Thailand is now one of the top places in Southeast Asia for digital asset businesses. There are over 40 licensed companies working with cryptocurrency, and the rules are clear for everyone. If you are a founder or if your company is looking to start in Thailand’s fast-growing crypto market, there are two main ways to start. You can buy a company that already has a license, or you can apply for a new license from the SEC.

This guide brings together all the details you need to know about money, rules you have to follow, fees, company prices, and things to think about before buying a licensed crypto company in Thailand.

The Thai market gives a good reason to invest. Bitkub is the leader with a 77% market share. Its value is between $1 and $3 billion. Some big deals were done recently, with prices from $102.8 million to $535 million. From 2025 to 2029, there will be no capital gains tax for people who invest, which will bring more people to regulated trading platforms. To start here, you can buy an existing license or set up a new one. You need to have between $1.4 million and $2.8 million ready, and it can take 12 to 18 months to get through all of the rules.

Part 1: The Thai Regulatory Framework – Building Blocks of Market Entry

The Legal Foundation

Thailand’s cryptocurrency market works under the Emergency Decree on Digital Asset Business B.E. 2561 (2018). It is also supported by the Royal Decree on Digital Asset Businesses (No. 2), B.E. 2568 (2025). The Ministry of Finance (MOF) enforces these rules, and the Securities and Exchange Commission (SEC) oversees the market. Thailand puts in place some of the world’s clearest and most detailed rules for digital asset businesses.

The framework sees licensed digital asset operators as the same as banks. So, they must follow banking rules for things like anti-money laundering, knowing who their customers are, and keeping data safe. This way of making rules balances new ideas with keeping people safe. Because of this, big names like Binance, KuCoin, and regional banks now want to join the market.

A key change in 2025 (Section 26/1) made it so the SEC can control cryptocurrency platforms outside of Thailand if they serve people living in Thailand. Now, if a platform uses the Thai language, takes Thai baht payments, or tries to attract users in Thailand, it must have an SEC license. This new rule stopped companies from looking for ways to avoid local laws. All large global exchanges now need to set up teams inside Thailand, or they risk being blocked or getting criminal charges. These charges can lead to jail for two to five years and fines from 200,000 to 500,000 THB.

