Crypto trading bots have evolved from niche tools to essential infrastructure for modern traders. In 2026, AI-powered bots can execute 24/7 without emotional bias, but the critical reality is that only 10-30% of users achieve consistent profitability. This comprehensive guide covers the 10 best Binance trading bots, proven strategies (DCA, grid, arbitrage), realistic performance expectations, security concerns, and setup protocols to help you outperform market conditions.

Why Binance Trading Bots Matter in 2026

Cryptocurrency markets operate around the clock. While you sleep, prices shift across dozens of pairs. Manual trading becomes physically and psychologically exhausting – and that’s where bots excel.

The statistical case for automation:

- Approximately 70% of U.S. equity trading volume is already driven by algorithms, signaling mainstream adoption

- AI-powered trading systems achieve annualized returns of 35–48% in optimal conditions

- Bots execute trades with zero emotional bias – no panic selling, no FOMO buying

- Backtested strategies outperform untested models by up to 2.5x

However, the gap between potential and actual results is wide. Without proper strategy, risk management, and backtesting, traders often lose capital. This guide isolates the critical factors separating winners from the majority.

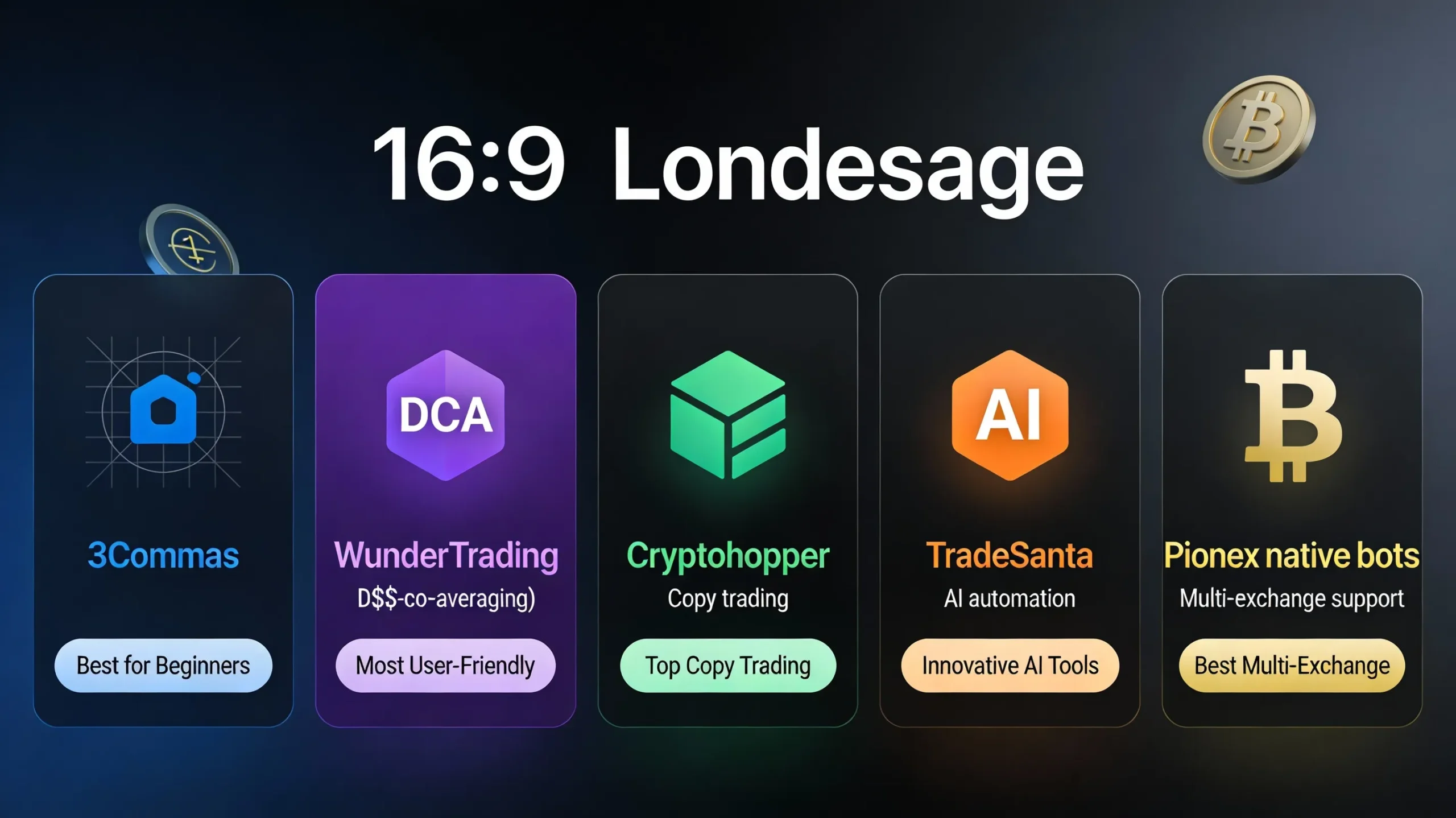

Top 10 Best Binance Trading Bots: Detailed Comparison

1. WunderTrading – Best for Copy Trading & Social Collaboration

Platform Type: Cloud-based multi-exchange bot with social trading features

Key Features:

