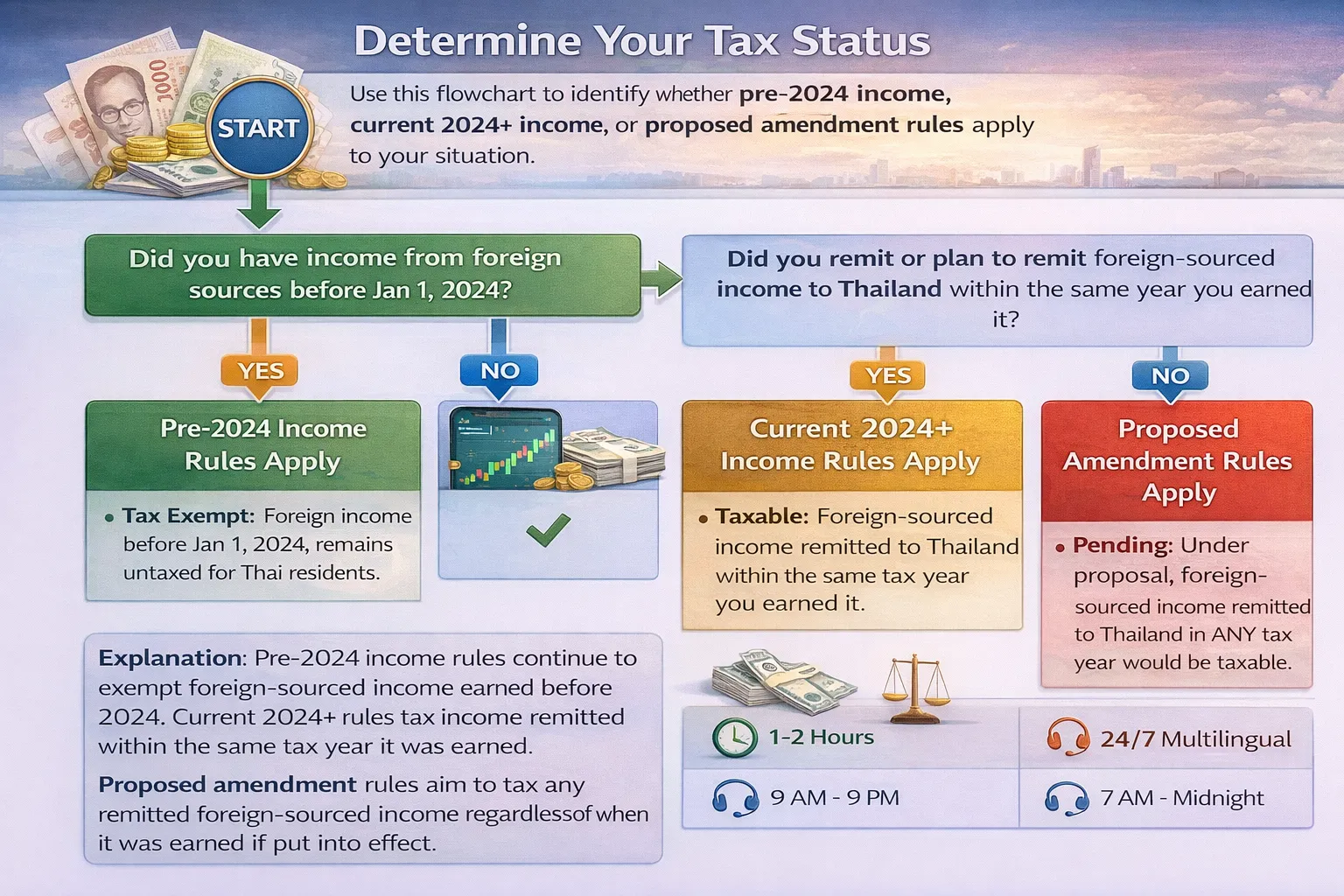

Thailand’s foreign income taxation landscape shifted fundamentally on January 1, 2024, with the implementation of Revenue Department Order No. Por. 161/2566. For the first time, Thai tax residents face mandatory taxation on foreign-sourced income when remitted to Thailand, closing a decades-old loophole that had attracted expatriates worldwide. However, Order No. Por. 162/2566 provides critical grandfathering protection for pre-2024 income, and a proposed 2025 amendment promises a two-year exemption window for timely remittances starting 2026.