Seven Categories of Regulated Digital Asset Businesses

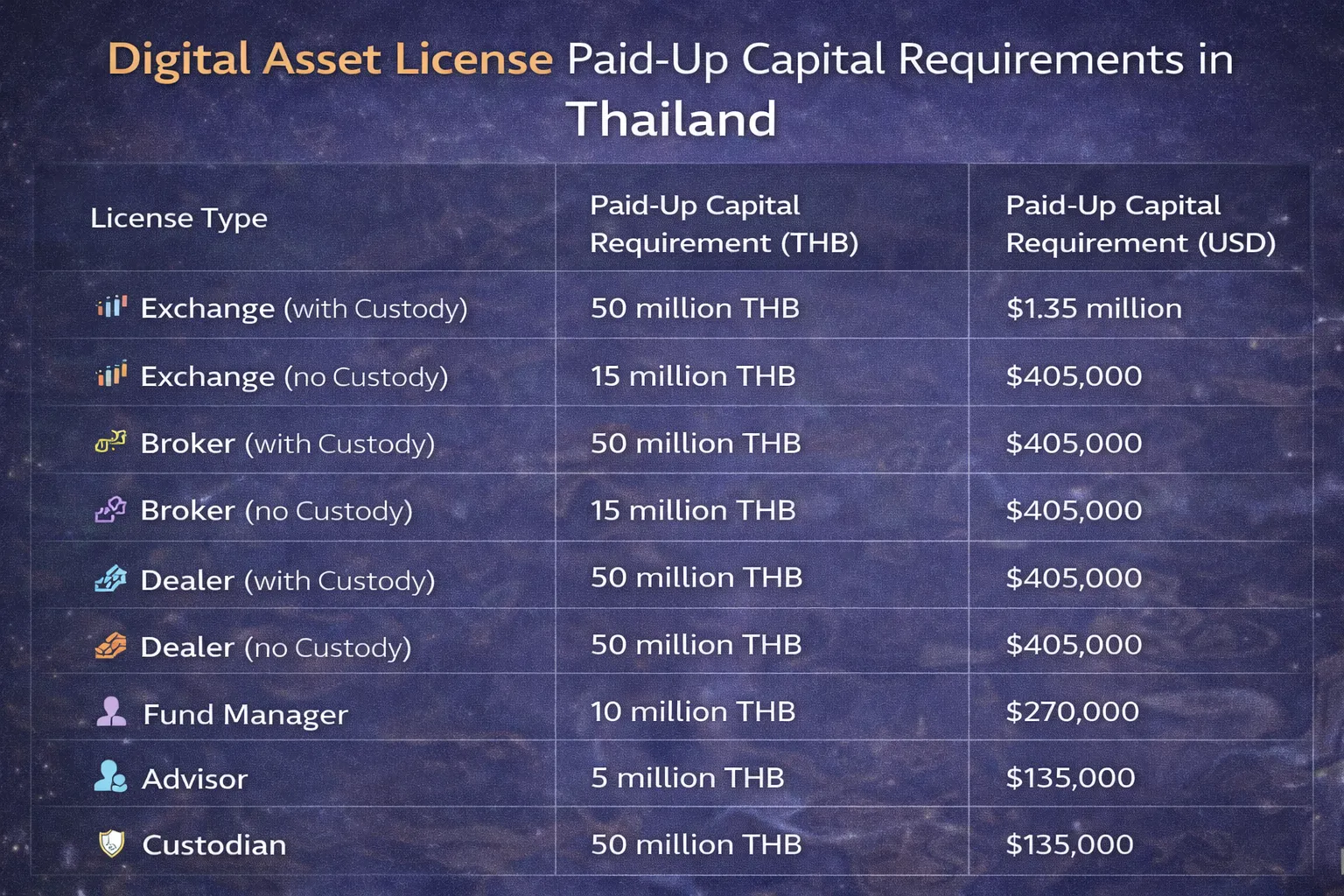

Thailand’s rules for business have seven clear types. Each one needs its own license. The rules for how much money you need to start also change for each one.

Core Trading Categories:

- Digital Asset Exchange: Running a place where people can buy and sell different cryptocurrencies or digital tokens.

- Digital Asset Broker: Working between people in cryptocurrency deals to help with the trade and get a fee for their work.

- Digital Asset Dealer: Buying and selling digital assets for themselves and for their clients.

Support & Management Services:

- Digital Asset Fund Manager: Handling and looking after digital funds for people.

- Digital Asset Advisor: Giving advice on digital asset investments.

- Digital Asset Custodial Wallet Provider: Keeping customer digital assets safe and watching over them.

- Digital Token Portal Provider: Helping with starting initial coin offerings (ICOs).

Each group works by itself. The people who run these services cannot have both types of licenses at the same time. For example, you cannot have both an exchange license and a dealer license because they do not go together.

Thailand Digital Asset License – Minimum Capital Needs by License Type (2025)

Part 2: Capital Requirements and Financial Qualification – The Price of Entry

Thailand’s SEC has set different rules for how much money must be kept, depending on what the business does and if the operator keeps client money. If the operator keeps customer digital money, the rules are stricter. This is because holding customer money comes with more risk.

As of November 1, 2024, based on SEC Notification No. KorThor. 28/2567, there are new rules for minimum paid-up capital. A digital asset advisor will need at least 1 million Thai baht ($28,000). A full-custody digital asset exchange will need at least 100 million Thai baht ($2.8 million).

The difference between how wallets are held is important. Platforms that keep wallets for their users, by storing private keys and digital coins, need to have much more money on hand. They need to keep money saved up that is about 5 to 10 times higher than companies that do not hold wallets for users. This is what rules say because there is more risk to users’ money. So, when there is more at risk, companies must keep more money saved to protect people.

Operators need to keep the required net capital while they run their business. At this time, the rules say asset-keeping operators must have at least 25 million THB ($700,000) in net capital. Non-custody operators must have at least 5 million THB ($140,000). If they go below these amounts, the SEC may step in. This can bring limits on how the company works and can also take away its license.

Part 3: Fee Structure and True Cost of Licensing

The licensing fees in Thailand include large one-time payments. There are also yearly supervisory fees. These are based on business numbers.

Thailand Digital Asset Business – Full Fee List (One-Time, Yearly & ICO Fees)

One-time licensing fees start at 15,000 THB ($420) for a digital asset advisor. The fee goes up to 2,500,000 THB ($70,000) for a digital asset exchange. If you apply for more than one license type, like exchange and custodian, you must pay an application and granting fee for each category.

Supervisory fees follow a risk-based and performance-based model each year. Digital asset exchanges pay 0.002% of their total trading volume. The least they have to pay each year is 500,000 THB ($14,000), and the most is 20 million THB ($560,000). A medium-sized exchange with $50 million in trades each month would pay about 1.2 million THB each year ($33,600).

