On June 17, 2025, Thailand’s Cabinet approved – and the Royal Gazette officially published on September 5, 2025 – a landmark five-year personal income tax exemption on cryptocurrency and digital asset capital gains. Effective from January 1, 2025, through December 31, 2029, this exemption represents a strategic pivot to position Thailand as a global digital asset hub. However, the exemption comes with critical conditions and ambiguities that most investors overlook, creating both opportunities and significant tax risks.

This guide cuts through the noise to explain exactly what is exempt, what is not, who qualifies, and the practical compliance steps required to benefit from this historic tax break.

Is There Really 0% Tax on Crypto in Thailand?

Short answer: Yes – but with major conditions.

Thailand has introduced a complete personal income tax exemption on capital gains from cryptocurrency sales if and only if those sales occur on a platform licensed by Thailand’s Securities and Exchange Commission (SEC). The exemption applies to residents and non-residents alike and covers purchases made between January 1, 2025, and December 31, 2029.

However, a critical distinction exists that separates this opportunity from a blanket exemption: the phrase “0% tax on crypto in Thailand” is misleading. Thailand has not exempted all crypto-related income. Rather, it has exempted a specific type of income – capital gains from regulated platform transactions – while leaving other crypto income streams fully taxable.

This distinction is crucial because most retail investors engage in multiple forms of crypto activity, many of which remain subject to tax.

What the 2025 Thai Crypto Tax Exemption Actually Covers

Capital Gains from Licensed Platform Transactions (EXEMPT)

The core of the exemption is straightforward: profits from buying and selling cryptocurrencies on SEC-licensed exchanges, brokers, or dealers are 100% exempt from personal income tax.

Examples of exempt transactions:

- Buying 1 Bitcoin at $30,000 and selling at $50,000 on a Thai SEC-licensed exchange (entire $20,000 gain is tax-free)

- Swapping Ethereum for USDT on a licensed Thai platform (any gain on the Ethereum is tax-free)

- Receiving cryptocurrency through a regulated broker sale (proceeds are tax-free)

Key requirement: The transaction must be conducted through an entity licensed and supervised by Thailand’s SEC. This currently includes platforms such as:

- Bitkub (Thailand’s largest exchange)

- Satang Pro

- Coins (Coins Co. Ltd)

- Other SEC-regulated operators

The exemption eliminates personal income tax and withholding tax (previously 15% on capital gains), meaning you receive the full proceeds without government tax deduction.

What Remains Taxable: The Critical Exclusions

While capital gains from licensed platforms are exempt, dozens of other crypto income streams remain fully taxable at personal income tax rates (0–35% progressive scale). This is where most investors make costly mistakes.

Explicitly Taxable:

Mining Rewards – Any Bitcoin or cryptocurrency earned through proof-of-work mining is taxed as ordinary income under Section 40(8) of Thailand’s Revenue Code. The taxable amount is determined at the time of receipt, using the cryptocurrency’s market value in Thai Baht on the date earned. Example: Earning 0.5 BTC from mining when Bitcoin trades at 3,000,000 THB = 1,500,000 THB taxable income.

Staking Rewards – Yield farming, liquidity pool returns, and staking income (Ethereum 2.0 staking, Cardano staking, etc.) are taxed as ordinary income. Unlike the licensed platform exemption, the regulation does not mention staking, and professional tax advisors presume it remains taxable until the Thai Revenue Department clarifies otherwise.

Airdrops – Free cryptocurrency received through airdrops, forks, or token distributions is taxed as ordinary income at the fair market value on the date of receipt.

Yield and Lending Income – Returns from crypto lending platforms, deposit yields, flash loans, and similar interest-bearing activities are fully taxable as ordinary income.

Derivatives and Leverage Trading – Gains from perpetual futures, margin trading, options, and other leveraged instruments remain fully taxable at ordinary income rates, even if executed on regulated platforms.

Unlicensed Platform Transactions – Any cryptocurrency gains realized on international exchanges (Binance, Kraken, Coinbase, etc.) or decentralized exchanges (Uniswap, Curve, 1inch) are taxable when the proceeds enter Thailand or are remitted into the Thai financial system.