This guide decodes the three distinct tax regimes governing foreign income in Thailand and provides actionable strategies for optimizing your tax position while remaining fully compliant. Whether you’re an expat with decades of offshore savings, a digital nomad earning remote income, or a Thai national returning with foreign-earned wealth, understanding these rules can save you tens of thousands of dollars in unnecessary tax liability.

Key Takeaway: Income earned before January 1, 2024 remains permanently exempt under Por. 162/2566, regardless of when remitted. Income earned 2024 onward is currently taxable on remittance but may qualify for exemption under a proposed two-year window beginning 2026.

Part 1: Understanding Thailand’s Tax Residency Rules

Before diving into foreign income exemptions, you must establish your tax resident status, as this determines your entire tax liability in Thailand.

Who Qualifies as a Thai Tax Resident?

Thailand classifies you as a tax resident if you are physically present in the kingdom for 180 days or more during any calendar tax year (January 1 to December 31). This threshold is cumulative – you don’t need to be continuous. Visa type is irrelevant. An individual on a tourist visa, education visa, or work permit entering Thailand on January 15 and leaving December 15 accumulates 335 days and becomes a tax resident for that full year.

Critical distinction: Tax residency is assessed annually. You can be a non-resident in one year and a resident in the next, triggering different tax obligations for each year.

Tax Implications of Resident vs. Non-Resident Status

Thai Tax Residents face the broadest tax obligation: income tax on all assessable income sourced both in Thailand and abroad. This includes employment income, business profits, rental income, investment returns, pensions, and any foreign-sourced income that meets the remittance rule.

Non-Residents (fewer than 180 days) bear a narrower obligation: personal income tax only on income sourced within Thailand. Foreign-sourced income brought into Thailand is completely exempt for non-residents, creating a strategic planning opportunity for individuals who can maintain non-resident status.

Part 2: The Three Foreign Income Tax Eras in Thailand

Era 1: Pre-2024 Regime (Before January 1, 2024)

The original rule under Section 41, Paragraph 2 of the Thai Revenue Code was conditional. A Thai tax resident incurred liability for foreign-sourced income only if two criteria were both met: (1) they were a resident in the year the income was earned, AND (2) they remitted the income in the same tax year it was earned.

Example: A Thai tax resident earned $50,000 in dividend income from a US stock portfolio in March 2023. Because she earned it in 2023 while resident in Thailand, she incurred tax liability only if she brought the dividends into Thailand in 2023. If she delayed remittance to January 2024, the income became permanently exempt – a loophole that incentivized capital preservation abroad.

Order No. Por. 162/2566: Grandfathering Protection

On November 20, 2023, the Revenue Department issued Order No. Por. 162/2566 to clarify that the pre-2024 rules would not apply retroactively. This order explicitly exempts all foreign-sourced income earned before January 1, 2024 from the new taxation regime, regardless of when such income is remitted into Thailand.

Permanent exemption terms:

- Applies to any income earned before January 1, 2024

- Remains exempt even if remitted after 2024

- No time limit on when remittance occurs

- Applies to all tax residents

Income qualifying for pre-2024 exemption includes:

- Employment income earned abroad before 2024

- Business profits from foreign ventures prior to 2024

- Investment returns (dividends, interest, capital gains) realized offshore before 2024

- Rental income from foreign property earned before 2024

- Pension and annuity distributions received before 2024

- Intellectual property royalties and licensing fees earned before 2024

Documentation is critical. Tax authorities increasingly scrutinize remittances of large sums and expect taxpayers to prove the source and earning year. Best practice includes maintaining year-end bank statements from 2023 and earlier, employment contracts or income documentation dated pre-2024, investment account statements showing contribution dates, and clear records separating pre-2024 funds from later earnings.

Era 2: Current Rules (January 1, 2024 through December 31, 2025)

Order No. Por. 161/2566, effective January 1, 2024, introduced a fundamental shift in Thailand’s approach to foreign income. The new interpretation of Section 41, Paragraph 2 closes the remittance-timing loophole entirely.

The Core Rule: Remittance-Based Taxation

Under Por. 161/2566, any foreign-sourced income earned by a Thai tax resident from 2024 onward is subject to personal income tax in the year it is remitted into Thailand, regardless of the year in which the income was originally earned.