The total money needed for a digital asset exchange startup in the first year is usually between 1.76 and 2.23 million USD. This amount includes the minimum paid-up capital of 50 million Thai baht for the non-custody model, licensing fees of 2.53 million THB, and legal and consulting services that cost from 1.5 to 3 million THB. The cost for the platform runs from 2 to 5 million THB, and security checks will be between 500,000 and 1.5 million THB. Setting up your office space costs from 1 to 2.5 million THB, and all year-one staff costs will be from 3 to 8 million THB.

Part 4: The Licensing Process – From Concept to Operations (12-18 Months)

Thailand’s licensing process uses a simple five-step system. It can feel tough at times, but it is easy to follow if you go one step at a time. If you stick to the plan, you will know what to expect.

Thailand Digital Asset License – Five Steps You Need to Know (It Can Take from Twelve to Eighteen Months Overall)

Phase 1: Pre-Application Preparation (60-90 Days)

Applicants must set up a Thai company. It can be a Public or Private Limited Company. You have to register it with the Department of Business Development. At least one Thai citizen or someone who lives in Thailand all the time must be a director. You need to get a real office in Thailand. A minimum amount of money must be deposited into a Thai bank.

At the same time, you have to make sure you follow the rules for protecting people. Write AML/KYC policies that match SEC notifications. Put in place Know Your Customer steps and Customer Due Diligence rules. Add systems that watch transactions. Set up ways to report difficult activity.

You also must pick partners for tech and run checks to make sure things work well and are safe.

Phase 2: SEC Application Submission (5-10 Days)

The formal application package is sent in Thai language to the SEC. It has the SEC’s application form, company registration documents from the Department of Business Development, bank statements that show money deposit, director CVs and background checks, full business plan with market analysis and five-year plans, detailed AML/KYC policies, transaction monitoring steps, platform architecture documents, and IT security plans. The application fee of 30,000 THB cannot be refunded. This fee has to go with the application.

Phase 3: SEC Review (60-90 Days)

The SEC checks many things before making a decision. They look at how strong the money behind it is. This means they check if there is enough capital and where the money comes from. They also make sure it can last over time.

They see if rules are being followed. This includes checking the process for AML/KYC, looking at how sanctions are screened, and making sure transactions are watched the right way.

The SEC also checks leaders, like directors and anyone who owns more than 10%. They look into these people’s backgrounds and make sure there were no problems with licenses before. If someone had a license refused or taken back, they will find out.

They want to keep tech safe, too. They look closely at how platforms are built and check if wallets are protected. They see if the group is ready for problems and if there are steps for coming back after disasters.

The SEC will often send one or several requests for information (RFI). These RFIs are for applicants to explain, add information, or give more papers. Groups with strong compliance and legal help usually reply in 5–7 days. This helps move their application forward.

Phase 4: Ministry of Finance Approval (60 Days)

The SEC gives its advice on the application. Then, the application moves to the Ministry of Finance. The Ministry of Finance checks if the SEC’s advice fits with its rules, the country’s money rules, how the market will be affected, and what is good for the people. Most of the time, the Ministry of Finance says yes within 60 days after the SEC gives its view.

Phase 5: Post-Approval and Operational Commencement (180-Day Window)

Licensed operators must start business in 180 days after getting approval. This is not up for discussion. The trading platform must be running, take customer sign-ups, handle trades, and start earning money. If you do not start within 180 days, your license will be cancelled right away. The SEC or MOF will not look at it again. This is a big challenge for people who do not have a system already set up.

The combined timeline of 12 to 18 months is for companies that have managers with good work experience and legal help. If this is your first time applying and you do not have background in crypto, know much about rules, or have strong partners, it may take 18 to 24 months for you.

Part 5: Regulatory Compliance Obligations – The Ongoing Burden

AML/KYC Framework: Banking-Sector Equivalent Standards

Licensed operators must have customer ID programs with strong rules that:

- Full legal name, date of birth, where you are from, and check of where you live

- A government photo ID

- Shareholder details for business customers (anyone with over 25%)

- Show where funds come from by using work letters, business papers, or bank bank statements

For customers that have more risk, teams use stronger checks. These checks include using credit reports, business lists, sanctions checks, and keeping track of how these customers use their accounts again and again.

Transaction Monitoring and Suspicious Activity Reporting

Operators must set up systems to watch transactions as they happen. These systems flag any transactions that go over SEC limits. The limits are usually 2 million THB total in a month or 200,000 THB for one transaction. The systems also show when patterns look off, like cutting up payments, quick moves between the accounts, or too many payments from the same area. The systems send out alerts so staff can check if things look the right way.

Reports about these activities must be sent to the Thai Financial Intelligence Unit in 5 to 10 days after they are found. There are rules to keep things private, so the customer will not be told unless the officials say it can happen.