Peer-to-Peer and Private Sales – Direct sales of crypto to other individuals, over-the-counter (OTC) desk transactions, and private wallet transfers are not covered by the exemption and remain taxable.

Salary and Freelance Income Paid in Cryptocurrency – Work compensation received in digital assets is classified as ordinary employment income (Section 40(1)) or self-employment income (Section 40(2)), regardless of platform.

The Foreign-Sourced Income Ambiguity: The Hidden Tax Trap

This is the issue that separates sophisticated investors from those facing surprise audits.

The Problem: What Happens When You Transfer Appreciated Crypto to Thailand?

Imagine you bought Bitcoin overseas in 2024 for $30,000 and it appreciated to $50,000 by June 2025. You now want to bring this asset to a Thai SEC-licensed exchange to sell it under the tax exemption. What are your tax obligations?

Two interpretations exist:

Interpretation 1: Full Exemption – The taxable event is only the final sale on the Thai exchange. Since the sale occurs in Thailand and falls within the exemption window, the entire $20,000 gain is exempt.

Interpretation 2: Partial Taxation (The Prevailing Professional View) – The gain accrued offshore ($20,000) is “foreign-sourced income.” When you transfer this appreciated asset to a Thai exchange, Thai tax law treats this as “bringing income into Thailand” (remittance rule). Under this view, Thai tax residents are taxed on the $20,000 gain accrued abroad at ordinary income tax rates (0–35%), with only future gains realized on the Thai platform being exempt.

What Tax Authorities Will Likely Require

The Thai Revenue Department has not issued explicit guidance on this scenario, creating a regulatory vacuum. However, a strong consensus has emerged among leading tax advisors in Thailand: the revenue authorities will almost certainly treat the transfer of appreciated cryptocurrency as a taxable remittance event for Thai tax residents (those in Thailand 180+ days annually).

This means:

- Gain earned January 1, 2024 – June 2025 (offshore): Taxable at up to 35%

- Gain earned June 2025 – December 31, 2029 (post-transfer, on Thai platform): Exempt from tax

- Effective outcome: Partial taxation

Who This Affects

This ambiguity creates highest risk for:

- Standard Thai tax residents holding significant unrealized gains on international exchanges

- Those transferring large positions from Binance, Kraken, Coinbase, or private wallets to Thai platforms

- Investors who cannot precisely document their cost basis and purchase dates

Who This Does NOT Affect

LTR Visa Holders – Individuals holding Thailand’s Long-Term Resident (LTR) visa in three specific categories – “Wealthy Global Citizen,” “Wealthy Pensioner,” and “Work-From-Thailand Professional” – are exempt from Thai personal income tax on all foreign-sourced income. For this group, the entire gain (whether accrued abroad or in Thailand) is tax-free, regardless of when or where the cryptocurrency was purchased.

Onshore-Only Traders – Investors who conduct their entire crypto lifecycle (purchase through final sale) exclusively on Thai SEC-licensed platforms entirely avoid this issue, as no foreign-sourced income is involved.

Non-Residents – Non-residents in Thailand (fewer than 180 days annually) are not subject to Thai tax on foreign-sourced income, though they must verify their home country’s taxation of capital gains.

The Official Policy: Ministerial Regulation No. 399 (B.E. 2568)

Key Policy Details

What is exempt:

- Personal income tax on capital gains from the sale or transfer of cryptocurrencies and digital tokens

- Applies to Bitcoin, Ethereum, altcoins, utility tokens, and investment tokens

- Value-added tax (VAT) remains suspended for all SEC-regulated platform transactions (permanent, since 2024)

- Withholding tax is eliminated (previously 15% on capital gains)

Who can benefit:

- Thai tax residents (180+ days in Thailand)

- Non-residents trading on Thai platforms

- Both individual investors and professional traders

Who cannot benefit:

- Companies and corporate entities (remain subject to 20% corporate income tax)