- Advanced grid, DCA, and futures trading strategies

- Copy-trading functionality – replicate profitable traders’ strategies

- AI bot capabilities for automated decision-making

- User-friendly interface requiring no advanced coding

- Supports spot trading and Binance Futures with short positions

- Live backtesting and strategy customization

Pricing: Freemium model with premium subscription tiers

Pros:

- Easy setup – configure a bot in minutes

- Social learning – discover and copy successful traders

- Multi-strategy support for different market conditions

- Full support for Binance spot and futures

- AI suggestions for parameter optimization

Cons:

- No dedicated mobile app

- Copy-trading requires vetting trader track records (not all succeed)

- Subscription costs add up for advanced features

Best For: Traders seeking social proof, collaboration, and copy-trading alongside self-managed automation

2. 3Commas – Best for Advanced Traders & Multi-Exchange

Platform Type: Enterprise-grade bot platform supporting 20+ exchanges

Key Features:

- Stop-loss and take-profit automation

- Multiple simultaneous trades with risk controls

- Margin trading and leverage (Binance Futures)

- AI trading bot option with signal integration

- DCA and grid strategies

- TradingView integration and signal execution

Pricing: Tiered subscription model ($13–$99/month depending on features)

Pros:

- Robust analytics and detailed trade logs

- Professional-grade tools for serious traders

- Signal-based trading from TradingView

- Comprehensive portfolio management across exchanges

- Superior documentation and customer support

Cons:

- Steeper learning curve

- Subscription costs are higher than competitors

- Requires API key management and security awareness

Best For: Professional traders, active money managers, and those integrating signals from multiple sources

3. Cryptohopper – Best for Cloud-Based AI Trading

Platform Type: Cloud-based bot with built-in AI algorithms

Key Features:

- Supports 16+ major exchanges including Binance

- AI-based algorithm selection – the bot analyzes multiple strategies and chooses the best one

- Trailing stop-loss and trailing stop-buy

- Dollar-cost averaging (DCA) strategies

- Social trading platform to mirror professional traders

- Custom trading signals and webhook support

Pricing: Freemium ($0–$99/month)

Pros:

- Cloud-based – no VPS required

- AI algorithm automatically selects best-performing strategy

- User-friendly interface, excellent for beginners

- Real-time signals and market analysis

- Extensive community with shared strategies

Cons:

- Advanced features require paid subscriptions

- Market maker and arbitrage available only on premium plans

- AI-generated signals are not always transparent (black-box)

Best For: Beginners and intermediate traders wanting AI-driven automation without coding

4. TradeSanta – Best for Grid & DCA Automation

Platform Type: Simplified cloud-based bot focusing on grid and DCA strategies

Key Features:

- Pre-configured grid trading bots optimized for ranging markets

- DCA bots for systematic accumulation

- Cloud-based execution – no VPS needed

- Binance spot and futures integration

- Copy-trading for following other traders

- Demo mode for testing with virtual funds

Pricing: Freemium to premium ($9.99–$99/month)

Pros:

- Extremely easy to set up – ideal for newcomers

- Transparent fee structure

- Reliable execution on Binance

- Clean, intuitive interface

- Grid parameters pre-optimized for common trading pairs

Cons:

- Limited advanced customization compared to 3Commas

- AI capabilities are minimal vs. competitors

- Copy-trading success varies by trader quality

Best For: Beginners and traders prioritizing simplicity and fast deployment

5. Bitsgap – Best for Portfolio Management & Arbitrage

Platform Type: Multi-exchange bot platform with portfolio tracking

Key Features:

- Grid, DCA, and combo bot types

- Advanced portfolio analytics and backtesting

- Smart orders to minimize slippage

- Arbitrage detection across exchanges

- Supports spot and futures trading

- Customizable risk parameters

Pricing: $14–$99/month depending on features

Pros:

- Robust backtesting engine to validate strategies before live trading

- Deep portfolio analytics

- Multi-exchange arbitrage detection

- Professional charting and technical analysis tools

- Excellent for managing multiple coins and strategies simultaneously

Cons:

- Slightly higher pricing tier

- Requires more hands-on optimization than plug-and-play platforms

- Steeper learning curve for beginners

Best For: Traders managing multiple coins, seeking arbitrage opportunities, and needing detailed analytics

6. Pionex – Best for Free Built-In Automation

Platform Type: Exchange-integrated bots (native to Pionex exchange)