Cybersecurity and Custody Standards

Digital asset operators who give custody services have to use risk management policies that are approved by the board. These policies must cover:

- Multi-signature wallet checks (often needs 2 out of 3 or 3 out of 5 people to say yes)

- Private keys kept safe using hardware security module (HSM)

- Every year, testing is done to find weak spots in the system and in the code

- Steps for fast response to security problems, with 1 to 5 days to let SEC know

These rules are for anyone who looks after assets. This includes places that keep your full assets or the ones that just hold them.

Part 6: Tax Incentives – The Financial Acceleration of Thai Operations (2025-2029)

Thailand’s 2025 tax policy changes have strongly changed how people look at investing in crypto businesses.

Individual Investors: Complete Capital Gains Tax Exemption

From January 1, 2025, to December 31, 2029, people who invest to sell cryptocurrency and digital tokens on SEC-approved platforms pay no capital gains tax. This tax break is new and now helps Thai residents and investors from other countries too. It works for spot trades and trading with contracts, but it does not work for income made by mining or rewards from staking, as these are counted as normal income.

This five-year time frame encourages:

- Thai residents to move cryptocurrency holdings from offshore unregulated platforms to licensed Thai exchanges

- Traders from other countries to do arbitrage and trading strategies on Thai platforms

- People who hold capital for a long time to get gains before exemption runs out in 2029

Corporate Entities: Continued 20% Corporate Income Tax

Corporations pay a standard 20% corporate income tax on their profits. They do not get capital gains exemption. Companies from outside the country that trade on Thai platforms get the same tax rules as local corporations.

Withholding Tax: Eliminated Through 2029

Before, people from other countries who invest had to pay 15% tax on money they made from crypto. Now, that tax is gone until December 31, 2029. This means people from other places can keep all of their gains from crypto with no money taken out right away.

VAT Exemption: Permanent

Cryptocurrency deals are not part of Thailand’s 7% value-added tax. This rule started on January 1, 2024, and will stay this way with no end date.

Part 7: Market Landscape – Existing Licensed Players and Acquisition Opportunities

Current Licensed Operators (February 2025)

As of February 14, 2025, Thailand’s SEC has said yes to:

- 12 licensed Digital Asset Exchanges

- 13 licensed Digital Asset Brokers

- 3 licensed Digital Asset Dealers

- 9 licensed ICO Portals

- 2 licensed Fund Managers

- 2 licensed Digital Asset Advisors

- 2 licensed Custodial Wallet Providers

Market Leadership and Acquisition Valuations

Bitkub is the top player in Thailand with 77% of the market. Every day, trading on its platform reaches about $66 million. The company’s value sits between $1 billion and $3 billion. This is based on price-to-earnings multiples of 10 to 30 times, says CEO Jirayut Srupsrisopa. In July 2022, Bitkub had a $165 million Series A valuation, equal to 6 billion THB. The company is now looking into a $200 million IPO in Hong Kong as soon as 2026. This move comes as the domestic stock market in Thailand faces its own problems.

Kasikornbank, which is Thailand’s fourth-biggest bank, bought a 97% share of Satang Corporation. That company runs a cryptocurrency exchange. The deal cost $102.8 million (3.705 billion Thai baht) and was done through the bank’s subsidiary, Unita Capital. In 2022, Satang made $1.7 million in revenue and had 24-hour trading volumes of $430,000. The company was then renamed “Orbix” and became part of Kasikornbank’s digital asset group. Now, Orbix works together with Orbix Invest, which handles fund management, and Orbix Technology, which deals with blockchain infrastructure. Kasikornbank said it aims to get 20% of the cryptocurrency market share in Thailand, showing strong belief in using big purchases to grow in the market.

SCB X’s Attempted Purchase of Bitkub (2022): Siam Commercial Bank is the oldest bank in Thailand. In 2022, the bank wanted to buy 51% of Bitkub Online for 17.85 billion Thai baht ($535 million). The SEC did not agree with the deal because of rules they have. Still, the deal shows the price at the high end when people buy top crypto exchanges in Thailand.

These deals set the buying price range. A mid-size exchange (Satang) costs $102.8 million. The top exchange (Bitkub) costs $535 million. The price reflects things like trading volumes, customer numbers, being approved by rules, and how much money they make.