- Individuals engaging in mining, staking, or other excluded activities

- Transactions conducted outside SEC-regulated platforms

Compliance requirements:

- Know Your Customer (KYC) verification mandatory

- Anti-Money Laundering (AML) compliance required

- Transaction record-keeping: minimum 5-year retention

- Reporting obligations to Thai Revenue Department (platforms are required to share transaction data)

Duration: January 1, 2025 – December 31, 2029 (temporary, subject to renewal or expiration)

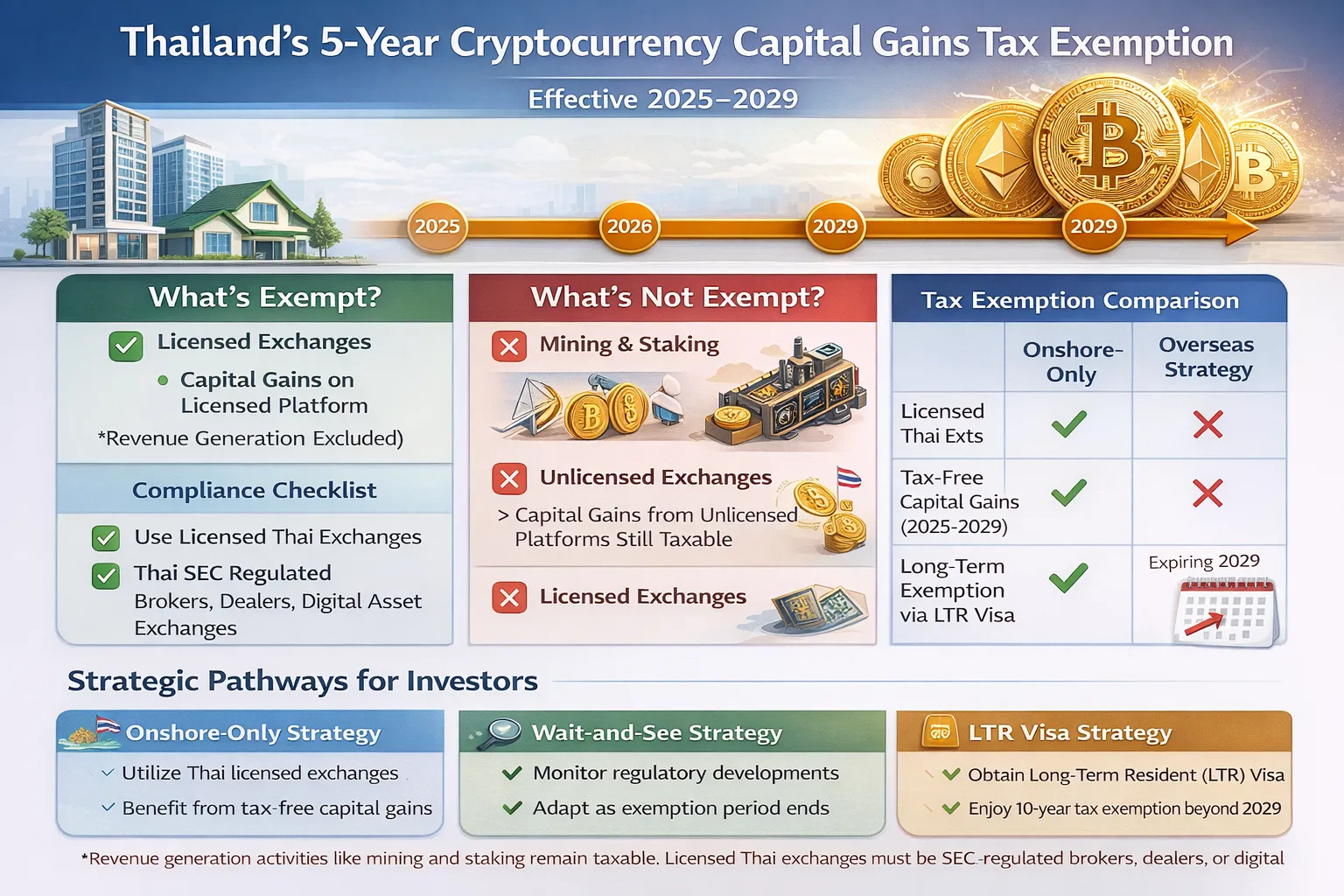

Strategic Pathways: How to Navigate the Tax Rules

Given the ambiguities and conditions, investors should adopt one of three strategic approaches:

