- Document pattern for tax purposes

For Active Traders:

- Use multiple vault platforms (diversification, not structuring)

- Maintain cold wallet for larger holdings (no limits)

- Plan weekly transaction calendar around reset times

- Build relationships with support teams for faster responses

- Monitor limit policy changes (platforms update quarterly)

For Passive Holders:

- One-time verification to highest available tier

- Set calendar reminders for major sales planned months ahead

- Use hardware wallet for holdings not needing frequent access

- Understand your platform’s limit before crisis situations arise

Future of Vault Sales Limits: 2026-2027 Trends

Regulatory and technological changes are reshaping limit frameworks.

Regulatory Landscape Shifting:

GENIUS Act Impact (US, Signed July 2025)

- Restricts interest payments on payment stablecoins

- May push platforms toward points/rebate systems

- Opens opportunity for securities-based yield alternatives

- Expected full implementation: Q2 2026

European Digital Finance Package (MiCA 2)

- Harmonizing crypto regulations across EU

- Likely to increase harmonization of limits

- Emerging Markets Regulation (EMR) integration

- Expected implementation: Early 2026

FATF Travel Rule Global Expansion

- More countries adopting $3,000+ threshold

- Some proposing lowering thresholds to $500-$1,000

- Likely increase in transaction processing delays

- Expected timeline: Mid-2026 onwards

Technological Improvements:

Layer 2 Blockchains Reducing Gas Fees

- Arbitrum, Optimism, Polygon maturing

- Sub-cent transaction costs becoming standard

- Reducing need for “unlimited internal transactions”

- Impact: More platforms may shift to per-transaction fees

Interoperability Protocols

- Cross-chain bridges improving

- Reducing lock-in to single platforms

- Users can arbitrage limits across chains

- Example: Move funds to platform with higher daily limits on Layer 2

Self-Custody Standards Improving

- Hardware wallets becoming more user-friendly

- Browser extensions for hardware wallets advancing

- Reducing need for custodial vault wallets

- Impact: Higher-limit decentralized alternatives becoming mainstream

Frequently Asked Questions: Vault Wallet Sales Limits

General Questions

Q: What’s the difference between a daily limit and a velocity limit?

A: Daily limits reset every 24 hours based on when you hit the threshold (rolling). Velocity limits are instantaneous per-transaction caps—you can’t execute a single transaction larger than X amount, regardless of daily usage. Most vaults use daily limits; a few (Coinbase, Kraken) use both.

Q: Can I increase my vault wallet sales limits instantly?

A: No. Even expedited tier upgrades take 24-48 hours minimum (usually requires identity verification review). Ether.fi offers fastest processing; deVere Vault typically takes 2-7 days. Plan ahead for large anticipated sales.

Q: Are vault sales limits the same across all countries?

A: No. US limits (~$5,000-$10,000 daily) differ significantly from EU limits (~€4,500 retail, €1,300 ATM daily) and UK limits (lower due to FCA stricter oversight). Always verify your specific country’s limits.

Q: What happens if I exceed my limit accidentally?

A: Transaction is rejected, funds return within 24 hours. Gas fees may still be charged even on rejected transactions. You must wait for limit reset (typically 24 hours) before retrying.

Q: Do hardware wallet sales have limits?

A: No daily/monthly limits for hardware wallets. Only blockchain network throughput constrains you. You can sell unlimited amounts, unlimited times per day—only your balance and gas fees matter.

Technical Questions

Q: Why does my limit reset at random times instead of midnight?

A: Most platforms use rolling 24-hour windows from your last transaction/usage, not calendar-based resets. If you spend at 3:00 PM, limit resets 3:00 PM next day. Check your platform’s specific reset time in settings.

Q: Can I use multiple cards/wallets to bypass daily limits?

A: Depends on platform:

- Ether.fi: Multiple cards per account contribute to single vault limit; each card has independent daily limit ($5,000 default)

- deVere Vault: Each card has independent limits; multiple cards add up to household totals

- General strategy: This is legitimate diversification, NOT “structuring” (illegal limit-avoidance through fragmented transactions)

Q: How do leverage and liquidation interact with sales limits?

A: On DeFi protocols, liquidation happens automatically if your position exceeds LTV threshold. No sales limit applies; smart contract execution overrides all user choices. Liquidation penalties apply regardless of limit status.

Q: If I have multiple verification tiers simultaneously, which limit applies?