Major Licensed Players Overview

| Exchange | License Type | Market Position | Key Features |

|---|---|---|---|

| Bitkub | Digital Asset Exchange | Market leader (77% share) | 237 coins, $66M daily volume, $800M+ assets |

| Orbix (formerly Satang Pro) | Exchange + Custodian + Fund Manager | Kasikornbank subsidiary | Three ISO certifications, Wallet Lock feature |

| Gulf Binance | Exchange + Broker | Binance + Gulf Energy JV | Binance technology, Gulf’s Thai relationships |

| Upbit Thailand | Exchange | South Korean expansion | 167 digital assets, mobile-first interface |

| InnovestX | Exchange + Broker | SCB X subsidiary (formerly SCB Securities) | Integrated stocks, funds, and digital assets |

| KuCoin Thailand | Digital Asset Exchange | Global KuCoin subsidiary (formerly ERX) | Cross-border ASEAN trading, token focus |

| MEXC Thailand | Digital Asset Exchange | Global MEXC subsidiary | Multi-asset exchange, copy trading |

| TDX | Digital Asset Exchange | Stock Exchange of Thailand subsidiary | Investment tokens, DLT infrastructure |

The fact that big Thai banks, like Kasikornbank and SCB X, are here along with global crypto exchanges, like Binance, KuCoin, MEXC, and Upbit, as well as stock exchange groups, shows that there is trust in how the market is watched. It also means people expect to earn money here.

Part 8: Pathways to Market Entry – Building vs. Acquiring

Pathway 1: Acquire an Existing Licensed Company

Advantages:

- You can go straight into the market. You do not have to wait 12-18 months for licenses.

- There is an already set group of buyers. Trading and making money is happening right now.

- The system for following the rules is ready and working.

- The platform is tested and comes with safety proofs.

- A team to run things and people to manage everything are set up.

Disadvantages:

- It costs a lot to buy one of these ($100 million – $500 million+ for exchanges that are already running).

- The seller may want more money because they think the business can grow more than what is shown in its normal cash flow.

- A lot of regulatory checks are needed (SEC approval for changes in who owns the company).

- You need to blend the buyer’s team and tools into what’s already there.

- There can be some loss of customers if the brand changes or the level of quality goes down.

Strategic Considerations:

The Kasikornbank deal to buy Satang ($102.8 million) set a base price for exchanges that follow the rules and have the right licenses. The bank’s goal was to get 20% of the market. This goal proved the purchase made sense even though Satang did not make much money by itself ($1.7 million). This means buyers look at how much they can grow in the market, not just at how much money a company makes right now.

Pathway 2: Obtain New License from SEC

Advantages:

- Build platform that matches the main business plan.

- Change compliance setup and daily work steps to fit business needs.

- Keep all equity shares, without losing any in a buyout.

- Opportunity to stand out using the the tools, how you serve your customers, or the market you go into.

- Create brand from the start that fits with the people you want to reach.

Disadvantages:

- 12-18 month time needed to get the okay from regulators

- A large amount of money used ($1.76-2.23 million USD in the first year)

- There may be risk with starting the platform and getting new customers

- The founding group must know how to follow rules set by regulators

- There will not be any customers or trading volume when the platform starts

Strategic Considerations:

New licensing works best for teams that have strong funds, know a lot about crypto, and have good tech systems. It helps if they also connect with big groups that offer market support and storage. If you are new and do not have these skills, it can take you much longer to get things started and there are more chances for things to go wrong. Buying an existing company helps you earn money faster and lowers risks.

Part 9: Comprehensive FAQ Section – Answering Critical Questions

Regulatory & Licensing Questions

Q1: What is the fastest way to run a crypto exchange in Thailand?

Buying a business that already has the right license is the quickest way to enter the market. If the SEC says yes to a change in ownership, this may take only 30 to 60 days. Getting a license from the start takes much more time. This can be 12 to 18 months from the day you turn in your application until you open for business. How long buying a business takes will be based on finding someone who wants to sell. You also need to check their background, talk about the deal, and get the SEC to approve the change of owner.

Yes, people from other countries can own a licensed crypto company in Thailand. However, they need to follow the rules set by the government. They must have the right papers and meet every requirement. If you want to open this kind of company, it’s a good idea to read about Thailand’s laws first. You can also talk to a local expert who knows about these laws.

Foreign ownership is allowed. But companies have to be mostly Thai-controlled unless they get a Foreign Business License. Regulatory specialists say it’s very hard to get that license. A good way is to set up Thai subsidiaries with Thai teams and local partners. This is like Binance Thailand (a team-up of Binance and Gulf Innova) and Upbit Thailand (a team-up of South Korean Upbit and Thai partners).

Q3: Which license type is most profitable?

Digital Asset Exchanges that have the most trading get the most money. This is because they pay a 0.002% fee on each trade. But, there are small license types that can also be very good for making money. Digital Asset Advisors (who need $1 million) do consulting and make a lot from that. Custodial Wallet Providers (who need $50 million) help bigger clients keep their assets safe and also do well.