Pathway 1: The “Onshore-Only” Strategy (Lowest Risk)

Approach: Conduct all cryptocurrency activities – from initial purchase through final sale – exclusively on Thai SEC-licensed platforms.

Advantages:

- Completely avoids the foreign-sourced income complication

- All capital gains are unambiguously exempt

- Straightforward compliance

- No documentation disputes over cost basis or timing

Best for: New crypto investors in Thailand, those building fresh positions, or investors without significant offshore holdings.

Practical implementation:

- Open accounts on Bitkub, Satang Pro, or other SEC-licensed platforms

- Fund accounts via Thai bank transfer or international wire

- Execute all trading on the licensed platform

- Withdraw proceeds when ready

Pathway 2: The “Wait-and-See” Strategy (For Standard Tax Residents with Offshore Gains)

Approach: If you’re a Thai tax resident with significant unrealized gains on foreign exchanges, hold positions offshore and await clarification or regulatory changes expected in 2026.

Why: The Thai Revenue Department is reportedly drafting a new ministerial regulation that would grant a general exemption on foreign-sourced income for all tax residents if remitted within the calendar year earned or the following year. If enacted, this would eliminate the tax risk on offshore gains entirely.

Advantages:

- Avoids triggering the 35% tax on foreign-sourced gains today

- Potential to benefit from more favorable rules in 2026

- Preserves flexibility

Disadvantages:

- Market timing risk (could miss gains while waiting)

- Regulatory uncertainty

- No guarantee the proposed law will be enacted

Best for: Tax residents with substantial offshore positions who can afford to wait and accept market volatility.

Pathway 3: The “LTR Visa” Strategy (Optimal for High-Net-Worth Investors)

Approach: Secure a Thailand Long-Term Resident (LTR) visa to obtain a permanent exemption on foreign-sourced income.

How it works: Holders of LTR visas in the “Wealthy Global Citizen,” “Wealthy Pensioner,” or “Work-From-Thailand Professional” categories are exempt from Thai personal income tax on all foreign-sourced income brought into Thailand. This completely resolves the ambiguity.

Advantages:

- Foreign gains are unambiguously tax-free

- Can transfer appreciated crypto from any offshore source to a Thai platform and sell tax-free

- Exemption is permanent (not expiring in 2029 like the general exemption)

- Applies to all foreign income, not just cryptocurrency

Disadvantages:

- LTR visa application fees (800,000 THB minimum investment for “Wealthy Global Citizen,” though this may be partially recovered)

- Visa renewal requirements and compliance obligations

Best for: High-net-worth investors with significant offshore crypto holdings, those planning long-term Thailand residency, and individuals seeking comprehensive foreign income tax relief beyond crypto.

LTR visa categories most relevant:

- Wealthy Global Citizen (minimum 800,000 THB investment or 42,000 THB monthly income)

- Wealthy Pensioner (monthly pension income thresholds)

- Work-From-Thailand Professional (specific income requirements)

Compliance Essentials: What You Must Do

The exemption is not automatic. To claim it and avoid tax disputes, investors must satisfy several compliance requirements.

1. Use Only SEC-Licensed Platforms

Critical: Verify your platform is licensed by Thailand’s SEC before trading.

Current licensed operators include:

- Bitkub – Thailand’s largest exchange

- Satang Pro

- Coins (Coins Co. Ltd)

- Smaller regional exchanges (verify on SEC’s official registry)

Do not assume that major international exchanges (Binance, Kraken, Coinbase) qualify. These are not licensed in Thailand and transactions on these platforms do not qualify for the exemption. If you earn gains on Binance while in Thailand, those gains are taxable when remitted to Thailand.