Key Features:

- 16 free trading bots built into the exchange

- Grid trading, DCA, rebalancing, infinity grid, arbitrage

- PionexGPT AI assistant for strategy configuration

- Futures bots with leverage options

- Demo trading for risk-free testing

- Direct Binance liquidity partnerships

Pricing: Free (0% subscription fees beyond standard trading costs)

Pros:

- No subscription cost – only standard trading fees

- Liquidity sourced from Binance and Huobi Global

- AI assistant simplifies strategy setup

- Quick deployment – no API key configuration

- Excellent for long-term DCA investors

Cons:

- Must trade on Pionex exchange (not your main exchange if you prefer another)

- Less advanced customization than third-party platforms

- Limited to Pionex’s bot selection

Best For: Cost-conscious traders, long-term DCA investors, and those comfortable with Pionex’s exchange

7. Coinrule – Best for No-Code Rule Builder

Platform Type: Visual rule-based bot builder with multi-exchange support

Key Features:

- Visual rule builder – no coding required

- 250+ pre-built strategy templates

- Backtesting engine for strategy validation

- Multi-exchange support (Binance, Coinbase Pro, Kraken, etc.)

- TradingView integration on premium plans

- DCA, trend-following, and breakout strategies

Pricing: Free tier + $15–$99/month premium

Pros:

- True no-code solution – drag-and-drop strategy building

- Extensive strategy template library

- Backtesting before live deployment

- Affordable entry for beginners

- TradingView charting integration

Cons:

- Free tier is limited in bot count

- Advanced features require subscription

- Less customization than code-based platforms

Best For: Non-technical traders wanting custom strategies without programming

8. HaasOnline – Best for Professional Scripting & Arbitrage

Platform Type: Advanced scripting platform for custom bot development

Key Features:

- Custom bot development via HaasScript language

- External and internal arbitrage strategies

- Multi-exchange portfolio balancing

- Advanced risk management and position sizing

- Visual editor for non-coders

- Real-time market monitoring

Pricing: $99–$500+/month for professional tools

Pros:

- Maximum customization and control

- Professional-grade tools for serious traders

- Advanced risk controls and position management

- Strong community of developers sharing strategies

Cons:

- High cost of entry

- Steep learning curve for beginners

- Requires technical knowledge

- Self-hosted options require VPS knowledge

Best For: Experienced developers, professional traders, and institutional clients

9. Binance Native Bots – Best for Zero Additional Cost

Platform Type: Exchange-native bots integrated into Binance

Key Features:

- Spot grid bot (buy low, sell high within ranges)

- Futures grid bot with leverage

- Auto-invest bot (DCA functionality)

- TWAP and VWAP bots for large order execution

- Portfolio rebalancing tools

- No subscription fees – only standard trading costs

Pricing: Free (no subscription; only exchange trading fees apply)

Pros:

- Zero additional subscription cost

- Direct integration with Binance account

- Direct access to Binance’s liquidity

- Split orders reduce slippage

- DCA strategies enable automated investing

Cons:

- Requires technical knowledge to optimize

- Limited customization vs. third-party platforms

- Ongoing strategy monitoring and adjustment needed

- Trading fees can accumulate quickly with grid strategies

Best For: Users deeply embedded in Binance ecosystem preferring native solutions

10. Tickeron – Best for AI-Driven Alerts & Pattern Recognition

Platform Type: AI research platform with bot-generated signals

Key Features:

- AI agents focused on specific tickers and patterns

- Candlestick pattern recognition and technical analysis

- Multi-model crypto strategies combining tech + sentiment

- Audit-able trading records with public performance metrics

- 5-minute and 15-minute AI agents for intraday trading

- High-frequency signal generation

Pricing: Subscription-based (varies by tier)

Pros:

- Transparent, audited performance track records

- Multi-model AI combining multiple data sources

- Intraday signal generation with low latency

- Excellent for active day traders

- Professional-grade analytics

Cons:

- Requires active monitoring of signals

- Not fully automated – alerts only, not execution

- Higher pricing for premium alerts

- Requires integration with separate execution platform

Best For: Active traders wanting AI-generated alerts without full automation

Detailed Strategy Guide: Making Your Bot Profitable

The bot platform is just infrastructure. Strategy is everything. Here are the three core approaches that generate consistent returns.

Strategy #1: Dollar-Cost Averaging (DCA) – Best for Long-Term Accumulators

What It Is: Purchasing a fixed dollar amount of crypto at regular intervals, regardless of price.