Q4: What happens if someone with a license does not start work in 180 days?

The license ends right away. There is no need for SEC or MOF to look at it again. This deadline cannot be changed. It applies to those people who got approval but were not able to start using technology and begin work on time.

The SEC gives updates to the list of approved operators from time to time. This does not always happen on a set date. The SEC will make changes when there are new approvals, removals, or updates. You can check the most current list on their website, so you always have the right and up-to-date details.

The SEC keeps the official list up to date at market.sec.or.th. The list shows which operators are working right now. It does not show operators who are stopped for a short time or those with rules against them.

Capital & Financial Questions

Q6: What is the minimum capital needed to start a crypto exchange in Thailand?

If you want to start a crypto exchange in Thailand, you must have a set amount of money as your starting capital. The rules in Thailand say that you must have at least 50 million baht ready. This is about 1.4 million dollars. The money can help make sure the company runs well. It also gives users a sense that their money is safe.

If there is a digital asset exchange that does not hold money for users: 50 million Thai baht ($1.4 million) must be paid as starting capital. For exchanges that keep money for users (this is what most do): 100 million Thai baht ($2.8 million) is needed. The money must be paid in full and kept in a Thai bank during its work.

Q7: Can the minimum capital be borrowed, or does it have to be your own money?

The minimum capital must come from the owners. You can not use money that you borrowed for this. The people starting the company need to put in their own money for the minimum capital requirement. This is to show that they put some of their own funds into the business. You should not use loans or borrowed money for this part.

Capital needs to be owned by the company itself. It should come from shareholders. It must not be borrowed from anyone. The money must stay in the company’s Thai bank account. SEC asks for proof that the company owns it. They also want to know where these funds come from.

Q8: What is the total year-one investment for establishing a crypto exchange?

The total investment you need in the first year to set up a crypto exchange will depend on many factors. It can change based on what kind of features you want, your location, and the team you hire. In most cases, you will need money for development, security, marketing, and getting the right licenses. The cost can range a lot, so it is best to plan your budget before you start. If you want more details, talking to industry experts can help you know how much money to set aside.

Total investment is between $1.76 million and $2.23 million USD. This amount covers several things: A regulatory capital minimum of 50M THB (~$1.4M), licensing fees (2.53M THB / ~$70K), legal and consulting costs (1.5-3M THB / $42-84K), platform (2-5M THB / $56-140K), security checks (500K-1.5M THB / $14-42K), office and IT tools (1-2.5M THB / $28-70K), and costs for people in the first year (3-8M THB / $84-224K).

Q9: What are ongoing annual costs after licensing?

Yearly supervisory fees are between 0.001% and 0.002% of the trading volume. There is a minimum and a maximum cap on the fee. You will also need to pay for staff, office space, platform upkeep, software to meet rules, and security checks. If an exchange has around $50 million trading each month, the total yearly cost to run it is usually 10 to 20 million Thai baht. This is about $280,000 to $560,000.

Tax & Financial Incentive Questions

Q10: Who can get the zero capital gains tax break on crypto trading?

This tax break is for some people based on their income and tax rules in their place. You need to check the laws where you live. People who earn less money can get this zero capital gains tax. Not everyone will get this. If you are in a lower tax group, there is a good chance you can use this rule. It is the best to read about your country’s crypto tax laws to know if you get this break.

All people trading crypto on SEC-licensed sites until 2029 can join, like Thai residents and people from other countries. Businesses do not get this. A company’s profits will still need to pay a 20% company income tax.

Q11: What kinds of crypto deals do not have to pay capital gains tax?

Spot trading (buy and sell) and trading with things like futures or options on licensed platforms do not need to be taxed. But mining income and staking rewards do not get this benefit. They are counted as normal income and you must pay more tax if you earn more from them.

Q12: Is the capital gains tax exemption for a short time or is it there for good?

The exemption will be in place for a short time. It will start on January 1, 2025, and last until December 31, 2029. That is a five-year span. After 2029, the regular capital gains tax will start again unless the government decides to keep or extend the exemption.

Q13: Do people from other countries who invest face withholding tax on crypto gains in Thailand?

No. The 15% tax that was put on investors from outside the country is not there anymore. This change stays until December 31, 2029. Investors from outside now get all of the capital gains, and they do not have to pay the tax right away.

Operational & Compliance Questions

Q14: What are the minimum AML/KYC requirements for customer accounts?

The customer must give basic details like their name, date of birth, place of birth, address, and government ID number. The company uses these details to check the person’s identity. This helps to make sure the person is real and not trying to hide anything. If the company needs, they may ask for you to send more papers to show who you are. All these steps are needed for the company to follow the rules for AML/KYC.