2. Maintain Comprehensive Transaction Records

Thai tax law requires a minimum 5-year retention period for all cryptocurrency transaction documentation.

Required documentation:

- Date and time of each buy/sell transaction

- Amount of cryptocurrency bought or sold

- Price in Thai Baht (or price in foreign currency plus exchange rate to THB at the time)

- Platform used (must verify it was SEC-licensed at time of transaction)

- Counterparty (especially for OTC or P2P transactions)

- Proof of platform identity verification (KYC documentation)

For offshore purchases transferred to Thailand:

- Original purchase documentation (date, amount, cost in original currency, exchange rate at purchase)

- Wallet transfer records showing movement to Thai platform

- Documentation of fair market value at transfer date (this determines the offshore gain)

Use spreadsheets, exchange account statements, or specialized cryptocurrency accounting software (Koinly, CoinTracker) to maintain records.

3. Satisfy KYC/AML Requirements

All SEC-licensed platforms in Thailand require:

- Verified government-issued ID

- Proof of address (utility bill, bank statement, lease agreement)

- Sometimes: Proof of funds source (bank statements, employment letter)

- Tax identification number (Thai TIN) or passport number for non-residents

Do not use anonymous wallets, VPNs that conceal location, or other measures that violate platform KYC policies. Non-compliance may result in account suspension and loss of transaction history.

4. Monitor Changes and Report Accurately

The Thai Revenue Department has increased scrutiny of cryptocurrency transactions through:

- Automatic data sharing agreements with major licensed platforms

- Integration with international frameworks (Common Reporting Standard, OECD Crypto-Asset Reporting Framework)

- Cross-referencing with bank deposits and remittances

- Transactions exceeding 1.8 million THB (approximately $58,000 USD) trigger automatic reporting

Even if you believe your gains are exempt, report them accurately and timely. Non-reporting can trigger audits, penalties, and loss of the exemption defense.

5. File Taxes Correctly (If Required)

If you have only exempt gains from licensed platforms in 2025–2029: Technically, you may not be required to file a full tax return for that income alone, as it is exempt. However, if you have any other taxable income (salary, mining, staking, etc.), you must file and may reference the exemption for platform gains.

If you have mixed income (exempt platform gains + taxable mining/staking): File Form PND.90 or PND.91 and separately itemize exempt and taxable income.

Filing deadlines:

- Paper filing: March 31 (of year following tax year)

- Online filing: April 8

Accounting for Gains: FIFO vs. Moving Average

When you sell a portion of a cryptocurrency position, Thai tax law permits two methods to calculate your cost basis and thus your taxable gain:

First-In, First-Out (FIFO)

Assumes the first coins you bought are the first you sold.

Example:

- January 2024: Buy 10 Bitcoin at 1,200,000 THB each = 12,000,000 THB cost basis

- June 2024: Buy 5 Bitcoin at 2,000,000 THB each = 10,000,000 THB cost basis

- December 2024: Sell 8 Bitcoin at 2,500,000 THB each = 20,000,000 THB proceeds

- FIFO calculation: 8 coins from January purchase = 8 × (2,500,000 − 1,200,000) = 10,400,000 THB gain

Moving Average Cost (Weighted Average)

Averages your purchase price across all buys.

Example (same transactions):

- After all buys: Total cost = 22,000,000 THB for 15 Bitcoin

- Average cost per coin = 22,000,000 ÷ 15 = 1,466,667 THB per Bitcoin

- Selling 8 Bitcoin: 8 × (2,500,000 − 1,466,667) = 8,266,664 THB gain

Key point: Choose one method at the start of the tax year and use it consistently throughout. Switching methods can trigger audits.

Which to choose?