A: Highest verification tier’s limits apply to your account. You don’t get limits from multiple tiers—upgrade replaces previous tier entirely.

Compliance & Regulatory Questions

Q: Why does my transaction get delayed for reporting when I exceed $3,000?

A: US Travel Rule (FinCEN) requires exchanges to share sender/recipient information with counterparty institution when transfers reach $3,000+. This causes 1-2 hour delays as compliance teams verify information. It’s legal and mandatory—not a “limit” but a reporting requirement.

Q: Will exceeding my daily limit affect my credit score?

A: No. Crypto vault limits are platform policies, not credit events. However, multiple rejections may flag your account for review and potentially restrict it. This doesn’t affect credit, but affects access to the platform.

Q: What’s the difference between exceeding limits and “structuring”?

A:

- Exceeding limits: Attempting transaction larger than policy allows; rejected automatically

- Structuring: Deliberately breaking transactions into smaller amounts to avoid reporting thresholds (illegal in most countries)

- Not structuring: Using multiple wallets for legitimate security/diversification reasons

- Key test: Intent. If you’re avoiding limits for convenience, that’s fine. If avoiding reporting requirements, that’s illegal.

Q: Are vault sales limits enforceable in court?

A: Yes. Terms of Service make limits enforceable contracts. If you accept T&Cs, you accept limits. Platforms can restrict accounts for exceeding limits; courts typically side with platforms on enforcement of agreed-upon policies.

Q: Will new regulations change my current vault limits?

A: Likely. GENIUS Act (US) and MiCA 2 (EU) both expected to influence stablecoin yields and transaction framework by mid-2026. Monitor your platform’s official announcements for policy updates.

Account Management Questions

Q: How long does it take for daily limits to reset after I hit them?

A: Exactly 24 hours from when you triggered the limit (not from midnight). Most platforms show exact reset time in your account. Set phone reminders if timing is critical.

Q: Can I request a temporary limit increase?

A: Maybe, but rarely. Ether.fi: Contact support (usually denied for standard users). deVere Vault: Possible with enhanced verification. Vault Wallet: Not applicable (unlimited internal transactions). Most platforms don’t offer temporary increases for security reasons.

Q: What happens to my limits if I close and reopen an account?

A: New account = new limit tier structure. Most platforms reset you to Tier 1 (lowest limits) requiring full reverification. Takes 1-2 weeks to rebuild to previous tier. Plan accordingly.

Q: Will my limits transfer if I move to a different crypto platform?

A: No. Each platform has independent verification and limit systems. You must go through full verification process on each platform. Reputation/history doesn’t transfer between platforms.

Q: Can I appeal if my account gets restricted for exceeding limits?

A: Yes, contact support. Explain the situation. Most platforms will lift temporary restrictions after review (24-72 hours). Permanent restrictions are rarely appealed successfully unless you prove the account was compromised.

Vault Strategy & Optimization Questions

Q: What’s the best vault setup to maximize transaction flexibility?

A: Hybrid approach:

- Hardware wallet: Cold storage for long-term holdings (NO LIMITS)

- Ether.fi vault with multiple cards: Daily trading ($15,000-$30,000 daily with multiple cards)

- Vault Wallet: High-frequency small transactions (unlimited internal transfers)

- RESULT: No practical limits while maintaining security

Q: How do I optimize my vault choice for frequent sales?

A: Consider transaction frequency:

- Daily trader: Vault Wallet (unlimited internal) or DEX (blockchain limits only)

- Weekly sales: Ether.fi with premium tier ($50,000+ monthly)

- Monthly sales: deVere Vault (€4,500 daily is usually sufficient)

- Infrequent large sales: Hardware wallet (zero limits, full control)

Q: Can I use DeFi yield vaults to circumvent sales limits?

A: No. DeFi vault yields are separate from sales limits. Earning 10% APY on your deposit doesn’t unlock higher sales limits. Withdrawal limits on DeFi vaults are your balance only (no daily caps), but they’re separate from platform transaction limits.

Q: What’s the smartest way to structure a $500,000 cryptocurrency sale?

A: Multi-step approach:

- Weeks before: Open multiple platform accounts, complete all verifications

- 1 week before: Move 40% to hardware wallet cold storage (no limit stress)

- Days 1-5: Sell 20% per day through Ether.fi ($200,000/day spread across days = within typical limits)

- OTC option: For remaining large blocks, use OTC desk (no limits, different fee structure)

- Maintain records: Document spread to prove it’s strategic planning, not structuring

Q: Should I wait for limit resets or use multiple platforms simultaneously?