Key mechanics:

- Trigger event: The remittance of money into Thailand

- Timing: Tax is assessed in the calendar year remittance occurs

- Rates: Taxed at progressive rates from 5% to 35% combined with other assessable income

- Scope: Applies to employment income, business profits, investment returns, rental income, pensions, and all other categories of foreign-sourced assessable income

Practical Example 1: A UK expatriate in Thailand earned £100,000 in consulting fees from a London-based firm in December 2024. She did not remit the funds to Thailand. In 2025, she decides to bring the £100,000 into her Thai bank account. Under Por. 161/2566, this £100,000 becomes assessable income in 2025 and is taxed at progressive rates in her 2025 tax filing.

Practical Example 2: The same expatriate earned another £100,000 in 2025 but remits it in January 2026. This £100,000 is taxable in 2026 when remitted, not in 2025 when earned. If the proposed amendment passes, this 2025-earned income would be exempt because it was remitted within the two-year window (earned in 2025, remitted by end of 2026).

What Counts as a Remittance?

The Thai Revenue Department has clarified that remittance includes multiple transfer methods, not merely bank wire transfers. Careful planning of transfer methods can optimize timing.

Transfers triggering the remittance rule:

- Bank transfers from overseas accounts to Thai bank accounts

- Foreign debit or credit card spending in Thailand (purchases made with cards tied to foreign accounts while physically in Thailand)

- ATM withdrawals in Thailand using foreign cards or accounts

- Cryptocurrency or digital asset conversions from foreign holdings to Thai bank accounts or fiat currency

- Cash physically brought into Thailand

- Transfers to Thai entities where the individual has beneficial ownership

Transfers that are not considered remittances for tax purposes:

- Spending foreign currency while outside Thailand

- Maintaining offshore accounts and earning returns within those accounts without withdrawing

- Transferring funds between foreign accounts with no Thailand connection

Applicable Tax Rates

Foreign-sourced income remitted to Thailand is combined with all other assessable income (Thai employment income, business profits, rental income, etc.) and subject to Thailand’s standard progressive personal income tax rates:

- 0% on the first 150,000 THB (~$4,300)

- 5% on income from 150,001 to 300,000 THB

- 10% on income from 300,001 to 500,000 THB

- 15% on income from 500,001 to 750,000 THB

- 20% on income from 750,001 to 1,000,000 THB

- 25% on income from 1,000,001 to 2,000,000 THB

- 30% on income from 2,000,001 to 5,000,000 THB

- 35% on income above 5,000,000 THB

This means an expatriate with combined 2024 assessable income of 2,500,000 THB (including remitted foreign income) faces marginal rates approaching 30%, significantly reducing the tax-deferred benefit of keeping money offshore.

Exemptions and Special Regimes During 2024-2025

Despite the broad remittance rule, certain taxpayers benefit from carve-outs:

1. Non-Residents (Fewer than 180 Days)

Non-residents are completely exempt from taxation on foreign-sourced income, even if remitted. This status is earned through careful day-counting: maintaining absences that keep annual presence below 180 days.

2. Double Tax Agreement (DTA) Benefits

Thailand has signed comprehensive Double Tax Agreements with over 60 countries. These DTAs may provide relief from double taxation through:

- Foreign tax credits: Reducing Thai tax by the amount paid to the foreign jurisdiction

- Exemptions: Certain categories of income (pensions, specific types of investment income) may be exempt from Thai tax if taxed in the country of source

- Reduced withholding rates: DTA provisions may eliminate or reduce withholding taxes on dividends, interest, and royalties

Example: A US citizen earning pension income from a US pension plan (which was already taxed in the US) can claim a foreign tax credit against Thai tax liability on the same income, potentially eliminating Thai tax on that portion.

3. Long-Term Resident (LTR) Visa Benefits

Thailand’s newly expanded Long-Term Resident Visa program (launched 2024) offers 100% exemption on foreign-sourced income for qualifying individuals. This is perhaps the most valuable exemption for high-net-worth expats. Qualifying categories include:

- Wealthy pensioners: Proven pension income of approximately $80,000+ annually

- High-net-worth individuals: Documented net worth of approximately $1,000,000+

- Highly skilled professionals: Specific occupational categories with monthly income thresholds

- Retired individuals: Direct investment or government savings requirements

LTR visa holders avoid Por. 161/2566 taxation entirely on foreign-sourced income. The exemption applies regardless of remittance timing or amounts.