- Use FIFO if you bought early and prices increased significantly (delays reporting of large gains)

- Use moving average if your purchase prices are clustered (often results in more uniform, lower taxable gains per transaction)

- Consult a Thai tax advisor for your specific situation

Special Considerations: Non-Residents, Business Use, and Remittances

Non-Residents Trading in Thailand

If you are not a Thai tax resident (fewer than 180 days in Thailand), you can take advantage of the 0% exemption by trading on SEC-licensed platforms without triggering Thai tax liability. However, you must verify that your home country (country of tax residence) does not tax this income.

Many countries claim tax on “worldwide income” regardless of where you earn it. US citizens, for example, are taxed on global income regardless of Thailand residency. Non-residents must check with a tax advisor in their home country before assuming the Thai exemption is sufficient.

Cryptocurrency Business Activity

If you operate a cryptocurrency business (frequent trading, market making, proprietary trading, etc.), you may be classified as a business operator rather than an investor. Business income is taxed as corporate income (20% corporate tax) rather than capital gains, and the 0% exemption likely does not apply.

The distinction: Occasional trading = capital gains (exempt). Frequent, professional trading with business infrastructure = business income (taxable at 20%).

Remittance Mechanics

If you hold gains on a foreign exchange and want to bring them to Thailand:

- Sell cryptocurrency on the foreign exchange, converting to USD or another fiat currency

- Transfer to a Thai bank account via international wire or payment service

- Once in Thailand, you may purchase cryptocurrency on a licensed Thai platform

- Sell on the Thai platform (this gain is exempt)

Tax implication: The gain from the foreign exchange sale is subject to the remittance rule (taxable when brought into Thailand). Only gains realized after arrival on the Thai platform are exempt.

Practical Steps: How to Benefit from the Exemption

For New Investors in Thailand (Clearest Path)

- Choose a platform: Open an account on Bitkub or Satang Pro

- Fund the account: Transfer THB from your Thai bank account

- Trade: Buy and sell cryptocurrencies on the platform

- File taxes: If you have other taxable income, file PND.90 by March 31 and reference the exempt crypto gains

- Keep records: Retain all transaction confirmations for 5 years

For Expats with Offshore Holdings (Higher Complexity)

- Assess your position: Determine:

- Are you a Thai tax resident (180+ days)?

- Do you have unrealized gains on foreign exchanges?

- What is your home country’s tax residency?

- Consider your strategy:

- If low risk tolerance: Implement the “onshore-only” strategy (open a Thai exchange account, buy fresh assets there)

- If can wait: Implement the “wait-and-see” strategy (hold offshore pending 2026 clarification)

- If high net worth: Explore the LTR visa strategy

- Get expert advice: Consult a Thai CPA or international tax advisor on your specific situation

- Document everything: Begin maintaining precise cost basis, purchase dates, and exchange rates for any assets you plan to bring to Thailand

For Those Seeking Certainty (Highest Confidence)

- Apply for an LTR visa – Secure the permanent foreign income exemption

- Open a Thai exchange account – Transfer your offshore holdings once visa is approved

- Sell on licensed platforms – Your entire gain is unambiguously tax-free

- Reinvest if desired – Use Thailand’s tax-free environment to grow your portfolio

Timeline: Key Dates and Deadlines

| Date | Event | Relevance |

|---|---|---|

| January 1, 2025 | Exemption effective date | Start trading on Thai platforms to benefit |

| September 5, 2025 | Ministerial Regulation No. 399 published in Royal Gazette | Official legal confirmation |

| December 31, 2029 | Exemption expires (unless extended) | Tax breaks end; gains become taxable again in 2030 |

| January 1, 2026 (projected) | Potential foreign income relaxation | Proposed law may exempt foreign gains if remitted timely |

| March 31 (annual) | Tax filing deadline (paper) | File PND.90/91 if you have reportable income |

| April 8 (annual) | Tax filing deadline (online) | Final deadline for e-filing |

FAQs: Questions Every Investor Should Ask

Q: If I buy Bitcoin on Binance and never withdraw it, is it tax-free in Thailand?