How It Works:

- Bot automatically buys $50 of BTC every Monday

- Continues for months/years regardless of price movement

- Smooths your average entry price across market cycles

- Captures “down” prices automatically without emotional resistance

Example Configuration:

- Asset: Bitcoin (BTC)

- Interval: Weekly (every Monday 9 AM)

- Amount: $100 per trade

- Timeframe: 24 months

- Take-profit: 15% above average entry

When DCA Excels:

- Sideways or bull markets (accumulation phase)

- Long-term wealth building (5+ years)

- Reducing timing risk for volatile assets

- Passive income investors

When DCA Fails:

- Extended bear markets (continuing to buy falling assets)

- In downtrends without a clear reversal signal

- For traders needing quick returns

Performance Data: DCA users report 5-12% annualized returns in realistic conditions (conservative estimates), significantly lower than grid trading but with lower risk and drawdown.

Strategy #2: Grid Trading – Best for Ranging Markets

What It Is: Placing multiple buy and sell orders at predetermined price intervals, profiting from oscillations.

How It Works:

textExample: Bitcoin Range $42,000 – $46,000 (4% range)

Buy Orders: $41,900, $41,800, $41,700, $41,600 (below current price)

Sell Orders: $42,100, $42,200, $42,300, $42,400 (above current price)

As price fluctuates:

- Price drops to $41,800 → BUY order executes

- Price recovers to $42,200 → SELL order executes (profit captured)

- Cycle repeats multiple times within the range

Grid Configuration Parameters:

- Price Range: Define upper and lower bounds (research historical support/resistance)

- Grid Lines: Number of orders (typically 10–20 for retail traders)

- Grid Step: Distance between orders (smaller = more trades, higher fees)

- Investment Size: Total capital divided by number of open positions

Realistic Example:

- Capital: $1,000

- Price range: $41,500–$43,500 (Bitcoin)

- 20 grid lines

- Grid step: $100

- Expected profit per cycle: $50–$200 (fees deducted)

When Grid Trading Works:

- Sideways/ranging markets (±3% price movement)

- High volatility with clear support/resistance

- Traders with capital to absorb temporary drawdowns

- Pairs with consistent liquidity (BTC, ETH, USDT pairs)

When Grid Trading Fails:

- Strong trending markets (price exits grid)

- Low-volatility periods (no oscillations)

- Tight spreads on low-volume pairs (fees exceed profits)

- Unexpected news events causing gap moves

Performance Data: Grid traders in optimal conditions report 15-35% monthly returns but with significant variance. Studies show only ~40% of grid traders remain profitable after 6 months, highlighting the need for proper parameter tuning.

Strategy #3: Arbitrage Trading – Best for Exploit Opportunities

What It Is: Buying an asset on one exchange/pair and selling immediately on another where the price is higher.

How It Works:

textOpportunity Detected:

- BTC/USDT on Binance: $42,000

- BTC/USDT on Coinbase: $42,050

Bot Action:

1. Buy 1 BTC on Binance for $42,000

2. Instantly sell 1 BTC on Coinbase for $42,050

3. Profit: $50 (minus fees ~$10-15)

4. Net: ~$35 per trade

Scale: 100 trades/day × $35 = $3,500/day (in theory)

Arbitrage Subtypes:

- Spot Arbitrage: Buy/sell across different exchanges

- Futures Arbitrage: Exploit futures premium vs. spot prices

- Pairs Arbitrage: Buy undervalued pair, sell overvalued pair (ETH/BTC on different pairs)

When Arbitrage Works:

- Market inefficiencies (usually <30 seconds window)

- High-volume pairs with adequate liquidity

- Low-latency execution (co-located servers)

- Stable stablecoin pairs (USDC/USDT)

When Arbitrage Fails:

- Efficient markets (BTC/ETH have minimal gaps)

- High withdrawal fees offset profits

- Slippage and execution delays

- Regulatory restrictions on fund movement

Performance Data: Professional arbitrage bots report 0.5-2% daily returns but require significant capital ($100K+) and sophisticated infrastructure. Retail traders rarely achieve profitable arbitrage due to latency and fee disadvantages.

How to Set Up Your First Binance Trading Bot: Step-by-Step Guide

Phase 1: Preparation & Security

Step 1: Choose Your Platform

- Decide based on your strategy (TradeSanta for grid, 3Commas for advanced, Pionex for free)

- Create an account on your chosen platform

- Verify email and enable 2FA (mandatory)

Step 2: Create a Binance API Key (Safely)

This is critical. Never expose your API key.

On Binance:

- Go to Account → API Management

- Create a new API key (name it: “TradingBot-[Platform Name]”)

- Enable IP whitelist and enter your bot platform’s IP address

- Restrict permissions:

- ✅ Enable: Spot Trading, Futures Trading

- ❌ Disable: Withdraw, Transfer (security)

- Copy the API key and Secret key

- Store them in a password manager (NOT plain text)

Critical Security Rule: Never use an API key with withdrawal permissions. If a bot is compromised, the hacker can only trade – not drain your account.