4. Thailand Privilege Membership (Former Elite Visa)

Thailand Privilege members (the rebranded Thailand Elite program) also receive exemptions on foreign-sourced income under certain conditions.

5. Board of Investment (BOI) and Other Incentive Programs

Specific investment structures approved by the BOI may qualify for foreign income tax exemptions.

Part 3: The Proposed Amendment and the Two-Year Exemption Window (2026+)

In June 2025, Deputy Director-General Panuwat Luengwilai announced that the Revenue Department is drafting legislation to ease the foreign income tax burden. This proposed amendment represents the first major policy reversal since the stricter rules took effect.

What the Proposed Amendment Would Change

Under the draft legislation (status: pending Cabinet approval and Council of State review), foreign-sourced income earned by Thai tax residents from 2024 onward would be exempt from taxation if remitted within a two-year window – specifically, within the calendar year it was earned or the following calendar year.

Proposed rule:

- Applicable to: Foreign-sourced income earned January 1, 2024 onward

- Exemption trigger: Income remitted within the same calendar year earned OR in the following calendar year

- Tax status if within window: 100% exempt from personal income tax

- Tax status if outside window: Subject to progressive tax rates (5%-35%)

- Implementation timeline: Expected to take effect for the 2026 tax filing period (filing in 2026 for 2025 income)

- Legal mechanism: Ministerial regulation (secondary legislation), subject to Cabinet approval

Illustrative Scenarios Under the Proposed Amendment

Scenario 1: Income Earned 2025, Remitted 2025

- Status: TAX-EXEMPT

- If enacted, you may remit 2025-earned income in 2025 with zero tax liability

Scenario 2: Income Earned 2025, Remitted in 2026

- Status: TAX-EXEMPT

- The two-year window extends through the following calendar year

Scenario 3: Income Earned 2025, Remitted in January 2027

- Status: TAXABLE (exceeds two-year window)

- Falls outside the exemption period and is taxed at progressive rates

Scenario 4: Income Earned in 2024, Remitted 2026

- Status: Depends on final language, but likely EXEMPT if the amendment applies retroactively to 2024-earned income

Current Status and Risk Factors

As of December 2025, the proposed amendment is not yet law. The legislative process requires:

- Cabinet approval

- Review by the Council of State (Thai legal body)

- Ministerial regulation drafting

- Royal endorsement

Pessimistic timeline: Could take 12-18 months beyond current date. Optimistic timeline: Implementation by mid-2026. Tax planning should account for the possibility of this amendment while relying on the certainty of current Por. 161/2566 rules.

Part 4: Special Situations and Edge Cases

Mixed Income (Pre-2024 and 2024+)

If you transfer a lump sum containing both pre-2024 (exempt) and 2024+ (potentially taxable) income, Thailand’s tax authorities expect you to allocate the transfer between the two pools.

Best practice: Maintain separate bank accounts for pre-2024 and post-2024 income. When remitting, clearly document which pool you are drawing from. If funds are commingled, retain detailed records showing the original source and earning year of each component.

Conservative approach: If audit risk is a concern, remit pre-2024 funds first (establishing their exemption via banking records), and remit 2024+ income in separate, clearly labeled transactions.

Crypto and Digital Assets

Cryptocurrency holdings trigger unique timing issues. The Revenue Department guidance treats the sale/conversion of crypto offshore (e.g., selling Bitcoin on Kraken, a US-based exchange) as the “earning” event, even if the proceeds are not immediately remitted.

Example: You purchased 1 Bitcoin in 2023 for $30,000. In March 2024, you sell it for $100,000 on a US exchange but leave the USD in the exchange account. You later remit $100,000 to Thailand in June 2024. The $70,000 gain was earned offshore in March 2024 (post-January 1), making it subject to current Por. 161/2566 rules upon the June 2024 remittance.

Strategic tip: If you hold pre-2024 crypto, sell (realize the gain) in 2023 or earlier to lock in exemption, even if you leave proceeds offshore temporarily.