Customers need to give a photo ID from the government. They also need to share their date of birth, where they are from, and where they live. You must show where you live with a bill or a bank statement. This paper cannot be more than 3 months old. You also need to say what your job is and show proof of where your money comes from. More checks are done for some customers. These are people in government, people with a lot of money, or people who spend over 2 million THB in a month.

Q15: How often do operators need to file reports about activity that looks odd (SARs)?

SARs have to be sent to the Thai Financial Intelligence Unit in 5 to 10 days after you spot something suspicious. These reports stay private. This means customers do not get told unless the rules say so.

Q16: What cybersecurity standards apply to digital asset custody operations?

When you have digital asset custody operations, there are several important cybersecurity standards you should know about. A few of the main standards are ISO/IEC 27001 and SOC 2. These help feel confident that the data will be kept safe and every person who uses the service can trust it. These rules show what people have to do to make sure all information, keys, or money in a system is safe from dangers, people who are not supposed to see it, or any problem. Banks, businesses, and other groups that keep digital stuff for people will often use these standards in their work.

Operators who hold customer digital assets need to use several safety steps. They must use multi-signature wallet sign-in (2-of-3 or 3-of-5 sign-offs). Private keys should be kept safe in a Hardware Security Module (HSM). There also needs to be a yearly test for hacking risks. They need steps ready if something bad happens and must tell the SEC in 1 to 5 days. A plan for problems should be ready, with practice walk-throughs each year.

Q17: Can crypto platforms from other countries run in Thailand if they do not have a Thai license?

No. The April 2025 amendment (Section 26/1) says that platforms from other places that give services in the Thai language, take Thai baht for payments, or try to reach Thai people, will be seen as working in Thailand. They may have to go to jail for 2-5 years and pay fines between 200,000 and 500,000 THB. If the problem keeps going, they will have to pay 10,000 THB each day. The SEC can also block these platforms so that people in Thailand cannot use them.

Q18: What happens if a licensed person who runs things falls below minimum net money needs?

If someone who runs things and has a license does not keep enough money as needed, they can get in trouble. There may be checks and rules that they must follow. The team who checks on them may tell them to fix the problem fast. They can also stop them from doing things, or even take away their license if they do not get enough money in time. There can be more steps to solve this problem, but it is important to keep the right amount of money.

The SEC will send a quick notice, and the operator has 10 business days to give a plan to fix the problem. They will need to get the needed capital back in 30 days. If this does not happen, the license will be taken away or stopped. Every few months, they must also turn in checked money reports that show they have enough capital.

Acquisition & Market Entry Questions

Q19: What was the price paid for the last big crypto exchange buyout in Thailand?

Kasikornbank bought 97% of Satang Corporation for $102.8 million (3.705 billion Thai baht) in October 2023. Satang made $1.7 million in revenues each year. It also had $430,000 in 24-hour trading volume. This set a lower value for licensed exchanges.

Q20: Can someone buy Bitkub (Thailand’s largest exchange)?

Bitkub is a private company. It has not shared any news about being available for sale. The company is looking into a $200 million IPO in Hong Kong. This could happen as soon as 2026. This shows that the founders want to get money from the public market instead of selling the business. But, if Bitkub does get sold, the market says it could be worth $1-3 billion. This means the price to buy Bitkub could be set in that range.

Q21: What regulatory approval is needed to buy an existing licensed company?

The SEC has to say yes to big ownership changes. This usually means when someone gets more than 10% of the shares or takes over the company. The SEC will check if the buyer has enough money, a good plan for the business, if they can follow the rules, and if they have ever been turned down for a license before. It usually takes the SEC about 60 to 90 days to look over everything and give approval.

Q22: Can people or companies from outside Thailand get licensed crypto operators in Thailand?

Yes, people or companies from other countries can buy licensed operators. But the company they buy must still be a Thai company with a Thai director. A buyer from outside Thailand will often set up a company in Thailand to follow the Foreign Business Act rules. The SEC looks at who is buying, but it does not stop buyers from other countries.

Q23: What percentage of a licensed crypto company must be owned by Thai people?

The rule is that a company must be “majority Thai-controlled.” This often means that Thai people own more than half of it. But, from what is seen in practice, Thai involvement in running the company and being on the board matters more than who owns how much.

Q24: Which license type would be the easiest to get in the market right now?

Digital Asset Brokers need at least 10 million THB if they do not hold funds. If they do keep custody, they need 50 million THB. These brokers are the most easy for people to get because they do not need as much money, and their revenue is not as high, which many small investors like. Brokers bring in less money compared to exchanges, but they do not have the tough work of taking care of custody systems.

