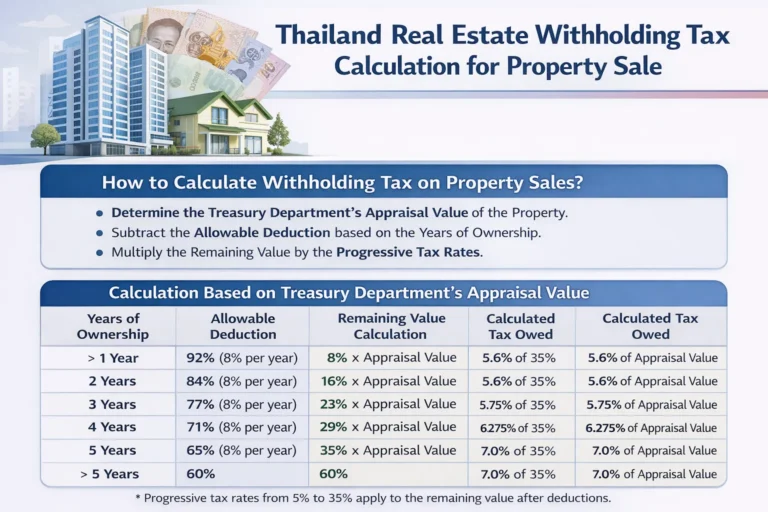

Thailand Property Withholding Tax: Individual Calculation 2026

Selling a condo or house in Thailand comes with a hidden shock for many individuals: the Withholding Tax (WHT). Unlike in many Western countries where capital gains tax is filed at the end of the year, Thailand demands this tax upfront at the…