Rental Income from Foreign Property

Ongoing rental income from foreign real estate is particularly sensitive under Por. 161/2566. Each monthly or annual rent payment is a separate “earned” income event.

Example: You own a condominium in Phuket that generates 200,000 THB monthly in rental income for Thai nationals. This is Thailand-sourced rental income (fully taxable) regardless of where tenants reside. Conversely, you own a condo in Singapore generating SGD 2,000 monthly. If you are a Thai tax resident, this foreign-sourced rental income is taxable under Por. 161/2566 when remitted.

To minimize compliance complexity, remit foreign rental income within the same calendar year it is earned (positioning it for exemption under the proposed amendment if enacted).

Pensions and Annuities

Foreign pensions often provide exemption under Double Tax Agreements. However, the exemption typically requires:

- DTA eligibility: The pension is sourced in a country with which Thailand has a DTA

- Proper documentation: You must file a DTA claim form with your Thai income tax return

- Consistent treatment: You must have already paid tax (or been taxable) on the pension in the country of source

Without DTA protection, a US-source pension remitted to Thailand by a Thai resident is fully taxable under Por. 161/2566.

Action step: Request a copy of your foreign pension provider’s tax treaty certificate or consultation letter. File the correct DTA claim with the Revenue Department to avoid paying tax twice.

Part 5: Compliance and Documentation Strategies

Thailand’s tax authorities have increased audit activity on high-value foreign income remittances. The following compliance framework minimizes audit risk:

Documentation Checklist for Pre-2024 Income

- Year-end bank statements from all foreign accounts (December 31, 2023)

- Employment contracts or income documentation proving 2023 or earlier earning date

- Investment account statements showing contribution and purchase dates

- Pension provider statements indicating payment dates (pre-2024)

- Property deeds or ownership documentation for pre-2024 real estate

- Correspondence from foreign tax authorities confirming tax year of assessment

Documentation Checklist for 2024+ Income

- Invoices, pay stubs, or earnings statements dated 2024 or later

- Foreign tax assessments or certificates of tax payment for income earned 2024+

- Bank statements showing the specific remittance date

- Correspondence from employer or income source confirming payment dates

- Crypto exchange records showing sale date and conversion to fiat

- Business income records, profit and loss statements for self-employed income

Fund Segregation Strategies

Strategy 1: Dedicated Pre-2024 Account

Open a separate foreign bank account exclusively for pre-2024 funds and maintain it distinctly. When ready to remit, transfer from this account with a clear memo line: “Pre-2024 exempt funds.”

Strategy 2: Staggered Remittances

Instead of one large remittance mixing multiple income sources and years, execute several smaller, documented transfers clearly attributed to distinct sources and earning years.

Strategy 3: Timing Coordination with Tax Filing

Remit 2024+ income in December of the same year it was earned (capturing the exemption window in the proposed amendment). File supporting documentation with your income tax return the following year (e.g., 2024 income remitted December 2024, filed March 2025 return).

Evidence Storage and Audit Defense

The Revenue Department’s audit selection focuses on large remittances (typically 1,000,000+ THB) and individuals with inconsistencies between reported income and lifestyle.

Audit-resistant practices:

- Store original documentation in a secure cloud service (Google Drive, OneDrive) with multiple backups

- Maintain a “remittance log” showing each transfer date, source, earning year, and documentation

- Request letters from foreign financial institutions confirming account ownership and fund sources

- File formal DTA claims for any foreign-sourced income qualifying under treaty provisions

- Preserve foreign tax documents (foreign tax assessments, payment receipts) proving you paid tax elsewhere

Part 6: Action Plan by Taxpayer Profile

Profile 1: Expat with Decades of Offshore Savings

Your situation: You’ve accumulated $500,000+ in foreign investments and bank accounts earned before January 1, 2024.

Your advantage: All pre-2024 income is permanently exempt under Por. 162/2566.

Your action plan:

- Document the earning year of each pool of funds (investments, savings, business proceeds)

- Segregate pre-2024 and 2024+ funds into separate accounts

- Remit pre-2024 funds on your timeline – no tax penalty for delay

- If 2024+ earnings exist, hold them offshore until the proposed two-year amendment passes (expected 2026), then remit within the exemption window

- File supporting documentation with your annual income tax return

Expected tax impact: $0 on pre-2024 remittances; potentially $0 on 2024+ remittances if amendment passes and you time correctly

Profile 2: Digital Nomad / Remote Worker Earning 2024+ Income

Your situation: You work for a US company, earning $4,000-6,000 monthly. You’ve been in Thailand since September 2024 (180+ days in 2024 calendar year), making you a tax resident.