Phase 2: Configuration (Using TradeSanta Grid Bot as Example)

Step 3: Link Your Binance Account

- Log into TradeSanta

- Go to Settings → Exchange Connection

- Select Binance

- Paste API key and secret

- Click Test Connection (must show “Success”)

Step 4: Select Your Trading Pair & Strategy

- Choose: BTC/USDT (high liquidity, stable price action)

- Strategy: Grid Trading

- Bot Type: Long Grid (buy low, sell high)

Step 5: Define Grid Parameters

textPrice Range:

- Lower Price: $40,000 (support level - research on chart)

- Upper Price: $44,000 (resistance level)

Grid Configuration:

- Number of Grids: 10 (balance between trades and fees)

- Grid Step: $400 (price distance between orders)

- Investment Amount: $1,000 (total capital allocated)

Profit Target:

- Take-Profit: 3% (capture per cycle)

- Stop-Loss: -10% (protection if trend reverses)

Step 6: Backtest Your Strategy

- Click Backtest on the bot creation page

- Select Historical Period: Last 6 months

- Review metrics:

- Total Return: Should be positive (ideally 10%+)

- Max Drawdown: Should be <20%

- Win Rate: Aim for 50%+

- Profit Factor: Should be >1.5 (gross profit / gross loss)

Red Flag Results:

- Backtest shows -50% return: Strategy is unsuitable for current market

- Profit factor <1.0: You’re losing money (skip this configuration)

- Max drawdown >30%: Too risky for most traders

Step 7: Deploy Live (Cautiously)

- Start with small capital: $100–$500 (not your life savings)

- Enable paper trading first if available (simulate live market)

- Monitor for first 48 hours to confirm trades execute correctly

- Increase capital only after proving profitability

Critical Reality Check: Why 95% of Bots Fail

The Backtest Trap

You create a bot, run a backtest, and see +150% returns over 6 months. You’re excited. You deploy it live. Within 2 weeks, it’s losing money. What happened?

Why Backtests Lie:

| Backtest Assumption | Real Market Reality |

|---|---|

| Instant execution | Your order fills late; slippage occurs |

| Zero slippage | Bid-ask spread costs money |

| Perfect fills at close price | Fills happen mid-candle at worse prices |

| Fixed spreads | Spreads widen during volatility |

| No unexpected events | Black swan events, news shocks, gap opens |

| Optimized parameters | Parameters that worked yesterday fail today |

The Math: A bot backtesting +20% return can easily produce -5% live after accounting for slippage, fees, and execution delays.

How to Avoid the Backtest Trap:

- Use multiple timeframes: Test on 3-month, 6-month, and 12-month periods. Consistency across periods = more robust.

- Stress test: Simulate market crashes, volatility spikes, and low-liquidity scenarios.

- Avoid over-optimization: If your bot has 50 parameters tuned to historical data, it will fail on new data (overfitting).

- Account for real costs:

- Maker fee: 0.1% (Binance standard)

- Taker fee: 0.1%

- Withdrawal fees: $1–$5

- Total per round-trip trade: ~0.2-0.3%

- Conservative profit target: If backtest shows 30% return, live target should be 10%.

- Monitor live performance weekly: Compare actual vs. backtest. If it underperforms by >50%, pause and re-evaluate.

Security & Scam Prevention: The $5B Risk in 2026

Crypto scams cost users $5+ billion annually in 2026, and trading bots are primary vectors. Here’s how to avoid them.

Common Bot Scams & Red Flags

| Scam Type | How It Works | Red Flags |

|---|---|---|

| Fake Bot Websites | Replica of real platform (fake URL) | Domain name slightly different; no HTTPS lock; poor grammar |

| Guaranteed Returns Bot | “Risk-free 10% daily returns” | No legitimate bot guarantees returns; always unsustainable |

| Phishing Links | Email “Your bot needs verification – click here” | Official platforms never ask for credentials via email; always verify URLs |

| Malware Bot Packages | “Download this bot code” | Downloaded code installs wallet-draining malware |

| Ponzi Scheme Bots | New user payouts funded by later deposits | Recruitment bonuses; unsustainable payment structure |

| Signal Pump Scams | Telegram bots claiming insider trading signals | “70% win rate” claims with no proof; refusal to show track records |

Real 2026 Scam Example

AstraX Trading: A fraudulent platform that targeted California residents with fake margin call notices, extracting $5,000+ per victim before disappearing.

How to Stay Safe

✅ DO:

- Use only official websites of known platforms (Binance, 3Commas, TradeSanta, etc.)