A: Multiple platforms is better strategy:

- Faster: Don’t wait 24 hours between tranches

- Safer: Diversification reduces single-platform risk

- Cleaner: Each platform sees reasonable transaction patterns

- Legitimate: Using different platforms for security is standard practice

- Warning: Using them in coordinated sequence to avoid reporting appears like structuring—document business reason

Q: Do I lose interest/yield if I move crypto to cold vault?

A: Depends on vault type:

- DeFi yield vault: Moving withdraws you from strategies, yield stops immediately

- Staking vaults: Unstaking takes 1-15 days, yield continues during wait period

- Lending platforms: Withdrawal stops all yield accrual

- Plan: Only move what you don’t need ongoing yield on; leave rest in vault

International & Tax Questions

Q: What sales limits apply if I’m a US citizen but live overseas?

A: Generally:

- US Limits Apply: $3,000 travel rule, SEC/CFTC restrictions still bind you

- Local Limits Also Apply: Wherever you reside (EU, Asia, etc.) may impose stricter limits

- Stricter Standard Wins: If US is $10,000 daily but your country is €4,500, the €4,500 applies

- Tax Obligation: US citizens owe taxes on worldwide gains; file FBAR if foreign accounts exceed $10,000

Q: Do I need to report vault sales limits to tax authorities?

A: Not the limits themselves, but your actual sales. Limits are irrelevant for tax reporting—only actual transactions reported. However, patterns matter:

- Repeatedly hitting same limit might flag IRS audits

- Deliberately structuring to avoid reporting is criminal

Q: How do I handle sales limits across multiple countries?

A: Keep organized records:

- Each transaction: Date, amount, platform, limit status

- Cumulative: Running total of monthly/annual sales

- Tax: Separate calculations for each country’s rules (if applicable)

- Strategy: Spreadsheet documenting which platform for which sales

Q: If I’m moving countries, do my vault limits change?

A: Usually yes:

- Automatic: Residency changes detected via new address verification

- Manual: May need to update country/region in account settings

- Tier Reset: Some platforms reset verification when residency changes

- Limits: New country’s limits apply going forward

- Transition: Can take 2-7 days for system to implement

Choosing the Right Vault for Your 2026 Transaction Needs

The vault wallet landscape in 2026 offers solutions for every transaction pattern and risk tolerance.

For unlimited high-frequency transactions without daily restrictions, Vault Wallet’s unlimited internal transfer system is unmatched. The never-more-than-$8 gas fee structure transforms how traders think about execution velocity.

For daily spenders wanting personal finance management, Ether.fi’s customizable daily and monthly limits provide security with flexibility. Multiple card strategies can unlock $30,000+ daily spending through legitimate account structuring.

For international users in Europe, deVere Vault’s comprehensive spending framework (€4,500 retail daily, €1,300 ATM daily) combined with EUR/GBP/USD/CHF settlement options covers most use cases without geographic limitations.

For passive holders requiring zero limits, hardware wallets remain supreme. No platform restrictions, no daily caps, no velocity constraints—only blockchain network throughput and your own security discipline matter.

For DeFi yield optimization, recognizing that supply caps and borrowing limits work differently than transaction velocity limits is critical. Smart contract constraints supersede any platform-imposed limits.

The key to successfully navigating vault sales limits is planning. Understanding your transaction patterns—whether trading daily, selling monthly, or moving large positions rarely—lets you choose the vault solution matching your actual needs rather than your perceived needs.

By leveraging account tier upgrades, multiple platforms strategically, and cold storage for holdings not requiring frequent access, you can effectively eliminate practical sales limit constraints while maintaining security and regulatory compliance.

The future of vault limits points toward higher allowances, better cross-chain interoperability, and continued regulatory harmonization. By understanding the current framework thoroughly, you’re positioned to adapt quickly as 2026 brings inevitable changes to this rapidly evolving landscape.

Additional Resources & Support Contacts

Vault Wallet Support: support@vaultwallet.com (24/7) | Live Chat: vaultwallet.com

Ether.fi Support: help.ether.fi | Email: support@ether.fi | Discord: https://discord.gg/ether-fi

deVere Vault Support: support@devere-vault.com | Live Chat available

For Regulatory Questions: Contact your local financial regulator or tax authority

Security Note: Never share your recovery phrases, private keys, or account passwords with anyone claiming to provide support. Official support never requests these credentials.