Your challenge: Your income is earned 2024 onward, placing it under Por. 161/2566 current rules (taxable on remittance).

Your action plan:

- Open a separate Thai bank account for 2024+ income

- Remit monthly salary within the same month earned if possible, positioning for exemption under the proposed amendment (earn in Dec 2024, remit by Dec 2025 for the two-year window)

- Request a DTA claim form from your US employer (if applicable) to reduce US-Thailand double taxation

- Consider restructuring as a Thai-registered company to qualify for business income deductions

- Monitor for the proposed amendment and plan 2025+ remittances accordingly

Expected tax impact: 5%-20% tax on 2024-2025 remittances; potentially 0% if amendment passes and you remit within window

Profile 3: LTR Visa Applicant

Your situation: You’re considering applying for the Long-Term Resident Visa and want to structure foreign income optimally.

Your action plan:

- Time your LTR visa application for Q3-Q4 2025 (expect processing 3-4 months)

- Once approved (target: early 2026), all subsequent foreign-sourced income becomes 100% exempt from Thai taxation

- For 2024-2025 income earned before LTR approval, plan remittance within the proposed two-year amendment window (if passed)

- Ensure your LTR visa category qualifies for foreign income exemptions (most do, but verify with Immigration Bureau)

Expected tax impact: $0 on all 2024+ income if LTR approved; potentially minimal tax on pre-LTR 2024-2025 income if amendment passes

Profile 4: Returning Thai National with Foreign Pensions

Your situation: You’re a Thai citizen returning to Thailand after 20 years abroad. You have US Social Security and a private pension totaling $35,000 annually.

Your action plan:

- File a DTA claim with your Thai income tax return for US-source pension income

- Request a US tax authority certificate confirming you paid or were taxable on this pension income in the US

- Thai tax should be reduced or eliminated by the DTA foreign tax credit

- For any income earned after January 1, 2024 (if still working), follow the 2024+ income rules or wait for the proposed amendment

Expected tax impact: Potentially $0-20% depending on DTA treatment; consult a tax advisor to optimize

Part 7: Addressing Common Misconceptions

Myth 1: “Foreign Income Is Untaxed If I Keep It Abroad”

Reality: Under Por. 161/2566, keeping money abroad does not prevent taxation. Taxation occurs when you remit, not when you earn. The moment you bring foreign income into Thailand (via bank transfer, ATM withdrawal, foreign card spending, or any other means), it becomes taxable in Thailand for that calendar year.

Implication: Delaying remittance does not reduce tax liability – it only delays the tax payment year. A 2024-earned income remitted in 2027 is taxed in 2027 at that year’s rates and against that year’s income.

Myth 2: “ATM Withdrawals and Foreign Card Spending Are Safe”

Reality: The Revenue Department’s guidance explicitly clarifies that ATM withdrawals in Thailand using foreign cards and purchases made with foreign credit cards in Thailand are remittances triggering taxation.

Example: You withdraw 100,000 THB from your US bank account at a Thai ATM in August 2024. This 100,000 THB of 2024-earned income is taxable in 2024 under Por. 161/2566, even though you didn’t “intentionally” remit it in a formal wire transfer.

Implication: Daily expenses using foreign cards while in Thailand contribute to your taxable foreign income remittances. Track these carefully and include them in your tax return.

Myth 3: “Paying Tax Overseas Removes All Thai Tax Liability”

Reality: Paying tax in a foreign country reduces but does not eliminate Thai tax liability without a Double Tax Agreement. Only countries with which Thailand has a DTA (approximately 60+ nations) provide credit mechanisms.

Example: If you pay US federal income tax on foreign-sourced income and remit it to Thailand, Thai tax is calculated on the full amount. The DTA allows you to credit the US tax paid, but only if you properly file DTA claims and maintain documentation.

Implication: Always verify whether Thailand has a DTA with your income-source country. If no DTA exists, you face true double taxation.