Risk & Penalty Questions

Q25: What are criminal penalties for operating without an SEC license?

If you work without an SEC license, there can be strict criminal penalties. A person or company may need to pay heavy fines. There might be prison time too if you break the law. This is to make sure people follow the rules set by the SEC. It is very important to get the right license before doing any work that needs one.

Imprisonment for two to five years and fines between 200,000 and 500,000 Thai baht (about $5,600 to $14,000). There can also be more daily fines of up to 10,000 Thai baht for each day the issue continues. These penalties are set and cannot be handled through settlement committees.

Thailand has blocked some crypto platforms that do not have a license. The government wants these companies to follow the rules set by Thai law. If a crypto exchange is not licensed, it can’t work in Thailand. This helps protect people from scams and keeps trading safe for everyone.

Yes. The SEC gave blocking orders to big platforms like Binance, Bybit, OKX, and eToro in June 2025. This was because they did not follow the April 2025 rules about getting licensed in other countries. The internet providers and hosting services have to follow these blocking orders. This stops people in Thailand from getting on those sites using DNS blocking and IP blocking.

If a platform is found to be making the trading volumes look higher than they are, it can get into trouble. The rules are clear about cheating like this. They may get fined, and in some cases, their license might be taken away. This is because the number of trades happening should show the real activity on the platform. Making it look bigger than it is can fool people who want to trade there. Regulators want to stop any bad behavior like this to help protect people and keep the market fair for everyone.

The SEC can give fines up to many millions of Thai baht. It can also stop a business from working. The SEC can take away licenses too. Bitkub was sued by the SEC in September 2022. They said Bitkub made trading volumes look higher than they really were. This shows that even top operators can get in trouble for trying to move the market.

Q28: Can someone with a license be banned for good from working in Thailand?

Yes. The SEC can take licenses away for big problems, like when a group works without a license. The SEC may also do this if there are big problems with checking customer ID rules, if there are cyber issues that hurt customer funds, or other serious actions. If your license is taken away, it is for good. You will need to apply again and meet all the rules as if you are doing it for the first time.

Strategic Framework for Market Entry

Thailand’s digital asset market is a good place to invest. It offers clear rules, chances to grow, and tax breaks you can’t find in other places. Bitkub leads the market with 77% share. Its value is between $1 and $3 billion, and it wants to grow in the region. These things show that running a crypto exchange well can be very good for the economy.

For banks that have been in business for a long time and for crypto companies with a lot of money:

Buying existing licensed operators, especially mid-sized exchanges like Satang before it was bought, helps you enter the market faster. It lets you skip 12-18 months of waiting for rules and approvals. You also get a working platform and people who are already customers. A smart buy in the $100-300 million range can be a good way for companies wanting to use Thailand as a hub in Southeast Asia.

For crypto-native entrepreneurs who have technical skills:

Building a new exchange by getting approval from the SEC helps a company stand out in areas like how it uses tech, how it treats customers, and by reaching special market groups. To do this, you need a skilled team, a lot of money to invest, and people who know the rules. These things stop weak applications and let new license holders focus on real ideas that work and help the market.

For both pathways:

Success depends on knowing all of Thailand’s compliance rules. It also means having enough money saved, making sure AML/KYC operations are honest and clear, and hiring people who know both the crypto industry and how things work in Thailand. The five-year capital gains tax break makes more people want to join. This should bring more users and higher trading numbers for platforms that are run well.

Thailand does not allow just anyone to take part in crypto. Instead, the country gives permission to groups that have enough money and follow rules. These groups also need to be run by people who know what they are doing. For those who can meet these needs, Thailand is one of the best and fastest growing places in the world for digital asset markets.

Citations

Cyprus Consulate – Thailand Crypto License Requirements

AIM Bangkok – Crypto License in Thailand

Silk Legal – Licensing and Market Entry for Digital Coin Businesses

Fintech Singapore – List of Licensed Cryptocurrency Exchanges Thailand

Global Legal Insights – Blockchain & Cryptocurrency Laws cy Laws 2026 | Thailand

Tilleke & Gibbins – Thailand to Regulate Offshore Digital Coin Businesses

CoinMarketCap Academy – Bitkub Thailand IPO

CoinDesk – Thai Crypto Exchange Bitkub $3B Valuation

CoinLaw – Bitkub Hong Kong IPO Plans

Architect Partners – Kasikornbank Buys Satang

Baker McKenzie – Thailand Tech M&A Trends

Belaws – Digital Coins Crypto Businesses Thailand

Cyprus Consulate – Best Crypto Exchanges Thailand 2026