- Enable 2FA on your bot platform account

- Create API keys with trading-only permissions (no withdrawal)

- Whitelist IP addresses on API keys

- Use strong, unique passwords (20+ characters)

- Store credentials in a hardware password manager

- Verify bot performance documentation (audited, public track records)

❌ DON’T:

- Download bot code from unknown GitHub repos

- Share your API key or seed phrase with anyone

- Trust platforms promising “guaranteed returns”

- Use bots from Telegram or Discord groups without verification

- Trade with leverage if you don’t fully understand margin calls

- Assume past performance guarantees future results

Red Flag Checklist for Any Bot Platform:

- No HTTPS or security certificate? SKIP IT

- No customer support or social proof? RED FLAG

- Promises “100% guaranteed profit”? SCAM

- Requires deposit before free trial? LIKELY FRAUDULENT

- Can’t find independent reviews or feedback? AVOID

- Asks for your seed phrase or private key? IMMEDIATE RED FLAG – NEVER DO THIS

Realistic Profit Expectations: Setting Your Goals

Conservative (Safe) Expectations

| Strategy | Monthly Return | Notes | Risk Level |

|---|---|---|---|

| DCA Bot (Long-term) | 2–4% | Consistent, passive | Very Low |

| Grid Trading (Ranging Market) | 5–10% | Requires market conditions | Low-Medium |

| Arbitrage | 0.5–2% | Difficult for retail | Very Low (if profitable) |

Reality: A $1,000 bot producing 5% monthly = $50 profit. After fees, real profit = $35–$40. Scale matters.

What You Should Actually Expect in Your First 3 Months

- Month 1: Learning curve, configuration errors, -2% to +3% return

- Month 2: Bot finds rhythm, +3% to +8% return

- Month 3: Either profitable or you’ve identified strategy flaws

Only 10–30% of traders using bots become consistently profitable. The rest either:

- Give up after losses

- Over-trade and over-fee the account

- Deploy in wrong market conditions (grid bot in strong trend)

- Lack discipline to follow the bot without manual intervention

Professional Bot Performance Benchmarks

The elite AI trading systems achieve:

- Profit Factor: 3.0–4.4 (meaning $3–$4.40 earned per $1 lost)

- Win Rate: 45–55% (profitability comes from risk-reward, not win rate)

- Max Drawdown: 10–15%

- Annual Return: 20–48% (highly variable based on market conditions)

But these are outliers. They require:

- $100K+ capital (money makes money via scaling)

- Professional infrastructure and low-latency execution

- Constant optimization and monitoring

- Market conditions that favor the bot’s strategy

Frequently Asked Questions (FAQ) – Answering Your Biggest Questions

Is It Really Possible to Make Money with Trading Bots?

Yes, but with caveats. Professional bots with proper strategy, risk management, and capital achieve consistent returns. However:

- Most retail users lose money due to poor setup or wrong strategy selection

- Past performance does not guarantee future results

- Market conditions determine bot success (a grid bot fails in strong trends)

- Capital size matters – $100 bot rarely generates meaningful returns

Truth: If your goal is to turn $100 into $1,000 quickly, bots won’t do it. If your goal is consistent 5–10% annual returns on $10K+, bots can help.

Do Trading Bots Actually Work on Binance?

Yes, Binance’s API is stable and widely supported. However:

- Binance’s trading fees (0.1% maker/taker) are low, making profitability easier

- Binance Futures (margin trading) allows leverage strategies (higher risk/reward)

- Binance’s liquidity is high – orders fill quickly with minimal slippage

Recommendation: If you’re new, use Binance’s native bots first (free). If you outgrow them, move to 3Commas or Bitsgap.

What’s the Best Strategy for Beginners?

DCA (Dollar-Cost Averaging) is the safest entry:

- Buy $50 of BTC every week, auto-reinvest profits

- Works in any market condition

- Removes emotional decision-making

- Long-term wealth accumulation (not quick riches)

- Risk: -5% to +10% monthly in realistic conditions

Why it works: You’re not trying to time the market or catch short-term moves. You’re building a position over time, which historically beats lump-sum investing in volatile assets.

Is It Safe to Use My Binance API Key with a Trading Bot?

Mostly yes, if configured correctly:

Safe Setup:

- Create dedicated API key for each bot

- Enable IP whitelist (restrict to bot provider’s IP only)

- Disable withdraw/transfer permissions (only trading allowed)

- Use a unique, 20+ character password

- Store API key in password manager, never in emails/docs

Unsafe Setup:

- Sharing API key across multiple platforms

- Using your main account API key (no whitelist)

- Enabling withdrawal permissions

- Telling anyone your API key

Reality: If a bot platform is hacked, hackers can only trade, not withdraw. Your BTC stays safe. The worst case: they lose money on bad trades using your funds.

How Much Capital Do I Need to Start?

Minimum: $100 (to avoid minimum order minimums on Binance)

Recommended: $1,000–$5,000 (enough to see meaningful profits and absorb losses)

Professional threshold: $10,000+ (where monthly returns become substantial)

Scaling Math:

- $100 bot at 5% monthly = $5/month profit

- $1,000 bot at 5% monthly = $50/month profit

- $10,000 bot at 5% monthly = $500/month profit

Most people start too small and give up when returns don’t reach expectations.