Myth 4: “Cryptocurrency Cannot Be Taxed Because It’s Hard to Trace”

Reality: The Thai Revenue Department treats cryptocurrency earnings (from mining, trading, or staking) as assessable income subject to the same rules as traditional foreign income. Sales of offshore-held crypto for fiat currency trigger the “earning event,” making the proceeds taxable upon remittance.

Example: You mine Bitcoin in 2024 on a US-based mining pool, accumulate 0.5 BTC (~$25,000 value), and remit the fiat equivalent to Thailand in 2025. This is 2024-earned income (when mining occurred) remitted in 2025, triggering taxation in 2025.

Implication: The IRS and other tax authorities increasingly share information with Thailand. Maintaining transparent records and properly reporting crypto income protects you against audit risk.

Myth 5: “Only Bank Transfers Count as Remittances”

Reality: Remittance includes any method of bringing foreign value into Thailand, including physical cash, asset transfers, wire transfers, credit card deposits, ATM withdrawals, and crypto conversions.

Example: You carry $10,000 cash into Thailand in a suitcase in March 2024. This is a remittance of 2024 income (assuming you earned it in 2024) and is taxable under Por. 161/2566. The fact that you carried it physically (not via bank) does not exempt it from taxation.

Implication: All methods of fund movement into Thailand are taxable events. Plan accordingly.

Part 8: Planning for the Proposed Amendment

Given the significant potential impact of the proposed two-year exemption window, here’s how to position yourself for favorable outcomes:

Best-Case Scenario (Amendment Passes, Takes Effect 2026)

If enacted as drafted, foreign-sourced income earned 2024 onward would be exempt if remitted by the end of the calendar year following the earning year. This would allow you to:

- Accumulate 2025-earned income throughout 2025 and remit by December 31, 2026 (tax-free)

- Plan large capital transfers within a two-year window post-earning

- Optimize cash flow and investment timing without immediate tax pressure

Worst-Case Scenario (Amendment Does Not Pass)

If the amendment fails or is significantly watered down, Por. 161/2566 remains the law. Foreign-sourced income is taxable whenever remitted. In this case:

- Maintain offshore capital as long as economically feasible

- Remit strategically in lower-income years to minimize tax brackets

- Explore LTR visa or other exemption mechanisms

- Structure remittances to avoid exceeding tax brackets

Hedging Strategy (Recommended)

Current year (2025) planning:

- For 2024-earned income not yet remitted: Hold offshore until Q2 2026 (post-amendment decision likely). If amendment passes, you have time to remit within the window. If not, you understand your tax liability.

- For 2025-earning income: Remit on your normal schedule but document carefully. If amendment passes retroactively, you may have grounds for refund claims.

- For 2026 and beyond: Assume the amendment passes (timing your remittances within the two-year window) but remain flexible. If it doesn’t pass, you can adjust strategy.

Part 9: Tax Resident Determination and Non-Resident Optimization

One often-overlooked strategy involves managing tax resident status itself. Strict day-counting can preserve non-resident status, which exempts all foreign-sourced income from Thai taxation.

Practical Day-Counting Strategy

If you can maintain fewer than 180 days in Thailand annually:

- You avoid tax resident classification

- All foreign-sourced income is fully exempt

- You remain taxable only on Thailand-sourced income

Example: You spend January-May in Thailand (151 days), June-July in Europe (61 days), and August-December abroad (152 days). Total: 151 days, qualifying as non-resident.

As a non-resident, any foreign income remitted to Thailand is exempt. This offers a powerful alternative to the remittance-rule complexity.

Caveat: Immigration may view frequent border crossings and rapid transit patterns as visa violations. Consult with an immigration lawyer before adopting an aggressive day-counting strategy.

Part 10: Frequently Asked Questions

Q1: Do I have to declare foreign income if I don’t remit it?

A: Not under Por. 161/2566. The tax trigger is remittance, not earning. Income earned but not brought into Thailand is not declared or taxed. However, certain visa categories (LTR) or voluntary disclosure programs may require declaration of worldwide income regardless of remittance.

Q2: If I remit money to Thailand to purchase a condo, do I pay income tax?