A: Technically, gains on Binance are not taxed in Thailand as long as they remain outside Thailand. However, Binance is not an SEC-licensed Thai platform, so the 0% exemption does not apply to Binance transactions. The moment you transfer proceeds to Thailand, they become taxable under the remittance rule. Additionally, you’re exposed to ongoing foreign-sourced income ambiguity.

Q: Can I use a VPN to hide my location and trade on Binance without triggering the remittance rule?

A: No. This violates Binance’s terms of service and Thai law. If discovered, you risk account seizure, forfeiture of funds, and criminal charges. Use only licensed Thai platforms.

Q: I made 500,000 THB mining Bitcoin last year. Is this covered by the 0% exemption?

A: No. Mining income is explicitly excluded. It is taxed as ordinary income at your marginal tax rate (0–35%). Your mining reward is taxed in the year earned based on Bitcoin’s value on the date of receipt.

Q: I hold an LTR visa. Can I bring all my offshore gains to Thailand tax-free?

A: Yes, if you hold an LTR visa in the “Wealthy Global Citizen,” “Wealthy Pensioner,” or “Work-From-Thailand Professional” category. Your foreign-sourced income is entirely exempt from Thai personal income tax.

Q: What happens to the exemption after December 31, 2029?

A: Unless renewed by the Thai government, the exemption expires. Gains realized after that date will be taxable at ordinary income tax rates (0–35%). The Thai government may extend it if the policy proves successful, but no commitment exists today. Plan accordingly.

Q: Do I have to report the exempt gains to the Thai tax authorities?

A: Technically, income exempt from tax may not require filing, but if you have any other taxable income, you should reference the exempt gains in your return to create a clear record. Proactive disclosure protects you in case of future inquiries.

Q: If I earned gains on a Thai exchange in early 2025 but haven’t withdrawn them yet, are they still exempt?

A: Yes. The exemption applies to gains realized (sold) on licensed platforms between January 1, 2025, and December 31, 2029, regardless of when you withdraw the proceeds.

Thailand’s Competitive Advantage and Your Strategy

Thailand’s five-year cryptocurrency tax exemption represents a historic opportunity for investors seeking tax-efficient wealth growth. By eliminating personal income tax and withholding tax on regulated platform capital gains, Thailand has positioned itself as one of the most attractive jurisdictions for cryptocurrency trading globally.

However, the opportunity is not a blank check. The exemption applies only to capital gains from regulated platform transactions – a specific, narrow category. Mining, staking, unlicensed platform trades, and offshore gains face continued taxation or ambiguity.

Success requires:

- Using only SEC-licensed platforms (Bitkub, Satang Pro, and others)

- Maintaining meticulous records (5-year minimum retention)

- Understanding the foreign-sourced income implications (offshore gains remain taxable until clarification)

- Choosing the right strategy for your situation (onshore-only, wait-and-see, or LTR visa)

- Acting before 2030 (the exemption expires December 31, 2029)

For new investors, the path is straightforward: open a licensed Thai exchange account and trade. For those with offshore holdings, the decision requires careful planning with a qualified tax advisor.

The five-year window is limited. Those who structure their cryptocurrency activities correctly during this period can build substantial tax-free wealth in Thailand. Those who neglect compliance risk audits, unexpected tax bills, and loss of the exemption defense.

Start now. Document everything. Stay compliant. Build wealth.

Resources and Further Reading

- Thai Revenue Department: Official tax guidance and forms (PND.90, PND.91, PND.94)

- Thai SEC: Licensed digital asset platform registry

- Royal Gazette: Ministerial Regulation No. 399 (B.E. 2568) – official legal text

- Professional Advisors: Consult a Thai CPA or international tax advisor for personalized guidance

- LTR Visa Information: Thailand Board of Investment (BOI) – official LTR visa details

Disclaimer: This guide is educational only and does not constitute professional tax or legal advice. Cryptocurrency taxation is complex and rapidly evolving. Consult a qualified tax advisor licensed in Thailand before making investment or tax planning decisions. Tax laws may change, and individual circumstances vary. The information herein is accurate as of December 2025 but may be superseded by official regulatory guidance.