Can I Use Multiple Bots on the Same Account?

Yes, but:

- Risk: If you run 10 bots simultaneously, 1 bad bot can drain capital

- Capital is shared: $5,000 across 10 bots = $500 per bot (too small to be profitable)

- Fees compound: 10 bots × 0.1% taker fee = 1% per round-trip (massive slippage)

Best Practice: Start with 1 bot, master it, then add 1–2 more after proving profitability.

What If the Bot Loses Money? Can I Get It Back?

No. A bot trading on your account with your capital is your responsibility. If the bot trades at a loss:

- It’s not the platform’s fault (you set the parameters)

- You cannot sue for losses

- The exchange/bot platform provides no insurance

Exception: If a platform is hacked and funds are stolen, some platforms offer insurance (check their policy).

Prevention: Always backtest, start small, monitor weekly.

How Often Should I Monitor My Bot?

Minimum: Weekly (spend 30 minutes reviewing trades and performance)

Weekly Checklist:

- Total return vs. expected (e.g., 5% expected, got 3%?)

- Max drawdown (sudden spikes indicate strategy misalignment)

- Fee impact (are fees eating profits?)

- Market conditions (did the market change, invalidating your strategy?)

Do NOT:

- Check every hour (leads to emotional intervention)

- Change parameters mid-week (let bots complete cycles)

- Override bot decisions (defeats the purpose of automation)

What’s the Difference Between Grid Trading and DCA?

| Aspect | Grid Trading | DCA |

|---|---|---|

| Frequency | Continuous (whenever price hits grid level) | Fixed interval (e.g., daily) |

| Best Market | Sideways/ranging (±3% oscillations) | Any market (bull, bear, sideways) |

| Return Timeline | Days to weeks | Months to years |

| Capital Requirement | Moderate ($500+) | Low ($50+) |

| Monitoring | Moderate (weekly check) | Minimal (set and forget) |

| Risk Profile | Medium (price can exit grid) | Low (averaging reduces risk) |

| Profit Potential | 5–30% monthly (highly variable) | 2–8% monthly (consistent) |

Choice: Grid for active traders in volatile markets. DCA for passive long-term holders.

How Do I Know If My Bot Strategy Is Working?

Key Metrics to Track:

- Return vs. Backtest:

- Backtest showed +8% return

- Actual: +5% return

- Acceptable (within 60% of backtest)

- Backtest showed +20% return

- Actual: -5% return

- Strategy failed (rethink approach)

- Profit Factor (best metric):

- Gross profit / Gross loss

- 1.5 = profitable

- 1.0–1.5 = marginal (may not beat fees)

- <1.0 = losing money

- Drawdown (measure of risk):

- <10% = conservative and safe

- 10–20% = acceptable (temporary loss from peak)

- 20% = risky (can trigger emotional panic)

- Consistency:

- Profitable 8 out of 12 months? Good

- Profitable 4 months, negative 8 months? Bad strategy

Should I Use Leverage/Margin with Bots?

Short answer: Probably not.

Why leverage is risky with bots:

- Bot can’t manage liquidation scenarios (humans panic)

- 10x leverage means a 10% loss = total account loss

- Unexpected volatility can trigger liquidation in seconds

- Margin fees (8–12% annually) eat into profits

Real example:

- You deposit $1,000 with 5x leverage = $5,000 trading power

- Grid bot gets caught in a flash crash

- Price drops 5% = $250 loss on your $1,000 account

- Exchange liquidates your position to prevent deeper loss

- You’re left with ~$700 (permanent loss)

Recommendation: Master leverage-free bots first. Only use margin after 1+ year of profitability and deep understanding of liquidation mechanics.

Are There Any Free Trading Bots Worth Using?

Yes:

- Binance Native Bots (free, integrated into exchange)

- Pionex Free Bots (16 free bots, no subscription)

- Coinrule Free Tier (limited, but functional)

- TradeSanta Free Tier (basic grid/DCA)

- Cryptohopper Free Tier (limited signals, good for learning)

Limitation: Free tiers often have:

- Fewer simultaneous bots (1–3 max)

- Delayed signals (premium gets real-time)

- Limited exchanges

- Ad-supported

Value Proposition: Free bots are excellent for learning and testing. Once profitable, upgrade to paid plans for advanced features.

Can AI Bots Predict Market Crashes?

Realistically: No.

Why:

- Market crashes are driven by unpredictable events (regulatory shock, geopolitical crisis, etc.)