A: Not if the funds are pre-2024 earnings (exempt under Por. 162/2566) or if the remittance is a return of previously invested capital (not new income). However, if the funds represent 2024+ income earned during your tenure as a Thai tax resident, the remittance is taxable unless it qualifies for an exemption (LTR visa, DTA, non-resident status).

Q3: What is the maximum annual income for an individual to be exempt from Thai tax?

A: There is no income ceiling for exemption. Instead, the exemption depends on your status: (1) pre-2024 earnings are always exempt under Por. 162/2566, (2) 2024+ earnings are taxable under Por. 161/2566 unless you qualify for LTR visa (100% exempt), DTA relief, non-resident status, or the proposed amendment. Individuals earning any amount can be fully exempt if they fall into one of these categories.

Q4: How do I know if Thailand has a DTA with my home country?

A: Consult the Thai Revenue Department’s official DTA list (available on the TRD website, english.rd.go.th) or contact a tax advisor. Most developed nations (US, UK, EU countries, Australia, Japan, Singapore) have DTAs with Thailand. Developing nations often do not.

Q5: Can I amend a prior tax return if I mistakenly included foreign income that should have been exempt?

A: Yes. Thailand allows amended returns (filing within a prescribed period) to correct errors. If you remitted pre-2024 income and incorrectly reported it as taxable in 2024, you can file an amended return to claim a refund. Keep documentation proving the earning year (2023 or earlier).

Q6: Does my spouse’s income mix with mine for tax purposes?

A: Yes. Thailand taxes married couples on their combined assessable income (unless separated or under a specific legal arrangement). If both spouses are tax residents, remitted foreign income from both is aggregated and taxed at progressive rates applied to the combined total.

Q7: What happens if I fail to report foreign income remitted to Thailand?

A: The penalty is significant: late payment penalties (typically 15% of unpaid tax) plus interest accrued from the original tax due date. Additionally, the Revenue Department may assess penalties for underreporting (up to 2x the underpaid tax in egregious cases) and pursue criminal charges for willful tax evasion. Always report, even if you believe an exemption applies.

Q8: If the proposed amendment passes retroactively, can I claim a refund for 2024 taxes already paid?

A: Likely yes, but this depends on final amendment language. If it applies retroactively to 2024-earned income remitted within the two-year window, taxpayers who paid tax in 2024 should be able to file amended returns claiming refunds. This underscores the importance of preserving all 2024 tax documents.

Q9: Does the proposed two-year amendment apply equally to expats and Thai nationals?

A: Yes. Thailand’s tax law applies equally to all tax residents, regardless of nationality. The proposed amendment (if passed) would apply to all tax residents who remit foreign-sourced income earned 2024 onward within the two-year window.

Your Roadmap Forward

Thailand’s foreign income taxation regime has fundamentally shifted, but significant opportunities remain for strategic tax planning. The permanent exemption of pre-2024 income under Por. 162/2566 protects substantial accumulated wealth. The proposed two-year exemption window (expected 2026) may ease the burden on 2024+ earned income. And for qualifying individuals, LTR visas and DTA provisions offer pathways to 100% exemption on foreign-sourced income.

Your next steps:

- Establish your tax resident status for 2025 (did you spend 180+ days in Thailand this calendar year?)

- Document the earning year of all offshore funds (pre-2024 vs. 2024+)

- Consult with a Thai tax advisor to understand your specific exemptions and obligations

- Plan remittances strategically within the proposed amendment timeline

- File accurate, well-documented tax returns with supporting evidence to minimize audit risk

By understanding the nuances of Por. 161/2566, Por. 162/2566, and the emerging proposed amendment, you can optimize your foreign income tax position while remaining fully compliant with Thailand’s revenue regulations.

Authoritative Sources and Further Reading

- Revenue Department Order No. Por. 161/2566 (September 2023) – Tax treatment of foreign-sourced income remitted 2024 onward

- Revenue Department Order No. Por. 162/2566 (November 20, 2023) – Grandfathering exemption for pre-2024 income

- Thai Revenue Code Section 41, Paragraph 2 – Statutory basis for foreign income taxation

- Revenue Department Departmental Instructions and Q&A – Official TRD clarifications on foreign income

- LTR Visa Program Guidelines – Foreign income exemptions for qualifying visa holders

- Double Tax Agreement Provisions – Relief mechanisms for specific countries (consult thailand.go.th)