- Black swan events have 0% historical precedent

- Most “predictive” AI is pattern-matching on past data

- AI excels at identifying oscillations within ranges, not catching singular events

What AI Bots CAN Do:

- Detect trend reversals (high confidence on 1-4 hour timeframes)

- Recognize support/resistance breaking

- Identify volatility spikes

- Execute risk management (stop-loss) emotionlessly

What They CANNOT Do:

- Predict macroeconomic events

- Catch flash crashes

- Understand geopolitical news impact

- Outperform human judgment on unprecedented events

Risk Management Strategy: Use stop-loss on all bots (e.g., -10% maximum loss per position). No bot can predict crashes, but you can protect against them.

Which Bot Is Best for Copy Trading?

Top Picks:

- WunderTrading – Excellent copy-trading ecosystem, large trader base

- Cryptohopper – Strong community with audited track records

- 3Commas – Professional copy-trading with detailed performance metrics

Risks of Copy Trading:

- Copied trader’s past performance ≠ future performance

- Leverage used by copied trader can amplify losses

- No control over entry/exit points

- Fees: You pay bot platform + fees to copied trader (double fees)

Best Practice: Review copied trader’s last 12 months of performance, not just last 3 months. Look for consistency, not a lucky month.

Your Action Plan to Success

Binance trading bots are powerful tools, but they amplify your decision-making – both good and bad. A well-configured bot executing a solid strategy beats manual trading. A poorly-configured bot becomes a money-burning machine.

Your Roadmap:

Week 1: Research & Setup

- Choose 1 platform (TradeSanta for simplicity, Bitsgap for advanced)

- Create Binance API key with trading-only permissions

- Link your exchange account

Week 2: Configuration & Backtesting

- Select 1 strategy (DCA for beginners, Grid for intermediates)

- Configure parameters conservatively

- Backtest on 6+ months of historical data

- Aim for >1.5 profit factor

Week 3: Micro-Deployment

- Deploy with $100–$500 capital

- Monitor daily for 2 weeks (confirm trades execute correctly)

- Compare live vs. backtest performance

Week 4–12: Scale & Optimize

- If profitability confirmed, increase capital by 50%

- Review weekly performance metrics

- Adjust parameters if market conditions change

- Document lessons learned

Year 1: Mastery

- Master one strategy deeply (don’t hop between bots)

- Achieve consistent 10%+ annual return

- Only then consider adding a second bot

Key Takeaways:

- Only 10–30% of bot users profit consistently. You’ll be in the minority if you follow this guide.

- Backtests lie. Expect live performance to be 50–70% of backtest results.

- Capital size matters. A $100 bot won’t change your life. $10K+ is where meaningful returns appear.

- Risk management is non-negotiable. Stop-loss, position sizing, and capital allocation determine survival.

- Security is critical. Protect your API keys as fiercely as your seed phrases.

Additional Resources & References

- Backtesting Tools: QuantConnect, TrendSpider, SpeedBot

- Performance Analytics: Bitsgap Backtest Engine, CryptoRobotics performance tracking

- Research: Token Metrics for AI-driven grid parameter optimization

- Community: Reddit r/algotrading, r/binance; Telegram bot communities (with caution)

Disclaimer

This article is for educational purposes only and not financial advice. Cryptocurrency trading, including automated bot trading, carries significant risk of loss. Past performance does not guarantee future results. Always conduct your own research, start with small capital, and never invest funds you cannot afford to lose. Trading bots can amplify losses as easily as they amplify gains.

Author’s Note on Your Success

Automated trading is not a shortcut to wealth – it’s a tool for executing a strategy consistently. The traders who succeed are those who:

- Invest time learning strategies deeply

- Test thoroughly before risking capital

- Stay disciplined and avoid emotional overrides

- Monitor continuously without obsessing

- Accept losses as part of the journey

If you approach trading bots with this mindset, they become valuable assets in your investment toolkit. If you chase quick returns, they become expensive lessons.

Start small. Think long-term. Execute with discipline. Good luck.

Cited Research & Sources

AI Trading Performance Data (2025-2026): Tickeron, Agentive AIQ research on profit factors and annualized returns; findings show top AI bots achieve 35-48% annualized returns, while only 10-30% of retail users achieve consistent profitability.

Trading Bot Strategy Performance: TokenMetrics analysis of DCA vs. Grid strategies; research shows DCA returns 5-12% annually in realistic conditions, while grid trading can achieve 15-35% monthly returns in optimal ranging markets but fails in ~60% of live deployments.

Backtest Reality Gap: MQL5 analysis titled “Why 95% of Trading Bots That Backtest Well Fail in Real Markets” documents systematic reasons why backtests overestimate live performance by 50-150%, including slippage, execution delays, and parameter overfitting.

2026 Crypto Scam Landscape: AInvest News reports scams surpassed hacks as primary crypto threat, with $5+ billion in losses from AI-driven social engineering, deepfakes, and phishing schemes. AstraX and similar platforms defrauded victims through fake margin call notices and unrealistic return promises.